iPads and tablet growth

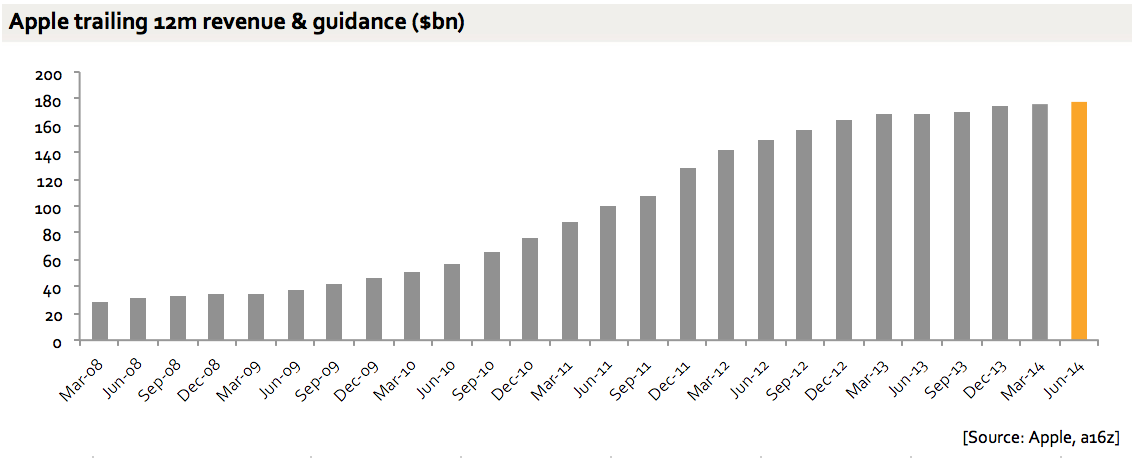

Apple's revenue has pretty much stopped growing. This chart shows the quarterly revenue the company has reported - a series of ever larger spikes upward around new product launches, but with a flattening trajectory.

If you look at this on a a trailing 12 months basis, to smooth out the spikes and see the underlying trend, you see a very clear 'S' curve.

And the US revenue is pretty much flat, though China is certainly growing.

Apple has three main buckets of revenue - iPhone, iPad and everything else. If you split these out, you can see that the really dramatic slowdown is actually in the iPad business, not iPhone.

This is something of a change - a year ago the general narrative was around the rather obvious ceiling on iPhone sales and the possibly huge but unknowable potential of the iPad. Now things have turned around.

Part of this slowdown in revenue is due to a decline in ASP as Apple rolled out cheaper iPad models...

But if you look at unit sales you see pretty much the same trend: flat for the last year.

Shifting back to the raw quarterly numbers, you can see the same trend.

When asked about this on the conference call earlier this week, Tim Cook talked a bit about changes in inventory. But actually, that isn't the point - the underlying trend looks the same whether you look at sell-in or sell-through.

(Note, incidentally, that no other mobile device company provides anything like this much this data)

So iPad sales are slowing. Why? Is it competitive pressure from Android? Not really.

This chart, and dozens of others from every possible source, makes it very clear that the iPad dominates tablet web traffic in a way that it does not dominate smartphone web traffic. This particular chart shows the USA, but I hear the same story from companies everywhere from the UK to China. The same is seen for app use. People are not substituting iPad use for Android use, not at anything like the scale needed to explain the slowdown. And Android tablets that try to offer the same 'post-PC vision' as the iPad are not selling especially well - the real global volume is in the generic black plastic devices at much lower prices - and they don't even show up in usage stats.

The classic negative view on iPads was that they couldn't compete with PCs because they lacked multitasking, keyboards, Office (until now) etc, etc. But that' s an incomplete response, because PC sales are suddenly weak too (and only part of that is Windows 8).

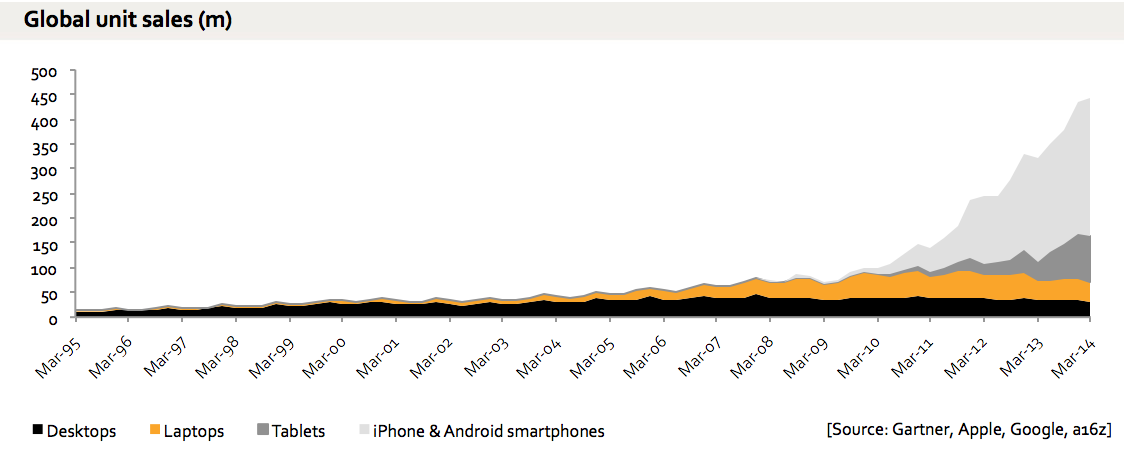

So what IS going on? Perhaps one answer is in this chart.

On one hand, as I wrote here and Steven Sinofsky discussed in this podcast, moving to new devices and form factors involves new software experiences, and new software also often both creates and requires new business processes. It's hard to spend a day creating a 20-slide sales report on an iPad, even now that MS Office is available for iPad. But actually, that sales report should be a SAAS dashboard that takes 10 minutes to annotate. It will take time for those business processes to shift to enable more corporate tablet use.

On the other hand, the smartphone explosion is putting the internet into the hands of far more people than ever before, and it's alway there. If you're watching TV and want to know about an actor or a product, do you go upstairs and turn on your PC, walk across the room to pick up a tablet, or just pull a smartphone out of your pocket? The declining relative utility of the PC is reflected in a slowing replacement cycle (you don't replace the one you have) - the tablet has yet to make the sale in the first place, outside the initial wave of adopters.

Compounding this, the smartphone explosion is accompanied by an apps explosion. There are thousands of amazing apps on iPad (and very few on Android tablets, which is why the balance of use between the two is so skewed), but the smartphone opportunity is so much bigger that it attracts much more attention: there are more of these devices, some use cases make much more sense on them (such as Instagram) and some only make sense on them (such as Uber, Hailo or Lyft). So the smartphone experience now is very rich.

(A complicating factor, of course, is that these categories can't be neatly divided - phablets blur the boundary between phones and tablets and 'convertibles' blur the laptop/tablet boundary. But sales of both these are relatively small for now - even phablets)

A good illustration of this shift from the PC to mobile was Facebook's results this week: it now has more mobile-only than desktop-only MAUs and 79% of MAUs are mobile.

So, looking at tablets and smartphones as mobile devices in a new category that competes with PCs may be the wrong comparison - in fact, it may be better to think of tablets, laptops and desktops as one 'big screen' segment, all of which compete with smartphones, and for which the opportunity is just smaller than that for smartphones. And so tablets will over time eat away at laptop and desktop sales just as laptops ate away at desktop sales, but the truly transformative new category is the smartphone. Maybe.