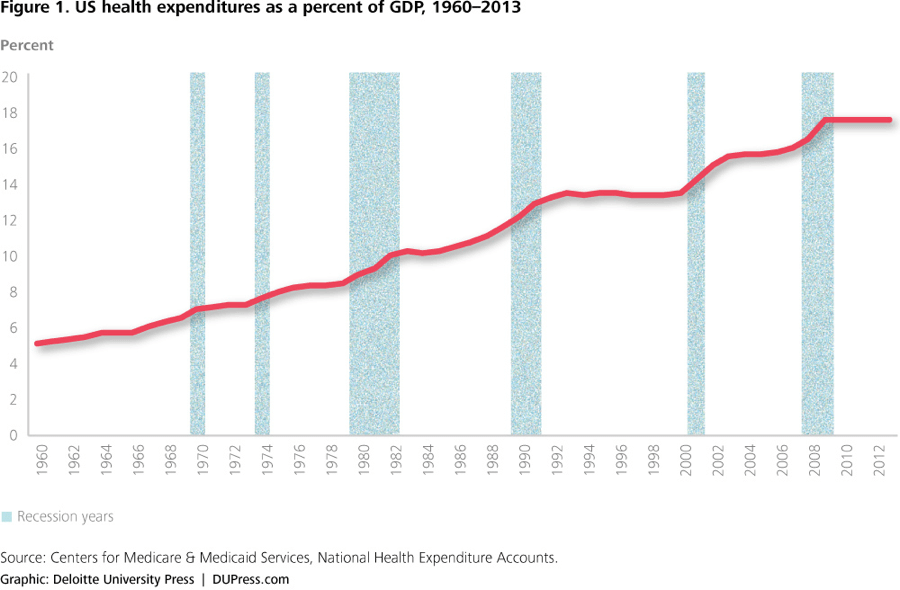

My first corporate job after graduating from college was as an “employee benefits consultant” at Wausau Insurance companies. It wasn’t a particularly inspiring job, but I was lucky to get this job as I had graduated during a deep recession. I remember being blown away when I learned on the job just how big a market health spending was at the time — it accounted for about 10% of U.S. GDP. And not only was the level of health spending huge, it was also growing very fast.

Fast-forward a few decades and U.S. health expenditures as a percent of GDP have almost doubled, to 17.5%. This is remarkable given that GDP grew materially during this same period of time.

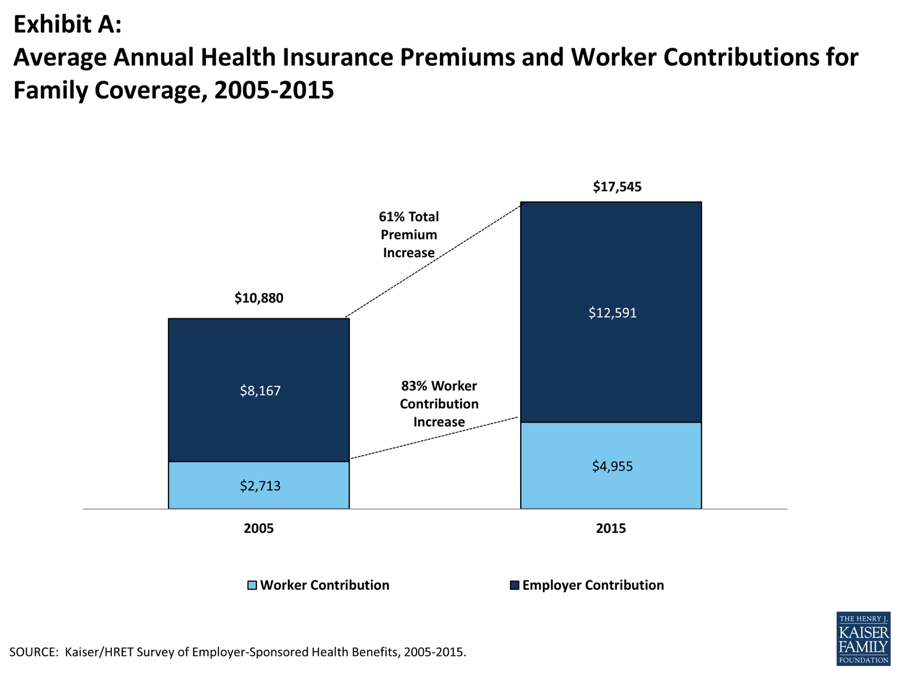

The cost of health insurance has escalated as a result of these rising healthcare costs. In fact, the total average cost of health insurance for a family has increased from $11K in 2005 to $18K in 2015 — a 61% increase in just 10 years. Since the dominant way that the U.S. population gets health insurance is through their employer, managing these costs can be a nightmare for company managers. The primary techniques deployed to mitigate cost increases include:

- Reduce benefit levels

- Increase deductibles

- Increase employee contributions

- Increase company spending

The first three options hurts employees, and the fourth hurts employers. Yet unfortunately these painful options are the primary options being pursued.

For example, the amount that employees have to contribute to their family coverage has increased by 83% in the past decade, from $2.7K to $5.0K.

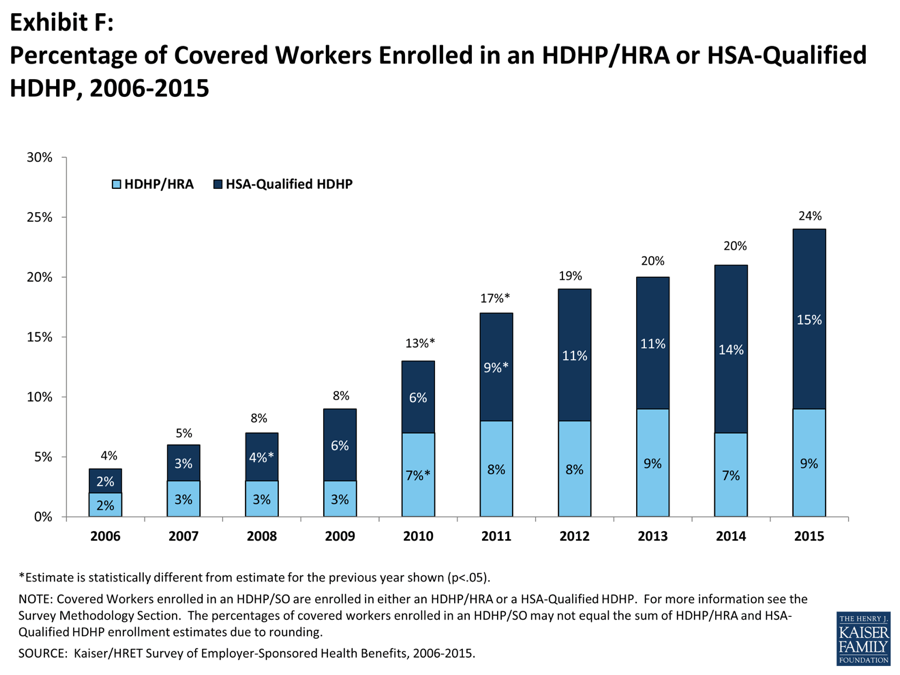

The proportion of workers covered in a “High Deductible Health Plan” has also exploded, growing from 4% in 2006 to 24% in 2015. Though these plans are accompanied by more tax-friendly medical savings accounts, they also require employees to share more of the risk and as such require a deductible of at least $1000 (for individuals) and $2000 (for families).

These trends negatively impact employees’ financial situations — not to mention morale. For employers, too: I remember feeling helpless when trying to manage healthcare costs as a manager; the increases felt unrelenting and they were highly material from a financial perspective. Knowing that people’s health and livelihoods were behind the numbers made it even harder to choose the right outcome for everyone.

Obviously this is a problem of massive proportions. Meaning it’s an area that’s ripe for potential innovation.

And potential solutions are emerging. Over a half TRILLION dollars of annual healthcare spending could be saved “if people listen to healthcare companies as much as they accept suggestions from online retailers”, according to consulting firm Oliver Wyman’s projections. Savings opportunities exist in:

- Helping people with chronic disease take their medication… $200 billion.

- Helping people get only the care they need (i.e., eliminating over-treatment)… $150 billion.

- Reducing the risk of ‘lifestyle diseases’ with healthy living prompts and support… $110 billion.

- Guiding people to the most appropriate site of care for their condition… $45 billion.

- Improving care coordination through better communication and information sharing… $25 billion.

And that’s where Accolade comes in.

By focusing on bringing back the humanity, combined with technology and clinical science, to health systems, Accolade helps guide people through the healthcare process in a deeply personal manner.

Here’s how it works: Accolade is an on-demand healthcare concierge for employers, health plans, and health systems. The Accolade health assistant becomes your first and main point of contact, someone to help unravel the frustrating complexity of the health system when you have any healthcare questions. Accolade’s team of health assistants — which includes social workers, clinicians, and nurses — gets to know each person, understands the context of their healthcare decisions, builds trust, and influences decisions toward smarter and better health. At the same time, Accolade is building out a data layer that shows why, how, and when people use — and mis-use! — the healthcare system, as well as a software layer to more quickly and efficiently work with their clients and benefits teams.

Accolade seeks to help people make better, more informed healthcare decisions, consuming the right healthcare and benefits at the right time. The results speak for themselves, as do their customers:

High Engagement — Accolade generates incredibly high levels of employee engagement. An amazing 70% of the entire employee population engages with the Accolade platform to inform their healthcare decisions. And this high-level engagement is not just with Accolade; other benefit providers for the company also experience higher user engagement because of the Accolade model — as shown by, for instance, the 10x increased usage of price transparency tools. As one employee noted, “[it] encouraged me to ask better questions sooner. Before Accolade, I was charged $600 for an out-of-network anesthesiologist. With Accolade, I didn’t make that kind of mistake.”

Better Outcomes — These high levels of engagement in turn help drive better health outcomes. As one company partner observed, “Accolade is on the back of the ID card. They have access to the health plan system; they can look up your claims and have a sense for what’s going on when they have a conversation with you. The impact for us has been real. We have seen a reduction in hospital days per thousand; a reduction in re-admissions; we’ve had positive impact on ER usage; and the list goes on. All of the things that we would consider problems with our claims, we’ve seen Accolade have a positive impact.”

Cost Savings — These better health outcomes in turn help save lots of money. Employers and health plans who implement Accolade on average see savings totaling 10% of claims costs. Given most large employers self-insure their health costs, these savings immediately accrue to the company, and of course, insurance companies (like Independence Blue Cross) who are rolling out Accolade to their fully-insured customers directly realize those savings as well. As one health system customer noted, “I had run the gamut on being able to get savings from changing benefit plan design, switching to self-insurance, and better managing drug costs. We needed to do something different—something that was going to engage employees and their families in a more active world of wellness.” He acknowledged that if you engage with an individual before a health issue occurs, “you’ll end up with fewer emergency room visits and fewer in-patient admissions…It’s about engagement. They develop a trust that allows them to make the right decisions about what to do and when to do it.”

User Satisfaction — The engagement and the improved outcomes result in happy employees. Satisfaction ratings with Accolade average 98%, and the average NPS (net promoter score) is a stunning 70. To put this NPS into context, there are few companies in the world – nonetheless dealing with healthcare – that generate this level of NPS.

Accolade is the best tool we’ve seen to help companies simultaneously improve both the quality and the cost of healthcare. The results are magical – employees are healthier and happier while at the same time employers and insurance companies see big savings.

We are proud to be supporting Accolade CEO Rajeev Singh and his team. Rajeev’s prior job was as co-founder and President & COO of expense management company Concur — which made the unusual and successful transition from an on-premise to SaaS company — and sold to SAP in 2014 for $8.3B. He’s a proven operator like no other. Rajeev believes that Accolade has even more potential than Concur!… and so do we.