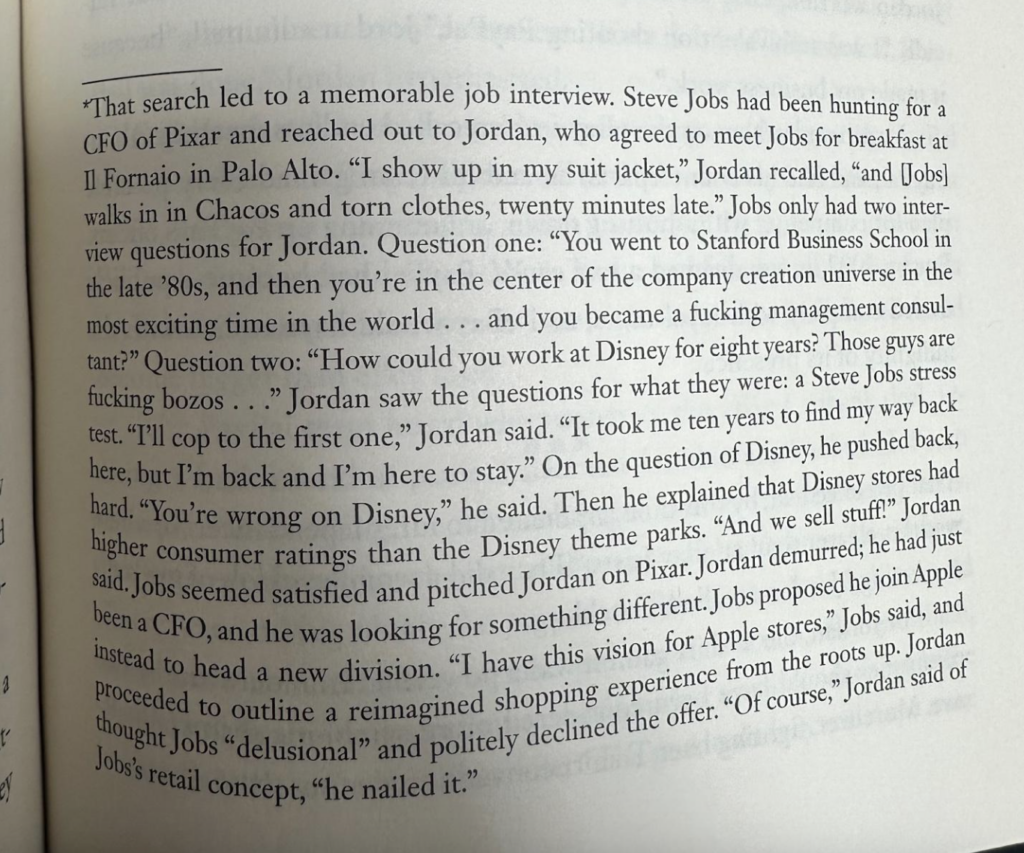

I was well into my career when I discovered the magical world of technology start-ups. This anecdote from Adam Lashinsky’s excellent book Inside Apple summarizes the point quite well:

I have been working in this tech start-up space for almost a quarter century, basically since this Steve Jobs breakfast.

During my first 12 years in tech I was an operator, managing Reel.com (one of the worst tech companies ever!) before taking on leadership roles at eBay.com, PayPal (which eBay acquired in 2002), and OpenTable.

And for the past 12 years, I’ve been a venture investor at a16z, specializing in Consumer investment opportunities often similar to the ones I operated: businesses seeking network effects often through a digital marketplace mechanism. Here is the hiring announcement that Marc penned when I joined the firm:

https://a16z.com/meet-our-new-general-partner-jeff-jordan/

I absolutely have adored my time working in the technology start-up world, both as an operator and an investor. Simply put, magic happens here with absurdly high frequency! I’ve been privileged to watch early stage start-ups bloom into important, successful companies, including eBay, PayPal, OpenTable, Airbnb, Pinterest, and Instacart.

The best part of working in technology for me is that many of the companies that I have been involved with have literally made the world a better place through economic empowerment to their community of users:

- eBay has driven over $800 billion of GMV over the past 10 years, most of which is earned by individual sellers around the world.

- Airbnb drove over $60 billion in Gross Booking Value in 2022 alone, most of which is paid out to individual hosts around the world.

- Instacart and Rappi became essential services during the COVID-19 pandemic while providing livelihoods for over 600,000 and 250,000 shoppers, respectively.

- Incredible Health is helping nurses find great employment opportunities at over 650 hospitals across the nation.

As a GP at a16z, I am proud that the returns that I helped generate have gone to LPs who often are nonprofit university endowments, foundations, or hospital systems. And I, along with some early GPs at a16z, individually took the “Buffett Pledge,” committing that at least half of our personal earnings from a16z will go to philanthropy.

So why did I move across the table from being an operator to being an investor in 2011? I operated high-growth tech companies for 12 years, and I had a preference for doing so at relatively early stage companies. By the time I got to Opentable, I felt I had gotten pretty adept at managing tech companies at these early stages. But the flip side is that my learning curve shallowed a ton over time, which significantly impacted my job satisfaction.

In crossing the table to the investor side, I got to confront a new learning curve in the same industry I loved. And be careful what you ask for—the learning curve was SUPER steep early on. I made a ton of mistakes (fortunately, none were fatal), and I tried to learn from each one. I highly value the learnings and knowledge I’ve gained on my investor journey.

I was employee #22 at a16z. The firm has grown a ton over my 12 years, and we are now more than 500 employees strong. I’m incredibly proud to have been able to contribute to the development of the firm, both as a General Partner for 12 years and as Managing Partner for a number of years.

Alas, the learning curve has again started to shallow. The firm is at the top of its game right now, which is why I feel permission to start thinking about the next chapter of my career. So I will not be actively investing in future funds raised at a16z, though I will continue to steward my existing portfolio companies and board seats.

And while this may seem like an ending, I hope it’s a new beginning for me. As my spouse has frequently and astutely observed, I’m not the retiring type. I’m ready for my next challenge—bring it on!

I have a lot of folks to thank for a fantastic 12 years:

- Marc and Ben for taking a chance on an experienced operator as an investor; I hope I have rewarded that trust.

- My partners over the years, both on the investing and operating side. a16z has an incredibly talented team from top to bottom, and deeply embedded in the firm culture is “we win as a team.” It has been a joy to be a part of this group.

- The founders, CEOs, and teams whose efforts I was able to support along the way. Working with you all is an absolute privilege, it’s the reason I wake up pre-dawn every day!

- The a16z LPs who have trusted us to invest their money wisely.

- My spouse and kids for being continuously supportive amidst over a decade of fire drills. I don’t know about other venture firms, but we work damn hard at a16z and I appreciate how my family has supported me over the years.

Thanks for reading.