AI is changing what skills people have, what tasks people do, and what teams look like. That change is hitting big companies differently from small companies. While big companies are getting incremental benefits to existing team structures, at startups we’re seeing truly AI-native companies emerge, built around the next generation of software.

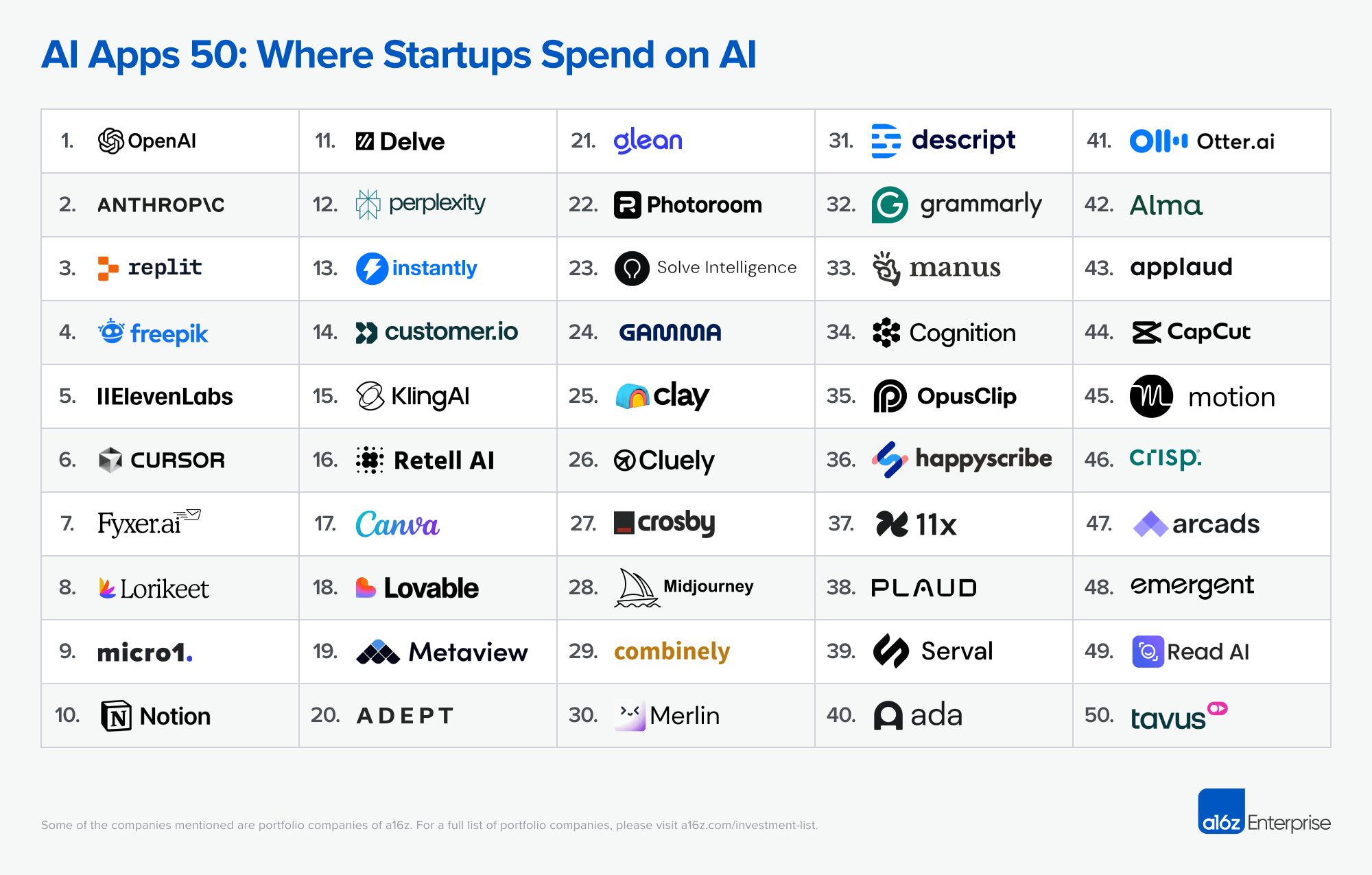

But what does this next generation of software look like? We worked with Mercury, the fintech ambitious companies use for banking*, credit cards, and all their financial workflows, to collect and analyze spend across their database of over 200,000 customers, looking at patterns over the last three months (June – August 2025). We then identified the top 50 AI-native application layer companies – similar to our Top 100 Gen AI Consumer Apps, but built around spend data versus web traffic data.

Unlike infrastructure providers, which reflect the capabilities startups are enabling (compute, models, developer tools), these companies show where AI is actually being applied in products and workflows and that distinction matters: this ranking gives us a real-time signal of what early stage startups are “buying” in AI. The findings draw a relevant parallel to Mercury’s broader survey of non-Mercury customers showing most early-stage companies surveyed are planning to ramp AI spend, and those using AI are seeing a higher ROI than with traditional tools.

Companies that made the list range from vibe coding platforms to creative tools to customer service solutions. And, the rankings bring real evidence to what AI enthusiasts have intuited – not only is AI augmenting employees in specific roles (“AI for patent lawyers”), it’s turning specific roles into broadly deployed skills across a company (everyone can be a creative now!).

Methodology notes – we did not include companies that primarily sell cloud services (ex. Azure) or GPUs (ex. Coreweave) or infrastructure tools. Spend for Google includes both Google Cloud and Gemini models, as we were unable to disentangle the two.

This data is limited to transactions made via Mercury such as ACH, IO card spend, and wires. It does not capture Mercury customer spend on other sources including on non-Mercury cards that may be reimbursed. The data does not reflect spend from Mercury Personal customers.

1. Horizontal applications have a slight majority in spend.

We separate applications into those that are horizontal (focused on boosting overall productivity across a company, with anyone able to use them) and those that are vertical (targeting specific roles). Horizontal companies make up 60% of the list, compared to 40% for vertical companies.

Within horizontal applications, the most well known names are the general LLM assistants – #1 OpenAI, #2 Anthropic, and #12 Perplexity, followed by #30 Merlin AI. We’re also seeing workspaces emerge where users can access LLMs in-context of their existing files – including #10 Notion and #33 Manus. The fact that several products in this category made the ranks indicates the race here is not won. We’ve either yet to see the emergence of a true winner, or this space will not be “winner takes all,” with users switching between different UIs (or models) depending on their needs.

Beyond general assistants, another major category of horizontal products was meeting support. These are primarily notetakers – #7 Fyxer (which also drafts email), #36 Happyscribe, #38 Plaude (manufacturer of a hardware pin), #41 Otter AI, and #49 Read AI. However, the category is also expanding with products like #26 Cluely, which offer real time, in-meeting feedback.

Two other application categories that we would argue are now horizontal? Creative tools and vibe coding! These previously would have been the domain of specific functions: marketing or design departments would have used creative tools, while engineering teams would have been drawn to vibe coding. However, AI has opened up applications in these categories that can be (and are) used by people in any role. We’re seeing this in a few categories, where typically domain-specific tools are becoming more horizontal.

Creative tools are represented by ten names on the list, ranking as the largest single category. The leader is all-in-one suite Freepik (#4), followed by text to speech generator ElevenLabs (#5). Image and video had the most applications in the ranks – with Canva, Photoroom, and Midjourney, and Descript, Opus Clip, and Capcut, respectively. But, avatars are also emerging with #47 Arcads (primarily used for advertisements), and #50 Tavus (multi-purpose).

2. Vertical applications can be augmentors – or substitutes.

There are two ways to think about vertical AI. On the one hand, it can supercharge human employees in their roles by reducing the most repetitive or mundane tasks, so that they can spend their time on higher-value work. On the other hand, it can reduce or remove the very need for human teams.

So far, we’re mostly seeing the former. Of the seventeen vertical application companies, 12 focus on supercharging humans – while five aim to serve as “AI employees” that complete workflows end-to-end. The latter includes #27 Crosby Legal (agentic law firm), #34 Cognition (AI engineer), #37 11x (automated GTM employees), #39 Serval (AI IT service desk), and #42 Alma (AI-powered immigration law services).

Nevertheless, we expect to see more end-to-end agentic products – and even AI-native services businesses – emerge. These are especially likely to be represented in the Mercury customer base, as new startups may not be locked into multi-year contracts with expensive providers like lawyers, accountants, etc. – and instead “hire AI”!

What about the most popular categories of vertical software? We determined a few representatives for each of three verticals:

- Customer service: Lorikeet (#8), Customer.io (#14), Ada (#40), Crisp (#46)

- Sales / GTM: Instantly (#13), Clay (#25), 11x (#37)

- Recruiting / HR: Micro1 (#9), Metaview (#19), Applaud (#43)

Furthermore, two companies belong into the broader “operations” bucket. These include Delve (#11, compliance automation) and Combinely (#29, accounting).

3. Vibe coding is no mere consumer trend – it has landed in workplaces.

One category that’s made a particularly strong enterprise transition is vibe coding. Four companies that target AI app building – whether for engineers or non-engineers – made our list: Replit, Cursor, Lovable, and Emergent. And beyond the two biggest model companies (OpenAI and Anthropic), the top product on the list was Replit (#3) – an agentic product development tool.

On our consumer top 100 list based on web traffic (not revenue), Lovable made it into the top quarter, while Replit found itself further down the list. This order was reversed in our enterprise list. While Lovable did make the list, Replit generated ~15x more revenue than Lovable from the Mercury customers we examined.

Why might that be? We have some theories. Whereas Lovable is more focused on rapid UI and component generation (and arguably provides a lower barrier to entry for pure consumers), Replit goes beyond front-end design by enabling the development of enterprise-grade, fully functional apps, agents, and automations. Its Agent can run autonomously for hours, and it also provides built-in cloud services like databases, authentication, and secure publishing directly within the platform. That combined with Replit’s enterprise controls means the feature set often makes more sense within companies.

We are interested in observing the vibe coding evolution over time. Will the space “fragment” through a rise of platforms for developing different types of applications? Or will the space start to converge, with one winner “taking most” – at least in the enterprise realm?

4. Products are moving from consumer -> prosumer -> enterprise.

The vast majority (nearly 70%) of companies on the list can be adopted by individuals and brought in to teams – they don’t require an enterprise license to use. In fact, 12 companies in the ranks also appeared on our most recent Consumer Top 100, which tracks traffic primarily for B2C AI products.

Of these, 11 companies started out as primarily individual products and have evolved to offer team or enterprise functionality over time. Moreover, several of them are still generating consumer-majority revenue (Cluely, #26, and Midjourney, #28, are two such examples). This is also true for many of the largest model companies, such as OpenAI: as of last October, 75% of revenue came from consumers, with recent estimates closer to a 50/50 split.

What’s happening here? We wrote about this trend in “The Great Expansion: A New Era of Consumer Software.” Thanks to AI, consumer products are more powerful than ever before while being able to serve enterprise use cases at the same time. Given the urgency around AI adoption to boost employee efficiency, these tools are also getting “pulled” into enterprise faster than ever before.

In contrast to prior eras of software, excelling at product-led-growth and moving upmarket has become a viable feat in the first year or two of a company’s life. In future editions of this enterprise list, we expect to see ever more companies that start consumer-first – so keep your eyes out!

*Mercury is a financial technology company, not a bank. Business banking services provided through Choice Financial Group, Column N.A., and Evolve Bank & Trust; Members FDIC. Personal banking services provided through Choice Financial Group; Member FDIC. The IO Card is issued by Patriot Bank, Member FDIC, pursuant to a license from Mastercard®.

-

Olivia Moore is a partner on the investing team at Andreessen Horowitz, where she focuses on AI.

-

Marc Andrusko is a partner at Andreessen Horowitz, where he focuses on B2B AI applications and fintech.

-

Seema Amble is a partner at Andreessen Horowitz, where she focuses on investments in B2B software and fintech.