This is the fifth edition of our Top 100 Gen AI Consumer Apps which reflects two and a half years of data on how everyday AI usage is evolving.

This is the fifth edition of our Top 100 Gen AI Consumer Apps which reflects two and a half years of data on how everyday AI usage is evolving.

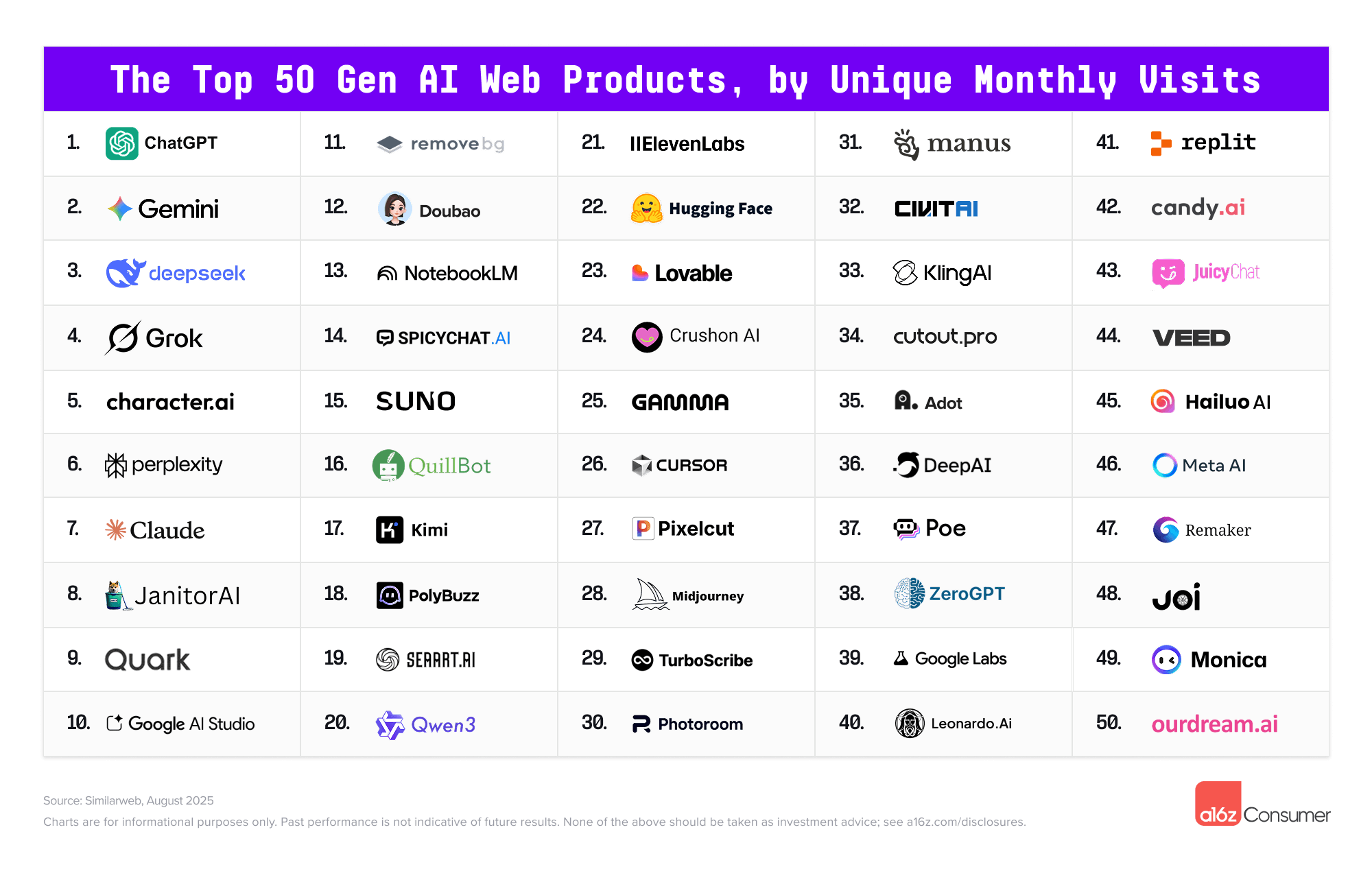

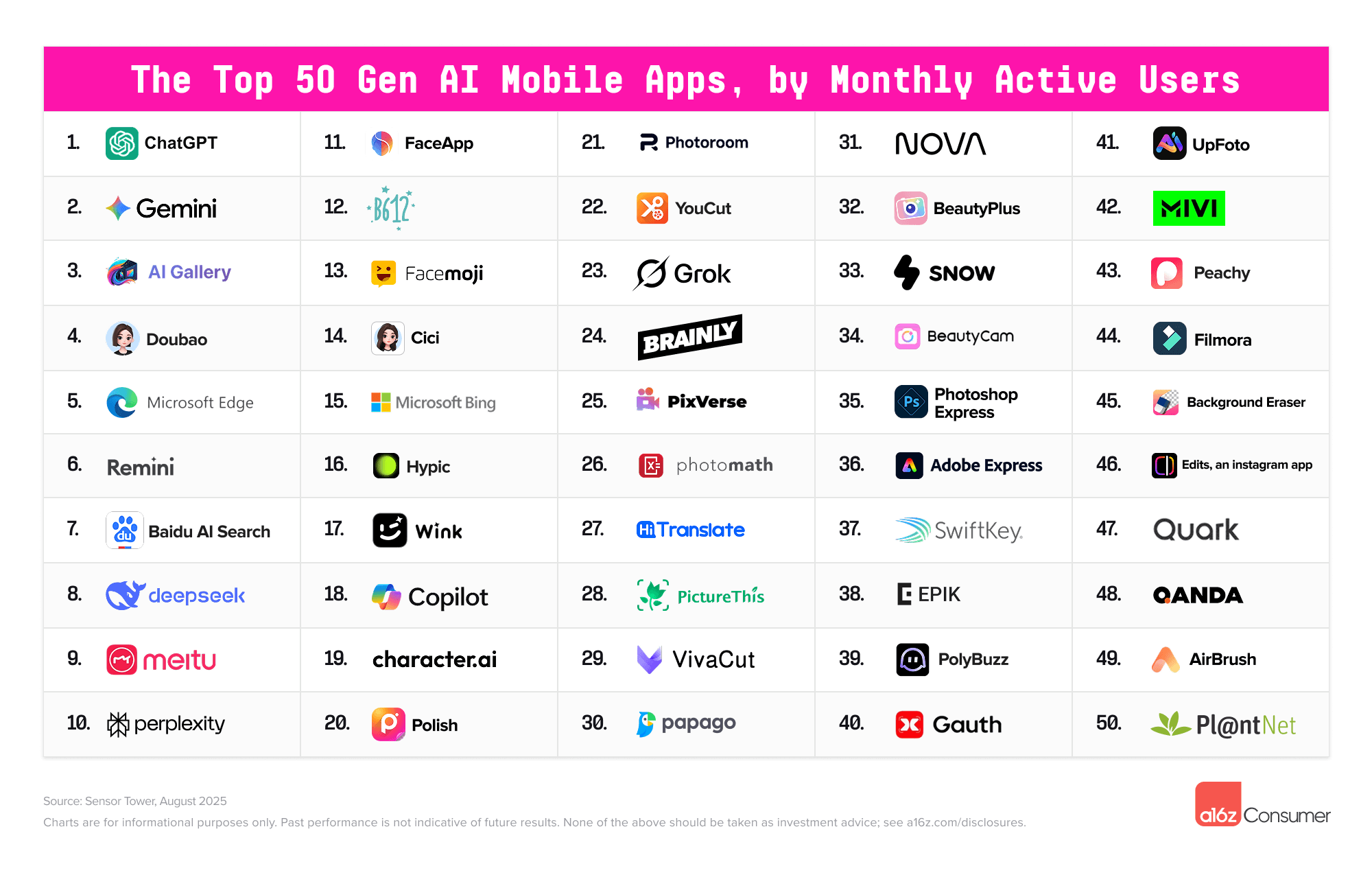

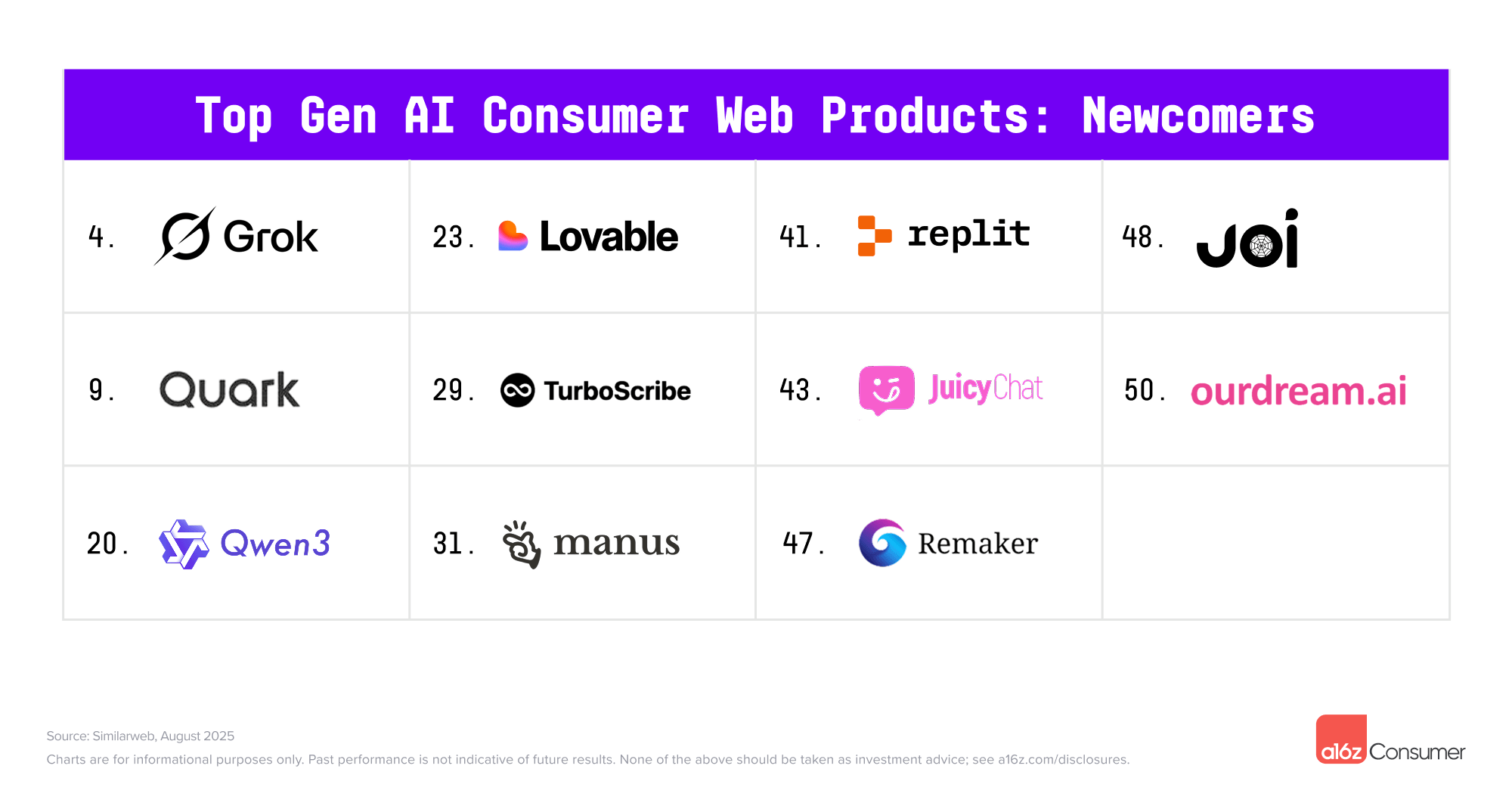

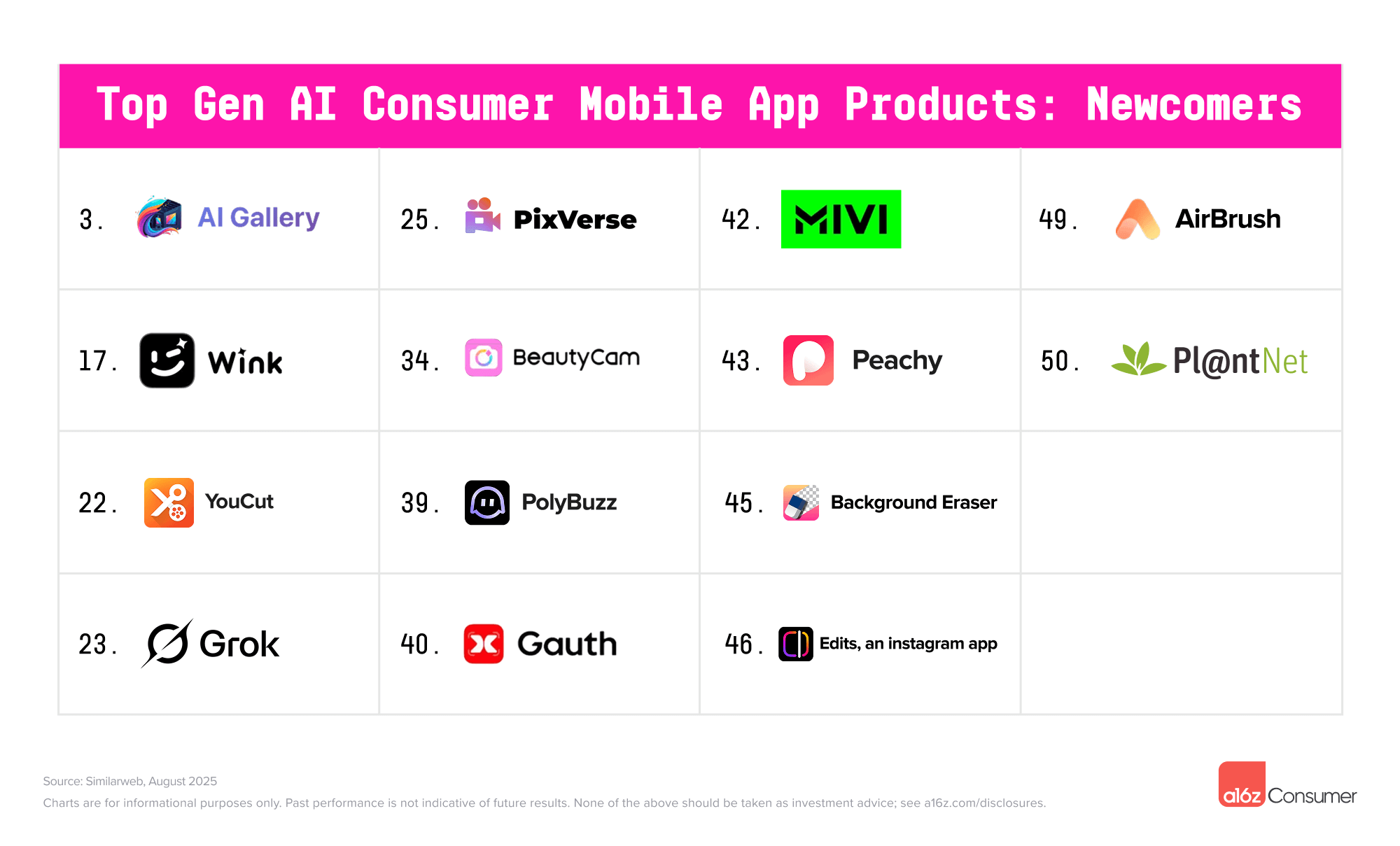

The biggest takeaway from this edition of the list? The ecosystem is starting to stabilize, with 11 new names on the web list driven by traffic increases.* This compares with 17 newcomers in our March 2025 ranking. The mobile list has significantly more newcomers (14), as the App Stores have cracked down on “ChatGPT copycats”—opening up room for more original mobile apps.

*Note – Google has four new products on the list as they have further separated the domains, allowing us to track their AI initiatives individually for the first time! This yields 15 newcomers in total, but these four would have ranked on prior lists if they had been measurable.

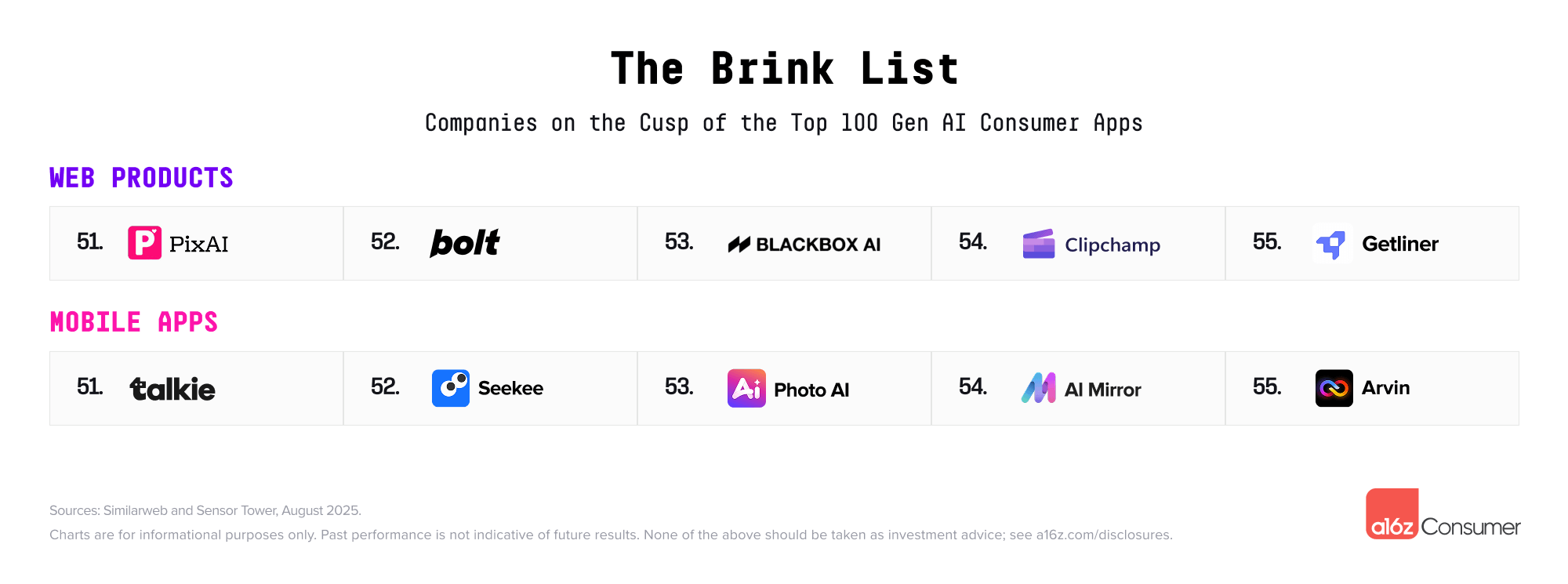

For the second time, we’re also publishing the “Brink List”: the next 10 companies (five on web, five on mobile) that just missed the cut-off. From last edition’s web Brink List, one company moved into the top 100—Lovable, jumping to an impressive #22 in the rankings! This jump highlights the broader rise of AI-powered app generation.

From the last mobile Brink List, two companies—PolyBuzz and Pixverse—moved into the core rankings.

A methodology note: the lists are a ranking of the top 50 AI-first web products (by unique monthly visits, per Similarweb) and top 50 AI-first mobile apps (by monthly active users, per Sensor Tower). Products that have added significant generative AI features but are not AI-native, such as Canva and Notion, are not included here.

Here are some of our other top takeaways:

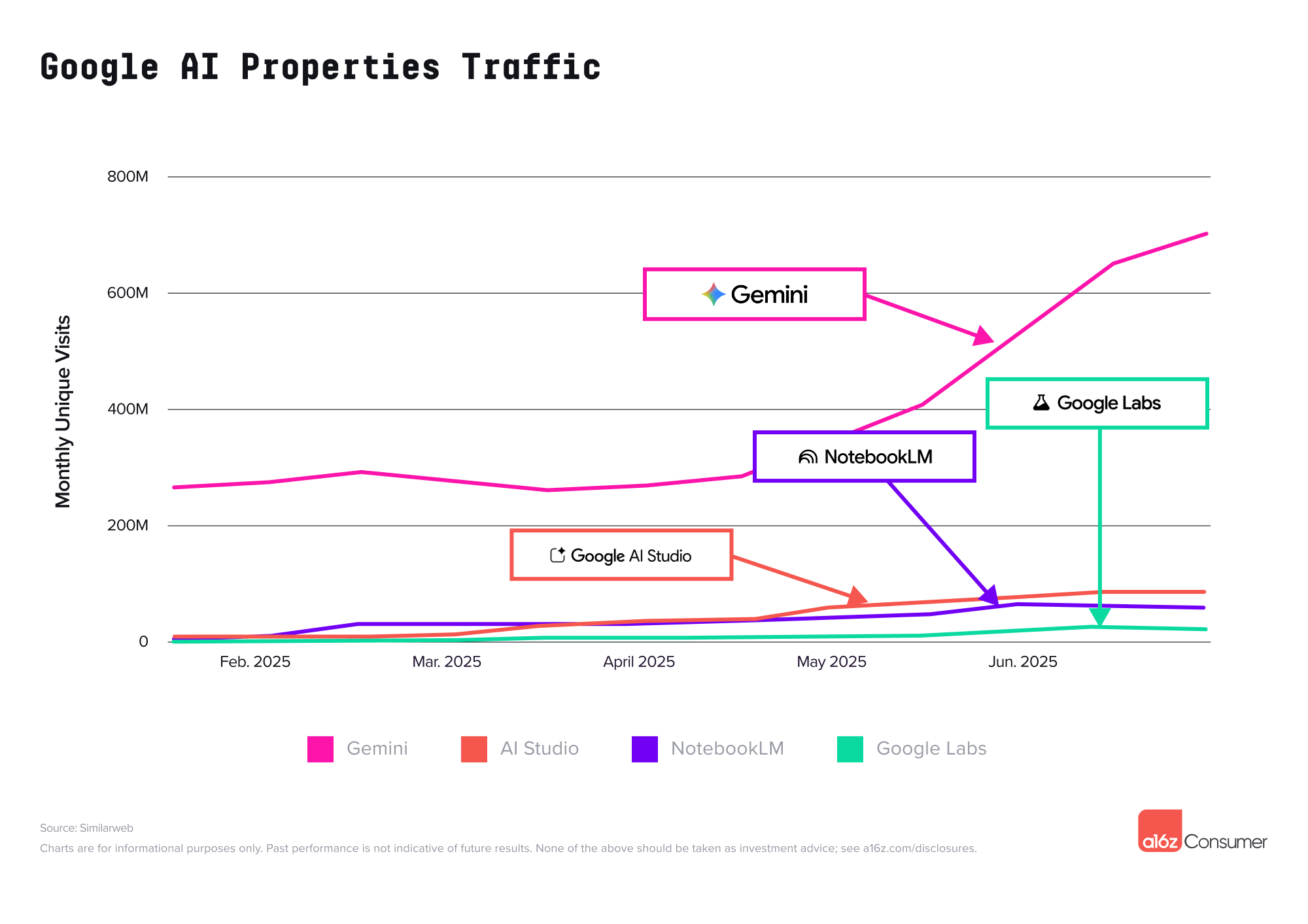

Google saw four entrants on the web list—for the first time, we are able to rank their traffic and include them each independently. The company’s general LLM assistant, Gemini, came in second place behind ChatGPT, with approximately 12% of ChatGPT’s visits on web.

What other Google products made the list? AI Studio debuted in the top 10. The site, which is developer-oriented, hosts a sandbox to start building with Gemini models, including multimodal models (ex. talk and stream with Gemini Live).

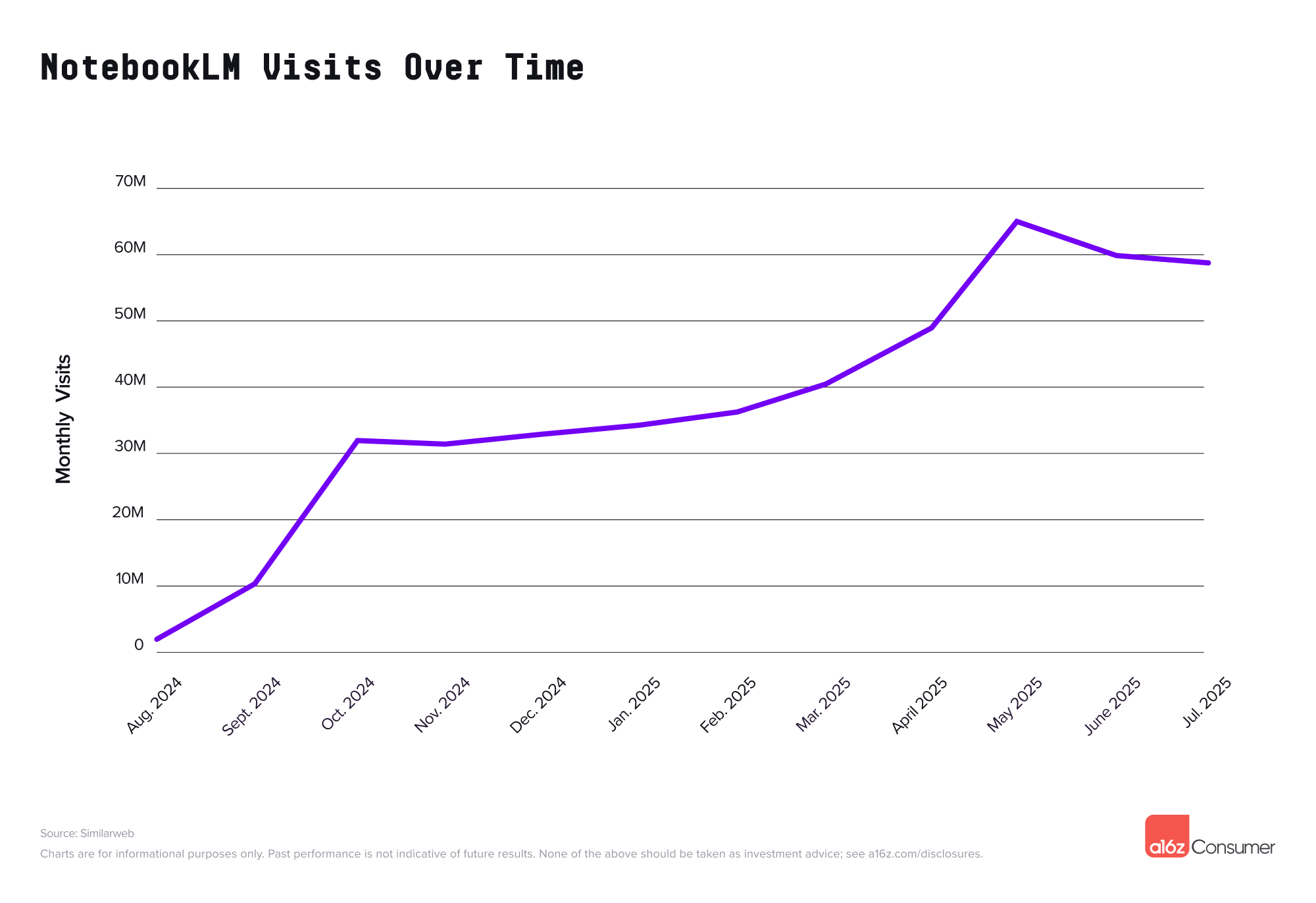

AI Studio was followed by NotebookLM at #13, now hosted as an independent website after debuting as part of Google Labs. NotebookLM first went viral nearly a year ago and has grown steadily since, with only a slight dip over the summer (likely when academic users temporarily churn).

Google Labs, the consumer-facing home for AI experiments at Google, came in at #39 on the list. Labs hosts Flow, where users can try video model Veo 3, as well as a variety of other apps, including Doppl (clothing try-on), Portraits (AI coaches), and Project Mariner (agentic browser). Google Labs’s traffic spiked more than 13% following Veo 3’s launch in May 2025, its largest one-month climb over the past year.

On mobile, Gemini ranks #2 behind ChatGPT – but by a much narrower margin, with nearly half as many monthly active users (MAUs). Gemini sees particularly strong usage on Android devices, with nearly 90% of their MAU base represented here, compared to 60% of users on Android for ChatGPT.

In the battle of the general LLM assistants, ChatGPT still leads, but Google, Grok, and Meta are narrowing the gap.

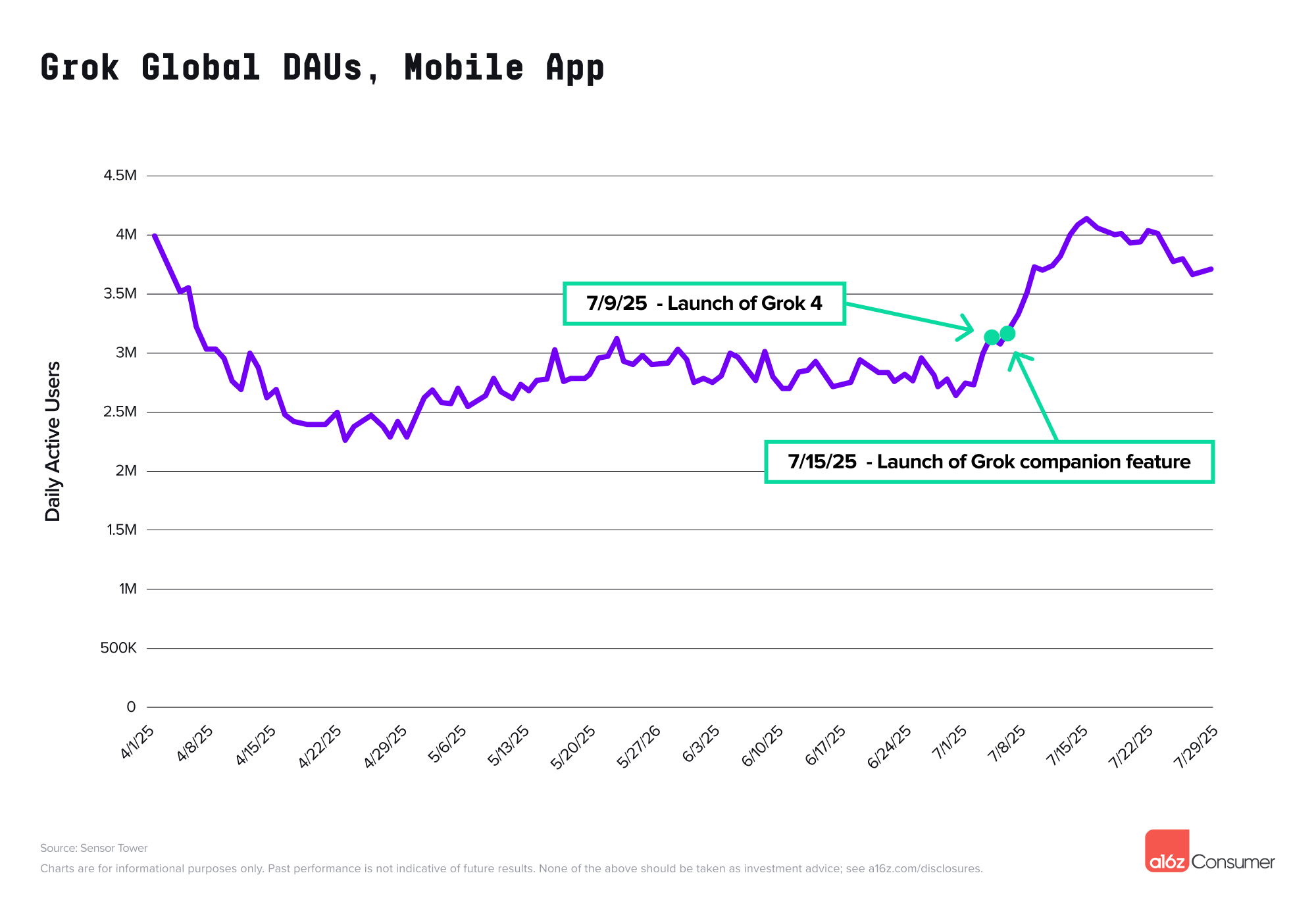

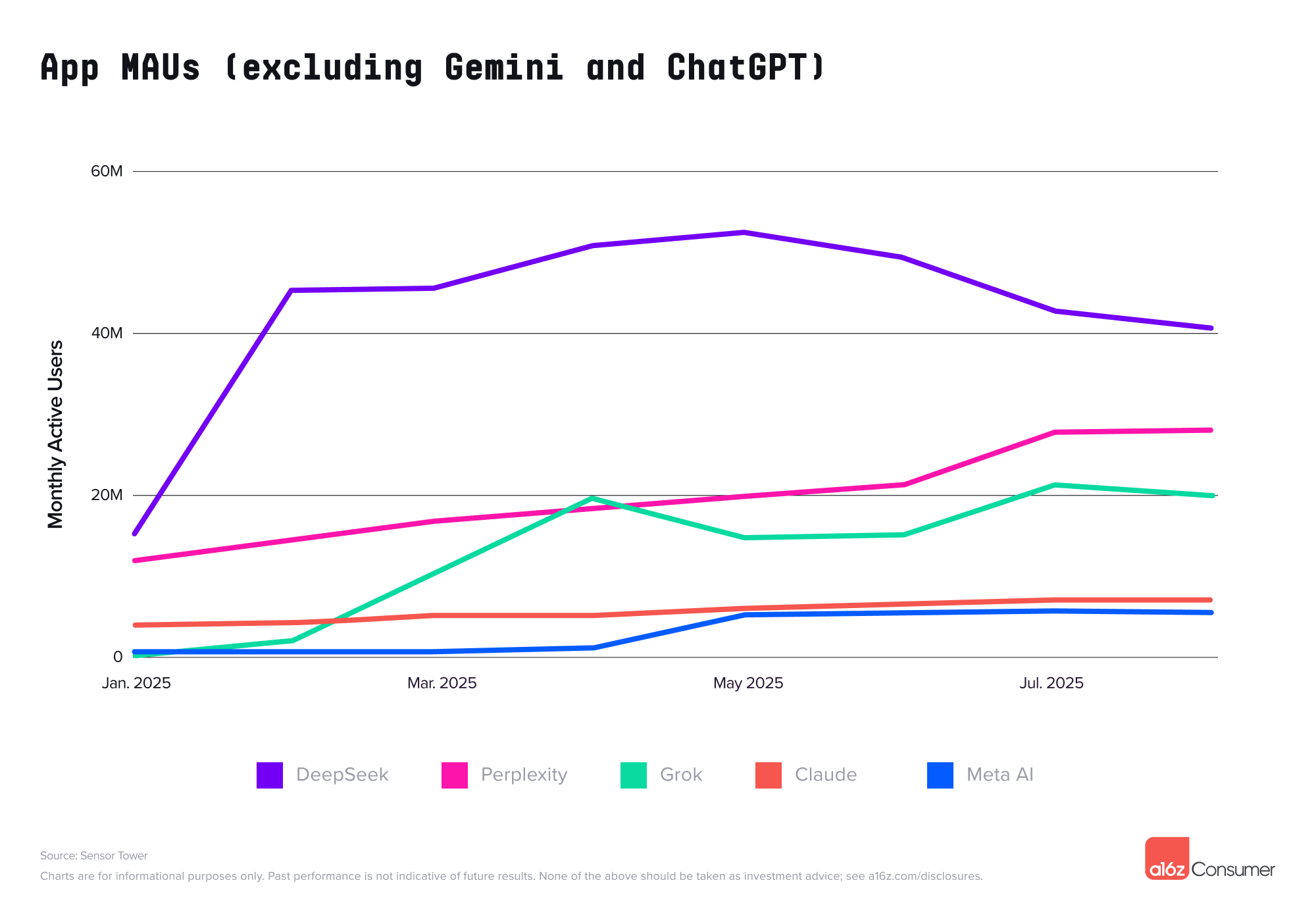

X’s (formerly Twitter) assistant Grok ranked fourth on web and #23 on mobile. The company’s jump on mobile has been particularly striking, going from a “cold start” with no app at the end of 2024 to upwards of 20M monthly active users now.

Grok saw a particularly large bump in mobile usage in July 2025, climbing nearly 40% with the release of new model Grok 4 (with superior reasoning, real-time search, and tool integration) on July 9. This was followed by the introduction of AI companion avatars on July 14. At launch, anime avatar Ani (which includes NSFW options) was particularly popular.

Meta has seen more muted growth (thus far) for its efforts. General assistant Meta AI ranked #46 on web, and missed the cutoff for the mobile list. Meta AI debuted in late May 2025 but saw a much slower ramp than Grok, especially after a June 2025 incident when users realized some posts were appearing on a public feed.

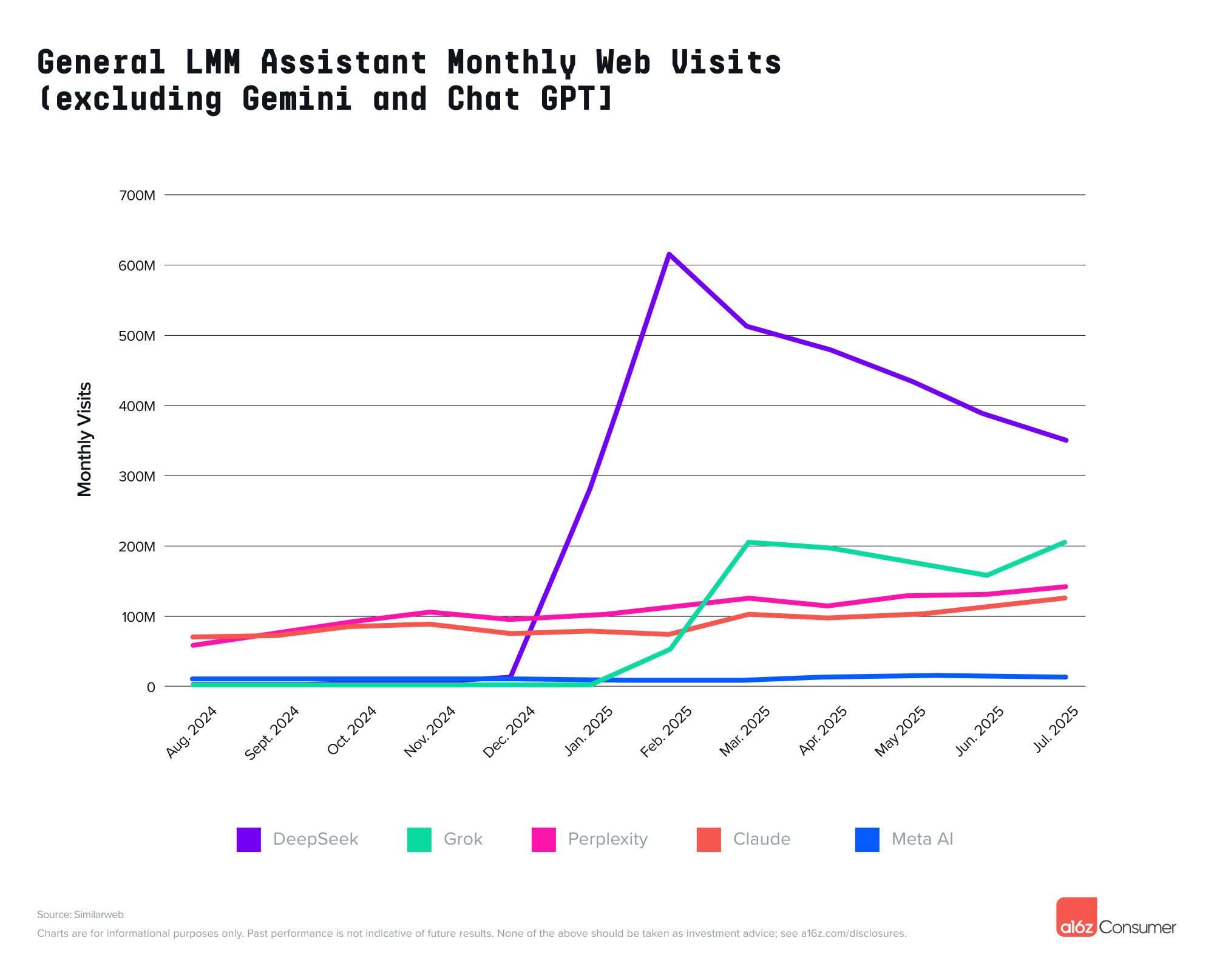

Elsewhere in the general LLM assistant battle, DeepSeek and Claude have both significantly flattened on mobile, with DeepSeek falling off its peak by 22%. Perplexity has continued to show strong growth alongside Grok.

On web, DeepSeek saw an even more dramatic dropoff, down more than 40% from its peak in February 2025, while Perplexity and Claude have continued to grow.

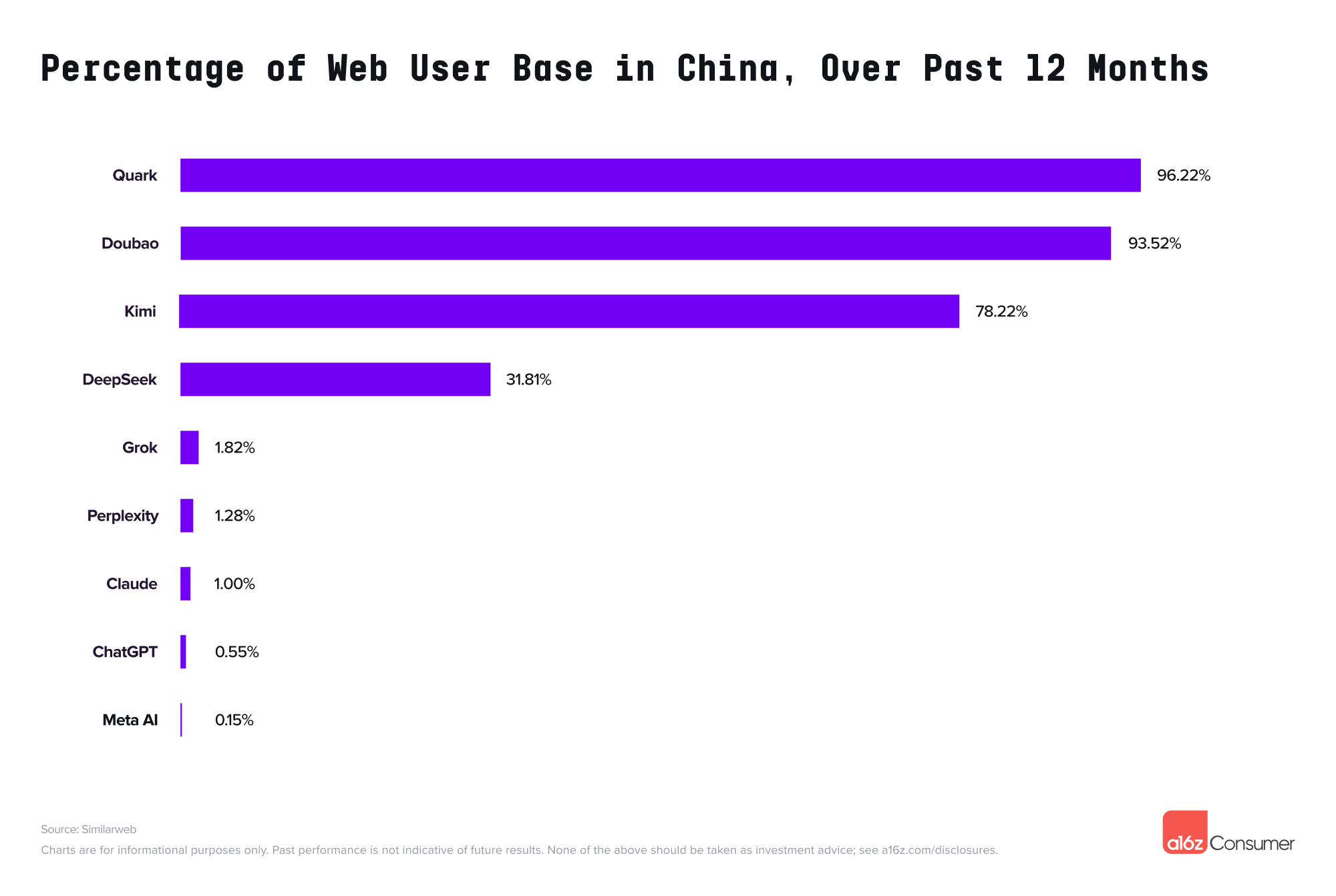

On the web list, three companies that primarily serve users in China rank in the top 20. Each has a Chinese-language website and more than 75% of its traffic coming from China. This includes #9 Quark, Alibaba’s “all-in-one” AI assistant (which also ranks #47 on the mobile list), #12 Doubao, Bytedance’s general LLM product (ranked #4 on mobile), and #17 Kimi, a chatbot from startup Moonshot AI.

Why are these products appearing on the list? China is the world’s largest country, and direct access to many non-Chinese developed general LLM assistants—such as ChatGPT, Perplexity, and Claude—is either blocked or limited. AI providers that want to operate in China have to register and obtain a license, which requires hosting data onshore and complying with censorship and content moderation rules.

Some users still access unregistered products via VPNs, or are able to access products from within China via corporate or academic network gateways—which is why traffic for products like ChatGPT in China is non-zero.

A significant percentage of the web list was also developed in China, and now “exported” globally—with the vast majority of usage in other countries. Some of these tools are even blocked in China. Public data suggests seven additional companies fit this criteria—including Deepseek, Hailuo and Kling (video generation models), SeaArt (image generation), Cutout Pro (image editing), and Manus and Monica (prosumer / productivity).

Chinese video models, in particular, have tended to have an advantage over Western-developed models—both because there are more researchers focused on video in China, and there are fewer IP regulations (with likely training on copyrighted data). Veo 3 was the first U.S. model to break this trend, which is partially trained on YouTube data.

This trend is even more striking in the mobile ranks. An estimated 22 of the 50 apps were developed in China, while only three are primarily used in China. There is particularly heavy concentration in the photo and video category, as Meitu alone produced five entries: Photo & Video Editor, BeautyPlus, BeautyCam, Wink, and Airbrush. Bytedance is also a significant player, producing Doubao and Cici (general LLM assistant), Gauth (edtech), and Hypic (photo / video editing).

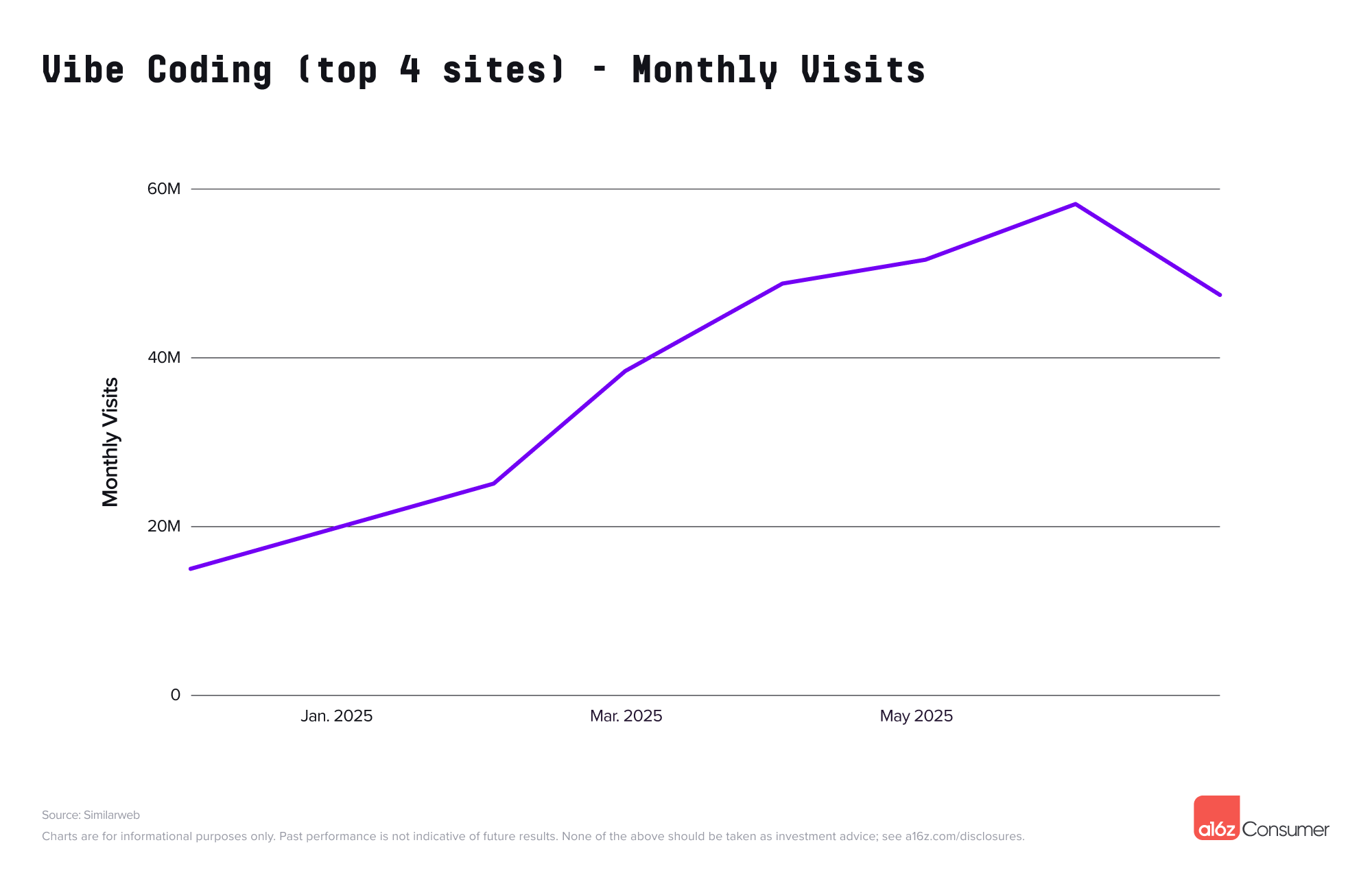

In our last ranking in March 2025, vibe coding had just begun to emerge—with only Bolt on the web list. Now, Bolt is on the Brink List (just missing the cut!), while Lovable and Replit both debuted on the main list.

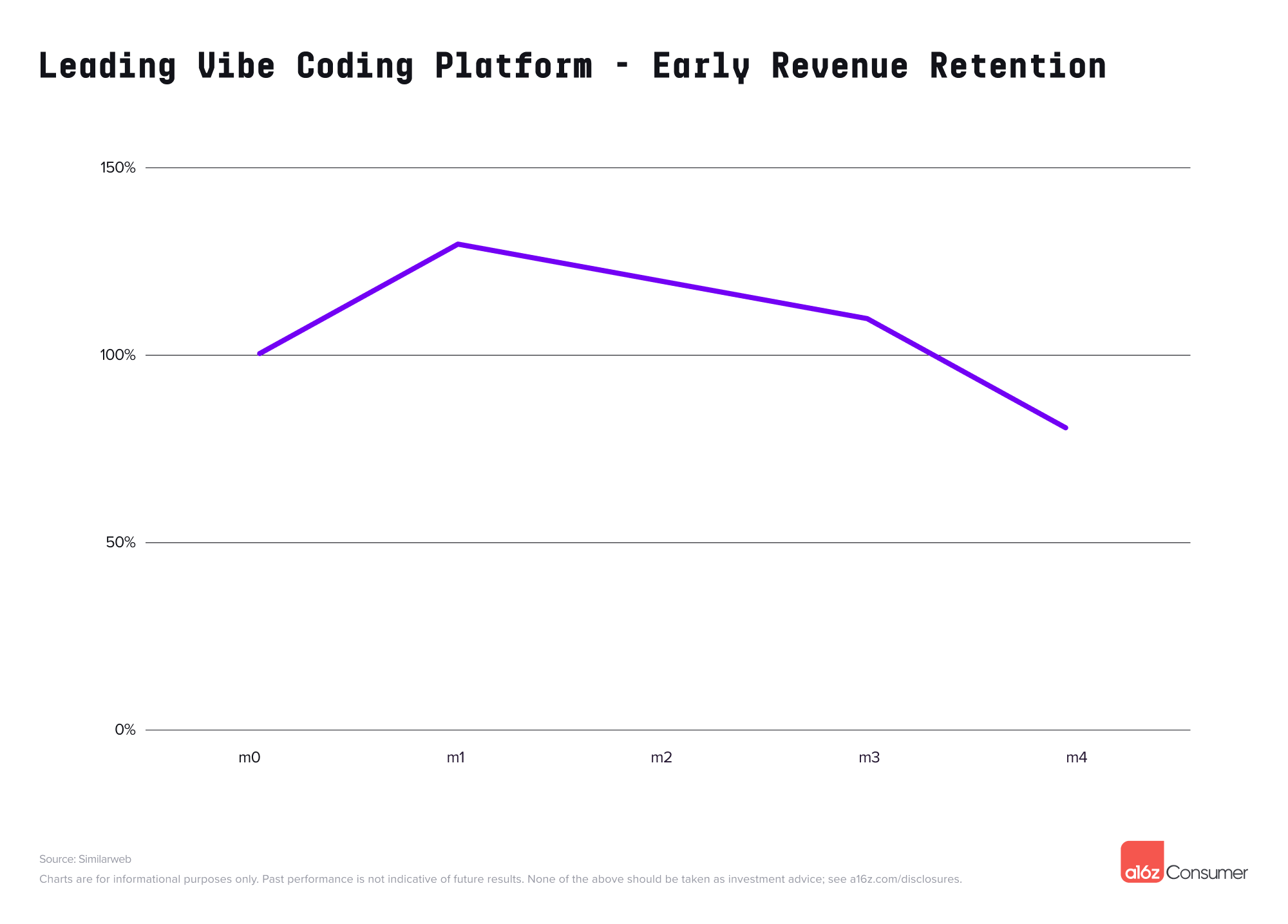

While vibe coding usage may seem transitory, early data reveals that these users stick around—or, at least enough of them do and expand their usage over time. Data from credit card panel provider Consumer Edge shows cohorts for U.S. based users of one top vibe coding platform see revenue retention upwards of 100% for several months post-signup. This means that including users who churn, cohorts are growing overall spend on a monthly basis.

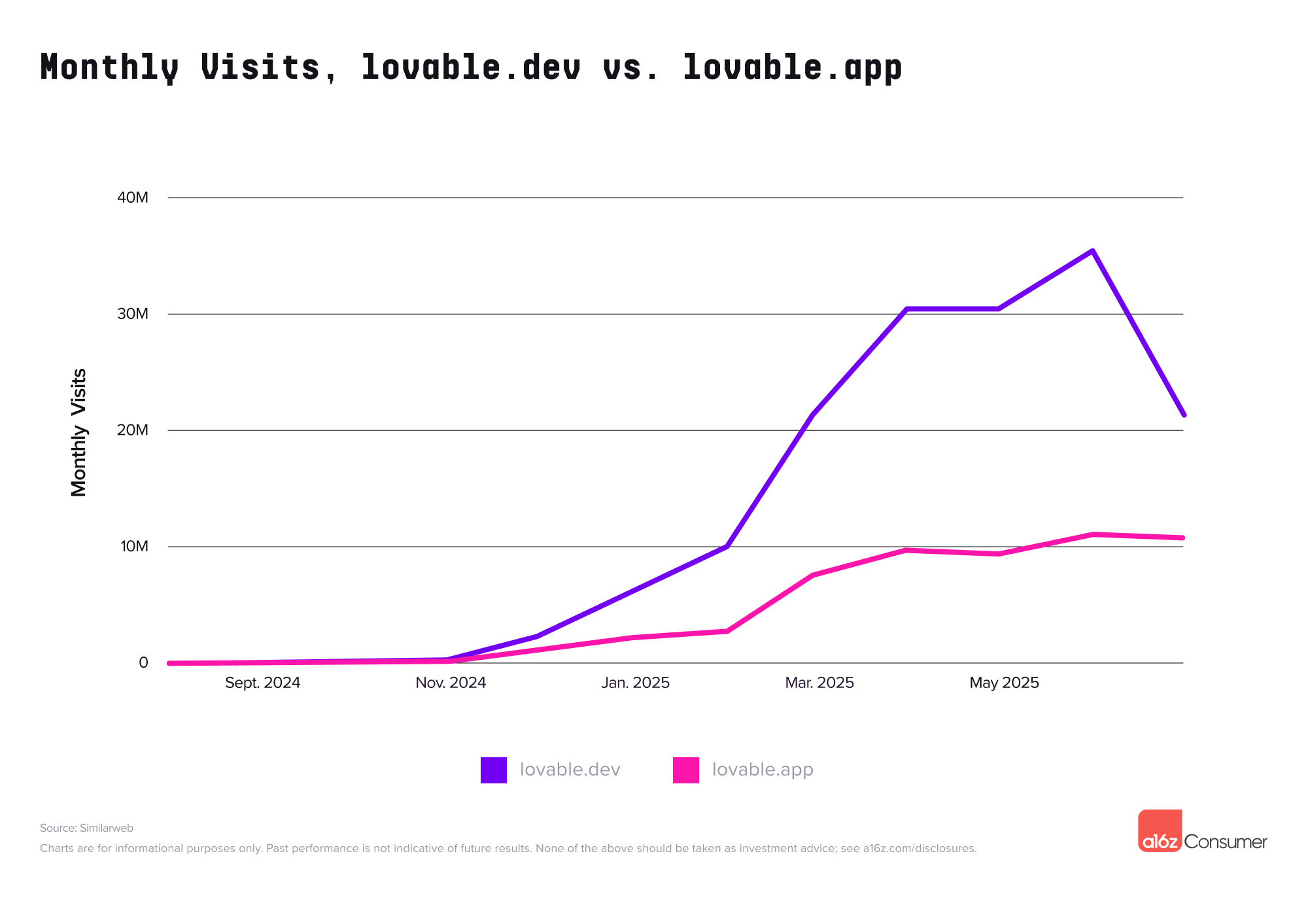

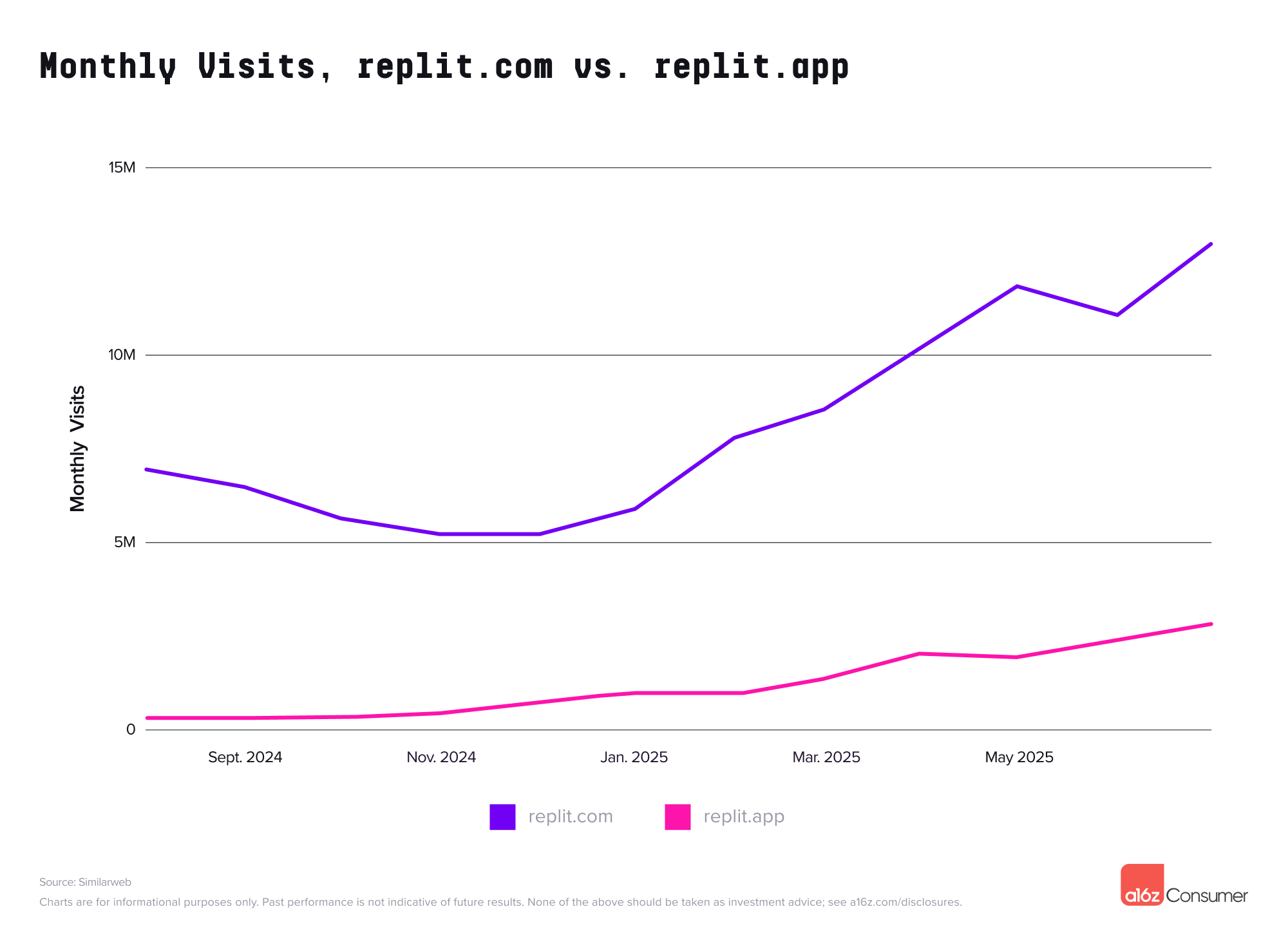

These platforms are also driving usage to other AI products. Sites built and published via Replit and via Lovable (without custom domains) appear under traffic for replit.app and lovable.app, respectively. Both have significant traffic of their own (traffic to lovable.app would have ranked in the top 50 of the list), but less traffic than their builder-face sites.

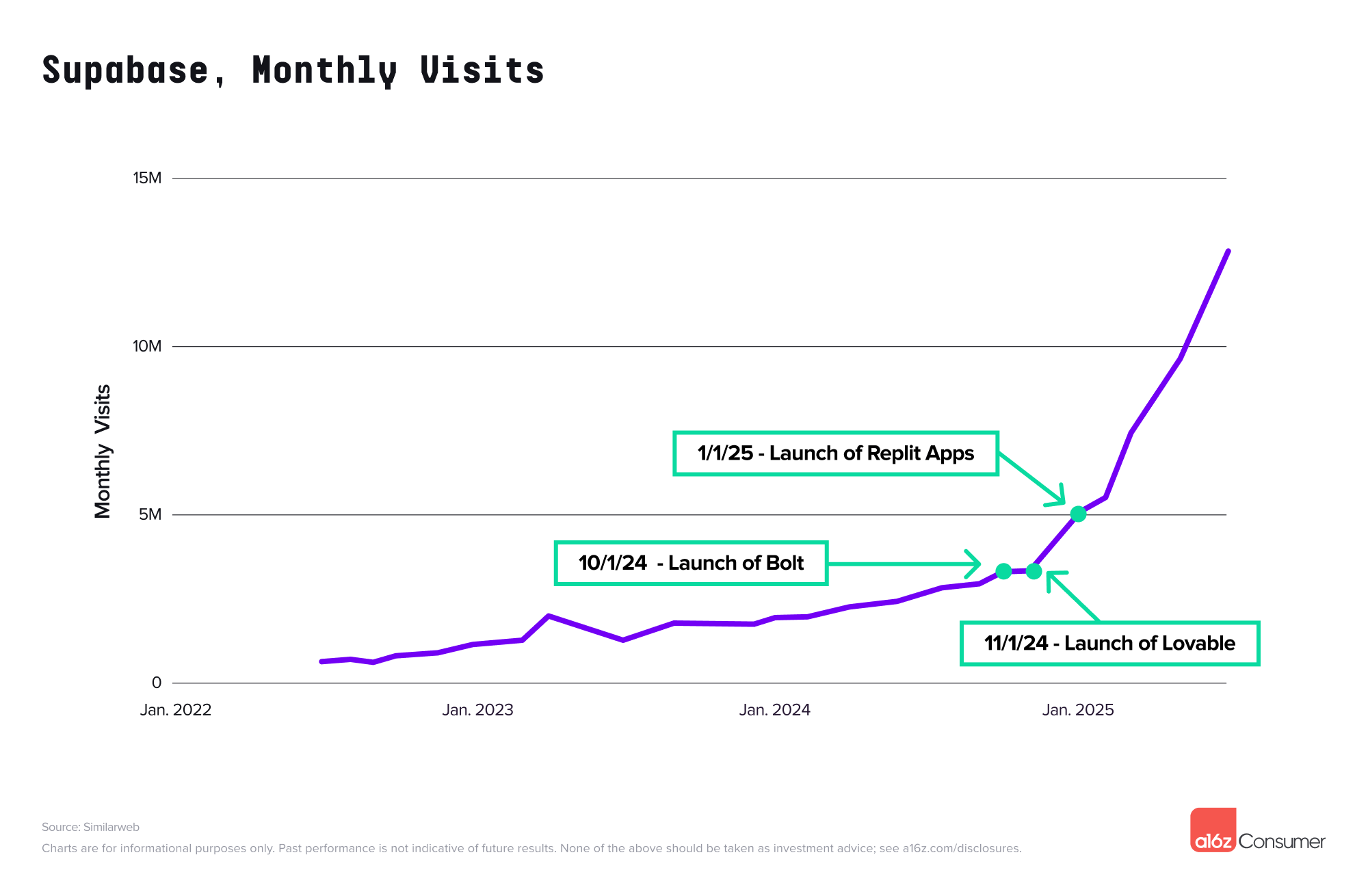

Products that are part of the “vibe coding stack” are also seeing jumps in traffic, as vibe coders adopt them to push their projects live. These are not eligible for the list (as they are not AI-native companies themselves)—the canonical example is Supabase, a database provider. Supabase’s traffic has been in near-lockstep with the rise of core vibe coding platforms, with a significant acceleration over the past nine months as compared to the years prior.

We see real room left for growth and new products within vibe coding—for more, read Batteries Included, Opinions Required: The Specialization of App Gen Platforms.

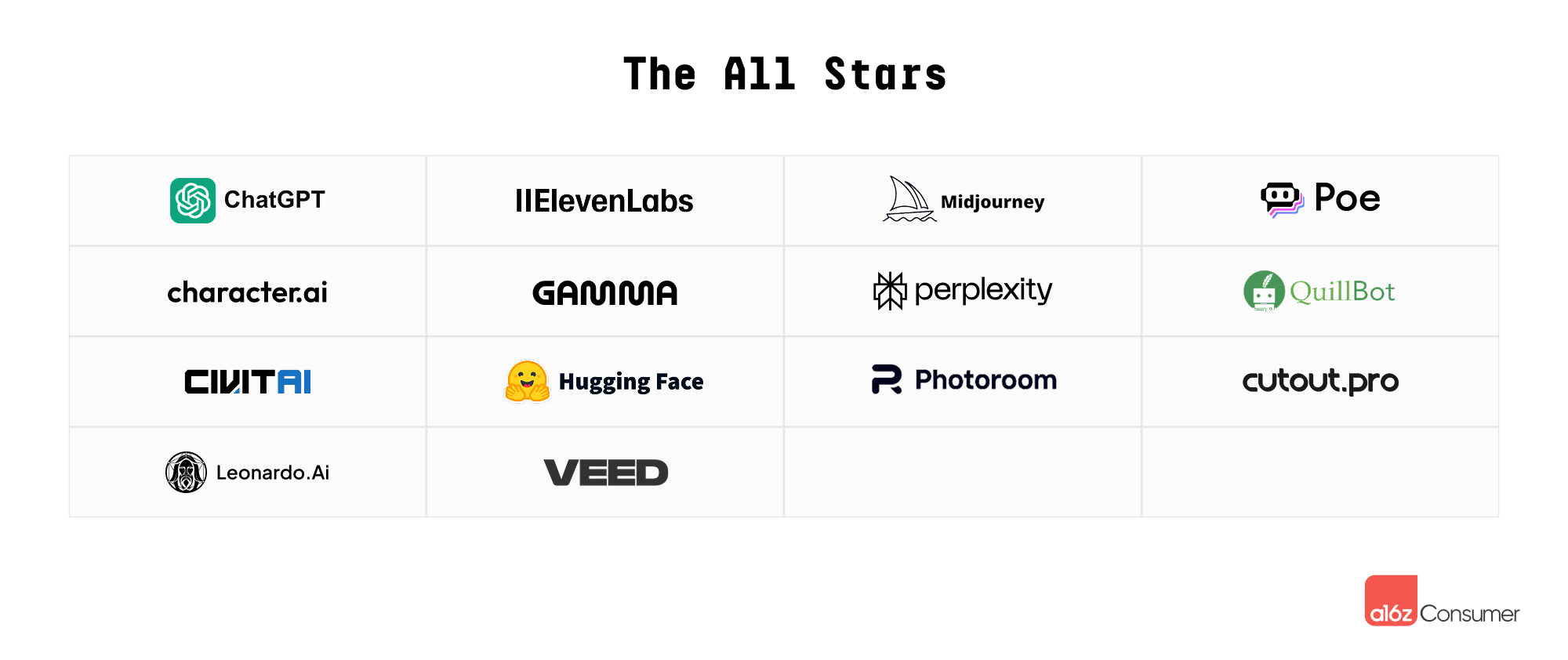

In our five iterations of the web top 50, fourteen companies have appeared every time – we call them the “All Stars”!!

These companies represent a true cross section of consumer behavior with AI—general assistance (ChatGPT, Perplexity, Poe); companionship (Character AI); image generation (Midjourney, Leonardo); image and video editing (Veed, Cutout); voice generation (Eleven Labs); productivity tools (Photoroom, Gamma, Quillbot); and model hosting (Civitai, HuggingFace).

In our first list (published almost two years ago!), we wondered whether all leading AI consumer companies would train their own foundation models. Now, we have an answer—of the fourteen All Stars, five have proprietary models, while seven utilize API-available or open source models from other companies, and two are model aggregators.

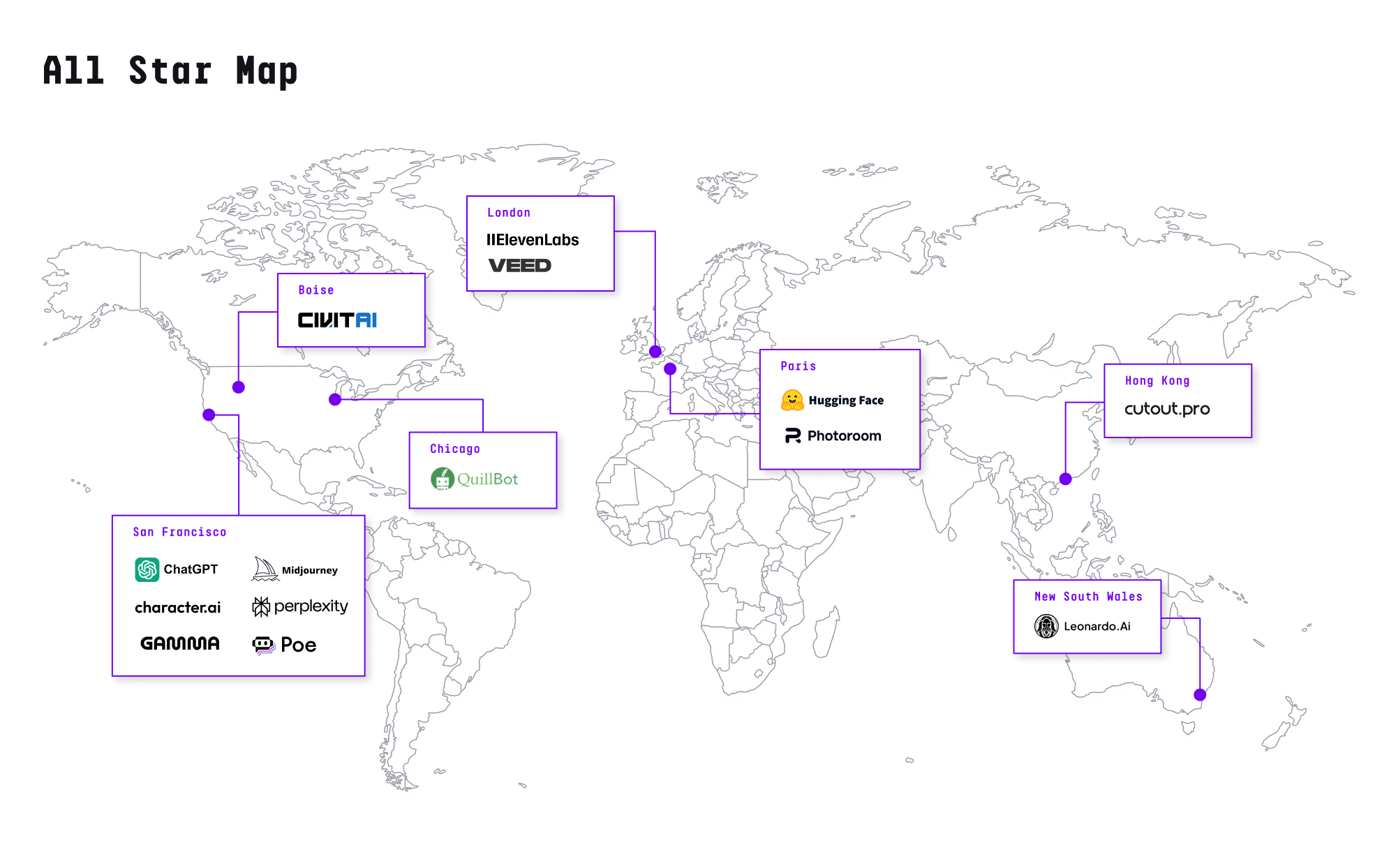

Interestingly, despite the list’s increasingly global scope, all fourteen consistent listmakers come from just five countries: the U.S., the UK (Eleven Labs, Veed), Australia (Leonardo); China (Cutout Pro); and France (Photoroom, HuggingFace). And, all but two have now raised venture funding—Midjourney is famously bootstrapped, and Cutout Pro has also not fundraised.

Excluding the very first list, an additional five companies would make the cut—reflecting their recent momentum. These similarly represent a variety of AI consumer applications, including: Claude and DeepAI (general assistance), JanitorAI (companionship), Pixelcut (image editing), and Suno (music generation).

We’ll be tracking which All Stars persist, and which new ones emerge, in the next five editions.