There’s been a lot of discussion lately (see for example this, this, this, this, and this) about what happens when founders who don’t have “muscle memory” — from having been through a down market — meet a market where capital is so readily available.

We thought it would be worth sharing more of what we tell our founders about how to think more strategically and take a long-term perspective when raising (and budgeting) capital. And while we go into some detail below, our advice to founders is actually very simple: Whenever you’re raising capital, think about constructing the round in such a way that you’re strongly positioned for the future. This means raise enough money to put the company in a strong position to achieve the necessary operational and financial milestones and maximize the probability of raising future capital — even if you don’t think you’ll need to.

Because building a company is hard. To quote serial entrepreneur Danny Shader from a recent a16z podcast on valuations: “If you’re doing something ambitious… where you know you’re going to consume a reasonable amount of capital on the way there, you want to make sure you’ve got access to capital the whole path.” As clichéd as it seems, it’s a marathon, not a sprint.

But first: Why is capital so readily available right now?

Besides larger factors at play, some of the reasons capital is so readily available right now is due to the following trends coming together at once:

1. For various reasons, companies are taking longer to transition to the public markets. Most of the growth and subsequent investment returns are also now being realized in the private (vs. the public) markets.

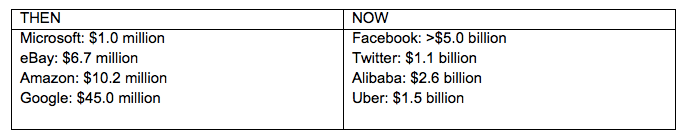

2. As companies stay private longer, the dollars raised per company has sharply risen — see below chart — which has created a perceived if not actual funding gap in the private market.

[The total private funding raised by companies in the 2000s is in the billions (compared to millions for companies in the 1990s). While the numbers above reflect aggregate funding, single funding rounds have also often exceeded $1 billion. sources: Capital IQ, Pitchbook, company filings]

3. The funding gap is now being filled by new market entrants or existing players assuming a larger role — including corporate investors and sovereign wealth funds — as well as traditional public market investors such as hedge funds, mutual funds, and private equity funds.

How to think about valuation and deal structure

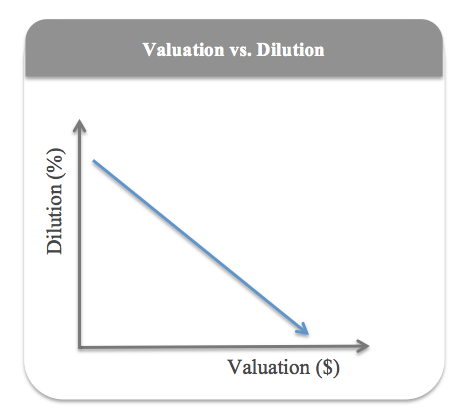

The easiest way to think about valuation is the tradeoff it provides relative to dilution: As valuation goes up, dilution goes down. This is obviously a good thing for founders and other existing investors.

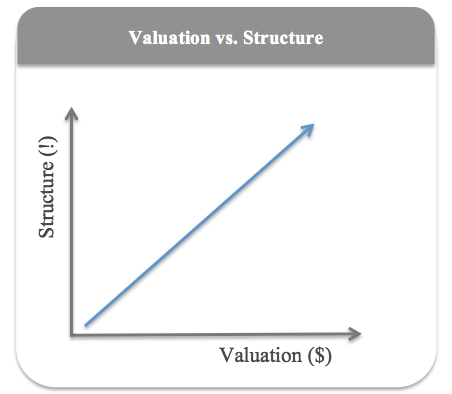

However, for some startups there’s an added wrinkle; they may face an additional tradeoff, of valuation versus “structure”. Which reminds us of the old adage that You set the price, I’ll set the terms.

What is structure? Think of it as terms and conditions that appear in a term sheet below the headline valuation number.

All venture capital deals have some sort of structure. The question is what happens when those terms get more complicated, and what implications those terms have in the future (in both good times and bad).

In some situations, the goal of additional structure is to preserve or achieve a high valuation by altering the traditional risk/reward profile for both the investors and early shareholders. Some examples of more structural terms include:

Multiple liquidation preferences, where preferred investors can realize a return of multiple times of their investment (i.e. 1.5x or 2.0x) upon liquidation (rather than the traditional 1.0x) prior to common stock receiving any consideration;

Senior liquidation preferences, where new preferred investors receive a return of their capital prior to earlier preferred investors (rather than “pari passu” with earlier investors);

Participating preferred, where preferred investors can realize both a return of their capital while also participating in the upside after their capital is returned as part of the preference;

Full or partial ratchet, where preferred investors will reset the price of their shares (by receiving more shares) if any subsequent financing round is completed at any price below their investment valuation; and

Redemption provision, where preferred investors have the right to force the company to buyback their investment on demand.

There are multiple flavors of each of the above, and other forms of structure as well. (The opposite of structure, by the way, is a “clean” term sheet where investors take on more equity risk and have less protection if the company fails, but get to fully participate in the returns — along with the founder and startup employees — if the company does well.)

What to optimize for when raising capital

Besides valuation and structure, there are many other things to consider when raising capital. As our founders evaluate the tradeoffs, a simple framework breaks the decision down into two primary categories: deal and source.

Deal includes all of the key components and terms of the proposed deal. Some of these you can quantify — such as valuation, dollars raised, and option pool refresh. Other components may include items that are difficult to quantify because they depend on an uncertain future, such as the structural terms discussed above.

Source includes the key components related to the provider of the capital. For example, firm resources, reputation, and precedents; partner experience, chemistry; available reserves in the fund, and so on.

So what should founders optimize for when raising capital?

Because each company and every stage is different, different founders face a different set of circumstances and challenges. They should therefore choose to optimize for different things. The challenge is that not all the available criteria are quantifiable or objective. In fact, some of the most important criteria, such as boardroom chemistry, may be very subjective.

Some founders may feel tempted to aim for the highest short-term valuation, and that may be the optimal strategy in some situations. However, in other situations, founders may have to prioritize other considerations — such as choosing a partner with a very specific and highly relevant skill set that can help the company execute on their strategy.

Ultimately, the key is to optimize for the full relationship over time by focusing on partners whose goals are aligned with the founder’s and whose investment will enable the startup to realize — not hinder — its potential.

This decision is especially important for younger companies still in the formative stages. Why? Because having a high valuation hurdle too early, restrictive terms imposed by investors, or a problematic deal structure can inhibit the ability to raise more money just when you need it the most.

Furthermore, terms agreed to in an earlier financing round tend to become the starting point for the terms negotiation in the next financing round; subsequent investors will naturally want at least the same terms. Disregarding deal structure at the early stages (Series A, B, and even C rounds) also creates complexity in the cap table or “who owns what”.

If everything goes well, then the downside of more structure is limited: The company grows into a successful behemoth and everyone, from the founder to startup employees to investors, wins.

The question is what happens when things don’t go according to plan or take much longer than expected: Someone else releases a competitive product, an incumbent decides to enter the space, launch is delayed, key hires leave the company, etc. Things can also change course for very good reasons: We want to GO BIG; growth was faster than expected; early customer traction was great; we have the opportunity to hire some really awesome folks that will position us well for the long term; etc. (In that sense, spending capital isn’t a bad thing; as we’ve argued before, today’s startups have a chance to be a lot bigger due to potentially larger end-user markets.)

Regardless of whether it’s for unexpected or planned, good reasons, the company will need to raise more money regardless of market conditions. This is where getting the right valuation, with the right set of terms, and with the right capital provider really matters.

How should founders go about all this?

The key is to run an organized fundraising process that’s aimed at creating competition.

If investors compete, founders are more likely to get the best set of terms and have a better set of alternatives from which to choose: They have all the leverage in the negotiation. The tradeoff that founders need to balance is that time spent away from the business while fundraising can have significant negative impacts on that business. Founders therefore need to strike a balance of targeting a broad enough group of capital providers to create competition while focusing on a group of capital providers that are highly likely to transact, so time isn’t wasted.

Founders should foster competition amongst potential investors to ensure the best terms — not just the best valuation — because potential investors will compete against each other to win a deal by offering either a higher valuation, or more company-favorable terms … or both. (By the way, savvy investors also want to avoid competition, and will price and structure deals competitively from the outset to avoid founders having to seek better offers).

Note, once the company signs a term sheet and all other potential investors fall away, the leverage flips from the company to the investor. Not completing or renegotiating the deal at this point could put the entrepreneur at a disadvantage: Those who were previously interested may assume the deal wasn’t done because something negative was discovered during due diligence.

* * *

As our managing partner Scott Kupor noted recently in The Wall Street Journal, entrepreneurs — by definition — are risk takers. They should be optimistic about the prospects for their businesses … or they wouldn’t make it through the struggles that building a company entails.

But a small amount of planning can go a long way toward ensuring your business can sustain a down cycle. So be thoughtful about what tradeoffs you’re making, and when.