The product/market fit (PMF) concept was developed and named by Andy Rachleff. The core of Rachleff’s idea for PMF was based on his analysis of the investing style of the pioneering venture capitalist and Sequoia founder Don Valentine.

Why Market Matters More Than Anything

#1 “Give me a giant market — always.” “Arthur Rock is the representative of: you find a great entrepreneur and you back him. My position has always been: you find a great market and you build multiple companies in that market.” “Our view has always, preferably, been: give us a technical problem, give us a big market when that technical problem is solved so we can sell lots and lots and lots of stuff. Do I like to do that with terrific people? Sure. Are we unwilling to invest in companies that don’t have them? Sure. We invested in Apple when Steve Jobs was about eighteen or nineteen years old — not only didn’t he go to Harvard Business School, he didn’t go to any school.” – Don Valentine

One way to look at venture capital investing and creating a valuable business is as an effort to build a stool with three legs: people, markets, and innovative products. All three legs are required for success, but different venture capitalists and entrepreneurs emphasize and weight each of the three core elements differently at different times. While Valentine believed that yes, of course you need decent people, “the marketplace comes first, because you can’t change that, but you can change the people” (according to Pitch Johnson, who was a venture capital industry pioneer at the same time Valentine was developing his investing style).

A famous example of changing people was when the Cisco board of directors replaced the then-husband-and-wife team who founded the company. In other cases, new team members are brought in to supply new skills instead of replacing people; Eric Schmidt being recruited to Google is a famous example of that approach.

What is Product-Market Fit, Really?

#2 “A value hypothesis is an attempt to articulate the key assumption that underlies why a customer is likely to use your product. Identifying a compelling value hypothesis is what I call finding product/market fit. A value hypothesis identifies the features you need to build, the audience that’s likely to care, and the business model required to entice a customer to buy your product. Companies often go through many iterations before they find product/market fit, if they ever do.” “When a great team meets a lousy market, market wins. When a lousy team meets a great market, market wins. When a great team meets a great market, something special happens.” “If you address a market that really wants your product — if the dogs are eating the dog food — then you can screw up almost everything in the company and you will succeed. Conversely, if you’re really good at execution but the dogs don’t want to eat the dog food, you have no chance of winning.” Andy Rachleff

One way to rephrase a key point Rachleff is making is to say that that nothing is as irreplaceable as a great market. In saying this, no one is saying this means that a great team isn’t an accelerant to what a great market can enable! (The modified Gary Larson cartoon at right captures this idea).

Nor is anyone rejecting the idea that PMF is needed. There are other venture capitalists, like Pitch Johnson and Arthur Rock, who put the quality of entrepreneurs first. But it’s a matter of emphasis and timing. Rachleff observes that if you look at the most successful startups, they actually didn’t have “the world’s best management teams in the very early days. They happened to have conceived, or more likely pivoted into, an idea that addresses an amazing point of pain around which consumers where desperate for a solution”.

The Process Behind Product-Market Fit

#3 “You often stumble into your product/market fit. Serendipity plays a role in finding product/market fit but the process to get to serendipity is incredibly consistent. What we do is teach that incredibly consistent process.” Andy Rachleff

Even though serendipity plays a role here, there is a process — which is why Rachleff later created and teaches a course at Stanford, Aligning Startups with their Markets. Steve Blank also developed a customer development process based on the idea that startups should apply the scientific method just like scientists do: start with a hypothesis, test it, prove it, move on or further iterate on the hypothesis. Similarly, Rachleff observes that “First you need to define and test your value hypothesis. And then only once proven do you move on to your growth hypothesis. The value hypothesis defines the what, the who, and the how. What are you going to build, who is desperate for it, and what is the business model you are going to use to deliver it?” Startups should therefore start with the product and try to find the market, as opposed to starting with the market to find the product. It’s important to emphasize here that the iteration is more about the market and the business model than the product itself.

Finally, as Reid Hoffman notes, “Product/market fit requires you to figure out the earliest tells.” Using an analogy to poker is appropriate since the process finding PMF fit is an art rather than a science. PMF emerges from experiments conducted by the entrepreneurs. Through a series of build-measure-learn iterations, PMF is discovered and developed during a process rather than a single Eureka moment. A-ha moments of inspiration do happen, but PMF is not created that way.

How Can You Tell Whether You Do (or Don’t) Have Product-Market Fit?

#4 “You can always feel when product/market fit isn’t happening. The customers aren’t quite getting value out of the product, word of mouth isn’t spreading, usage isn’t growing that fast, press reviews are kind of ‘blah’, the sales cycle takes too long, and lots of deals never close. And you can always feel product/market fit when it’s happening. The customers are buying the product just as fast as you can make it — or usage is growing just as fast as you can add more servers. Money from customers is piling up in your company checking account. You’re hiring sales and customer support staff as fast as you can. Reporters are calling because they’ve heard about your hot new thing and they want to talk to you about it. You start getting entrepreneur of the year awards from Harvard Business School. Investment bankers are staking out your house. You could eat free for a year at Buck’s.” Marc Andreessen

According to Andreessen, “product/market fit means being in a good market with a product that can satisfy that market.” But too often the focus is on latter part of the sentence (a product that can satisfy the market) and not the former (in a good market). Andreessen emphasizes that market matters most: “You can obviously screw up a great market — and that has been done, and not infrequently — but assuming the team is baseline competent and the product is fundamentally acceptable, a great market will tend to equal success and a poor market will tend to equal failure.” That’s why time spent building a business around the product alone is pointless: “Best case, it’s going to be a zombie. … in a terrible market, you can have the best product in the world and an absolutely killer team, and it doesn’t matter – you’re going to fail. You’ll break your pick for years trying to find customers who don’t exist for your marvelous product, and your wonderful team will eventually get demoralized and quit, and your startup will die.” The converse is also true. You can have an OK team and a buggy and incomplete product but if the market is great and you are the best product available success can happen both suddenly and quickly. That success won’t last unless those products are fixed, but at least the business has the beginnings of something wonderful.

#5 “The term product/market fit describes ‘the moment when a startup finally finds a widespread set of customers that resonate with its product’.” Eric Ries

The “satisfy the market” part of the Andreessen definition is where the PMF concept necessarily starts to get qualitative. Various math tests have been devised in an attempt to quantify PMF, but they are proxies for something that is fundamentally like Justice Stewart’s famous definition of pornography: “I know it when I see it.” Even if there is a best practices test for whether PMF exists that does not mean that creating PMF can be reduced to a formula.

So what are considered some of the best tests for PMF? Rachleff writes that “You know you have fit if your product grows exponentially with no marketing. That is only possible if you have huge word of mouth. Word of mouth is only possible if you have delighted your customer.” Tying together the concepts, Rachleff also shares that entrepreneurs too often confuse product/market fit with growth in what Ries calls vanity metrics (“numbers or stats that look good on paper, but don’t really mean anything important”). So what does? Rachleff suggests Net Promoter Score (NPS) as a great tool to predict the magnitude of customer love for one’s product/service — ideally a score of 40 or higher “to know you’re on the right track.” However, while NPS is a pretty good proxy for likely fit, it is “not nearly as accurate as having market feedback in the form of purchases.” People vote with their dollars, after all.

#6 “The number one problem I’ve seen for startups, is they don’t actually have product/market fit, when they think they do.” Alex Schultz

Many founders seem to believe that what they have developed is the modern equivalent of magic beans and that people will accept them as payment for a cow. My post last weekend on growth talks about the need for an offering to have core product value. Chamath Palihapitiya believes that a value hypothesis is driven by core product value — “what the market desires about a product” … but that it “is elusive and most products don’t have any.” And in fact, Rachleff has observed that this is where technology inflection points can play a role: “Truly great technology companies are the result of an inflection point in technology that allows the founder to conceive a new kind of product. The question then is: who wants to buy my product?” Marc Andreessen writes: “In a great market — a market with lots of real potential customers — the market pulls product out of the startup.” Ideally in the easiest stages of a product development process pull is happening organically (i.e., without any advertising spending).

Common Misconceptions About Product-Market Fit

#7 “First to market seldom matters. Rather, first to product/market fit is almost always the long-term winner.” “Time after time, the winner is the first company to deliver the food the dogs want to eat.” “Once a company has achieved product market fit, it is extremely difficult to dislodge it, even with a better or less expensive product.” Andy Rachleff

Rachleff has cited examples like Intuit, Apple, and Google as examples of how being the first mover isn’t necessarily the advantage here. Facebook was not the first social network either. Finding product market fit is a process that is not unlike “creating a ‘dance’ between the product and the market” as Mike Maples Jr has described it. It also involves taking the most powerful and compelling aspects of the product and delivering them in the form of ‘WTF’ level features that are not merely compelling – they rise to the level of changing people’s points of view about what’s even possible and create intense delight in customers.” To reach that level, the target isn’t just product-market fit, but “product-market scale,” observes Casey Winters. As I explained in my previous post on growth, Facebook has a superior approach to generating growth and in a business with network effects that not only captures customers and changed points of view, but keeps out competitors.

#8 “Product/Market Fit Myths: Myth #1: Product market fit is always a discrete, big bang event; Myth #2: It’s patently obvious when you have product/market fit; Myth #3: Once you achieve product/market fit, you can’t lose it; and Myth #4: Once you have product/market fit, you don’t have to sweat the competition.” Ben Horowitz

Even though tight product-market fit and product-market scale help beat out the competition, that doesn’t mean that the struggle stops there. Markets and the actions of competitors in that market (which are not always visible to outsiders) are always changing. Constant adaptation is therefore required to retain PMF. Steve Blank observes, “What matters is having forward momentum and a tight fact-based data/metrics feedback loop to help you quickly recognize and reverse any incorrect decisions.”

One mistake many people make is to believe that the process described in feedback loop diagrams does not apply to them. The reason the process is depicted as a circle is that it is both iterative and continuous. It is highly unlikely that even a hundred internal whiteboard product planning sessions will result in a product that has perfect PMF from the start.

#9 “Getting product right means finding product/market fit. It does not mean launching the product. It means getting to the point where the market accepts your product and wants more of it.” Fred Wilson

One of the most common ways that startups die is “premature scaling,” a term first used by Steve Blank. A business is “scaling prematurely” if it is spending significant amounts of money on growth before it has discovered and developed PMF. Steve Blank describes one important reason why premature scaling can happen: “Ironically, one of the greatest risks … is high pressure expectations to make these first pass forecasts that subvert an honest Customer Development process. The temptation is to transform the vision of a large market into a solid corporate revenue forecast — before Customer Development even begins.” A study conducted by Startup Genome concluded:

“Startups need 2-3 times longer to validate their market than most founders expect. This underestimation creates the pressure to scale prematurely… In our dataset we found that 70% of startups scaled prematurely along some dimension. While this number seemed high, this may go a long way towards explaining the 90% failure rate of startups.”

An entrepreneur quoted by the authors of the study said:

“Premature scaling is putting the cart before the proverbial horse…As an entrepreneur there’s always the temptation to grow the sales team at the first sign of revenue traction, but there is always the danger that this early traction is coming from the subset of the market that are early adopters and not the actual market itself. Additionally, too often I’ve seen startups ramp up sales before they’ve figured out the most efficient way to achieve profitability. A vicious cycle ensues wherein the more a company grows, the more it farther away from profitability it becomes.”

Viddy is often cited as an example of a company that died of premature scaling. For a period of time Viddy was able to use Facebook OpenGraph to grow its user base to millions of users before it ever had PMF. That mistake eventually meant the company was sold for very little and it faded away like the Cheshire Cat. Other business that suffered from premature scaling included Friendster, Orkut, and Digg. Groupon suffered from premature scaling but was able to pivot and save itself so far.

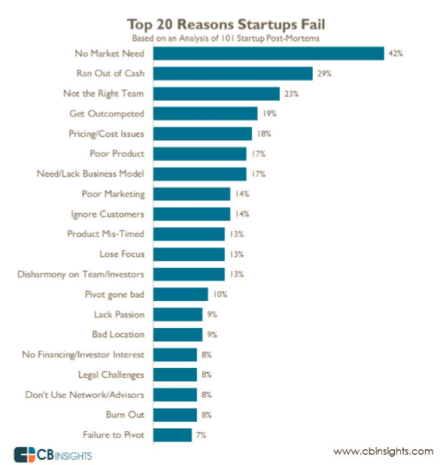

By the way: Not everyone uses this premature scaling terminology. For example, if you look at this list of reasons why startups fail from CB Insights, premature scaling is not even listed but is perhaps buried in other categories:

[As an aside, “Pivot Gone Bad” is a popular Country Western song written by a founder who wrote: “My Co-founder Left with my Husband and I’m sure going to Miss Her.”]

How to Get There

#10 “In the early days of a product, don’t focus on making it robust. Find product market fit first, then harden” Jeff Lawson

Again, the process is discovery-based and experimentation is required. There is no value in hardening something that customers don’t want to buy. Andreessen argues that “The product doesn’t need to be great; it just has to basically work. And, the market doesn’t care how good the team is, as long as the team can produce that viable product.” If nearly everyone at the business is focused on trying to fulfill product demand instead of “siting around” trying to dream up new feature to create demand, there is almost certainly PMF — but the reverse is not the case.

PMF is not a magic elixir. It signifies an important milestone that is necessary but not sufficient for success. Once a company has PMF it still must find a sustainable growth model and create a moat against competitors and so on. What PMF does do is help prevent businesses from spending money trying to grow a business (often inorganically) in a way that is doomed to fail.

#11 “In general, hiring before you get product/market fit slows you down, and hiring after you get product market fit speeds you up. Until you get product/market fit, you want to a) live as long as possible and b) iterate as quickly as possible.” Sam Altman

What Altman is saying is reflected in what co-founder Jessica Livingston calls the Y Combinator motto: “make something that people want. If you create something and no one uses it, you’re dead. Nothing else you do is going to matter if people don’t like your product.”

Andreessen argues that the life of any startup can be divided into two parts: before product/market fit (what he calls BPMF) and after product/market fit (APMF):

“When you are BPMF, focus obsessively on getting to product/market fit. Do whatever is required to get to product/market fit. Including changing out people, rewriting your product, moving into a different market, telling customers no when you don’t want to, telling customers yes when you don’t want to, raising that fourth round of highly dilutive venture capital — whatever is required. When you get right down to it, you can ignore almost everything else. I’m not suggesting that you do ignore everything else — just that judging from what I’ve seen in successful startups, you can.

#12 “Founders have to choose a market long before they have any idea whether they will reach product/market fit.” Chris Dixon

Some venture capitalists want to see product-market fit before they invest and leave it to angels to do the investing pre-product market fit. They would rather buy a business with product-market fit than try to predict whether a founder will find it. Key as always is for the venture capitalist to let the founders do the heavy lifting (“You do not want a venture capitalist who hire a dog and then tries to do the barking.”). The key point Dixon makes is that founders have control over this by thinking carefully about what they’re trying to do and why. There is also founder-market fit.

This post was syndicated by permission of the author (who blogs at 25iq.com). About the author: Tren Griffin’s professional background has primarily involved areas where business meets technologies like software and mobile communications. He currently works at Microsoft. Previously, he was a partner at private equity firm Eagle River (established by Craig McCaw) and before that, a consultant in Asia. Griffin’s latest book, Charlie Munger: The Complete Investor is about the legendary Berkshire Hathaway vice chairman, and how he invokes a set of interdisciplinary “mental models” involving economics, business, psychology, ethics, and management to keep emotions out of his investments and avoid the common pitfalls of bad judgment.

notes and sources

http://digitalassets.lib.berkeley.edu/roho/ucb/text/valentine_donald.pdf

https://www.fastcompany.com/3014841/why-you-should-find-product-market-fit-before-sniffing-around-for-venture-money

http://pmarchive.com/guide_to_startups_part4.html

https://blog.wealthfront.com/demystifying-venture-capital-economics-part-3/

http://firstround.com/review/When-it-Comes-to-Market-Leadership-Be-the-Gorilla/

https://a16z.com/2010/03/20/the-revenge-of-the-fat-guy/

http://avc.com/2013/03/revenue-traction-doesnt-mean-product-market-fit/

http://startupclass.samaltman.com/courses/lec06/

https://www.media.mit.edu/events/2012/04/04/media-lab-conversations-series-reid-hoffman-summary

https://twitter.com/johnhenderson/status/829388910903955456

https://twitter.com/sama/status/610902540608122880

https://mixergy.com/interviews/wealthfront-with-andy-rachleff/

https://www.cbinsights.com/research-reports/The-20-Reasons-Startups-Fail.pdf

https://austinstartups.com/dare-to-make-your-startup-legendary-9db6aa524f5d

https://www.linkedin.com/pulse/first-product-market-scale-casey-winters

http://500hats.typepad.com/500blogs/2007/09/startup-metrics.html

Casey Winters of Pinterest: https://www.youtube.com/watch?v=bpnYFG1-rdk

Andy Rachleff: https://www.youtube.com/watch?v=7G9Cb6sCjL8

Mike Maples: https://www.youtube.com/watch?v=zfOsP3PmI1U

Marc Andreessen: https://www.youtube.com/watch?v=zfOsP3PmI1U

Sachin Rekhi: https://youtu.be/huTSPanUlQM

Don Valentine: https://www.youtube.com/watch?v=nKN-abRJMEw