Before an a16z founder event I hosted a few weeks ago, I was telling anyone who would listen that they should really read The Partnership by Charles Ellis, which chronicles Goldman Sachs’s nearly 160 year history. I was not doing this to be pedantic (or to sneak a late entry into our “You can just read 25 books” series). I had a good reason, because the event was kicked off by a fireside chat with Goldman Sachs’s CEO David Solomon, and a16z’s Ben Horowitz.

I’d argue that Goldman was and still is, one of the most entrepreneurial financial institutions in the world. I even wrote about Goldman in my Firm > Fund essay for this reason: unlike many of its peers who grew primarily through a series of bank mergers, it was built brick-by-brick by generations of entrepreneurial partners raising their hands to grow the firm. This meant pursuing a lot of different opportunities, whether it was expanding into Europe, or starting the merchant banking business, or the wealth management division. Many of these business units became global franchises.

I kind of like to think that working at a16z today is what Goldman Sachs must’ve felt like 50 or 75 years ago: a small partnership of entrepreneurial investors betting on the future.

Here are four of the biggest takeaways from the conversation:

- If you’re a leader in the industry, the industry’s growth depends on you. That’s a paraphrase from one of Ben’s mentors, Andy Grove, the former CEO of Intel. The meaning is pretty self-explanatory: you can’t sit by passively and wait for winning conditions; you need to create them for yourself and everyone else. This mentality has influenced how a16z operates, from our approach to scaling our service to portfolio companies and founders, to the policy work a16z has pursued in AI and crypto.

The great Dave Swenson said. . . a good venture capital firm is like a basketball team . . . five, maybe six players. That’s it. But you can’t address a market where you have to be in 150 companies with six players . . . So how do you organize, how do you scale, how do you design the firm so that you can get to the whole opportunity? – Ben Horowitz

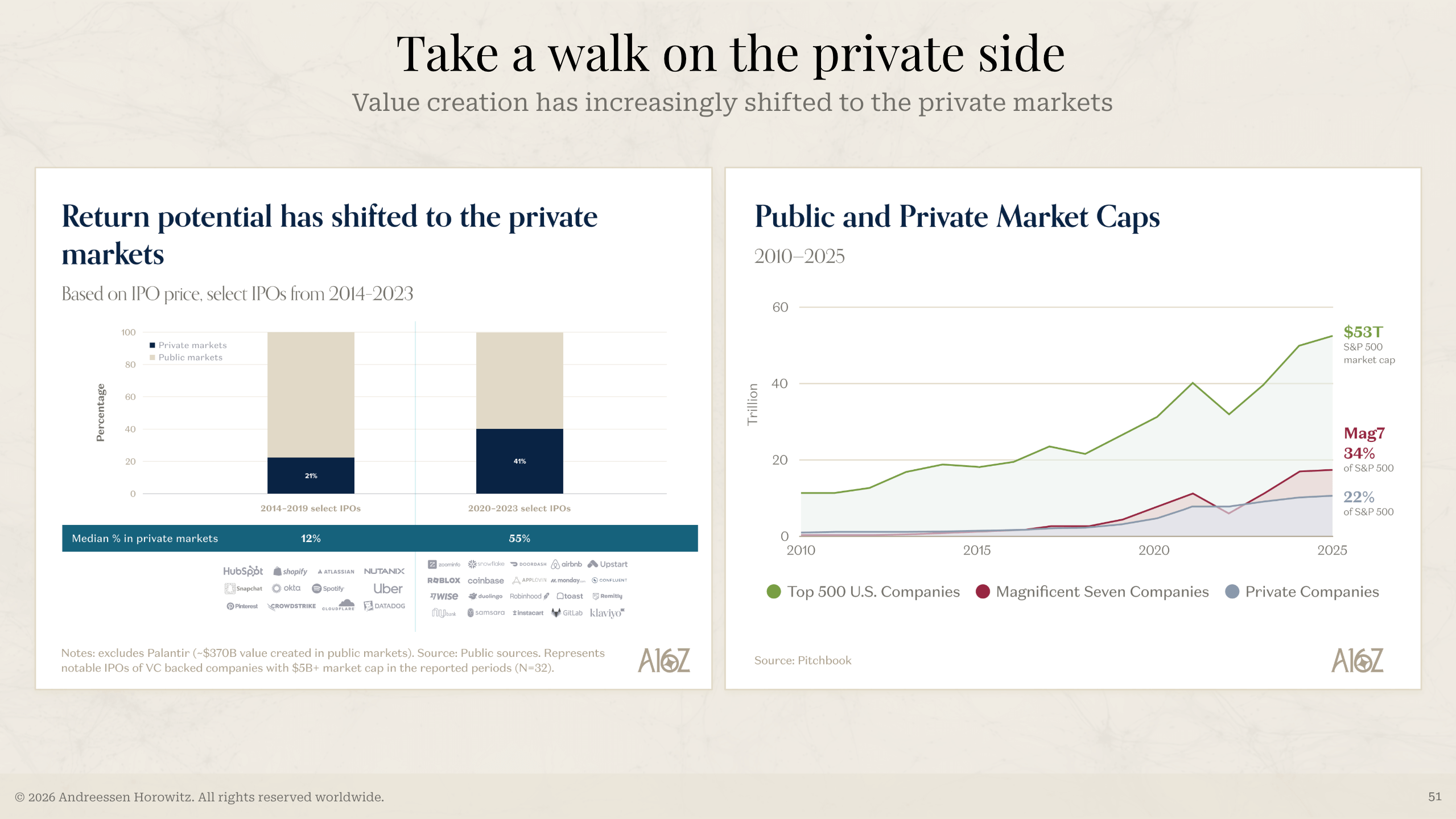

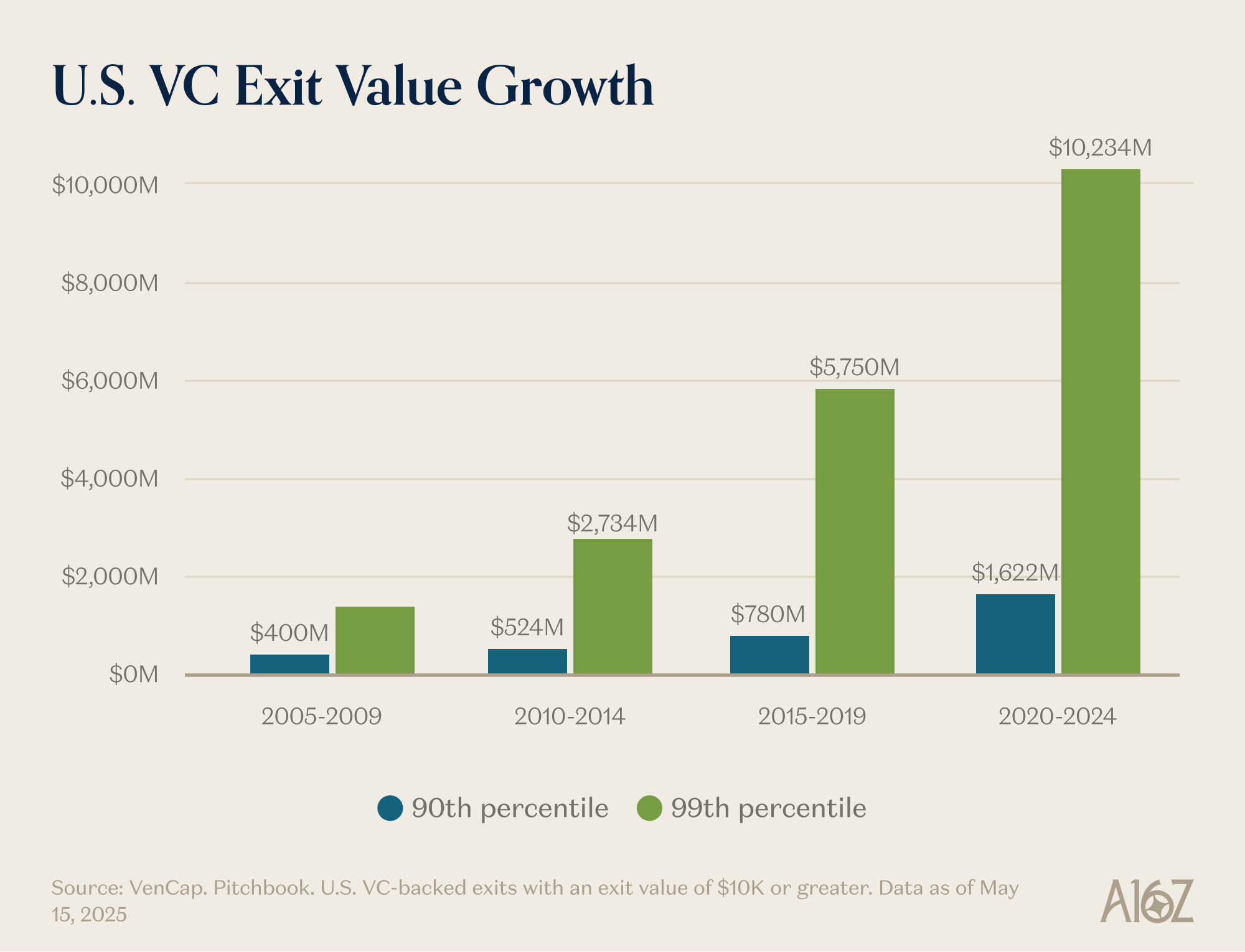

Value creation on the private side has become an increasingly large piece of the overall pie (relative to public markets), with both top decile and top centile exit values increasing substantially.

This attitude could also be used to understand the history of capital markets in America. When you look at the six most important financial institutions globally, all of them are American. This reality is the product of an environment that has, for the most part, been pro-finance, pro-growth, and pro-entrepreneurship. Goldman, founded in 1869, became what it is because it operated in a country where capital formation and deployment wasn’t impeded by a hostile regulatory environment.

- AI makes it possible to throw money at a problem (for the first time in the information age). Traditionally, software development followed the “mythical man month” principle: you couldn’t throw more people or dollars at a problem to solve it faster. But with AI, more data and more compute (in other words, more money) can actually accelerate results and improve outcomes. This is important because it creates a new model where capital deployment can directly drive faster progress. It means earlier-stage companies may raise more money, since capital is now a real edge.

With AI, if you have data . . . and you have enough GPUs, you can solve almost any problem. It is magic, but it means that you can throw money at the problem – Ben Horowitz

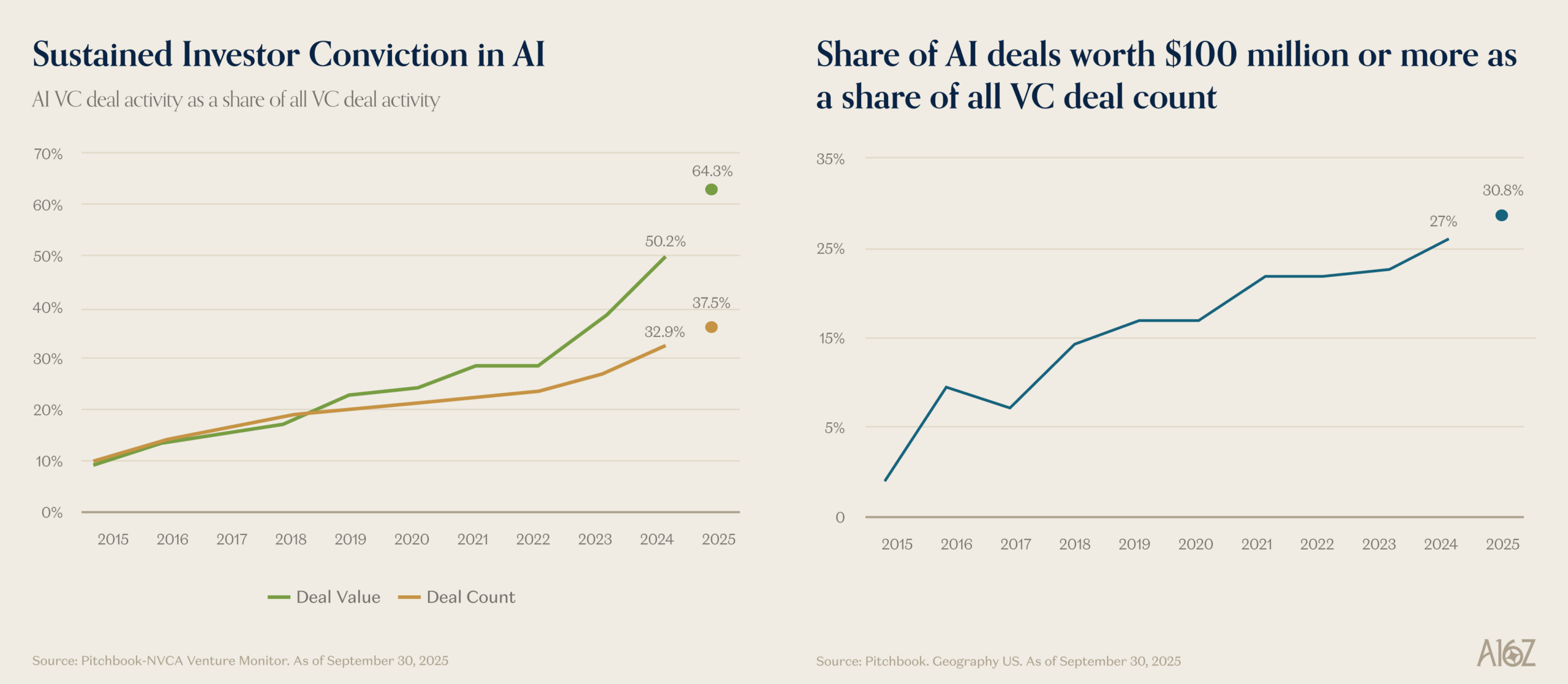

AI investments (and $100M+ deals, in particular) comprised an historically large share of VC capital in 2025.

For CEOs, this means they can allocate significant capital with visibility into returns in ways that weren’t possible five or ten years ago. This shift is also driving the IPO market and changing how businesses think about growth and capital allocation. The bitter lesson has finally reached Wall Street.

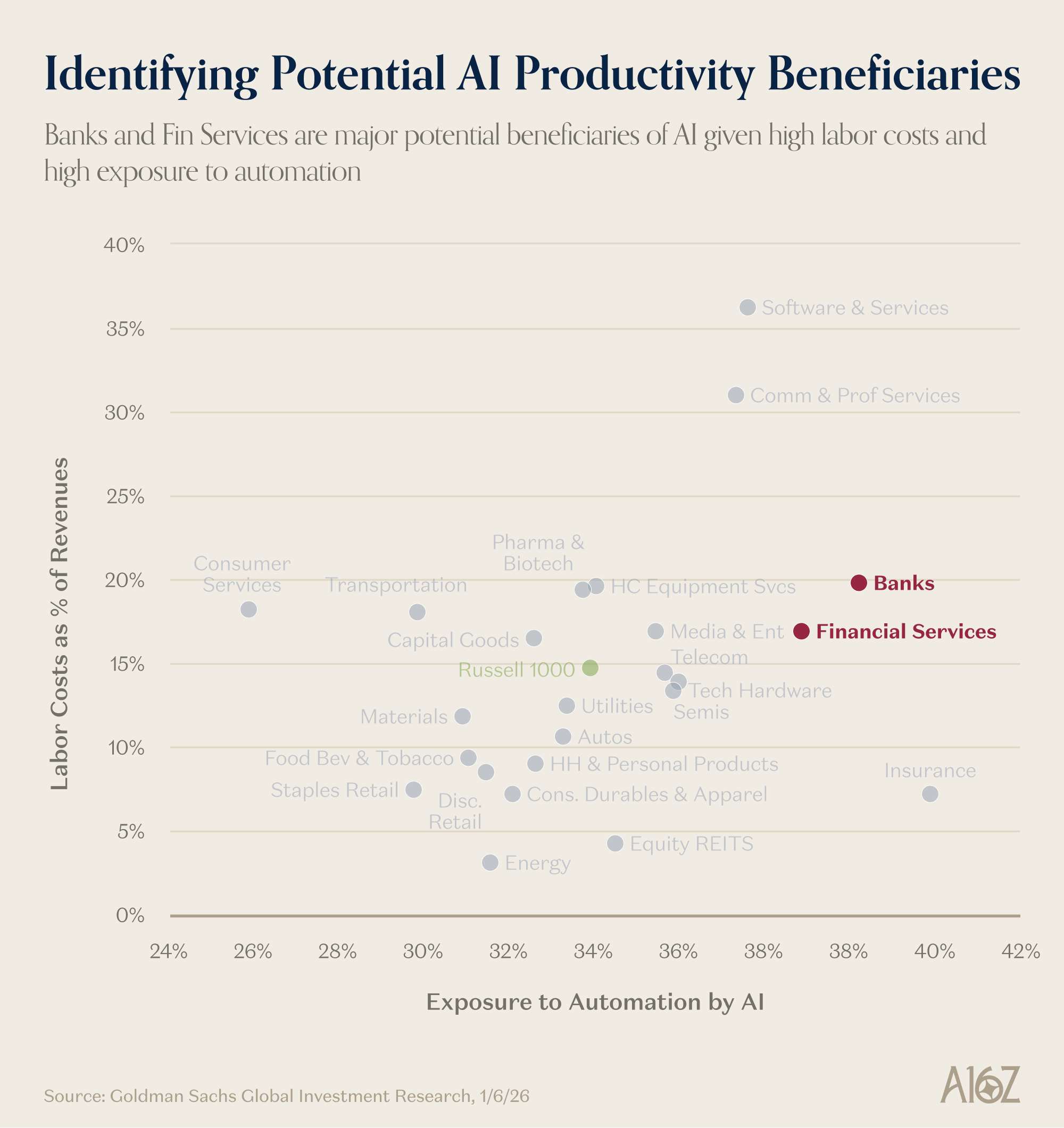

- Internal tech investing is very different at private and public companies: Unlike private AI companies that can justifiably burn through cash while building for the future, shareholders expect public companies like Goldman to generate returns every single year on their $110 billion in equity capital. Public markets will only tolerate so much “investing in the future” before they demand to see a near-term return.

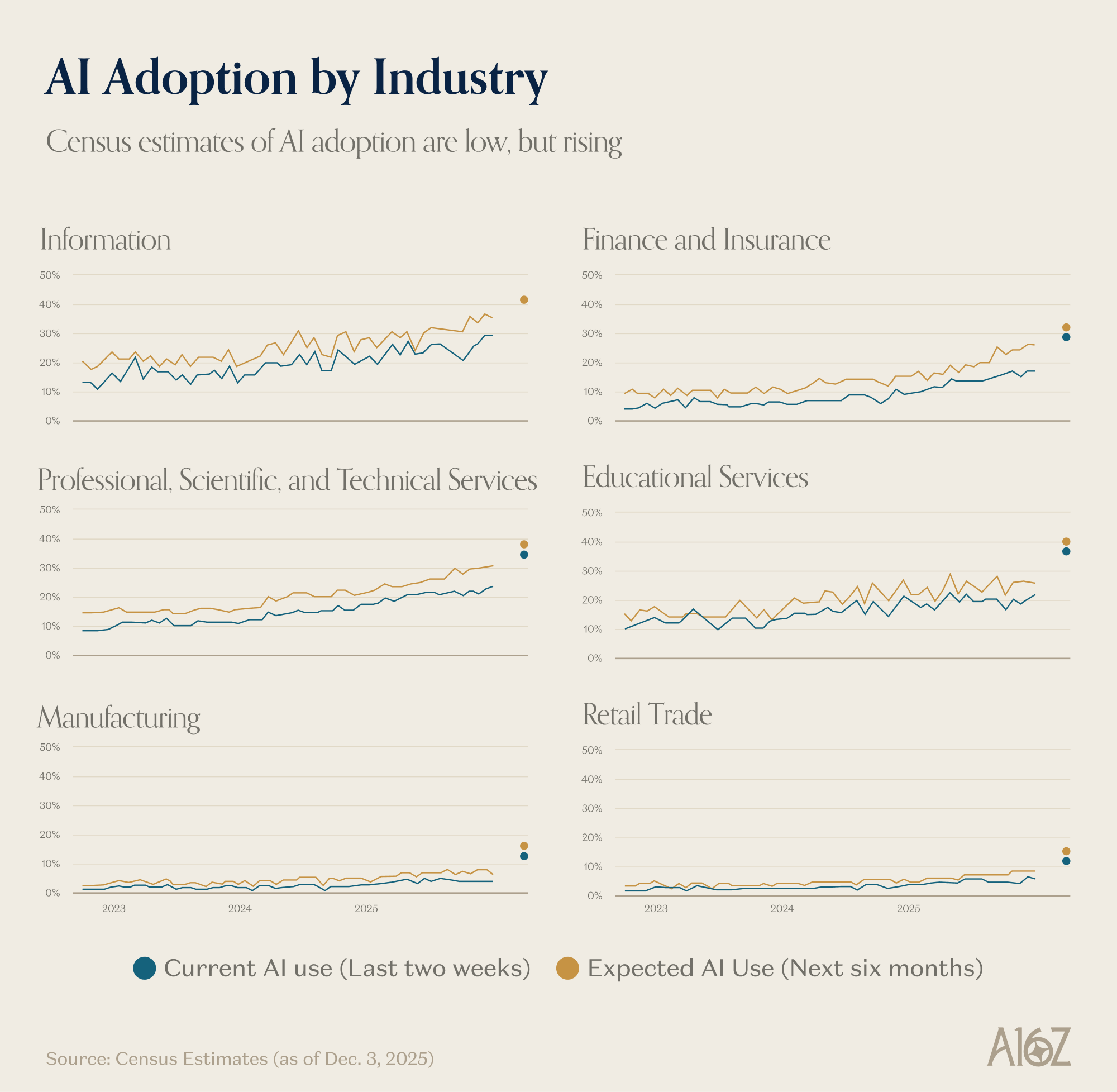

Contrast that with private AI companies: they can spend freely to capture market share, while public companies must find efficiencies first, battle internal resistance, navigate regulatory constraints, and deliver returns every quarter. This helps explain why, despite enormous potential, enterprise AI adoption remains “at the very beginning,” as Ben notes.

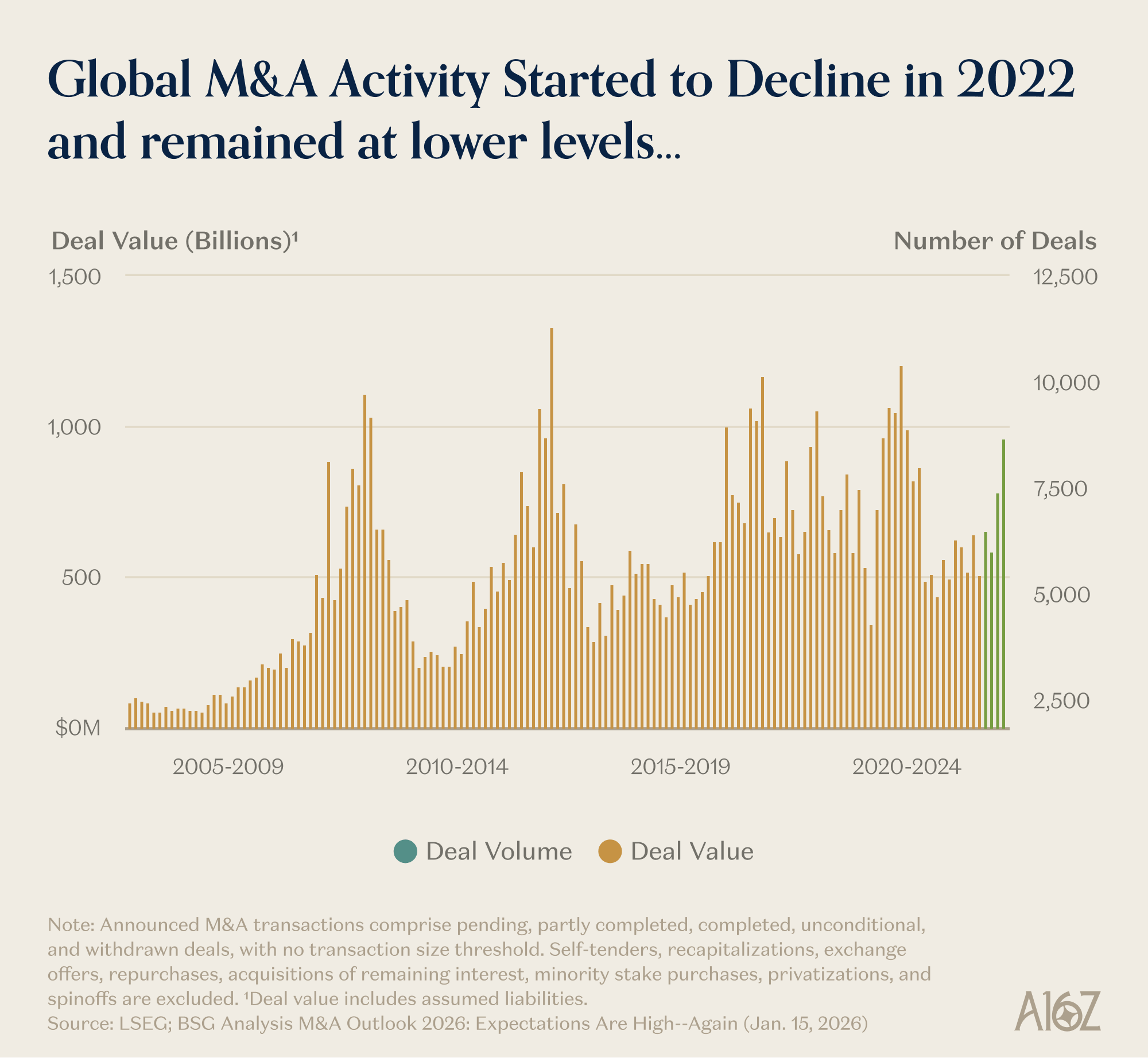

- The last takeaway, because it’s the kind of thing that when David Solomon talks, we listen, is that 2026 could be a very big year for M&A. The biggest, in fact.

It’s just me predicting, [but] I think this could be the biggest M&A year in history” – David Solomon

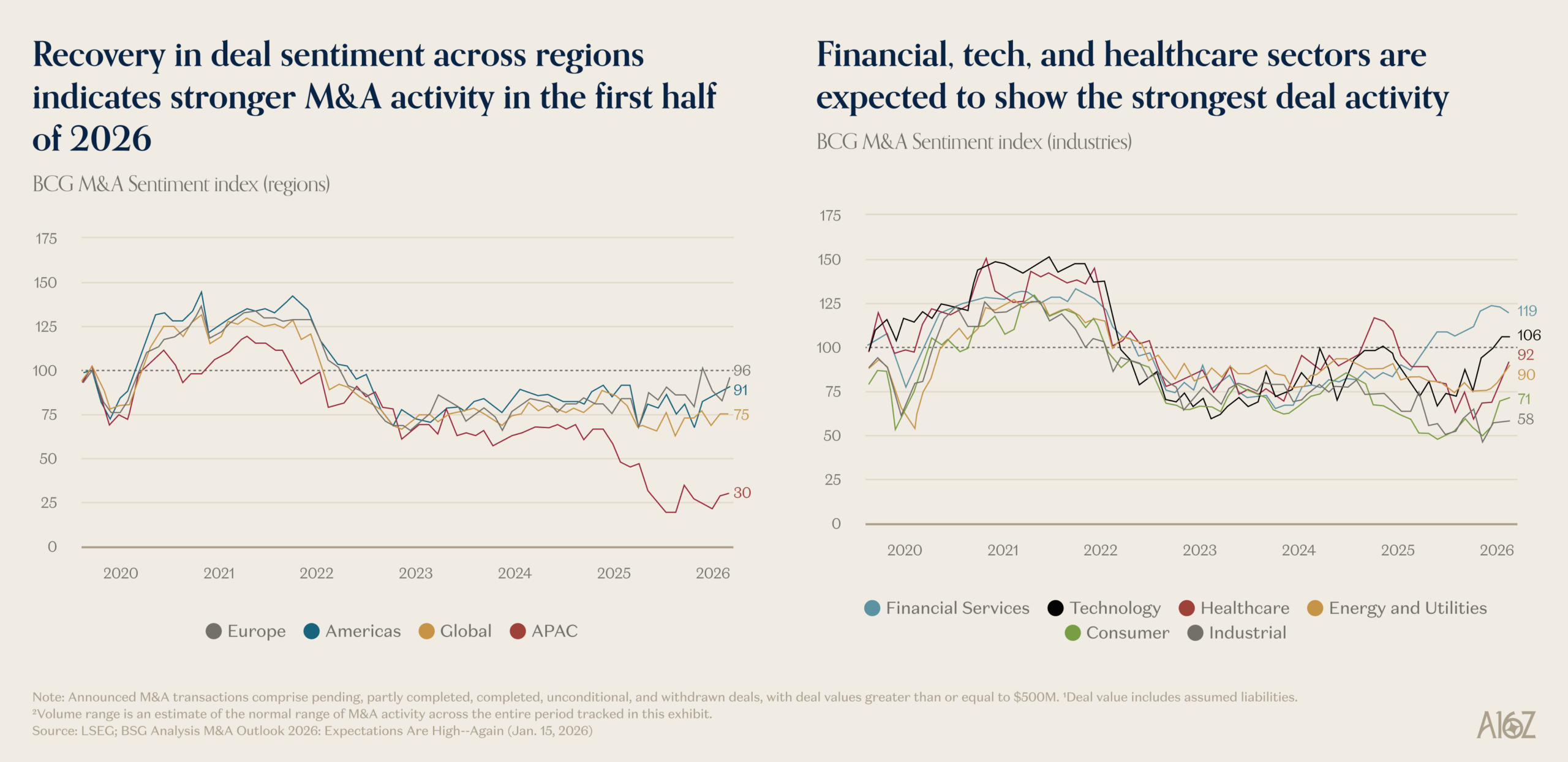

While global M&A activity has been relatively depressed since 2022, it started to pick up substantially in Q4 ’25. The BCG M&A sentiment index has increased across the board, especially in Financial, Tech, and Healthcare.

We have fiscal stimulus, we have monetary stimulus . . . we’re in a rate cutting cycle . . . We are in a capital investment supercycle, like something we’ve never seen. Last year, the four largest companies contributed 1% to GDP growth with their $400 billion of spending . . . it’s just such a cocktail of stimulus that it’s very, very hard to slow the economy down – David Solomon

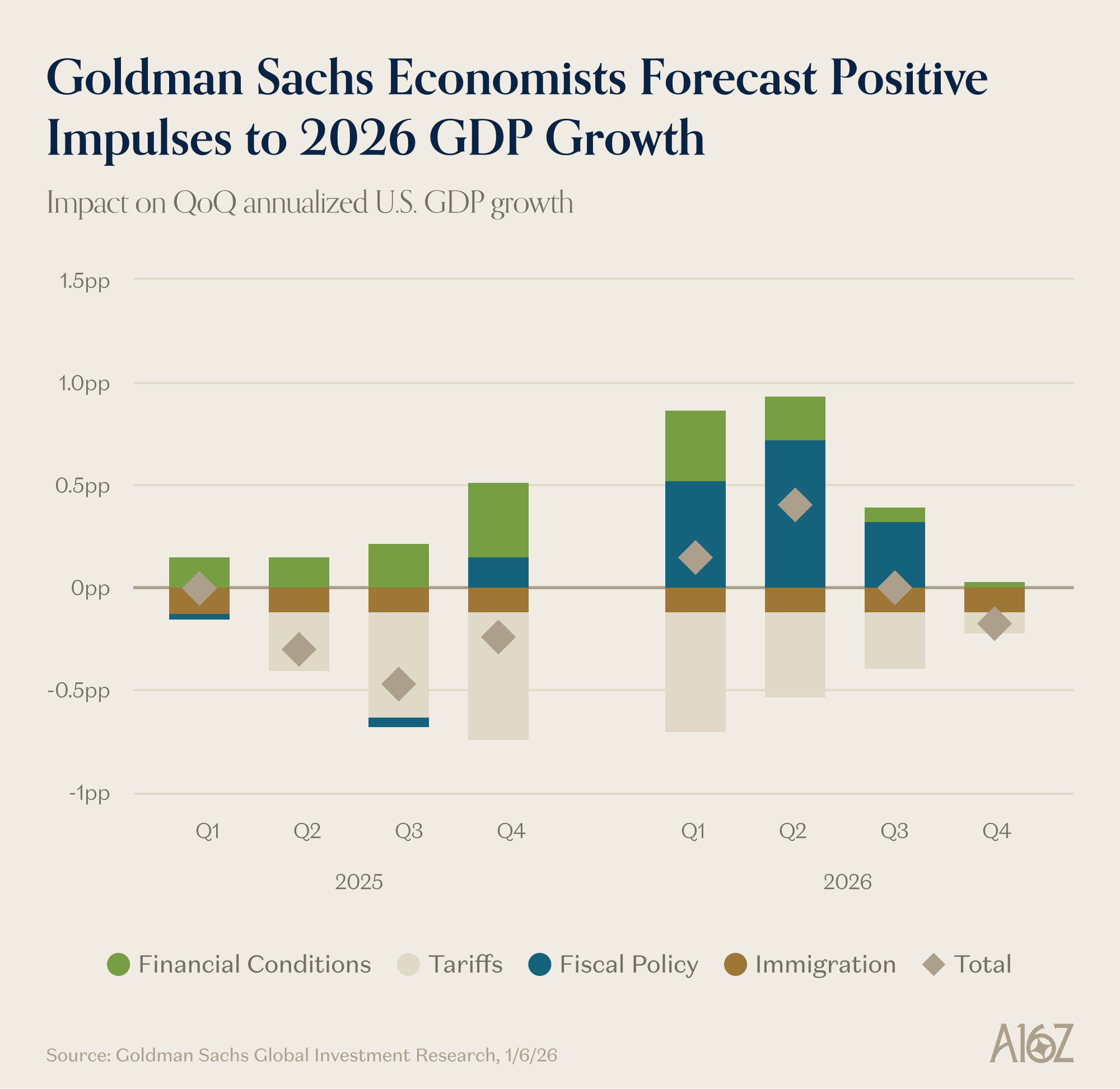

Goldman is forecasting a substantial lift to growth from a combination of loosening fiscal conditions, and fiscal policy.

Something to look forward to!