This first appeared in the monthly a16z fintech newsletter. Subscribe to stay on top of the latest fintech news.

Business in a box: financial tools for solopreneurs

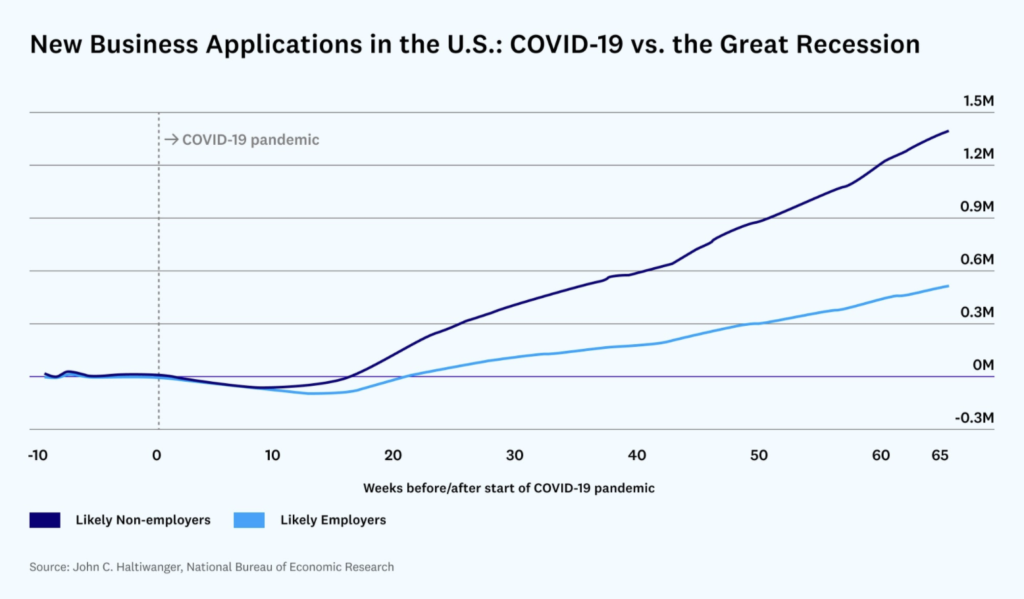

Seema AmbleFintech can help vertical SaaS companies scale and capture winner-take-most markets by providing industry-specific software for small and mid-sized businesses. However, over the course of the COVID-19 pandemic, more individuals have struck out on their own, leaving behind the infrastructure of existing firms to become solo workers. These solo workers represent a growing market segment with specific software and fintech needs. “The firm” traditionally supported the core craft or product by providing operational support (functions like finance, legal, and HR), demand (generating customers through marketing/sales, branding, and relationships), and networks (access to communities that support the individual). Now, the new software stack for these workers going solo will provide these firm functions.

A key part of the software stack is the fintech products that can be offered. Software serves as the system of record for the workers’ customers, transactions, and overall data, and the platform on which fintech products (insurance, lending, payments, etc) can be provided. Whereas a business can qualify for a small business loan or working capital line, an individual may have to take out a personal loan with a guarantee against their sole and family assets, even if the money would be used for business purposes. Here, vertical SaaS platforms can help by pooling data together to underwrite and negotiate better rates for solo workers in a specific profession. For example, Substack Pro gives writers an advance payment to support them branching out on their own. Similarly, dentists, doctors, or photographers might need to secure lending to buy equipment that directly generates revenue.

Additionally, when it comes to benefits, different professions have different needs. A fitness instructor has different workers’ compensation needs than a designer who sits at a desk all day. Solo truckers can’t negotiate for fuel card discounts, but a software platform that aggregates demand could do so. There are also financial products that could be unique to solo workers, such as income-smoothing products for contract-based payment.

So, in which professions do these new software stacks for solo workers make sense? That depends on how rapidly the market of solo workers is growing; the attractiveness of a category in terms of acquisition dynamics, specialization, and monetization opportunities; and the specialized value that software can provide to that vertical.

Read “As More Workers Go Solo, the Software Stack is the New Firm”»

Fintech with a side of crypto

Sumeet SinghFinancial services and crypto are colliding — Visa is buying NFTs, Robinhood, and Square are earning a majority of their revenues from crypto trading, and many infrastructure companies are vying to become the “Stripe for Crypto.”

For consumer fintech companies with existing distribution, crypto brings opportunities for new products beyond stock trading, interchange, and lending, such as high-yield savings powered by crypto lending pools — which for now are one of the few ways to provide high yield in a 0% interest rate world. This is proving to be a regulatory challenge, however, given the SEC’s view that these yield products (such as Coinbase’s) should be considered securities and individual states shutting down BlockFi’s high-yield accounts.

Assuming regulatory issues are not an impediment, there’s also an opportunity to use crypto as a wedge to build the next First Republic or JP Morgan Private Bank for consumers who have amassed wealth in a crypto native way. Imagine if you could deposit/stake your crypto assets, earn yield, and get a line of credit in fiat to spend in the regular economy — all in one account. The major question here would be whether or not these people would want to spend and diversify their wealth in the “normal” off-chain world, with existing financial intermediaries.

On the financial infrastructure side, the next Plaids and Stripes may be built as crypto goes mainstream. As we hypothesize what may get built, the latest generation of financial infrastructure startups may provide clues. Looking at payments, for example, massive payment gateways have been built for different categories — Square for small businesses, Stripe for ecommerce sellers, Checkout.com for enterprise merchants — plus a whole host of adjacent, value added services for fraud, faster payments, etc.

Given the greenfield, global opportunity and the lack of existing infrastructure (and therefore lots of hands on work to be done with different types of customers), there may also be multiple winners as crypto apps beyond trading go mainstream (where, say, holding a native token or wallet is required). There may be one winner providing on/off payment ramps to metaverse and entertainment companies, another for bringing the benefits of DeFi (banking & lending services, stablecoins, etc.) to emerging market economies, and others for adjacent services like fraud.

The flip side to this argument is that some of these crypto infrastructure providers will actually acquire end consumers with their own wallets (think Shopify’s ShopPay on steroids), creating network effects on the consumer side (i.e., each consumer sets up a wallet that can be used across multiple different merchants/brokerages/entertainment companies).

A new future in financial services is being built, and we’d love to refine our hypotheses with founders who are living in that future.

The rise of independent insurance agents

Joe SchmidtThe growth and success of independent agent distribution — not direct marketing — has been the single most important trend in insurance over the past decade. An independent agent (IA) is simply an agent that is not tied, or “captive,” to one insurance company.

Insurance carriers have historically leveraged a distributed salesforce of W-2 agents to sell products. These jobs were steady, but the real money was made by the insurance company through profitable underwriting. But “where the real money is made” has shifted dramatically over time, from underwriting to distribution, as evidenced by higher multiples on brokerages vs carriers and the percentage of premium paid to agents for acquiring customers.

What’s behind this shift? Customers want more choice, and they know that working with an independent agent offers more options. As of 2019, nearly 90% of commercial, 50%+ of life, 48% of homeowners, and 31% of auto policies were sold by independent agents — and the numbers continue to grow faster than not only the entire market, but also outpacing direct sales growth over the same period.

Insurance carriers have responded to reduced underwriting profitability by embracing independent agents and the variable costs of distribution that come with them. Notably Nationwide, a Fortune 150 company, converted its entire 2000+ captive agent base to IAs in 2020.

We believe in the future of the independent insurance agent and that the market is undergoing a second wave of innovation to support them. Software focused on the independent agent isn’t a new idea. Large businesses, like Vertafore ($5.4B), Applied Systems ($1.75B), iPipeline ($1.63B), have targeted this segment. More recently, many next-generation carriers (notably Hippo, Swyfft, Coalition, Pie) have utilized independent agents to distribute their product, and others have launched strategies after starting direct to consumer (Ethos, Bestow, CoverWallet).

But this is still the early days of independent insurance agents, and we expect several valuable companies to emerge and continue to improve and streamline workflows around aggregation, marketing, sales, payments, compliance, and more.

Fintech influencers in Latin America

We’ve written before that Latin America is seeing an explosion of fintech activity. Behind the boom: a large unbanked population, a young consumer base, and increased adoption of smartphones and consumer apps. In Mexico, for instance, 43% of the population is under the age of 25, 50% of the population is unbanked, and only 31% of the population has access to credit products.

The forces behind the fintech boom are many of the same forces driving Latin America’s creator and influencer economy. Social media is particularly prevalent in Latin America — 88% of Latin America internet users use social media (in North America, it’s only 73%), and one out of three follows an influencer. Not surprisingly, fintech influencers have become a powerful force for introducing unserved or underserved financial customers to formal financial systems and creating breakout businesses — Grupo Universa built a two-pronged monetization engine in the space, and was snapped up by BTG Pactual, Latin America’s largest investment bank. Universa was the result of the merger of independent investment content company Empiricus, which had amassed over 400,000 paying subscribers, and Vitreo, one of the largest independent online investment platforms, whose growth was fueled almost exclusively from the integrated cross-promotion via Empiricus’ newsletter and content.

An examination of Latin American’s media and influencer landscape today reveals new opportunities for the region’s influencers to catch up with their global counterparts in the creator economy. Novel models such as building digitally native brands and fusing content with business can propel the Latin American creator economy into the future.

Read “Inside Latin America’s Creator Economy,” a Future article by Julio Vasconcellos, managing partner of Atlantico, a venture capital fund focused on Latin America »

Worth reading

- Square sellers now able to accept payments through Cash App Pay (Square)

- This Startup Sees a New Business Opportunity: Teaching Gen Z About Money (Time)

- Who Owns Your Life Insurance Policy? It Might Be a Private-Equity Firm (Wall Street Journal)

- Latin America Digital Transformation Report 2021 (Atlantico — fintech begins on page 108)

- Twitter brings tips to everyone (Twitter)

- Need for Speed in AI Sales: AI Doesn’t Just Change What You Sell. It Also Changes How You Sell It.

- Investing in Stuut: Automating Accounts Receivable

- Investing in FurtherAI

- The AI Application Spending Report: Where Startup Dollars Really Go

- Oil Wells vs. Pipelines: Two Strategies for Building AI Companies