To receive this monthly update from the a16z fintech team, sign up here.

Record ATM fees; Looming zero interest rates; High-yield savings accounts proliferate; Nubank hits 15 million users

Why the buzz around high bank fees is actually good for consumers

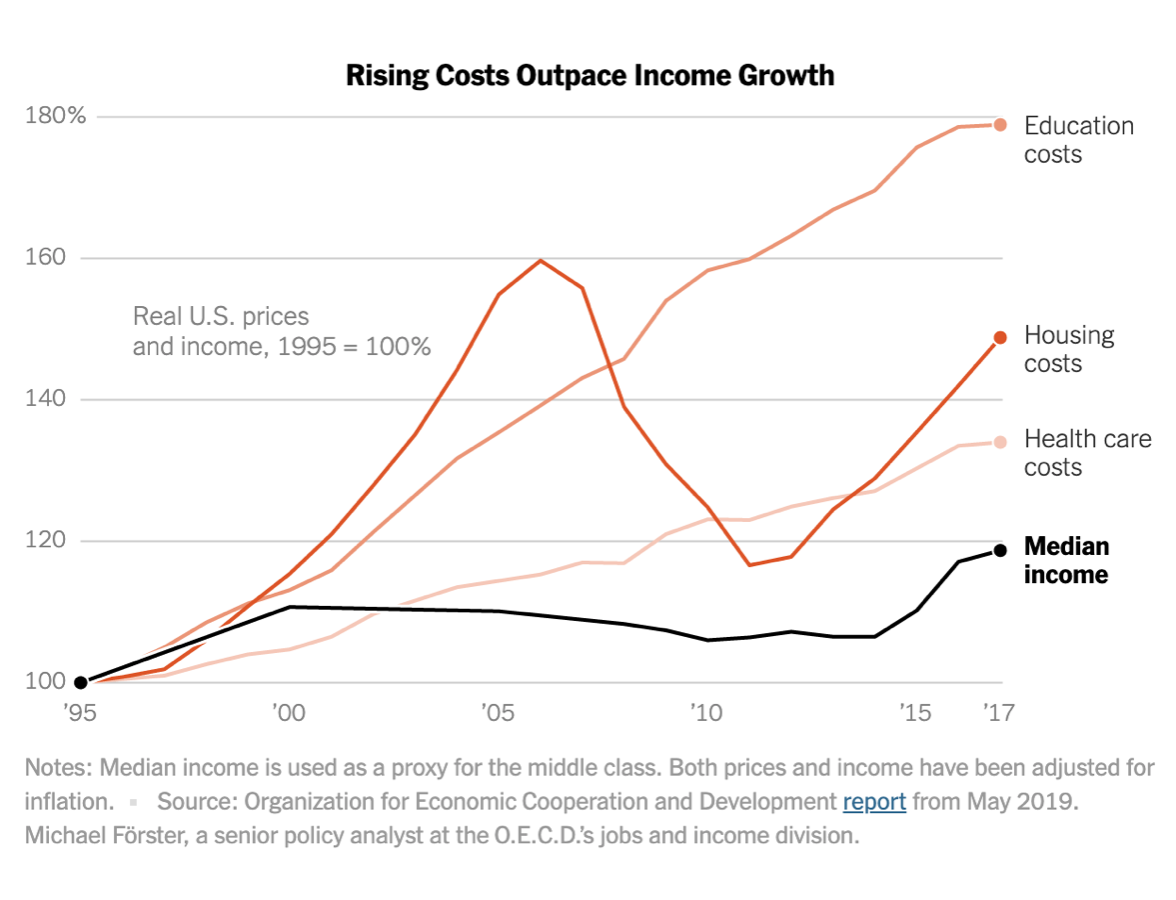

Angela StrangeATM fees hit a record high this month of nearly $5. But bank fees have been rising for a long time—why is this suddenly mainstream news? First, it’s getting harder and harder to be middle class. Median income has risen 20 percent since 1995, but costs are rising faster still: healthcare costs are up 40 percent, housing costs are up 50 percent, and education costs are up 80 percent. The New York Times recently depicted that divergence in a chart:  Like a frog in boiling water, fees have hit a tipping point. Remember free checking? It’s likely a bygone perk if you can’t keep a minimum balance of a few thousand dollars. Overdraft fees are now up to $35, which translated to $34 billion in fees paid last year. Rent late fees can be up to 10 percent of your monthly rent. And, of course, there’s those despised ATM fees. For people living paycheck to paycheck—the majority of the population—there’s no buffer for these costly and often unpredictable fees.

Like a frog in boiling water, fees have hit a tipping point. Remember free checking? It’s likely a bygone perk if you can’t keep a minimum balance of a few thousand dollars. Overdraft fees are now up to $35, which translated to $34 billion in fees paid last year. Rent late fees can be up to 10 percent of your monthly rent. And, of course, there’s those despised ATM fees. For people living paycheck to paycheck—the majority of the population—there’s no buffer for these costly and often unpredictable fees.

The silver lining: fintech companies are providing consumers with better alternatives. Want free checking? Several neobanks now offer it, including Chime. Need access to your cash before payday? Earnin can spot you. Through lower cost infrastructure, cheaper customer acquisition, and products that drive consumer retention, fintech companies can offer (better than!) traditional banking products at significantly lower costs.

And while the overall market share of fintech is still relatively small compared to the centuries-old financial services industry, these new companies are having an outsize impact. Incumbents are feeling pressure to react: Robinhood has approximately 6 million users for its free trading app; Schwab and TD recently cut commissions entirely, partly in response. (As a result, Schwab may lose up to $400 million in commission revenue this year.) Chase is now offering options for lower income customers, such as no-overdraft fee checking accounts.

Counterintuitively, perhaps, it’s great for consumers that high banking fees are finally attracting media attention—it means new companies are stepping up to offer alternatives, and incumbents are feeling the squeeze.

- Investing in FurtherAI Joe Schmidt and Angela Strange

- Oil Wells vs. Pipelines: Two Strategies for Building AI Companies Joe Schmidt and Angela Strange

- How Big Bank Fees Could Kill Fintech Competition (July 2025 Fintech Newsletter) James da Costa, Alex Rampell, Angela Strange, and David Haber

- How Will My Agent Pay for Things? (May 2025 Fintech Newsletter) James da Costa, Angela Strange, Seema Amble, and Gabriel Vasquez

- What’s Working in AI, Rebuilding Core Banking (March 2025 Fintech Newsletter) James da Costa and Angela Strange

Zero interest rates spur competition

Anish AcharyaJPMorgan Chase CEO Jamie Dimon says the bank has begun discussing what fees and charges it could introduce if federal interest rates go to zero or lower. This caps a strategic shift made by banks in the aftermath of the 2008 financial crisis—paying a zero interest rate on deposits.

There are three big ways banks make money: net interest margin, interchange, and fees. Net interest margin is the difference between the interest income generated by banks (by lending money to consumers and businesses) and the amount of interest paid out to their lender (you, the depositor). Though interest rates have risen over the past decade, banks have kept APYs near zero while increasing the APR on loans. As a result, we’ve seen an unexpected margin expansion. Paying no interest on deposits has become the new normal for banks, regardless of what the Fed rate is. Understandably, consumers are up in arms.

Now fintech companies are entering the fray and providing market-leading yields on deposits. Since many of these companies see this as a way to attract new customers, not necessarily a revenue generator, they’re in direct competition to offer the highest yields. To date, Wealthfront appears to have seen the most success: between high yield and investment products, the company has had $20 billion in AUM since launching its deposit product in January.

That original margin expansion that banks captured by dropping APYs to zero in perpetuity may have been a Pyrrhic victory. Startups are quickly gaining market share and changing consumers’ expectations in the process.

2019: The year of the high-yield savings account

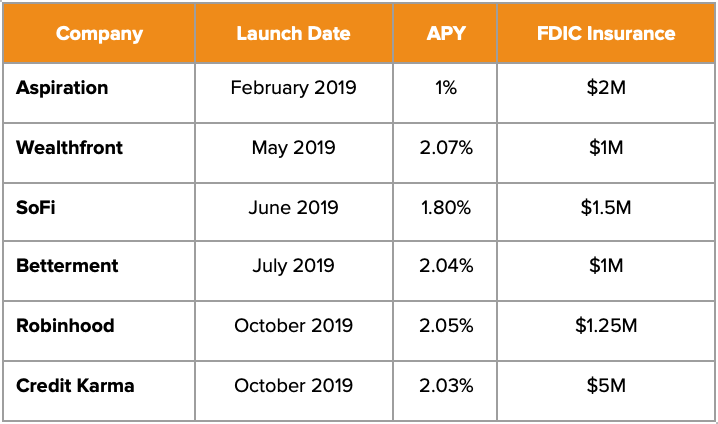

Seema AmbleRobinhood and Credit Karma both launched high-yield savings accounts this month. They’re the latest in a wave of companies that have introduced similar accounts in the US this year, including Betterment, Wealthfront, and SoFi. Typical terms include APYs that are 20 times the average savings rate (.09%) and FDIC insurance amounts that are substantially higher than the standard $250K.

Wealth management companies like Robinhood hope that these high-yield savings accounts will persuade customers to keep and reinvest excess cash with them, rather than move it to an external checking or savings account. They’re also valuable for a company like Credit Karma, which eventually aims to be an all-in-one financial hub for users.

By partnering with deposit networks through Cambr (Credit Karma) and Promontory (Robinhood), fintech companies can start creating high-yield savings accounts for customers in less than three months, without a banking license. The arrangement is attractive to both ends of the banking spectrum: for struggling regional banks, deposits can help fuel growth; for bigger banks, deposits provide a lower cost of capital.

In addition to high-yield savings accounts, Robinhood announced the launch of a Mastercard debit card this month (via Galileo), not unlike Betterment’s new Visa debit card (via Cambr). Both offer no fees and free ATM access. Fintech companies continue to entice customers not only to park their cash with them, long-term, but also use their services daily. Sounds a lot like a neobank…

- Investing in Lio Seema Amble, James da Costa, Eric Zhou, and Brian Roberts

- Need for Speed in AI Sales: AI Doesn’t Just Change What You Sell. It Also Changes How You Sell It. Seema Amble and James da Costa

- Investing in Stuut: Automating Accounts Receivable Seema Amble, Joe Schmidt, and Brian Roberts

- The AI Application Spending Report: Where Startup Dollars Really Go Olivia Moore, Marc Andrusko, and Seema Amble

- The Rise of Computer Use and Agentic Coworkers Eric Zhou, Yoko Li, Seema Amble, and Jennifer Li

The forces behind Nubank’s massive growth

The Brazilian fintech startup Nubank reached 15 million users this month, making it one of the largest neobanks in the world. After starting with a credit card product, the company’s introduction of a debit card last year is likely to drive that figure higher still. Nubank is already expanding beyond its Brazilian roots, most recently into Mexico and Argentina.

Fifteen million users is a new milestone in the neobank space. By comparison, the US challenger bank Chime—which launched the same year as Nubank, 2013—recently hit 5 million customers. British neobanks Revolut and Monzo, both founded in 2015, claim 7 million and 3 million users, respectively. The German mobile bank N26 announced 3.5 million users in June. In fact, Nubank is likely to close in on traditional US banks within the next couple years—Chase, Bank of America, and Wells Fargo each have 33 million, 25 million, and 22 million active users on their mobile apps.

In part, this rapid growth is a reflection of Latin America’s opportune market. In the US and Europe, neobanks must convince users to transfer their core accounts from well-known incumbent banks, which often translates into a saturated market and expensive customer acquisition costs. In Latin America, where approximately 50 percent of adults do not have access to financial services or bank accounts, the rise of mass market credit and debit products has propelled neobanks’ success. In addition, Brazil is known for extreme banking concentration—82 percent of banking assets are held by the five largest banks—and steep interest rates. All these factors point to Brazil and Latin America as exciting breeding grounds for additional neobanks and fintech companies to emerge.

More from the a16z fintech team

The ‘Google Maps for Money’

Imagine a future where you could outline your goals early in life and an app would execute your optimal financial plan, rerouting and adjusting for “traffic” along the way. That’s the promise of autonomous finance.

By Angela Strange

16 Minutes on the News: Record ATM Fees, Crypto Regulations [Podcast]

More on how rising ATM fees disproportionately affect low-income people in neighborhoods banks tend to avoid.

By Angela Strange, Scott Kupor, and Sonal Chokshi

Five Ways Fintech Startups Can Find Users

Customer acquisition is tougher than ever. Here are five overlooked ways new companies can acquire new customers. (Hint: It’s not Google or Facebook ads.)

By Anish Acharya

To receive this monthly update from the a16z fintech team, sign up here.