In the Greek classics, there is one meta-storyline that rises above all else: being respectful to the Gods vs. being disrespectful to the Gods. Icarus gets burned by the sun, not because he is too ambitious per se, but because he is not respectful of the divine order. A more recent example would be pro wrestling. You can tell who’s the face and who’s the heel by simply asking, “who here is respectful to wrestling, and who is disrespectful to wrestling?” All good stories take some form or other like this.

VC has its own version of this story. It goes, “VC is and has always been boutique. The mega-firms have gotten too large, and aimed too high. Their downfall is assured, because it is simply disrespectful to the game.”

I understand why people want this story to work. But the reality is, the world has changed, and venture has changed alongside it.

There is more software, leverage, and opportunity than there used to be. There are more founders building much larger companies than there used to be. Companies stay private for longer than they used to. And founders demand more from their VCs than they used to. Today, the founders building the best companies need partners who can actually roll up their sleeves and help them win, not just write checks and wait.

So the topline goal of the venture firm now is creating the best interface to help founders win. Everything else—how you staff a firm, how you deploy capital, what size funds you raise, how you help get deals done and broker power in service of founders—is downstream from that.

Mike Maples is famous for saying that your fund-size is your strategy. What’s also true is your fund-size is your belief in the future. It’s your bet on how big startup outcomes are going to be. It may have been “arrogant” to raise big funds over the last decade, but the belief was fundamentally correct. So when top firms continue to raise massive funds to deploy over the next decade, that’s them betting on the future and putting their money where their mouth is. Scaled Venture isn’t a corruption of the venture model: it’s the venture model finally growing up and adopting the characteristics of the companies they back.

Yes, venture capital is an asset class

In a recent podcast, the legendary Sequoia investor Roelof Botha made three claims. First, despite venture scaling, there are a fixed number of “winning” companies each year. Second, the scaling of the venture capital industry means that too much capital is chasing too few good companies—so venture doesn’t scale, and it isn’t an asset class. And third, the venture industry should be smaller, in order to correspond to the actual number of winning companies.

Roelof is one of the all-time great investors, and he’s also a great guy. But I disagree with his claims here. (And it’s worth noting, of course, that Sequoia has scaled too: it’s one of the largest VC firms in the world.)

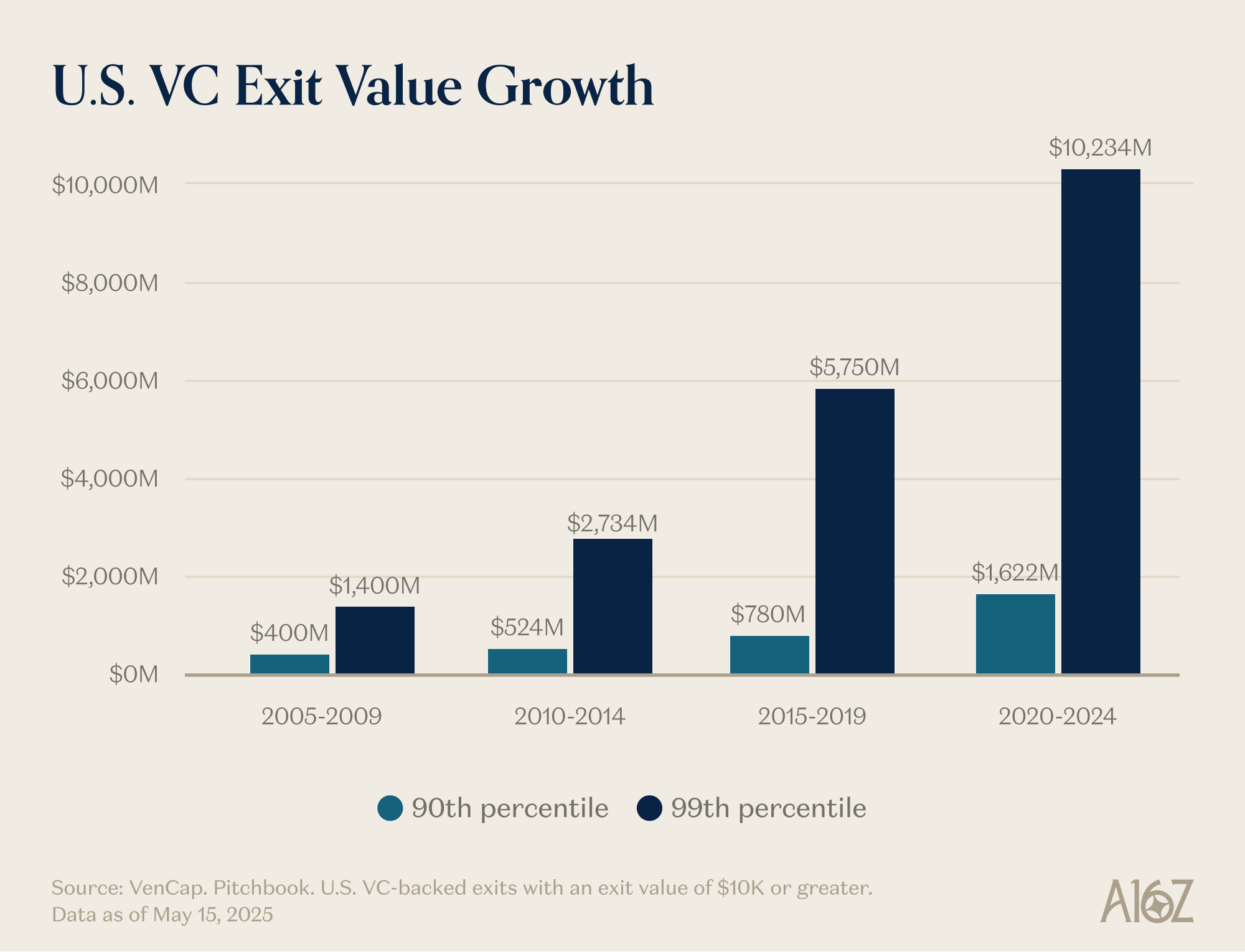

His first claim—that there is a fixed amount of winners—is easy to disprove. There used to be ~15 companies a year that got to $100m in revenue, now there are ~150. Not only are there more winners than there used to be, but the winners are also bigger than before. While entry prices are also higher, outcomes are vastly bigger than they used to be. The ceiling for what a startup can become went from $1 billion to $100 billion to, now, a trillion dollars and beyond. In the 2000s and early 2010s, YouTube and Instagram were considered to be huge acquisitions at $1 billion: those valuations were so rare that we called companies valued at $1 billion or more “unicorns.” Now we just assume that OpenAI and SpaceX are going to be trillion-dollar companies and that several others will follow them.

Software is no longer a scrappy sector of the American economy, home to quirky oddballs that are too weird to work elsewhere. Software now is the American economy. Our largest companies, our national champions, are no longer General Electric and ExxonMobil: they’re Google, Amazon, and Nvidia. Private tech companies are equivalent to 22 percent of the S&P 500. Software isn’t done eating the world—really, thanks to the acceleration that AI is bringing, it’s just getting started—and it’s even more important than it was fifteen, ten, or five years ago. So the scale that a successful software company can achieve is bigger than it used to be.

The definition of “software company” has also changed. Capital expenditures are dramatically higher —the big AI labs are becoming infrastructure companies, owning their own data centers, power generation, and chip supply chains. Similar to how every company became a software company, every company is now becoming an AI company, and perhaps an infrastructure company too. More companies are entering the world of atoms. The lines are blurring. Companies are verticalizing aggressively, and the market potential of these vertically integrated technology conglomerates is exponentially larger than anyone imagined a pure software company could become.

Which brings us to why the second claim—that there’s too much capital chasing too few companies—is false. Outcomes are much bigger than they used to be, the world of software is much more competitive, and companies are going public at a much later stage than they used to. All of this means that great companies simply need to raise a lot more capital than they did before. Venture capital exists to invest in new markets. What we’ve learned, over and over again, is that in the long run new markets are always much larger than we anticipate. The private markets have matured enough to support the very best companies at unprecedented scale—just look at the liquidity available to top private companies today—and both private and public market investors now believe in venture outcomes being extraordinarily large. We have continually misjudged how large VC as an asset class can and should be, and venture is scaling to catch up with this reality—as well as the opportunity set. The new world demands flying cars, global satellite grids, abundant energy, and intelligence too cheap to meter.

The reality is that many of the best companies today are capital-intensive. OpenAI needs to spend billions on GPUs—more computing infrastructure than anyone else can imagine securing. Periodic Labs needs to construct automated laboratories for scientific innovation at unprecedented scale. Anduril needs to build the future of defense. And all of them need to hire and retain the best people in the world, in the most competitive talent market in history. The new guard of massive winners—OpenAI, Anthropic, xAI, Anduril, Waymo, etc.—were capital-intensive and raised big initial rounds at high valuations.

Modern tech companies routinely require hundreds of millions in capital because the infrastructure required to build world-changing frontier technology is just so expensive. In the dotcom era, a “startup” was entering an empty field, anticipating demand from consumers still waiting for their dial-up to connect. Today, startups enter an economy shaped by three decades of technology giants. Fighting for Little Tech means that you have to be ready to arm David against a handful of Goliaths. Companies in 2021 were definitely over-funded, with a larger share of dollars going into sales and marketing to sell products that weren’t 10x better. But today the money is going into R&D or capex.

So the winners are far bigger than they used to be, and they need to raise much more money than they used to, often out of the gate. So of course the venture industry has to be much bigger to meet that need. That scaling makes sense, given the size of the opportunity set. If VC was too big for the opportunities in which venture capitalists are investing, we would expect to see the largest firms see bad returns. But we haven’t seen that at all. During the same time of expansion, the top venture firms have repeatedly returned extremely strong multiples—as have the LPs who’ve been able to enter them. A famous venture capitalist used to say that you could never have a 3x return on a $1 billion fund: it was just too big. Since then, certain firms have more than 10xed a $1 billion fund. Some people point to the lower-performing firms to indict the asset class, but any power-law industry is going to have massive winners and a long tail of losers. The ability to win deals without having to win on price is why firms can have persistent returns. In other major asset classes, people sell to or take a loan from the highest bidder. But VC is the canonical asset class where you compete on other dimensions besides price. VC is the only asset class with meaningful persistence of firms in the top decile.

And the last point—that the venture industry should be smaller—is also false. Or, at the very least, it would be bad for the tech ecosystem, for the goal of creating more generational tech companies, and ultimately for the world. Some people complain about the second order impacts of the increase in venture capital (and there are some!) but it has also coincided with a significant increase in startup market cap. To advocate for a smaller venture ecosystem is also likely advocating for a smaller startup market cap, and also likely slower economic development as a consequence. Which might explain why Garry Tan said in a recent podcast, “venture can and should be 10x bigger than it is now.” To be sure, it might be good for any individual LP or GP if there’s no more competition and they’re the only game in town. But it’s obviously better for founders, and for the world, if there’s more venture capital than there is today.

To flesh that out further, let’s consider a thought experiment. First, do you think there should be a lot more founders in the world than there are today?

Second, if we suddenly got a lot more founders, what kind of institutions would best serve them?

We’re not going to spend much time on the first question, because if you’re reading this, you probably know that we think the answer is obviously yes. We don’t need to tell you much about why founders are so good and so important. Great founders create great companies. Great companies create new products that improve the world, organize and direct our collective energy and risk appetite to productive ends, and generate a disproportionate share of the new enterprise value and interesting job creation in the world. And there’s just no way we’ve reached the equilibrium where every person who is capable of starting a great company has already started a company. Which is why more venture capital helps unlock more growth for the startup ecosystem.

But the second question is more interesting. If we woke up tomorrow and there were 10 times or 100 times the number of entrepreneurs than there are today (which, spoiler alert, is happening), what should the entrepreneurial institutions of the world look like? How should venture firms evolve in a world with much more competition?

“Come here and win deals instead of losing deals”

Marc Andreessen likes to tell a story of a famous venture capitalist who used to say that the VC game is like being at a sushi boat restaurant: “A thousand startups come through and you meet with them. And then every once in a while you kinda reach out, and you just pluck a startup out of the sushi boat, and you invest in it.”

The type of VC that Marc is describing—well, for most of the last few decades, that was pretty much every VC. Back in the 1990s or 2000s, it was just that easy to win deals. And because of that, the only really important skill for a great VC was judgment: being able to tell a good company from a bad one.

There are a lot of VCs that still operate this way—basically the same way that VCs operated in 1995. But underneath their feet, the world has changed in an enormous way.

Winning used to be easy—sushi boat easy. But now it’s extremely hard. People sometimes describe VC as poker: knowing when to pick a company, knowing at what price to enter, etc. But maybe that masks the all-out war you need to wage for the right to invest in the best companies in the first place. Older VCs romanticize the days where they were the only game in town and they could dictate the terms to founders. But now there are thousands of VC firms, and it’s easier than ever for founders to get term sheets. So more and more of the best deals involve an intense level of competition.

The paradigm shift is that the ability to win is becoming as important as picking the right company—if not more important. What’s the point of picking the right deal if you can’t get in? A few things have happened to cause this change. First, there was an explosion of venture capital firms, which means that venture firms need to compete with each other to win deals. And because there are more companies than ever competing for talent, customers, and market share, the best founders need strong institutional partners who can help them win. They need firms with the resources, networks, and infrastructure to give their portfolio companies an edge.

Second, since companies are staying private longer, investors can invest later on—once the company is much more proven and thus the deal is more competitive—and still get venture-style outcomes.

The last reason, and the least obvious one, is that picking has become slightly easier. The VC market has become more efficient. On the one hand, there are more repeat entrepreneurs who continue to create iconic companies. If Elon or Sam Altman or Palmer Luckey or a genius repeat founder starts a company, VCs will quickly line up to try to invest. On the other hand, companies get to insane scale quicker (with more upside due to staying private longer), so elements of product market fit are derisked relative to the past. And lastly, since there are so many great firms now, and so much easier for founders to get in touch with investors, it’s just harder to find deals that other firms aren’t pursuing. Picking is still central to the game—the right enduring companies at the right price—but it’s not by far and away the most important anymore.

Ben Horowitz posited that being able to repeatedly win automatically makes you a top-tier firm: because if you can win, the best deals come to you. You only have the right to pick if you can win any deal. You may not pick the right one, but at least you have the opportunity. And of course, if your firm can repeatedly win the best deals, you’ll attract the best pickers to come work for you, since they want to be in the best companies. (As Martin Casado said when recruiting Matt Bornstein to join him at a16z: “Come here and win deals instead of losing deals.”) So the ability to win begets a virtuous cycle that improves your ability to pick well.

For these reasons, the game has changed. My partner David Haber described the transition that venture needs to make to account for this change in his piece: “Firm > Fund.”

A fund, by my definition, has a single objective function: “How do I generate the most carry with the fewest people in the shortest amount of time?” Whereas a firm, in my definition, has two objectives. One is delivering exceptional returns, but the second is equally interesting: “How do I build a source of compounding competitive advantage?”

The best firms will be able to invest their fees into strengthening their moat.

“How can I be helpful?”

I got into venture a decade ago, and I quickly noticed that, of all the venture firms, Y Combinator was playing a different game. YC was able to get preferential terms in excellent companies at scale, while seemingly able to serve them at scale too. It seemed as though in comparison to YC, many other VCs were playing a commoditized game. I’d go to Demo Day and think, I’m at the craps table, and YC is the house. We were all glad to be there, but YC was glad the most.

I soon realized that YC had a moat. It had positive network effects. It had several structural advantages. People said venture firms couldn’t have moats or unfair advantages—after all, you were just giving out capital. But YC clearly had one.

And that’s why YC has remained so strong even as it’s grown. Some critics don’t like that YC has scaled; they think it’s only a matter of time before it dies because they think it has no soul. People have been predicting the death of YC for the last 10 years. But it’s just not happening. They replaced their entire partnership over that time, and it still isn’t happening. A moat is a moat is a moat. And just like the companies they invest in, the scaled venture firms have moats beyond just brand.

I then realized that I didn’t want to play the commoditized venture game, so I cofounded my own firm, along with other strategic assets. These assets were valuable and generated strong deal flow, so I had a taste of what a differentiated game could look like. At around the same time, I began to observe another firm build a moat of its own: a16z. So years later when the opportunity to join a16z emerged, I knew I had to take it.

If you believe in venture as an industry, you believe—pretty much by definition—in power laws. But if you really believe that the venture game is governed by power laws, then you should believe that venture capital itself will follow power laws. The best founders will concentrate at the firms that can help them win most decisively. The best returns will concentrate at those same firms. And the capital will follow.

For founders trying to build the next iconic company, the scaled venture firms provide a compelling product. They offer expertise and full-service offerings for everything a rapidly scaling company needs—recruiting, go-to-market strategy, legal, finance, communications, government relations. They offer enough capital to actually get you where you need to go, rather than forcing you to ration resources and move slowly against well-funded competitors. They offer gigantic reach—access to everyone you need to know in business and government, introductions to every Fortune 500 CEO and every world leader who matters. They offer access to 100 times more talent, with a network that spans tens of thousands of the best engineers, executives, and operators in the world, ready to join your company when you need them. And they’re everywhere you need to be—which, for the most ambitious founders, is everywhere.

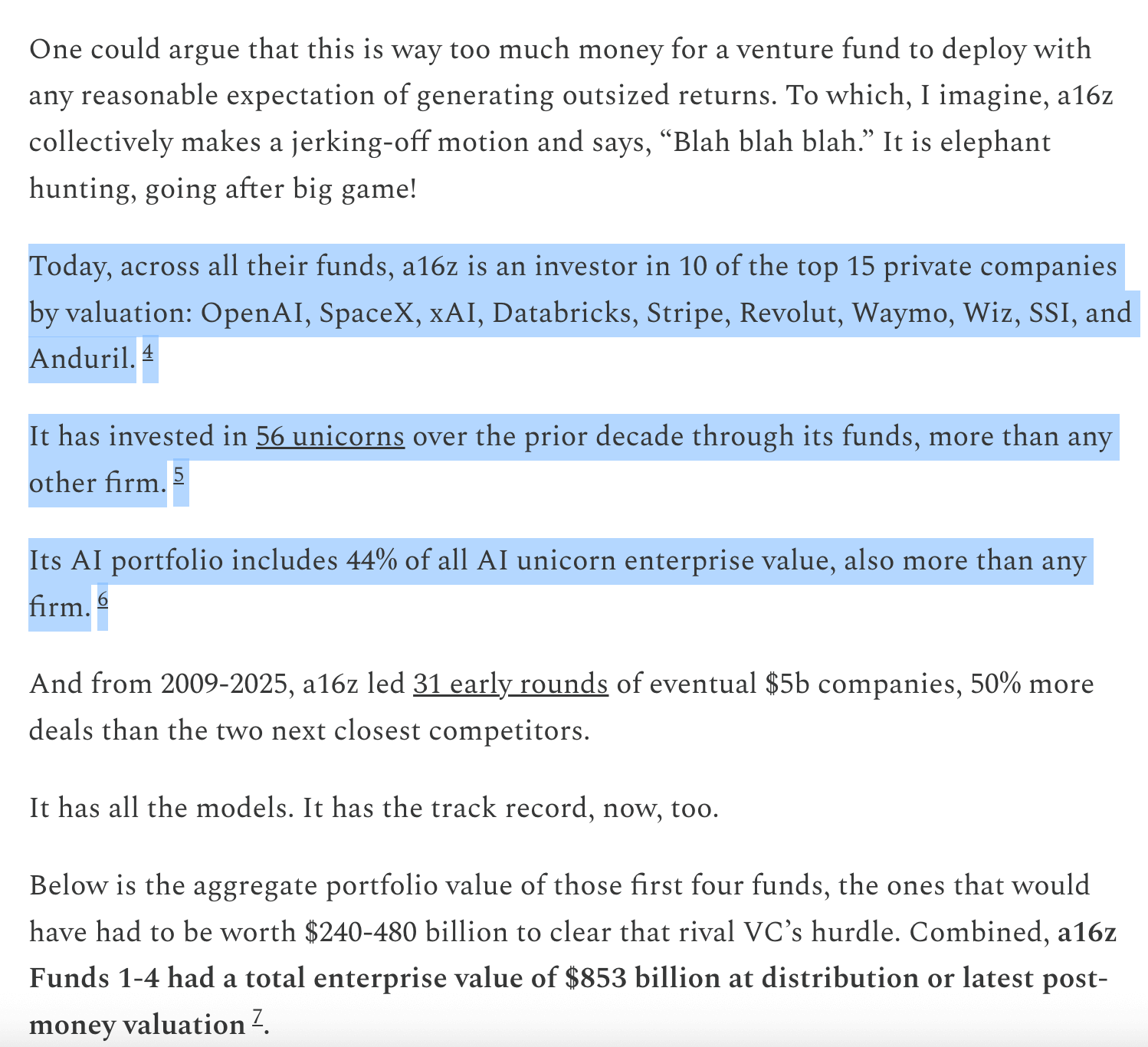

For LPs, meanwhile, the scaled venture firms are also a compelling product on the simple question that matters most: are the companies driving the most returns choosing them? The answer is simple—yes. All the big companies are working with scaled platforms, often at the earliest stages. Scaled venture firms get more swings to get the companies that matter, and more ammo to convince them to take their money. This is reflected in the returns.

From Packy’s piece “The Power Brokers”

Consider where we are at this moment. Eight of the ten largest companies in the world are venture-backed companies based on the West Coast. These few companies have supplied the lion’s share of growth in new enterprise value in the world over the last few years. The fastest-growing private companies in the world, meanwhile, are also largely venture-backed companies based on the West Coast: companies that only came into existence a few years ago are speeding toward trillion-dollar valuations and the largest IPOs in history. The best companies are winning more than ever, and they’re all backed by the scaled firms. Not every scaled firm does well, of course—some epic flameouts come to mind—but nearly every great tech company has a scaled firm backing it.

Go Big or Go Boutique

I don’t think that the future will just be scaled venture firms. Just like everything the internet touches, venture will become a barbell: a handful of mega-scaled players at one end, and many small, specialized firms at the other, each operating in specific domains and networks, often working in partnership with the scaled venture firms.

What’s happening to venture is what typically happens when software eats a service industry. At one end, four to five big power players, often vertically integrated services firms; and on the other end, a hyper-differentiated long tail of small providers, whose creation was enabled by the “upending” of their industry. Both ends of the barbell will prosper: their strategies are complementary and they both empower each other. And we’ve backed hundreds of boutique managers outside the firm, and will continue to back and partner with them closely.

Scaled and boutique will both be fine, it’s the middle that’s in trouble: the funds that are too big to afford to miss out on the mega-winners, but too small to compete with bigger firms who can structurally offer a better product for founders. a16z is unique in that it’s both sides of the barbell—a collection of specialized boutique firms benefiting from a scaled platform team.

The firms that can best partner with founders will win. That could mean a supersized reserve of capital, or unprecedented reach, or a huge platform of complementary services. Or it could mean irreplicable expertise, excellent counsel, or simply unbelievable risk tolerance.

There’s an old joke in venture capital where VCs think that every product can be improved, every great technology scaled, and every industry disrupted—except their own.

And indeed, many VCs don’t like the fact that scaled venture firms exist at all. They think that scale sacrifices some soul. Some people say that the valley is too commercial now and no longer home to weird misfits. (Anyone who claims there aren’t enough weird misfits in tech hasn’t been to any SF tech parties, or listened to the MOTS podcast.) Others appeal to a self-serving storyline—that change is “disrespectful to the game”—while ignoring that the game is in service of founders, and always has been. Of course, they’d never express the same concern about their companies, whose existence is predicated on them achieving great scale and changing the game in their respective industries.

To say that scaled venture firms aren’t “real venture capital” is like saying that NBA teams shooting way more 3s aren’t playing “real basketball.” Maybe you don’t think so, but the old game doesn’t reign supreme anymore. The world has changed, and a new model has emerged alongside it. The irony is that the game here has changed in a similar way to how the startups VCs back change the game in their industries. When technology disrupts an industry and a new set of scaled players emerge, there’s always something lost in that process. But there’s also much more that’s gained. Venture capitalists know this trade-off firsthand—they back it all the time. The same process of disruption that venture capitalists hope for in the startups that they back also applies to venture capital itself. Software ate the world, and it sure as hell didn’t stop at VC.