Why is it so damn hard to meet a sales forecast? There are so many ways things can go wrong during the sales process — prospects were super excited at first and indicated they were eager to buy your product, but then things got cold as it traveled through the enterprise; you were so close and thought you FOR SURE had the deal, then later hear “I’m sorry, but we’re going with competitor X”; …and so on.

All it takes for a big deal your company is counting on to slip out of the forecasted period is for just one little thing to go wrong. Because enterprise selling is a lengthy, convoluted process (much like trying to pass a bill through Congress), even the best products and salespeople won’t ensure you’ll meet your sales forecast.

Sales professionals — as well as CROs, CFOs, and CEOs — can respond to this scenario in one of two ways: Control, or be controlled. But “control” means putting in place a strong sales, forecasting, and deal qualification process. This is not some nice-to-have operational exercise — it’s a must-have for successfully scaling your company.

‘Control’ means putting in place a strong sales, forecasting, and deal qualification process.

Early in my tenure leading sales at Opsware with Ben Horowitz, he started to tease me about acting like Jack Bauer on 24 when it came to managing the forecast at the end of the quarter. One quarter, we had to close 12 out of 13 deals in the last two weeks to meet over 90% of the company’s number. Ben and our CFO Dave Conte looked like ghosts during that tense period.

“How’s it look Cranney?”, one of them would ask; “same as it looked two hours ago,” I’d answer. Though things looked bleak in the “done” column of the sales forecast (i.e., deals that had actually closed), I knew we still had enough high-quality opportunities that had progressed deep enough in our sales process if we inspected the forecast with rigor. That’s where the “Jack Bauer” label came from — it was about interrogating the sales team and prospects, sometimes with hard, uncomfortable questions. And just like any highly competitive ballgame, managing the clock across a forecast period requires that you get the right people in the right place at the right time with incredible precision and execution. But first, you need a playbook in place.

It begins with a strong sales process

What is a sales forecast? Exactly what it’s called: It’s a forecast of expected sales in a given period of time. Businesses depend on the accuracy of a sales forecast to plan for the future.

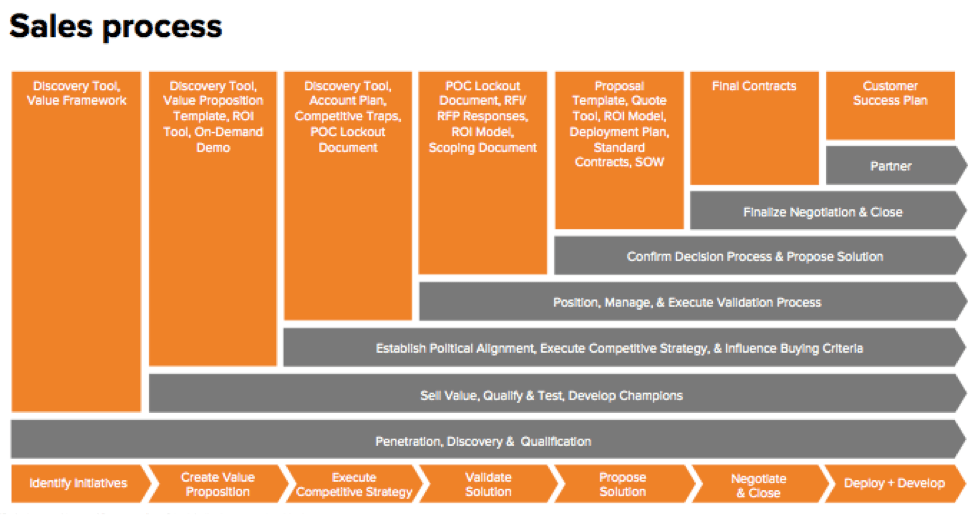

You can’t have a highly accurate forecasting methodology without a scalable and repeatable sales process, however. I’ll share more on sales process in later posts, but for the purpose of this post let’s assume you already have something like this in place:

A technical sales process that activates when a “marketing-qualified lead” is converted into a “sales-accepted lead”; the bottom layer represents the stages, the middle layer (grey) represents activities, and the top layer represents supporting deliverables

Forecasting begins with asking individual contributors and/or front-line sales managers to assign likelihood percentages to closing deals, adding committed close dates for each opportunity, and then rolling them up into the sales forecast. This is called a “roll up”.

But to achieve great forecast hygiene you cannot — I repeat, cannot — trust your roll up to spreadsheets and customer relationship management (CRM) tools alone. The best sales managers will make a “management adjustment” or “forecast override” by interrogating, scrubbing, and sometimes even distributing forecast risk across their team and territories. For example, a sales manager with eight reps may adjust a $10M roll up to $9.5M after assessing the entire forecast as a whole.

Why? Because sales teams consist of people with different levels of optimism, skills, scales, and tenures, so inaccuracies are normal. That’s why aggressively managing the team roll up is key to a strong forecast. But first, let’s take a look at some of the common pitfalls here…

The culprits of forecasting

More seasoned sales reps tend to be more trustworthy in their forecasts… but that’s only a general rule of thumb. (For example, this isn’t necessarily true if they’re selling in an environment they haven’t sold in before or selling a product that’s new to them.)

Don’t trust your forecast roll up to spreadsheets and CRM tools alone!

Otherwise, here are some of the archetypes behind common forecasting errors at all levels of a sales organization:

Rose-colored Glasses Glen is too optimistic about every opportunity he sees in his pipeline.

Hard of Hearing Harry’s ears are too full of wax to hear that his prospect is really suspect.

Sandy Sandbagger may be a pessimist, fear accountability, or just enjoys being the last-minute hero. She refuses to commit deals until quarter end.

Peter P.O. Perfect is too much of a perfectionist to commit to any deal in the forecast until he has a purchase order in hand.

Korner Kutter Keno forecasts deals, no matter what size, every time a prospect smiles at him. He can’t resist taking shortcuts and is too impatient to take prospects through every stage in the sales process.

Fifty/Fifty Freddie won’t commit to a forecast, because he’s not sure which way his deal will go. A quarter in your pocket would give you a better forecast than he could!

Finally, every sales leader should also watch out for these two types of forecasted deals:

“Birthday candles” This deal has been in and out of the forecast so many times that we’re lighting a candle for its every anniversary. So then how should you handle these? Easy: You shouldn’t count on them. If they close, great; only then put them in the closed column.

“Bigfoot sightings” These big but rarer deals will always take longer than normal. Since they’re large and complicated, it’s best not to commit the entire deal and instead only forecast part of it. In fact, I recommend forecasting these deals altogether outside your normal process.

And since large deals can chew up a lot of resources, be aware of them disproportionately hogging resources. That’s why it’s critical to layer deal size in your sales forecasts.

Layering and bucketing: Forecasting best practices

Larger deals usually require different qualification criteria and metrics than smaller deals, so you should layer your prospects’ budget authority by deal size. Smaller deals, especially at enterprise companies, can receive the same level of attention and move just as slowly as deals with bigger price tags, particularly if you’re working on the first “land” deal. (Once you’ve landed a deal, the “expand” deal is often more predictable because you know the customer’s buying process, criteria, and power structure by then.)

Here is an example of layering deal size in your forecast:

- Big Deals: >$1M

- Green Zone: >$100k-$999k

- Transaction Business: > up to $99k

While every company’s deal recipe mix is slightly different, when comparing the original forecast to the previous one, about one in every three or four large forecasted deals end up closing in the same time period. To provide sufficient backfill, you should have three additional deals for every “green zone” or “big deal” forecasted. Again: because an individual contributor may not have three deals to backfill their one big deal, it’s important for the sales manager to continually adjust and/or override the forecast across the entire team and spread the risk (or upside) across multiple territories.

Sales managers may also need to add other qualification layers to the forecast, depending on deal velocity — which in turn is based on target market, vertical, and/or size of account. For example, deals with Global 2000 companies will move at different rates than those with small- and-medium-sized businesses, and federal and financial service opportunities will move much slower than ones in high tech. So adjust accordingly.

Finally, don’t forget to account for seasonality and prospects’ fiscal year budget cycles! Besides obvious things like taking into account major holiday periods, you may need to remind Rose-Colored Glasses Glen to remove his shades during forecasting when half his territory is going to be on vacation for a month in late summer. Or that international deals are on a different holiday calendar than U.S. ones.

Once you account for all of the above, typical forecast buckets should include:

Work in Progress All sales-accepted leads in the pipeline for each sales rep or team

Best case Your most optimistic forecast and upside deals that could become backfill

Commit The committed deals mostly likely to close inside the forecast period

Done Business that has actually closed (not that someone has said will close)

But how do you qualify deals in the first place?

Good qualification of deals adds another lens of scrutiny to the forecasting process, and can significantly enhance its predictability and execution. Qualification forces alignment between buyer and seller, not only removing the power differential between the two but positioning sales teams to actually deliver on their forecasts.

What do I mean by the “power differential”? Ideally, buyers and sellers should allot and invest equal resources in evaluations and negotiations. Too many salespeople don’t treat their time as if it’s as important as the customer’s. But salespeople have to be just as (if not more so) willing to withdraw from the conversation!

The forecasting methodology I recommend was originally created in the 1980s by Parametric Technology Corp sales development legend Jack Napoli called “MEDDICC”. With a defined qualification methodology like MEDDICC, sales management can quickly diagnose each opportunity in a forecast roll up, prescribe next steps to ensure closure, and prioritize high velocity or high value deals. Here’s how MEDDICC breaks down — with corresponding example questions to ask in the forecast call or meeting:

Metrics These are quantifiable measurements of how what you’re selling benefits a prospect’s business. It includes before-and-after examples of how your company has accomplished similar objectives for other customers. Example forecast question: Have we (the sales team and/or customer) developed a business case / ROI that justifies an investment in our solution?

Economic buyer This involves identifying the individual who can approve funding for your proposal (typically, this person will have access to discretionary spending) and building a trusting relationship with them. Example forecast question: Do we have a mutually agreed-upon process and timeline with this buyer to transact in the sales period?

Decision criteria These are the formal requirements and specifications each participant will use to evaluate your solution against other options in their decision-making process. Example forecast question: Do we know and can/have we influenced and met their technical and business criteria to align with our proposed solution?

Decision process This is the defined process by which a customer will consider, evaluate, select, and acquire a solution. Example forecast question: Do we understand the decision process and players? Do we have time and the political alignment to execute in the forecasted timeframe?

Identify pain These are the pain points — both business and technical — driving your buyer to act within a set timeframe. Example forecast question: What is the compelling event or sense of urgency for them to complete the deal in the forecasted timeframe?

Champion Different from the economic buyer, this is the person with power and influence in the organization who can evangelize and advocate for your solution. Example forecast questions: Who is/are our champion(s)? Have you tested the champion? How confident are they of completing our deal in the timeframe? Do they have more juice than our competition has?

Competition Clear understanding of your competition’s strengths, weaknesses, and differentiators — as well as who and how effective their enemy champion is — leads to your having a strategy to beat them. Note: when considering who your competition is, be sure to include inertia, where the prospect does nothing; fighting the “not invented here” syndrome; or just building a solution themselves, internally. Example forecast question: Have we beat or are we on the path to defeating our competition in the allotted timeframe?

Too many salespeople don’t treat their time as if it’s as important as the customer’s. But salespeople have to be just as willing to withdraw from the conversation.

Beyond asking these questions, how can sales leaders get more out of this methodology?

Use MEDDICC throughout the quarter

MEDDICC is a qualification methodology that overlays your sales process — it is not the sales process itself! — and the more letters (M, E, D, D, I, C, C — in any order) you can assign to a particular deal in the pipeline, the more likely you are to close it in the expected timeframe. As you assess the health of your forecast as each quarter progresses, you should be able to assign more of MEDDICC to your deals. The closer you get to the end of the quarter, the more letters your forecasted deals should show.

Resources are always constrained, so beware of sales reps who don’t ask the right questions to evaluate deals, especially if they want extra management attention or technical resources to ensure their success. With the MEDDICC approach, however, sales managers can get to the reality quicker, and better know when and where to deploy resources across the entire sales team.

What are some examples of those “right questions”? They should go something like this: Is the pain you’ve identified acute enough? When you say you understand the decision process, do you know exactly what approvals are required? Have you accounted for and impacted different buying criteria for different decision makers? And so on.

Use MEDDICC during sales forecast calls

Sales rep manager Anastasiya may want to make herself feel good about her forecast, but the VP of Sales is ultimately responsible — to their CEO, board, and investors — for Anastasiya’s number… and for everyone else’s as well. A good sales manager’s job is to pressure-test what reps say, with an ice pick to remove ear wax on hearing the truth. While it doesn’t sound politically correct, sometimes a little torture is the only way to get to the truth.

I generally recommend scheduling weekly forecast calls throughout the quarter, preferably on Fridays, so the team thinks about business calmly during the weekend. As the quarter progresses, the pace needs to quicken to daily, even hourly check-ins if needed.

Another key strategy is to staff a deal team — e.g., legal and finance resources — in a “war room” to help speed up negotiations, terms & conditions, and revenue recognition. Every little bit goes a long way when you’re close to the deadline.

Automate MEDDICC into the CRM infrastructure

Are you still pulling your roll up out of your CRM and then applying management adjustments into a spreadsheet? It’s 2016! Build your sales process and forecasting methodology directly into your CRM.

Don’t use what comes out of the box. Customize it — or better yet, get a forecasting package that sits on top of your CRM. (I recommend customized forecasting solutions like Aviso, which optimize sales forecasting by automating roll up and adjustment processes.)

* * *

Back to Opsware and the end of the quarter. Ben and Conte were having heart palpitations as we moved through those 12 deals, but I knew we’d be okay. I’d recruited a great sales management team and had seen us divide and conquer to execute our sales and forecasting process: In any given quarter, we assigned management ownership and ensured we had experienced, objective eyes on major deals — touching and moving them at the right time.

With two days to go, I came back from the field to host a major European bank for a two-day visit. By this time, Ben and Conte were “WTFing” me. “Two days to go and still only 10-15% done? What are you doing?” they’d ask. “Playing John Elway”, I replied. (At the time, NFL quarterback Elway was famous for starting “The Drive” and rallying his team toward last-minute victories.)

As devoted Oakland Raider fans (Elway was a Denver Bronco), Ben and Dave only got more frustrated when they heard me say this. But I reminded them that Elway led 47 “come from behind” wins in his career, and we were losing by three touchdowns to our fiercest competitor on the bank deal. That deal is not coming in for us this quarter, I told them, “But next quarter it will be here in 48 hours.” (I knew this because I’d been to Europe twice that quarter just to slow the deal down; I knew we’d lose it if we tried to close that quarter.)

So what was our final play to pull it off? While I “played Elway”, the rest of my managers mimicked another NFL great Jerome Bettis, known as “The Bus”, and punched through 11 red-zone deals in two days. Yes, you read that right — 11. Even though two deals slipped, we pulled forward a backfill deal and grew it to meet our quarter number. As for the bank, we blocked our competitor and closed the deal the following quarter for multiple millions. That deal ended up becoming our lighthouse customer in Europe.