The landscape of cell and gene therapies—where cells or genes are engineered to treat disease—is changing rapidly, with 4 US approvals since 2017 and 40-60 launches projected by 2030. Entrepreneurs, biopharma leaders, and contract organizations are all doubling down on the promise of these new modalities. The Cell & Gene Meeting on the Mesa annual 3-day conference aims to connect key players throughout the industry and address the most pressing issues across the value chain. In this post, I’ll share some hot topics and insights from this year’s conference.

What we’ll cover:

-

- Go-to-Market Strategy: Autologous vs allogeneic; liquid vs solid tumors; AAV vs. Lenti vs. everyone else; and the most popular indications

-

- Manufacturing is Everything: Endless problems, and a fierce race to find solutions

-

- Gray Areas in Gray Matter: Both hopes and challenges in tackling CNS (central nervous system) disease

-

- The Dark Side of the Cure: Solving for immunogenicity—when “one and done” cures aren’t one and done

Go-to-Market Strategy—Pick Your Team (Now)

There are endless factors to consider for go-to-market strategies in this new area, from modality to delivery to therapeutic area and more. The OG cell & gene therapy crew has focused and clarified their strategies, while newer companies are committing to specific development pathways from the get-go. This level of focus is essential given the complexity of drug product, high costs, and the risks associated with development and manufacturing. With so many unknowns and variables across the value chain, biopharma leaders are trying to solve one(ish) problem at a time.

Some of the key categories in which companies are committing to a specific strategy are:

- Cell Therapies: Autologous vs. Allogeneic. Autologous cell therapies are derived from a patient’s own cells, while allogeneic cell therapies are derived from donor tissue (such as bone marrow) and then administered to many different patients. Autologous is preferable from an immunity perspective; allogeneic is preferable from a manufacturing and scale perspective.

- Oncology Targets: Liquid Tumors vs. Solid Tumors. Liquid tumors (blood cancers like lymphomas, myelomas, and leukemias) make up ~10% of the market; solid tumors (brain, lung, breast, etc.) make up the remaining ~90%. But because targeting liquid tumors has seen more success with CAR T-cell therapies, the vast majority of candidates to date are being developed for blood cancers.

- Delivery Modality: Adeno-Associated Virus (AAV) vs. Lentivirus vs. Everything Else. Different types of viruses have been engineered to function as gene therapy delivery vectors, AAV and lenti being the dominant viruses of choice. Tradeoffs include insert size, transduction efficiency, immunity, and toxicity considerations. Non-vector methods (like electroporation, passive delivery, and ballistic delivery) and membrane-bound vesicles (like lipid nanoparticles) are also being explored.

- Popular (read: crowded!) Indications: Both genetic and delivery considerations have driven the industry to prioritize a particular set of indications, resulting in hot competition in:

-

- Genetic Disease – Lysosomal Storage Disease (Fabry, MPS, etc.), Hemophilia

- CNS Conditions – Parkinson’s, Multiple Sclerosis, DMD, ALS

- Oncology – Blood Cancers (Leukemias, Lymphomas and Myelomas)

- Ophthalmology – Retinal Dystrophies, Age-Related Macular Degeneration

Manufacturing is Everything—and Everything is a Damn Mess

As one would expect, these advanced therapies are incredibly difficult to manufacture. With delays, quality control and scale issues making headlines, it is clear there are endless problems to solve in process development. Traditionally, biopharma companies have largely outsourced manufacturing needs to CDMOs (contract development and manufacturing organizations), which are struggling to meet demand given challenges associated with technology complexity, low yields, and inconsistency between batches. Meanwhile, they’re being inundated with vendors claiming to have solved all their manufacturing woes, so much so that many CDMOs will now only adopt external innovations when a specific request comes from a biopharma partner or client.

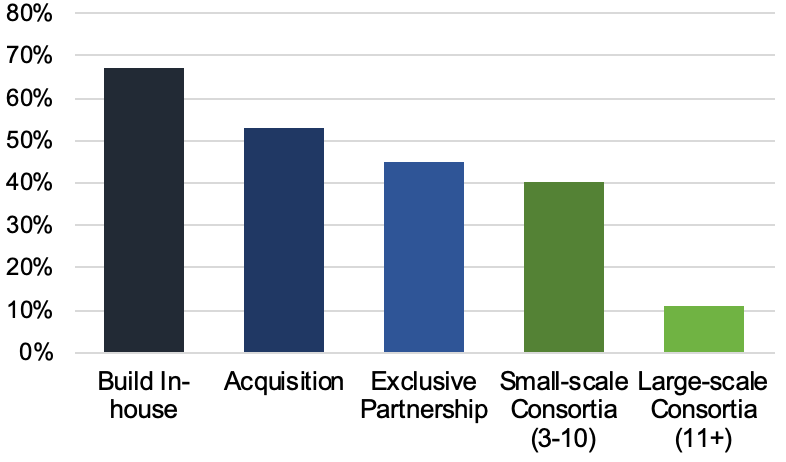

All this means that each incremental advancement carries a huge amount of value, such that biopharma and CDMOs alike are holding trade secrets particularly close. The graph below reflects a poll taken at the conference and shows that biopharma is more often choosing to build manufacturing capabilities either completely in-house or through acquisition (vs. outsourcing to CDMOs). Lack of information sharing across the industry has resulted in massive inefficiencies, as everyone tries to reinvent the wheel at the same time.

Nonetheless, CDMOs are preparing for the onslaught of demand just around the corner, with a slew of M&A and investment activity. Other manufacturing-related conversations covered topics like how to most efficiently factor the patient into the workflow and “bring the process bedside” for autologous cell therapies; and how biopharma companies can set themselves up for manufacturing success from day one by planning for delivery and scale with the use of approvable cell lines, standardized plasmids, assay prep for comparability studies, and more.

Gray Areas in Gray Matter

Because gene therapies have the potential to correct the underlying genetic defects that cause many CNS conditions, activity has exploded for diseases like Huntington’s, Parkinson’s, ALS, and DMD. However, the CNS space has always come with particular challenges that still need to be overcome, including:

- Less predictive models: Even with all the advancements in the space, CNS disease biology remains one of the areas we know the least about. This paired with inadequate translational preclinical models (turns out our brains are pretty different from a rat’s!) makes drug development inherently riskier.

- Delivery: It’s extremely difficult to get therapeutic payloads past the blood-brain barrier (BBB) and into the right cells — so much so that effective delivery often requires invasive procedures.

- Control groups: The placebo effect is remarkably strong for this therapeutic area, as parts of the CNS subject to disease may be modulated directly by expectations and conditioning. So anticipated placebo effects must be controlled for, in order to dissociate them from measured efficacy. Plus, placebo control designs for trials often pose their own ethical quandaries—for example they may even require sham surgeries for patients who are not receiving drug.

- Endpoints: Both functional and biomarker-based endpoints pose particular difficulties for CNS. For approvable endpoints, changes in motor control deficits are easier to measure than changes in cognitive decline, but not always possible or relevant depending on the indication.

The Dark Side of the Cure

Much of the promise of gene therapies resides in the idea of a “one and done” medicine—fix the error, cure the disease. But what happens when this approach doesn’t work, or fades over time? Do you try, try again? Unfortunately, that’s not an option. Immunogenicity—when a drug provokes an immune response—is a major issue for therapies delivered via viral vector. If a patient has a T cell-mediated immune response to the transfer vector or transgene, any attempt to re-treat will likely be futile. Developing strategies to overcome this is therefore an important area of focus. Manufacturing again comes into play here, as contaminants derived from certain manufacturing processes (e.g., host cell DNA contaminants and plasmid DNA for AAV manufacturing) can add to the severity of immune responses. On the brighter side, vectors like AAV5 have shown evidence of only antibody response and not T-cell response, so “capsid switching” (re-treatment with the same vector but a different capsid) is one possible effective approach. Other approaches include apheresis prior to treatment, immunosuppression methods, and avoidance of neutralizing antibody generation altogether via novel platforms.

Looking to 2020 and Beyond

This set of notes is just a small taste of the exciting advancements and massive challenges facing the cell & gene therapy space today. With ~40 Phase 3 trials expected to read out in 2020 alone, there is much more to look forward to just around the bend. We will see how these issues, among others, evolve as industry leaders continue to drive progress and innovation in the development of cell and gene therapies.