This post first appeared as an issue of the a16z Bio Newsletter. Subscribe to stay on top of the latest trends in bio and healthcare.

IN THIS EDITION:

- Field notes from the Cell & Gene Meeting on the [Virtual] Mesa

- AlphaFold! Protein folding, beyond the hype

- The latest step towards healthcare price transparency

- Power law for professors

- The light at the end of the COVID-19 tunnel?

Field notes from the Cell & Gene Meeting on the [Virtual] Mesa

Ginger LiauLike everything in 2020, the ARM Cell & Gene Meeting on the Mesa was a little bit different this year. While the Mesa was swapped for home offices, closets, and garages, the incredible science and energy driving these modalities forward remained constant. My high-level summary of the meeting is below.

Key Statistics

- >1000 clinical trials for cell & gene therapies underway

- 55-60% of trial activity in hematology and oncology, with neuro, endocrine, and ophthalmology gaining momentum

- ~200 Investigational New Drug (IND) applications expected per year starting in 2020

- ~10-20 approvals expected per year by 2025

- ~500k patients treated by 2030

The Big Themes

The entire industry ecosystem must evolve, and fast.

Many panel discussions centered around the systemic challenges standing between cell & gene therapies and patients, including: (1) regulatory approvals, (2) market access, pricing and reimbursement, (3) manufacturing and supply chain, and (4) care delivery. Scaling models used by first movers (e.g., Zolgensma, Luxturna, Yescarta, Kymriah) is neither operationally nor economically sustainable. Payor hurdles are particularly steep, with high front-loaded costs and no guarantee that the efficacy of one-time treatments will last. The industry has toyed with value-based contracts that spread payor costs, but agreements developed thus far are too complicated and expensive to implement for more than a handful of drugs.

How can we derisk “one and done” modalities for new indications and patient populations?

One-time, curative treatments for rare, debilitating conditions have been the first areas of focus. But while “one and done” treatments sound good, it isn’t ideal for most patients or most conditions. Cutting-edge research may enable us to: (1) branch out from simpler, monogenic diseases and (2) expand into patient populations beyond the most severe, while maintaining appropriate risk-benefit and cost efficiency requirements.

The blistering pace of scientific progress continues.

The immense challenges we face in delivering cell & gene therapies are countered by the astonishing scientific progress driving improvements in safety, efficacy, flexibility, and scalability of these platforms. Four key areas moving the scientific needle are: (1) viral vector and novel gene delivery mechanisms, (2) allogeneic cell therapy production, (3) the gene editing toolbox, and (4) immune cloaking. These innovations continuously bring us closer to getting transformative therapies to the patients that need them.

AlphaFold! Protein folding, beyond the hype

The bio world is buzzing with the news that Google DeepMind’s AlphaFold system for predicting the 3D structure of proteins outperformed 100 teams across 20 countries in the 14th Community Wide Assessment on the CASP (Critical Assessment of Structure Prediction) challenge. But is the protein folding problem truly solved, as some have said? Will it really revolutionize drug discovery? On this episode of our show 16 Minutes — where host Sonal Chokshi focuses on teasing apart what’s hype/ what’s real — a16z general partner (and Stanford professor and founder of Folding@Home) Vijay Pande weighs in on whether this is a breakthrough or not. How should big companies, startups, and the next generations of students be thinking about it?

The latest step towards healthcare price transparency

Julie YooIn this episode of 16 Minutes, Justin Larkin, Sonal Chokshi, and I share our take on the new Centers for Medicare & Medicaid Services (CMS) price transparency rule for payors. A few of my key takeaways:

- This new rule addresses some gaps left open in last year’s hospital rule, such as handling of non-employed physicians and medical loss ratio impact to payors for resulting shifts in spend.

- Although the direct impact to consumers is still a few years out, the bigger near-term lever is how payors and hospitals will conduct business. We have always believed that transparency tools, while valuable to consumers, are more valuable to referring providers — who guide the majority of provider recommendations today.

- It’s unfortunate that one of our industry’s top complaints about the rule is that ~10M lines of data would crash their spreadsheets & computers; we have dynamic pricing systems in airline/ecomm that handle multiple orders of magnitude higher volume and complexity on a daily basis.

- Overall, this new rule is a positive move — one of many CMS policies that are driving upgrades to our healthcare system’s infrastructure and more efficient market dynamics — albeit ironic, in that it forces disclosure of terms of proprietary business contracts (counter to efficient market dynamics). But are we really surprised? After all, this is healthcare!

- Also check out this deep dive companion pod on Bio Eats World with me and Dr. Marty Markary, author of The Price We Pay, that speaks to more of the consumer-facing consequences of price transparency (or lack thereof).

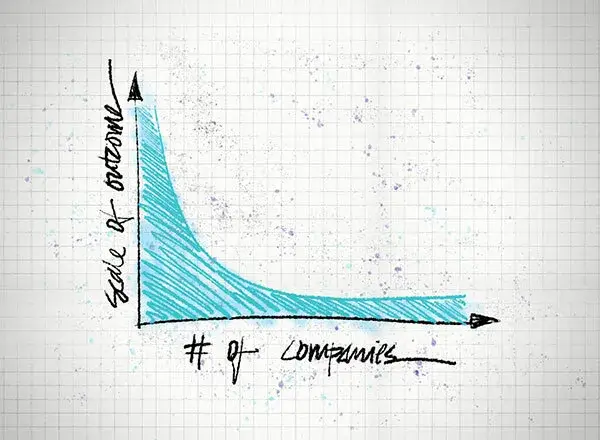

Power law for professors

We all know the type: the star academic who spins out multiple companies from their lab, while retaining their tenured position. Seems like the dream, right? But in this piece, Vijay Pande argues that this dream might come with a harsh reality. Read on to find out how to avoid the trap of the power law and the best way to set yourself and your startup up for success.

The light at the end of the COVID-19 tunnel?

News about COVID-19 vaccines is coming fast. On December 2, Pfizer and BioNTech received the first authorization from a western regulatory agency, the UK’s MHRA, and are ready to start delivering doses immediately. So have we entered the pandemic’s endgame?

In this episode of 16 Minutes — recorded after Pfizer/BioNTech announced their candidate is more than 90% effective — a16z general partners Vineeta Agarwala and Jorge Conde and host Sonal Chokshi breakdown the math, the science, and the practical considerations. And for an in-depth conversation on the science of vaccines and the coming renaissance of vaccinology, check out this episode of the a16z podcast.