With the explosion of trends like product-led growth over the past several years, companies bought a significant amount of software through non-traditional channels, like product teams. As the macro environment has shifted and companies try to do more with less, CFOs are scrutinizing and consolidating their investments. I was speaking to an executive at a growth-stage company the other week and they mentioned that they intended to cut the bottom 100 of their 300 SaaS apps in 2023. How then do you ensure that your product doesn’t get cut?

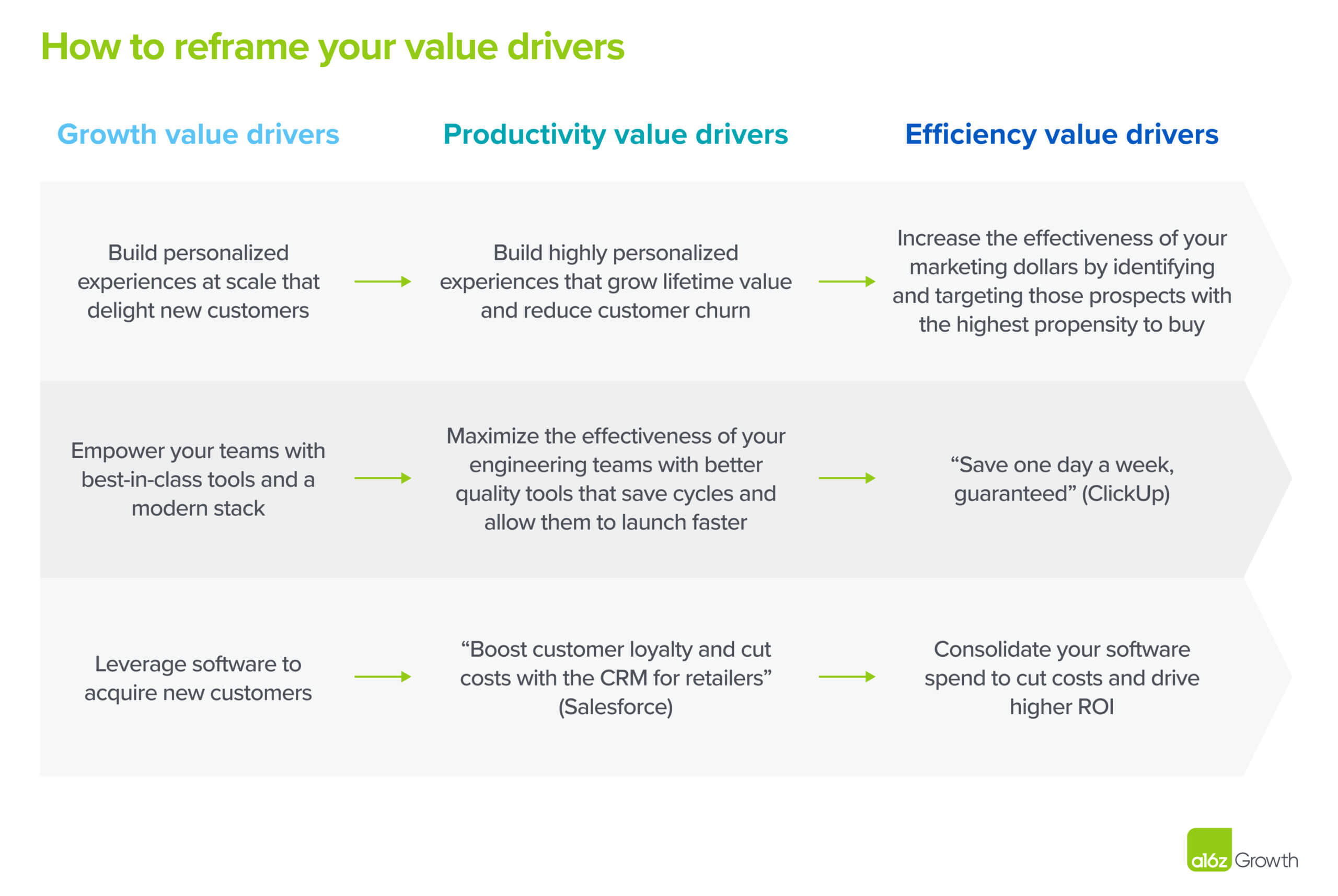

Tailor your messaging to productivity and efficiency value drivers.

TABLE OF CONTENTS

What is a value driver?

A value driver is a top-of-mind concern that exists with an economic buyer/customer, whether you, the vendor, show up or not. Value drivers fall into four buckets: growing revenue, reducing risk, accelerating time-to-value, or reducing cost. Every company will have its own specific pain points that it wants to solve with new technology, but when you drill down and ask why a particular problem is important, you’ll always get an answer that impacts cost, risk, time, or revenue.

Customers now value efficient growth

Customers over the past several years have primarily been interested in growth-related value drivers: companies have invested heavily in software in order to drive new revenue streams and accelerate existing ones. Today, however, customers are laser-focused on productivity and efficiency value drivers, like automating workflows, consolidating tech stacks, and reducing costs.

According to C3’s Tom Siebel, there are two types of customers going into 2023:

- Customers who anticipate a recession and cut costs across the board, including their IT spend

- Customers who invest in IT to drive efficiencies and save on costs

Companies need to focus on winning both customer profiles by explaining how their products help do more with less.

Emphasize productivity and efficiency value drivers

It’s still important to tell a growth story about your product, but leading with productivity and efficiency drivers will better help you address your customers’ pain points. Ask yourself: your customers have many choices for investing in growth, so how is your product going to give them the most value for their dollar? If you have a renewal coming up and you initially sold your product on making data-driven decisions to identify new revenue opportunities, for instance, consider instead emphasizing to your customers how your product can help them identify previously overlooked opportunities for efficiency and productivity gains.

Reassess value drivers across go-to-market motions

In this climate, most software purchased through a product-led growth motion is going to come under scrutiny. Some product-led companies may not have developed messaging that speaks to value drivers at all and are now in the position of developing value-driven messaging from scratch. Some sales-led companies, on the other hand, may have muddled messaging that doesn’t make it clear what value their product delivers. I’ve also seen companies—both product-led and top-down—unwittingly bias toward growth value drivers across all of their messaging strategies.

In all of these cases, it’s critical to get crisp on what problems your product solves for your customers today. “Your entire customer-facing team needs to be crystal clear on the problems you solve as it relates to the current challenges your buyers are facing right now,” according to John Kaplan at Force Management. “That value and your differentiation may have changed given this economy. The companies that weather this storm will have cross-functional alignment on how they provide value and agreement on how their customer-facing teams will execute that message with the buyer.”

How companies are responding to the shift

On the Salesforce earnings call at the end of last year, president and COO Brian Millham explained that the company is making “a big effort on the enablement side… to pivot away from messaging around growth to cost efficiencies, productivity, automation, and value delivered against dollars saved in the business.” At the end of last year, Labster started “consolidating our tech stack and leveraging automation tools to lower costs and manual effort. This helped us advance our approach to customer acquisition and retention,” says SVP of global revenue Matt Kaylie. And at Databricks, “we’ve pivoted our message more towards total cost of ownership/cost savings,” says CRO Ron Gabrisko. “The key is to continue to make sure you’re the top strategic partner for your champion, but you definitely need to be super crisp on how you can deliver cost savings.”

We’re in the middle of a major consolidation of software investments, dollars are scarce, and customers need to maximize the ROI on every dollar spent. Communicating how your product helps customers do more with less will be key to weathering the storm.

Thanks to CRO of Databricks Ron Gabrisko, SVP of global revenue at Labster Matt Kaylie, and John Kaplan at Force Management for their contributions to this piece.