For a full landscape of the commercial space market, see our previous post: Space: A Market Map.

Few achievements illustrate American Dynamism in a more visceral way than a rocket blasting off. It is, in a sense, controlled chaos — the culmination of expertise in a number of scientific disciplines, harnessing explosive forces to escape our planet’s grip. In recent years, technical innovations and market opportunity have ushered in an ecosystem of new launch providers, and a domain once reserved for nations is now led by private companies.

Their simple goal is to put mass, in the form of commercial or government spacecraft, into orbit. Of course, this is literally rocket science, so there’s actually nothing simple about it. Earth’s atmosphere and gravity attempt to restrain us, and although we regularly break free today, there’s still much innovation to come if we’re going to truly open up space for anything beyond satellites and exploratory research missions.

This resurgence of the launch ecosystem is young, but segments are emerging. There are a lot of rocket companies, and more are popping up every year. What follows is an explanation of how the launch market works and where it might be headed.

The market for rocket launches

Launch prices have dropped precipitously in recent years, expanding the potential for profitable applications. Notably, in this period, we’ve seen satellites dramatically shrink in size. But while they may differ in mass, they remain similar in principle: The largest segments of the space economy today are satellites transferring information through the electromagnetic spectrum. Doing this in space is really cheap, as it is on Earth, and is especially worth it if that data can only be supported by space-based infrastructure (e.g. remote sensors, satellite internet, GPS, etc.). As of now, information technology is the king of space — and both commercial and government customers are driving demand.

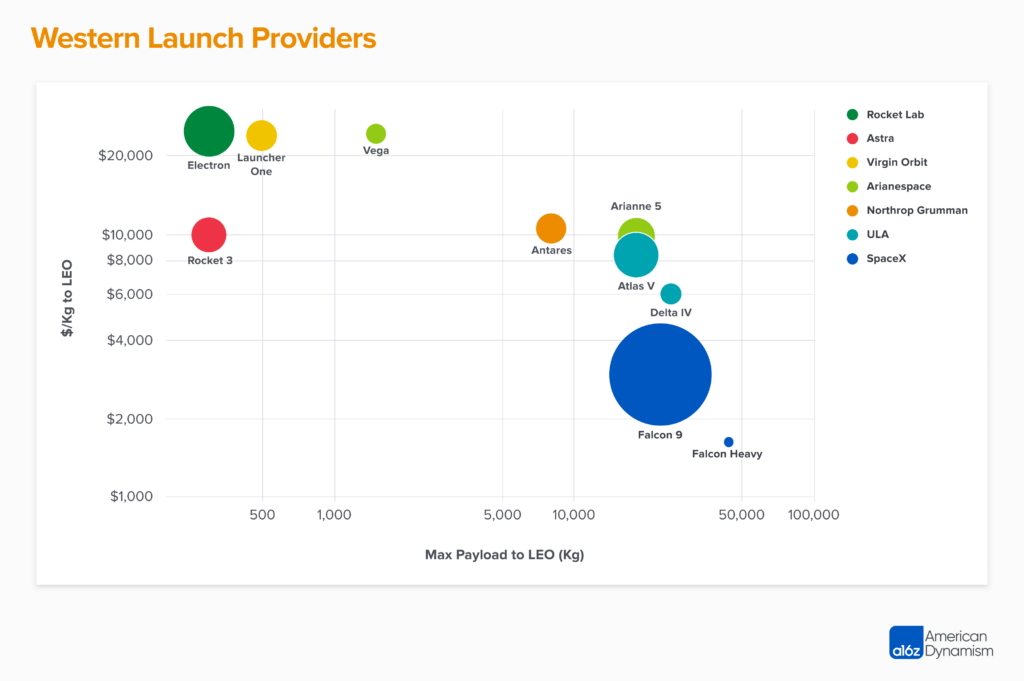

Understandably, customers want to quickly and successfully reach orbit for the cheapest price. Reliability and speed aside, price is commonly measured in $/kilogram (kg). This is often expressed as the price per unit if the rocket is full; more practically, the lowest costs fall between $3,000/kg and $6,000/kg. This is due in part to reusability, scheduling, and volume requirements. However, most customers won’t fill a rocket alone, as few companies have payload demands exceeding tens of thousands of kilograms.

Cost per launch better reflects the true price of reaching orbit. You can either fill the full payload capacity and achieve the lowest $/kg costs, or fill only a small fraction of the total capacity and pay more per unit. But the launch company charges the same price whether it’s at full capacity or empty. Naturally, rideshares enable multiple companies to split the cost per launch, which is why “$/kg” is commonly used for comparisons (more on this later).

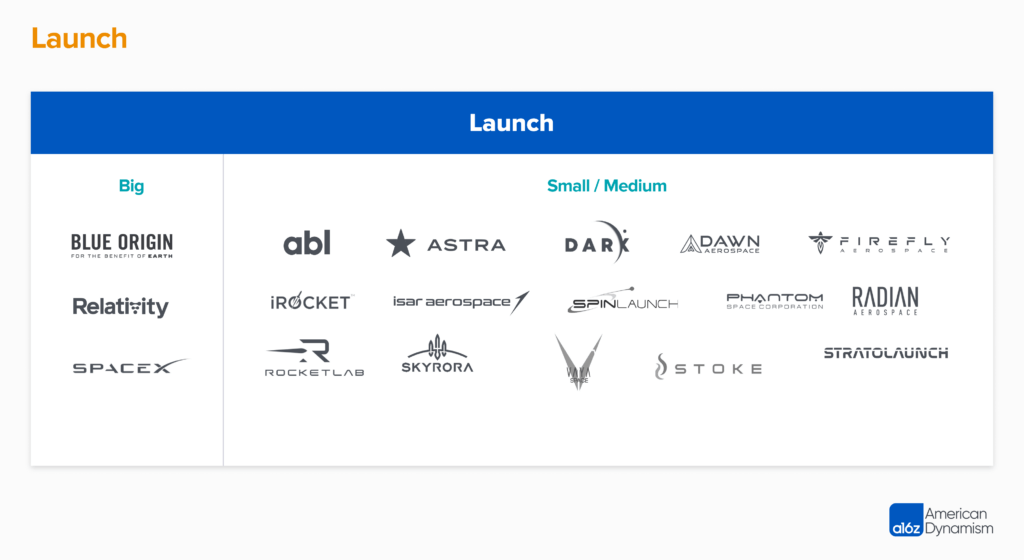

For optimal efficiency and pricing, launch capacity would be matched to payload demand. Large rockets that aren’t filled end up being far more expensive than a smaller rocket that is fully filled; economical viability can trump technical capability, in that sense. The launch market is commonly categorized by how much mass the rocket can carry – small, medium, heavy, super heavy. I’ve elected to simplify this according to the groupings of customers and use cases, not just launch capabilities: Big rockets launch big payloads, often mega constellations, and Small / Medium rockets launch smaller payloads, enabling dedicated scheduling and deployment location for spacecraft.

Today, the launch market is roughly $12 billion, but is estimated to grow to $30 billion or more by 2030. The western launch providers that flew at least once in 2022 are illustrated below, including legacy players like United Launch Alliance (ULA) and Arianespace.

If you can fill them, big rockets are the cheapest per-unit launch option. The SpaceX Falcon 9 has proven to be the most effective vehicle for this market, making up a whopping 60 of the 91 western launches in 2022 — and there is no close second. But that stat only illustrates who’s dominating the launches: Unpacking the customers in this segment reveals broader insights about the launch market and where it’s headed.

Let’s start with SpaceX. In 2022, over 50% of SpaceX’s launches were dedicated to Starlink, which now makes up the majority of objects in low-Earth orbit (LEO). These are very “full” launches. It’s worth noting here that Falcon 9’s listed max payload — 22,800 kg — is for the expendable version; its reusable rocket version peaks at around 80% of listed capacity — roughly ~18,000 kg for LEO. Even so, Starlink missions regularly pack in over 16,000 kg (approximately 50 satellites), and geosynchronous transfer orbit (GTO) missions pack over 4,000 kg. In 2022, four of Falcon 9’s launches were dedicated to U.S. government payloads, and three others were for allied governments.

For ULA, six out of eight launches on their Atlas V and Delta IV rockets flew U.S. government hardware. The majority of these government payloads are expensive, research-focused or classified, and demand reliability; they can’t risk a failed launch.

SpaceX’s Falcon Heavy found a unique use case in this government market, and its present usage illustrates the broader importance of matching rocket size with payload demand. Heavy was initially designed for the massive thrust to get large telecom satellites into GTO — a highly elliptical orbit that circulates into geosynchronous orbit (GEO) with time, and is much easier to reach than heading to GEO directly. However, the Falcon 9 improved so much over the years that it stole this market from its sister rocket. In 2022, roughly 20% of Falcon 9’s launches were for large commercial payloads entering GTO.

Though Heavy’s unit prices are very low when full, few customers will pay the $97 million launch price when the Falcon 9’s $67 million cost maps better to their needs. Heavy would be flown for Starlink missions, but its payload volume is actually similar to the Falcon 9. Effectively, you can’t fit more Starlinks in a Heavy anyway, so the added thrust is worthless. On top of this, difficulties with coordinating large enough launchpads makes scheduling difficult. Falcon Heavy only flew once last year, carrying heavy Space Force satellites directly to GEO.

Still, the majority of the launch market is in deploying large constellations in LEO. This will not just be Starlink. Other large telecom deployments, like Amazon’s Project Kuiper and OneWeb, will also demand high-volume, cheap launches. Given the competitive atmosphere, however, both of these constellations appear to be avoiding launching with SpaceX. Project Kuiper is looking at Arianespace, ULA, and, of course, Blue Origin for their future needs. And OneWeb selected India’s space program and Relativity’s future rocket, Terran R. Additionally, OneWeb is launching a couple of payloads with SpaceX due to the last minute cancellation of their Russian Soyuz launches because of the war in Ukraine.

There is also significant demand from other satellite operators, albeit not at the scale of communication satellites. For example, since 2017, Planet Labs has launched from the Russian and Indian state space organizations, Arianespace, Rocket Labs, Northrop Grumman, and SpaceX. Today, of the ~7,000 satellites in various orbits, around 1,000 operate in a remote sensing capacity like Planet Labs.

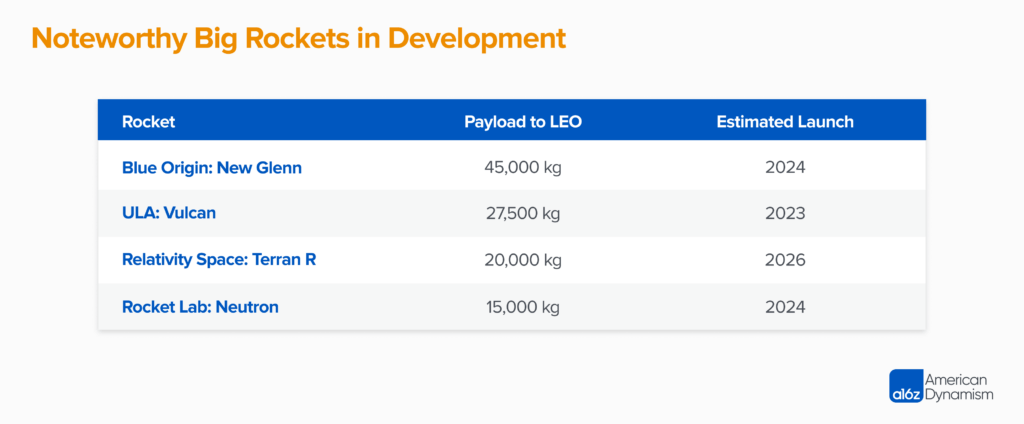

Building and maintaining increasingly large constellations of satellites requires big rockets, and there is certainly demand in this market available to whoever is able to launch reliably. Noteworthy big rockets in development include:

Existing players will likely dominate this market, and steep development costs — hundreds of millions, minimum — put new entrants at a disadvantage. The majority of the satellites going into space will continue to belong to and be launched by SpaceX; the rest of the market will likely be fighting for chunks of other large constellations. Additionally, the loss of Russian launch has effectively taken offline around 20% of global capacity, and Amazon bought up nearly all remaining viable launch partners until around 2025. Many companies that started building smaller rockets, like Relativity and Rocket Lab, are now moving upmarket to meet this opportunity. We’ll see rockets get as large as regular payload demand can fill — by some estimates, tens of thousands of satellites by 2030.

However, although larger rockets are potentially very profitable, there is still demand in the smaller market, buoyed by significant startup activity.

Small / medium rockets: targeting dedicated launch

If you have a single, 200-kilogram satellite you want to get into LEO, you won’t be buying out an entire Falcon 9. The common solution to this is to buy a ride with a big rocket that’s already launching and is sharing capacity. Last year, for example, SpaceX operated 3 rideshares to LEO to serve this “remainder” market — starting at roughly $6,600/kg.

However, like a bus, you are subject to their timelines and destinations — and, frankly, you’re competing for capacity against their own Starlink satellites. An additional concern, in some situations, is that precise deployment into a specific orbital position is impossible without a dedicated launch. Currently, there also is a two-year (or more) wait time for rideshare missions. Many smallsat companies are already dealing with tight timelines, so any uncertainty or waiting around for launch is painful. This reality has opened the door for smaller, dedicated launch providers that map closer to smaller payload demand and have more personalized schedules and destinations — effectively, a space courier.

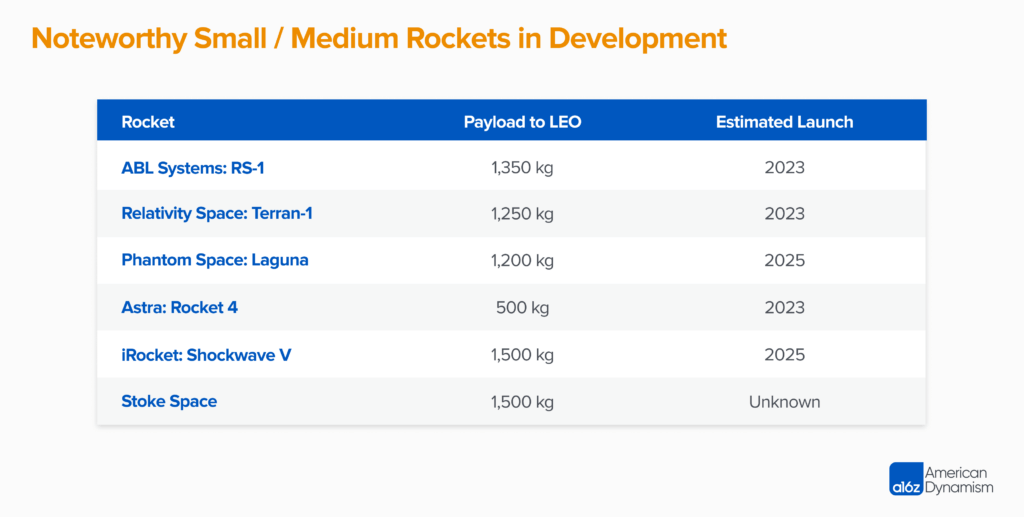

There are dozens of companies working in this segment. Because the rocket is smaller and has lower development costs, we’ve seen a bit more flexibility on launch system design: launching from a mid-flight plane, hypersonic platforms, kinetic first stage, and fully reusable rockets. Right now, Rocket Lab’s Electron is the leader in this small / medium launch category, flying nine times in 2022 (I would’ve placed Rocket Lab in the “Big” category, given Neutron’s development, if not for the success of Electron). Others, like Astra and Firefly, also succeeded in launching last year, and more are just behind them.

Candidly, though, I expect this market to be tough. While there is demand for dedicated launch, and it will surely increase in the coming years, there will likely only be a handful of players (or fewer) with meaningful market share. Today, whoever can actually launch will get business, although I expect this to change as more systems go online. (However, even successful launches won’t save you if the economics don’t work out, as recently exhibited in the case of Virgin Orbit.) Reliability and scheduling will be important differentiators against bigger rockets, but within the smaller rocket ecosystem, cost will be a differentiator in order to win business. Price declines will likely fall into three categories:

- Minimizing propellant mass: Using air-breathing jet engines to get to fast speeds before igniting a less-efficient rocket, or using another non-combustion method to gain velocity

- Greater re-usability: Building rapid, fully reusable systems, effectively making the cost of launch equal to the cost of propellant

- Building larger rockets: Fixed costs and economies of scale make larger rockets cheaper per kilogram, but you need to find the customer demand to make this viable

We’re also already seeing companies like Rocket Lab, Relativity, and Astra focus their efforts on building larger, cheaper per unit rockets, like the Neutron, Terran R, and Rocket 4. Small rockets want to become medium rockets, if not larger – SpaceX, too, began with the small Falcon 1 before focusing on the bigger Falcon 9. Additionally, companies in this segment have extended into adjacent markets; Rocket Lab actually makes much of their revenue from their Photon spacecraft, and Astra is focusing revenue efforts on their acquired propulsion system. All of this to say that the size of this dedicated launch market remains unclear, and survival might require expanding into other, higher-margin, spaces.

More pessimistically, as the big launch market grows to fuel mega constellations and higher-energy orbit destinations, they might also operate more rideshares. These alone won’t cover the development costs of big rockets, but they can still be profitable to launch on a regular basis and they will likely draw demand away from dedicated launch. Furthermore, the development of efficient satellite propulsion systems and space tugs might eliminate the desire for precise orbital drop offs. Rideshare could do the hard part, then you can find another way to go that last mile once in orbit.

National security will drive launches

As noted above, governments are also large buyers of launch services, and their involvement definitely matters when it comes to how the launch market will evolve. In fact, 109 of the 186 launches globally last year were dedicated to government payloads. When it comes to industries relevant to national security, governments will go out of their way to maintain a healthy industry of domestic suppliers — and, of course, space is becoming increasingly critical.

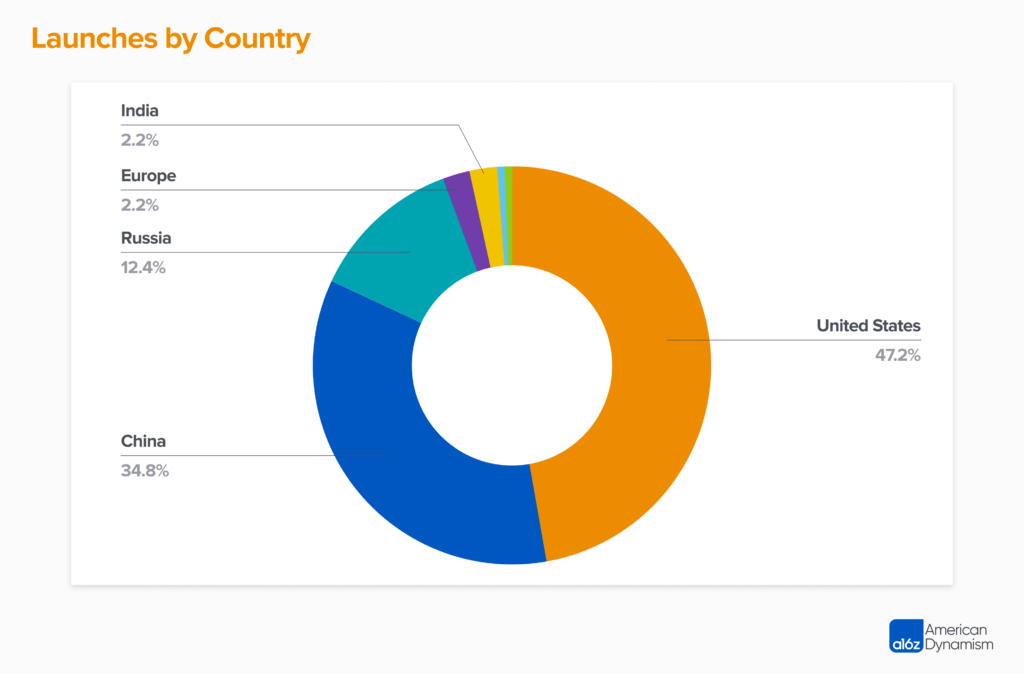

Today, only a handful of nations can regularly enter orbit. There are effectively three players — the United States, Russia, and China — with distant rivals in Europe, India, Iran, Israel, and South Korea. Perhaps most concerningly, China has accelerated their launch efforts in recent years and plans to deploy a 13,000-satellite mega constellation of their own. In 2022, the launch geographic split looked like this:

There is global demand for launch; last year, SpaceX flew 3 missions consisting of foreign government hardware, and there are many international satellite companies seeking orbital access. The largest launch providers will remain in the largest economies, but growing international demand will likely be subsidized by the governments that want it and channeled toward domestic industry. The days of SpaceX launching German or Japanese government satellites will likely disappear.

If a nation doesn’t have launch capacity, and can afford it, they will likely develop it. South Korea has recently achieved this, and Australia is attempting to follow later this year. However, accessible launch pads are a limiting factor here, as most countries lack good locations. Many of Europe’s launches, for example, take place in French Guiana. To address this, we’ll likely see countries partner to develop shared launch pads, or focus on alternative launch methods that do not require them — like launching from a mid-flight plane.

Why does launch capacity matter? Tactical response: the ability to quickly design and launch a spacecraft to replace a damaged satellite … or other more kinetic things. A country with security concerns should not rely on another nation for this service. In time, I expect most advanced nations to develop a domestic launch industry, likely small payloads, if only to maintain rapid response capabilities in times of conflict. Tactical response is an explicit goal of the U.S. Space Force, and last year Firefly was selected to take part in the third TacRS exercise, “Victus Nox”

Future of launch

The rise of the commercial launch industry catalyzed the growth of the modern space economy — both directly in orbit and in markets enabled by assets in space. Like the transcontinental railroads of the late 19th century, many of these companies will not survive, but their efforts will lay the foundation for a new frontier. No doubt, SpaceX has been the chief architect of this progress so far.

However, even with weekly Falcon 9 launches, it is still incredibly expensive to move mass into and around in space. This is in part because even the best rockets suffer from “the tyranny of the rocket equation,” a physics principle illustrating one of the field’s great challenges — that it takes propellant to lift propellant. While aircraft typically take off with around 50% of their mass being fuel, rockets hover around 85%, counting both fuel and oxidizer (liquid oxygen). To minimize total propellant needed for a mission, weight is shed mid-launch. Often this involves dropping the heavy and high-thrust first stage after ascending beyond the thicker parts of the atmosphere. By reducing weight mid-flight, achieving orbital velocity with the second-stage engine is easier. Typically, the second stage burns up in the atmosphere upon re-entry.

SpaceX has achieved a number of firsts here. Namely, pioneering rapid re-use of the first stage through vertical landing, and developing some of the best rocket engines with the Merlin and Raptor, the latter vying to be the first full-flow, methalox propulsion system to reach orbit. In terms of rocketry, this would be a significant achievement that helps balance specific impulse (fuel economy), propellant storage mass, and pure thrust — tempering the tyranny of the rocket equation.

Like an aircraft, however, building a rocket is far more expensive than fueling it — the Falcon 9’s propellant costs are only around $200,000 per flight. By far the most expensive part of a rocket is the massive first stage, nearly 60% of the total cost for the Falcon 9. A reusable first stage amortizes this across a number of launches, now exceeding 10 for the Falcon 9. Naturally, reducing the largest cost factor shook the launch market.

The question now is: What is next for launch in its current state? Looking farther forward, what new opportunities will open up when the next step function decline in launch costs occurs?

A wave of new rocket companies seek to dethrone the Falcon 9 by achieving even greater reusability and further reducing production costs. Personally, I’m excited for Stoke Space’s fully reusable rocket, Relativity Space’s 3D-printed engines, and Rocket Lab’s structural innovations in their Neutron launch system. Real competition in the launch market is coming, and it’s likely we’ll see Falcon 9’s dominance — and margins — erode as competition comes online.

However, SpaceX’s Starship, a 100,000-kg-payload, fully reusable rocket will completely change the space ecosystem. And this is not just for deploying large volumes of Starlink satellites. Starship makes space markets of physical goods, and moving people, become very real possibilities.

While Starship will not launch at breakeven, nor severely undercut existing prices, it will nonetheless usher in an era of larger payloads, unconstrained by mass, for both in-orbit and deep space objectives — realistically, something closer to $1000/kg would still shake up the market. A Starship sitting in LEO could also act as a gas station, fueling a web of spacecraft activity serving commercial stations and transporting assets throughout cis-lunar space. With Starship for logistics, budgets for a Moon base become comparable to other government research programs, and the supply chain necessary for a Mars colony becomes achievable.

Looking further ahead, we might envision a science-fiction-inspired single-stage space plane — something like a Star Wars X-Wing that can take off from a standstill, reach cruising speeds, and then accelerate into deep space. Completely optimizing launch systems for specific atmospheres and speeds — a transition from jet engines into rockets — is incredibly difficult, but it is theoretically optimal when it comes to high-speed flight. At slower speeds, air-breathing jet engines would minimize the perils of carrying oxidizer, and wings enable assistance from aerodynamic lift. Reaching orbit is a speed, not an altitude, and if you leverage jet engines when accelerating in the thicker parts of the atmosphere, before igniting faster rocket engines, competing with Starship prices might be feasible. In this sense, one could consider many hypersonic companies as efficient launch booster stages. I remain hopeful that more advanced technology will make this sci-fi vision achievable, pioneering orbital access that mirrors modern air freight rates of around $2 to $5/kg.

Launch is the beautiful beginning of a never-ending journey. To reach orbit, let alone build a business out of it, is exceedingly difficult. In a world of increasing unseriousness, the sheer complexity of it all gives you hope, reflecting mankind’s fiery spirit and deep, eternal curiosity for the mysteries of space.

* * *