Read this article in Portuguese.

As a continuation of our debt capital market pieces, we decided to spend some time studying the credit landscape in Brazil.

In recent years, we’ve noticed a significant increase in the number of funds, banks, and startups offering debt financing to startups in the country. This growth has been driven by the high increase of fintech companies in Brazil (now more than one thousand) and the attractive returns demonstrated by successful startups like Nubank and Creditas. However, despite the momentum, founders still find raising debt capital a complicated and largely opaque process.

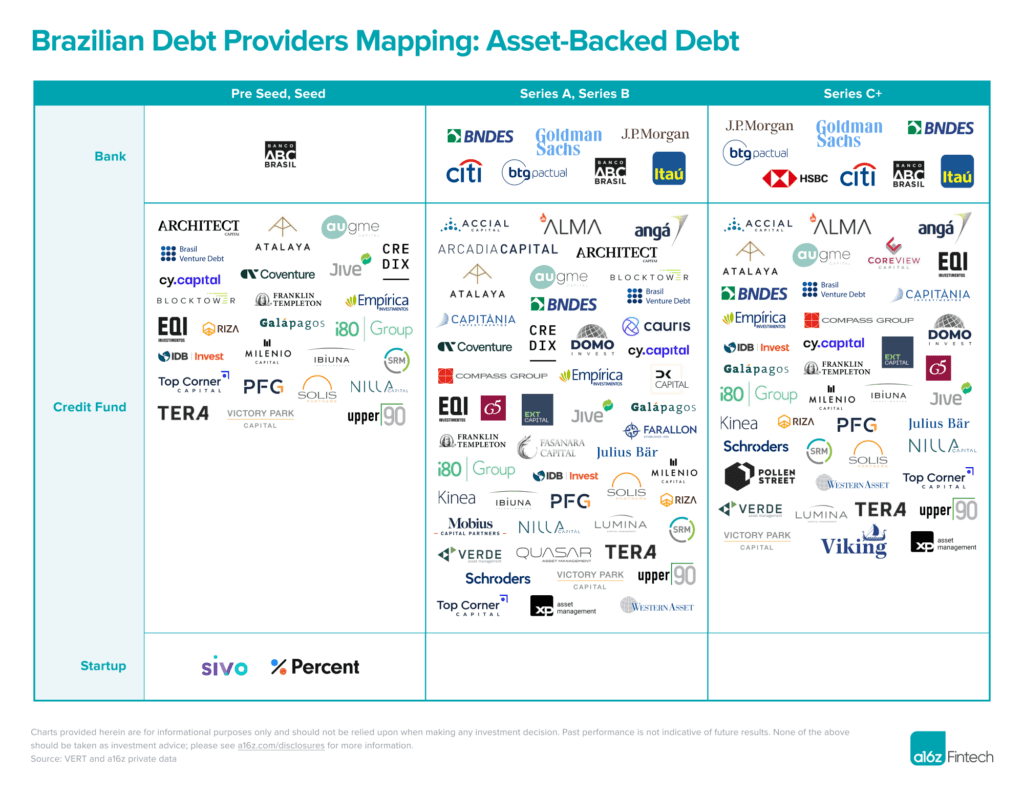

To address this issue and assist founders in the region, we have collaborated with our friends at VERT to create a market map of leading debt funds and providers. This resource aims to provide a clear and practical roadmap for founders looking to raise debt capital in Brazil.