When Infrastructure Climbs the Stack

When generative AI first broke into the mainstream, companies like OpenAI and Anthropic were understood primarily as infrastructure providers. Developers were encouraged to build on top of them, with the promise that AI models would be the foundation layer of a vast new ecosystem of applications. But today, these same companies are climbing further up the stack.

Take OpenAI’s recent release of Sora2, a consumer-facing app for video generation. What was once just a raw capability (text-to-video) is now packaged into an end-user experience, competing head-on with startups that thought they’d have room to build applications. Similarly, Anthropic has launched Claude Teams, not just offering API access to Claude models but delivering a ready-made productivity suite for enterprises.

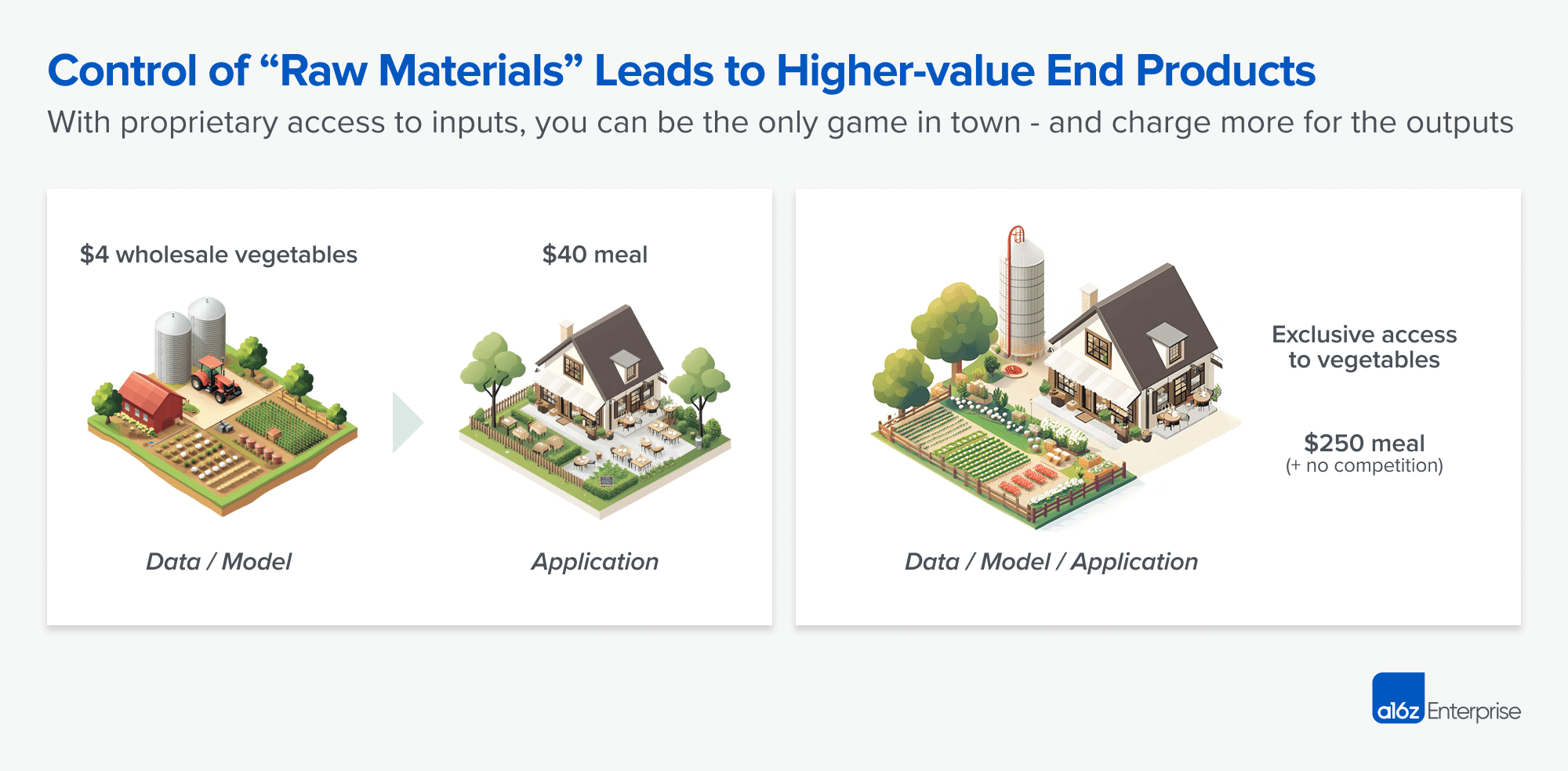

Think of the model companies as farms. They used to sell ingredients to restaurants — the startups — who turned them into meals. Now the farms are running restaurants too. To stand out, you can either cook better with the same ingredients or source ones no one else can.

This raises a key strategic question: how can startups build defensible businesses when their infrastructure providers are also their fiercest competitors?

Our answer: by planting seeds in walled gardens of data. In this case, walled gardens of data are domains where access to information is restricted, proprietary, and highly valuable — and where exclusivity itself creates a moat. These datasets are typically:

- Proprietary: not freely available on the open web

- Regulated or sensitive: requiring compliance, licensing, or credentials to gain access

- Dynamic and curated: constantly updated and validated

With that definition in mind, let’s review two examples: VLex in law and OpenEvidence in medicine.

VLex and OpenEvidence: Case Studies in Data Moats

VLex, a legal software company in Spain, began in 2000 as an ambitious effort to “revolutionize legal information access” by building a comprehensive legal content platform and applying new technologies to legal research. Spanish court decisions, statutes, and regulations were historically scattered across fragmented regional jurisdictions and often not available in machine-readable formats. Over the years, VLex systematically acquired, licensed, and digitized this content — effectively creating one of the most comprehensive legal databases in Europe. The result is something akin to LexisNexis + Westlaw + Bloomberg Law, specifically for Spanish legal history.

By the time generative AI models became viable, VLex had already amassed a proprietary corpus of legal data spanning decades of judgments and commentary. This gave it a defensible wedge to build AI-native legal research tools: unlike general-purpose models, VLex’s system can actually reason over authoritative, complete, and current legal texts. Its moat isn’t the model — it’s the painstakingly assembled dataset that no one else has.

Said differently: a lawyer crafting the best possible brief or argument needs access to every legitimate matter of precedent. A general-purpose model — even one as powerful as OpenAI’s — might produce a sophisticated-sounding legal argument, but missing even a few critical historical cases could be the difference between winning and losing.

If the stakes are high in law, they’re even higher in medicine. OpenEvidence pursued a parallel strategy to VLex, but in healthcare. While health information is plentiful online, most of it is unvetted or consumer-grade (think WebMD articles or forum posts). Clinicians, by contrast, rely on peer-reviewed literature, systematic reviews, and clinical guidelines — much of which sits behind paywalls like Elsevier or is restricted to medical institutions.

OpenEvidence spent years building partnerships, licensing agreements, and ingestion pipelines to create a structured database of vetted medical research. With that foundation, its AI can answer complex clinical questions with evidence-backed precision, rather than hallucinating or relying on incomplete public data. In medicine, where trust and accuracy are existential, this walled garden is not only a moat but also provides a far superior user experience to that offered by general-purpose models. If you’re researching a personal ailment, you’d much rather get scientifically grounded advice than spiral into WebMD doom-scrolling.

These stories show the power of owning unique, hard-to-access data. But the opportunity doesn’t stop at law or medicine. Across industries, fragmented datasets remain unclaimed — waiting to be cultivated into walled gardens that could anchor the next wave of AI-native companies. Let’s examine a few.

Potential “De Novo” Walled Gardens

1. Supply Chain & Logistics

- Today: Shipping manifests, port records, customs filings, and trucking/rail logistics are fragmented and poorly digitized.

- Opportunity: A startup that aggregates and cleans proprietary global trade data could build an AI layer for predictive supply chain management, trade finance, or geopolitical risk modeling.

- Why it’s open: Maersk, Flexport, and others each see a slice — no one owns the full global corpus.

2. Local & Municipal Government Records

- Today: Permits, zoning applications, environmental impact studies, inspection records — scattered across thousands of local jurisdictions.

- Opportunity: A startup could systematically crawl, digitize, and normalize this data into a walled garden for real estate, infrastructure, and energy developers.

- Why it’s open: LexisNexis and Westlaw own case law, but no one has consolidated local regulatory data at scale.

3. Frontier Science Domains

- Today: Fields like synthetic biology, quantum materials, or advanced chemistry publish research in disparate journals and lab repositories.

- Opportunity: Aggregate experimental results and preprints into structured datasets to train AI that accelerates R&D.

- Why it’s open: Unlike medicine (where Elsevier and PubMed dominate), frontier sciences are less centralized and still up for grabs.

4. Cultural & Creative Archives

- Today: Museums, historical societies, and cultural archives have vast but fragmented collections (images, manuscripts, recordings). Much of it isn’t digitized or is locked in individual silos.

- Opportunity: A company could license and structure these datasets to power AI models for cultural preservation, education, or entertainment (e.g. historically accurate immersive experiences).

- Why it’s open: Most of this remains under-monetized, sitting in primarily offline institutions without AI ambitions.

5. Niche Industry Workflows

- Today: Many industries generate proprietary but unstructured datasets (e.g. veterinary records, construction blueprints, niche manufacturing specs).

- Opportunity: Startups can target verticals too small for incumbents but where data exclusivity creates defensibility.

- Why it’s open: Incumbents may not view these niches as large enough to pursue walled gardens — but AI could make them valuable.

6. Climate & Environmental Data

- Today: Fragmented across government agencies, NGOs, and scientific institutions, often in PDFs or inaccessible formats.

- Opportunity: A company could license and unify emissions data, supply-chain carbon intensity, or local climate risk data into a proprietary corpus. Structured properly, this data could power AI products for compliance (e.g. SEC climate disclosures), risk underwriting, or clean-energy development.

- Why it’s open: No Bloomberg-equivalent exists yet for climate.

Why This Matters: The Path to Defensibility

The model companies will always command bigger models, more compute, and more distribution–those are hard games for startups to win. But there’s an opening in ecosystems where high-quality data has historically been fragmented, sensitive, or difficult to access — places where sovereignty and trust matter more than raw capability.

Building new walled gardens isn’t easy: it requires significant upfront investment and often painstaking groundwork, striking deals across companies, governments, and institutions. Yet when it works, the result is nearly impossible to replicate, offering one of the rare durable edges in an increasingly competitive AI landscape.

Are you building a new walled garden? We’d love to hear from you.