The enterprise AI battleground is heating up, and we’ve got some fresh data on the state of play and who’s winning.

Contrary to predictions that model progress would slow and a flood of open source and closed source players would flatten the field, the opposite is happening. An emerging oligopoly continues to dominate the leaderboard and accelerate innovation. And in a market where current perception can drive future reality, the stakes couldn’t be higher.

The enterprise leaderboard has been a hot topic on X lately…but who is the actual king of enterprise AI?

Based on our third annual CIO survey of 100 companies in the Global 2000, the honest answer is: it’s complicated. The market is too dynamic to crown a single, durable winner. But the data does reveal clear leaders, fast gainers, and a few outcomes that run counter to popular narratives.

First, let’s get one thing out of the way: we are investors in OpenAI. To keep ourselves as clear-eyed as we can, we triangulated our survey results with third party data and public revenue estimates. We also want to underscore that our survey is focused on large enterprises, where the majority of IT budget dollars sit today, and not startups where market dynamics have their own nuance and where market share may look very different.

Our methodology at a glance:

- We surveyed 100 verified VPs and C-level executives in the Global 2000.

- Companies surveyed generated at least $500M in annual revenue, with 88% over $1B and 30% over $10B. Over 50% of companies had more than 10,000 employees and over 80% were multinational.

- A broad set of industries are represented, including financial services (15%), software and technology (12%), manufacturing (11%), healthcare (10%), retail (10%), and professional services (8%).

Now, onto the takeaways….

OpenAI still leads the enterprise, for now. Anthropic and Google are gaining fast.

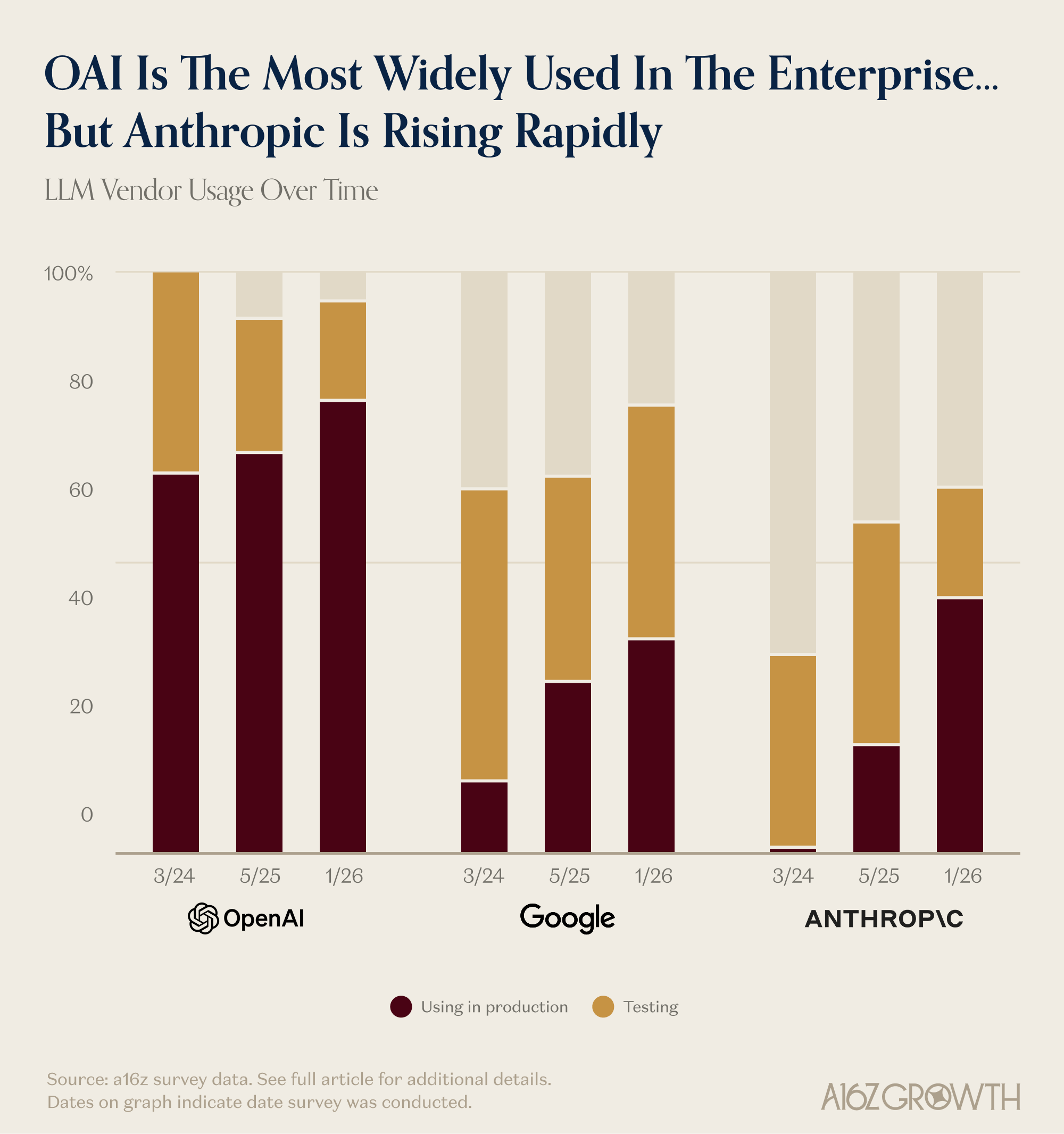

- OpenAI is the clear enterprise leader today. 78% of surveyed enterprise CIOs are using OpenAI models in production, either hosted directly or via cloud service providers (CSPs).

- But momentum is shifting. Anthropic and Google have made meaningful share gains with Anthropic’s rise particularly striking, even excluding AI coding startups. Since May 2025, Anthropic posted the largest share increase of any frontier lab, growing 25% in enterprise penetration. 44% of enterprises are now using Anthropic in production, rising to over 63% including testing.

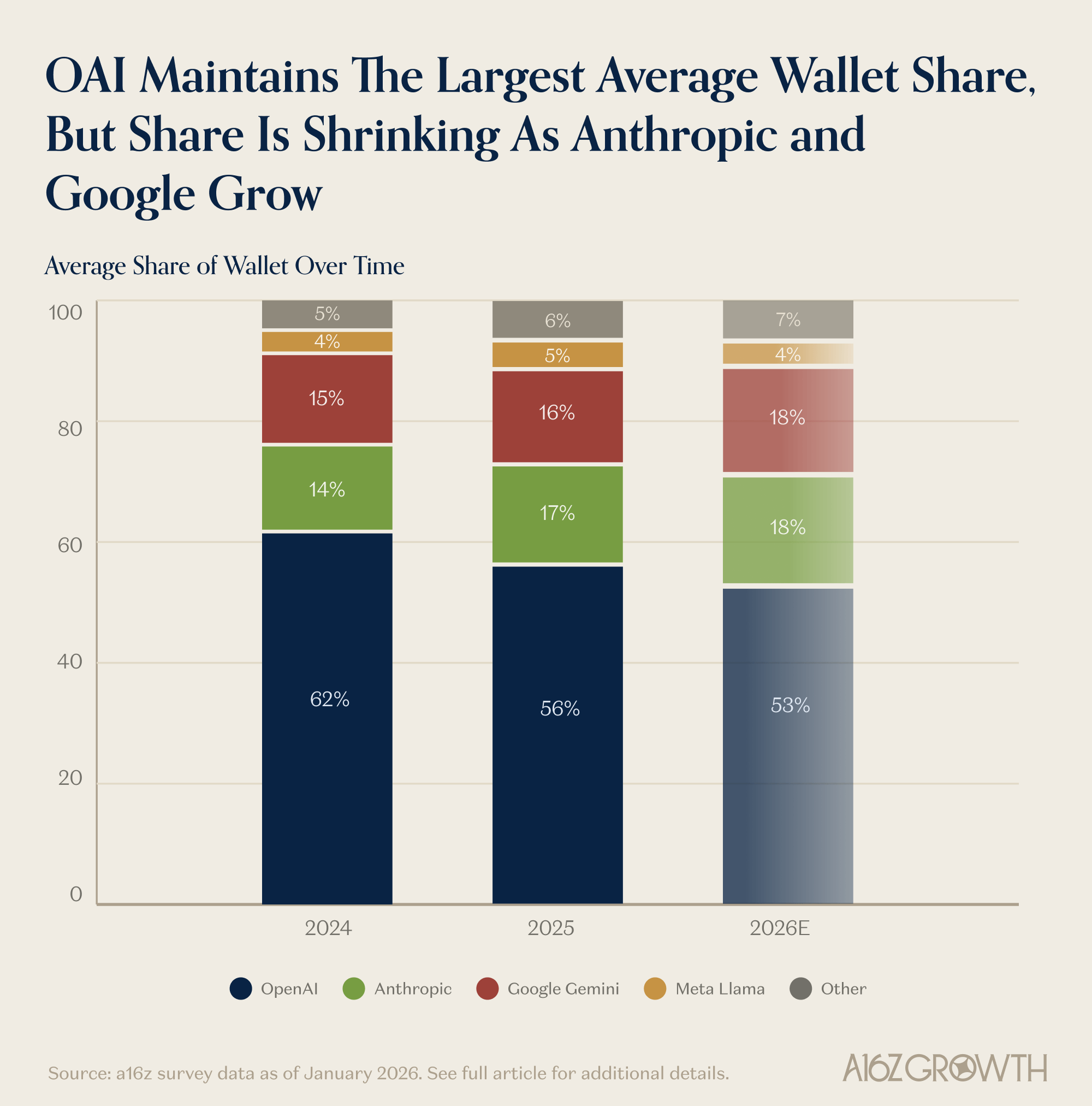

- Wallet share tells a similar story. OAI still commands a majority at ~56%, but Anthropic and Gemini are steadily gaining at OpenAI’s expense. The survey also suggests that respondents expect that shift to continue into 2026. Despite share shifts, all three model providers saw strong absolute spend growth.

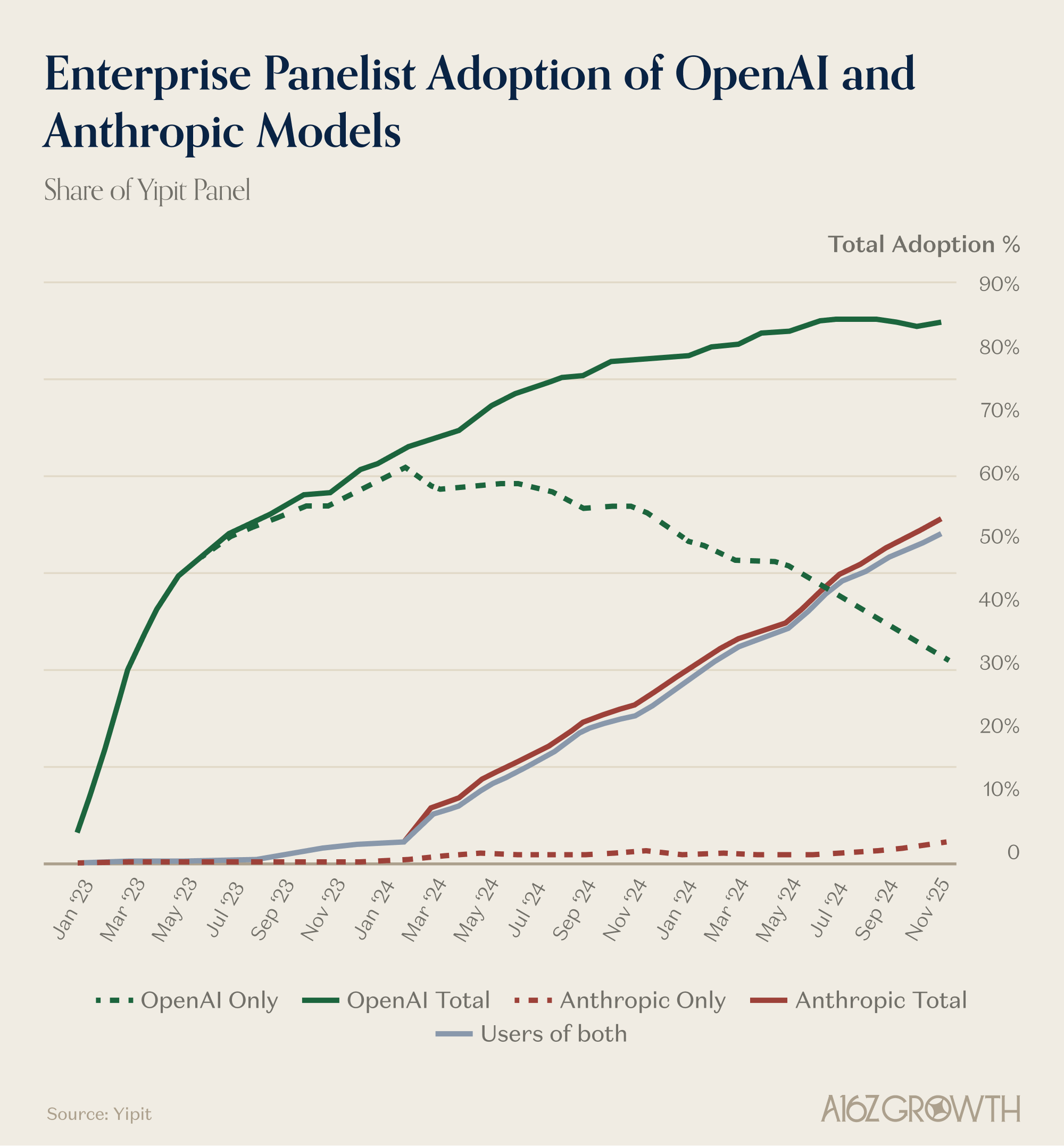

For what it’s worth, Yipit’s panel data of ~1,000 mid-market and enterprise companies shows adoption rates that closely mirror our findings, with OpenAI around 85% and Anthropic near 55% and rising.

Data provided by Yipit from a proprietary panel of 1,000 mid-market and enterprise companies, showing vendor adoption over time (API or applications).

Leadership depends on the use case

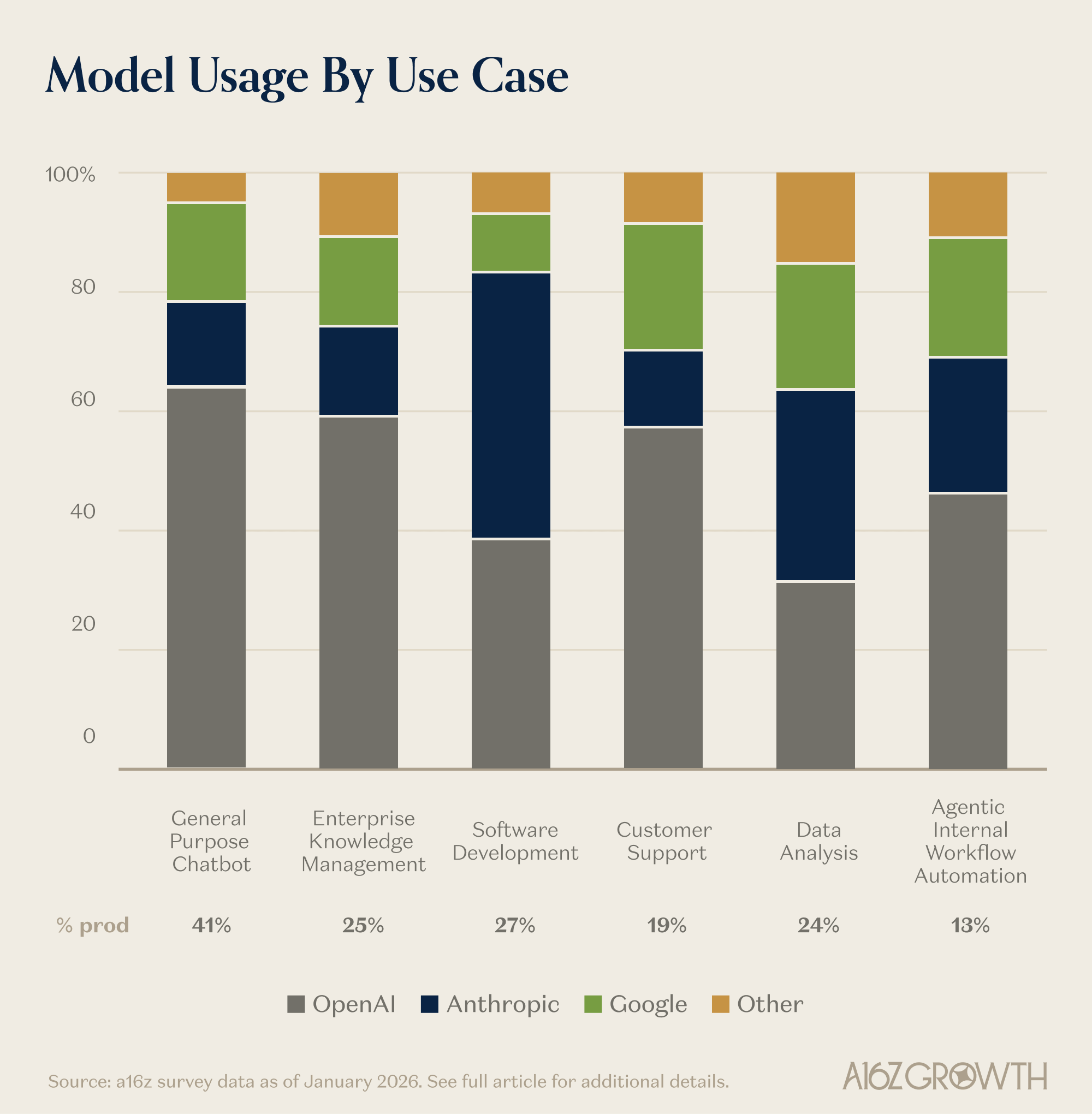

Enterprise AI isn’t a single market but instead a rich and diverse set of use cases. Unsurprisingly, leadership varies sharply by workload.

- OpenAI dominates early, horizontal use cases like general purpose chatbots, enterprise knowledge management and customer support. These were among the first AI workloads enterprises adopted–and incumbency matters.

- Anthropic leads in use cases such as software development and data analysis, where CIOs consistently cite rapid capability gains since the second half of 2024 as the catalyst for adoption and broader proliferation of AI across these use cases.

- Google Gemini is a strong player across a wide range of use cases, with one notable exception: coding, where Gemini’s enterprise share remains meaningfully lower among those surveyed.

- Given these differences, most enterprises aren’t betting on a single model provider. 81% now use three or more model families in testing or production, up from 68% less than a year ago.

What’s actually driving these shifts? A few themes came through clearly:

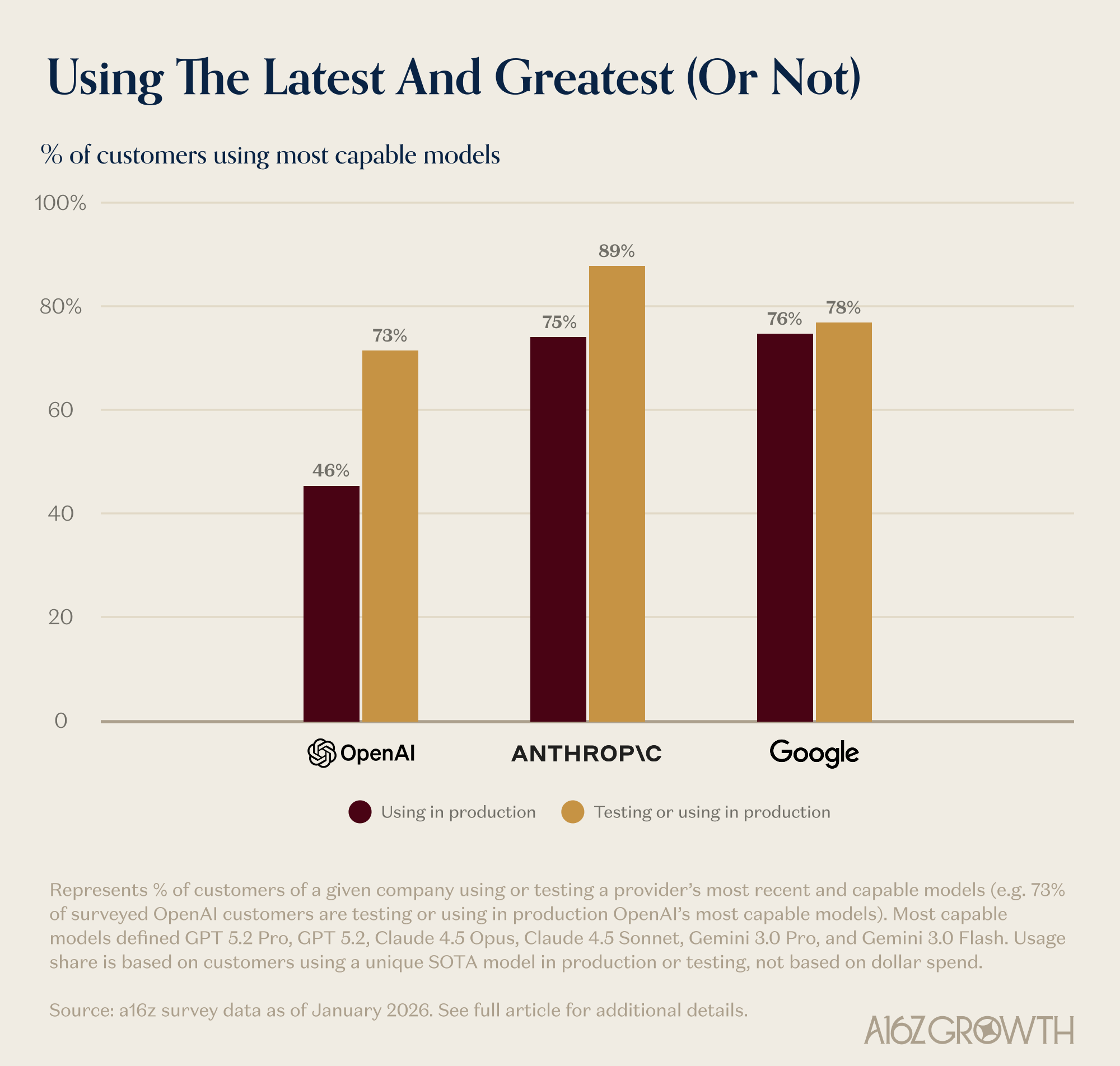

- R&D is customer acquisition. Anthropic’s gains are driven by its most advanced models. 75% of Anthropic customers had Sonnet 4.5 or Opus 4.5 in production, far outpacing adoption of its older, cheaper models. OpenAI, by contrast, still sees significant usage of earlier model families–often because they were adopted early and continue to “work well enough.” Switching costs are rising, reinforcing the advantage of early enterprise footholds. 46% of OpenAI’s customers had GPT 5.2 or 5.2 Pro in production.

- Token intensive use cases are a large growth driver. While AI coding startups were excluded from our survey, token-heavy coding use cases also accounted for a large portion of Anthropic’s enterprise wallet share gain. At the same time, CIOs were also impressed by Anthropic’s leaps across writing, reasoning, and analytical tasks.

- Early 2025 hype around reasoning models appears justified. 54% of respondents say reasoning models accelerated LLM adoption, citing faster time to value, less prompt engineering, better integration with internal systems and higher trust through accuracy and explainability. These models are enabling entirely new agentic workflows, from AI SRE to complex multi step agents.

Build v. Buy: reports of the app apocalypse are greatly exaggerated

We also wanted to add insight into the age-old question: are enterprises building directly on models, or are they buying applications, instead?

The answer is nuanced, but one thing is clear: the reported death of third party apps is greatly exaggerated, to put it mildly.

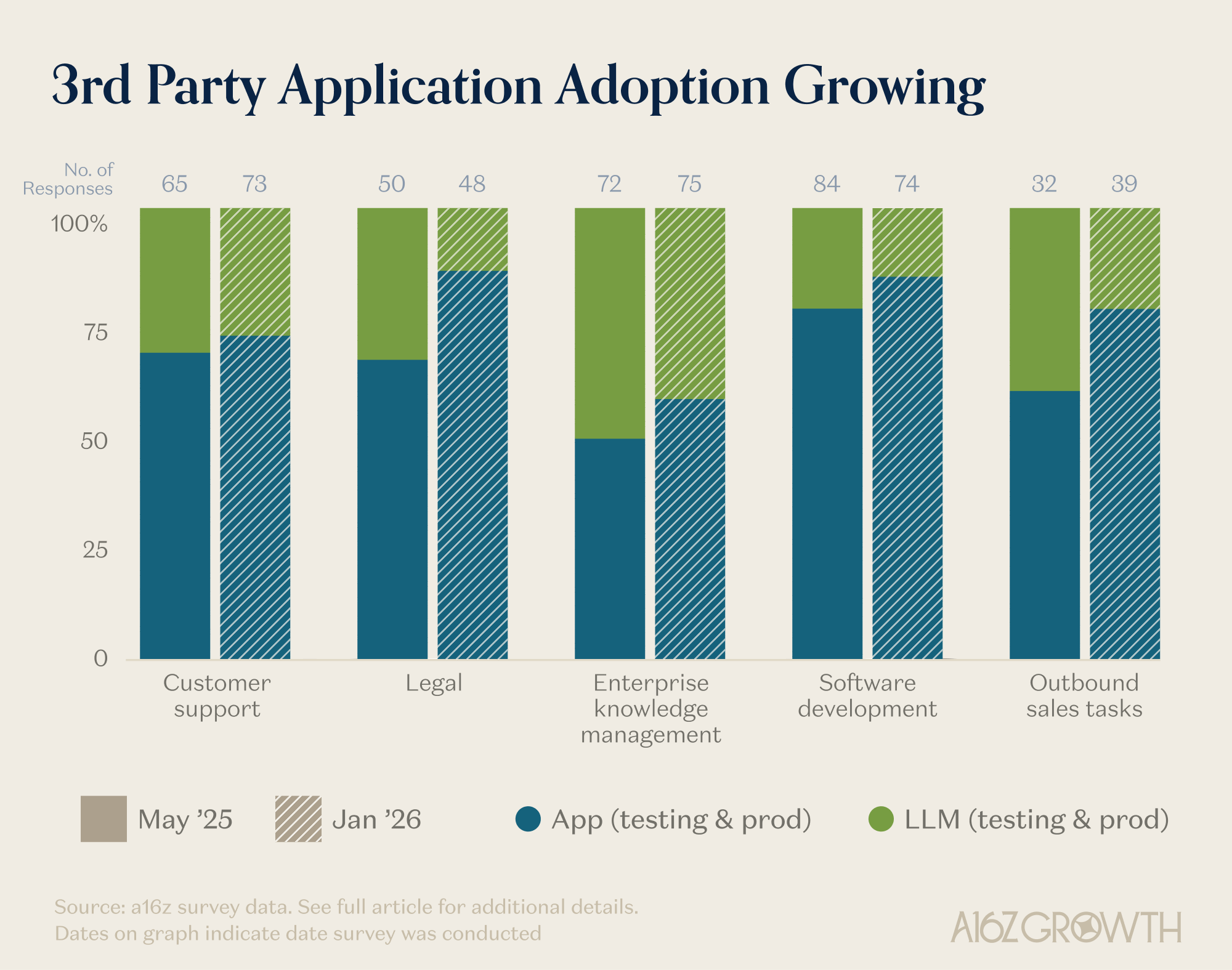

- Today third-party apps appear to be alive and well. Our data shows a continued shift toward 3rd party applications across most use cases.

- Even in areas like knowledge management and workflow automation, where in-house builds have historically dominated, many enterprises expect to migrate from DIY LLM implementations to packaged applications over time.

But the future is still unknown. The ongoing race between how quickly 3rd party apps can build deeply (with domain-specific workflows and harnesses) vs. how quickly model capabilities can improve has only intensified. That’s particularly true in the arena of software development.

Apps benefit from a multi-player market, where they can drive stronger business outcomes with intelligent model routing (that plays to the various models’ respective strengths). As the model market structure continues to evolve and mature, the outlook for certain types of applications may change drastically.

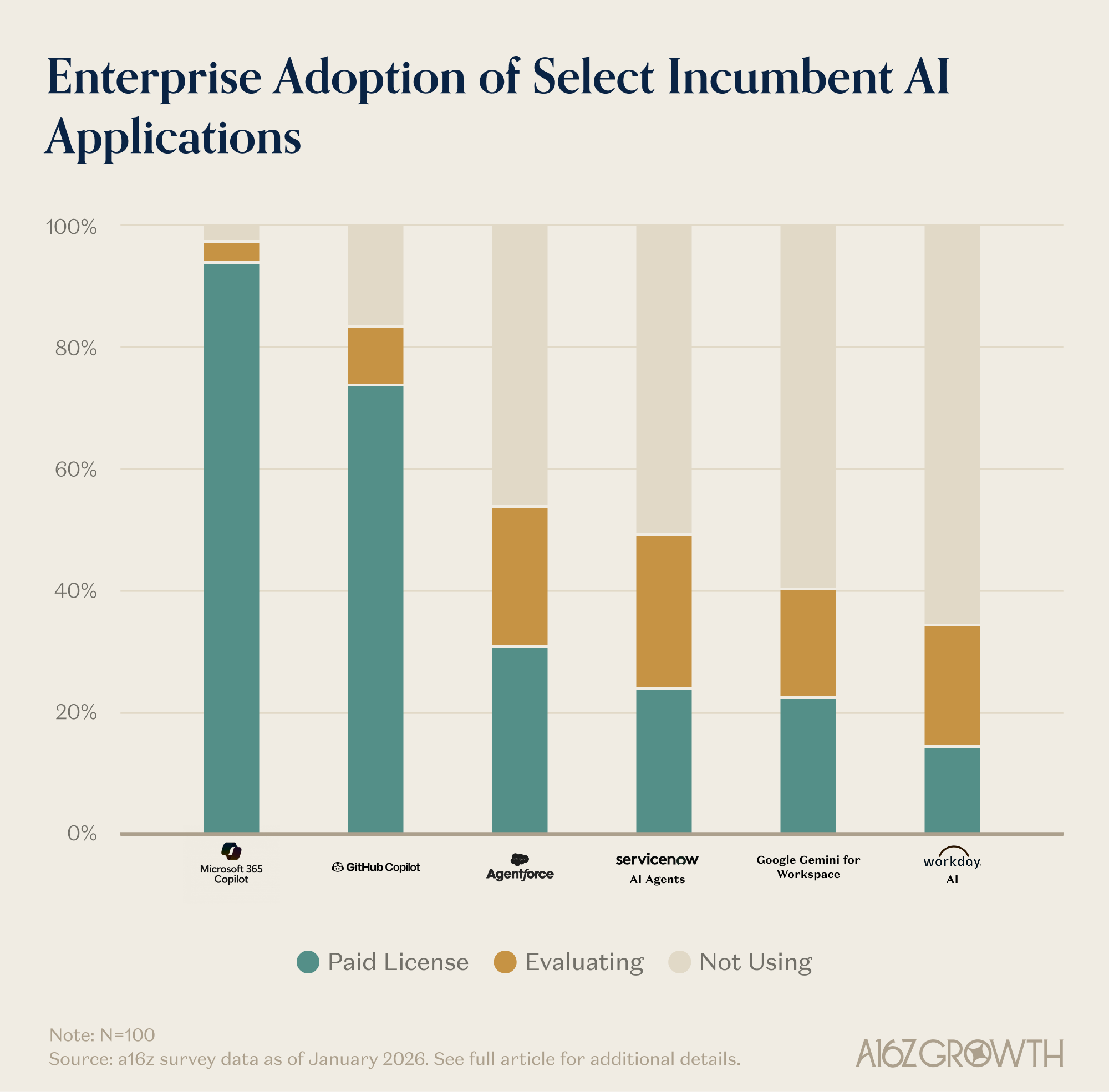

In enterprise AI apps, the winner so far is…Microsoft

Here’s where the data most clearly contradicts the online narrative.

Microsoft still rules enterprise apps. With all the talk of OpenAI vs. Anthropic and Claude Code vs. Codex vs. Cursor, it’s important to keep in perspective that Microsoft continues to dominate the enterprise. Much of the Global 2000 AI adoption still runs through Microsoft or AI products launched by incumbents.

- Microsoft 365 Copilot leads enterprise chat though ChatGPT has closed the gap meaningfully.

- Github Copilot is still the coding leader for enterprises.

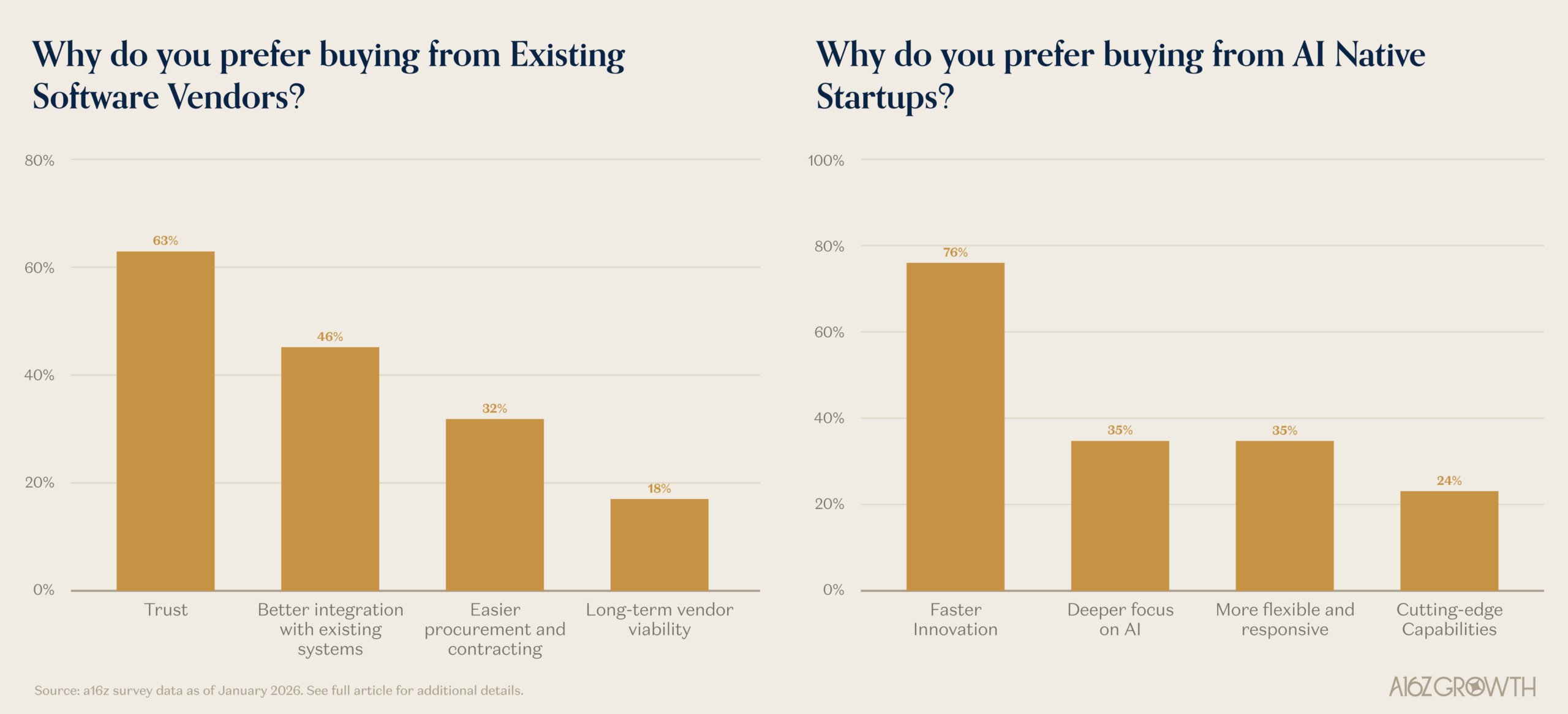

- 65% of enterprises noted they preferred to go with incumbent solutions when available, citing trust, integration with existing systems, and procurement simplicity as compelling value propositions for incumbents.

All this said, the prize is still up for grabs. While these are difficult to overcome (in addition to the far reaching distribution of an incumbent such as Microsoft), we believe there is an enormous opportunity for startups to chip away at these advantages. Platform shifts create openings and enterprises consistently say they value faster innovation, deeper AI focus, and greater flexibility paired with cutting edge capabilities that AI native startups bring.

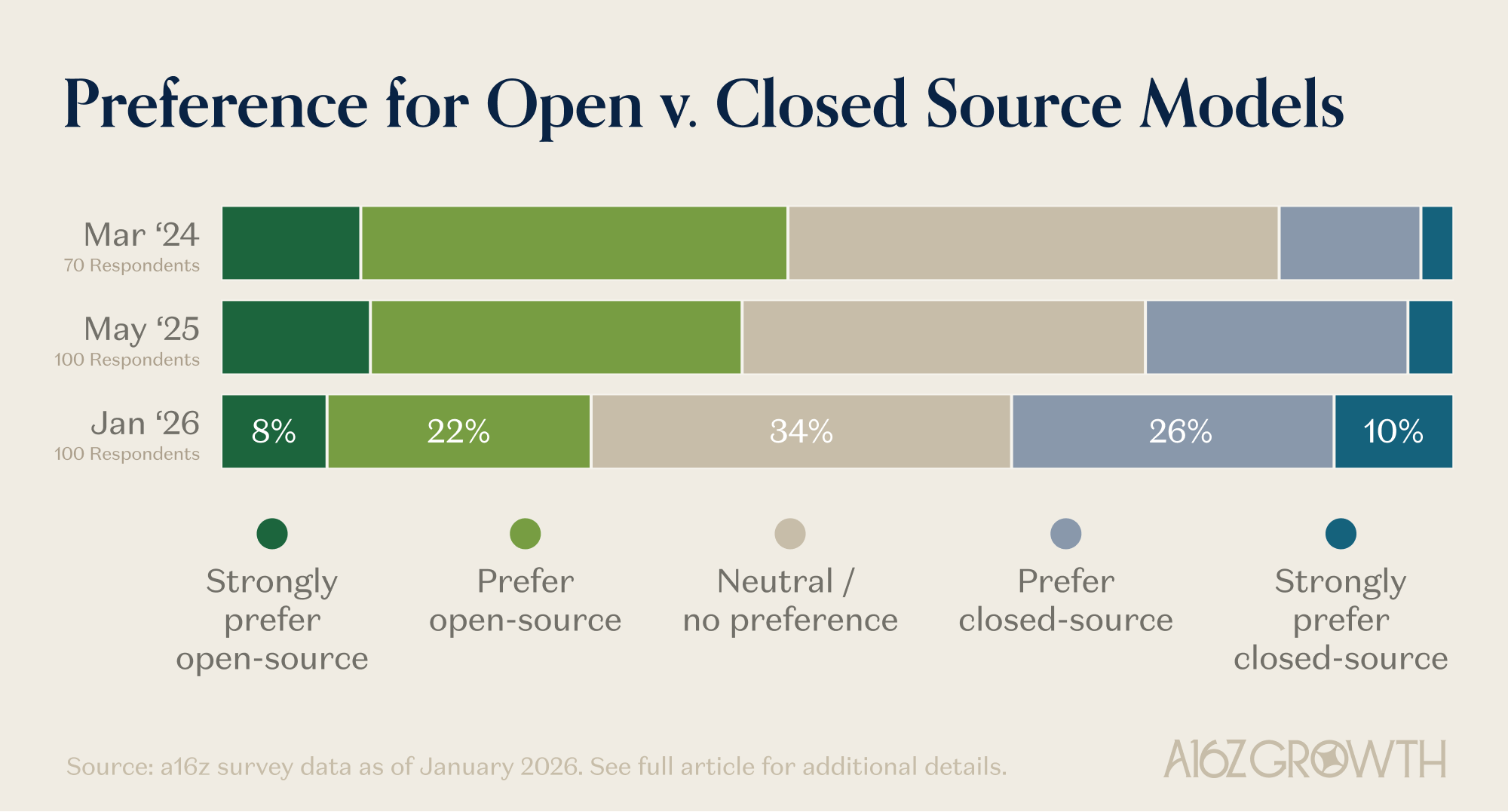

Trust in frontier labs keeps rising

- Preference for using closed source models has increased steadily since our first survey in March 2024. Over a third of enterprises now prefer closed source models, driven by the rate of change in model quality, limited internal AI talent, and (surprisingly) data security. Trust in frontier labs such as OpenAI and Anthropic has risen materially over the past two years.

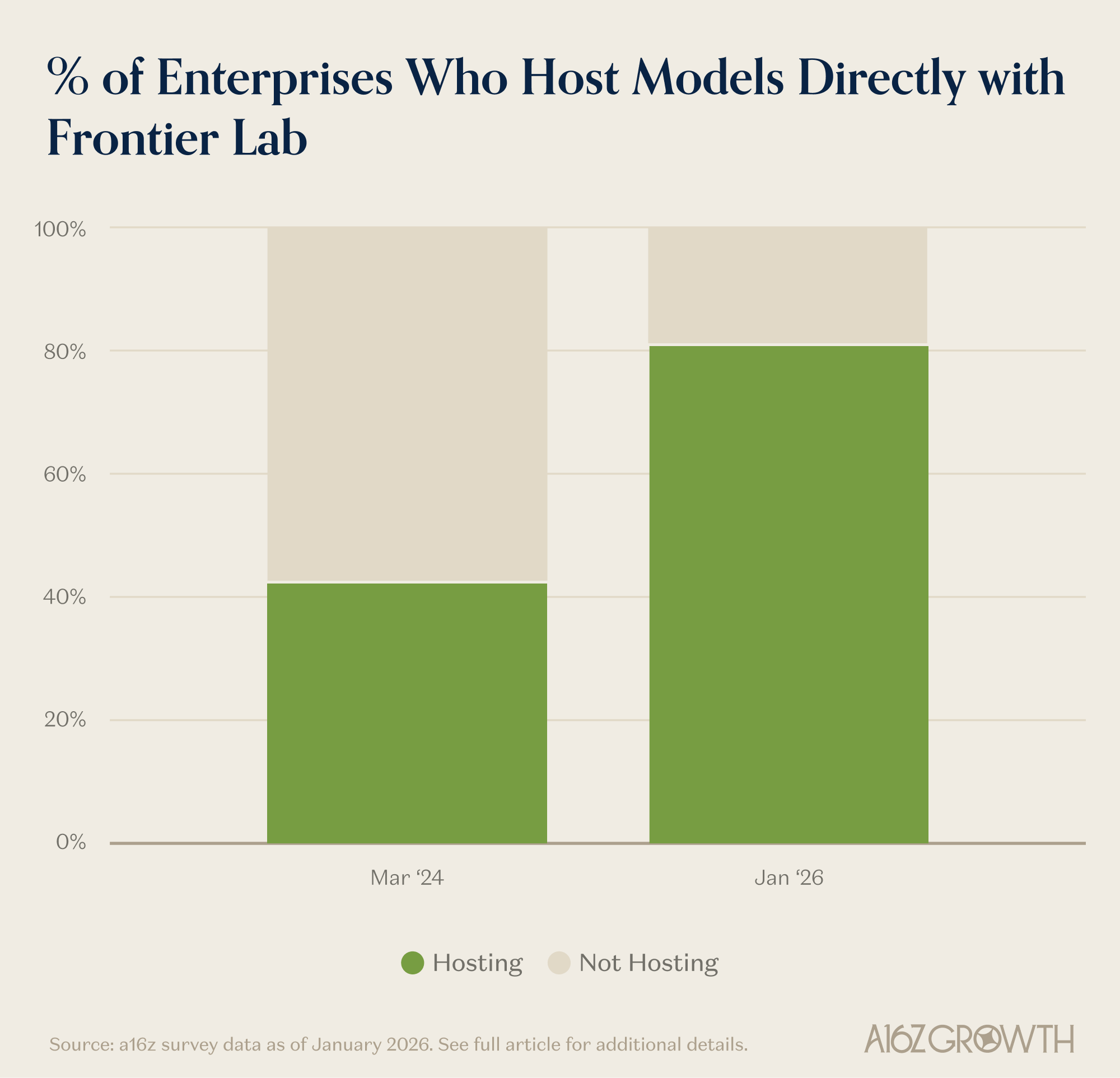

- As another signal of trust, ~80% of enterprises are comfortable hosting their models directly with enterprises vs. CSPs and other sources, up from ~40% in March 2024.

- CIOs also report that total cost of ownership (TCO) between open and closed models is converging as labs and CSPs have pushed down the cost of intelligence over the last few years and created a compelling end to end offering. In cases where TCO of closed models is higher, the capability gap justifies the higher cost.

- While startups are frequently deploying fine-tuned open source models, enterprises have trended away from fine tuning models and instead moved towards prompt engineering and routing across models for different tasks.

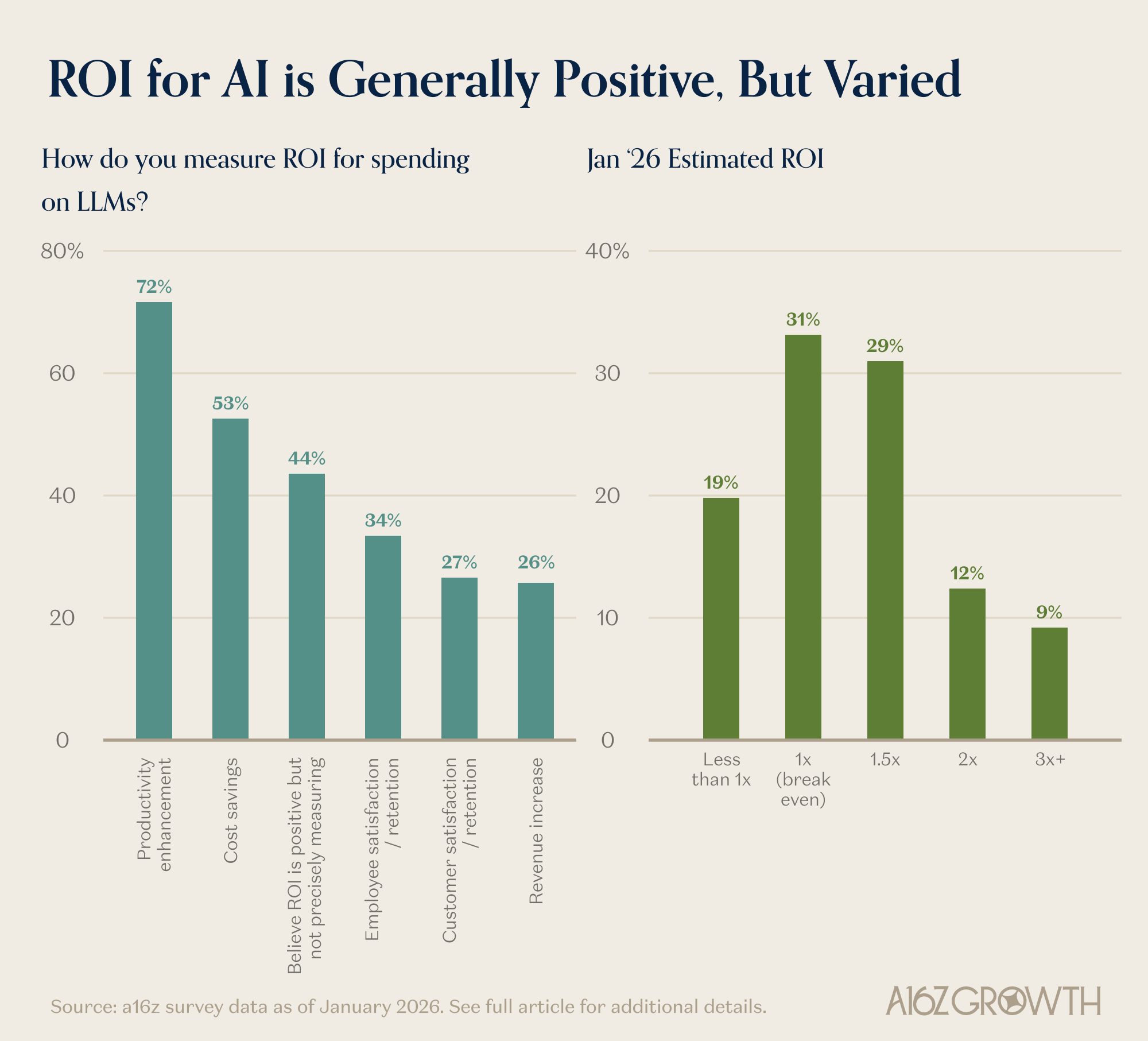

Reported tangible ROI doesn’t quite match up to “X” ROI

Reported ROI for AI is positive, but there is still a ways to go.

ROI reported by enterprises on LLMs (and AI applications) is less dramatic than one might expect based on the X AI discourse. This gap likely reflects two things:

- First, enterprises are still learning how to deploy AI effectively, and often need partners (like AI application companies) to translate models into real workflows.

- Secondly, as we’ve seen before, enterprises don’t know what “good” looks like until they try it and many of them are working with incumbent AI solutions that may not raise the ceiling as noted above. In our prior survey, the NPS score of Microsoft Copilot dropped 48 points after the same software developers tried Cursor. Experience changes expectations.

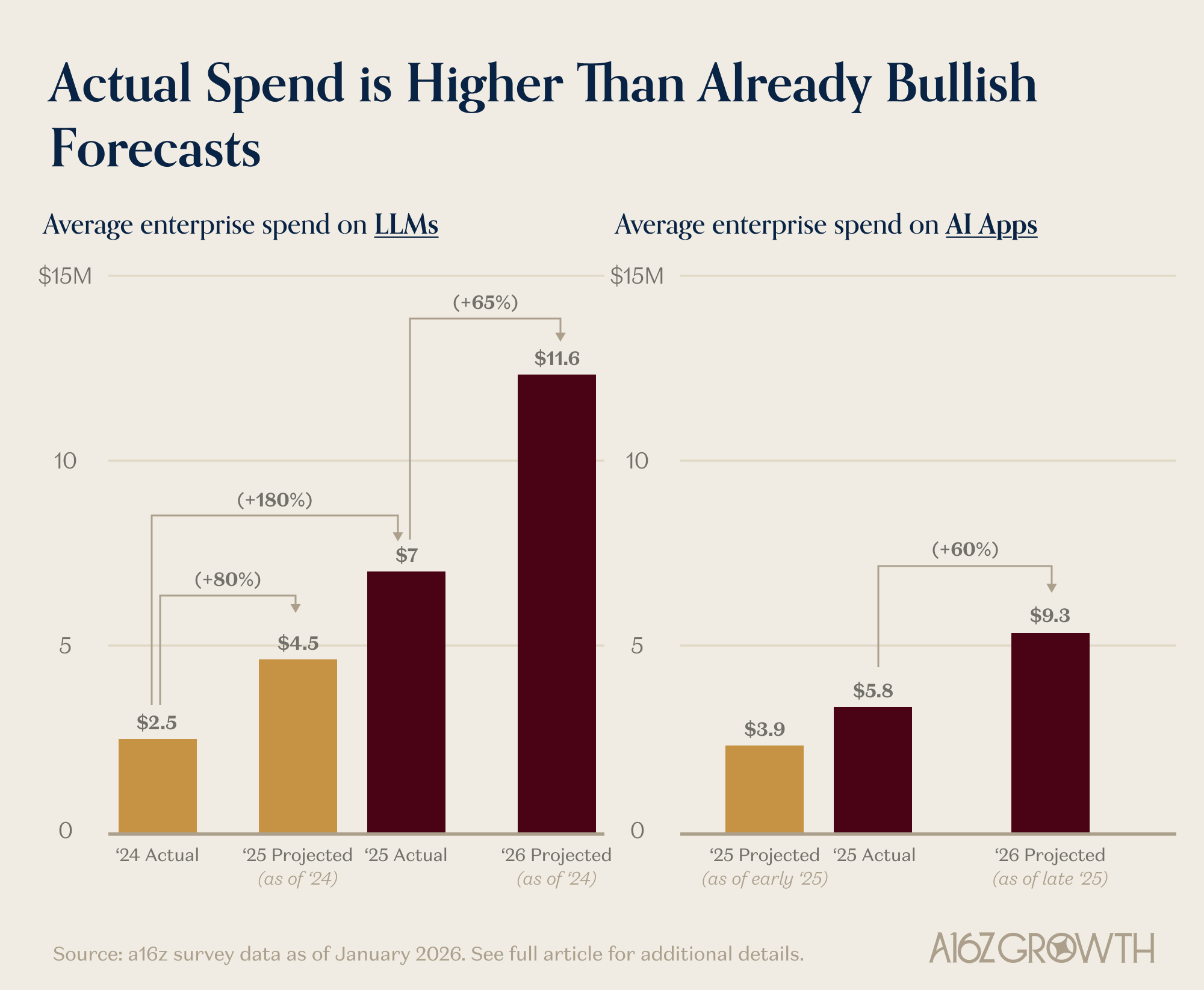

The market is massive and (still!) growing faster than expected

- Enterprise AI spend continues to surprise to the upside. Demand remains stronger than enterprises, and even model providers, anticipated.

- Over the last 2 years, average enterprise AI spend on LLMs has risen from ~$4.5M to ~$7M, and enterprises expect it to grow another ~65% this year to ~$11.6M.

- Application spend followed the same pattern: enterprises expected to spend an average of ~$3.9M but actually spent nearly $6M.

The prize is enormous. The dynamics are shifting. And given everything we’ve seen over the last 18 months, enterprise AI will remain the battleground to watch.

* The data presented is based on a third-party survey conducted by an independent expert network vendor. Responses reflect the views of senior decision-makers (Vice President level or above) at Global 2000 companies operating in the United States, Canada, the United Kingdom, the European Union, Asia, or Australia, and have engaged in active deployment of AI or large language model (“LLM”) solutions. Participants were selected from the vendor’s proprietary database using targeted screening criteria and were not randomly sampled. As a result, the findings may not be representative of the broader market and may over-represent organizations that are more advanced in AI adoption. Responses are self-reported, subject to inherent limitations and bias, and reflect opinions and expectations at the time of the survey. The results are provided for informational purposes only and should not be construed as an endorsement or recommendation of any technology, vendor, or investment strategy.

-

Sarah Wang is a general partner on the Growth team at Andreessen Horowitz, where she leads growth-stage investments across AI, enterprise applications, and infrastructure.

-

Justin Kahl is a partner on the Growth investing team.

-

Shangda Xu is a partner on the Growth investing team, focused on enterprise technology companies.