Last February, we introduced the a16z Marketplace 100, a ranking of the largest consumer-facing marketplace startups and private companies. The series was a hit, spurring debate about the evolution of marketplaces and promising new consumer categories.

Then COVID turned into a pandemic.

The past year has been a gut-punch for many marketplace categories. Ticketing marketplaces found their businesses drastically diminished when events were cancelled around the world. As schools were shuttered and many businesses enacted work-from-home policies, childcare marketplaces scrambled to adopt new safety precautions and stay afloat. Even the #1 marketplace last year, Airbnb, grappled with shutdowns, cancellations, and refunds.

As 2020 drew to a close, however, many marketplaces proved to be extraordinarily resilient—a testament to the flexibility of the model. In a year when in-person interactions were heavily restricted and unemployment went through the roof, marketplaces allowed people to access the products and services they needed and, in many cases, monetize their own talents, services, and resources. From food and alcohol delivery to games, online education to outdoor getaways, marketplaces like Instacart, Valve, Outschool, and Hipcamp helped us weather a difficult year.

But while it’s tempting to view the data exclusively through the lens of COVID, as a firm we’re obsessively focused on the future: What’s new and intriguing? Which categories are growing fastest? What’s next? This year’s ranking features more than two dozen newcomers–including marketplaces devoted to thrifting, dogs, and cannabis—that not only survived the pandemic, but thrived.

The Marketplace 100 is based on data from Bloomberg Second Measure, a consumer data analytics company that analyzes billions of purchases to track real-time consumer behavior and relative sales across over 5,200 merchants. The startups and private companies on the Marketplace 100 are then ranked using a common industry metric, Gross Merchandise Value (GMV), which is extrapolated from the total dollars consumers are spending against each company. See the complete methodology, as well as data caveats and exclusions, below.

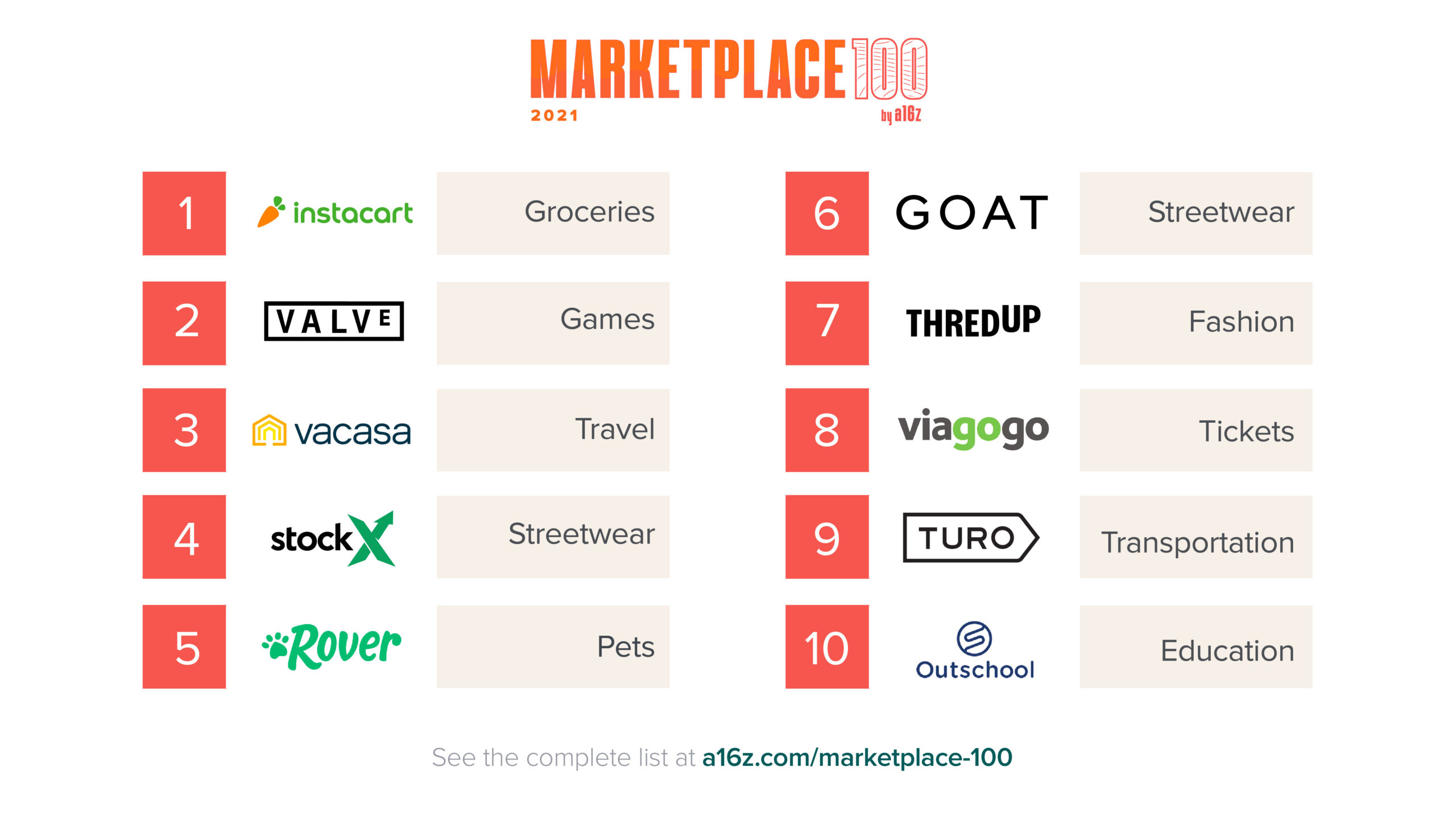

The Top Consumer Marketplaces

The second edition of the Marketplace 100 offers a new perspective. The ranking is revealing not only in uncovering the top companies and categories of an unprecedented year, but also in showcasing certain startups’ consistency since 2019. You’ll see that data indicated by the rank change from last year.

| Rank | Company | HQ | Categories | YoY Change | Website |

|---|

|

1

2

|

|

San Francisco, CA | Groceries | 2 | Instacart |

|

2

3

|

|

Bellevue, WA | Games | 3 | Valve |

|

3

6

|

|

Portland, OR | Travel | 6 | Vacasa |

|

4

6

|

|

Detroit, MI | Streetwear | 6 | StockX |

|

5

2

|

|

Seattle, WA | Pets | 2 | Rover |

|

6

10

|

|

Los Angeles, CA | Streetwear | 10 | GOAT |

|

7

10

|

|

Oakland, CA | Fashion | 10 | ThredUp |

|

8

15

|

|

San Francisco, CA | Tickets | 15 | Viagogo |

|

9

5

|

|

San Francisco, CA | Transportation | 5 | Turo |

|

10

59

|

|

San Francisco, CA | Education | 59 | Outschool |

|

11

17

|

|

Austin, TX | Travel | 17 | Outdoorsy |

|

12

9

|

|

San Francisco, CA | Beauty | 9 | StyleSeat |

|

13

5

|

|

New York, NY | Tickets | 5 | SeatGeek |

|

14

21

|

|

Akron, OH | Travel | 21 | RVshare |

|

15

28

|

|

San Francisco, CA | Education | 28 | MasterClass |

|

16

4

|

|

New York, NY | Wedding | 4 | Zola |

|

17

3

|

|

Redwood City, CA | Education | 3 | Course Hero |

|

18

35

|

|

San Francisco, CA | Wholesale | 35 | Faire |

|

19

-

|

|

Chicago, IL | Discounts | - | Raise |

|

20

13

|

|

San Francisco, CA | Education | 13 | Udemy |

|

21

6

|

|

Chicago, IL | Auto | 6 | SpotHero |

|

22

11

|

|

New York, NY | Health & Wellness | 11 | ClassPass |

|

23

15

|

|

Mountain View, CA | Education | 15 | Coursera |

|

24

21

|

|

New York, NY | Health & Wellness | 21 | TalkSpace |

|

25

21

|

|

Delray Beach, FL | Food & Beverage | 21 | DeliveryDudes |

|

26

1

|

|

St. Louis, MO | Education | 1 | VarsityTutors |

|

27

2

|

|

New York, NY | Shopping | 2 | 1stDibs |

|

28

13

|

|

San Francisco, CA | Home Services | 13 | Modsy |

|

29

new

|

|

San Francisco, CA | Music | new | Bandcamp |

|

30

4

|

|

Boston, MA | Food & Beverage | 4 | ezCater |

|

31

36

|

|

Chicago, IL | Celebrity Engagement | 36 | Cameo |

|

32

12

|

|

Melbourne, Australia | Professional Services | 12 | Envato |

|

33

14

|

|

San Francisco, CA | Home Services | 14 | Thumbtack |

|

34

new

|

|

San Diego, CA | Groceries | new | Mercato |

|

35

23

|

|

Bellevue, WA | Shopping | 23 | OfferUp |

|

36

new

|

|

Arlington, VA | Food & Beverage | new | Territory Foods |

|

37

13

|

|

Los Angeles, CA | Pets | 13 | Wag |

|

38

19

|

|

New York, NY | Education | 19 | Skillshare |

|

39

new

|

|

San Francisco, CA | Cannabis | new | Eaze |

|

40

33

|

|

San Francisco, CA | Travel | 33 | Hipcamp |

|

41

4

|

|

Santa Monica, CA | Shopping | 4 | Tradesy |

|

42

10

|

|

San Francisco, CA | Shopping | 10 | Tophatter |

|

43

new

|

|

Berkeley, CA | Groceries | new | Dumpling |

|

44

22

|

|

San Francisco, CA | Tickets | 22 | Gametime |

|

45

21

|

|

Philadelphia, PA | Auto | 21 | EverWash |

|

46

new

|

|

London, United Kingdom | Fashion | new | Depop |

|

47

7

|

|

San Diego, CA | Education | 7 | TakeLessons |

|

48

17

|

|

Los Angeles, CA | Food & Beverage | 17 | Saucey |

|

49

19

|

|

Chicago, IL | Auto | 19 | ParkWhiz |

|

50

16

|

|

New York, NY | Childcare | 16 | Sawyer |

|

51

-

|

|

San Francisco, CA | Transportation | - | Getaround |

|

52

20

|

|

Toronto, Canada | Food & Beverage | 20 | Ritual |

|

53

new

|

|

St. Cloud, MN | Food & Beverage | new | Food Dudes Delivery |

|

54

new

|

|

Paris, France | Fashion | new | Vestiaire Collective |

|

55

25

|

|

Boston, MA | Shopping | 25 | SidelineSwap |

|

56

16

|

|

San Francisco, CA | Professional Services | 16 | Toptal |

|

57

7

|

|

Mountain View, CA | Auto | 7 | YourMechanic |

|

58

40

|

|

New York, NY | Transportation | 40 | Via |

|

59

10

|

|

New York, NY | Health & Wellness | 10 | Zeel |

|

60

29

|

|

New York, NY | Food & Beverage | 29 | MealPal |

|

61

11

|

|

San Francisco, CA | Office Space | 11 | Peerspace |

|

62

10

|

|

San Francisco, CA | Beauty | 10 | Booksy |

|

63

new

|

|

San Francisco, CA | Fashion | new | Curtsy |

|

64

17

|

|

San Francisco, CA | Food & Beverage | 17 | Snackpass |

|

65

new

|

|

Dublin, CA | Beauty | new | Vagaro |

|

66

18

|

|

Minneapolis, MN | Fashion | 18 | Kidizen |

|

67

new

|

|

San Francisco, CA | Travel | new | Glamping Hub |

|

68

new

|

|

Vail, CO | Travel | new | Harvest Hosts |

|

69

13

|

|

San Francisco, CA | Childcare | 13 | UrbanSitter |

|

70

45

|

|

Santa Monica, CA | Tickets | 45 | Atom Tickets |

|

71

7

|

|

Chicago, IL | Food & Beverage | 7 | Chowbus |

|

72

new

|

|

Seattle, WA | Moving | new | Dolly |

|

73

new

|

|

Denver, CO | Health & Wellness | new | SonderMind |

|

74

12

|

|

Montreal, Canada | Travel | 12 | FlightHub |

|

75

14

|

|

Beaverton, OR | Music | 14 | Discogs |

|

76

new

|

|

San Francisco, CA | Shopping | new | Curated |

|

77

35

|

|

Vienna, Austria | Travel | 35 | TourRadar |

|

78

new

|

|

New York, NY | Furniture | new | AptDeco |

|

79

16

|

|

San Francisco, CA | Childcare | 16 | Wonderschool |

|

80

new

|

|

New York, NY | Pets | new | Good Dog |

|

81

10

|

|

Santa Monica, CA | Health & Wellness | 10 | ResortPass |

|

82

12

|

|

Vilnius, Lithuania | Shopping | 12 | Vinted |

|

83

10

|

|

San Francisco, CA | Groceries | 10 | GrubMarket |

|

84

10

|

|

Newton Upper Falls, MA | Health & Wellness | 10 | CoachUp |

|

85

new

|

|

Fort Worth, TX | Music | new | Musicbed |

|

86

new

|

|

Austin, TX | Music | new | BeatStars |

|

87

11

|

|

Fort Lauderdale, FL | Travel | 11 | Boatsetter |

|

88

3

|

|

Sao Paulo, Brazil | Health & Wellness | 3 | Gympass |

|

89

new

|

|

New York, NY | Travel | new | Tentrr |

|

90

77

|

|

Tel Aviv, Israel | Transportation | 77 | Gett |

|

91

new

|

|

Vancouver, Canada | Shopping | new | Spocket |

|

92

new

|

|

San Francisco, CA | Wholesale | new | Tundra |

|

93

45

|

|

New York, NY | Tickets | 45 | Headout |

|

94

new

|

|

San Francisco, CA | Food & Beverage | new | MealHi5 |

|

95

27

|

|

New York, NY | Childcare | 27 | KidPass |

|

96

8

|

|

San Francisco, CA | Travel | 8 | Verlocal |

|

97

new

|

|

London, United Kingdom | Flowers | new | Floom |

|

98

12

|

|

Austin, TX | Groceries | 12 | Burpy |

|

99

new

|

|

Los Angeles, CA | Collectibles | new | Whatnot |

|

100

25

|

|

Montreal, Canada | Office Space | 25 | Breather |

Here are the highlights from the second edition of the Marketplace 100, which we’ll unpack in detail below:

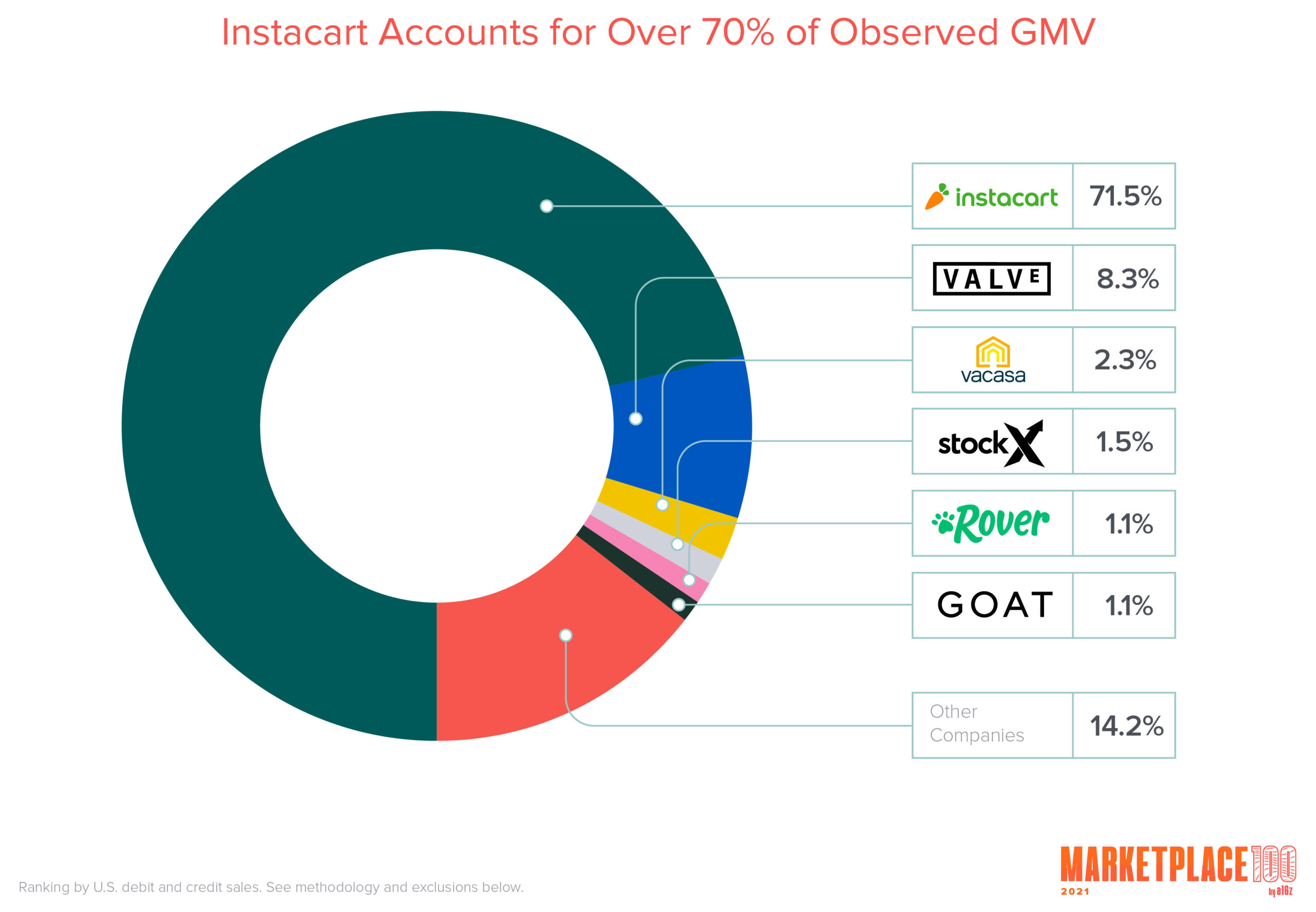

- Marketplace GMV is highly concentrated. In last year’s ranking, four startups accounted for 76 percent of consumer spend. This year, however, more than 70 percent of the Marketplace 100’s total GMV can be attributed to just one company.

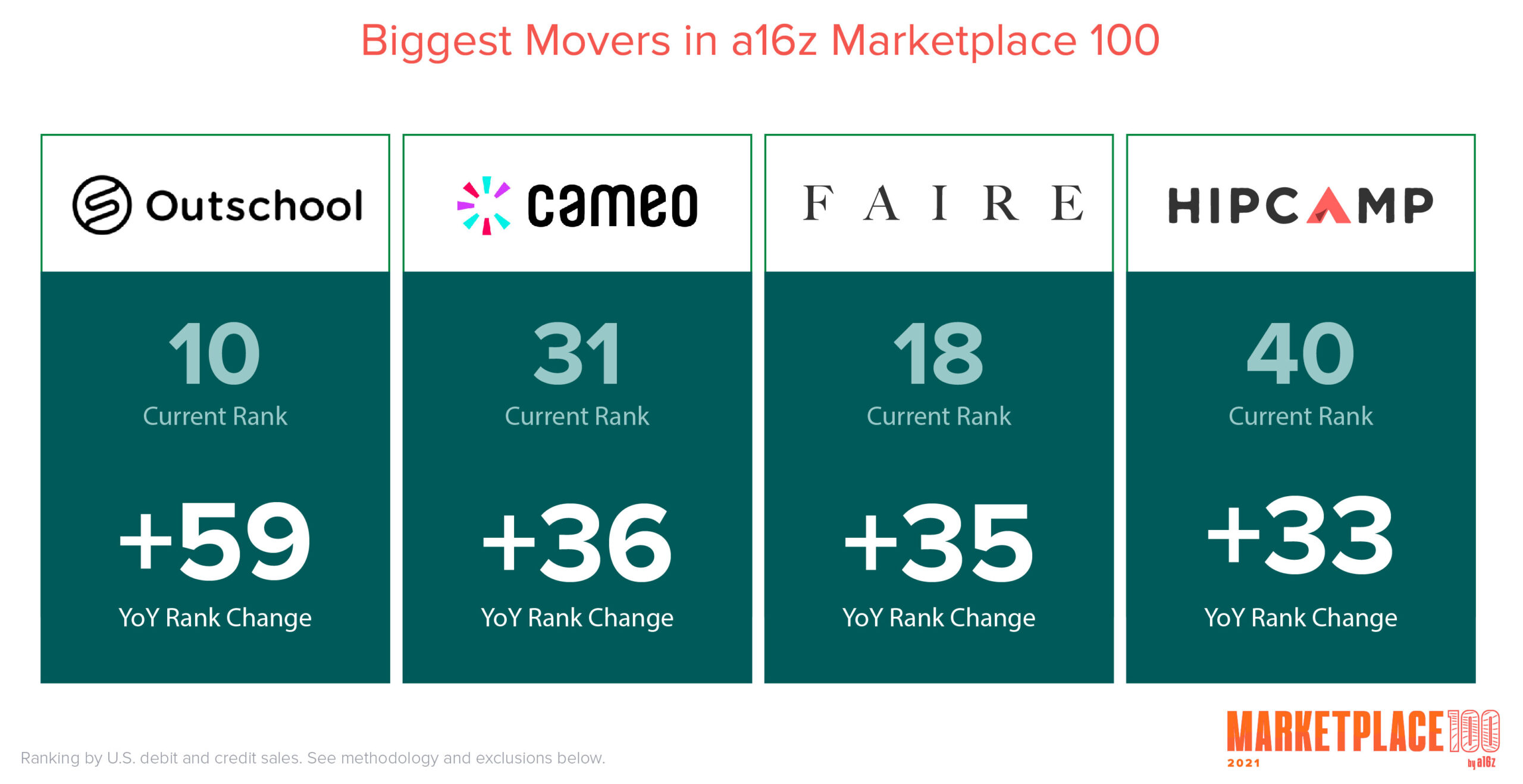

- Edtech accelerates. The biggest leap from last year’s ranking was in online education. One edtech company, Outschool, jumped 59 spots in a single year.

- It’s a battle to break out. Beyond the top three marketplaces in the Marketplace 100, the competition is tight: the difference in GMV among adjacent companies #4-100 is less than a half a percentage point. There’s likely to be movement in the ranks as startups vie for consumers’ dollars this year.

- The COVID effect is clear. Some newcomers to the list were surprising—including startups centered around fashion and travel—but indicate emerging trends in the way we shop and escape.

- Categories to watch: pets, cannabis, and collectibles. Changing consumer behavior (as well as pandemic fatigue) is evident in the data.

2019 to 2021: Freshmen, Graduates, & Dropouts

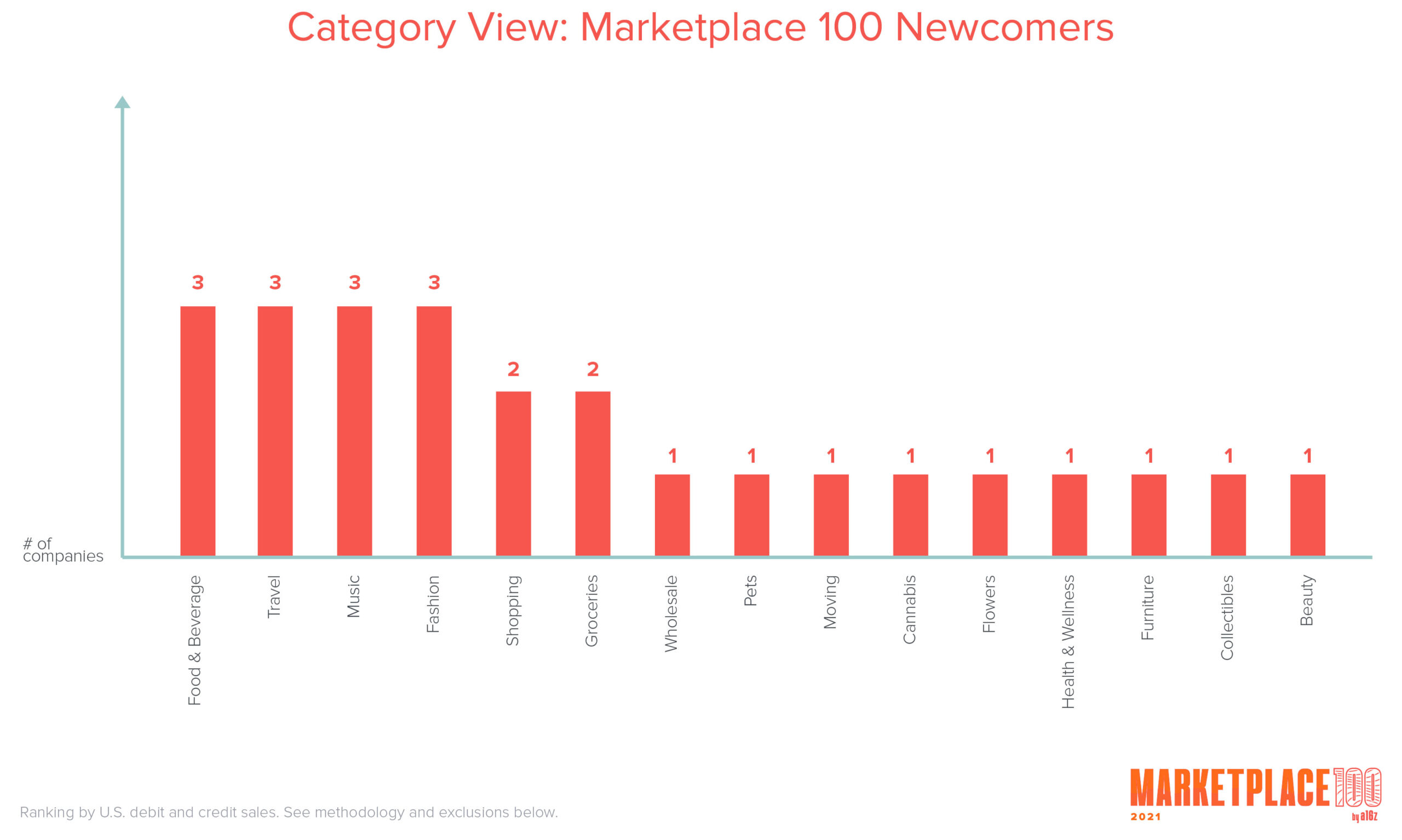

There was a significant amount of change in the Marketplace 100 ranks this year. Twenty-five “freshmen” companies broke into the Marketplace 100 for the first time. Ten companies that graced last year’s Marketplace 100 have “graduated,” meaning they’ve been acquired or filed for an IPO. Many others continued to climb the charts over the course of 2020, experiencing growth even amid the pandemic.

In many ways, the Marketplace 100 reflects the imprint of a year like no other.

Key takeaways from the a16z Marketplace 100

1. The Marketplace 100 newcomers reveal emerging trends in outdoor travel, hyper-local food, and secondhand fashion.

There were 25 new entrants to the Marketplace 100 this year, including the social shopping app Depop (#46), local grocery delivery apps Mercato (#34) and Dumpling (#43), and the secondhand furniture marketplace AptDeco (#78). While newcomers represent only 1 percent of the ranking’s total GMV, they provide a glimpse into emerging categories.

Of the companies new to the Marketplace 100, nearly half fell into four categories: food and beverage, travel, music, and fashion. Collectively, these categories represented more than 70 percent of the freshmen GMV—Bandcamp, the indie music marketplace, and Mercato, an online grocery marketplace focused on local merchants, were the highest-ranking new entrants. Some of these shifts reflect the fallout from COVID: how we eat “out” and shop has changed dramatically over the past 12 months.

Similarly, a number of Marketplace 100 freshmen center around travel—but not as we once knew it. Rather than focusing on flights or traditional tours and hotels, rising travel marketplaces are leaning into outdoor travel. The Marketplace 100 freshmen include a marketplace to book unique campsites (Tentrr), to travel in and park RVs (Harvest Hosts), and to discover “luxury” camping experiences (Glamping Hub). Those freshmen joined repeat Marketplace 100 companies like the camping marketplace Hipcamp (which shot from #73 on last year’s list to #40) and RV rental companies Outdoorsy (which climbed from #28 to #11) and RVshare (from #35 to #14).

The year also ushered in a wave of new fashion marketplaces, including Curtsy, Depop, and Vestiaire Collective. As opposed to focusing on top brands and luxury labels (like the RealReal or Poshmark), the freshmen fashion marketplaces specialize in unique, pre-owned items. The market for online thrifting continues to grow; it’s quickly becoming a stand-alone category to be reckoned with.

And though the pets category had just one new entrant—the dog adoption marketplace Good Dog (#80), which joins repeat Marketplace 100 contenders Rover (#5) and Wag (#37)—the addition appears to be a harbinger of things to come. Pets have become an increasingly important part of people’s lives and budgets, a trend that accelerated over 2020. More than 12 million households took in pets in between March and December last year—dubbed “pandemic puppies”—and adoption rates multiplied.

Lastly, Whatnot, a live shopping marketplace focused on collectibles, edged its way into the ranking at #99. Though the startup only launched in December 2019, the company has generated impressive growth (more on that below). In many ways, the collectibles space feels reminiscent of streetwear a few years ago, in the early days of GOAT (#6) and StockX (#4). (And now, via the rise of NFTs, anyone can monetize their art or media.) These companies offer a unique shopping experience—streamed live (Whatnot) or authenticated (GOAT, StockX)—to a niche category with passionate users. That combination has fueled jaw-dropping growth. Collectibles is a category to watch this year.

2. Within the marketplace ecosystem, consumer spending is concentrated at the very top.

Ten of the biggest marketplaces “graduated” from last year’s ranking when they went public or were acquired in 2020. Airbnb, Doordash, and Poshmark—three of the most prominent IPOs—represented over $150 billion combined in market cap at the end of their first day of trading. Postmates and Drizly are evidence that delivery-focused companies became hot acquisition targets this year.

Last year, we noted that the top marketplaces were big—really big. The graduates reinforce the idea that a handful of companies represent the bulk of the value. Through only 10 percent of the companies in last year’s Marketplace 100 went public or were acquired, those companies represented an astounding 57 percent of the ranking’s GMV last year. From a dollars perspective, that is a monumental amount of turnover.

One of the most striking results from this year’s ranking is Instacart’s impressive edge. The online grocery delivery and pick-up provider accounts for more than 70 percent of GMV in the Marketplace 100. (For context, last year’s #1 marketplace, Airbnb, represented just over 30 percent of total GMV.) And despite Instacart’s enormous scale, it was the fifteenth fastest growing marketplace of 2020, as well.

There’s intense competition among the ranks of the Marketplace 100. Beyond the top three marketplaces on the list, no company accounts for more than 1.5 percent of consumer spend, and no company is separated from its immediate neighbors by more than half a percentage point. That means there could be a fair amount of shuffling in the coming months, and it’s likely we’ll see a markedly different Marketplace 100 next year.

3. COVID crushed some marketplace categories…

Just as pandemic behavior catapulted a number of categories and companies into the ranking, the accompanying fears and necessary safety restrictions hindered others. In particular, childcare marketplaces shrunk 61 percent, ticketing marketplaces by 52 percent, and office space marketplaces by 30 percent.

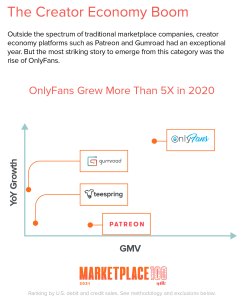

4. …and supercharged others, including online education, celebrity engagement, grocery delivery, and wholesale

There was considerable movement up the ranks by repeat Marketplace 100 companies. The biggest leaps came from the remote learning marketplace Outschool, the celebrity engagement platform Cameo, the campsite connector Hipcamp, and the wholesale retail marketplace Faire. These companies have something in common: they’re all fast-growing marketplaces in a “niche” category that was supercharged by pandemic behavior.

On average, these four standouts rose 41 spots in the Marketplace 100 ranking. Prior to 2020, the market size for these emerging companies was somewhat uncertain; the past year has revealed not only the enormity of the opportunity, but the strength of those companies’ product market fit.

When it comes to the success of business ideas—especially in tech—timing is critically important. The past year forced many marketplace companies to completely rethink their business models. Against all odds, a few lucky categories were in a position to grow.

Several categories doubled year-over-year, experiencing 100 percent growth or more.

Cameo spurred celebrity engagement, while the grocery category was fueled not only by Instacart, but also Mercato and Dumpling. Faire, a wholesale marketplace that allows boutique retailers to find and purchase merchandise from indie brands, single-handedly made wholesale the fastest growing category in last year’s ranking; this year, it jumped 35 spots. Floom, a service for sending deliveries of bouquets, plants, and floral arrangements from local independent florists across the U.S., advanced the flowers category during COVID. And music marketplaces also saw impressive growth, propelled primarily by Bandcamp.

Cameo spurred celebrity engagement, while the grocery category was fueled not only by Instacart, but also Mercato and Dumpling. Faire, a wholesale marketplace that allows boutique retailers to find and purchase merchandise from indie brands, single-handedly made wholesale the fastest growing category in last year’s ranking; this year, it jumped 35 spots. Floom, a service for sending deliveries of bouquets, plants, and floral arrangements from local independent florists across the U.S., advanced the flowers category during COVID. And music marketplaces also saw impressive growth, propelled primarily by Bandcamp.

In addition, the education category grew 77 percent, driven by companies like Outschool and MasterClass.

Despite the obvious challenges presented by COVID restrictions and lockdowns, the travel category also saw notable growth over the past year. This is due in large part to the contributions of companies that provide “socially distanced” travel options, such as RV rentals and remote camping experiences, like Hipcamp, Outdoorsy, RVshare, and Harvest Hosts.

5. As the year progressed, we shifted our spending on food, furniture, even cannabis delivery.

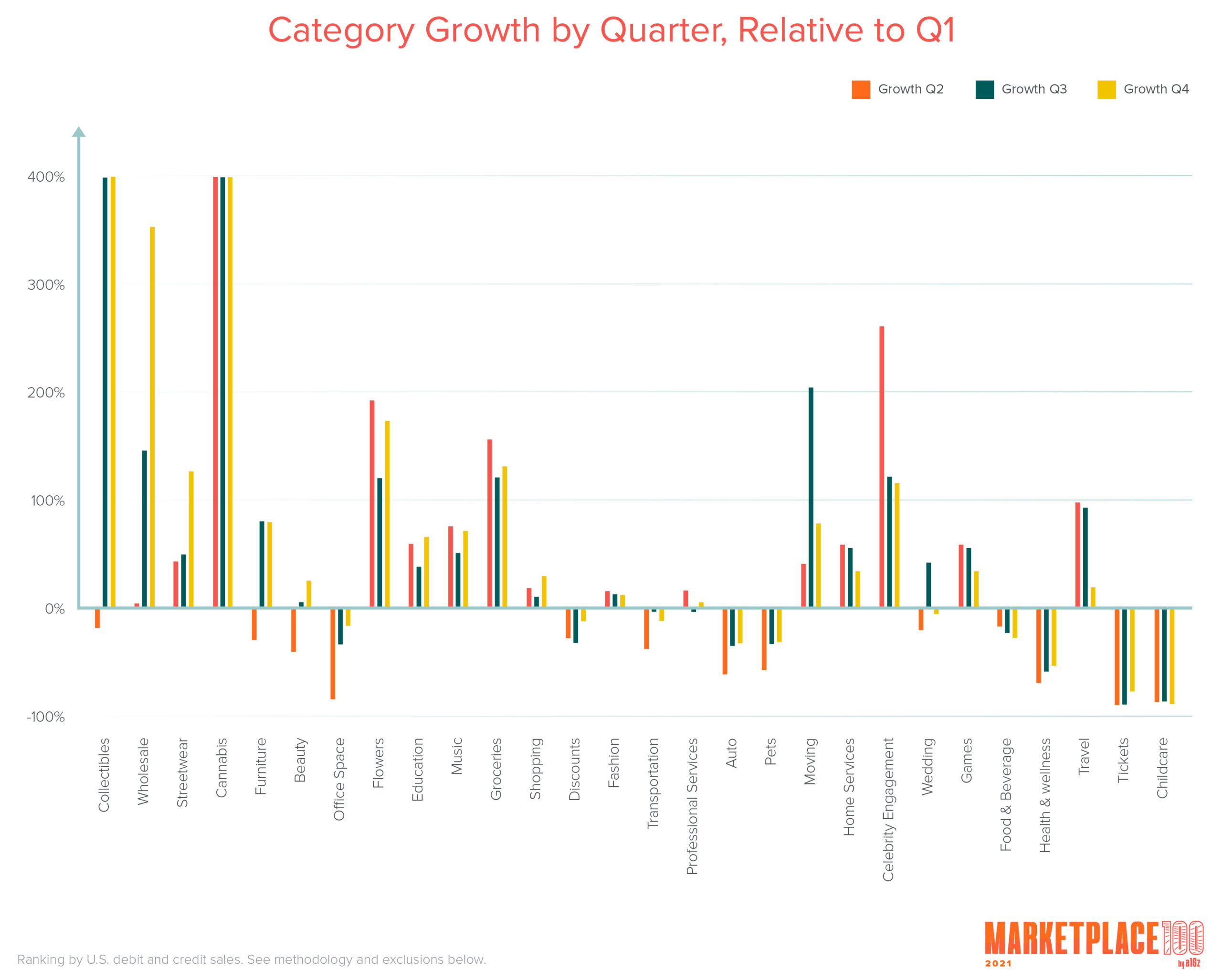

The year started out looking relatively normal: we purchased tickets for concerts and sporting events, we went to the gym and group fitness classes, we spent money on childcare and dog-walkers. Then, as COVID spread into a pandemic, marketplaces helped us stock up and stay home—at least at first.

- In the winter we were still in the “old normal,” spending on things like childcare and tickets. In fact, over 70 percent of total 2020 spend in both of those categories was in Q1 alone.

- In the spring, as shelter-in-place went into effect, people leaned on technology to stay entertained, connected, and relaxed: celebrity engagement (in the form of Cameo videos) grew approximately 250 percent from its Q1 mark, while flower delivery went up nearly 200 percent from Q1. While both those categories hit their high-water marks in Q2, cannabis delivery shot up well over 400 percent in Q2—and stayed there the rest of the year.

- As summer rolled around, consumer consumers were either settling in or relocating entirely. Moving services like Dolly were up 200 percent and furniture marketplaces like AptDeco were up nearly 100 percent, compared to Q1. Meanwhile, people stuck at home revived the collectibles craze: that category shot up over 400 percent, relative to Q1.

- And as the year came to a close, shopping started to make a comeback. Live shopping for collectibles maintained their momentum, and we saw increased spending on wholesale items (+350 percent, compared to Q1) and streetwear (+125 percent, compared to Q1), as well.

6. Network effects are no joke. And for companies without them, competition is fierce.

The power of network effects in marketplace businesses is evident in the data. In “open” categories—that is, those without a strong incumbent, like furniture or music—newcomers like AptDeco, Eaze, and Bandcamp were able to achieve growth. Meanwhile, in categories that are dominated by a large established marketplace, much of the category’s growth was attributed to incumbents, rather than newcomers.

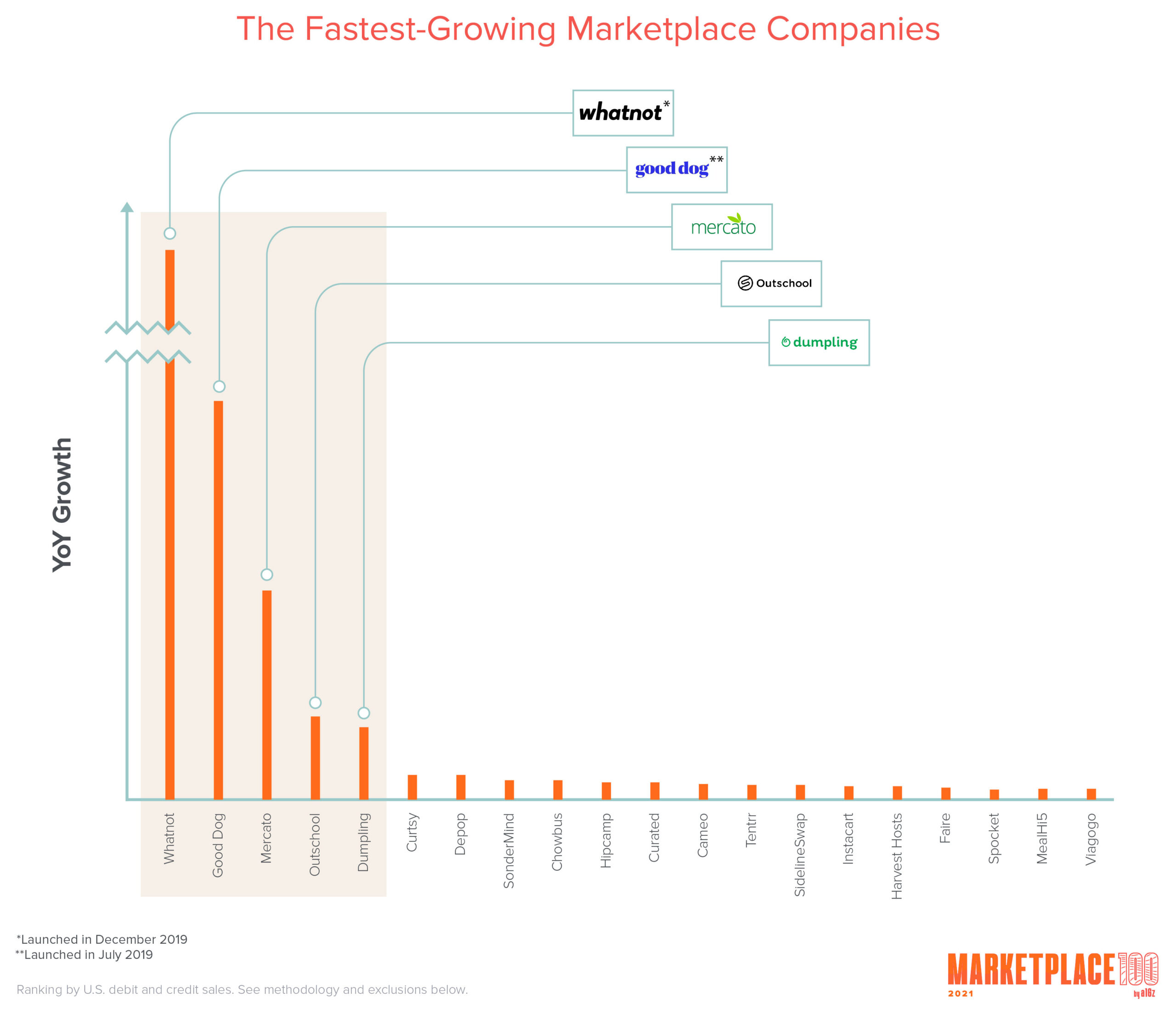

7. The five fastest-growing startups are growing really fast—more than 10x, year-over-year.

The fastest-growing startups reveal emergent consumer categories. Whatnot (#99), a community-driven marketplace for buying and selling collectibles, was the fastest growing marketplace in 2020 (caveat: It launched in December 2019, so its window for 2019 GMV is shorter than others on the ranking). Whatnot’s expansion highlights two emerging trends: collectibles and live shopping. Collectibles might seem niche in isolation, but when you combine the category with interactive video, it makes shopping feel novel. Look for live shopping—aka shopatainment—to grow.

Good Dog (#80), a marketplace that connects aspiring dog owners with vetted, certified breeders and shelters, was the next fastest-growing marketplace in 2020. Not only did pets become even more important in this isolating year, but the pandemic normalized shopping for pets online.

Mercato (#34) and Dumpling (#43) both match consumers with local grocery providers. Though online grocery shopping at large went mainstream this year, companies that combine local merchants and convenient delivery hit a sweet spot in customer demand.

The rapid growth of the remote learning marketplace Outschool (#10) over 2020 was likely a product of widespread school closures. But the company’s recent rise also could signal increasing adoption of home-schooling and online education.

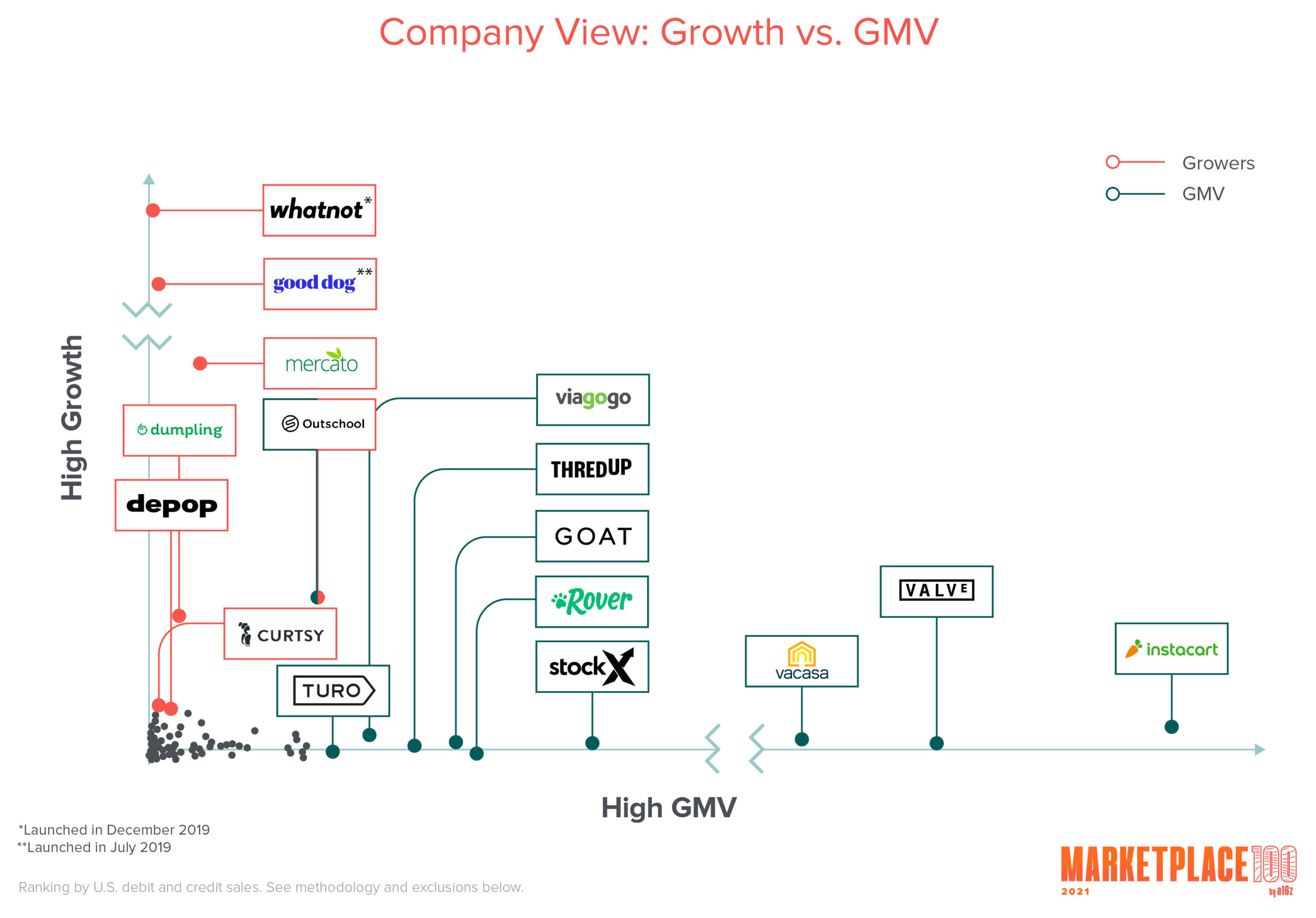

8. Growth and scale were possible in 2020

We’ve previously described the marketplace “mountain”—the idea that it’s difficult to maintain high levels of growth at high levels of GMV. This year’s Marketplace 100 challenged that conceit. A select few companies managed to pull off the improbable: reaching the top 25 in terms of GMV and growth.

Instacart, Faire, Viagogo, Outschool, and MasterClass were largely at scale in the lead-up to the pandemic; 2020 managed to vault them forward years. All achieved impressive growth rates and scale, simultaneously. This rarity occurs when a marketplace with clear network effects meets a shock of demand.

In the Marketplace 100, five of the top 10 fastest growing marketplaces also broke into the top 50 in terms of GMV: Mercato, Dumpling, Depop, Outschool, and Hipcamp.

The past year had the potential to be a very tough year for marketplace companies, as it was for many industries. Instead, the Marketplace 100 is evidence of many startups’ impressive stamina, adaptability, and, more often than not, growth.

From food delivery to edtech, music, and camping, the companies on the ranking represent the activities that helped us make it through a tough year. The pandemic fundamentally altered how we travel, learn, and shop—and marketplace companies innovated to serve those needs.

Marketplaces companies will continue to play a key role as the economy recovers. We’re excited to see what the year ahead holds, and we’re intrigued to see how post-pandemic behavior might shake up next year’s Marketplace 100.

Marketplace 100 Extras

Here are the top 10 largest marketplace startups and private companies in 2021.

Congratulations to this year’s honorees. If your company is featured on the Marketplace 100 and you’d like to share the news, you can download a shareable badge here.

For a complete PDF of the a16z Marketplace 100: 2021, including all the charts and analysis, plus more on marketplace metrics, suggested reading for entrepreneurs, and a marketplace glossary, go here.

* * *

How the Marketplace 100 is ranked

Once again, we turned to the data to help us analyze the state of the marketplace ecosystem: specifically, anonymized, aggregated U.S. consumer spending data captured via credit cards, debit cards, and bank transfers. The Marketplace 100 is based on data from Bloomberg Second Measure, a consumer data analytics company that analyzes billions of purchases to track real-time consumer behavior and relative sales across over 5,200 merchants. This information allows us to assess which marketplaces are capturing the most dollars, what’s trending up and down, and which categories are growing the fastest.

The startups and private companies on the Marketplace 100 are then ranked using a common industry metric, Gross Merchandise Value (GMV), which is extrapolated from the total dollars consumers are spending against each company. This provides an approximate measure of a marketplace’s scale and its importance in the economy, based on how much revenue is trading hands between buyers and sellers.

Of course, there are many caveats and limitations to this approach: Notably, it leaves out most B2B marketplaces (though there are many we’re excited about), and understates companies that might receive payments mostly via cash, check, or EBT. In addition, Bloomberg Second Measure’s transaction data is limited to the United States, which excludes many high-growth startups that do business internationally. Some companies that may meet the criteria of the Marketplace 100—including four companies that were included in last year’s ranking, Kaiyo, UpCounsel, Artsy, and Splacer—are no longer on Bloomberg Second Measure’s coverage list; likewise, some that were not covered by Bloomberg Second Measure’s coverage last year now are. Finally, some products are hybrids of marketplaces and other business models; in those cases, we’ve used our best judgement.

Methodology

A marketplace is any platform that connects buyers and sellers of goods/services with each other and facilitates a transaction.

Marketplace categorization

When the vertical-specific subset of a larger category accounts for more than a third of the overall category’s GMV, it is broken out into a separate category. For example, “streetwear” and “fashion” are subsets independent from “shopping” because they each account for at least one-third of all GMV in the greater category.

Data source

Bloomberg Second Measure, a company that analyzes billions of anonymized, aggregated credit, debit, and ACH transactions to track real-time consumer behavior and relative sales across 5,200 public and private merchants. The Marketplace 100 is drawn from companies on Bloomberg Second Measure’s coverage list. Please see the detailed list of data caveats and exclusions below.

Timeline

Observed sales are calculated over dates spanning January 2020 to December 2020. Year-over-year growth rates are counted as sales between January 2020 through December 2020 vs. January 2019 through December 2019. Companies that launched after January 2019 are labeled as such.

- Bloomberg Second Measure data is made up of billions of anonymous U.S. consumers’ credit card, debit card, and bank transactions. It excludes non-U.S. consumers, business spending, receipt-level information, and payments made via cash, check, or EBT.

- Transactions correspond to some companies’ Gross Merchandise Volume, a significant portion of which is not revenue to the company.

- Bloomberg Second Measure cannot reliably attribute bundled revenue streams.

- Tips are not reliably differentiated from purchases on marketplaces and may be included in some merchants’ GMV.

- Bloomberg Second Measure does not observe revenue from third-party retailers or other B2B revenue streams.

- Bloomberg Second Measure does not observe spending made with gift cards.

- Bloomberg Second Measure cannot reliably attribute purchases financed through third-party companies like Prosper and Affirm to the marketplace associated with the purchase.

- Bloomberg Second Measure cannot reliably observe spending financed through credits from selling on a marketplace.

- Bloomberg Second Measure does not observe revenue from corporate benefits partnership programs.

- Bloomberg Second Measure does not observe online payments through iTunes or the Apple App Store.

- Bloomberg Second Measure cannot reliably observe marketplace fees.

- Bloomberg Second Measure does not observe marketplace revenue generated by third-party referrals.

- There may exist companies that meet the criteria of the Marketplace 100, but they are not included because they are not on Bloomberg Second Measure’s coverage list.

* * *

The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; a16z has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information.