2022 marks our third year releasing the Marketplace 100, a ranking of the largest consumer-facing marketplace startups and private companies.

When we started this series in early 2020 (based on data from 2019), we had no way of knowing how volatile the next few years would be. Many businesses were temporarily shuttered by covid, especially in categories like travel and childcare. Other categories, like online education and grocery delivery, experienced unprecedented spikes in activity. Throughout it all, the marketplace model endured.

Here are the highlights from the third edition of the Marketplace 100, which we’ll unpack in detail below:

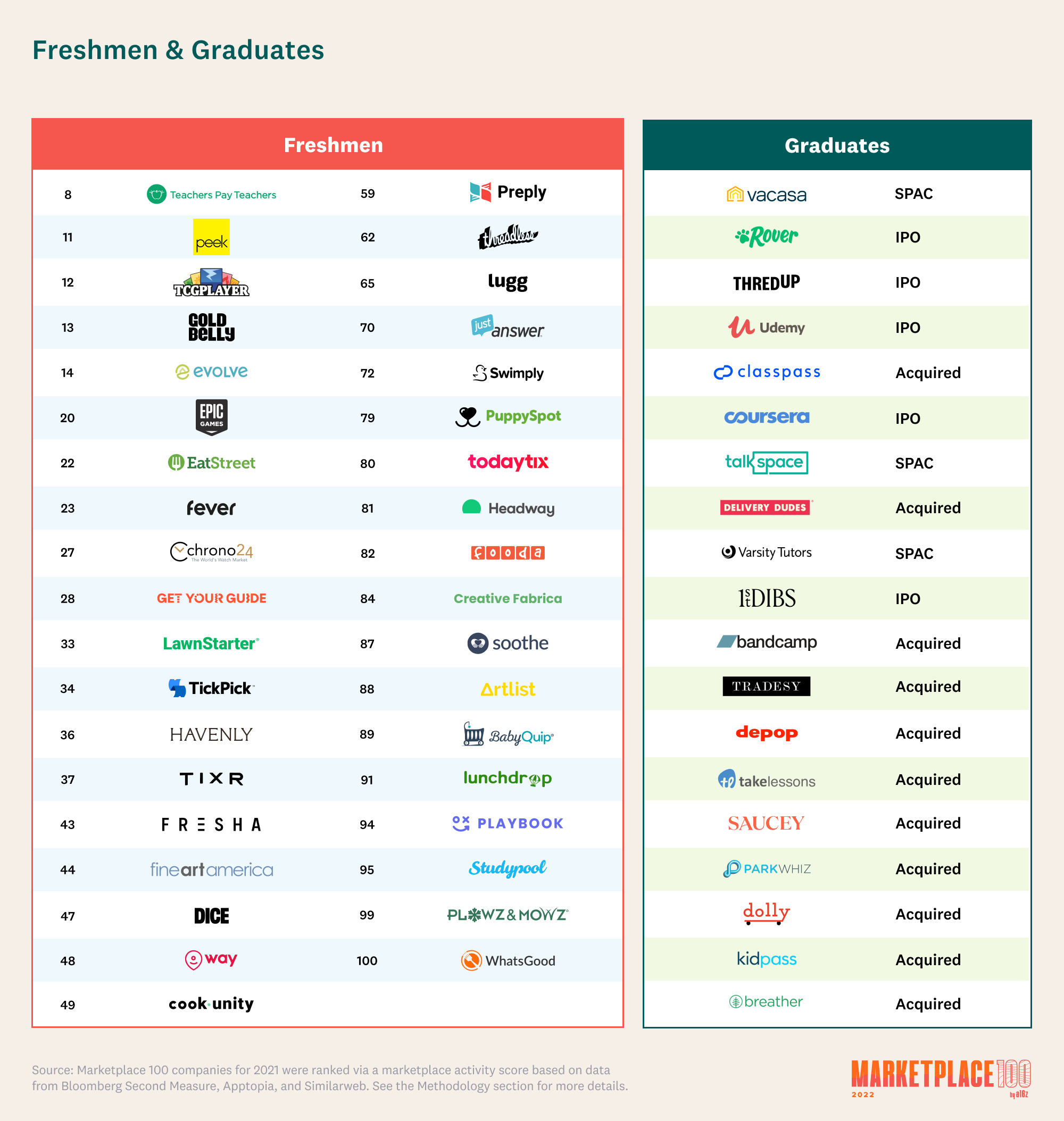

- Unprecedented turnover shows that early stage marketplaces are as relevant as ever. Nineteen companies “graduated” (versus 10 last year), due to five IPOs, three SPACs, and 11 acquisitions. There were also 37 “freshmen,” 48% more than last year.

- #1 Instacart’s ascendency in a “winner takes most” category may be hard for the next generation of marketplace giants to replicate — opening up more room at the top!

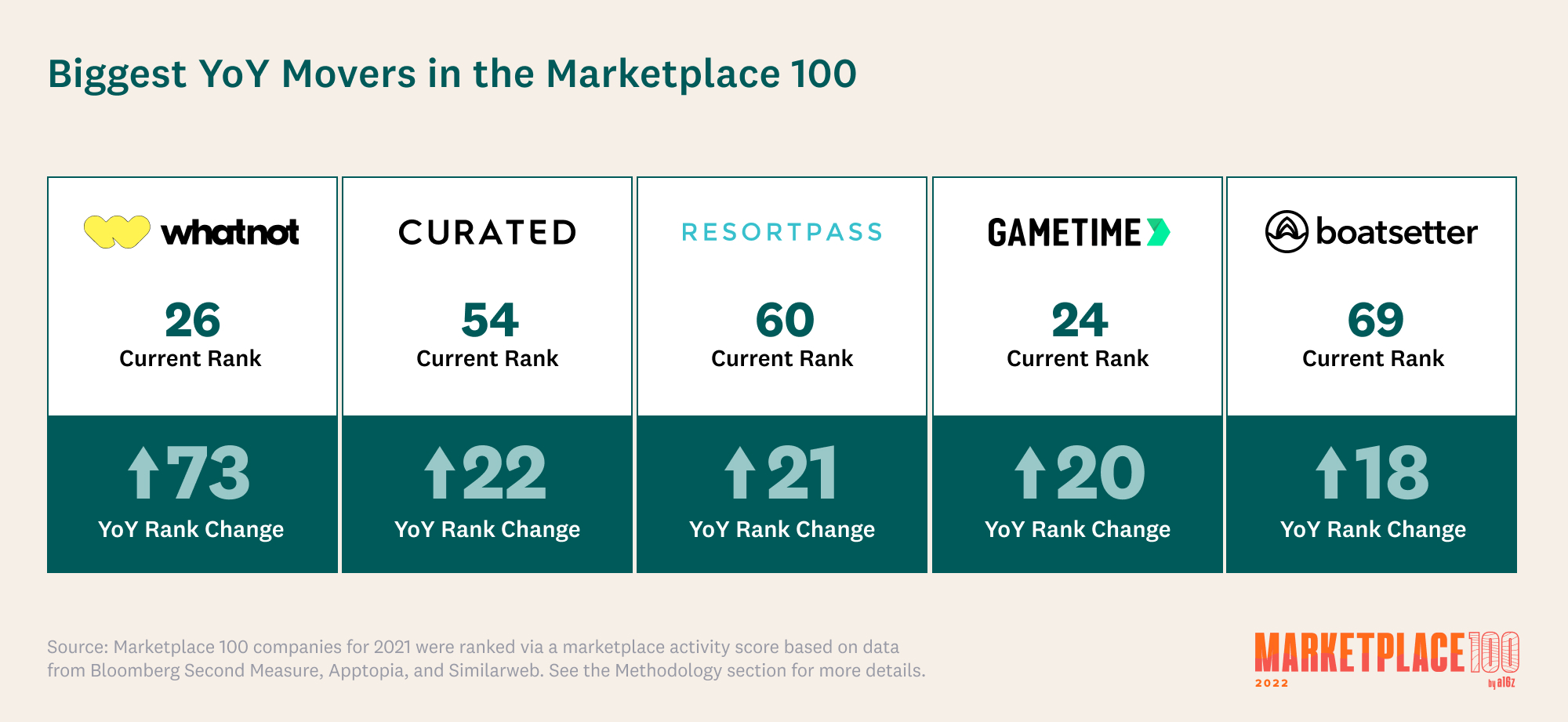

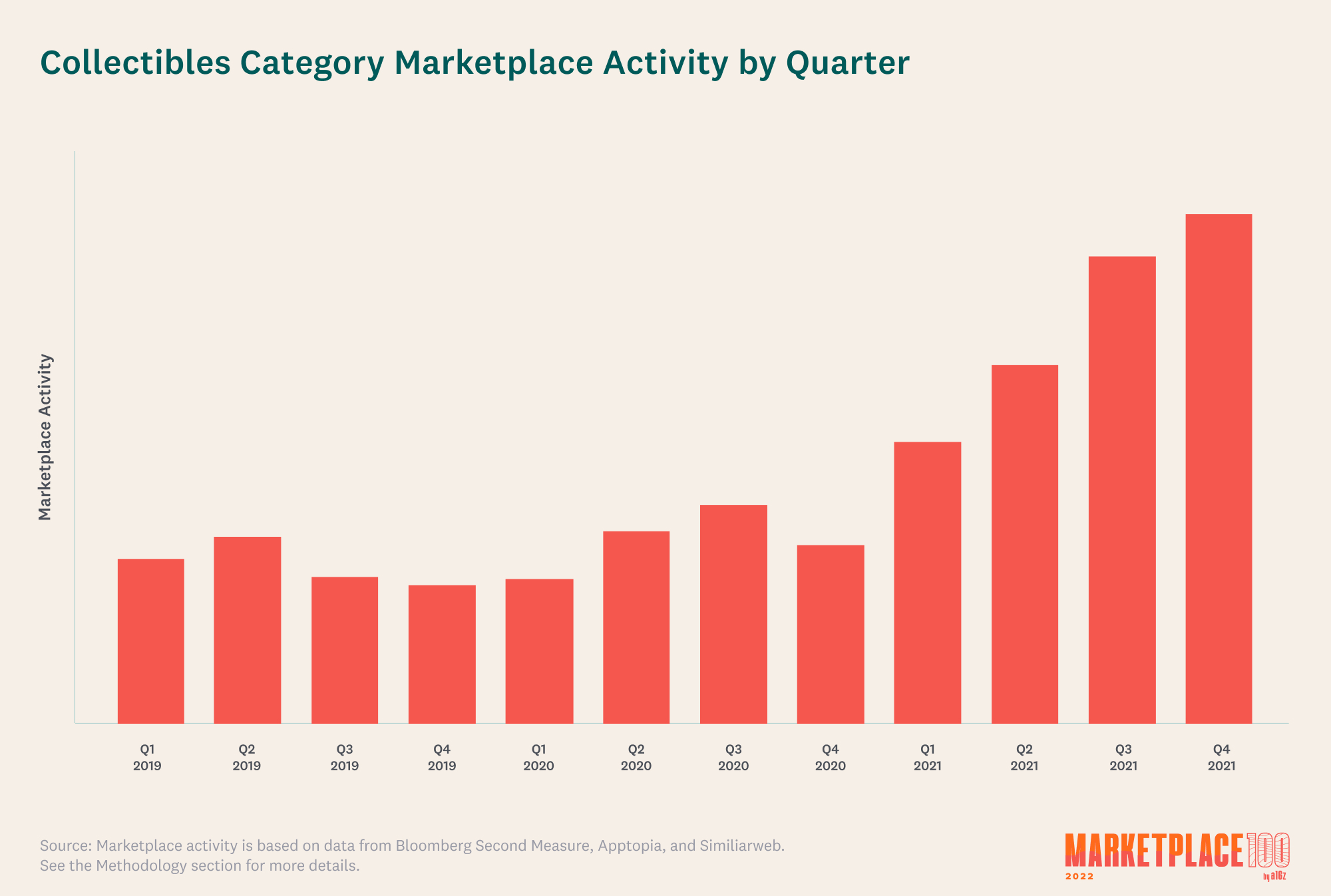

- Live shopping app Whatnot had the biggest YoY list jump ever, moving up 73 spots into #26, and contributing to the Collectibles category’s break-out year.

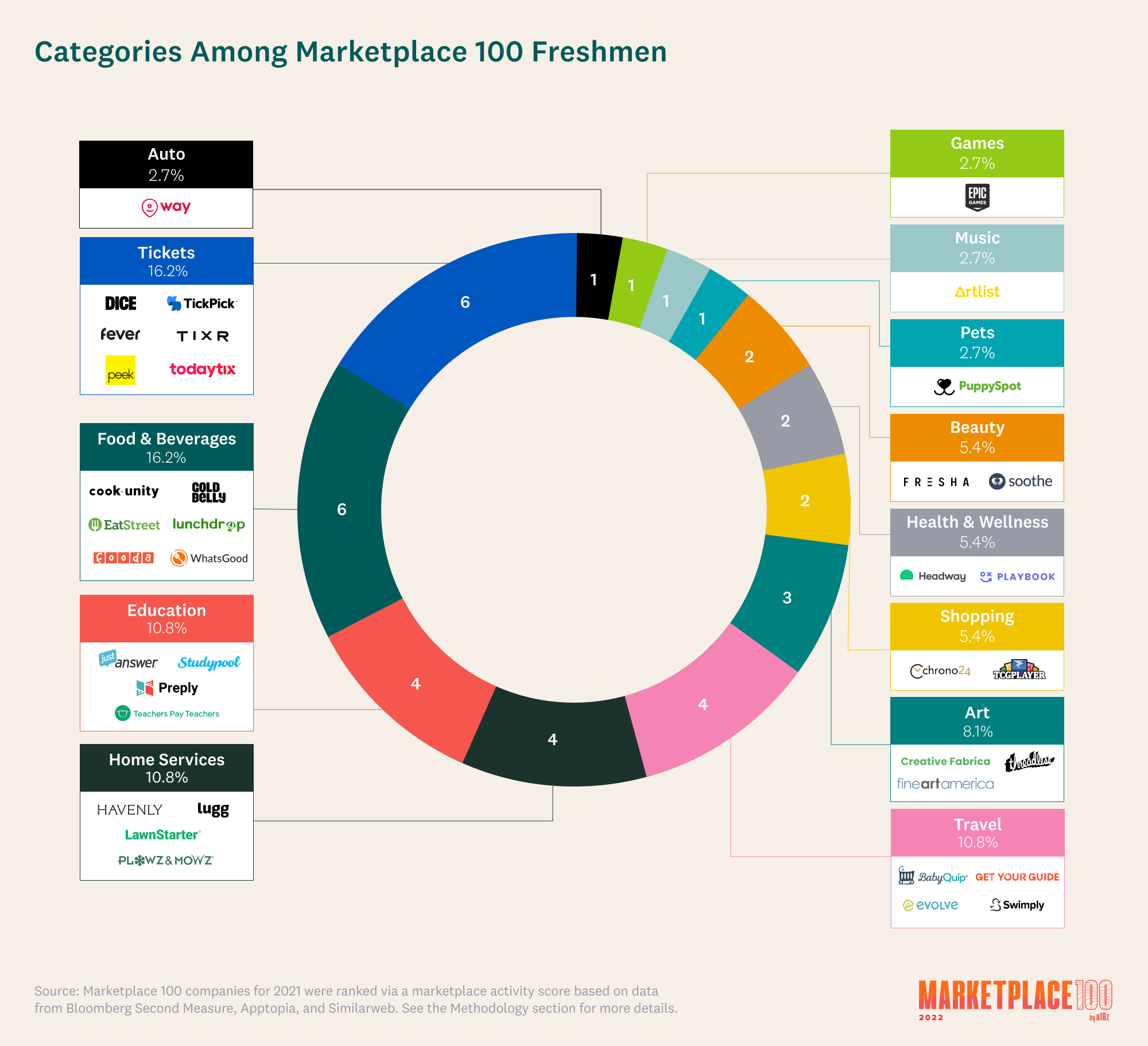

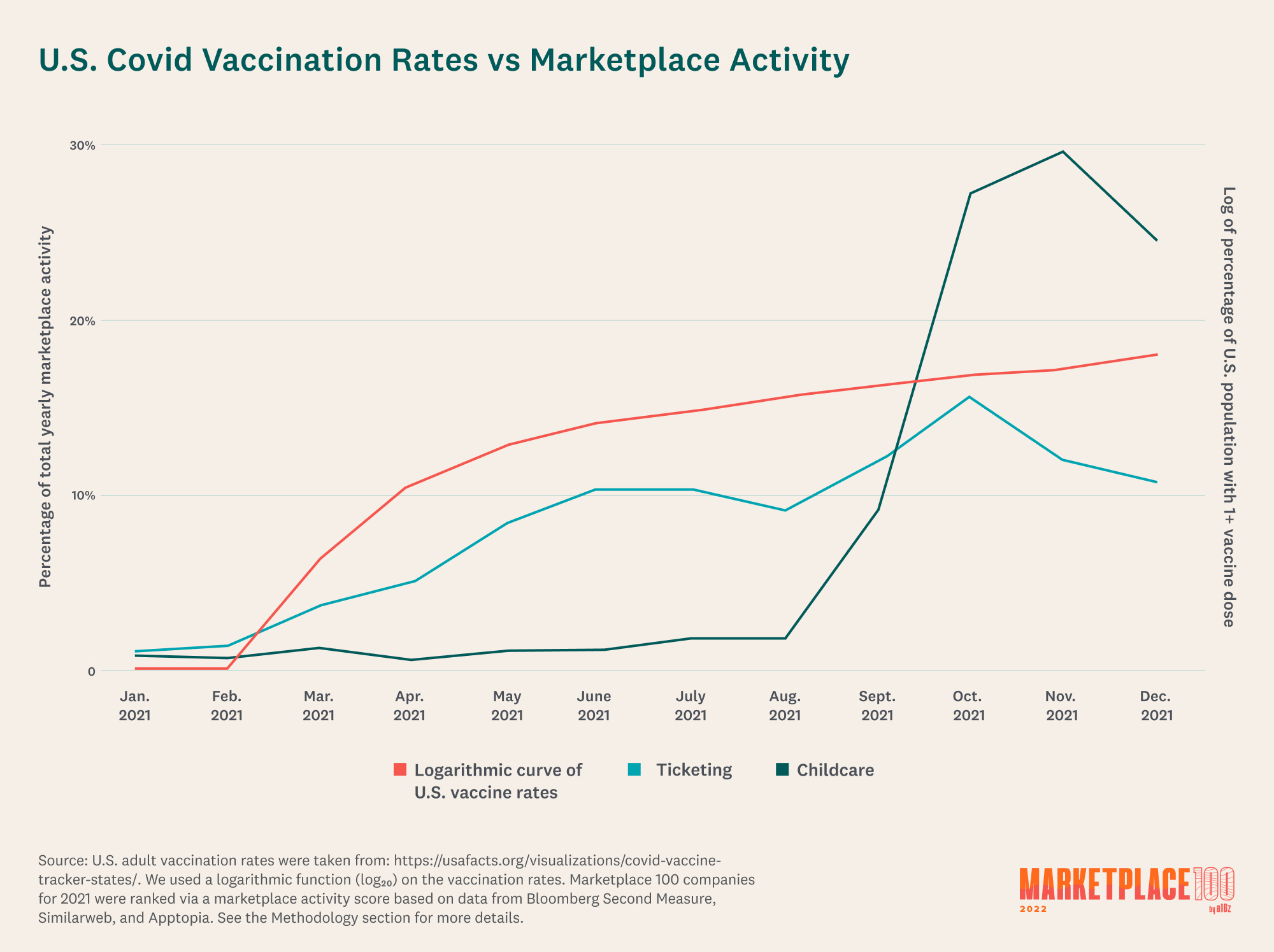

- Ticketing, Food & Beverage, and Education saw the most new entrants, as a result of a “covid bounceback” where consumers adjusted to a new normal. Vaccine rollouts were particularly closely correlated to recovery in categories like Childcare and Ticketing.

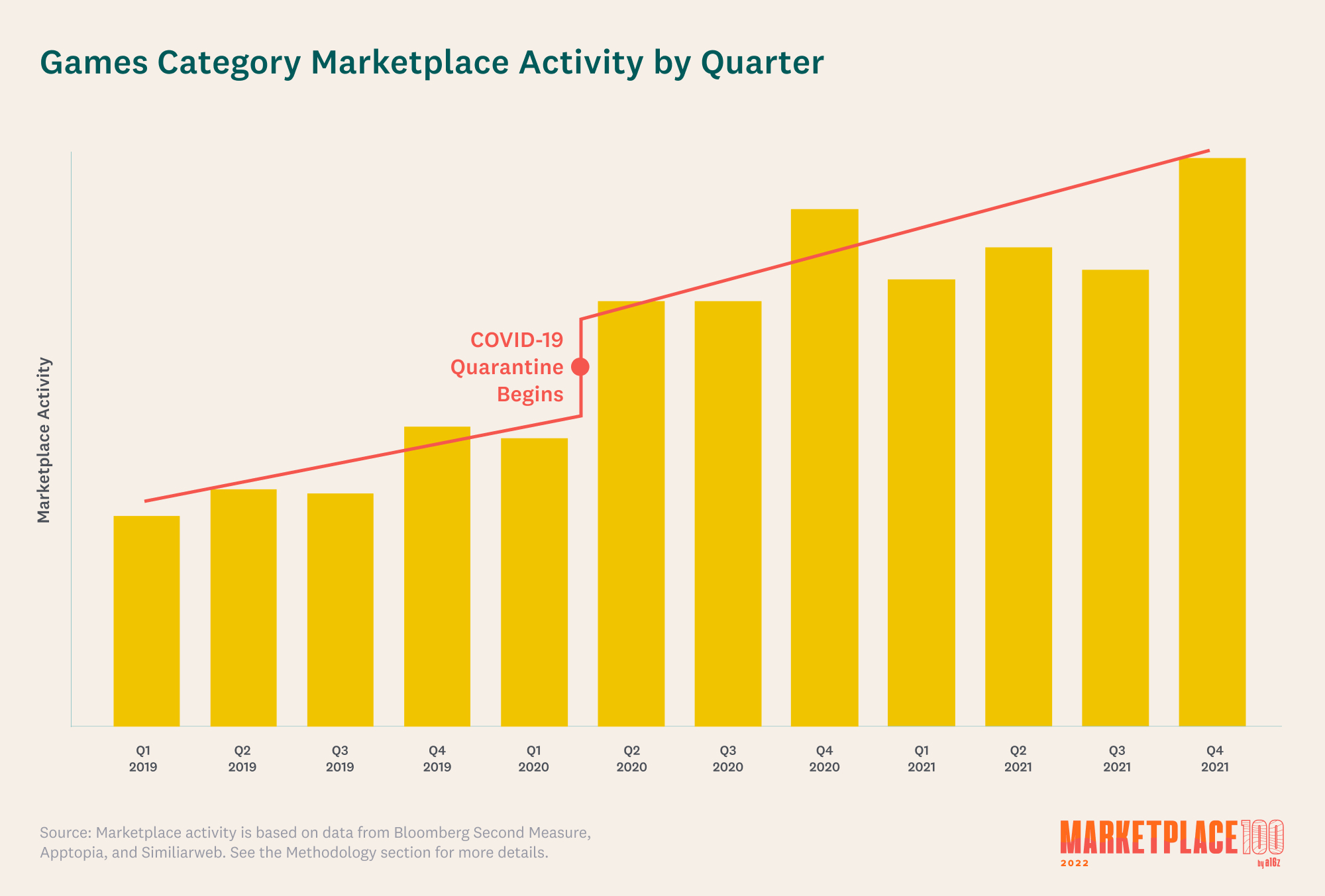

- For some categories, though, quarantine created lasting habits. In particular, the Games and Shopping/Collectibles categories saw sustained growth, moving beyond previous pre-covid baselines.

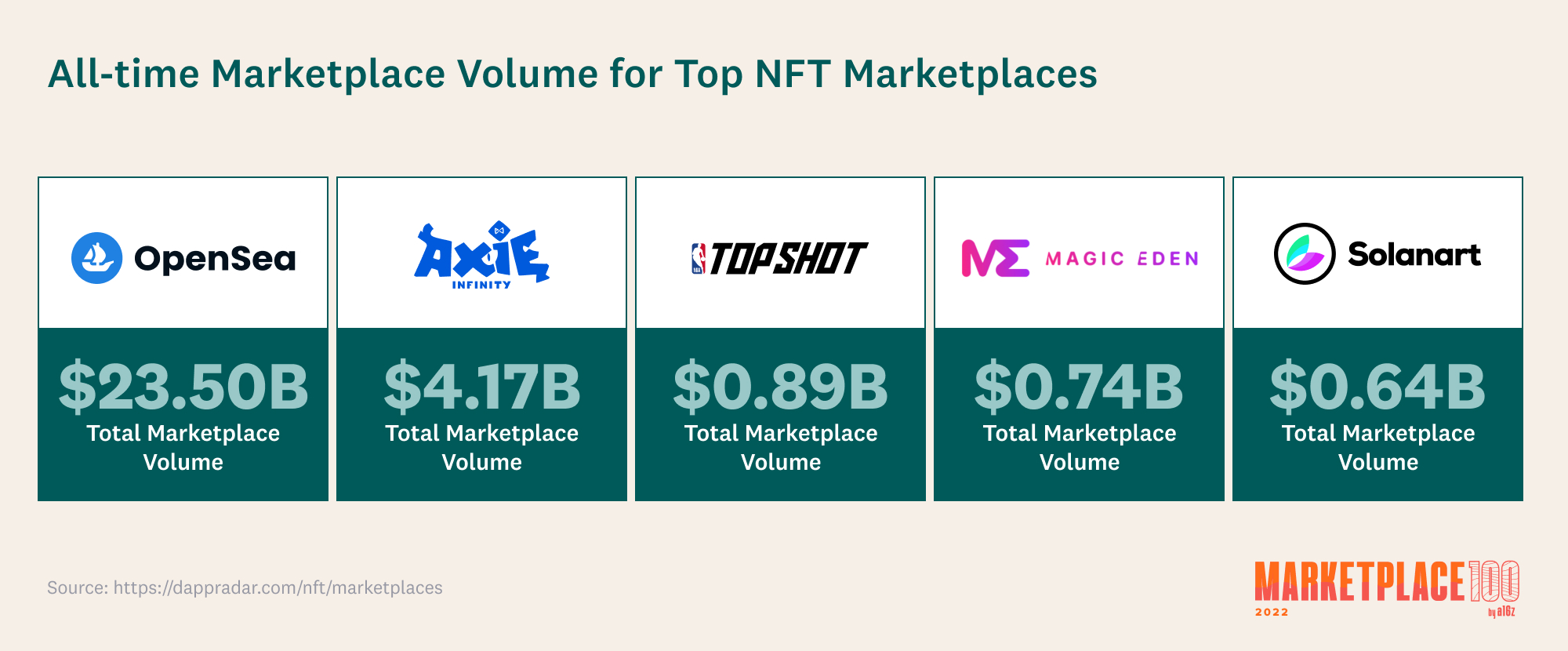

- Bonus: while not included on the Marketplace 100 list, NFT marketplaces exploded in 2021. We looked at all-time marketplace volume for the top NFT marketplaces, with OpenSea leading at $23.5B all-time, per Dapp Radar.

Though Instacart continues to dominate at the top slot on the list, all of this turnover begins to hint at the real story in marketplaces this year and going forward. Where does the next Instacart, Airbnb, Uber, or Lyft come from? Who will be in the next generation of marketplace giants?

While it’s too early to say, four categories have emerged from 2021 as ones to watch: Ticketing and Experiences; Shopping and Commerce; Games; and the growing world of web3 marketplaces.

A note on our methodology

This year, we’ve expanded our metric for measuring marketplace performance. In prior years, the ranking has been solely based on Gross Merchandise Value (GMV), which is extrapolated from the total dollars consumers are spending against each company, per Bloomberg Second Measure data.

In 2022, the rankings are based on a marketplace activity score for each company that includes GMV, per Bloomberg Second Measure (for companies that Bloomberg Second Measure tracks), as well as Apptopia data for app performance and SimilarWeb data for website traffic. Throughout this piece, when analyzing company or category performance for 2021, we’ll refer to “marketplace activity,” as per our expanded metric. Where appropriate (such as when discussing trends from past lists, for example), we will sometimes refer to GMV explicitly and specifically. For more on methodology, please go to the Methodology section below.

The Marketplace 100 List

The third edition of the Marketplace 100 uncovers the top companies and categories of the year, and also highlights how each startup’s ranking has changed since 2021.

| Rank | Company | HQ | Categories | YoY Change | Website |

|---|

|

1

-

|

|

San Francisco, CA | Groceries | - | Instacart |

|

2

-

|

|

Bellevue, WA | Games | - | Valve |

|

3

10

|

|

New York, NY | Tickets | 10 | SeatGeek |

|

4

5

|

|

San Francisco, CA | Transportation | 5 | Turo |

|

5

1

|

|

Detroit, MI | Streetwear | 1 | StockX |

|

6

2

|

|

San Francisco, CA | Tickets | 2 | Viagogo |

|

7

1

|

|

Los Angeles, CA | Streetwear | 1 | GOAT |

|

8

new

|

|

New York, NY | Education | new | Teachers Pay Teachers |

|

9

7

|

|

New York, NY | Wedding | 7 | Zola |

|

10

2

|

|

San Francisco, CA | Beauty | 2 | StyleSeat |

|

11

new

|

|

San Francisco, CA | Tickets | new | Peek |

|

12

new

|

|

Syracuse, NY | Shopping | new | TCGplayer |

|

13

new

|

|

New York, NY | Food & Beverage | new | Goldbelly |

|

14

new

|

|

Denver, CO | Travel | new | Evolve |

|

15

3

|

|

San Francisco, CA | Wholesale | 3 | Faire |

|

16

5

|

|

Austin, TX | Travel | 5 | Outdoorsy |

|

17

7

|

|

San Francisco, CA | Education | 7 | Outschool |

|

18

1

|

|

Redwood City, CA | Education | 1 | Course Hero |

|

19

5

|

|

Akron, OH | Travel | 5 | RVshare |

|

20

new

|

|

Cary, NC | Games | new | Epic Games Store |

|

21

-

|

|

Chicago, IL | Auto | - | SpotHero |

|

22

new

|

|

Madison, WI | Food & Beverage | new | EatStreet |

|

23

new

|

|

New York, NY | Tickets | new | Fever |

|

24

20

|

|

San Francisco, CA | Tickets | 20 | Gametime |

|

25

5

|

|

Boston, MA | Food & Beverage | 5 | ezCater |

|

26

73

|

|

Los Angeles, CA | Collectibles | 73 | Whatnot |

|

27

new

|

|

Carlsruhe, Germany | Shopping | new | Chrono24 |

|

28

new

|

|

Berlin, Germany | Travel | new | Get Your Guide |

|

29

1

|

|

San Francisco, CA | Home Services | 1 | Modsy |

|

30

11

|

|

Chicago, IL | Discounts | 11 | Raise |

|

31

2

|

|

San Francisco, CA | Home Services | 2 | Thumbtack |

|

32

7

|

|

San Francisco, CA | Cannabis | 7 | Eaze |

|

33

new

|

|

Austin, TX | Home Services | new | LawnStarter |

|

34

new

|

|

Austin, TX | Tickets | new | TickPick |

|

35

3

|

|

New York, NY | Education | 3 | Skillshare |

|

36

new

|

|

Denver, CO | Home Services | new | Havenly |

|

37

new

|

|

Los Angeles, CA | Tickets | new | Tixr |

|

38

6

|

|

Melbourne, Australia | Professional Services | 6 | Envato |

|

39

2

|

|

Los Angeles, CA | Pets | 2 | Wag |

|

40

-

|

|

San Francisco, CA | Travel | - | Hipcamp |

|

41

6

|

|

Bellevue, WA | Shopping | 6 | OfferUp |

|

42

11

|

|

Chicago, IL | Celebrity Engagement | 11 | Cameo |

|

43

new

|

|

London, UK | Beauty | new | Fresha |

|

44

new

|

|

Los Angeles, CA | Art | new | FineArtAmerica |

|

45

-

|

|

Philadelphia, PA | Auto | - | EverWash |

|

46

10

|

|

Arlington, VA | Food & Beverage | 10 | Territory Foods |

|

47

new

|

|

London, UK | Tickets | new | Dice |

|

48

new

|

|

Fremont, CA | Auto | new | Way.com |

|

49

new

|

|

New York, NY | Food & Beverage | new | Cookunity |

|

50

16

|

|

San Diego, CA | Groceries | 16 | Mercato |

|

51

11

|

|

San Francisco, CA | Beauty | 11 | Booksy |

|

52

9

|

|

San Francisco, CA | Office Space | 9 | Peerspace |

|

53

3

|

|

New York, NY | Childcare | 3 | Sawyer |

|

54

22

|

|

San Francisco, CA | Shopping | 22 | Curated |

|

55

-

|

|

Boston, MA | Shopping | - | SidelineSwap |

|

56

13

|

|

Berkeley, CA | Groceries | 13 | Dumpling |

|

57

6

|

|

San Francisco, CA | Transportation | 6 | Getaround |

|

58

2

|

|

San Francisco, CA | Professional Services | 2 | Toptal |

|

59

new

|

|

Brookline, MA | Education | new | Preply |

|

60

21

|

|

Santa Monica, CA | Health & Wellness | 21 | ResortPass |

|

61

7

|

|

Paris, France | Fashion | 7 | Vestiaire Collective |

|

62

new

|

|

Chicago, IL | Art | new | Threadless |

|

63

10

|

|

Denver, CO | Health & Wellness | 10 | SonderMind |

|

64

4

|

|

Vail, CO | Travel | 4 | Harvest Hosts |

|

65

new

|

|

San Francisco, CA | Home Services | new | Lugg |

|

66

3

|

|

San Francisco, CA | Fashion | 3 | Curtsy |

|

67

3

|

|

San Francisco, CA | Food & Beverage | 3 | Snackpass |

|

68

26

|

|

San Francisco, CA | Shopping | 26 | Tophatter |

|

69

18

|

|

Fort Lauderdale, FL | Travel | 18 | Boatsetter |

|

70

new

|

|

San Francisco, CA | Education | new | JustAnswer |

|

71

9

|

|

New York, NY | Pets | 9 | Good Dog |

|

72

new

|

|

Cedarhurst, NY | Travel | new | Swimply |

|

73

8

|

|

Dublin, CA | Beauty | 8 | Vagaro |

|

74

17

|

|

Mountain View, CA | Auto | 17 | YourMechanic |

|

75

4

|

|

Chicago, IL | Food & Beverage | 4 | Chowbus |

|

76

17

|

|

New York, NY | Health & Wellness | 17 | Zeel |

|

77

24

|

|

St. Cloud, MN | Food & Beverage | 24 | Food Dudes Delivery |

|

78

12

|

|

Minneapolis, MN | Fashion | 12 | Kidizen |

|

79

new

|

|

Los Angeles, CA | Pets | new | PuppySpot |

|

80

new

|

|

New York, NY | Tickets | new | TodayTix |

|

81

new

|

|

New York, NY | Health & Wellness | new | Headway |

|

82

new

|

|

Chicago, IL | Food & Beverage | new | Fooda |

|

83

31

|

|

Toronto, Canada | Food & Beverage | 31 | Ritual |

|

84

new

|

|

Amsterdam, Netherlands | Art | new | CreativeFabrica |

|

85

3

|

|

Sao Paulo, Brazil | Health & Wellness | 3 | Gympass |

|

86

8

|

|

New York, NY | Furniture | 8 | AptDeco |

|

87

new

|

|

San Francisco, CA | Beauty | new | Soothe |

|

88

new

|

|

Tel Aviv, Israel | Music | new | Artlist |

|

89

new

|

|

Santa Fe, NM | Travel | new | BabyQuip |

|

90

32

|

|

New York, NY | Transportation | 32 | Via |

|

91

new

|

|

Austin, TX | Food & Beverage | new | LunchDrop |

|

92

17

|

|

Beaverton, OR | Music | 17 | Discogs |

|

93

9

|

|

Newton Upper Falls, MA | Health & Wellness | 9 | CoachUp |

|

94

new

|

|

New York, NY | Health & Wellness | new | Playbook |

|

95

new

|

|

Mountain View, CA | Education | new | Studypool |

|

96

29

|

|

San Francisco, CA | Travel | 29 | Glamping Hub |

|

97

28

|

|

San Francisco, CA | Childcare | 28 | UrbanSitter |

|

98

16

|

|

Vilnius, Lithuania | Shopping | 16 | Vinted |

|

99

new

|

|

Syracuse, NY | Home Services | new | Plowz and Mowz |

|

100

new

|

|

Providence, RI | Food & Beverage | new | Whats Good |

2020 to Today: Freshmen and Graduates

This year’s Marketplace 100 saw an immense amount of change. For starters, there were more companies exiting via acquisition or IPO (“graduates”) than ever before. Nineteen companies from last year’s Marketplace 100 graduated, compared to a total of 10 graduates across 2020 and 2021, an increase of 80% YoY. Eleven of the 19 were acquired, as consolidation was a big theme across categories, with many companies being acquired by other marketplaces.

This year’s list also saw 37 “freshmen” break into the Marketplace 100 for the first time, compared to 25 freshmen last year. The growth in new entrants was driven by the high graduation rate and some “drop outs.” What was at the root of this? A combination of a covid rebound (and in some cases, a post-covid decline), and particularly active financial markets.

This has opened up new opportunities for the next generation of marketplaces.

From a methodology perspective, we were also able to include companies that would have made the list in 2020, but weren’t yet covered in our various data sets. We expect every annual list will include a few companies that fall under this criteria, leading to some high-ranking debuts!

While Instacart continues to lead the list, the next wave of marketplace giants may not share the same “winner take most” dynamics

For the past two years, the Marketplace 100 has been dominated by one company: Instacart. Instacart made up a whopping 71.5% of the entire Marketplace 100 list’s GMV last year, and represents 64.2% of marketplace activity this year. No other Groceries company ranked in the top 50, and the two others in the category that made the list each saw 0.1% (or less!) of Instacart’s marketplace activity.

Not all categories operate this way. Take Travel, for example. In the first Marketplace 100 two years ago, the top company, Airbnb, accounted for only 38% of GMV. A competitive travel company, Vacasa, also made the top 10, as well as a range of companies helping consumers book different types of lodging, like Outdoorsy, RVShare, Vacatia, and more. And this year, even though Airbnb and Vacasa are now public and growing companies, a competitor — Evolve — cracked into the top 20.

What accounts for this difference? In some categories, the marketplace dynamic tends to be “winner takes all” — or at least “winner takes most.” This determines whether or not the category can support many billion-dollar companies, or just one or two at a time. When you have a “winner takes all” company at the top of the Marketplace 100, it’s likely to “swallow” up the revenue of much of the rest of the list!

Groceries is one example that tends to be “winner takes all.” It’s more difficult to multi-tenant on the supply side, meaning that suppliers can only offer their products in a few places at a time. There is friction involved in getting a grocery store’s thousands of items of inventory onboard, constantly refreshing them, and fulfilling orders from a store.

And while pricing can be slightly different on different marketplaces, there’s a set (and fairly limited) number of grocery stores to onboard that make up most dollars spent. Supply is fairly concentrated — working with a few big grocers delivers the vast majority of what the average consumer needs.

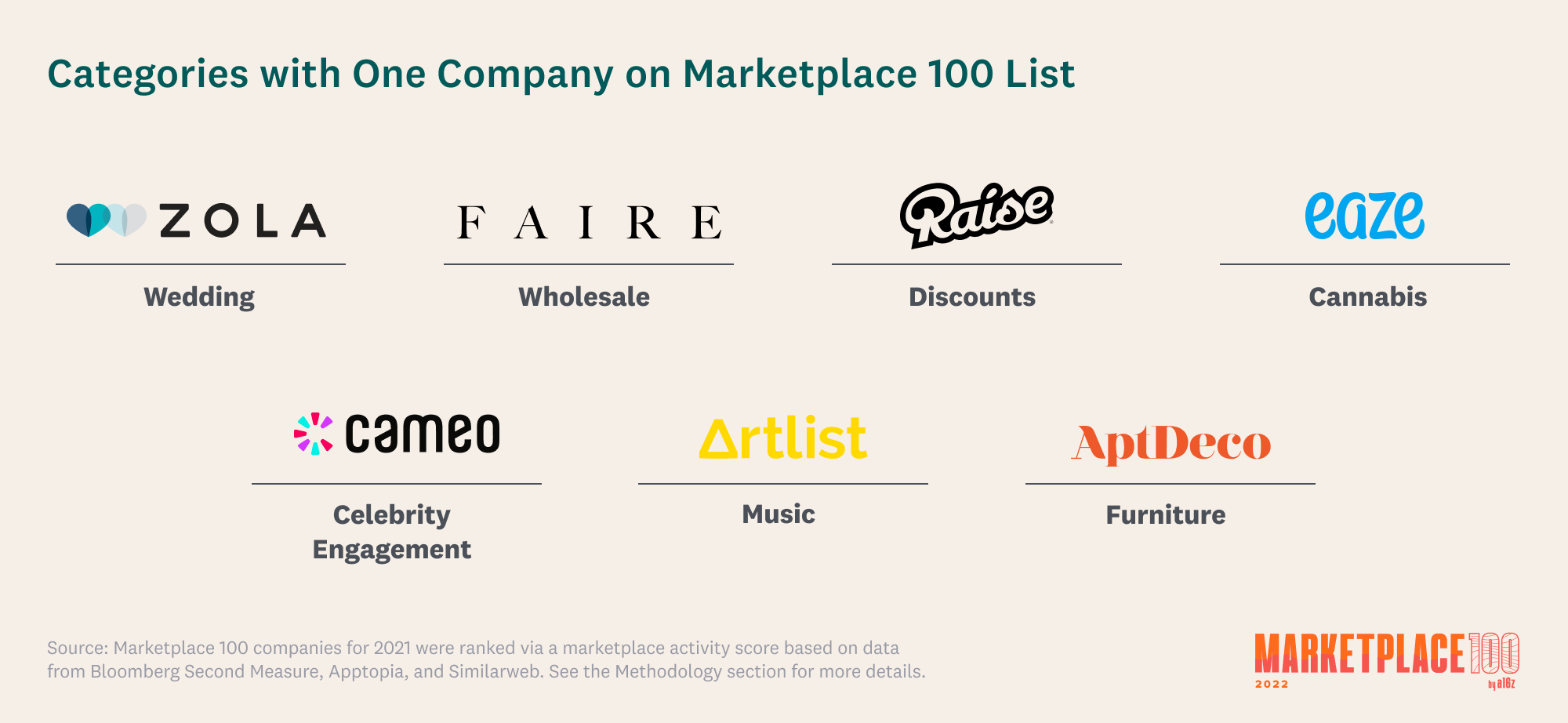

What are some other examples of possible “winner takes most” categories — and therefore, categories that have a chance of producing another Instacart? Below are categories that have only one company on the list (for now).

Some of these categories lack the multi-tenanting and high supply concentration that can create a “winner take most” outcome, while others may just need more time to develop competitors that can challenge the incumbents.

This year’s three categories to watch — Ticketing and Experiences; Shopping and Commerce; and Games — tend to look more like Travel than Groceries, especially with the total addressable market (TAM) tailwinds in a post-covid world (more on that below). These categories have a large and diversified TAM, and can likely support multiple marketplace giants.

The biggest list movers came from Shopping and Experiences

This year, even accounting for the change in methodology, there was one clear winner in terms of movement up the list. Whatnot, a marketplace for collectibles resale, saw the largest one-year gain in the rankings in Marketplace 100 history. It climbed from #99 last year to #26 this year — more than three times any other company on the list. Whatnot is for the second straight year the fastest-growing Marketplace 100 company.

This came as U.S. consumers began to embrace livestream video shopping, and Whatnot expanded beyond its initial category of Funko Pops into trading cards, sports cards, comics, and more. Whatnot’s growth is emblematic of the larger growth of livestream selling. In a year where many were eager to get out of their homes and back to in-person activities, Whatnot’s continued blistering growth is evidence that with or without quarantine, live shopping and niche collecting are here to stay.

The marketplace that saw the second highest rankings change was also in the Shopping category. Curated (#54) powers a next-gen commerce experience that matches consumers with experts to shop in specific categories, starting with sports.

The remaining three biggest movers are all in the Experience space, showcasing how consumers have adjusted leisure spend post-COVID. ResortPass (+20 spots) allows users to book day passes to hotel amenities, GameTime (+20 spots) enables booking of last-minute tickets to sports games and concerts, and Boatsetter (+17 spots) is a rental marketplace for boats.

Newcomers reveal opportunity in Ticketing and Food & Beverage

A third of this year’s new entrants fell into two categories: Ticketing and Food & Beverage. Within these categories, the highest ranking new entrants were #11 Peek, a marketplace for consumers and companies to book experiences, and #13 Goldbelly, a platform for gourmet food brands to offer nationwide delivery.

Several of the fastest growing companies of the year, measured by increase in marketplace activity, were in the Ticketing category. As vaccines rolled out across the country, consumers seized the opportunity to gather at sporting events, concerts, and festivals. Dice, Tixr, Fever, TodayTix, and TickPick appeared on the list for the first time, joining companies like ViaGoGo and SeatGeek, which both ranked in the top five.

Even with Instacart atop the list for the second year in a row, new Food & Beverage marketplaces started to gain traction. With (some) companies trying to lure employees back to the office with extra perks, catering marketplaces saw booms. ezCater moved up five spots to #25, and was joined by freshmen Fooda and LunchDrop.

On the other hand, consumers still working remotely continued to try new at-home food options: freshmen in this category included Goldbelly (#13), EatStreet (#22), and CookUnity (#49).

Another top category this year for freshmen companies? Education. Though some schools returned to in-person learning in 2021, the impact of so much time away from the classroom continued to reverberate for teachers, students, and parents.

Teacher stress and burnout have hit record highs, as educators struggle to help students get back to a pre-COVID trajectory, as well as deal with new behavioral issues. This has boosted the growth of sites like TeachersPayTeachers (which debuted at #8 this year), which allows teachers to buy lesson plans and other teaching materials from each other.

On the student side, Preply and Studypool also debuted as freshmen on this year’s list. Both marketplaces allow students to get extra help from tutors.

Vaccine rates were closely correlated with a resurgence of several big categories

2021 was a tale of two eras: pre- and post-vaccine. As vaccines rolled out nationwide, many categories saw dramatic reversals in activity from 2020. Categories that were crushed by covid surged back to normal, while others that saw boosts due to quarantine fell back to earth.

The best example of this came (again) from the Ticketing category. In 2020, total GMV for the Ticketing category fell by more than 50%, placing it in the bottom three categories by performance. In 2021, Ticketing saw a massive comeback, ranking as the #1 category in terms of change in marketplace activity for 2021. But it didn’t start out that way: Almost 40% of marketplace activity in Ticketing occurred in Q4 alone, as nationwide vaccination rates approached 70%.

Incumbents SeatGeek (#3), Viagogo (#6),and Gametime (#24) all used this resurgence to jump multiple spots on this year’s list. We also saw six newcomers in the Tickets space. A few highlights are Fever (#23), which focuses on curating the best local experiences in major cities, and Dice (#47), which specializes in providing tickets to virtual events, livestreams, and some IRL events.

Childcare followed suit, with almost 91% of marketplace activity taking place in Q4. As schools fluctuated between remote and in-person, Sawyer (#53) offered alternative learning opportunities for children in the form of online and in-person classes and experiences. UrbanSitter (#97) helped parents find sitters as in-person events became more common.

Gaming and Shopping benefitted from a “new normal,” even post-vaccines

There’s perhaps no better example of a lasting covid habit than gaming. Time spent in games saw a huge increase in 2020 — and somewhat surprisingly, continued to rise in 2021!

Only two gaming companies made the Marketplace 100, but they punched above their weight. Both made the top 20 and drove almost 10% of total marketplace activity, making Games the second largest category behind Groceries (the latter of which is largely driven by Instacart).

Valve, maker of Steam, maintained the #2 spot on this year’s list, while Epic Games’s marketplace debuted at #20. Both Valve and Epic’s marketplace allow consumers to purchase games and in-game items.

Looking at the pre-covid versus post-covid trend, specifically the jump between Q1 and Q2 2020, shows that we are now in a “new normal” for games. This was likely at least partially brought on by quarantine, where adoption of gaming and average time spent gaming both saw a rapid rise. Many consumers have now developed rich in-game personas and relationships that they won’t leave behind. The metaverse is here to stay, and we expect to see spending on Games continue to grow.

Similarly, Collectibles (within the Shopping category) has seen a massive boom during covid, that also appears to be lasting. A few factors are at play here. Quarantine drove record-high sales for tabletop games (and their digital counterparts), like Dungeons & Dragons and Magic: The Gathering. This boosted interest in cards for these games on marketplaces like TCGplayer (#12).

Beyond tabletop games, time spent at home pushed consumers to revisit their troves of broader collectibles. Many of them became sellers (or buyers) on video-first platforms like Whatnot (#26), which also served as a source of entertainment during lockdown! This created a new generation of collectibles traders, who seem unlikely to abandon their new passion even after quarantine.

Bonus: The Rise of NFT Marketplaces

While on-chain crypto transactions aren’t picked up by credit card panel data, NFTs were a huge and important part of the consumer marketplace story in 2021.

Below are top NFT marketplaces by all-time marketplace volume, per Dapp Radar data. NFT purchases have touched several categories of spend — specifically Games, Art, and Shopping. As NFTs (and crypto tokens more broadly) increasingly become “access passes” or provide credentialing for different communities and experiences, we expect to see them in Ticketing and Education in the coming years, as well.

The Future of the Marketplace Model

At a16z, we meet with dozens of early stage marketplaces every month, and while the marketplace model for startups is clearly alive and well, we’ve noticed some new trends in the evolution of the business model itself.

First, there’s a rise in startups focused on helping both consumer and business suppliers multi-tenant across various marketplaces in a category. This often involves listing and managing inventory across multiple sites at once.

Because these companies increase sellers’ ability to multi-tenant, they decrease “winner takes all” dynamics. A few examples of categories where this is beginning to emerge include Clothing (a seller can list on Depop, thredUP, and Poshmark in one click through sites like OneShop or Flyp), Rideshare (drivers can auto-switch between Uber and Lyft depending on fares and demand with apps like Mystro), and Food Delivery (restaurants can manage and optimize listings across DoorDash, Uber Eats, and Grubhub via platforms like Otter and Deliverect). It’s still early innings for these intermediaries, but the next generation of marketplaces will have to compete more to retain supply.

We’re also seeing more acquisitions of marketplaces by other marketplaces, which could impact a company’s ability to “lock down” a category. In both 2020 and 2021, most of the companies that “graduated” the Marketplace 100 were acquired — and many acquisitions were by other marketplaces!

This year, Bandcamp (#29 on last year’s list) was acquired by Epic Games, Tradesy (#41) was acquired by Vestiaire Collective, Depop (#46) was acquired by Etsy, and Breather (#100) was acquired by Industrious. This follows the 2021 acquisitions of Drizly and Postmates by Uber, and LetGo by OfferUp.

In some cases, such as Etsy’s acquisition of Depop, or Industrious’ of Breather, these acquisitions feel like a natural fit, as the businesses were adjacent or even competitive. In other cases, like Epic Games’s acquisition of Bandcamp, it looks as though one marketplace is acquiring another in order to enter a new vertical.

We’re also seeing many marketplaces evolve beyond purely offering a place to browse listings and transact. These “2.0 marketplaces” have baked in buyer or seller tools that make them a more attractive platform – sometimes even locking one (or both) sides of the marketplace into a subscription! One example of this on the list is ResortPass (#60), which focuses on letting day guests book amenities at resorts but also provides software to help resorts upsell more services to overnight guests. Another is Headway (#81), which allows therapists to start accepting insurance – and therefore reach an entirely new demographic of patients.

The additional value these kinds of marketplaces provide outweighs any value the buyer or seller would get from trying to arbitrage across platforms. Especially in the fast-growing categories with expanding TAM driven in part by new consumer trends, this kind of business of model innovation could have more impact than we can see in the data today.

While this year’s marketplace activity was unprecedented, we expect even more upheaval in 2022. A wave of exits for companies that defined digital marketplaces combined with new technologies and an evolving business model has created opportunity for the next group of marketplace giants to step in.

Methodology

A marketplace is any platform that connects buyers and sellers of goods/services with each other and facilitates a transaction. Marketplace activity is a blend of GMV, monthly active users (MAUs) in apps, and website traffic for each company on the list.

Data sources: The ranking for Marketplace 100 for 2022 is a blend of three data sources: Bloomberg Second Measure, Similarweb, and Apptopia.

Bloomberg Second Measure, a transaction data analytics company that delivers insights into company performance and consumer trends–across thousands of public and private companies. Note: Bloomberg Second Measure does not track some companies on the 2022 Marketplace 100 list.

- Bloomberg Second Measure data is made up of billions of U.S. consumers’ credit cards and debit cards. It excludes non-U.S. consumers, business spending, receipt-level information, and payments made via cash, check, or EBT.

- Bloomberg Second Measure cannot reliably attribute bundled revenue streams.

- Tips are not reliably differentiated from purchases on marketplaces and may be included in some merchants’ GMV.

- Bloomberg Second Measure does not observe revenue from third-party retailers or other B2B revenue streams.

- Bloomberg Second Measure does not observe spending made with gift cards.

- Bloomberg Second Measure cannot reliably attribute purchases financed through third-party companies like Prosper and Affirm to the marketplace associated with the purchase.

- Bloomberg Second Measure cannot reliably observe spending financed through credits from selling on a marketplace.

- Bloomberg Second Measure does not observe revenue from corporate benefits partnership programs.

- Transactions correspond to some companies’ Gross Merchandise Volume, a significant portion of which is not revenue to the company.

- Bloomberg Second Measure does not observe online payments through iTunes or the Apple Store.

- Bloomberg Second Measure cannot reliably observe marketplace fees.

- Bloomberg Second Measure does not observe marketplace revenue generated by third-party referrals.

- Bloomberg Second Measure is cited as a source, but did not contribute to the analysis.

Similarweb: As the most trusted platform for understanding online behavior, investors use Similarweb’s estimated data daily to analyze the digital performance of public and private companies in order to understand what is happening across the digital ecosystem. Similarweb provides data on one billion websites, 4.7 million apps, across 210 industries and 190 countries. Learn more here.

Timeline: The rankings were calculated over dates spanning January 2021 to December 2021. Year-over-year growth rates are counted as sales between January 2020 through December 2020 vs. January 2021 through December 2021.