This first appeared in the monthly a16z fintech newsletter. Subscribe to stay on top of the latest fintech news.

Deposit Beta: CAC in Disguise

Marc AndruskoIf you’re a fintech nerd like me, you’ve probably opened up more neobank accounts than you can count. As a result of this behavior, you’ve likely also received a recent uptick of emails from said neobanks that probably began: “Congratulations! Your new Neobank X Account Annual Percentage Yield (APY) is 3%!”

Upon seeing these emails, you might take a brief moment to celebrate your higher savings rate, and then promptly move on with your life. “I read something about the Fed raising rates,” you might think to yourself, “so I guess my bank is just doing that too.” This hypothetical thought would be 100% correct. But the degree to which any bank adjusts its deposit rates in response to changes in prevailing market rates — also known as “deposit beta” — actually says a lot about that bank’s customer acquisition strategy, and possibly even its funding and liquidity position. Let’s unpack this further.

Banks primarily make money through something called net interest margin, or the spread between the rate at which they borrow money (in the form of deposits) and lend it (in the form of mortgages, credit cards, auto loans, and so on). In rising rate environments, such as the one we’re in today, the market rate paid to consumers to deposit money typically goes up, since the Federal Funds Effective Rate, which governs the amount banks earn on deposits, is higher.

However, banks don’t always pass the entirety of these rate increases along to their customers, hence the concept of deposit beta. Mathematically, the equation for deposit beta is: Change in Product Rate / Change in Market Rate, where high betas are over 60% and low betas are under 20%. The neobanks inundating you with emails are in the high beta category. They’re deliberately choosing to make their high-yield savings account rates extremely competitive as a hook to entice new customers to bank with them.

In many ways, these costs are just paid customer acquisition costs (CAC) in disguise. While these banks may not be spending incremental dollars on digital ads or a piece of direct mail, they’re eating into their own net interest margin* in the form of paying out more interest to their customers. Why might they be doing this, especially as the behemoth traditional banks are conspicuously not doing the same? Because neobanks, unlike the largest banks in the country, don’t have a massive embedded base of customers that are unlikely to churn. Due to the high degree of inertia that exists in the banking market, neobanks need to fight to acquire and keep their customers, and deposit accounts are an excellent wedge into potentially cross-selling a more holistic suite of revenue-generating banking products, such as loans, financial advice, or insurance.

One more element to this equation that’s even more interesting to consider is the quality of the deposits a bank is able to raise. In an ideal world, banks want depositors that are loyal, long-term customers who only withdraw funds when they absolutely need them. Many of the loans that constitute the largest profit centers of banks (e.g., mortgages, auto loans, etc.) are outstanding for years, if not decades. To stay solvent, banks need funding sources that can accommodate these long durations. But the customers most banks are able to attract with very high deposit beta are actually, as it turns out, notoriously fickle. This is because most of these consumers are rate optimizers, and they are willing to open and close many bank accounts just to ensure they have the absolute highest deposit rate available to them at any given time. As you can imagine, this behavior does not make for a particularly attractive long-term loan funding source. In fact, this is exactly why banks offer accounts like CDs that carry fixed maturity dates — they allow them to match durations on both sides of their balance sheet with a higher degree of relative certainty.

When we talk about consumer fintech, we often discuss the importance of proprietary distribution. Without it, the category can quickly become a paid CAC race to the bottom, given the mind-blowing scale of the incumbent players in the market. While APY doesn’t show up in a bank’s CAC calculation, it does tell us plenty about how badly that bank wants to grow or needs funding. The neobank offering a 3% APY is eager to sign up as many new customers as possible, and it knows that an above-market rate is the easiest way to grab someone’s attention. But Chase, on the other hand, which already serves over 60 million U.S. households and holds almost $2.5 trillion in deposits, doesn’t necessarily feel this same pressure. It should come as no surprise to you, then, that the current savings rate they offer is a cool 0.01%. It all comes down to distribution.

*In reality, most neobanks are not actually charter-holding banks themselves, but rather work with a partner bank. So the neobank’s actual decision with respect to customer-facing rates is highly dependent upon their partner bank’s deposit rate and deposit beta.

A Welcome Blessing for Fintech Models: Interest Income

Jamie SullivanThis year’s rapid rise in global interest rates has been a blessing for fintech companies holding customer cash balances. With the U.S. effective federal funds rate now at 3.8%, banks and fintech companies alike have a newfound revenue stream that can have a significant impact on their business models. As recently as last year, banks had little to no interest in deposits; in fact, in Europe where central bank rates had been negative, UBS and Credit Suisse were charging wealth management customers up to 0.6% to hold their large balances.

As of Q3 2022, Robinhood has over $17 billion in interest-earning assets, and its net interest revenue comprised 35% of the company’s revenue in Q3 2022, up from 17% just a year ago. Coinbase holds roughly $3.5 billion in customer deposits and earned $102 million of interest income in Q3 2022, up from $8 million in Q3 2021. Wise has become a beneficiary of the rising-rate environment because its users have significantly larger account balances than at other remittance competitors; turns out, a couple of percentage points on roughly £7 billion of customer deposits is meaningful!

The question now for companies is what should they do with this newfound revenue? The three high-level options for a company are: 1) let the proceeds flow through to the bottom line, 2) share back the proceeds with customers via higher interest rates, or 3) reinvest in product development, pricing, or marketing to deepen customer relations. So far, what companies have chosen to do has varied by stage and business model.

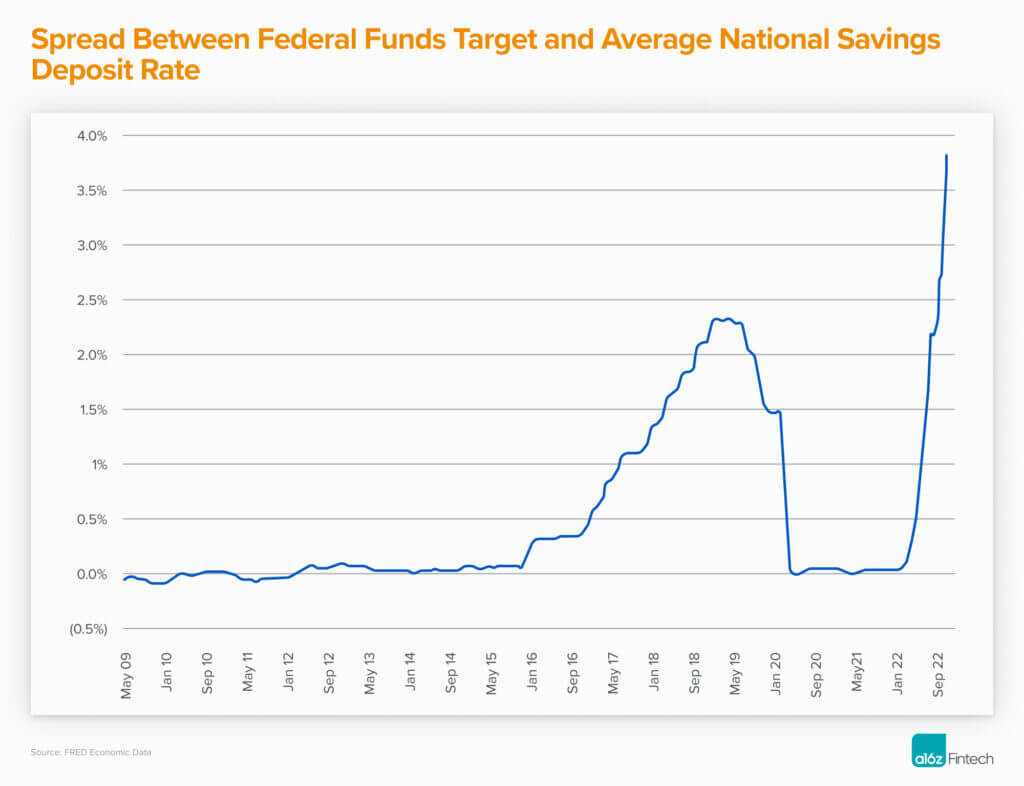

To date, big banks have decided to keep the benefit to themselves. Banks can lend their excess deposits to other depository institutions at 4% while keeping savings rates at just 0.18% APY, driving the largest deposit yield spread in the last two decades. Banks have incredibly sticky customer relationships and thus do not fear losing customers over a few percentage points back in a savings account. Paraphrasing the famous “your margin is my opportunity,” large banks’ unwillingness to share interest with their customers may enable fintech companies and other disruptors to continue to take share.

Fintech companies, which have gained popularity by giving traditional incumbent profit pools back to consumeers, have unsurprisingly taken a different approach than the big banks. Wise plans to pass some of the cash back to customers through lower prices, while also investing back in the platform to fuel growth. We expect many fintech companies to take a similar approach. Robinhood, in lockstep with the recent Fed interest rate hike, increased the cash back on its Gold product to 3.75%, in part to avoid cash shorting, but also to drive adoption of its subscription offering. Similarly, Upgrade launched its high-yield account, Premier Savings, with a 3.5% APY and signaled they would continue to follow the Fed such that next year, the APY could be 4.5%. M1 is launching at a 4.5% APY for its Plus members in early 2023. Previously, some fintech companies offered high-yield savings accounts, but as loss-leading customer acquisition tools. However, high rates can now be offered at profitable or breakeven levels.

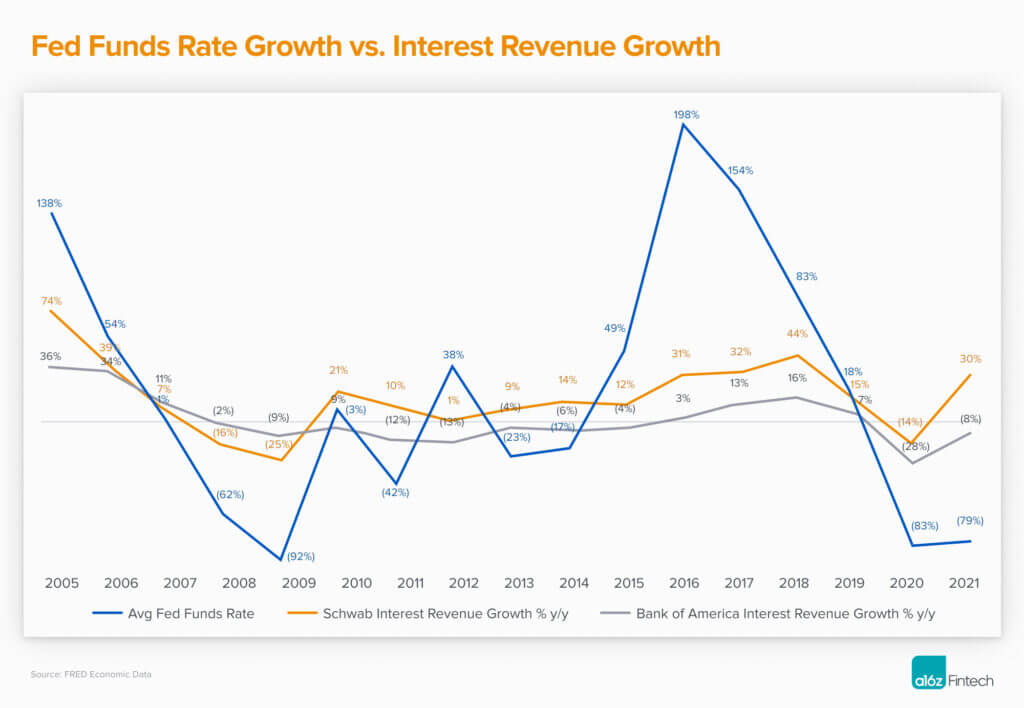

Over the last several years, fintech companies have largely monetized via transaction-based revenue streams such as interchange, payment-from-order-flow, or fees. But as macro headwinds pressure payment volume, float is becoming more relevant, and its high margin is currently helping to offset weakness seen elsewhere in the business. As the below chart shows, interest revenue is inherently lower quality as it ebbs and flows with interest rates. It is highly advantageous at the moment, but its current counter-cyclicality is anomalous compared to past recessions. Businesses need to plan for rates to inevitably turn back in the other direction, and if the macro environment remains weak, the transaction-based revenue streams may have not yet recovered. However, as we are seeing fintech companies do, the less-valued, cyclical interest revenue can be reinvested in the product or shared back with customers to drive acquisition and retention, hopefully leading to greater recurring, predictable, and higher-valued streams in the future.

Learn More

Escaping Hell’s Flywheel: Building Non-inflationary Distribution Channels

If you were interested in quickly launching a startup, here’s an easy formula for finding product market fit. First, identify an existing product in an industry with a low NPS (like most financial services) that has not traditionally been sold online. Second, create a new digital on-ramp to that existing product, such as digitizing an insurance or lending application. Third, start to buy digital ads to drive customers to said product. Assuming the digital ad market is not yet efficient, there is an opportunity here to quickly scale.

If you were to do this, you certainly wouldn’t be alone. This initial model can be a dangerously attractive way to start a company and has been tried by many financial services startups in lending, insurance, and banking over the years. It’s easy to see why — you can fully control your growth by throttling your spend, and early lifetime value to customer acquisition cost (LTV:CAC) ratios and paybacks are likely to be strong as you take advantage of a market inefficiency. But as competitors, incumbents, or both inevitably enter the market, the businesses that take this approach are forced to either find new distribution channels or expand their margins by cross-selling, upselling, or in some cases, vertically integrating.

In insurtech, a field I’ve been looking at since 2016, companies have focused mostly on the first part of this model during the most recent bull cycle of the last seven years or so. For example, a new business would spin up a digital insurance agency, buy ads to funnel leads to its product suite, and then start to scale. As few companies had built digitally native consumer funnels, these early entrants experienced significant growth, so long as they kept the cost of acquiring a customer lower than the business’s gross margin.

In fact, everyone I met with eight years ago believed that this digital agency was the initial wedge into the market, but nearly every pitch I saw focused on increasing revenue and product control by vertically integrating and forming a managing general agent (MGA). The theory was that as contribution margins started to contract in the commoditized digital agency model, the MGA structure would hypothetically lead to defensibility in the form of higher commission rates (leading to more revenue) and increased product control (leading to higher conversion).

The hypothesis proved to be untrue. To learn more, read a16z Fintech Partner Joe Schmidt’s piece on Escaping Hell’s Flywheel.