With every new technology cycle comes a new set of business software companies. AI will be no different.

In past cycles, much of enterprise software consisted of digitizing an offline process: turning paper records into databases with a front-end interface. In the first era of software, companies like PeopleSoft digitized HR records and made them available on-prem. In the cloud era, Workday made those digital HR records available anywhere, displacing PeopleSoft. Now, AI can do the work of humans who once used the software: software is becoming labor.

However, unlike previous cycles, AI is also a top priority for every incumbent software company. So, how does the startup win?

The Greenfield Strategy

As we’ve written before, the battle between every startup and incumbent comes down to whether the startup gets distribution before the incumbent gets innovation. One of the most powerful, and underrated, ways for startups to win distribution is to serve companies at their formation – greenfield companies.

Why does this work?

Simply put, acquiring customers de novo is easier than getting customers to switch:

- Many of the large software incumbents have hostages, not customers. Their customers would love to switch, but ripping and replacing existing software is risky and expensive. New companies don’t face those switching costs; they simply look for the best solution and evaluate based on merit.

- New companies don’t need as many features to have a complete solution. It would take months, if not years, to build a full Salesforce replacement, with all the edge cases that Salesforce has built. But newer companies don’t have all these needs. This means you can serve a narrow use case much better than an existing player.

- New companies have fewer stakeholders. If you serve a startup at formation, there is no compliance team to navigate, no CFO to get buy-in from, no security teams presenting hurdles to jump through. You only have to convince the founders.

Grow with your customers:

If you attract all of the new companies at formation and grow with them, you will become a big company as your customers become big companies. Consider Stripe: many of Stripe’s customers did not yet exist when Stripe was founded. Some of those early customers later became large businesses in their own right. So when enterprises outside of Silicon Valley also needed to prepare themselves for a shift to ecommerce models, Stripe was an obvious choice, with plenty of relevant reference customers already in place.’

Incumbents, on the other hand, would much rather sell to existing businesses rather than companies that don’t exist now but might exist in huge numbers in a few years. They are bound by the rules of P&L (Profit & Loss) – and there’s no “P” for greenfield companies that don’t exist yet, just “L” (in sales, marketing, and product development costs). The startup, however, isn’t bound to a financial model – the startup doesn’t need one; it’s still figuring stuff out! That leaves ample room for the startup to define the category.

Graduation moments:

In a similar way, software “graduation moments” – the moments when a startup begins to develop enterprise needs – also create opportunities to execute this greenfield strategy. New companies will need to migrate to more complex software systems as they scale. QuickBooks may be great for single-product, single-entity companies, but once businesses add multiple subsidiaries, currencies, or more complex reporting needs, they outgrow it and require the controls, integrations, and scalability of an ERP like NetSuite. Since they, like a new startup, are unburdened by switching costs, this is an ideal moment for them to adopt a cutting-edge new solution.

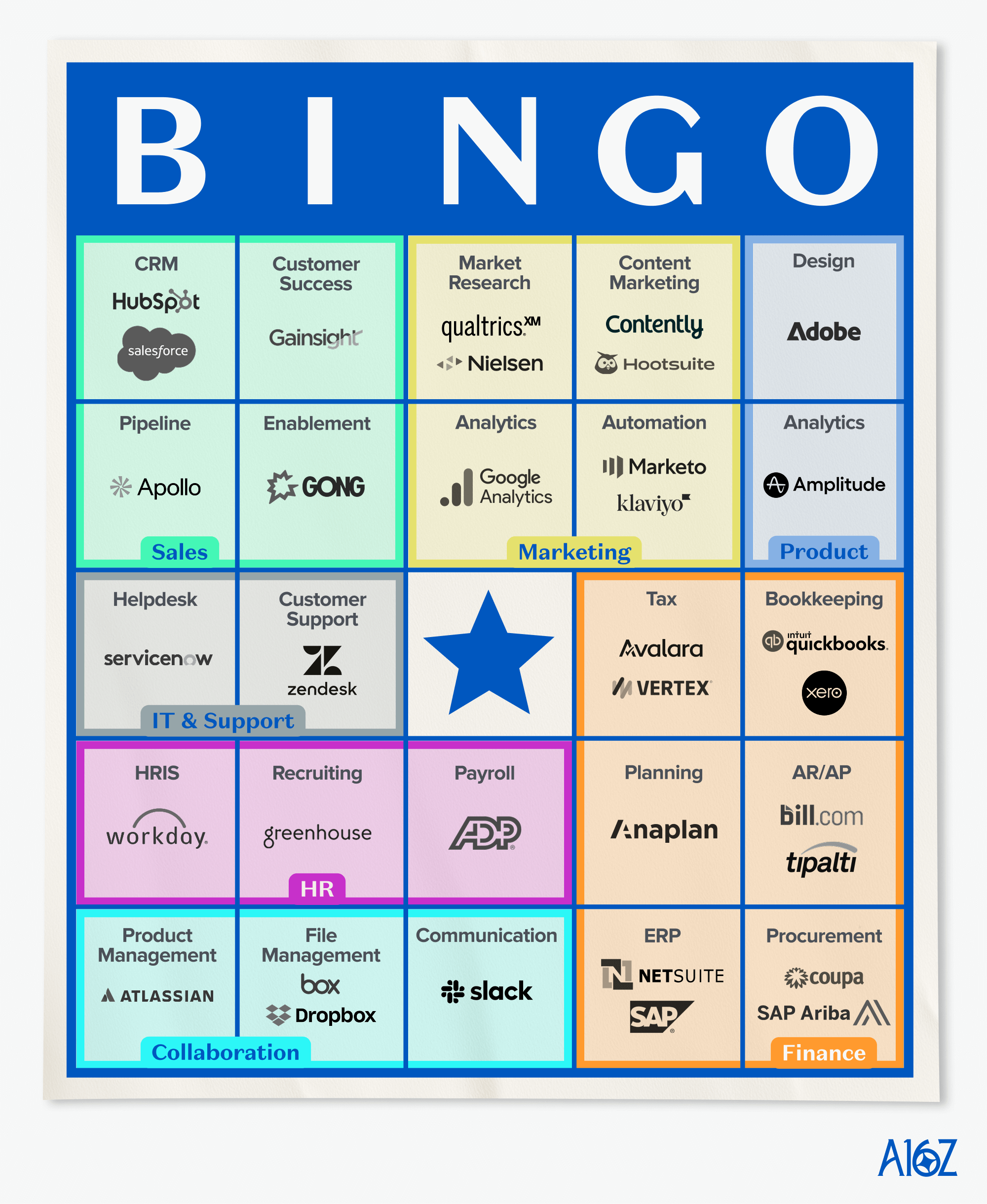

AI-native startup Bingo

There are many different categories of enterprise software. Enough to fill a 5×5 Bingo board and more! In every category, we believe each incumbent on the board could be unseated by an AI-native alternative.

So – how does a new company win the game of Bingo?

Make a narrow wedge much better: Take an AI-native approach to the smallest possible feature set that will drive customer love with new greenfield companies.

Rapidly iterate and add features to grow with your customers: Winning on a narrow wedge is a start, but expanding into adjacent workflows is what builds durability and prevents customers from churning to a broader platform.

Don’t be constrained by the division of existing categories: The by-product of AI is that spaces will move together, and these companies may be even bigger. Take HR and recruiting: historically, these have been separate systems. But with AI, they are converging into one continuous system: finding candidates, qualifying them, scheduling interviews, onboarding them, paying them, and making sure everything works with compliance.

Find a constant source of new customers: While startups are easier to sell to than enterprises, you still need to reach them. Mercury is a clear example: today, they are trusted by over 200,000 startups and over 50 percent of every YC cohort, after years of being ever-present in communities of early-stage founders. At first, these accounts likely represented insignificant deposit volume and fee revenue; now they are orders of magnitude bigger.

If you’re building a category-defining company on the Bingo board – come and talk to us.