This post originally appeared as my rebuttal to my friend Steve Blank’s opening statement in our debate in The Economist.

In reading my friend Steve Blank’s arguments, I found the bubble definition quite compelling:

“A tech bubble is the rapid inflation in the valuation of public and private technology companies that exceeds their fundamental value by a large margin.”

So I looked to find evidence to support the bubble hypothesis. I found the opposite.

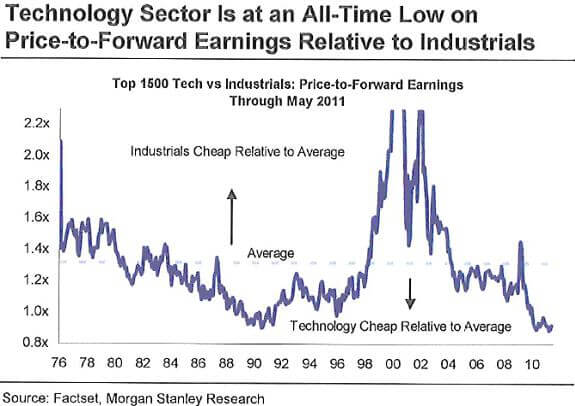

Consider the following chart. As you can see, the Technology Sector is trading at an all-time low, relative to Industrials. I further note that Industrials are cheap, relative to their average.

If Mr Blank is correct, I believe that this will be the first bubble in history where the public price of the bubble item in question is trading at an all time low.

Mr Blank later makes arguments about private companies, such as Facebook and Color, being overvalued. Since no public data exists on either company, it is difficult to determine anything about their valuations, but I will do my best. With respect to Facebook, Eric Schmidt, Executive Chairman of Google, recently stated that the four most important technology companies in the world are Amazon, Google, Apple and Facebook. At the $50 billion valuation that Mr Blank cites, Facebook would be, by far, the least valuable of the four. That is not to say that $50 billion is the correct valuation for Facebook, but it is not at all obvious that $50 billion for Facebook guarantees a bubble, because Facebook is clearly an exceptional company. As for Color, if we were in a bubble every time a venture capitalist overpaid for a new company, we would always be in a bubble.

Next, Mr Blank states, “The LinkedIn IPO valued the company at $8.9 billion at the end of the first day of trading. It sent a signal that there is an irrational demand for tech IPOs.”

Here, he smartly narrows his bubble argument from technology companies to technology company IPOs, because, as I have shown above, there is no technology bubble. As for LinkedIn, as of this writing, its market capitalisation is $6.5 billion, which is interesting because I thought that during the “mania phase” of a bubble, prices were supposed to go up. Perhaps LinkedIn’s high IPO price was due to its very small float, rather than a bubble. Perhaps that heart attack you just had was merely heartburn.

Maybe the strongest argument that we are not in a bubble is the fact that Mr Blank, who is arguing the side that “we are in a new tech bubble”, stops short of declaring a bubble. Quite specifically he states: “We have just entered the mania phase.” So Mr Blank does not argue that we are in a bubble; rather he argues that we will be in a bubble soon, although he does not say when.

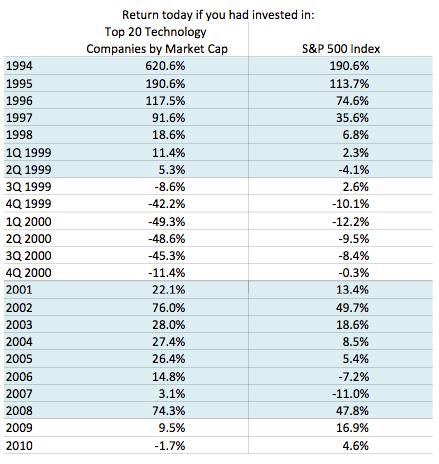

What is wrong with predicting a bubble with no definitive time frame? Nothing, if nobody listens to you. As the chart below shows, if you had invested in technology stocks in any year from 1990 through Q3 1999, you would have outperformed the S&P 500. The only investors who lost money in the last technology bubble invested during the actual bubble, not its imaginary predecessor. In fact, the very best time to invest was leading into the bubble—or during the boom. By Mr Blank’s bubble indicators—some private valuations going up, some sunny reporting, more traffic in Silicon Valley and some venture capitalists doing stupid stuff—the “mania phase” of the last bubble surely started in August of 1995, at the point of the Netscape IPO. Getting on board with the bubble theory then proved to be a bad idea. It is also a bad idea now.