Owning a home has long been a pillar of the American dream, but very few people fully understand the mortgage that powers it. How does a mortgage originated by a broker in California end up on the books of the Singapore sovereign wealth fund, with the homeowner sending her monthly checks to Ohio? And why does it still take 45 days to close? The entire process is complex, opaque, and downright anachronistic. Yet we continue to complacently accept this reality, despite living in an on-demand age where we expect more speed, transparency, and ease of use.

Part of the challenge is that the current mortgage process is very fragmented; different players collect disparate, often offline data; and multiple third parties — all profiting from different elements of the process — are required by regulation. This complexity, however, is where the opportunity for startups (and even incumbents) lies. What new strategies could help create a much better mortgage process, while still balancing necessary risk controls? How and where does technology come in? To explore the answers to those questions, we need to first understand how we got to this very complicated place.

A brief history of the mortgage

The term “mortgage” literally means “death pledge” in Latin, but the idea of collateral (in this case, property) against a loan is ancient, as old as lending itself. Early mortgages looked very different from today’s, requiring a 50% down payment, interest-only payments over 5-10 years, and the borrower paying the 50% outstanding principal or “balloon payment” at the very end. With so much up front capital, home ownership was out of reach for most.

Fast forward years later to the Great Depression, which depressed housing prices; most borrowers couldn’t afford the large down payments, so lending ground to a halt. By 1935, 10% of homes were in foreclosure and banks wouldn’t refinance these loans. So as part of the New Deal, President Roosevelt created three new organizations to help address the crisis in the housing market:

- The Home Owner’s Loan Corporation (HOLC), which bought up more than a million defaulted mortgages from the banks — and made them the longer term, fixed-rate mortgages we’re more familiar with today;

- The Federal Housing Administration (FHA), which created an appraisal system to insure mortgages that met certain guidelines — and thus reduced lenders’ risk, reviving lending through downside protection; and finally,

- Fannie Mae (Federal National Mortgage Association), which was established as a secondary market for FHA-insured loans from originators that were then sold as securities to the financial markets — this freed up capital for banks and other lenders to originate more mortgages and increase liquidity in the system.

It worked. Today, mortgages are one of largest asset classes in the U.S., totaling more than $10 trillion.

But with this growth and ensuing layers of regulation — for example, requiring separate insurance for the home, the title, and sometimes the mortgage itself — made the entire mortgage process more complex and drawn out: more steps, more players, and new types of mortgages to address different borrower and lender needs.

The mortgage process and players

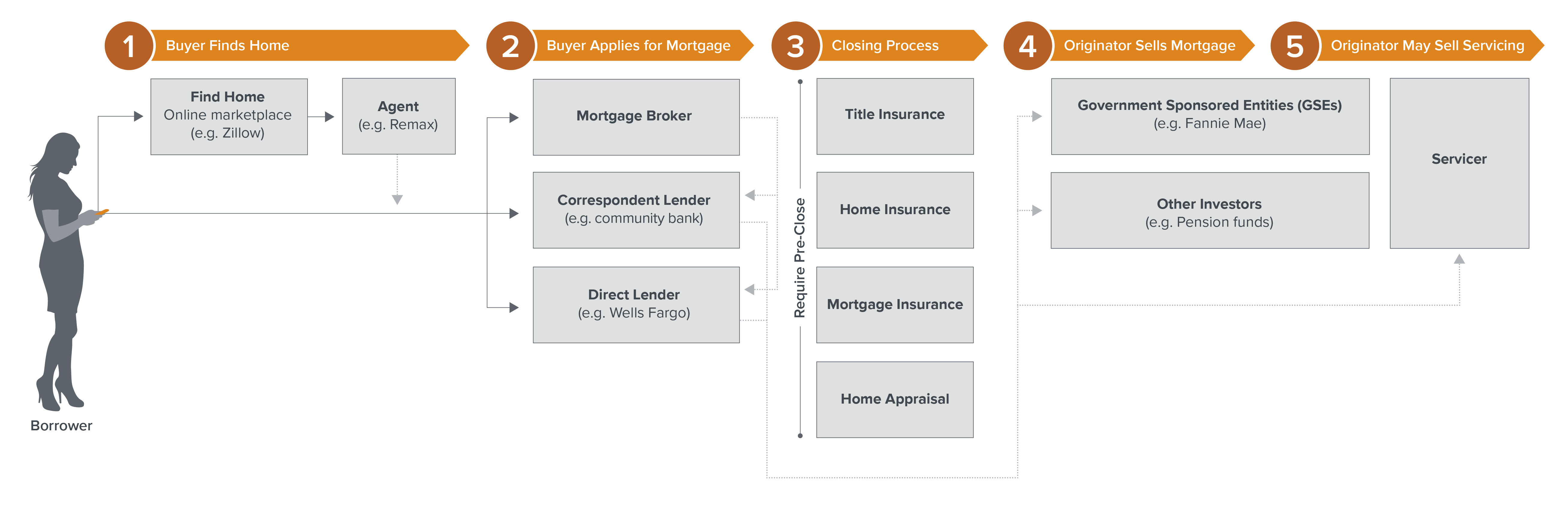

Today’s mortgage process looks roughly like this:

Let’s follow one homebuyer’s journey to get a better sense of this overwhelming mortgage flowchart…

Step 1. Mary finds a home.

After months of searching for a house that fits her criteria and price range, probably via an online marketplace (like Zillow), Mary finds her dream home. She either has a realtor already, or the site connects her with one who will help her complete the purchase. (Note, we aren’t even going to go into the complexities of the real estate process itself here!)

Step 2. Mary applies for a mortgage.

Most mortgages are actually what are called Qualified Mortgages, meaning they fit several criteria (current income, debt to value ratio) — that make it more likely that the borrower will be able to afford the loan. Qualified mortgages are capped at certain sizes (~$453K in most areas but up to $679,650 for high-cost areas like San Francisco), and limit the fees that can be charged to borrowers. Non-qualified mortgages — for borrowers who are self employed, or have lumpier income for example — often carry higher fees and are not offered by all lenders.

Mary has three primary channels through which she can secure her loan: a broker, a correspondent lender, or a direct lender. In this case, Mary’s agent referred her to a local broker with whom the agent has a strong relationship.

And we already need another glossary.

Broker: Using mortgage brokers — often individuals with strong relationships with mortgage originators — used to be the norm, but today account for only 10%. Citing better loan performance and control over customer service, many large banks like Bank of America, Chase, Citibank, and Wells Fargo no longer employ brokers and have moved to direct channels. However, brokers still have relationships with many lenders (most often wholesale lenders who do not have their own customer-facing channels), which allows for broader price comparisons, sourcing non-qualified mortgage loans, and relief from some of the paperwork burden. Brokers usually get paid 1-2.5% of the loan amount by the lender who originates the loan.

Correspondent Lender: A correspondent lender, often a community bank or credit union, will originate (either directly or indirectly via a broker) and fund home loans in their own name. They often offer a wider variety of loans than the larger banks and are better at handling exceptions such as non-qualified mortgage loans since it’s not cost-effective for large banks to deal with individual exceptions, as their business model depends on high-volume throughput. Since these correspondent lenders do not have enough capital to hold loans on their balance sheets, they often sell them immediately, usually to direct lenders.

Direct Lender: These are institutions, typically banks, whose employees review mortgage applications and directly underwrite and approve a mortgage in the bank’s name. The top ten banks used to dominate direct lending, but last year, only ~20% of mortgage originations were generated there. Non-bank lenders (such as Quicken Loans) are able to be more flexible with loan approval, and without large balance sheets, they sell mortgages more quickly in order to free up capital. Banks, on the other hand, are depository institutions so have the capital and therefore the option of keeping the mortgage on their books.

Step 3. Mary begins the mortgage closing process.

With a history of predictable and reliable income, Mary can get a qualified mortgage through a top bank. That bank has conditionally approved her loan after reviewing all her documentation, so Mary thinks she’s almost done… but she’s really just at the start of a process that takes an average of 45 days from start to finish!

Why so long? In addition to providing many pages of documentation to the lender, Mary is required to get title insurance; mortgage insurance (because her down payment is less than 20%); home insurance; an appraisal of her home… the checklist goes on and on. Each of these is a separate, often manual process, with different companies and multiple actors (like a live notary) and different paperwork (including the exchange of numerous printed and faxed documents). The scheduling overhead alone can add days. The bank needs to continually verify the accuracy of the mortgage application, which can reach 500 pages because it includes borrower disclosures (tax returns, credit reports etc.); home appraisal, title, and escrow documents; insurance docs; and more. In many cases errors are found and take time to correct.

Step 4. Mary moves in, but her mortgage moves on…

After a long wait and some back and forth, Mary’s mortgage finally closes, so she is finally able to move in, unpack, and make her first monthly mortgage payment (a word on where she sends her checks later). But her mortgage is far from done with its journey — and this is the part that’s most opaque to home buyers — because it may change hands several more times before landing with its final owner. Why? As mentioned earlier, most lenders don’t have enough capital to hold loans on their balance sheets long term, so need to sell the loans in the secondary market to free up capital to make more loans.

Here are the main players in the secondary market:

Government-sponsored entities: These organizations — i.e., Fannie Mae and Freddie Mac — were created by Congress to keep liquidity in the market, allowing lenders to issue more loans. But these entities do not lend directly to consumers: They purchase loans (only qualified mortgages, which make up 90% of all loans); guarantee them (for which they charge a fee to investors as insurance against loss in the case of borrower defaults); and package them into mortgage-backed securities. Some of these securities are then sold again to another investor, such as a pension fund or a sovereign-wealth fund.

Investors: Investors in mortgages include large banks, insurance institutions, sovereign wealth funds, and pension funds. While these investors do not have constraints on the types of loans they can buy, mortgage-backed securities made of qualified mortgages are more attractive to them since they come with a government guarantee of principal and interest payment. Non-qualified mortgage loans generally carry higher payments, yet lenders must sell them directly to the private market (since government-sponsored entities won’t buy them).

But wait, with all this buying and selling going on… how do lenders make money? First, lenders recover costs through fees charged to the borrower (often an upfront origination fee as well as closing costs; together, these can run between 2-5%). Then, they make the yield spread premium (the difference between the lender’s cost of capital and the interest rate the lender can charge the borrower). So a bank with deposits has a lower cost of capital (and hence higher spread), whereas a non-bank lender without deposits would have a higher cost of capital as they would need to pay interest on a warehouse line of credit.

Even if lenders have enough capital to hold mortgages on their balance sheets long term, most choose to sell the mortgages — either individually or in bundles as mortgage-backed securities — to investors in the secondary market for a profit. Which brings us back to Mary: Her mortgage was sold by her bank to Fannie Mae, and ultimately purchased by the Singapore sovereign wealth fund GIC.

Step 5. Mary’s loan originator sells off her loan servicing.

But now something else happens: Mary’s loan originator, a top-ten bank, doesn’t just sell her mortgage, it also sells off the loan servicing. The party that collects and processes checks is called the mortgage servicer. These servicers make money by charging a servicing fee in exchange for managing communications with the borrower and collecting monthly payments.

Furthermore, the servicer can change several times throughout the entire term of the loan. The homeowner will simply get a letter informing them to start sending her monthly payments to a new servicer. In this case, Mary is sending her mortgage payment checks to an entirely different company than the one she originally got her mortgage from.

…To recap so far: Mary’s agent referred her to a broker, who found a direct lender that would approve her for her mortgage. Mary’s bank bundled Mary’s mortgage with many other mortgages into a bond, which was sold to Fannie Mae, and then sold on the private market to the GIC (Singapore Sovereign Wealth fund). Her bank then also decided to sell the servicing rights to a servicer located in Ohio. So after 45 days Mary has a mortgage and is in her new home in Denver, while her mortgage is in Singapore, and her checks are mailed to Ohio.

It has to be better than this: Opportunities in the space

Given the historical evolution and current fragmentation of the mortgage industry and process, the obvious question is: How can it be made better and easier today? More specifically, where can new technologies and new companies come in? And why haven’t the existing players already in the market improved the process themselves?

Simply put, they don’t have to. Why bother improving the customer experience when you have so little competition? Also, banks face another set of challenges: legacy systems. For incumbents, replacing their intricate and interconnected systems is very onerous not to mention risky.

As for startups, it’s been hard for entrepreneurs to build a new mortgage company for several reasons. There’s a huge distribution challenge: Finding home buyers who need a mortgage is costly. For example, mortgage keywords on Google are the third most expensive, so it’s difficult for startups company to acquire customers cost effectively. And then it’s even more cost prohibitive due to the capital requirements (the pool of capital used to actually grant mortgages). There’s also a catch-22 here: In order for a new company to prove out the validity of its new business model and therefore attract investors, it needs a large amount of money to make loans with. However, capital providers are unlikely to provide said capital to an unknown startup until a significant number of loans have already been made and repaid. Finally, mortgages involve an incredibly complex regulatory system that varies by county and state; often involves multiple third parties; and requires a deep and intimate understanding of the current system. These same regulatory requirements — e.g, in-person home appraisals — also make it practically impossible for some of the processes to be fully digitized. Startups in this space often can’t fully bypass offline through online alone.

But now, there’s a new era of companies, spurred by increasing demand for better user experience — users are starting to expect the same efficiencies they have in so many other areas of their lives. Increasingly, people are starting to choose fintech companies over incumbent banks in other areas of financial services, and are now more open to procuring a mortgage from an unknown company. As a result, existing lenders are forced to prioritize improving the mortgage experience — sometimes through partnerships with new companies. Even the regulatory context is improving as agencies show more openness to making the process easier for consumers; for example, Fannie Mae is piloting a program that would allow homeowners to count their AirBnb rental income in mortgage refinance applications.

Furthermore, as entrepreneurs increasingly straddle not just tech-native know-how but other industry know-how as well, there’s new breeds of entrepreneurs and hybrid teams emerging that combine deep technical and financial expertise. Finally, there’s a number of obvious tech shifts happening here: As new sources of data and AI techniques come online, the mortgage data collection, underwriting, and appraisal process can be sped up dramatically through software. Entrepreneurs are already rebuilding parts of the mortgage stack to make processes far more efficient than they were with legacy software.

The question is now less of just technology capabilities, but more of what strategies startups could use today to be successful in building a company in this space.

The strategic wedge

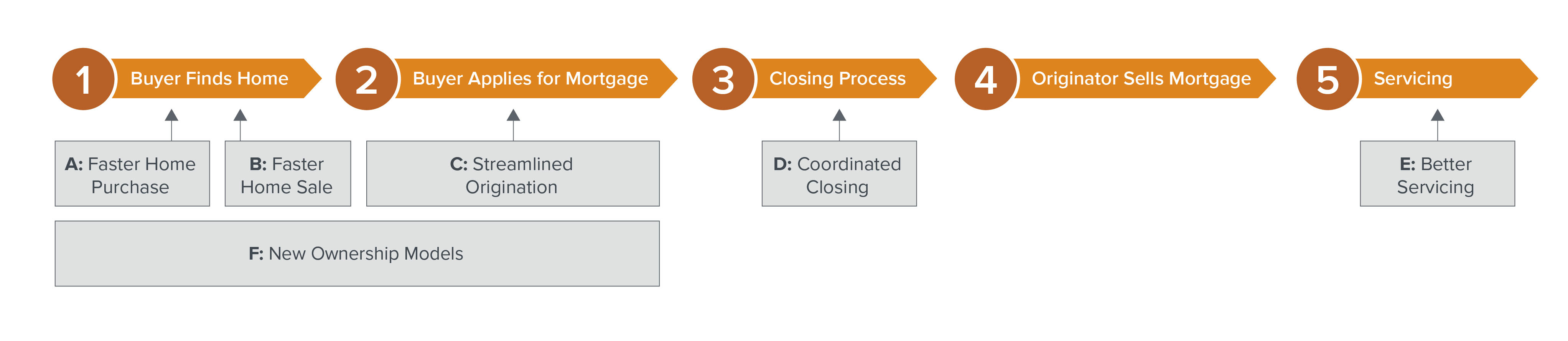

Instead of trying to redo the entire, multi-stakeholder process in one shot — which would be extremely costly and difficult to pull off — new mortgage companies are choosing a clever wedge from which to remake, simplify, or streamline part of the mortgage process. It’s the strategic point (and sometimes even the Trojan horse) where they insert themselves into the process, with ambitions to expand from that initial beachhead. And sometimes it doesn’t even start directly with the mortgage.

Below, we describe some of the strategies, and opportunities across the mortgage process.

A. Hide the complexity, then fix it — for seemingly faster home purchase

The fastest way to initially improve the mortgage user experience is to not actually try to improve it, but to shield the mortgage applicant from the backend complexity. What if an agent managed your full home buying process and your mortgage process? A startup here could choose to guarantee a mortgage to a home buyer, making it look “instantaneous”, as if the home buyers had made an all-cash offer (so practically no mortgage process). The company would then go secure the actual mortgage on the market which, without other process improvements, could still take up to 45 days. While the company does assume the risk that it may not be able to secure the mortgage at the rate given to the borrower, it could command a premium for the convenience offered to the user. (And spread over many mortgages, the premium charged would offset the risk of doing so in the first place.)

B. Make home sale timing faster and more predictable

Uncertainty around the timing and price of the home sale are some of the worst problems for buyers and sellers, especially when a seller wants to sell one property in order to buy another. Does she sell before obtaining a mortgage for a new home, and risk not having a new place to live… or does she wait to sell until after obtaining a new home, but then risk holding two mortgages at once?

Some startups (like OpenDoor) provide sellers with a “buy it now” price and a timing guarantee as a way to provide much-needed predictability in the process. But to deliver this predictability, these startups need to develop smart models — often with the help of machine learning techniques — to be able to forecast home sale prices and timing. The companies also need to have teams with the kind of entrepreneurial backgrounds that inspire enough capital market confidence such that they can raise an outsized balance sheet. But as these startups gain scale and sell thousands of houses, they can then use the data from those sales to better predict what types of houses will sell at what price and when, and hence offer faster liquidity and better prices, in turn attracting more buyers… a virtuous cycle. As the scale of sellers and buyers grows on their platforms, these startups will be well-positioned to offer more services — like mortgages! — and it will be harder for new entrants to compete with the data network effects.

C. Streamline origination, the most frustrating part

Since applying for a mortgage is the most visible source of user frustration, many startups choose that painful frontend — the application process — as the initial wedge.

One way to do this is to partner with existing originators to provide a better user interface for the mortgage application process, but with the necessary “hooks” into the banks’ legacy systems. If done right, the originator wins by providing a better user experience to its customers, and the startup benefits by leveraging the existing originator’s distribution channel (though startups should be careful with B2B2C). Some early companies are already employing a similar strategy, but for brokers. Once thousands of new mortgages flow through the platform at scale, potentially sourced from many different lenders, the startup will have gained a rich source of data and could start taking over more of the mortgage process to further shorten the full closing process.

Another way to do this on the frontend is to build a Kayak-like marketplace. There may be room for a new comparison site here (LendingTree, which was founded in 1996, is the giant in this space) that helps consumers not only better understand their options, but goes further to help homebuyers through the mortgage process. At scale, one could imagine a “new Kayak” (riffing on the travel-comparison site) but that offers its own branded product to compete side by side.

Conversely, some startups focus first on the backend of the origination process where there are large efficiency gains to be made. A mortgage can take up to 100 hours and cost almost $9K to produce. A startup could build new software from scratch which provides full flexibility but is more costly, or try to build upon and improve existing software which may limit flexibility. Some new players purchase an existing company with a steady flow of customers already in place. The existing flow of customers enables the NewCos to first focus on creating new software and processes to bring efficiency and drive down costs in mortgage production. From this improved cost position, the new company can then move to scaling its customer acquisition. Existing nimbler, smaller originators are also making strides to significantly reduce processing costs by developing new software.

Finally, some startups tackle both the frontend and backend at once by becoming a direct lender. These are the startups that don’t partner with incumbents or buy an existing company, so will need to develop the full stack of mortgage capabilities (as well as gain regulatory approvals).

The advantage of a full-stack strategy is that the startup will own the entire experience, end-to-end, of the mortgage process, which can be very appealing for customers. It’s not dissimilar to what Lyft and Uber did, where instead of trying to fix the taxi industry or sell software there bypassed it altogether. However, remaking the entire process here is far more complex, with far more players, and even more capital intensive. Startups pursuing this strategy often choose strategies to mitigate some of the initial risk, such as rolling out one state at a time or leveraging partner software for some pieces of the process at least. Also, rather than competing head on with the incumbents for qualified mortgages, these companies may target potential homebuyers who would have trouble getting a mortgage in the current framework but who may still be good credit risks (for example, gig economy workers who are responsible but do not fit the standard W-2 requirements for a qualified mortgage).

D. Coordinate the closing

The coordination of the many parties involved in a mortgage adds time and cost to the process — finding and scheduling (and even rescheduling!) a notary alone could take a few days of back and forth. A similar challenge exists with appraisers. Further adding to the logistical complexity here, lenders and insurance companies need coverage in many different geographies. If a new company wedges in by facilitating these time-consuming, offline processes for lenders and insurance companies, it could be in a good position to take over even more of the mortgage closing pie especially as these processes move from offline to online.

E. Offer better servicing

Mortgage servicing is the longest-lasting aspect of the mortgage process in terms of user interaction, as these companies collect checks over the life of the loan. Yet many servicers are still operating off legacy systems that are ill-equipped to deal with any new changes in regulation; they also don’t have good processes for cost efficiently dealing with delinquent borrowers. Meanwhile, for borrowers, it’s challenging to get fast, reliable information about their mortgages and easy answers to questions. Better servicing software could help reduce costs, keep up with compliance, and provide a host of other benefits that appeal to users. The challenge here for new servicers will be to convince originators (e.g., banks) to sell the servicing rights to a startup without a proven track record.

F. Create new ownership models

Although there have been many permutations of the mortgage across its history — e.g., 30-year fixed mortgage, adjustable-rate mortgage, interest-only mortgage — the basic concept has remained the same: homeowners pay a percentage now and the rest over time until they own 100%. What about rethinking this underlying financial instrument? For instance, what if a homeowner could sell just part of the equity in her home — thus allowing homeownership at 80% or 90% instead of the binary, all-or-nothing model of 100% ownership (companies like Point enable this model).

Other companies here (like Divvy Homes) help new homeowners that don’t have the full down payment, or whose credit score falls just short, to become homeowners. The company will buy the home and the potential homeowner will rent it back while also paying to build a small equity stake. At the end of a certain time period (in this case three years), the renter owns equity (10% in this case); has likely improved her credit score; and can purchase the entire home from the company.

These are just a couple examples of new models of home ownership, that arguably better align risk and incentives, unlock a whole new asset class for all kinds of investors, and potentially help avoid mortgage crises around the world.

* * *

Tackling the mortgage market has clearly been a daunting challenge for all of the above reasons. But it’s also where the opportunity lies — as is the case with many software-based startups, the technology and strategy together provide a wedge into reinventing a very manual, error-prone, and slow process. And there are opportunities for startups to insert themselves at nearly every stage of the home buying process.

Mary’s next mortgage, perhaps originated by a company that we have not yet heard of, will hopefully require very little of Mary’s time, cost Mary far less in fees, and close almost instantly… as she walks into her new home.

- Investing in FurtherAI

- Oil Wells vs. Pipelines: Two Strategies for Building AI Companies

- How Big Bank Fees Could Kill Fintech Competition (July 2025 Fintech Newsletter)

- How Will My Agent Pay for Things? (May 2025 Fintech Newsletter)

- What’s Working in AI, Rebuilding Core Banking (March 2025 Fintech Newsletter)