We believe right now is a truly transformative moment in the healthcare market—particularly in care delivery. In this article, I’ll describe some of the tailwinds that are creating this unique opportunity in health care for tech startups; what specific zones of opportunity are ripe for companies to have an impact; and some of the characteristics we think will make for a winning formula in this space.

In many ways, the incredibly stressful and operationally complex environment of healthcare truly is the holy grail of the application of technology. Typically, patients who are encountering the healthcare system are in a vulnerable, sometimes dire state of need, and face a tremendous amount of information asymmetry, inefficiency, and lack of transparency. All of these are the types of problems that are in fact highly conducive to the application of technology.

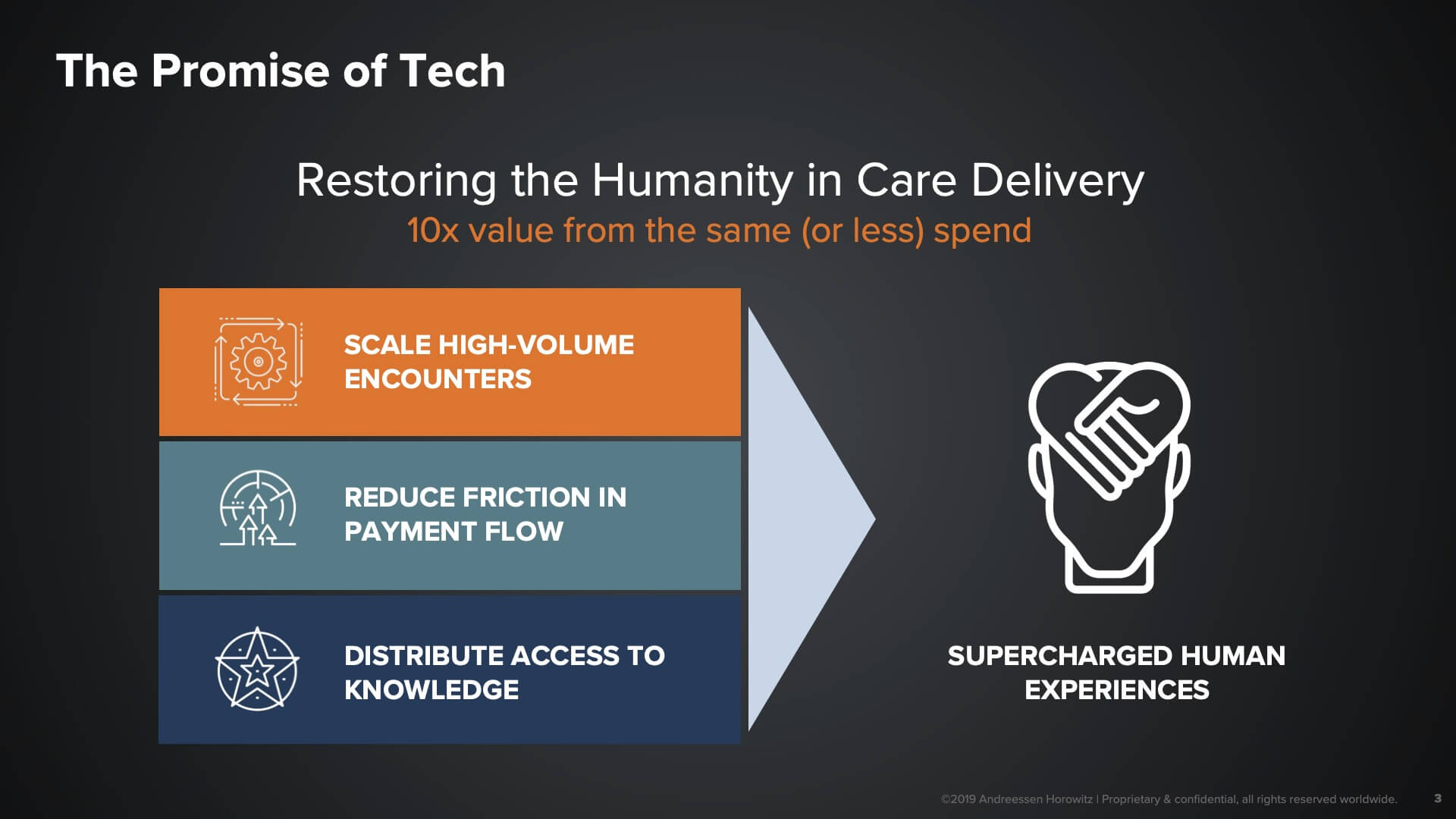

This is not just on the patient’s side, it’s on the provider and delivery side as well. Much of the conversation here has been around, “Will the robots and will AI replace doctors?” We think that the right question to ask instead is, what if robots could automate away the 80% to 90% of administrative tasks that doctors or frontline staff have to do—tasks that take away from the human experience they could otherwise be providing to their customers? That is the huge opportunity for tech startups to really make a difference.

(P.S.: If you’re interested in getting a PDF version of this deck itself, sign up for our newsletter here.)

So why now?

Foundational data layers within healthcare

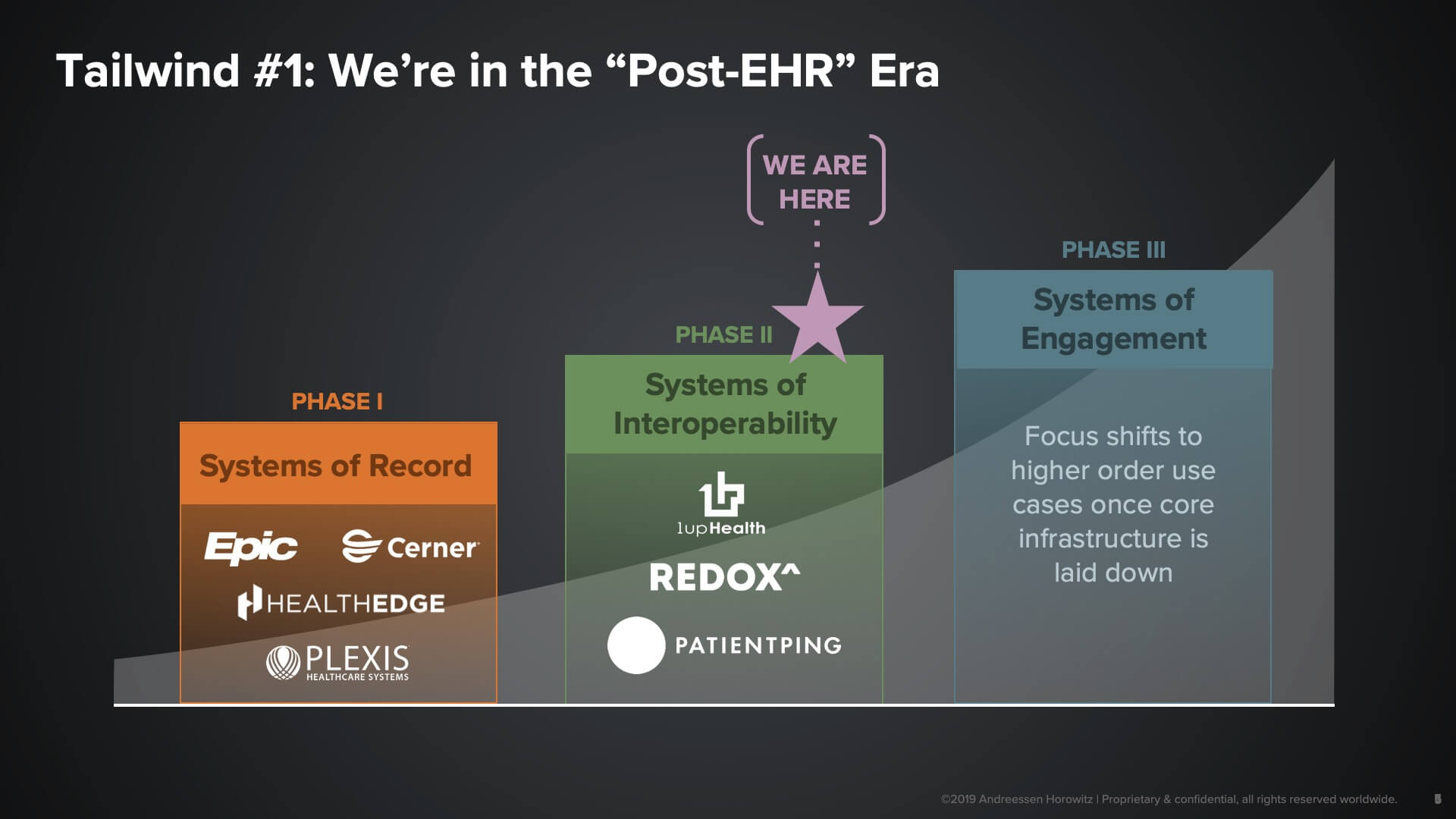

One of the major tailwinds is the fact that an entire layer of tech infrastructure has now been laid down. That allows us to lift our heads up and look towards the possible higher-order use cases and application areas. What I’m referring to is the use of electronic health records in the provider market, along with many core systems on the payor side that are creating systems of record that are very good at storing data.

What they’re not so great at doing is enabling interoperability and data liquidity. And that, as you can see here in Phase II, is one of the big areas of opportunity that we see for startups today: creating liquidity around clinical data, administrative data, or transactional interactions—essentially taking the form of APIs or platform companies that serve as connectors between distributed service providers in the space. It’s really with the laying down of that layer of interoperability that we believe companies can truly go after engagement opportunities.

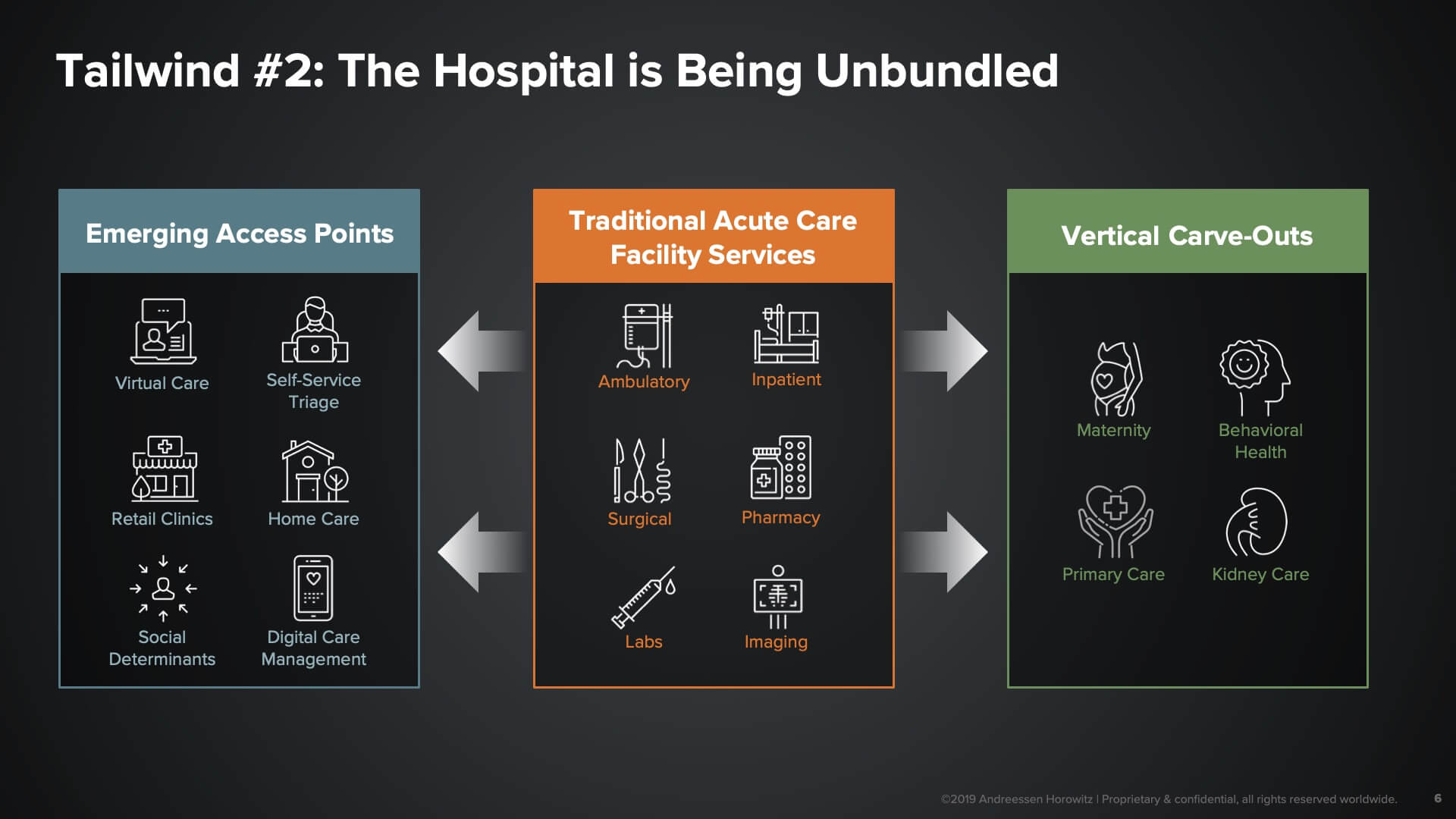

The second tailwind here—one that I’m particularly excited about—is this notion of the ‘unbundling of the hospital’. As patients, we used to have to travel to the monolithic acute care facilities called hospitals to get any kind of care service. Now, many of those hospitals services are being made available to us in far more convenient, accessible, and affordable ways.

We see two big business models being created with this tailwind:

- The emergence of novel access points. These are the emerging sites of care through which we, as consumers, can get access to more convenient and affordable care—whether it be things like virtual care, retail clinics, community-based services, or even home care. Tech platforms can serve as the infrastructure for both operating and connecting consumers to these access points.

- Vertical Full-Stack Models. Another set of business models we see being enabled here are vertical full-stack models. These companies target specific subpopulations of patients characterized by either a disease or a certain level of need, and essentially build full-stack managed services as expert end-to-end providers to those patient populations. These types of companies become super-specialized around those populations, and can take on risk and be far more aggressive about how they think about investing in making those patients better or keeping them well.

Switching to a more consumer-centric approach

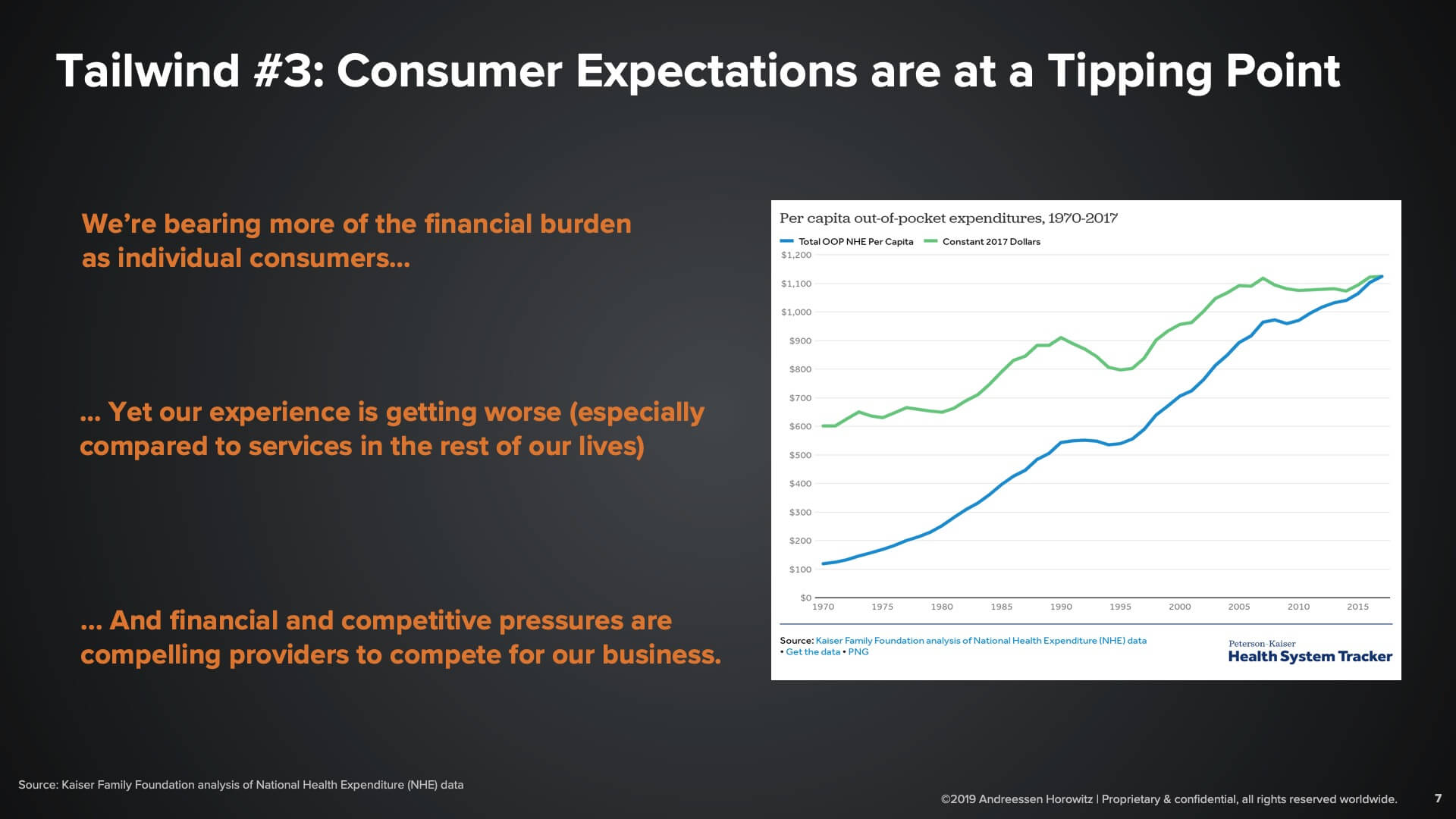

The final tailwind that we think a lot about is consumerism—or rather, the confluence of several factors that have compelled stakeholders to take a far more patient-centric and consumer-centric approach.

Consumers are bearing more of the financial burden out-of-pocket for healthcare needs. What used to be either reimbursed by our employers or health plans is now shifting to our pockets in the form of higher deductibles. At the same time, consumers are also comparing the experiences that we have with healthcare against the experiences in the rest of our lives—retail, travel, transportation—that have seen magical improvements in the last several years. The gap between those experiences is at a breaking point where many consumers are exasperated with what they’re getting in healthcare, and thus the provider side of the market is compelled to become more consumer centric and compete for the business of consumers.

And it’s not just that reimbursements are shrinking (and that the dynamics on the reimbursement side are very uncertain); there are also new entrants in the market, whether it be tech companies or the Walmarts of the world who are coming aggressively after some of the lower-acuity areas of the market. This is another forcing function for service providers to really rethink the way that they’re doing business.

All of that activity and the confluence of these macro trends are creating a unique moment for technology companies to be built in a number of areas of the market that we’re excited about.

So what are some of the areas of the market that we think will be transformed by this next generation of companies?

The next generation of healthcare companies will:

- Transform how we access care. These companies are essentially creating the new front door experience to healthcare. When you have a need, how do you understand what options are available to you, what is covered under your insurance, and what meets your preferences and needs from a convenience perspective?

- Transform how we pay for care. The notion of “fintech for healthcare” is one of the most obvious opportunities for technology to be applied—a very high-transaction area where much of the activity is highly administrative in nature, and so is highly conducive to automation, standardization, and tech-enabled scale.

- Transform how we experience care. This category of companies is actually transforming the actual care delivery experience itself. How is technology improving the care experience, both for you as a patient but also for providers?

We’ll dive into each of these segments to take a look at some examples of companies going after these market opportunities.

New ways to access care

Level of acuity is one way we think about the market: there are different levels of acuity that need to be served for consumers. If I need a flu shot or have a minor rash, my needs are very different than if I’ve been diagnosed with cancer or have to undergo a significant procedure. Highly correlated to that is the willingness to shop. How much are you as a patient going to want to self-serve and find your own option, versus relying on experts to guide you to the best option for you? We see a whole spectrum of companies along those two axes as you can see here.

We also see companies also selling into different market segments. There are companies who sell into the plan sponsor space—whether that be insurance companies, or self-insured employers who are essentially bearing the risk for the outcomes and cost of specific member populations. You also have companies who are going after the provider brands: the health systems, the hospital networks, those who care about maintaining long-term relationships with their customers once they are acquired. And finally, you have the notion of open marketplaces, which are essentially going after undifferentiated consumers who want to shop and want to see all of the various options that are available to them in a given market.

How fintech can streamline healthcare

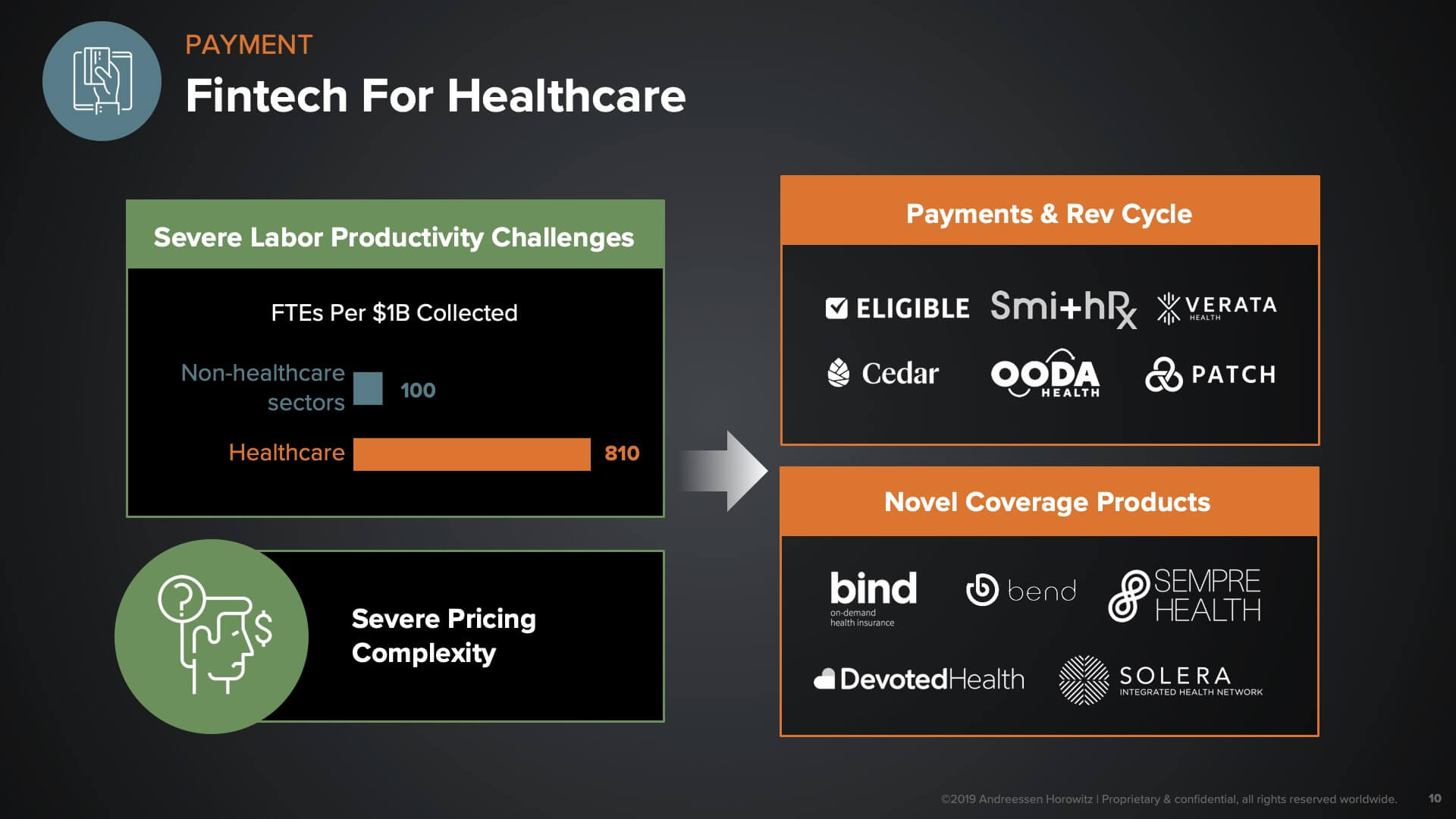

Once you’ve identified where you’re going to get your care, you’re going to care a lot about how that care is paid for. In the ‘fintech for healthcare’ category, we see opportunity around two dynamics. One is the fact that revenue cycle/healthcare payments is one of the areas of the industry with the worst labor productivity. We are roughly 8X less productive than other sectors when it comes to the number of employees affiliated with a certain level of revenue. Combine that with the fact that there is severe pricing complexity in our market, and it’s not at all straightforward to figure out how to pay for things or what they cost.

These dynamics create opportunity for a number of different companies to streamline the administrative processes by which payments are made. Many companies in the top box, above, are going after everything from the patient billing experience; to the provider facing claims-submission experience; to how claims are adjudicated and reimbursed—some even trying to forego or replace or get rid of the claims-based system altogether.

On the bottom right, we have companies who are creating either novel coverage products for novel insurance capabilities, or novel ways to cover the expenses associated with healthcare. There are lots of interesting dynamic-based pricing models there, and far more transparency and flexibility for consumers getting their care paid for.

Once you’re able to access care, you have to figure out how it’s going to get paid for. Then it boils down to: what is the experience when you actually receive that service?

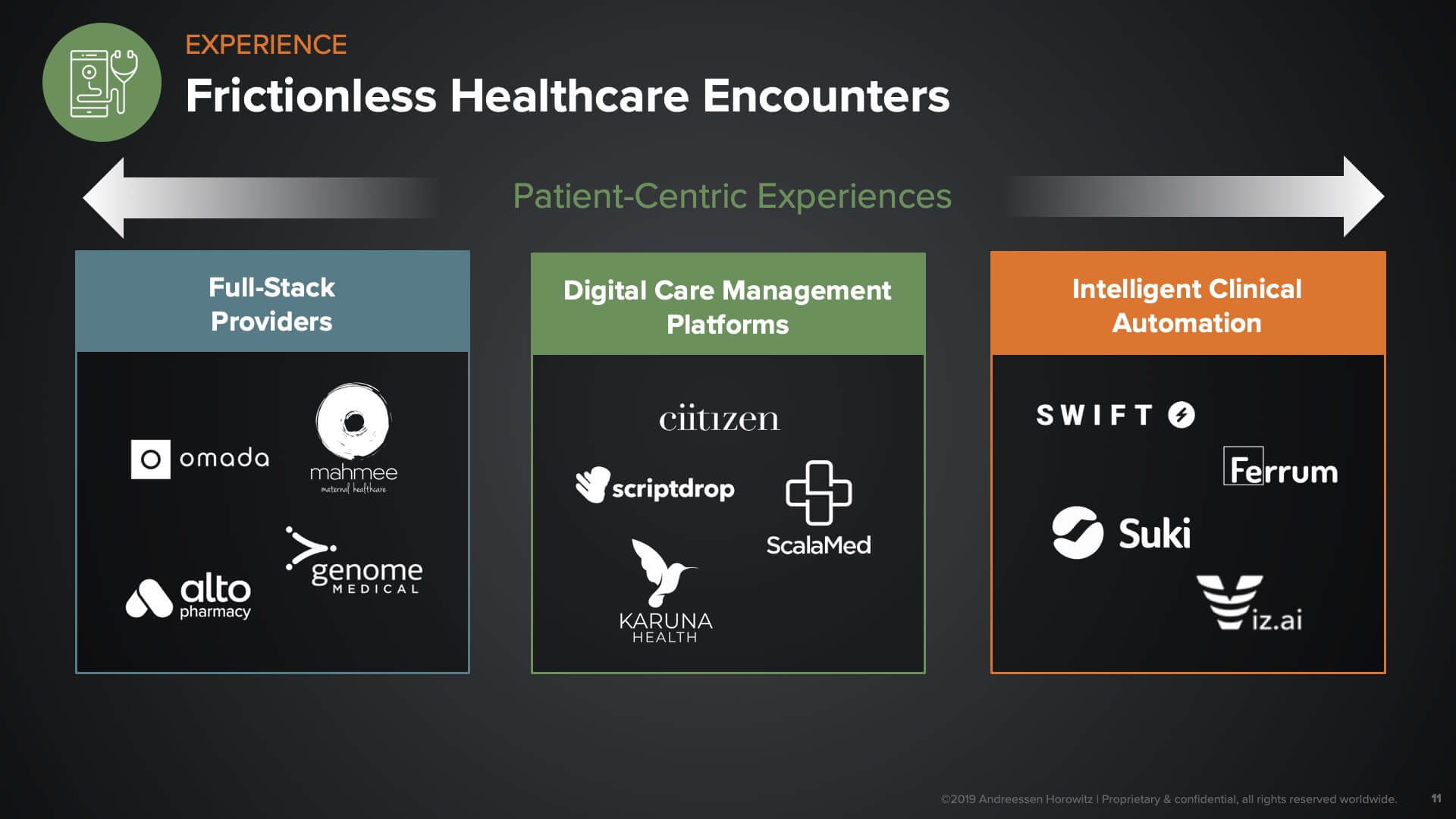

We see a whole spectrum of companies going after the entirety of the patient journey. These are full-stack providers with a dedicated focus around certain disease areas or conditions or specific domains within healthcare. One example would be the digital pharmacy companies implementing e-commerce models for managing your prescription drugs. The companies in the middle tend to be horizontal platforms that create the connective tissue for communications between patients and providers (or between encounters across different care settings). The goal here is to drive efficiency around the communication aspect of care coordination. And finally, there is the ‘last mile’ of care delivery. Many companies are creating ways to automate and leverage AI to reduce variation across the industry and automate administrative services.

As we meet with health tech entrepreneurs, here are some insights into what we look for and what we believe make for winning characteristics for companies in this space.

What are we looking for?

- Form of company. One of the main things we look at is the actual form of the company. This has real implications on not only growth opportunity but also how we think about capitalizing the business. For instance, if you’re a horizontal platform company that’s primarily tech-based and is being deployed in some kind of API-based way, that will have a very different financial profile than an infrastructure-based company, versus a full-stack managed services company that needs to put potentially lots of folks in the field to support a service-oriented delivery model.

- Characteristics of the business. What are the characteristics of the business that give it the potential to become really big? Is this business focused on a node of the healthcare space that has high-volume transactions? It’s more challenging to think about the opportunity for a type of product that’s only used once every few weeks, or once a year, for a given population of users—versus things that are sitting in the flow of hundreds or even thousands of transactions a day or encounters a day. We also consider whether a solution demonstrates a very clear ROI in a rapid fashion—such that the expansion opportunity within that customer set is far more clear and has less friction around it.

- Business model. Finally, of course, the business model is critical. It’s rare that a company fails solely because their product is poor. More often, companies see the most challenges around distribution. What is your distribution edge? What are the things that you are doing that grease the wheels or allow you to defy gravity in some way, as you sell into the B2B space? This could be things like channel partnerships; unique integrations that get you into a certain ecosystem, therefore reducing the risk of users adopting your solution; or network effects that you’re able to create, whether through geographic density or user populations that interact with each other through your platform.

- Revenue stream. Last but far from least—given that this is such a services-heavy market—is the notion of a recurring revenue stream as your dominant way to make money. (Dominant, because there are typically multiple revenue streams associated with some of these more complex businesses.) We look for a high leverage chunk of revenue stream to be recurring, and with some level of predictability.

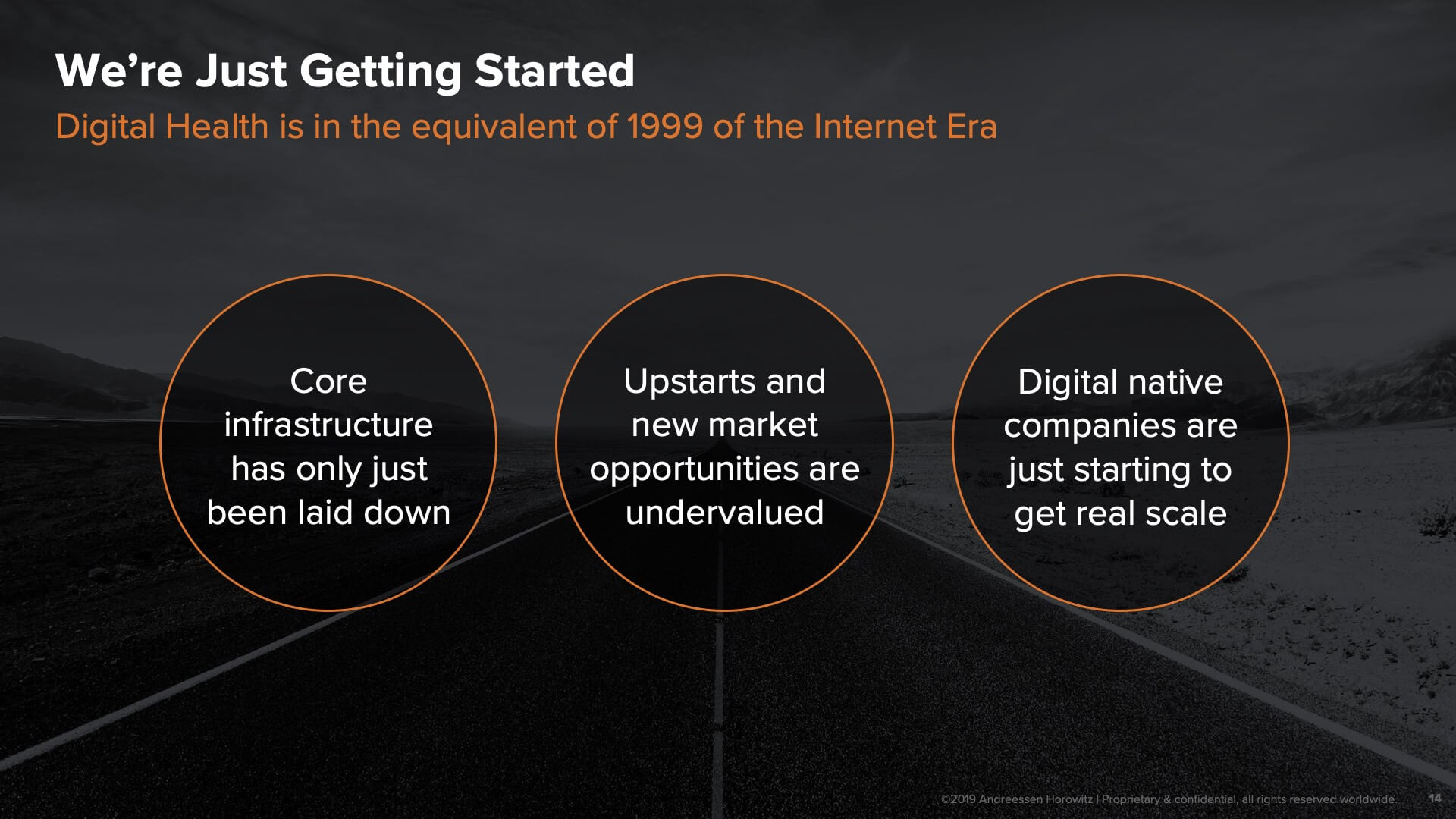

And we’re just getting started…

One of the biggest reasons that we’re so excited about the opportunity right now for tech entrepreneurs in healthcare is that we’re truly just at the beginning. Digital health is today where the internet was back in 1999—core infrastructure is only just being laid down. Add to that the early crop of digital-native companies formed in the last several years that are only now just getting scale, providing us with both general proof points in the category, but also increasing the confidence of the buyers and stakeholders we all rely on to adopt these solutions. Success often begets additional success—and in the healthcare market, which has traditionally been a laggard with regards to technology adoption, we’re optimistic about the early signs of the flywheel beginning to spin in the opportunity areas described above.