Building software has gotten insanely cheaper and faster. The infrastructure provided by the cloud or IaaS vendors has evened the technical ground for builders. A flourish of no-code tools have shortened the prototyping cycle down from weeks to days. As the barrier to entry lowers and the world becomes more product-led, what sets apart companies in the long run?

Until recently, that answer has been different for consumer and B2B products. For consumer products and organizations, a focus on user experience and the adoption journey has allowed them to ship new products, features, and even business models with speed and precision. Meanwhile, historically, B2B SaaS organizations have focused on building relationships with and selling to software decision makers. But the consumerization of enterprise is pushing more B2B organizations to imitate their consumer counterparts. As the distribution model tilts towards product-led, for the first time the user journey defines not just how the B2B product is being used, but how it’s bought and distributed.

As a result, user research has become a core competency for successful companies — not just in the product team, but throughout the organization — to turn the user journey into a coherent go-to-market engine. Some of the most successful companies across consumer and enterprise — Figma, Canva, Spotify and Robinhood — invest in consistent research activities and relentlessly share and act on this knowledge of the user across their organizations.

Earlier this year, I spent 6 months studying the market for user research platforms — interviewing 50 successful founders and practitioners, and surveying numerous new tools for user research. One thing became glaringly obvious: in a product-led world, “research” is no longer a job that belongs to only researchers or designers, it is a skill and a mentality similar to analytical thinking or logical reasoning. It allows an individual — and an organization — to see the world from different lenses, and make decisions with more confidence by drawing on quantitative and qualitative data. While research is not a new discipline, we’re seeing a new paradigm emerge — prioritizing curiosity over knowing, observation over expression, and understanding over intuition. When adopted organizationally, a research mentality becomes a unique competitive advantage and provides a fertile ground for innovations based on deep engagement and understanding of what customers truly need.

So, what is a research mentality?

A research mentality is the practice of looking beyond your own lived experience to critically engage with someone else’s. It is a way of approaching a task to understand user behavior, needs, and motivations; build empathy; and make observations. While that may sound simple, most of the time businesses engage with users with an explicit goal — to make a sale, increase engagement, or troubleshoot a stated problem — that often prevents them from understanding the user’s deeper needs and behavior.

Additionally, a company already doing evaluative research like usability testing and surveys is just scratching the surface of adopting research as a practice. Instead, some of the most impactful aspects of a research mentality are embodied in generative research. There are three key principles that can help foster the research mentality:

1. Start with your audience, not your product.

Most action-oriented people jump into a task to “get things done” and focus on making forward progress. However, when approaching a new opportunity — new product, new market, new vertical — or revamping an existing business model, the best approach is to treat the problem space as a blank canvas with (almost) no constraints and learn more about how the audience (a customer, a partner, or a team member) defines the problem — and to then take a holistic and fundamental approach to fully address their needs. As stated in The Mom Test: “If you just avoid mentioning your idea, you automatically start asking better questions. Doing this is the easiest (and biggest) improvement you can make to your customer conversations.”

For example, when a product marketer creates new messaging, interviewing prospects to learn about their unique pain points and understand how the new market functions differently can be tremendously valuable for the positioning. If the marketer starts with industry jargon and tries to shoehorn in existing categories, they’ll likely miss the bigger opportunity to apply the product to additional use cases or to connect with customers at an emotional level.

2. Map to the user’s mental model.

The open-ended conversations in generative research often lead to a deeper understanding of a user’s mental model, which contains context beyond their product usage. By understanding the end user’s experiences, thought processes, motivations, goals, and pain points, one can see opportunities that are far beyond the existing offerings.

For example, when conducting pricing and packaging surveys, asking “How much would you like to pay for this product?” is far less revealing than “How do you think about the value of this product?” How the customer perceives alternatives and what they deem as most valuable about the product are way more telling about what the price should be based on. Usage based billing and in-app purchases were invented because they map to the users’ thinking patterns — “I only want to pay for what is used”, and “I’d like to download and use the product before deciding if I want to invest in it.”

3. Make observations, not judgements.

Judgement is great at decision time, but premature judgement is horrible for uncovering insights. When researchers observe users, they often pick up on unspoken signals or behavioral clues as to how they are thinking and feeling. This goes hand-in-hand with understanding the mental model, and is critical to developing empathy towards a business counterpart, no matter if they are a client, a partner, or even a competitor.

For instance, when a customer success manager conducts quarterly business reviews, a customer can give mixed verbal signals around whether the product is performing. They might say how much they love the product, while the actions may tell a totally different story. The unspoken behaviors of hiring an external consultant, less frequent usage, or disconnected integrations may indicate a fundamental product flaw.

Adopting the research mentality as an organization

One of the biggest organizational skill upgrades in the last decade is the rise of data analytics. It has become a requirement for individuals and teams and operationalized by better tooling. The rise of user research is a similar and amplifying trend — it bases product development and user experience on data, facts, and insights.

While it’s intuitive to understand the benefits of the research mentality, fostering the adoption of this mentality throughout an organization takes time and best practices. Here are a few shared by the best-in-breed product-led companies.

1. Make research a continuous process, not a one-time exercise.

Traditionally, research is a semi-annual or project-based exercise when product teams need to collect feedback or when new product development kicks off. Cloud and SaaS has enabled product development and distribution to be an ongoing iterative process. Product analytics tools, such as Amplitude, Mixpanel or Snowflake, monitor product performance on an ongoing basis. Similarly, user research should be continuously applied from ideation to development to testing and post-adoption.

A continuous process requires human capital and tooling. Similar to data analytics teams and organizational structures, companies like Figma and Robinhood embed researchers in product teams to ensure there’s a dedicated resource that engages with customers on a continuous basis. Some even embed operational roles in go-to-market teams to funnel real-time feedback to product teams. Additionally, products, like Sprig, ensure feedback collection is native to the application and bring real time insight from users directly to PMs and designers.

2. Democratize access to insights.

The best organizations democratize access to insights. Because there are multiple touch points in the PLG world — content, community, core product experience, and support — knowledge sharing requires structure and continuity throughout these teams.

Some teams keep the knowledge in company wikis like Confluence, Notion, Coda, or even better to use a dedicated research repositories, like Dovetail, which allows anybody within a company to self-serve user insights, down to the raw soundbites. What’s even more important than tooling though is creating awareness, engagement and action around those insights, not just putting them somewhere and hoping someone will find them. Research is only done until a decision has been made and action has been taken – not when a report or insight was shared.

Similar to analytics dashboards, it takes effort to curate, surface, and discover the golden nuggets in customer conversations. This can be done through human intervention — creating lunch & learn opportunities for customer insights, sending scheduled emails, or integrating with Slack for real-time notifications.

3. Video opens up more ways to engage with customers.

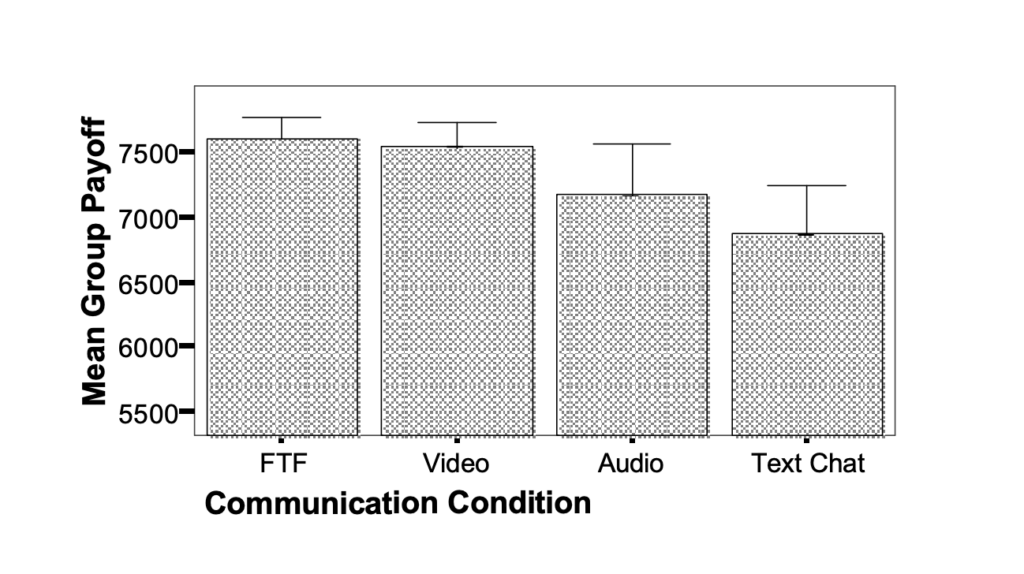

Conducting research requires trust from the end user — especially when the goal is to mentally align to the user’s mental model. Video, especially in a remote world, opens up more (and perhaps better) ways to engage with your customers and understand their experiences. It is almost on par in building trust compared with face-to-face — the caveat is it takes a couple rounds to get there. And virtual engagements through video have some unique benefits, it’s possible to engage with people in broader geographies and environments and to meet users in their own environment, which in turn helps deepen the understanding and broaden the reach of the audience.

Source: Being there versus seeing there: Trust via video

Source: Being there versus seeing there: Trust via video

Create a shared taxonomy for qualitative data.

Parsing and understanding qualitative data is hard. Communicating the findings can also be tricky because qualitative results contain multiple dimensions and subtle nuances. A shared framework or taxonomy in an organization makes it easier to collectively identify and interpret raw data, and categorize it into patterns and themes that can be applied to product or process improvements. It’s valuable to go one step deeper beyond “bugs” and “new feature requests” into specific goals and actions such as “retention improvement” and “conversion driver”, so non-researchers can easily discover or relate to the research content.

(If you want to learn more about how to best design taxonomy and the two approaches — bottom-up and top-down, this is a great blog.)

Business users are drowning in the growing catalog of software vendors. What we need is not more software, but better, user-centric, purpose-built software. Getting there requires having the users’ interest at heart as well as a research mentality that flows through the nervous system of an organization. The startups that master user research will set the foundation to build the great products of tomorrow.

As I continue to learn about research tooling and best practices, I’d love to hear from you about what has worked for your team. Mind and DM are always open.

Thanks to Behzod Sirjani (@beh_zod) for your insights and late night edits! His Reforge course “User Insights for Product Decisions” is a fantastic additional resource on the topic.