Pricing a new product or service can be confusing, and founders—be they first-timers who’ve just shipped their MVP or veterans whose products have been in market for years—are often unsure how much time they should be spending on pricing strategy. Pricing can be particularly tricky for B2B fintech companies, which have multiple paths to monetization (e.g., some combination of SaaS vs. transactional revenue, or freemium vs. subscription). B2B fintech companies also need to earn more trust from their customers than the average B2B business, because they’re handling someone else’s money.

Having talked to dozens of fintech companies inside and outside our portfolio, we’ve come to realize that simplicity is the key when it comes to pricing, especially at the earliest stages. This may seem counterintuitive given how “black box-y” this subject can often feel—look no further than any B2B fintech company’s website to see that Enterprise pricing requires you to “Call Sales.” To better understand pricing in practice, we’ve put together several frameworks (and our opinions on each) for the following:

- How to think about pricing at each stage of a company

- The tradeoffs to consider as pricing evolves

- Understanding different fintech pricing models at your disposal

- How to assess whether your pricing model is working

Though these frameworks primarily apply to B2B fintech companies, given that more and more companies are monetizing via fintech, we feel as if understanding fintech pricing could be beneficial for any number of companies. (And for web3-specific pricing, you should check out this guide from our colleagues at a16z crypto.)

Let’s dive in.

TABLE OF CONTENTS

Where to start

TABLE OF CONTENTS

After building an MVP that’s ready for showtime, one of the most daunting tasks for founders is determining what pricing to offer their customers in the earliest days of the business. There’s no perfect formula for how to do this, but there are several basic frameworks from which one can start.

TABLE OF CONTENTS

Customer-driven discovery

TABLE OF CONTENTS

Many pricing leaders say one overarching principle guides their pricing philosophies: put yourself in the shoes of the customer. Empathy is paramount to the pricing process; if you don’t understand where your customer is coming from, you won’t be able to accurately gauge if they’re willing to buy your product. The simplest way to understand your customer is to survey your early design partners, most committed prospects, or both and try to get a sense of their genuine willingness to pay. This can be a tricky conversation, but ultimately, you’re looking for a few internal champions to help you answer the following questions:

- “We are coming out of beta mode and are thinking about pricing. Would you have a budget for a product like ours? If so, what factors would go into how you quantify that budget?”

- “How would you prefer to pay for a product in this problem space? Per user, per API call, or something else?” (Ideally, the founder presents a few options here.)

- “This is an off-the-record conversation and I am not going to hold you accountable to any numbers, but is $X a reasonable starting point?”

There’s no easy way to ask some of these questions, but having a handful of very honest conversations will help you better understand how your customers value your product, which leads us to…

TABLE OF CONTENTS

Value-based pricing

TABLE OF CONTENTS

Understanding your customers’ motivations for considering your product and what their alternatives are allows you to do what everyone preaches but few actually understand: value-based pricing. This type of pricing refers to setting prices primarily (but not exclusively) according to the perceived or estimated value the product or service delivers to its customer (going one level deeper than basic customer-driven discovery). The key question here, of course, is how to ascribe value to your offering.

Our best advice here is to ask your discovery-phase prospects specific, pointed questions to better understand (1) if this sale would be a “rip and replace”—that is, if your product would fully replace what a prospect is currently using. In this case, you’d want to know what they pay their existing vendor for a specific set of services (noting, of course, where you would deliver incremental benefits). Or, (2) if this is a “greenfield,” or completely new sale, in which case you’d want to know how much the services you’re offering would theoretically cost if they were done by one or more full-time employees. This exercise should guide you toward a basic understanding of the value you deliver. It is a point from which you can propose a split of value capture (e.g., one-third for you, two-thirds for your customer) and establish a baseline of how much your customer is willing to pay. Especially in the early days, customers will try to benchmark your product against existing products in the market. This may or may not be fair in your eyes, but regardless, you need to be prepared and know what’s in the market, how it’s priced, and why your product is different.

One additional value-based sale, which is inherently harder to quantify, is the “quality of life” improvement your product may offer. If you’re saving your customers time, energy, and/or frustration, there’s an opportunity to assign a dollar value to that savings—it’s just unfortunately less formulaic than the other examples listed above. If quality of life is your primary selling point, then taking a test-and-learn approach feels like the best course of action!

TABLE OF CONTENTS

Gross margin reverse engineering

TABLE OF CONTENTS

One of the many virtues of B2B software companies is their potential for strong unit economics, with best-in-class gross margin profiles typically considered >80%. Depending on a given business’ specific cost of goods sold (COGS), founders may want to price their products such that the resulting gross margin has the potential to hit the 80% ballpark. However, this is not always possible, especially in the early days. In instances where the majority of the data and functionality used to power a product experience is proprietary, unit costs are almost entirely hosting expenses, DevOps employees, and customer support spend. Assuming that the company has a reasonable deal with a cloud services provider and a relatively lean headcount in these early days, COGS should be quite low, which in turn means the product can be priced competitively to yield that magic 80% number.

However, in cases where a material component of the solution offered relies on third-party data or services (like, for example, Twilio needing to pay its telecom partners to send text messages to users), COGS can be much higher, making it harder for the business in question to match customer willingness-to-pay and achieve a high gross margin. This is because the business is passing along the cost of the third-party service to its customer, who now needs to cover that cost and the typical software COGS covered above (it should come as no surprise to you now that Twilio’s gross margins are closer to 50% than 80%). In either case, an in-depth understanding of COGS, both today and in a future scaled state (e.g., COGS can come down over time, especially for API businesses), should allow founders to back into product pricing based on the desired gross margin profile for their business (which, as discussed above, ultimately depends upon the type of business they are running).

It’s worth noting that this is our least favorite of the frameworks. However, it may make sense to implement in markets where there are very well-defined competitor sets with well-understood margin profiles. The main challenges we see are (1) to be effective, this needs to encompass the full suite of products and how they’re typically used together (as opposed to backing into a desired margin for each individual product), and (2) it lacks customer validation (though this is why it’s just a starting point!).

TABLE OF CONTENTS

Kick the can down the road

TABLE OF CONTENTS

This strategy may sound facetious, but for many B2B businesses, the formation of a strong network of customers and end users is the ultimate aspiration and trumps any desire to (initially) make money. In fact, oftentimes a product’s utility is directly correlated with the number of users it serves (with Facebook serving as the simplest example here), and as such, rapid and frictionless adoption in the early days is essential. If your B2B business shares these characteristics (e.g., collaboration software, give-to-get infra, marketplaces, etc.), you might consider opting for freemium delivery or the developer-first, self-serve motion with clearly agreeable pricing based on comparable businesses in the market. You can change the proportion of value-capture later on once you’ve gotten the product into customers’ hands and reached an initially critical mass.

There’s no “right” strategy to start with, but early on, most companies do some combination of customer-driven pricing and kicking the can down the road. The most important thing is to pick a simple pricing structure to get the product into people’s hands for feedback. As the business matures, founders can put more time and effort into fine tuning their approach to pricing. Furthermore, remember pricing is just one of many inputs into sales. A focus on pricing pre-supposes a clear articulation of your value proposition and competitive differentiation, as well as a deep understanding of the market in which you operate.

TABLE OF CONTENTS

How does pricing evolve?

TABLE OF CONTENTS

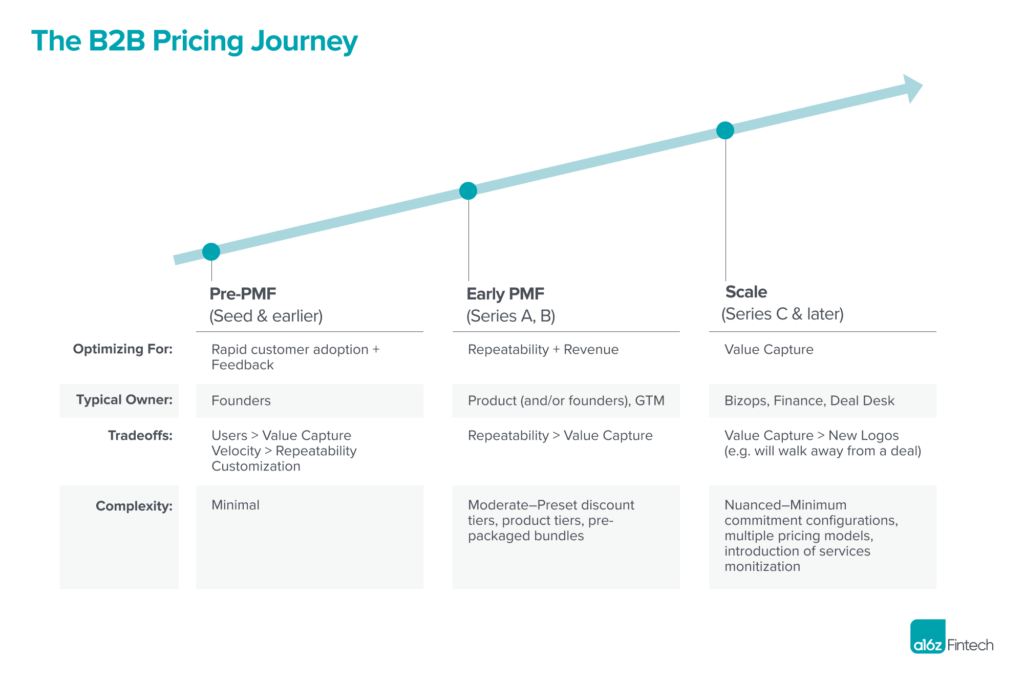

When you look at most companies over time, it’s clear that the overall approach to pricing—what’s being optimized, who owns the process, and the tradeoffs involved—depends heavily upon the stage of the business. For the purposes of providing an overarching framework, we’ve segmented the startup world into the following three buckets: Pre-PMF (Seed and earlier), Early PMF (Series A and B), and Scale (Series C and later).

Pre-PMF companies are typically optimizing for rapid customer adoption, such that they can receive early product feedback (especially from design partners) and/or bootstrap the beginnings of a network. At this stage of company building, usage is more important than revenue, and pricing sophistication and philosophy generally reflects that. Founders are often owning pricing at this point, and prioritizing new users over value capture and velocity over repeatability (specifically with respect to deal and pricing structure). Hence, they often pick the simplest pricing method for customers to understand.

This doesn’t necessarily mean giving away the product for free or choosing the lowest possible price. It’s still important to signal value to the customer, ensure their commitment, and avoid anchoring too low in the market. Sometimes, early stage companies choose to anchor high (almost to “shock” their customer!) as part of their price discovery, and then use heavy discounts with early customers to get the product into their hands while still indirectly signaling perceived value. Founders can also offer early customers sweetheart deals, as long as they keep the door for increasing prices open to revisit at a later date (i.e., at a renewal window). In fact, framing your pricing as a discounted price vs. a low starting price can help facilitate that conversation later on. You can also offer different customers different pricing models as you experiment, though we would only recommend doing so with the caveat that the test model is in fact an experiment, and should therefore come with clear parameters like time bounds and confidentiality.

Finally, some form of early price discovery can give you a sense of how to make the economics work for the business overall (i.e., is there a path to high enough ACVs here? Will this business be able to justify an inside sales team?). While this will change as you add more product and functionality (resulting in more leverage and perceived value), it is also worth thinking about even in the early stages (things may of course change!).

Early PMF companies, on the other hand, care more about repeatability and revenue. This is because they’re trying to prove that they’ve established a recipe for success in their market, which in turn means they can spend more money and resources on go-to-market efforts to efficiently acquire and retain customers. As such, revenue becomes a critical input into the equation, pricing becomes more complex, and more time is spent analyzing what works and what doesn’t. These types of market insights and their corresponding pricing strategies are usually owned by the product team, an early GTM hire (e.g., the first product marketer), and/or the founders. The key responsibility of the pricing owner in this phase of company building is to ensure pricing unlocks repeatability at least as much as it unlocks value capture. Incremental nuance here can come in the form of tools such as preset discount tiers (for a usage-based model), product tiers (for a freemium offering), or pre-packaged bundles (for a modular product) to ensure that each sale doesn’t require something totally new and bespoke.

Once your company has reached some scale, typically beyond Series C, pricing quickly becomes about maximizing value capture. It’s important to note that no one pricing model can necessarily maximize value capture on its own. This is more about what percent your company attempts to take of the perceived value generated by your product (i.e., moving from one-third toward one-half or two-thirds). As networks and initial repeatability have already been proven out (at least partially), pricing becomes one of the most essential tools in the business’ tool kit, and companies adjust their operations to reflect this. For example, we often see companies of this maturity start to introduce dedicated pricing teams and functions, which centralizes pricing intelligence and decision making with a key set of stakeholders like a deal desk or pricing council. While many other teams, like finance and business operations, will still own various components of the pricing stack, the deal desk often becomes the key hub for pricing and discounting decisions, particularly in enterprise-led software companies.

This represents a meaningful inflection point in a startup’s journey. Beyond this point, it’s not uncommon for companies to walk away from a given deal if it doesn’t capture sufficient value for them (versus in their earlier days, when they might have walked away from a prospect if it didn’t fit their ideal customer profile from a use case or usage perspective). The halo effect of the incremental logo may always threaten to outweigh suboptimal deal economics, but at this stage in the journey, we expect to see increased rigor in making that decision. Companies in the “Scale” bucket often introduce more nuance to reflect the sophistication of their pricing strategy. We expect to see things like:

- Different permutations and combinations of minimum commitments: monthly, annually, quarterly, with different options of how to handle overages, and discounts offered for early payment

- Multiple pricing models working in concert with one another, often blending a combination of fee- and usage-based approaches

- Introduction of services, premium support, and/or implementation monetization

- Elimination of legacy sweetheart deals (i.e., all-you-can-eat) to true up customers to a given pricing brand based on their size and usage

Not all of these will be right for every “Scale” business, but they are a few examples of the type of nuance we see at this stage of company building. Square, for example, started with the simplest, flat pricing, at a time when competitor point-of-sale providers were frustratingly charging merchants different rates for different payment methods. Square took a loss on some transactions in some cases with its universal pricing, but merchants welcomed the simple straightforward pricing compared to the complex pricing that competitors offered that were filled with hidden fees. This aligned with Square’s overall brand promise – easy to set-up, easy to understand, so you can get started quickly. Over time, as Square’s brand promise became known and it started adding additional features, it added additional fees (still trying to be transparent about those fees via its website). For further reading, check out this 2019 post from Square, in which they did an excellent job announcing a major pricing change (migrating from flat 2.75% transaction fees to 2.65% + 10c) and explaining their rationale.

TABLE OF CONTENTS

Pricing model definitions

TABLE OF CONTENTS

Now that we’ve outlined a few different strategies to help you build your pricing framework, let’s define the most common pricing models you have at your disposal.

There are many different options when ascribing value to the services you offer your customers, and in B2B fintech land, we often see one or multiple pricing methods at play. Perhaps the most important step in your pricing journey will be deciding which model(s) you want to use in your business, as this will determine who you are monetizing, how you are charging them, and the packaging through which you will deliver your product. While actual price points can be changed fairly fluidly as a business matures, changing the fundamental pricing model is much more challenging, as it requires thorough customer education, a new GTM team structure and compensation, fresh billing infrastructure, and possibly even a company cultural adjustment to match the new strategy.

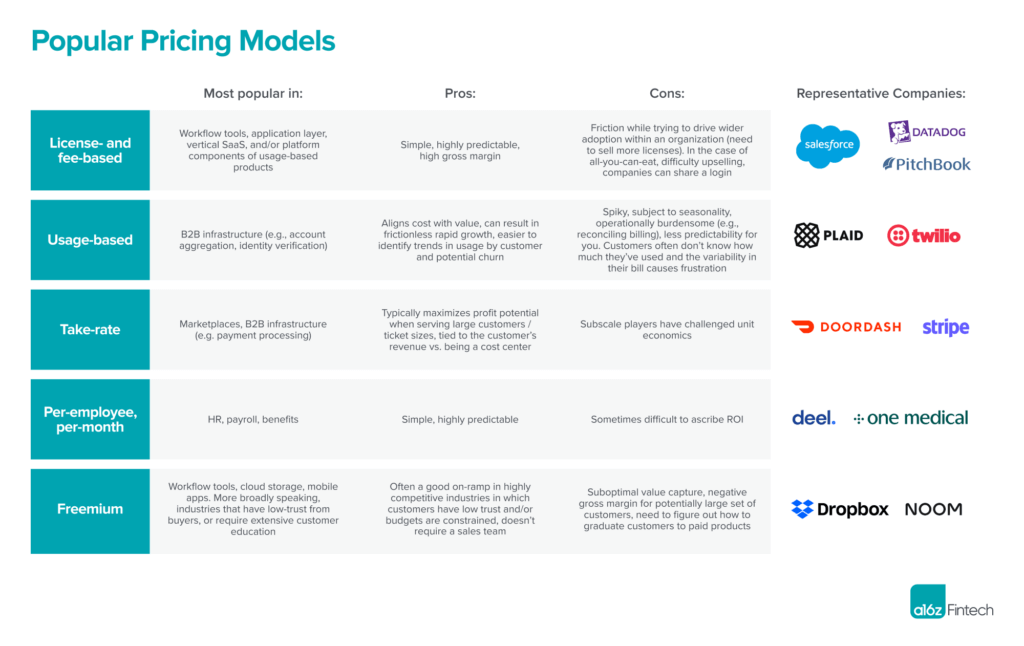

With this in mind, the most popular pricing models are:

- License- and fee-based: Often thought of as the original SaaS pricing model, this bucket encompasses everything from all-you-can-eat (i.e., a flat fee for a given software service), to various flavors of per-seat or user pricing (e.g., a flat fee per license, a tiered fee per license based on total number of seats, etc.), which generally tie to the size and complexity of the organization.

- Most popular in: Workflow tools, application layer, vertical SaaS, and/or platform components of usage-based products.

- Pros: Simple, highly predictable, high gross margin

- Cons: Friction while trying to drive wider adoption within an organization (need to sell more licenses). In the case of all-you-can-eat, there can be difficulty upselling as companies can share a login

- Representative companies: Salesforce, DataDog, Pitchbook

- Usage-based: Common amongst API-driven companies and other forms of enabling infrastructure, usage-based pricing involves dollar-based fees for a given set of billable events, such as the calling of an API, the verification of an identity, or the processing of a loan application. Another popular pricing driver in usage-based models can be the number of end customers to which the solution is deployed.

- Most popular in: B2B infrastructure (e.g., account aggregation, identity verification)

- Pros: Aligns cost with value, can result in frictionless rapid growth, easier to identify trends in usage by customer and potential churn

- Cons: Spiky, subject to seasonality, operationally burdensome (e.g., reconciling billing), less predictability for you. Customers often don’t know how much they’ve used and the variability in their bill causes frustration

- Representative companies: Plaid, Twilio

- Take-rate: Common amongst marketplaces and payments companies, take-rate pricing typically monetizes via a percentage of GMV being processed through the platform.

- Most popular in: Marketplaces, B2B infrastructure (e.g. payment processing)

- Pros: Typically maximizes profit potential when serving large customers / ticket sizes, tied to the customer’s revenue vs. being a cost center

- Cons: Subscale players have challenged unit economics

- Representative companies: DoorDash, Stripe

- Per-employee, per-month: Common amongst HR, payroll, and benefits companies, PEPM typically charges a flat fee per either an employee or user of a given product or service.

- Most popular in: HR, payroll, benefits

- Pros: Simple, highly predictable

- Cons: Sometimes difficult to ascribe ROI

- Representative companies: Deel, One Medical

- Freemium: Offers a certain set of basic product features or services to users at no cost, with the option to upgrade to supplemental or advanced experiences for a premium. The goal is to create credibility and trust with customers and use that to sell them more value over time. In freemium models, the free experience is a deliberate bridge into the set of paid options.

- Most popular in: Workflow tools, cloud storage, mobile apps. More broadly speaking, industries that have low-trust from buyers, or require extensive customer education.

- Pros: often a good on-ramp in highly competitive industries in which customers have low trust and/or budgets are constrained, doesn’t require a sales team

- Cons: Suboptimal value capture, negative gross margin for potentially large set of customers, need to figure out how to graduate customers to paid products

- Representative companies: Dropbox, Noom

Most B2B fintech companies employ a combination of these mechanisms to ensure business model resilience. Payments companies, as an example from our take-rate category, typically combine a flat dollar-based charge alongside a percent-based fee when processing a payment (e.g., $0.30 + 2.9%).This allows them to preserve their unit economics when handling a large number of small-dollar payments. They might also charge their customers “platform fees,” which are basically flat monthly SaaS fees, for the privilege of accessing the technology in the first place, or they might charge an implementation fee to help drive commitment and therefore initial adoption. There are also other levers to pull around minimizing friction, like using discounting.

As we discussed in our “How Pricing Evolves” section, over time, as companies shift from prioritizing usage to prioritizing value capture, they often make their pricing models more complex. For example, usage-based companies will often implement monthly minimums, and add more features and services with a recurring SaaS fee.

TABLE OF CONTENTS

How do you know if it’s working?

TABLE OF CONTENTS

One of the hardest parts of managing pricing is knowing whether or not your strategy is having its desired effect. The reason for this is simple – for the deals you’ve won, it’s nearly impossible to know how much money you might have left on the table based on the customer’s ultimate willingness to pay, and for deals you’ve lost, it’s possible your product’s functionality, or any number of other complications, might have been the primary culprit. For self-serve pricing, it’s difficult to measure which prospects may have dropped out of the funnel due to pricing vs. which felt they were getting the bargain of the century. The list of complexities goes on.

At the earliest stages, your analysis is going to be less sophisticated and will likely center around listening to customer feedback. As your company matures, you’ll have enough data points to analyze wins and losses, customer cohorts, revenue by segment, and other relevant trends. Here are a few strategies you can employ to get a sense of whether pricing at your company is working as intended, ordered from easiest to implement at the early stage to most sophisticated and requiring the most data:

- Ongoing competitive reviews and customer surveys: Just like you did when outlining your initial pricing strategy, you should continue to track how you price in comparison to your main competitors, and continue to talk to your customers to understand their perception of the value you deliver relative to the price you charge. Some of this feedback may come through via comments in NPS surveys, one-off discussions with account managers or support staff, or other unstructured channels, but we suggest carving out a pricing-specific check-in cadence with a handful of customers from each segment to ensure nothing is too far off the mark.

- Routine price increases: This is the simplest method. You can test pricing increases with a few customers. One popular question we, as VCs, like to ask during customer or prospect calls is whether the buyer of a given piece of software would still use it if the price doubled the following year. While this is an entirely hypothetical scenario, there is an opportunity to actually implement periodic price increases to gauge how much untapped willingness to pay exists in your customer base. If you’re able to facilitate these increases on a regular basis with limited churn, you have not yet brushed up against the willingness to pay asymptote for your product.

- Variance analysis: Create a scatter plot of all your current customers and their average sale price (ASP). When you segment your customers by certain characteristics—account size, region, number of employees, etc.—are you able to glean any insights about which price point has yielded the most success with a given set of customers? If the plot is all over the place, the answer will likely be no, which would indicate pricing has been more or less ad hoc on a deal-by-deal basis. If there’s concentration around certain pricing bands, your strategy is, at a minimum, consistent. An almost equally important part of the exercise is to identify outliers (on the low or high side of the spectrum) and decide whether they should be trued up in either direction. While those paying particularly high prices relative to their segment may allow you to capture more value and generate more revenue, you run the risk of them talking to other customers and losing trust in your business.

- Price realization: Create a similar scatter plot to the one mentioned above, but instead of ASPs, express your customers’ pricing in terms of percent discount to rack rate. What’s your median discount across deals of a certain type? 10%? 40%? 95%? Anything consistently above 50% probably tells you you’re starting too high, especially if discounts of a certain magnitude require explicit sets of approvals (more on this below).

- Sales efficiency and escalation analysis: Measure the typical number of touchpoints, redline negotiations, and escalations a deal in a given customer segment requires. As you adjust pricing, are you able to observe any impact on how long and arduous it is for sales reps to close deals? If these figures are much more drawn out than your ideal or expected sales cycle, your pricing is likely too high (and vice versa if deals are closing too fast, if there is such a thing!). As you grow, you will look at burn multiple and sales efficiency metrics, which may also signal if the price is too low or high.

Processes like those outlined above may be owned by any number of stakeholders (again, this number is largely dependent upon company stage). How often you formally revisit pricing is company specific; for those later-stage companies with dedicated pricing teams, it’s deliberated daily. For pre-PMF companies in heads down building mode, it’s likely done on an ad hoc basis.

TABLE OF CONTENTS

Conclusion

TABLE OF CONTENTS

While we’ve laid out a few frameworks to consider, one overarching theme that we’ve seen is: don’t overcomplicate things. In the early days, the owner of pricing should be the person with the best intrinsic sense of the value being offered by the product. Any explicit pricing work done should be to ensure that you’re directionally right, and you shouldn’t distract yourself with optimizing for the incremental 1 or 2% improvement at the margins. As you scale, pricing can and should become more of a science that’s ripe for all the A/B testing and scatter plotting needed to ensure you’re accomplishing your most important priorities. At any company stage, we hope this piece helps you navigate a few of the complexities involved, and sleep easier at night knowing that you’re not alone in the pricing maze!

- Investing in Crux

- My First 16: Launching a New Category with Modern Treasury’s Dimitri Dadiomov

- My First 16: Creating a Supportive Builder Community with Plaid’s Zach Perret

- My First 16: Welding Yourself to Early Customers with Marqeta’s Jason Gardner

- My First 16: Doubling Down on Founder-Led Sales with Pilot’s Waseem Daher