It was a big year for crypto. Asset prices gained much of the mainstream attention, with Bitcoin hitting its all-time high this month. Meanwhile DeFi, or decentralized finance, applications on Ethereum have attracted users eager to trade, loan, or borrow crypto assets, pushing the network to its limits.

New projects — networks, applications, and scaling solutions — have begun to discover the best practices around decentralizing and governing themselves by rewarding their users and contributors with ownership of those projects.

Here are five charts that capture some of the key developments and help tell the story of an eventful year.TABLE OF CONTENTS

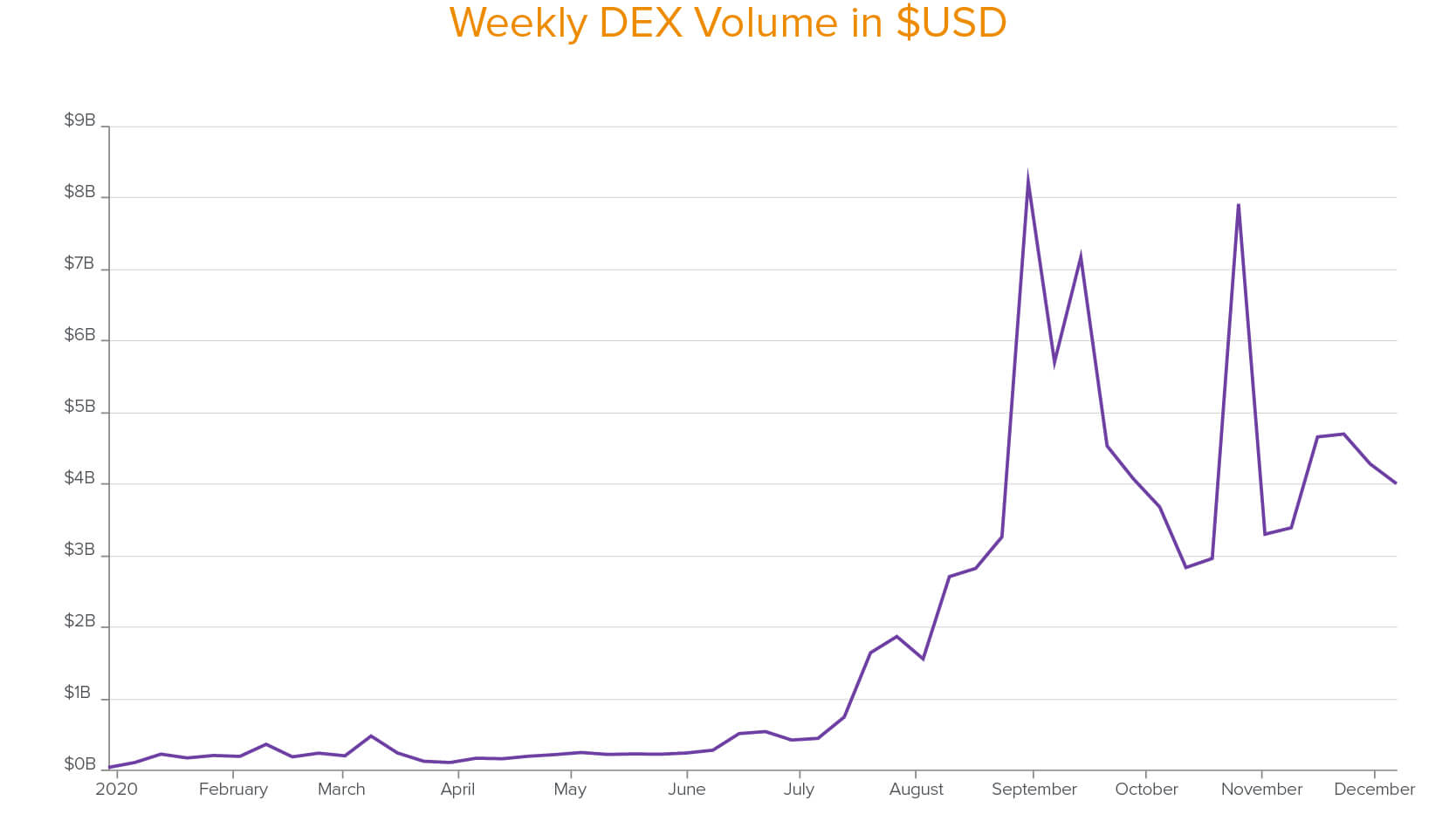

DECENTRALIZED EXCHANGES: VOLUME

Source: Dune Analytics. Includes volume from 0x, Balancer, Bancor Network, Curve, DDEX, dYdX, Gnosis Protocol, IDEX, Kyber, Loopring, Mooniswap, Oasis, Sushiswap, Synthetix, and Uniswap. Charts provided herein are for informational purposes only and should not be relied upon when making any investment decision. Past performance is not indicative of future results.

Early in the year, volume on decentralized exchanges (DEXes) was still nascent. By late summer, that volume had reached levels previously only seen on centralized exchanges.

A few years ago, these volumes might have seemed not just unlikely, but technically impossible. There are a lot of reasons, some people argued, that you can’t achieve volumes on-chain that are possible in a centralized system. That has now been plainly disproven. This is demonstrable proof of product-market fit for DEXes.

The rise in volume this summer came from the seeds that were planted in 2018, which bloomed as new projects launched. It was the rise of DeFi: protocols integrating with each other, yield farming, protocols decentralizing, and new tokens launching. Suddenly there were all these things people wanted to buy and use, and all the infrastructure was in place to allow it.

Decentralized exchanges are the platforms that can facilitate this new activity. When a new protocol launches, and in order to use it, you need a specific token that only exists on a DEX. If you already have some Ethereum on-chain, it’s just a couple of transactions to get the relevant tokens, and then go to the protocol, deposit, withdraw, or engage with it. All those things are not only easier to do with a DEX — in many cases, it’s the only way to do it.

If you want to get involved in the newest projects, you need to do it at the source. And the source is on-chain. That’s been true in crypto for a while, but only recently have these new tokens become incredibly accessible and easy to grab.

More broadly, this is evidence that yet another activity which is critical in financial infrastructure — trading — is now doable without ever leaving the crypto ecosystem. Being able to exchange assets in a trustless, non-custodial way has always been the core promise of crypto. And it’s here.

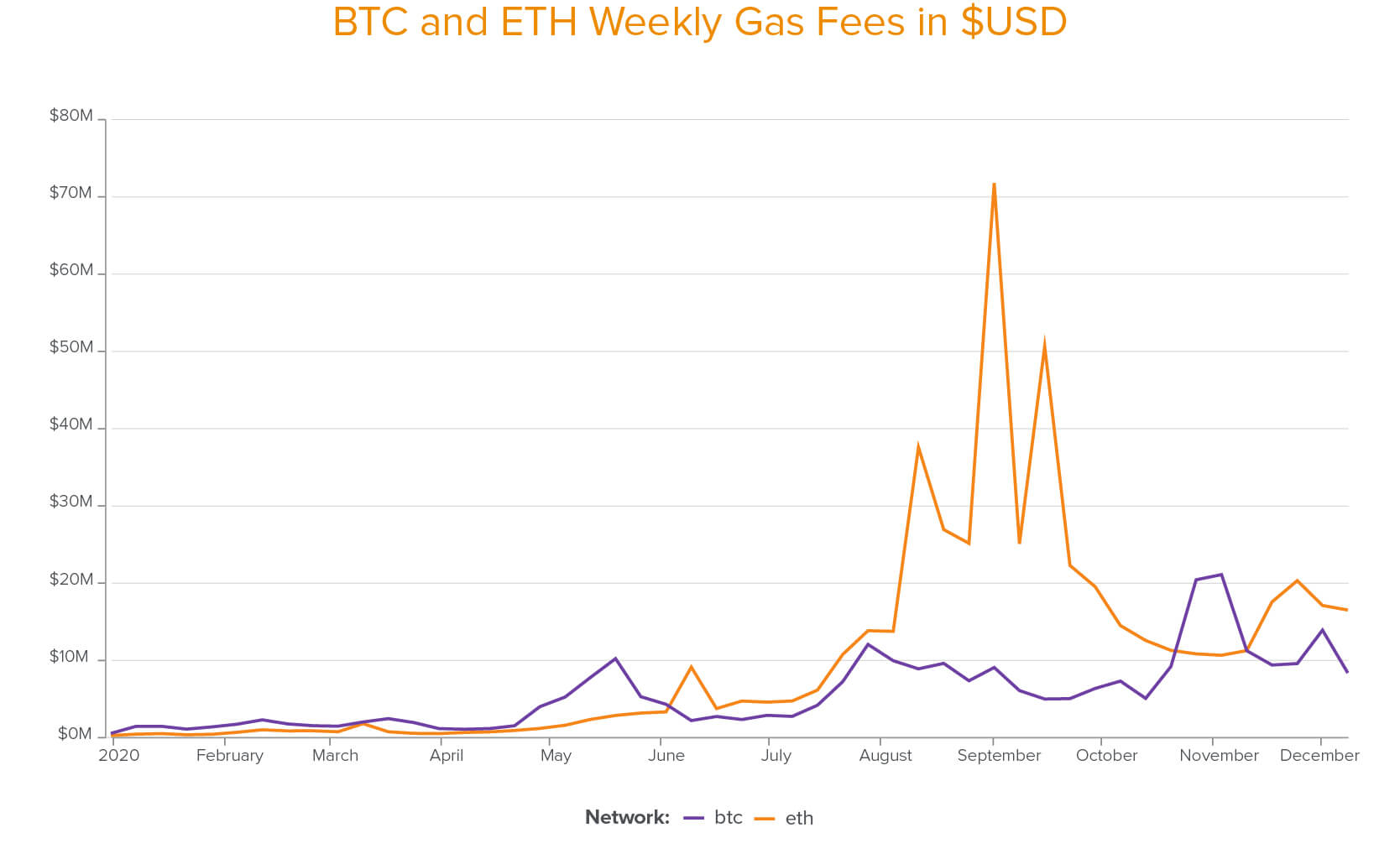

BITCOIN AND ETHEREUM FEES

Source: Coin Metrics. Charts provided herein are for informational purposes only and should not be relied upon when making any investment decision. Past performance is not indicative of future results.

At the beginning of the year, gas fees on Bitcoin and Ethereum — the transaction costs for doing things like transferring an asset, using a program, or adding a new program — were in the hundreds of thousands and occasionally millions of dollars per week. Now, even after a leveling-off from the huge peaks of the summer, we’ve reached a new normal where the gas fees per week are in the double-digit millions.

At recent prices, it costs about $4 to $8 to transfer tokens on Ethereum, no matter the amount. It costs about $12 to $25 to do a transaction on a decentralized exchange. It costs about $20 to $40 to take a loan on a decentralized money market.

Bitcoin may not have had the huge fee spikes seen by Ethereum in the summer, which were driven by the wave of interesting developments in DeFi. Nevertheless, people are still willingly spending to make Bitcoin transactions, even though fees are climbing because of limited throughput on-chain. They’re not doing it to make dozens of transactions a day for everyday payments as they might with traditional infrastructure, but they’re still willing to pay to move their Bitcoin.

There’s a big debate in crypto about whether high gas fees are good or bad. On the one hand, high fees are a negative, because networks shouldn’t be expensive to use — it excludes a lot of people and makes many valuable use-cases economically unfeasible. That’s antithetical to crypto’s promise of inclusivity.

On the other hand, high gas fees are strong evidence that there’s great demand for using these networks — even if the network can’t meet demand while keeping prices acceptable. There’s potential for even more activity if transaction fees can decrease through infrastructural upgrades — including the ongoing ETH 2.0 project and other Layer 2 scaling solutions.

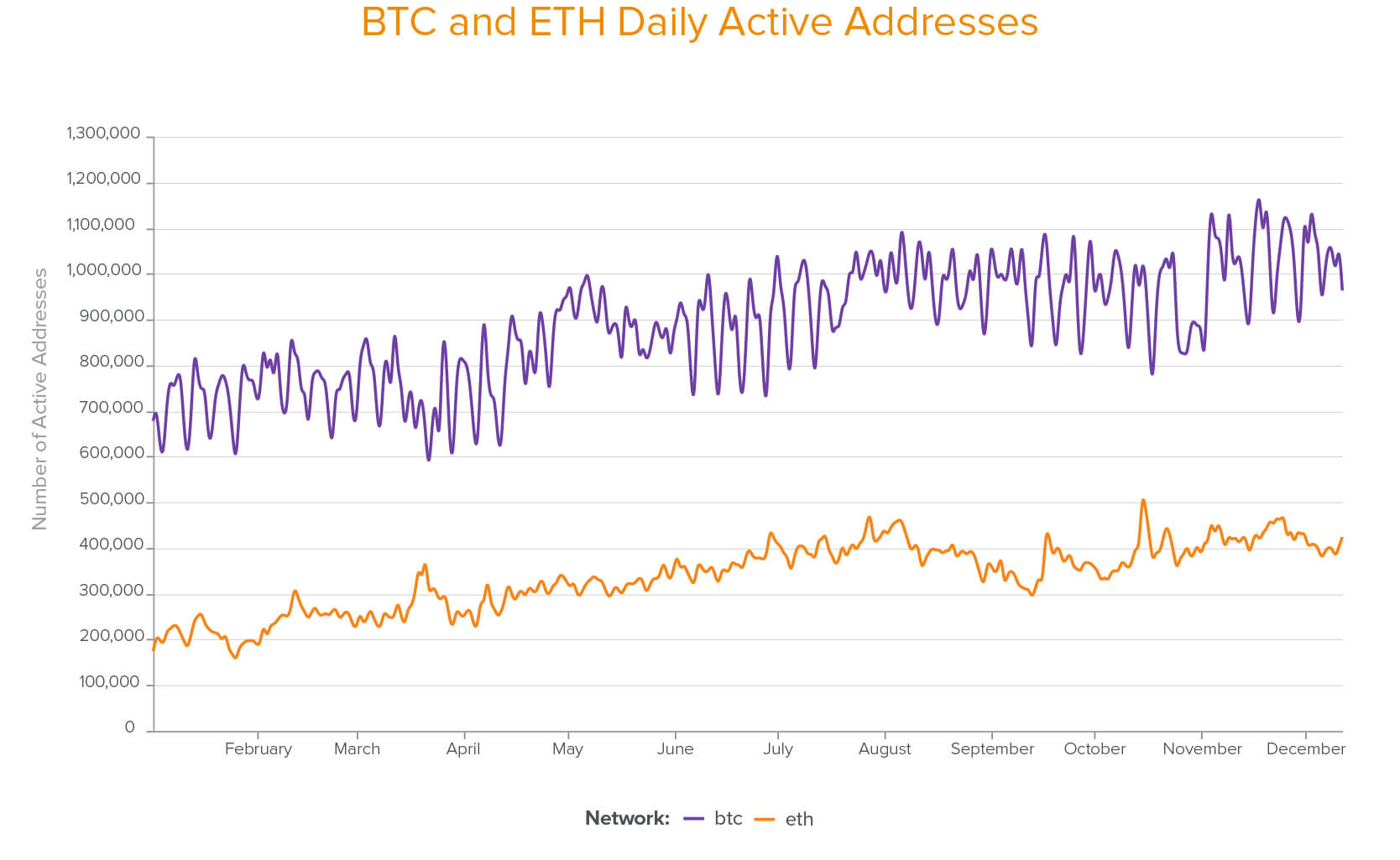

BITCOIN AND ETHEREUM ADDRESSES

Source: Glassnode. Charts provided herein are for informational purposes only and should not be relied upon when making any investment decision. Past performance is not indicative of future results.

It’s not only existing users who are willing to pay to transact on these networks — more people are joining and becoming active, despite the prices. As this chart shows, the number of daily active ETH addresses has doubled this year, from 200,000 to 400,000. Bitcoin grew from about 700,000 to almost a million.

Many people aren’t satisfied with the existing options provided by legacy financial systems. They want to put their money to work, and to own pieces of the systems they are using to do it. There is pent-up demand for more financial freedom and new ways to transact, and crypto networks are at the center of it — they’re a new kind of common space.

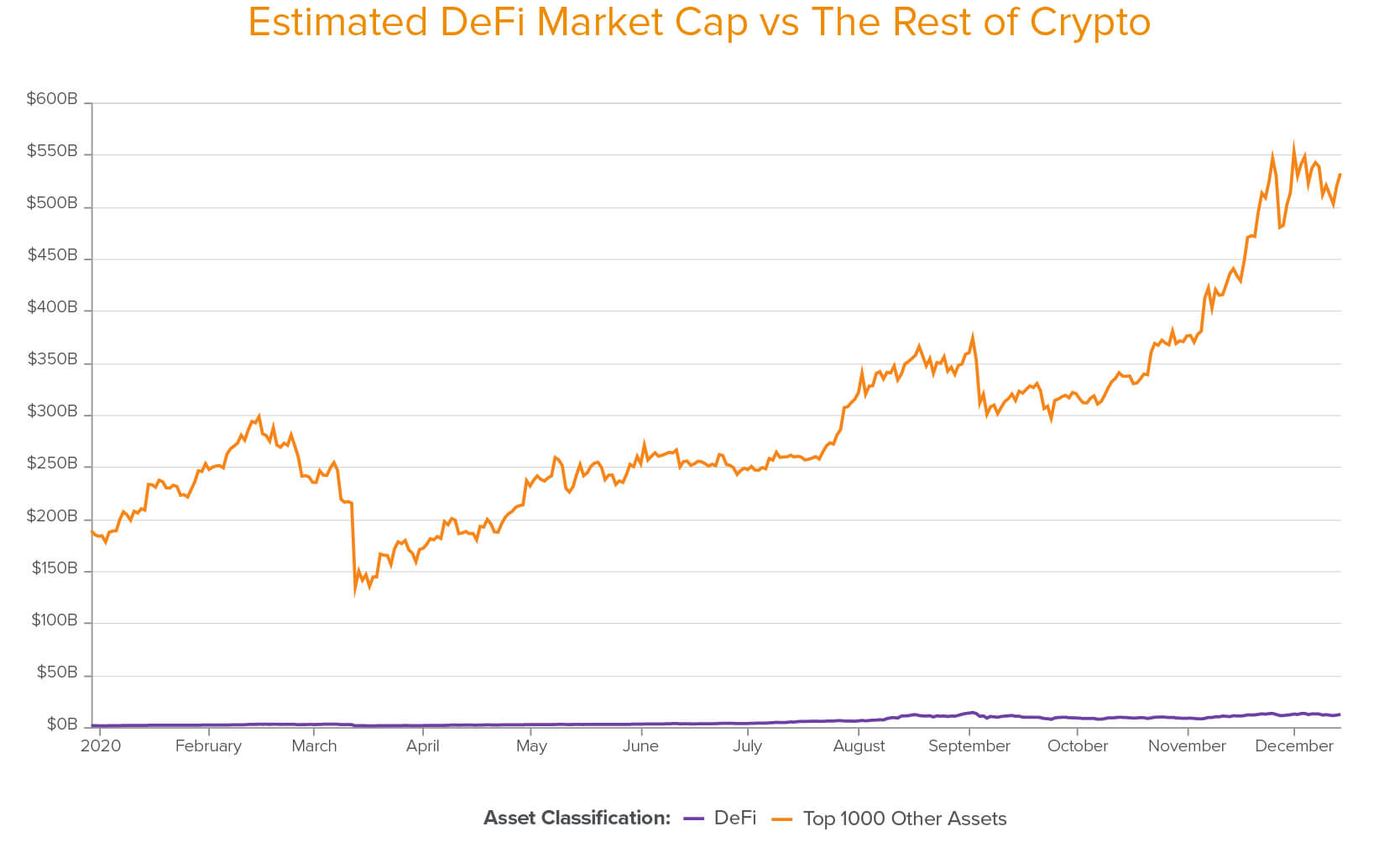

DE-FI MARKET CAP

Source: CoinGecko. Compares the Top 1000 crypto assets by estimated market capitalization listed by CoinGecko as of December 15, 2020 against the Top 100 DeFi assets, minus stablecoins, listed as of the same date. Charts provided herein are for informational purposes only and should not be relied upon when making any investment decision. Past performance is not indicative of future results.

DeFi is a darling of the crypto world, and of developers. Many of the most valuable projects launched this year were from DeFi. Despite that, it’s still tiny — about 2% of the estimated market cap of the rest of crypto.

In our view, this is good news for DeFi. It’s discussed more loudly than is merited based on its current overall market value, but we believe that the reason for that increased public attention — the excitement felt by many technologists over the potential of this growing sector — is a positive sign of its progress.

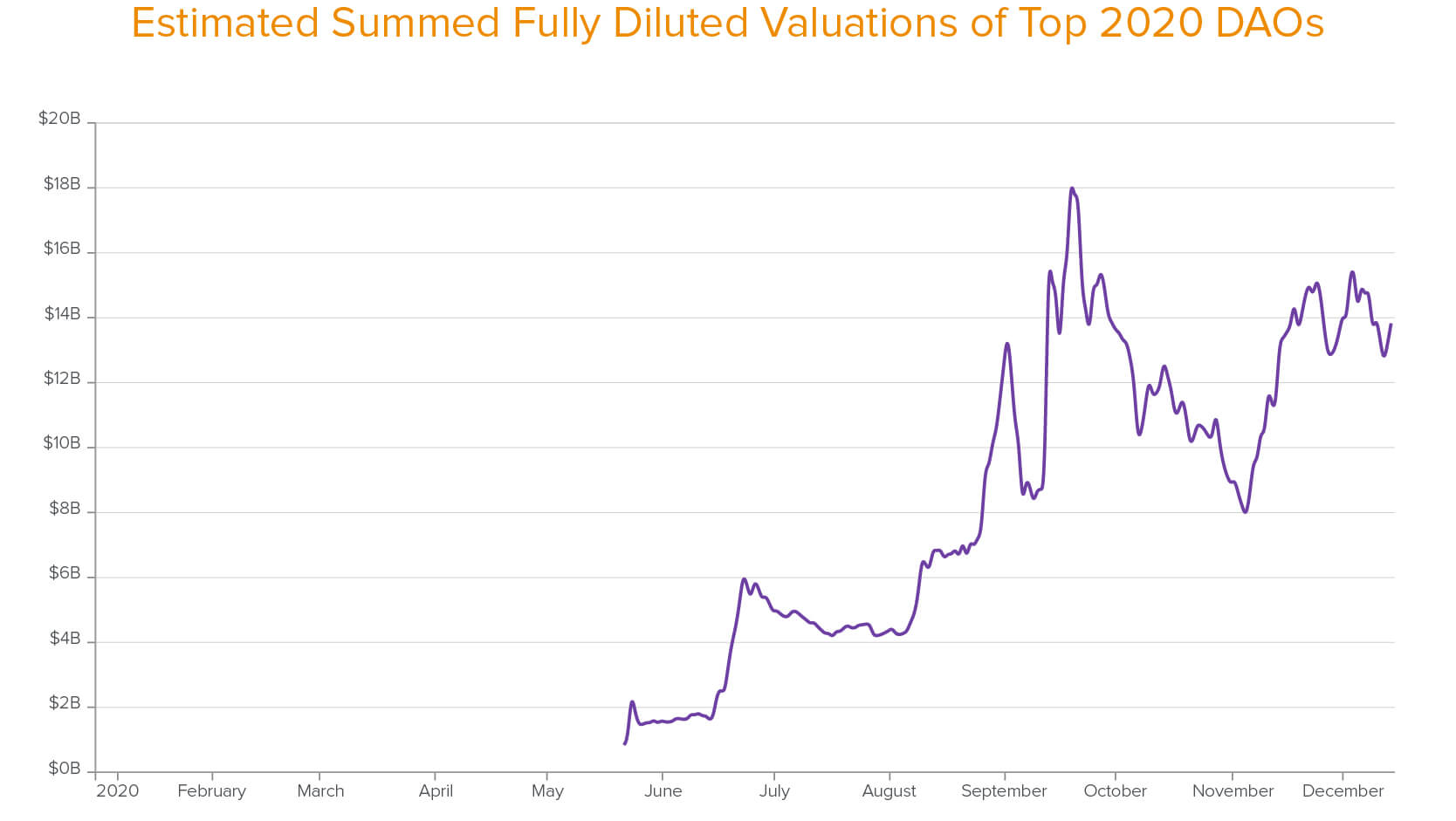

DECENTRALIZED AUTONOMOUS ORGS

Source: CoinGecko. Estimated combined fully diluted market capitalization of all projects that have fully launched and decentralized in 2020, using the top 150 tokens by market capitalization as a starting list. Charts provided herein are for informational purposes only and should not be relied upon when making any investment decision. Past performance is not indicative of future results.

The concept of a DAO (decentralized autonomous organization) has been in crypto for a while, but this is the first year it’s become the norm for new protocols. The top 12 new DAOs in 2020 have a combined fully diluted market capitalization of about $14 billion.

DAOs are really interesting not just because they’re valuable now, but because they’re also a new kind of institution.

People, many anonymously, are gathering online to debate and vote to change software that technically requires a vote to change. They’re changing parameters and updating protocols that they all own a part of. Some bought in, and some earned their share through their contributions.

These new DAOs have fees, or options to collect fees. And they have clear monetization plans. People used to talk a lot last year and the year before about how crypto assets don’t have fundamentals. How do you price them?

If you look at the top DAOs, most have fundamentals now. What are the potential or actual protocol fees over the fully diluted market capitalization? You can calculate this using purely on-chain data. But they’re not corporations. Corporation is not the right word. For these entities, the code is the law. Anyone in the world can be in them or earn a part of them. There are no employees or offices — just the community and contributors and the software.

DAOs are protocols, that’s true, but they’re not just protocols. They’ve been democratized. They’re governed by their communities, and those people have expectations, they vote, and they own it. They’re collaborating with people they’ve never met, on systems that hold and move billions of dollars of value. There must be another word for this community-owned and operated software.

Well, that word is DAO. That’s the word for that thing. And they represent a new kind of structure that exists now.