Introducing usage-based pricing requires a fundamental mindset shift away from securing cash up front and toward providing value so your customers consume more.

But too often, I see GTM leaders hit their customers with overages as a way to get those customers to commit to higher spends up front—which gives the vendor more predictable revenue streams and a reliable way to upsell existing accounts.

But using overages to secure your own revenue streams as a vendor comes at a cost for your customers. The point of usage-based pricing is to create a great experience that encourages your customers to consume, but overages slow down that seamless adoption and usage experience. Think about it: you’re penalizing your customers for buying more. This friction can significantly damage your relationship with your customers, making it much harder to renew, let alone expand, them down the road.

While some usage-based businesses might need to use overages as a stick to get more cash upfront (like SaaS providers who need to purchase cloud compute, for instance), many others can generate more revenue by removing that friction and tiering pricing for how their customers want to consume.

The problem with overages

Here’s how I usually see overages cause friction.

Say I’m a champion of service A. I’m paying as I go and I’m increasing my usage. Then I get a call from my rep and they tell me, “Hey, we’ve got a better deal for you: commit to $1M of consumption up front and you get a 20% discount.” I go back to my boss and say: “we’re definitely going to consume at least this amount of credits this year, so if you give me the budget to buy $1M of consumption, I’m going to save the company $200K.” I’m a hero.

But if I over-consume, service A hits me with an overage. This might happen at the end of my contract or, even worse, halfway through it. Now, I have to go back to my boss and say: “I burned through that $1M you gave me, but it’s not my fault. The business is doing so well!” And my boss says: “now I’ve got to come up with more money! Tell that service to go take a hike, we’ll just consume as we go.” And I say: “we’re actually now in overage territory. If we consume as we go, we’ll end up paying $2M instead of an extra $1M to them.” So my boss finds money from somewhere else and tells me that this should never happen again. I get the budget, but people up the line from me probably start looking at other companies that offer the same service but cheaper. (This is how new upstart companies get in, by the way.)

Champion: burned. Try circling back to them for a renewal or upsell and tell me how it goes.

Tier pricing for how your customers want to spend

Instead, when it comes to usage-based pricing, consider adopting a “more carrots, less stick” approach.

If your customers want to commit upfront, let them. There are actually a lot of reasons that customers would want to lock in a given spend. Maybe they’re confident in their usage forecast, maybe their procurement team wants a tighter hold on spend, or maybe they don’t want to have a large amount of cash parked on their balance sheets. Whatever it is, if your customers still want to pay up front and lock in a lower price, it’s wise to keep that option on the table. And if they don’t want to commit, don’t make them.

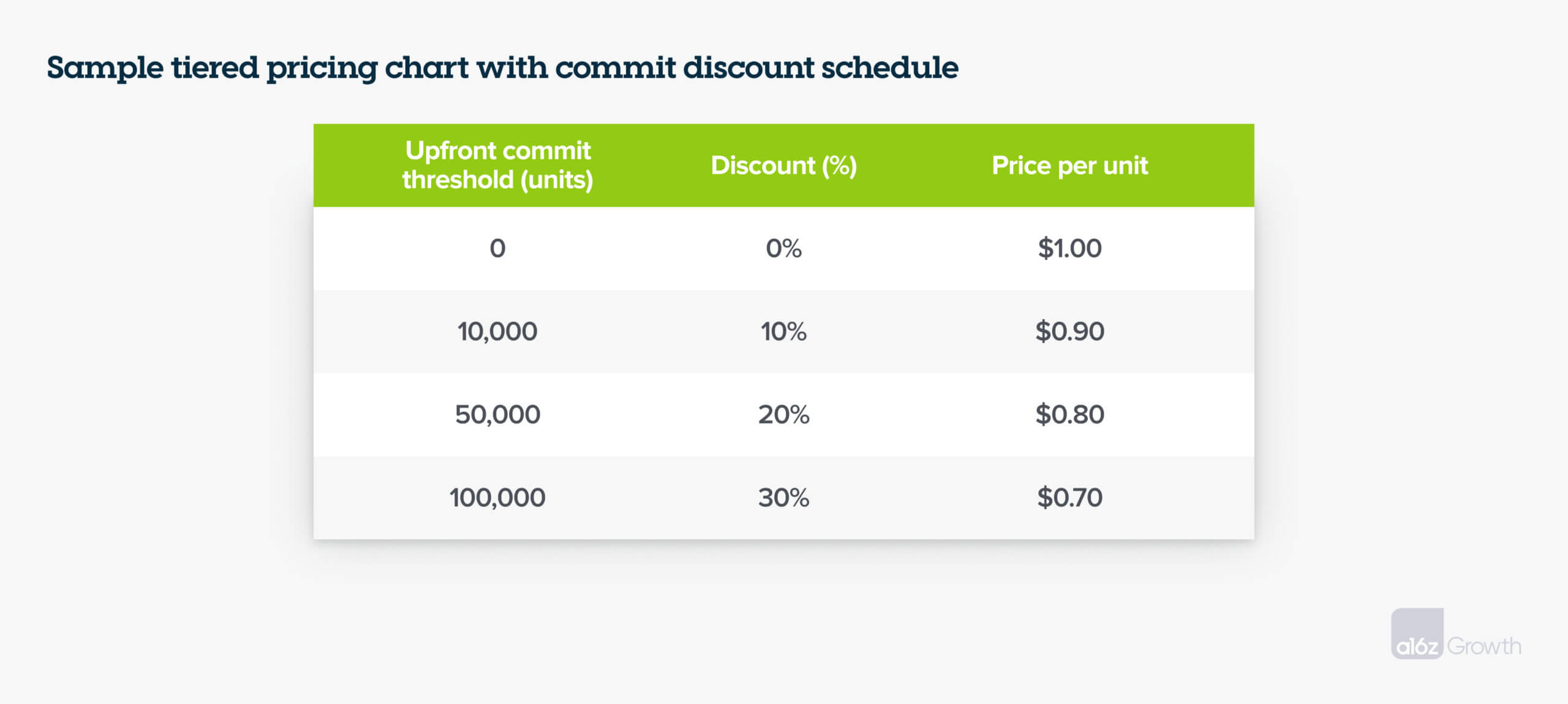

This is where I’ve seen tiered pricing that offers progressive discounts for increasing levels of commits work extremely well. In this pricing scheme, customers either pay as they go or pre-purchase usage that they can burn down at a better per-unit rate.

Now, we often see companies revert customers to pay-as-you-go once they burn through their commits (as in the scenario I outlined in the previous section). But for many companies, it could be wise to keep those customers consuming at that same discount rate after they’ve burned down their credits or commit to a higher tier to unlock a bigger discount.

Or, if you have customers with incredibly unpredictable spikes in usage that are difficult to forecast (like a media company), you can offer your customers a progressive discount schedule with even lower rates. For instance, in the pricing schedule above, if a customer purchased 50,000 units at a $0.80 per-unit rate and burned through all of those units, their incremental consumption (51,000+ units) would be billed at a per-unit rate of $0.70/unit instead of $0.80/unit. Customers can also buy more units at any time and get better discounts, and if they fall between tiers, your sales reps can work with them to find a good discount schedule.

The visibility and transparency of tiered pricing keeps everyone aligned. For those customers who are more confident in their forecasts and are willing to commit upfront, they enjoy slightly better economics. And for those who are less confident, you’re still giving them the option to start small and scale up their usage. By making your pricing as transparent and flexible as possible, you make it much easier for your customers to consume, you maintain your relationships, and you generate more revenue.

Of course, removing overages raises the question of how you, as a provider, can accurately predict your revenue streams. This pricing structure also changes the role of enterprise sales. Reps become more focused on getting customers onboarded and using the product, ensuring that the product addresses their use cases, and then doing the hard work of leveraging those champions to find other potential use cases in the organization so they can expand outwards. Reconfiguring your sales team to focus on making your customers successful raises a host of questions about the role of sales in usage-based pricing and how to compensate your teams—issues we’ll touch on in a future post.

A special thanks to Tugce Erten and Mark Regan for their contributions to this post.