There’s long been chatter about the analogies between financial services and healthcare. Both are massive, regulated markets with technological adoption challenges, legacy oligopolies, and tons of customer pain—and even fear! Both exhibit opportunities at the data and infrastructure layer, as well as in new B2C and B2B products.

But most of the wildly successful fintech companies haven’t done much in the healthcare sector. Why? The unique laws of physics of our $4 trillion healthcare system, primarily a result of third-party payor (e.g. insurance carriers, self-funded employers, and government entities) and esoteric regulatory dynamics, make healthcare a hard market for a generalist company to go after. For this reason, our bet is that dedicated, healthcare-specific fintech companies will win in this space—although many lessons learned from general fintech can certainly be applied.

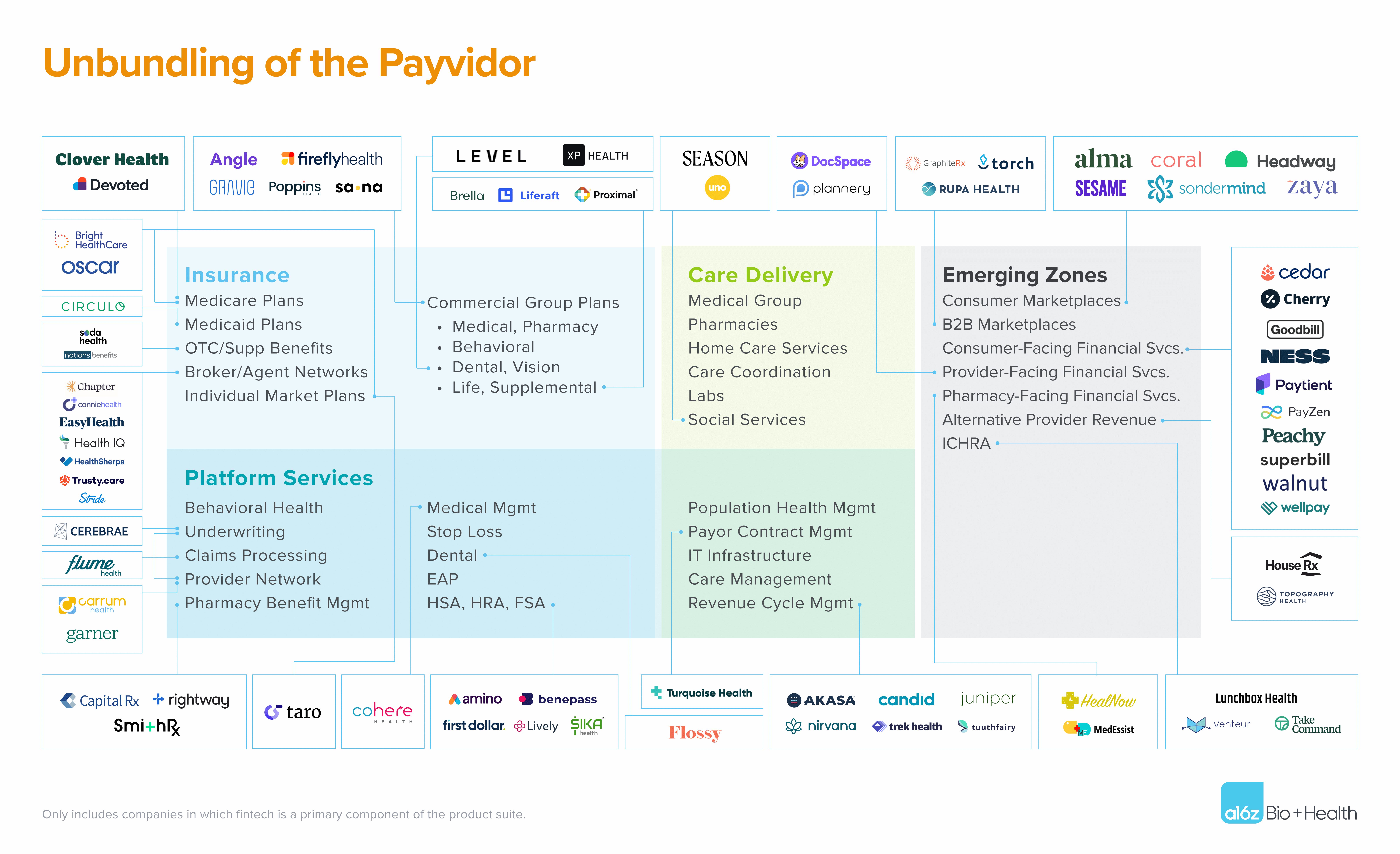

What big, hairy problems could these vertical-specific fintechs tackle? One way to answer this question is to look at the most important incumbents in healthcare financial services, and unbundle their components to identify opportunities for substantive improvement and areas of unmet need.

The biggest healthcare fintech incumbent is UnitedHealth Group (UHG), a Fortune 5 company with nearly 15% share in the U.S. health insurance market—a large share for such a fragmented market. UHG, also the largest single provider of care delivery services in the country, is a combined payor and provider, or “payvidor,” as are its peers, Anthem, CVS/Aetna, Cigna, Humana, and Centene. Together, as of May 2022, these 6 entities represent nearly $1 trillion in market cap. Even more remarkably, all except CVS have risen in market cap in the last 4 months, even as much of the stock market has fallen precipitously.

The fintech components of a payvidor

Despite the financial success and scale of these payvidors, their consumer- and provider- facing experiences remain frustratingly dated, opaque, and inefficient. Thus, upstarts have found opportunities to pick off and go after specific pieces of the payvidor services map with an aim to outperform on experience, performance, and cost structure, focusing on the following core components:

Insurance products

The bulk of payvidors’ revenue comes from health insurance products, including Medicare, Medicaid, employer (group), and individual health plans. The total addressable market (TAM) in health insurance is immense—over 90% of Americans have some form of health insurance, and segments like Medicare Advantage and individual ACA plans are growing at nearly 10% and 21%, respectively.

But, despite their prevalence, legacy insurance products are far from consumer-centric or user friendly: The average NPS among the six payvidors mentioned above is a measly 9 on a 100-point scale, and the experiences of healthcare providers who contract with and get paid by these insurance companies is typically equally dismal.

Companies aiming to address the shortcomings of insurance products have to be very deliberate about the initial build required to launch a viable solution; state and federal regulations can be strict, necessitating licensure and non-trivial capital reserves to launch a health plan. We also believe that a modern health insurance business that lacks core competencies in value-based care delivery will find it challenging to drive strong unit economics over time, so having a strong clinical muscle is key as well. At the same time, tech-first approaches have the opportunity to create significant leverage by lowering costs via automation of administrative tasks and enabling more efficient provider and member engagement.

Platform services

Most payvidors also offer a suite of commodified platform services to other payors and providers in the market (think Amazon Web Services)—for instance, outsourced underwriting, claims processing and provider network leasing. Many of the platform services offered by legacy payvidors are dependent on human labor, and also lack transparency and modularity for configuration (e.g. traditional lease-able provider networks are generally monolithic and opaque on pricing).

Digital-native companies have a leg up here in terms of being able to drive SaaS-like margins on their platform offerings. In turn, tech-enabled approaches to direct contracts, real-time payments, and closed loop referrals have the potential to significantly improve both unit economics and quality of experience for their end users.

Care delivery services

Big payvidors like UHG have integrated care delivery services into their chassis—a strategic move intended to provide greater control over medical costs and diversification beyond traditional insurance margin streams. This creates a fintech opportunity for financial services integrated into provider groups, whether related to driving higher yield on collections, or enabling value-based contracting with payors. As we’ve discussed before, entering into risk-based contracts requires purpose-built tech, underwriting, and risk management competencies, and can help practices move from transactional payments with long lead times on collection, to more resilient recurring revenue streams. It’s worth noting that these days, most incumbent payvidors view their platform and care delivery services business units as major growth drivers, if only for the simple reason that those businesses can access the full population of insured lives in the country (and globally in some instances), rather than being limited to the members of their in-house health plans.

It’s worth noting that these days, most incumbent payvidors view their platform and care delivery services business units as major growth drivers, if only for the simple reason that those businesses can access the full population of insured lives in the country (and globally in some instances), rather than being limited to the members of their in-house health plans.

In addition to unbundling the components of the payvidor stack, some upstarts are coming to market as full payvidors themselves, with modern tech platforms intended to drive superior scale, speed, and monetization. The first generation of these companies built most of their infrastructure from scratch, raising significant capital just to get to the starting line. Today, however, with more insurance infrastructure companies out there (see map above), new payvidors can focus on accelerating their time to market with differentiated provider- and consumer-facing services. So there’s a significant flywheel effect where the unbundling of payvidors actually enables the creation of new and better payvidors.

Emerging areas

Then, there are emerging spaces where legacy payvidors do not offer purpose-built solutions, and that are ripe for startup-driven innovation. These exist where novel business and risk-bearing models are gaining adoption (and thus legacy infrastructure is ill-suited), or where consumers are driving new purchasing behaviors due to their increasing role as payors themselves. A subset of these opportunities includes the following:

Enabling alternative revenue for providers

Between the chaos of the pandemic and a slow culture shift toward value-based care, many providers want to improve the resilience of their payment flows by diversifying away from purely fee-for-service, clinical revenue. Examples of fintech-oriented solutions include turnkey integration of new service lines like pharmacy, and assistance for provider practices seeking to conduct research to generate revenue from running clinical trials. Companies playing in these spaces can offer provider practices more predictable revenue by streamlining their billing processes, financing vehicles, and payments processing related to these ancillary services.

Modern third-party administrators (TPA)

Traditional payors often serve as TPAs in administrative services only, or “ASO”, arrangements, enabling self-funded employers to manage their own employee healthcare coverage. Tech-enabling and automating existing TPA capabilities in and of itself is an opportunity. Further, given the explosion of virtual-first clinics, TPAs increasingly will need to be able to price and contract with digital health companies, which may require different payment capabilities than with legacy provider networks. Finally, modern TPAs have the opportunity to implement consumer-facing virtual wallets that serve as an abstraction layer across multiple financial coverage sources (e.g. HSA, HRA, core medical benefits, BNPL services, or out-of-pocket) to streamline the consumer’s financial experience.

Marketplaces with integrated fintech

Many companies have tried to create consumer marketplaces for healthcare services that tie in navigation and payments, but most have failed to facilitate a true end-to-end consumer experience with high levels of supply-side liquidity. We are optimistic that these “healthcare superapps” are finally on the horizon, given the rise of providers that offer upfront price certainty, increasing numbers of APIs for tapping into a patient’s insurance benefits, novel point-of-care financing solutions, and modern efforts to streamline appointment booking across comprehensive provider networks. We’ve already seen models like this start to emerge in specific specialty areas like psychotherapy and women’s health.

Portable healthcare coverage

For those age 28 to age 34, the median employment tenure is 2.8 years, making it difficult for plan sponsors (e.g. employers, carriers) to take a long view on preventative health investments, and making it difficult for consumers to have longitudinal consistency in how they interface with and pay for healthcare services. We’re keen to see companies figure out how to build a consumer-centric abstraction layer that follows the individual across multiple health plans—and perhaps leverage the ICHRA (individual coverage health reimbursement arrangements) construct to operationalize. This same logic applies to any healthcare financing services distributed through employers that facilitate loan repayments through direct paycheck debit.

Principles for building in the next era of healthcare fintech

As our partner Alex Rampell says, “the primary battle between every startup and incumbent is whether the startup gets distribution before the incumbent gets innovation.” That adage certainly applies here. Can healthcare fintech upstarts achieve scale in distribution with their new solutions faster than incumbent payvidors can create me-too products for their well-established sales channels?

Critical to distribution scale is the upstarts’ ability to both pick and win at a solid initial wedge product, then rapidly launch adjacent products to diversify revenue and margin over time. For instance, in the first generation of general consumer fintech, high customer acquisition costs (CAC) for point solutions ultimately led unbundled startups to have to rebundle into full-stack neobanks to take advantage of cross-sell leverage within a captive customer base. Fintech companies with wide user funnels and near 100% approval rates for lending and credit products, along with a high frequency wedge (e.g. checking accounts versus term loans), also earned an edge over competitors. In healthcare fintech, we foresee a similar dynamic, with point solutions likely to evolve into either an insurance product with comprehensive medical and pharmacy benefits, a fintech-enabled marketplace, or a comprehensive infrastructure platform to maintain durability of engagement and favorable unit economics.

Also key to the long-term sustainability of startups is pragmatism about how fast (or slow) regulatory change may occur. For example, we see a lot of energy around the “Plaid for healthcare” concept, representing the opportunity to build an interoperability network for data sharing, which is necessary to power many of these new healthcare fintech products. While we certainly believe in the merits of leaning into regulatory tailwinds for category creation opportunities, founders should look to derisk data acquisition and interoperability without necessarily waiting for a government-driven solution to be fully implemented. While we do see a future where regulatory changes are operationalized industry-wide, entrepreneurs figuring out ways to bootstrap data acquisition pipes are likely to see a faster path to value in the near term.

Non-healthcare fintech products can teach us numerous other lessons. For instance, operating directly in the payments flow is fundamentally more strategic than being a read-only directory service. In a healthcare context, this could look like a barebones navigation solution as compared to a navigation solution that also facilitates the consumer’s ability to access financing for those healthcare services. Another example: issuing cards, factoring, and processing payments generate a fundamentally deeper level of insight and embedded relationship with parties on both sides of the transaction, not to mention low-friction revenue streams from interchange and other transaction-driven take rates. Finally, like we’ve seen in the fintech-plus-vertical-SaaS movement across other industries, becoming the system of record for a certain set of transactions or unique information sets can help streamline workflows for providers, but also positions the company to be able to embed payments and other financing products for their end customers.

Given the current pace of change with respect to new payment models, novel spending streams, and new competition for legacy payors from full-stack payvidors, the opportunities for building and growth in healthcare fintech are tremendous. The era of the “Big Payvidor” might not be over yet, but it’s certainly about to be unbundled.

-

Marc Andrusko is a partner at Andreessen Horowitz, where he focuses on B2B AI applications and fintech.

-

David Haber is a general partner at Andreessen Horowitz, where he focuses on technology investments in B2B software and financial services.

-

Daisy Wolf is an investing partner on the Bio + Health team, focused on consumer health, the intersection of healthcare and fintech, and healthcare software.

-

Julie Yoo is a general partner on the Bio + Health team, where she leads investments into companies that are transforming how we access, pay for, and experience healthcare.