When I got into growth investing, tech companies were a niche asset class in both the public and private markets. Today, technology has eaten everything, technology companies are the fastest growing among any sector, and the fastest growth in technology has stayed mostly behind the private‑market curtain. Private tech companies valued above $1B (~1,300 companies) now represent roughly $4.7T1 in aggregate value—about ~15%2 of the entire Nasdaq market cap, and closer to ~40% if you exclude the Magnificent 7. The Mag 7 in the public markets get the attention they deserve, but in the private markets over the last 10 years, the value of these private tech companies has grown almost 10x.3 By count, there are ~6x more private unicorns than public companies with a $1B+ market cap. In other words, there’s an enormous investable universe that public‑only investors don’t see.

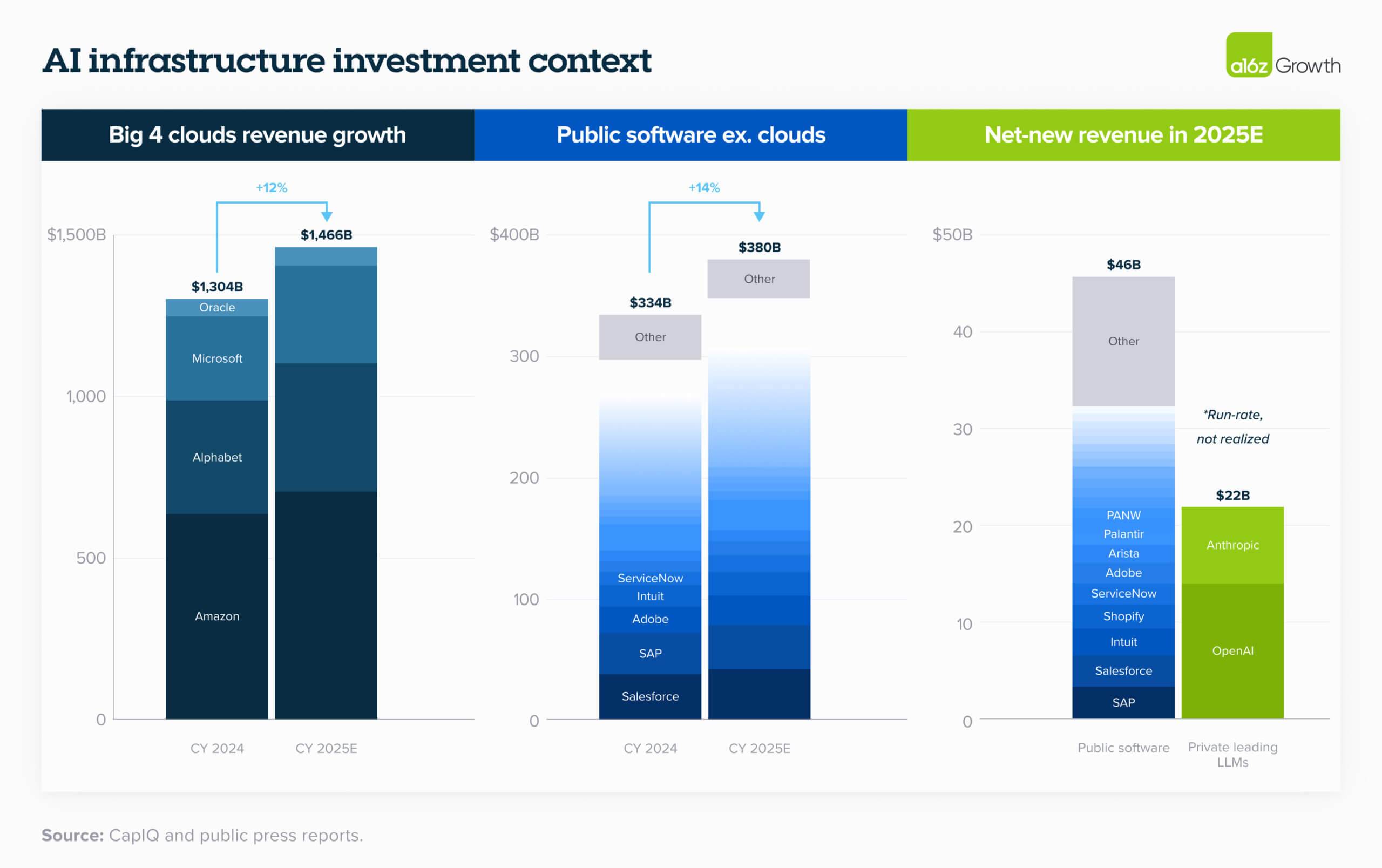

The composition of the public markets is affected by this trend. Across public software, internet, and fintech, there are fewer than 5 companies expected to grow at over 30% in 2026. Whereas in just the last year, we’ve seen over 100 series B or later rounds for companies growing well in excess of 30%. We estimate that OpenAI and Anthropic alone are adding almost half as much new revenue this year as all of the public SaaS universe, excluding the Mag 7.

And it’s not just AI. SpaceX, Anduril, and Palantir (albeit public) are now adding billions of net-new revenue every year while the large defense primes grow at low-to-mid single digits. Obviously, as a growth-stage investor, I was excited to see these stats. But I think it’s also important for investors to 1) understand how drastically the composition of the public and private markets has changed, and 2) recognize that today, the top decile of high-growth companies are almost exclusively in the private markets.

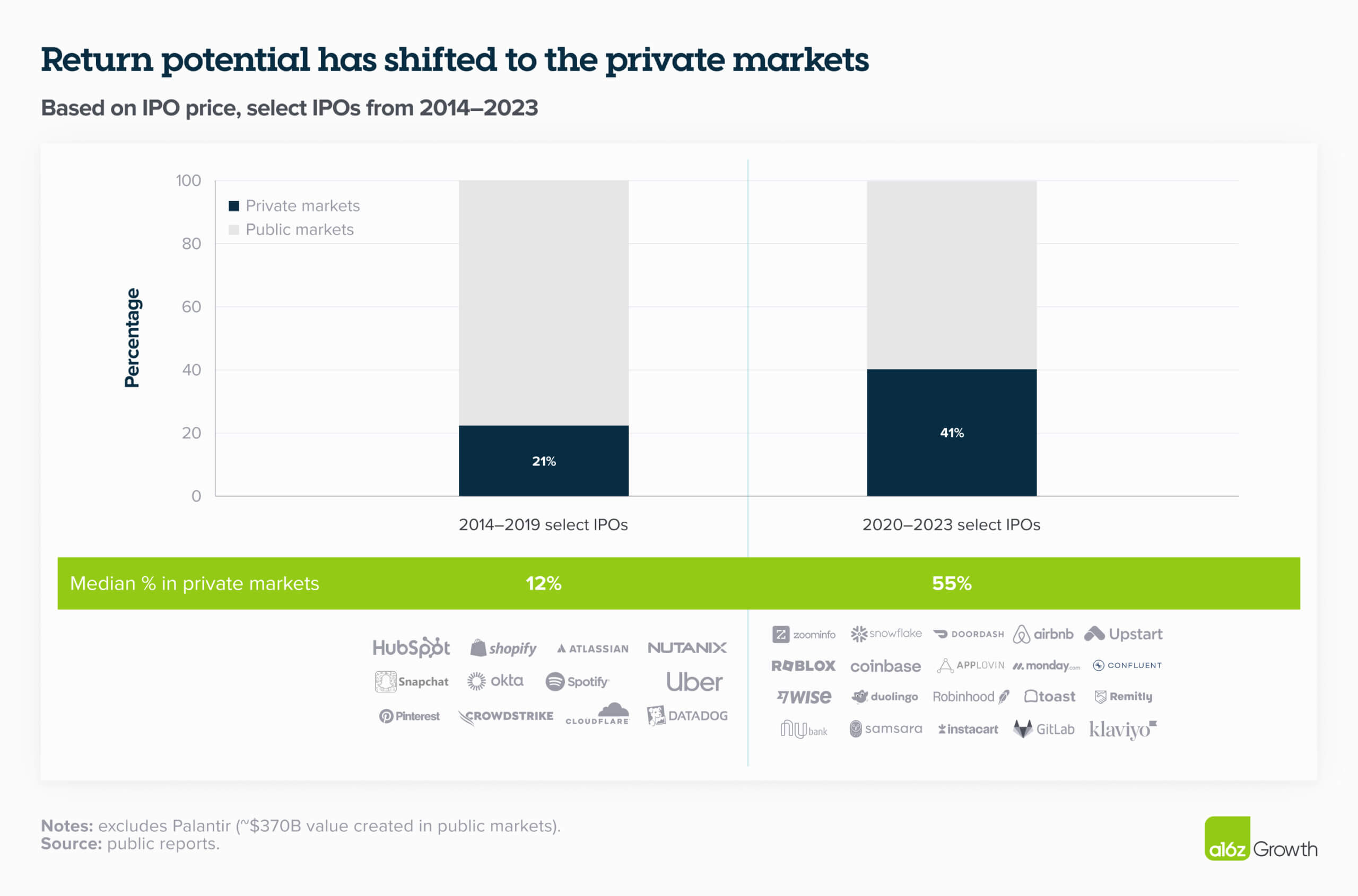

In addition to the current crop of private companies staying private for longer, the cohort of IPOs of the last 5 years demonstrate that the majority of the value creation has happened in the private markets. Companies used to go public much earlier in their growth journey and generate tremendous equity value once public. The median company in the crop of 2014–2019 IPOs, for example, generated 80%+ of their market capitalization after becoming public companies. The more recent cohort, however, went public after already capturing a higher portion of their market opportunity in the private markets. Combined with the fact that they IPO’d at valuations that appropriately reflected their long-term potential—and with the caveat that they’ve been public for a shorter amount of time—these companies generated over 50% of their market capitalization when they were private.

Why has this happened? There’s enough private capital and adequate capital solutions for the best companies like SpaceX, OpenAI, xAI, Databricks, Stripe, Anduril, and Revolut in the private markets, so it’s no surprise the median company IPO’ing now does so 14 years after founding, versus 5 years after founding 20 years ago. There are a ton of benefits to going public—like gaining easier access to liquidity, more liquid compensation for employees and new hires, better positioning your company for M&A, extending ownership to your community, and more—but companies can also obviously stay private longer.

Tech has added ~$25–30T in market cap over the last 10 years and ~$10T excluding the Mag 7. The next decade of value creation will likely come from 2015–2025 vintage companies—most of which are still private today. I think AI is going to widen the gap even further…but more on that front soon.