Multifamily real estate in the U.S., which includes apartment buildings, condominiums, townhouses, and mixed-use developments, is one of the largest asset classes in the world. Approximately 44 million residences are considered multifamily, and they account for 31% of all U.S. housing. Unlike single-family homes, multifamily homes are primarily owned by institutional owners and investors, as opposed to mom-and-pop landlords, and most take advantage of software to run their properties. Specifically, most multifamily owners and operators rely on a property management system (PMS) to process and account for the rent roll — the lifeblood of any property.

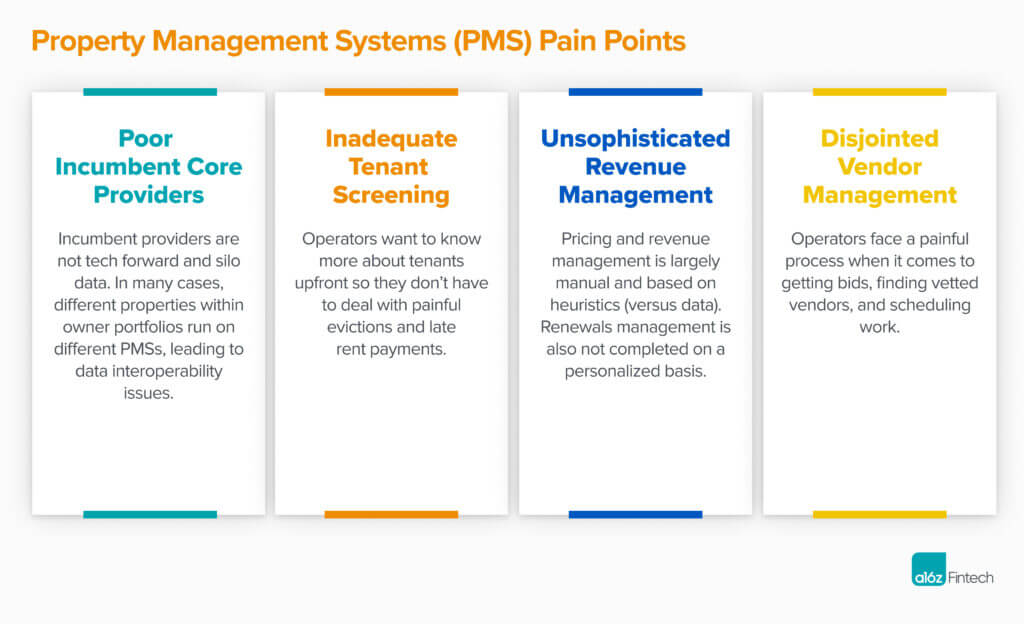

In addition to using a PMS as their primary operating system, most institutional owners and operators can now layer any number of new startup point solutions on top of their PMS to help them attract, engage, and screen tenants, and to manage maintenance requests and vendor coordination. However, even with all this new software, owners and operators are still dealing with several major pain points:

The primary issue is that incumbent property management systems like Yardi, Appfolio, MRI, and RealPage are legacy products that do not meet the needs of modern owners and operators. Instead, these existing PMSs silo data (creating extra hours of extraction work), lack interoperability, and often require customers to build custom software because many of their products still run on DOS, for example.

The primary issue is that incumbent property management systems like Yardi, Appfolio, MRI, and RealPage are legacy products that do not meet the needs of modern owners and operators. Instead, these existing PMSs silo data (creating extra hours of extraction work), lack interoperability, and often require customers to build custom software because many of their products still run on DOS, for example.

However, these platforms are systems of record, and thus incredibly sticky. They have also acquired previous generations of startups, allowing them to tack point solutions on top of rent roll processing. This in turn lets them offer out-of-the-box solutions to existing customers for free (putting newer, tech-forward point solutions at a disadvantage). Even though the PMS’ internal products pale in comparison to newer offerings, software expenses at the property level are intensely scrutinized, causing most owners and operators to choose the cheaper, more convenient option. This incumbent distribution vs. startup innovation dilemma has capped the value of point solutions historically.

That being said, we believe there are several catalysts and tailwinds that are driving the need for more software in the industry. If these new products can provide extraordinarily new capabilities that improve upon PMS platforms’ internal legacy solutions or are net-new improvements, they have the potential to become as valuable as these core systems.

TABLE OF CONTENTS

TABLE OF CONTENTS

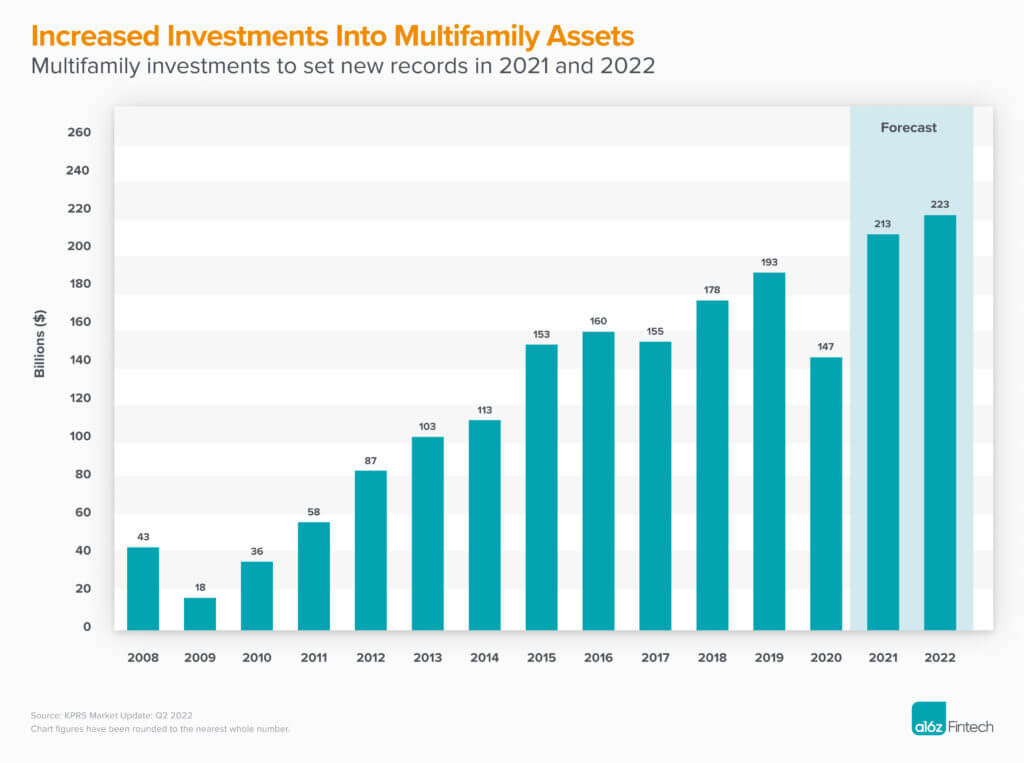

On a macro level, we believe institutional investment into the multifamily industry will continue to grow significantly over the next several years, even if there is near-term market volatility with investors looking for liquidity. As more offices embrace a hybrid work model post-Covid, investors who historically only focused on office real estate are moving into multifamily. We’ve also seen a flight to safety into multifamily by institutional investors whose focus has shifted to investing in single-family rentals (SFR) over the last decade. As more institutional investors emerge, so do more potential software buyers who want to more efficiently manage their properties.

Additionally, the tightness of the U.S. labor market is a boon for software companies looking to build products to replace the task-based work (e.g., tenant screening, which can take over three hours per applicant) previously done by back-office employees who have left the labor force.

On a micro level, limited partners (LPs) are increasingly pressuring general partners (GPs) to more efficiently manage their properties; this creates opportunities for new “property-management-in-a-box” type solutions for owners. Additionally, small and medium-sized business (SMB) operators (i.e., those that operate under 30,000 units) are increasingly being consolidated into larger companies, which are in turn being run more like franchises where regional heads make decisions. And finally, between marketing leads, tenant engagement, amenity usage, payment timeliness, etc., more data than ever now exists to help companies drive efficiencies, and firms should use this wealth of data to improve net operating income in existing portfolios given this challenging market environment.

TABLE OF CONTENTS

TABLE OF CONTENTS

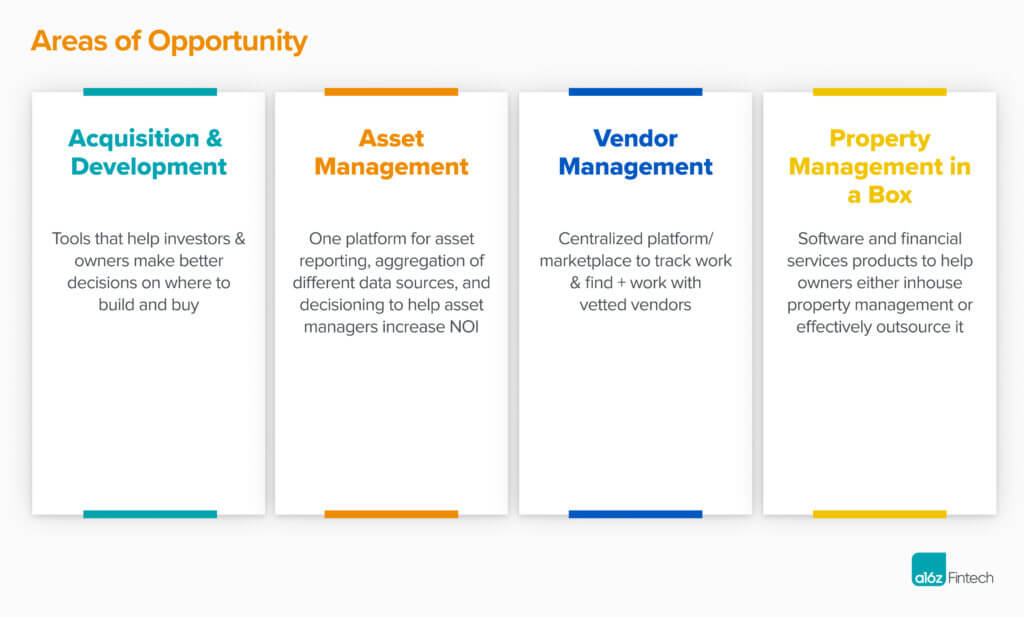

Given these macro and micro catalysts, we see several areas of opportunity for founders looking to build software for the multifamily real estate industry.

We believe startups operating in the acquisition and development category will need to use proprietary data sources as a wedge into the industry, so they can help investors and owners make better decisions on where to invest, what types of properties to buy (i.e., Apartment Multifamily vs. Scattered Site Multifamily), how much to pay, what zoning precedents allow them to build on site (i.e., how many units to build), and more. However, they cannot only rely on surfacing new opportunities for customers, as this type of data can often be commoditized away. In order to generate significant value, startups in this category will need to become some type of operating system that manages how these firms make investing decisions end-to-end. The good news is that we see the highest propensity to pay for software in this category.

Today, most asset management divisions for large multifamily owners and investors manually pull reports from the various PMSs their end properties run on to understand how their assets are performing. Often, everyone from an entry-level analyst all the way up to the heads of these groups, are manually searching these reports for errors and reconciling the data between how the different PMSs label line items, which is a tremendous waste of man- and brain-power. We believe there is an opportunity to build a system of record of data that sits on top of these various PMS products. Given the increased transparency and interoperability of data that would be a byproduct of this product, we believe this would be a catalyst for increased innovation in the industry. The primary risk in this category is that it can be challenging to deliver an immediate return on investment (ROI) from day one, making it difficult to justify gathering this level of data in the first place.

Another critical function for multifamily operators is sourcing, procuring, and managing all of the third-party vendors they work with to service their buildings. For most operators, this process is entirely manual, with most of the process living in email and Excel. We believe this process should be digitized via software and employ a marketplace-like model to help both operators ensure they are finding the best vendors possible, and SMB vendors find new work opportunities. Startups operating in this category will need to find markets where there are both labor shortages and building density to create liquidity.

As LPs push GPs to get more transparency into property management, we see an opportunity for new platforms to help owners either bring property management in-house or more effectively hire outside managers. Their goal here is to have full visibility into property finances, leasing activity, maintenance activity and expenses, and more. Additionally, given the largest property managers are run like franchises, there may be an opportunity to help managers spin out on their own via business-in-a-box products that automate all of the back-office functions needed to do so. These products may also help managers match with owners via a marketplace.

TABLE OF CONTENTS

TABLE OF CONTENTS

As we explore this category, we have three principles that are guiding our investment framework:

First, we’d look for startups serving mid-market owners & operators (30k-100k units). This is because SMBs (i.e., those that serve under 30,000 units) in the industry are generally being consolidated away and often lack the resources to enact real change. On the other end of the spectrum, larger owners (i.e., those with over 100,000 units) are either extremely hard to sell into or are already using their own custom software.

Second, we’d look for companies that build products that deliver clear ROI from day one. A majority of operating expenses for owners are locked in for things like maintenance, utilities, etc.; they only have a tiny amount of budget for property-level expenses they can actually control. Thus, software providers need to deliver a clear ROI from day one so that they do not have a negative impact on net asset value (NAV). That said, if you can sell software and have the buyer not attribute it at the property level, but perhaps at the fund level (where that cost is spread out amongst many underlying properties), you may be able to get around this.

Third, we’d look for founders who can nurture a captive customer base startup. Multifamily real estate is still a fairly stodgy industry where the bottoms-up adoption of any new product will be difficult. Therefore, another path to success could be by developing a captive customer from day one, who can trial and expand software products throughout their entire property base. Companies that do this, however, will need to balance serving a singular, large customer who could act as a case study for others, with not becoming a services business that’s building custom software for said customer.

In summary, we believe the most value in the growing multifamily real estate industry will be created by startups that lead with software products, versus those that only rely on financial products. If you’re building in this category, we’d love to chat.