We’ve been in a bull market for enterprise software-as-a-service (SaaS) for over 11 years, and it has been all about growth. Not only has the number of SaaS companies exploded, but companies like Slack, Zoom, and Shopify have grown into multi-billion dollar public companies during this time.

But with COVID-19, many SaaS founders find themselves in the unchartered territory of running a business amid extreme economic uncertainty, so we’re hearing three big questions from SaaS founders:

- How will these macro events impact my business?

- Which metrics should I pay attention to?

- How do I plan for 2020?

We examined how SaaS businesses weathered the 2008 economic crisis, not to make market predictions, or to compare 2008 to today – the current situation is unprecedented (it is happening much faster and is a health as well as an economic crisis) – but to help SaaS companies know where to focus in hard times. For businesses that are already generating revenue and that have found product-market fit, leaders should prioritize retention, focus on profitable acquisition, and manage costs to preserve runway.

The short answer to the above questions: In a volatile market, SaaS businesses should focus on efficiency, before growth.

In a volatile market, SaaS businesses should focus on efficiency, before growth.SaaS in 2008-2011: efficiency, before growth

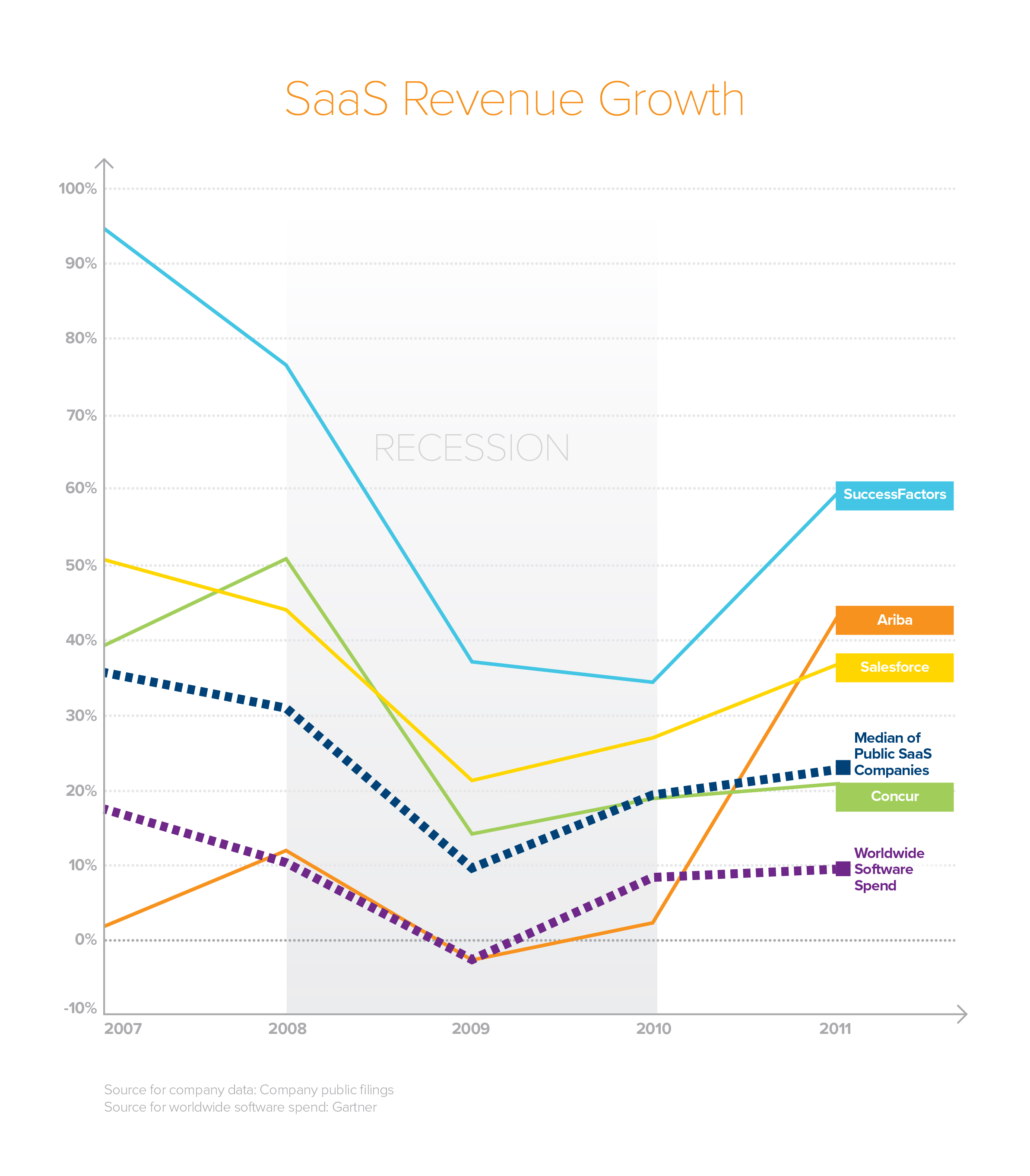

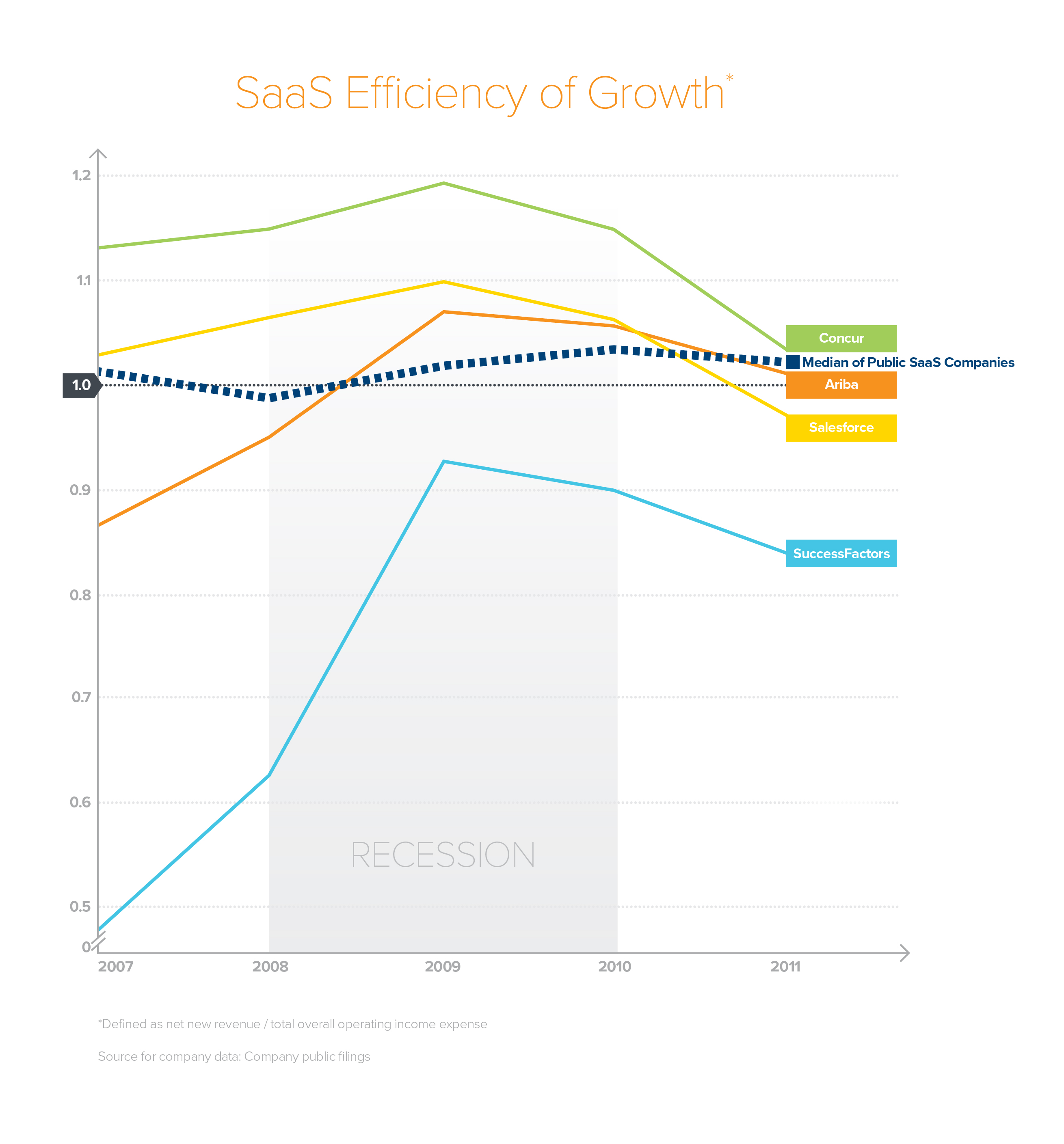

To understand how SaaS companies managed in the last economic downturn, we analyzed 18 public SaaS companies’ revenue growth and overall operating income burn from pre-recession 2007 through 2011. We then plotted the revenue growth and efficiency of growth for four of the most successful companies. Additionally, we have included the median trend line from all 18 of the companies that we looked at, as well as the trend line for worldwide software spend.

What we see: SaaS revenue was still growing, just more slowly, and SaaS companies were becoming more efficient.

Charts are for informational purposes only and should not be relied upon when making any investment decisions; past performance is no guarantee of future results.

As the first graph shows, SaaS growth slowed in 2009 – this is unsurprising, as software spending declined by 20+ percentage points in the previous three market crashes in 2009, 2000, and 1997. However, while total software spend declined, SaaS companies still grew in 2009. This growth is driven in part by the adoption of SaaS from on-premise software. The median SaaS company grew 10% in 2009, with only 4 companies (Ariba, SoundBite, Kenexa, and Dealertrack) declining in growth. Furthermore, their growth picked back up quickly, with median growth at 19% year-over-year in 2010, with an even sharper uptick in 2011.

Charts are for informational purposes only and should not be relied upon when making any investment decisions; past performance is no guarantee of future results.

What’s even more interesting to us, however, is the response to growth these companies took during the recession. Though growth slowed, these companies improved the efficiency of their growth (defined as net new revenue / total overall operating income expense), as shown in the second graph.

For every dollar of net revenue they earned, these companies spent less to get it. What’s more, many maintained their efficiency even when the market began to recover.

For every dollar of net revenue SaaS companies in 2008 earned, they spent less to get it. What’s more, many maintained their efficiency even when the market began to recover.The playbook for efficient growth

While our purpose in analyzing SaaS companies from 2008 is not to compare then to now, but to instead emphasize the importance of efficient growth rather than pure growth, here are the three things to focus on – and measure – for efficient growth.

1. Retention is first priority

In SaaS, but especially in times like these, existing customers are your life blood. The more that you can retain existing customers, the more predictable your revenue stream will be in the future.

To measure retention, look at gross retention (percentage of revenue from a customer segment that remains after 12 months, not including expansion) and net retention (percentage of revenue now received from a customer segment vs. 12 months, including expansion). When analyzing your retention, keep the following in mind:

- Churn will be higher for businesses that sell into SMB. When Workday went public in 2012, it only had around 325 customers and primarily sold to large global organizations with over 1000 employees. Today, many more SaaS companies target SMB businesses, whose churn could double in the near-term. We strongly believe a company with product-market fit in any customer segment can make it work, but founders should be prepared for the lower end to experience disproportionately higher churn.

- Proactively contact customers. All the typical customer success playbooks still apply and are more important than ever – conduct quality customer onboarding, make sure you have several advocates across the customer, frequently measure NPS, and quickly address any concerns. You will naturally have limited resources so segment your customers; focus high touch efforts on higher dollar accounts with stickier use cases, and leverage technology to reach the rest.

- Prepare for near-term downsell. Customers in many cases may be shrinking budgets or head count or both. Since most SaaS companies are priced per seat, customer contract sizes will likely get smaller. In the near-term, expect the downsell. In the long-term, keep your customers happy. When the market bounces back, so will your upsell (and revenue).

2. Efficient customer acquisition

Acquire customers that are quickly profitable.

Historically, you might have inched above the typically recommended 12-month CAC payback (i.e. customer acquisition cost payback – for every dollar spent on sales and marketing, how many months it takes to pay back through new revenue generated * your gross margin). Today you may want to tighten up acquisition spend and aim for a shorter CAC payback period so you acquire customers that help you generate cash.

Three additional points for thinking through customer acquisition:

- Use bottoms up for lower cost of acquisition – Even in this market, the innovation in go-to-market from field sales to inside sales to self-serve adoption has created meaningfully lower cost of customer acquisition. If you have strong bottoms-up adoption, you have an existing base of happy customers who could be convinced to pay for more. For instance, OpenDNS started in 2005 as a consumer business that monetized through ads, but in 2009, pivoted to selling into enterprises. With free users already embedded across a large number of enterprises, OpenDNS successfully mined that user base for two years and converted them into enterprise accounts before building out a full demand generation program once the trough of the recession had passed.

- Invest in customer acquisition in profitable customer segments – Segment your customer base by customer size (e.g. SMB, midmarket, enterprise) and/or industry end market (e.g. technology, travel). It is likely different segments have different customer acquisition costs. Deprioritize selling to higher churn segments (like SMB) or highly impacted sectors like travel and restaurants, when possible.

- Meet new customers where they are – Old marketing tactics like events, Facebook ads, and the like are unlikely to be as effective as before. Customer behavior has changed quickly, with remote work and decreased spending. Understand this new behavior and use it to experiment with new acquisition paths. For example, Zoom has removed meeting limits on video conferencing for all K-12 schools in the U.S.; Box has made its business edition free for 90 days for companies; and Atlassian is offering Jira and Confluence free to teams of 10 people or less.

3. Manage your runway

Goal #1 is to survive, so first and foremost, know your cash.

You can’t run your business and know how long you have unless you know what your actual cash balance is. That is, how much cash is in the bank – not what’s in an Excel sheet, not what is theoretically going to be collected – and how much you’re actually spending on a weekly and monthly basis. And once you know your cash, be realistic and take into account the cost of acquisition, increased churn, and downsell in your projections. Then plan for 24+ months of runway, including:

- Cut costs meaningfully – Optimize high fixed costs like office space and infrastructure costs like your Amazon Web Services or hosting instances, especially in light of the shift to remote work. People are the most valuable assets in any business, but you have to make sure you have a business to employ those people. For some companies, that will mean that you need to make cuts. If you have to make cuts, plan and manage them carefully and make sure the cuts are deep enough so you don’t have to do multiple rounds.

- Collect and manage accounts receivable – Calling your customers is not just best practice for investing in customer success, but is also important for clarity on if and when your customers will be able to pay, which will help you better understand your own cash flow situation.

- Restructure contracts for upfront payment or longer renewal periods – Discounting to incentivize customers is a natural inclination, but avoid giving large discounts, where possible, because it will be hard to raise your pricing later. The one tradeoff to consider: providing a small discount can provide a lever to extend a renewal period or restructure contracts to get cash upfront.

* * *

The recurring nature of subscription revenue makes business more predictable. This predictability helps founders to better prepare for market turmoil, and better forecast future revenue and cash.As a class of technology, it’s still very early days for SaaS. We are currently at only ~30% penetration for SaaS in total software spend, and ~6% penetration in cloud spend of total IT spend. Before this current crisis, SaaS was growing 16% year over year and projected to be a nearly $100B market globally in 2020.

SaaS has long been praised for having both an attractive infrastructure (a single code base to enable live updates to the product) and business (subscription revenue) model. In this period of economic turmoil, these can be even more advantageous – just imagine if a business were on-premise in a time where people are being asked to stay off premises!

The recurring nature of subscription revenue makes business more predictable. This predictability helps founders to better prepare for market turmoil, and better forecast future revenue and cash. Additionally, because SaaS is, by definition, hosted software (as a service), SaaS applications have become, for many of us, our new workplace as we shelter-at-home right now. While it’s still early days to make concrete predictions, it’s possible that we could see accelerated cloud/SaaS adoption as employees get used to “the new normal” of a distributed workforce and move further away from on-premise software. SaaS can rapidly – and almost immediately – iterate on the code base, providing much of the fabric for our new distributed work life. We hold meetings in Zoom, talk to colleagues on Slack, and collaborate in a myriad of other applications.

We believe in the SaaS business model, and believe that we still have many, many decades of building amazing SaaS companies. As we saw in the last recession, companies that focus on efficiency over growth are often able to weather the uncertainty. And they tend to come through with huge advantages – including grateful customers poised to reaccelerate their growth,– less competition, and a more efficient business poised for future growth.

—

image: Unsplash | Julian Vinci

ACKNOWLEDGEMENTS: Kristina Shen is our newest general partner, focused on enterprise SaaS and more. Prior to joining a16z, she was part of the Bessemer team that put together their annual “State of the Cloud,” which focused on the track record and signals for measuring the efficiency of SaaS companies.

SOURCES:

1) Gartner, “Gartner Market Databook, 4Q19 Update” (December 2019), “Gartner Market Databook, 4Q16 Update” (December 2016), and “Gartner Market Databook, 4Q13 Update” (September 2014). Growth rates calculated based on Gartner reported metrics.

2) Public company filings from Ariba, athenahealth, Blackbaud, Concur Technologies, Constant Contact, Dealertrack Technologies, DemandTec, Kenexa Corp, LivePerson, NetSuite, Rightnow Technologies, salesforce.com, SoundBite Communications, SuccessFactors, Taleo Corp, Vocus, The Ultimate Software Group, Zix Corporation. A note on attrition data: we included all public SaaS companies from this period, none of whom went out of business.

3) IDC, Worldwide Enterprise Application Spend by SaaS and On-Prem, 2013-2018.

4) Gartner, Worldwide Public Cloud Revenue (Nov 2019), Global IT Spending (Jan 2020).

5) Gartner

-

Kristina Shen is a former General Partner at Andreessen Horowitz where she focused on enterprise and SaaS investing.

-

Kimberly Tan is an investing partner at Andreessen Horowitz, where she focuses on SaaS and AI investments.