COVID is changing many things about the world. Some will be permanent, some will be temporary, but for most things, we simply don’t know yet. A decision framework I’ve been using when evaluating investments in companies has also proven to be useful for companies when they decide whether to radically alter course.

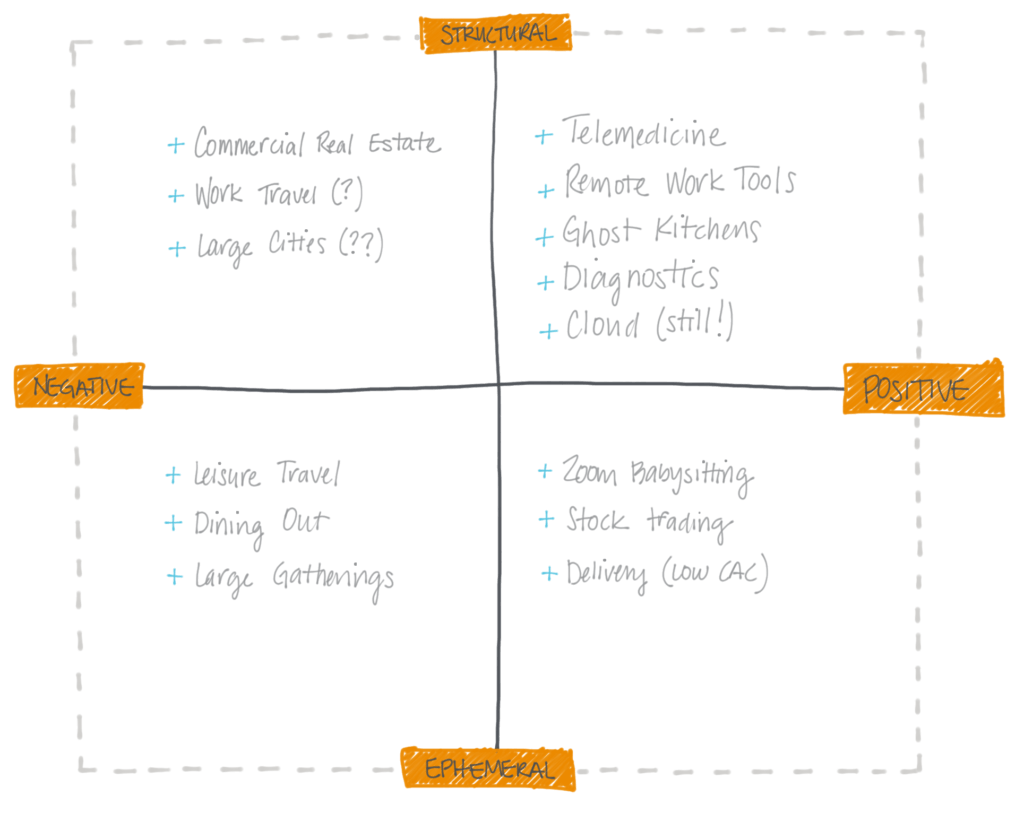

It’s easy to debate which might go in which bucket, but the best investments fall into two categories: structurally positive changes or ephemerally negative changes. Structurally positive means that something is 10x better, 1/10th the cost (roughly speaking on improvement and cost scale!), and has finally caught on—there’s no going back to the older, worse, more expensive alternative. For ephemerally negative changes, either sentiment has soured or consumption has been rendered logistically challenging, but there is a lot of latent consumer/business demand and, from an investment lens, durability to the business that ensures that when things resume, it will still soak up that demand.

The bad investments are ephemerally positive—that is, under the mistaken assumption that the euphoria for something temporary carries over into permanence—although ephemerally positive is also a potential bonanza in terms of free or cheap user acquisition. Think “one time boost” vs “changes all habits in perpetuity.” Think how many people downloaded a delivery app during COVID without any kind of advertising—that’s a free customer that will likely stick as a customer, even if they perhaps shop in stores again in the future when COVID is past us.

From a company’s perspective, it’s dangerous to get sucked into things that are ephemerally positive, since things are changing so quickly, but even more dangerous to ignore things that are structurally positive or structurally negative. The key is to make sure the cost structure is aligned to persevere past anything ephemerally negative and to invest in things that are truly structurally positive.