In the last 10 years, as neobanks emerged and consumer financial services came online, the prevailing assumption was that credit unions and community banks would slowly die off. How would a locally-focused, relationship-driven, branch-based banking model survive in the age of the internet?

But we believe credit unions’ perceived weakness could become their greatest strength, amplified by the internet. As tax-exempt, non-profit institutions with strong ties with their members, credit unions are well-positioned to retain ownership of consumer experiences and offer new and better products. And in the wake of COVID, as foot traffic to bank branches plummeted, credit unions have embraced digital experiences with a new sense of urgency. With a focus on tech and the right software tools, these long-tail banks have the opportunity to go from the providers of capital and regulatory “supply” to capture consumer “demand”—something that, to date, has been owned by fintechs.

In this post, we lay out the case for the market and regulatory forces that favor credit unions, as well as specific opportunities for innovative, digital-first credit unions.

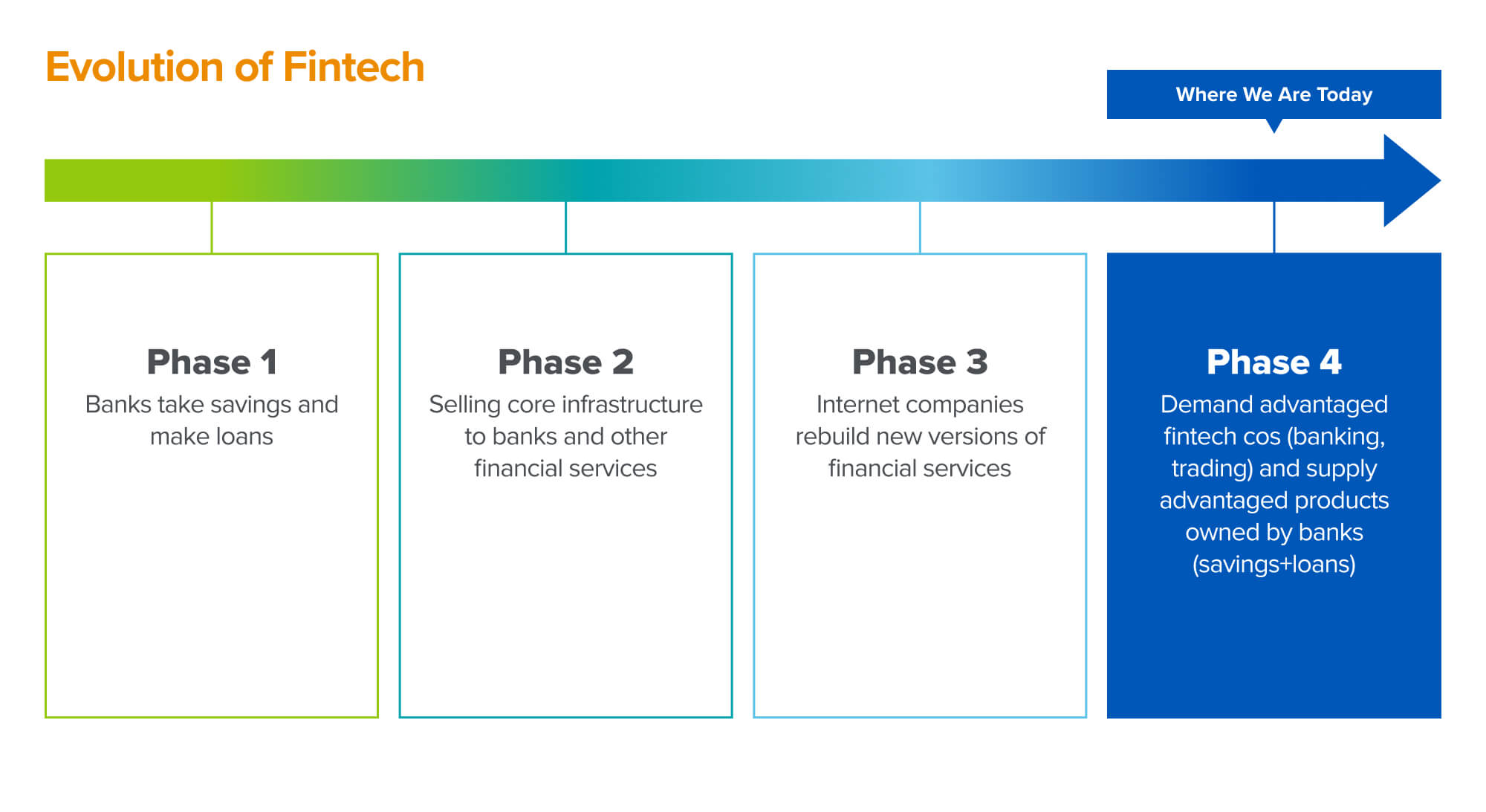

Dodd Frank, the Durbin Amendment, and the regulatory forces that evolved fintech

Several decades ago, the first iteration of fintech meant selling core infrastructure technology into banks to replace paper and pen-based functions. This “selling tech to fins” led to the emergence of companies like FIS and Fiserv. A little over 10 years ago, the emergence of mobile, along with the Dodd Frank Act, have led to a significant reconfiguration of the banking industry and emergence of fintech. The Durbin Amendment, which provided an exemption on interchange caps to banks with less than $10B in assets, such as small cap banks (colloquially called community banks, traditionally under $1B in assets and in counties with less than 50K residents) and credit unions (tax exempt entities owned by their members). These regulations positioned community banks and credit unions to power the new crop of neobanks and consumer financial companies as infrastructure and capital providers.

But in March 2020, COVID lockdowns shuttered branches of credit unions and community banks and catalyzed increased investment in digital experiences for their customers, opening new opportunities for both in a new phase of fintech.

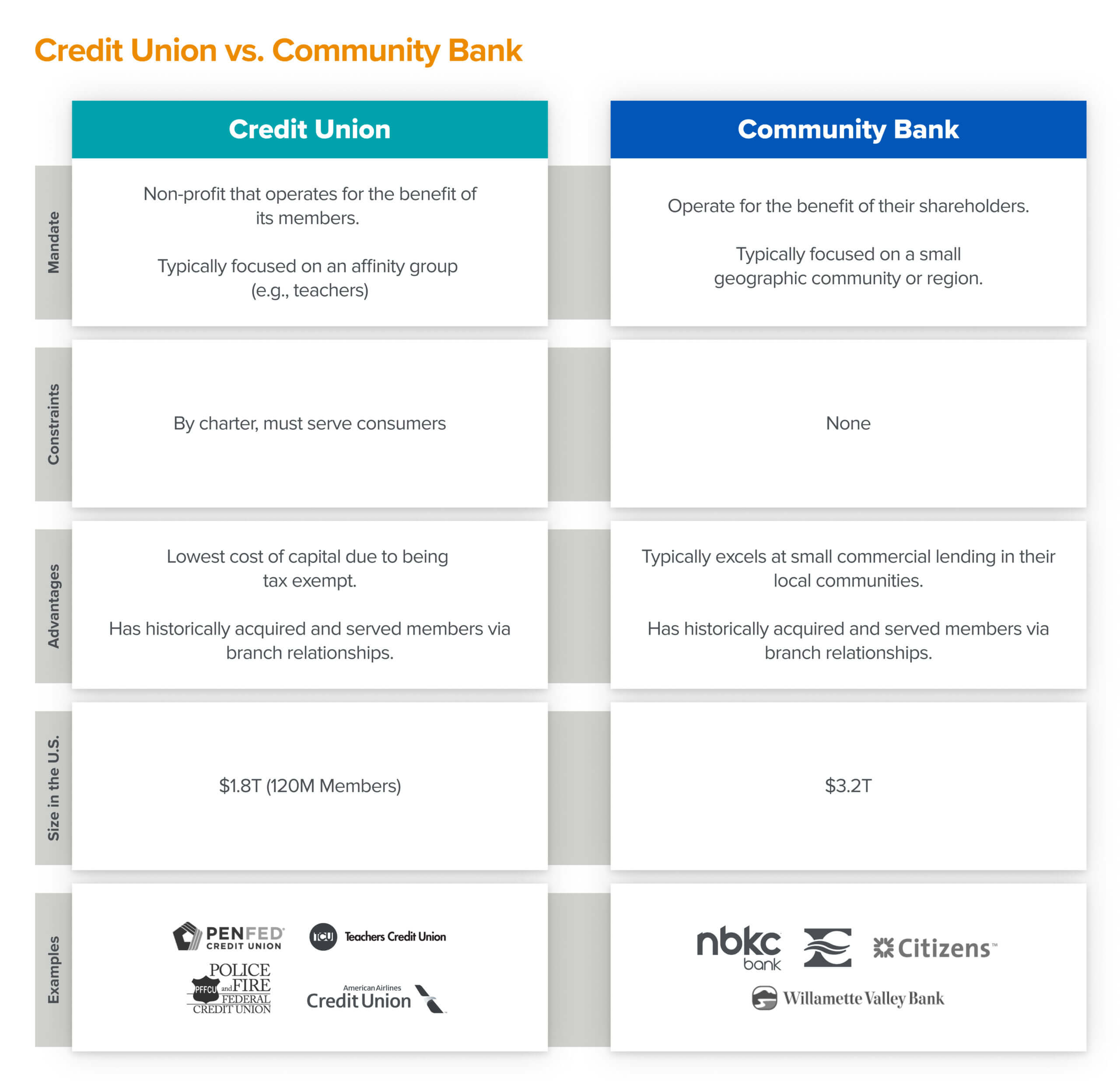

Credit Union vs. Community Bank

Credit Union vs. Community Bank

Credit unions and community banks have both typically served “niche” communities. For community banks, this often meant a focus on rural geographic areas that were otherwise overlooked by the largest financial aggregators (e.g., Central Bank of Boone County in Missouri, or Sunflower Bank in Kansas) — the heartland of the U.S. has the largest concentration of community banks. In the case of credit unions, these communities were often vertical slices of consumers that were aligned with a trade, profession, or affinity group (e.g., SF Mechanics or Christian Community Credit Union). Perhaps, even more importantly, Credit Unions are non-profits that have a legal mandate to operate for the benefit of a specific affinity group (many of the largest CU’s started as membership cooperatives for State or Military Unions), while community banks are for-profit entities that have no such constraints. More than 1 in 3 Americans is a direct member of a credit union, and this number rises to 120MM Americans when considering indirect products (e.g. auto loans originated through dealerships).

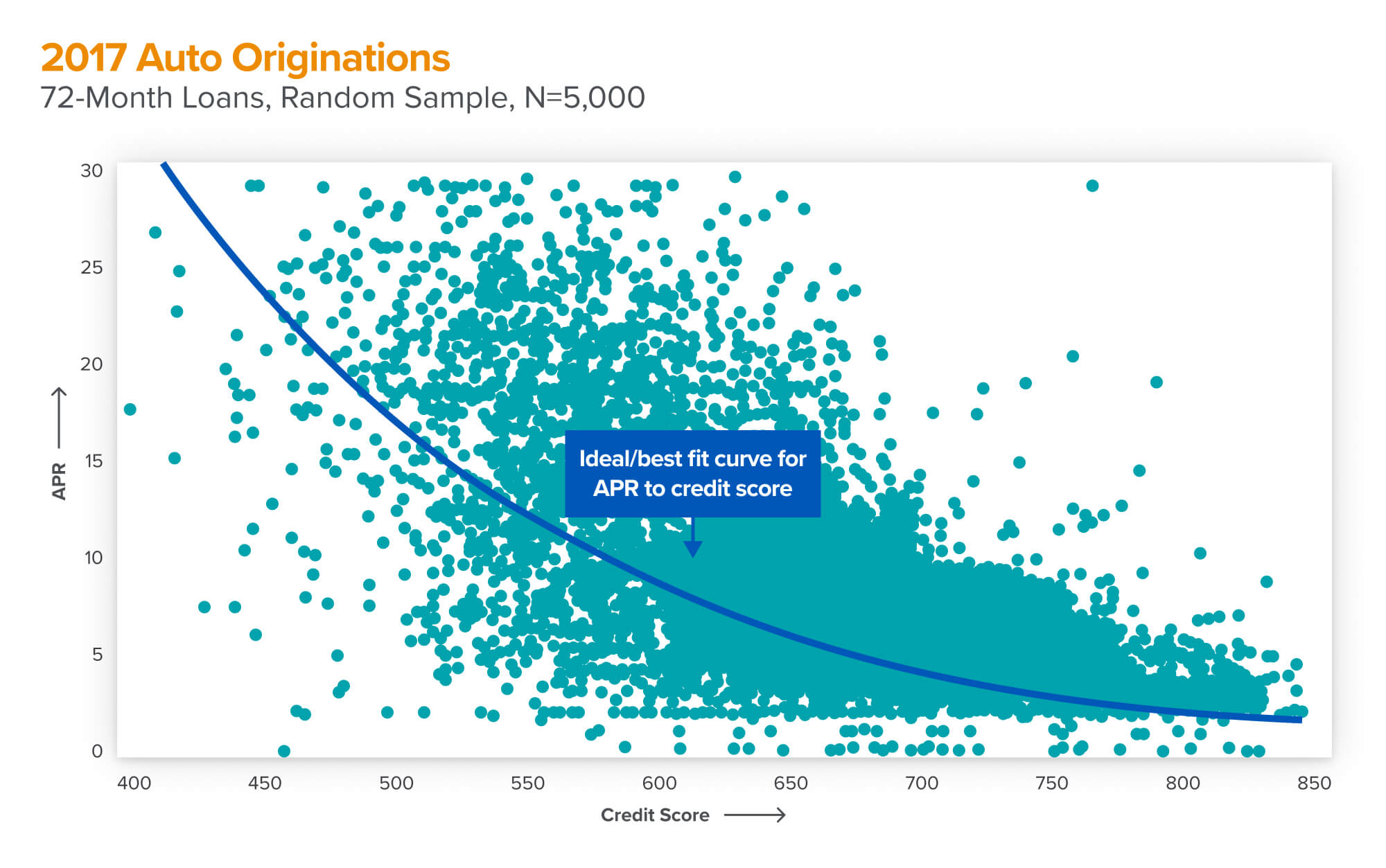

In an unexpected twist as American consumers’ balance sheets improved with increased rates of savings and decreased levels of borrowing Credit Unions encountered an oversupply of deposits and an inability to leverage these deposits to make new loans, which are the lifeblood of a bank. For example, credit unions have been struggling with auto loans (both due to the shift to online lending and the pull back in auto production), and are increasingly relying on channels like auto dealers to facilitate indirect lending. Though this may help Credit Unions leverage their deposit base more effectively it’s an unloved solution since the CU and the member never establish a direct relationship, and the cost of borrowing for the customer is typically very high (with the dealer taking the spread). In these cases it’s actually the CU that eats the spread paying large origination fees (1-3%) despite giving the same rate to a Direct vs. Indirect Member (e.g. someone who received a credit union loan through a car dealer, but was not already a member of that credit union). It’s the age-old promise that “Maybe they’ll get another loan … ” but that has rarely materialized.

Source: Credit Karma, Data & Machine Learning—Defining the Future of Personal Finance

The opportunities for credit unions

Paradoxically all of this has resulted in a bright future for Credit Unions. They have urgency around adopting software, the best (cheapest) product in the market (via the lowest cost of capital), and for the first time can leverage the aggregation power of the internet to grow their member base beyond a narrow footprint (Christian Community Credit Union should be acquiring Christians nationwide!). The power of the internet to find members will likely drive outsized growth to the broadest affinity groups over those with more limited geographic ties, as they have the largest pool of potential members to tap into.

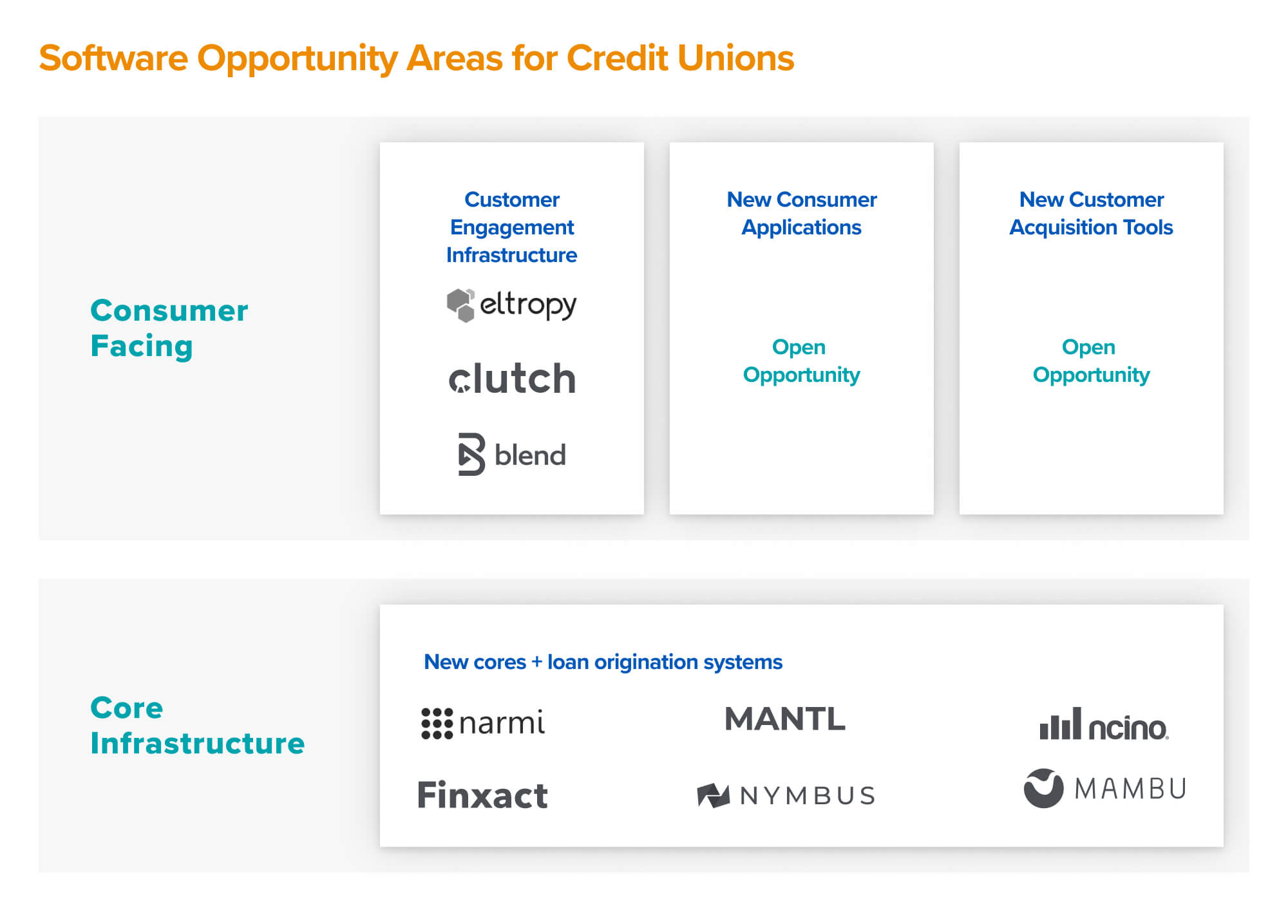

Here are the specific short term opportunities we see as these institutions rapidly digitize:

- New cores + loan origination systems: New digital cores offered by companies like Narmi and Mantl are cloud-based, developed with modern APIs and don’t take months to implement or integrate. They typically start by offering digital account opening software, but beyond that offer services like fraud detection, regulatory compliance (e.g. KYC/AML) and reporting, a modern ledger. Similarly, the loan origination system acts as a “system of record” for lending, and older players like Meridian Link are ripe for disruption. Importantly the move to a new core system and a new LOS unlocks the ability for Credit Unions to offer new products and services, such as BNPL loans or robo savings accounts.

- Customer engagement infrastructure: This enables credit unions to better interact with and grow the share of wallet within their existing customer base. Given many credit unions struggle to interact with their customer base outside the branch, these products not only enable better customer service, but help credit unions target offerings to their existing customer base. They can provide additional information on their customers and signal which customers are the best fit for an additional product. For example, Eltropy provides a way for credit unions to manage text and messaging communications with their customers. Clutch provides software for them to identify, reach, and easily refinance their customers’ auto loans.

- New consumer products: Credit unions want to launch additional products to their customers, but often don’t have the expertise to design these products in-house. This would combine both software and financial products – Everything from the user interface to the underwriting that a credit union would struggle to provide in-house. At the most basic level, they want products that put them on-par with other banks, and further, they want to compete with fintech companies, just as Zelle helped offer peer-to-peer payments. There are a number of other “features as a service” possible – it’s not hard to imagine a software provider building “Chime as a service” or “Affirm as a service” to help Credit Unions connect their balance sheet with consumer demand.

- New customer acquisition: Many credit unions have been subscale due to limitations in outreach. They could benefit from an intelligent routing layer that helps them, particularly the ones with a broader mandate (e.g. profession or affinity-based), find customers that fit their member profile digitally.

In the short-term most of these opportunities help credit unions build a stronger relationship with their customers and capture a greater share of wallet for their customer financial products. Over the longer term, the potential may be more ambitious: imagine that credit unions become the new digital neobanks for affinity groups. With the right software partners to find and serve their membership, it’s entirely possible. We see a bright future for Credit Unions and believe a number of multi-billion dollar software companies will be built to assist them in the transition to digital. Perhaps most importantly, the cost of capital + member focused mandate of Credit Unions means that we may finally achieve the vision of efficiently pricing American’s consumer debt.