This first appeared in the monthly a16z fintech newsletter. Subscribe to stay on top of the latest fintech news.

Every Company Will Spin Out a Fintech Company

Alex RampellBehind every great company lies a great team, a great product, some auspicious timing, and… a lot of internal tools. Sometimes, these tools break free of their parents, becoming startups and later great companies in their own right — because the process improvements they yielded have many more prospective customers than the “single company” environment where they came from.

This “company —> tool —> company” cycle is not new, of course. Confluent just went public and is now worth $13.5B, having started as a tool within LinkedIn. MongoDB ($24B!) came out of a problem/solution within DoubleClick (which Google bought for about 1/10th that price). And Slack, of course, was the internal communications tool at game company Glitch… which became Slack. But as the number of fintech “decacorns” (>$10B) increases — an explosion of these fintech tools is coming, and we continue to be on the hunt for more. The best entrepreneurs tend to be deeply steeped in a problem area, and having solved the problem within a company often provides irreplaceable expertise when doing it at a startup.

At Affirm, a problem with synthetic fraud has now yielded an industry leader in SentiLink. At Square, complexity in identity verification has yielded Persona. At Robinhood, real-time money movement wasn’t possible, but underwriting the probability of fund transfer success was — which yielded Parafin. Privacy.com was launching cards, which yielded Lithic. More and more of these are coming, largely because of the still complex task of launching a fintech company from scratch.

Sometimes these big businesses stay within the walls of the parent. Amazon Web Services (AWS) famously came out of Amazon — the ultimate “internal tool” for the core operation of hosting the Amazon website and dealing with peak holiday shopping traffic.

What makes the “future fintech tools” concept so interesting is that there is a lack of modern anything when it comes to launching a financial services product or company. Fraud is a huge problem, customer support is a huge problem, risk is a huge problem, interest allocation is a huge problem, etc. Some of these are highly generalizable, some are not — but just like DoubleClick and MongoDB, it’s likely that some of the largest financial services companies will emerge from problems that emerge from building, well, financial services companies.

- The Greenfield Strategy: AI-native startup Bingo James da Costa and Alex Rampell

- Fruits of the Walled Garden Marc Andrusko and Alex Rampell

- AI x Commerce Justine Moore and Alex Rampell

- Investing in Rillet Seema Amble, Marc Andrusko, and Alex Rampell

- How Big Bank Fees Could Kill Fintech Competition (July 2025 Fintech Newsletter) James da Costa, Alex Rampell, Angela Strange, and David Haber

From Clubhouse: What goes into an index with MSCI CEO Henry Fernandez?

Financial indices are critical to benchmarking investment performance as well as evaluating risk and opportunity. But what does it actually entail to calculate an index and keep it accurate? In this recently recorded Clubhouse conversation, MSCI CEO Henry Fernandez talks with a16z’s Alex Rampell and Scott Kupor about what goes into managing the MSCI world index, which tracks more than 20,000 companies in developed, emerging, and frontier economies.

Listen to the full conversation »

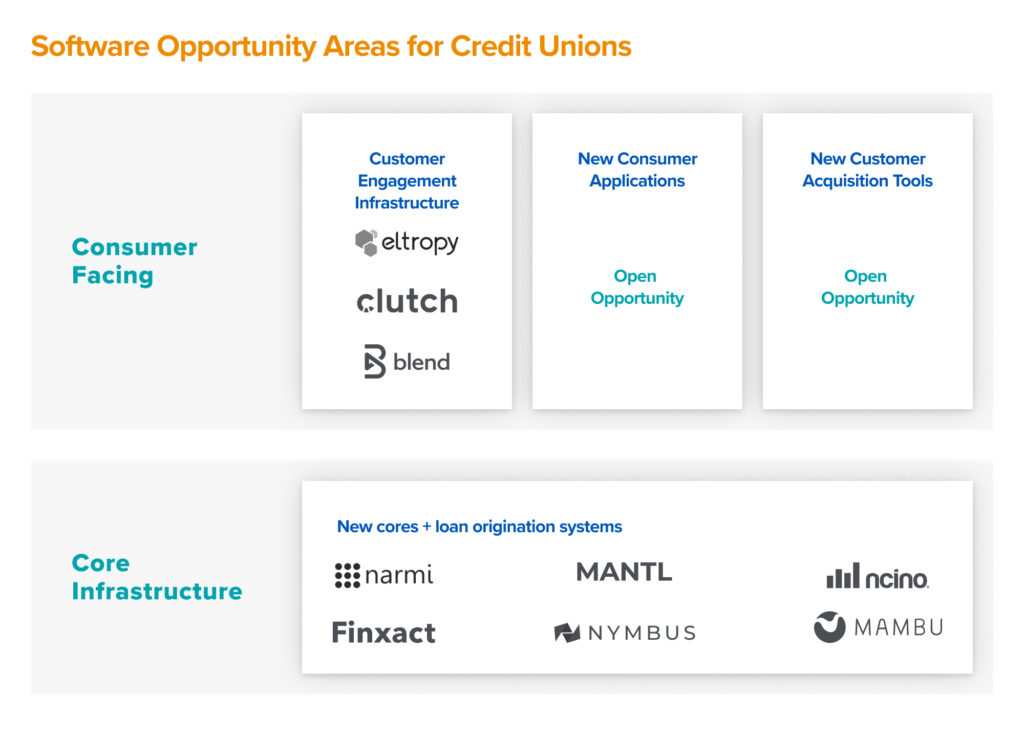

The New Opportunities for Credit Unions

Anish Acharya, Seema AmbleIn the last 10 years, as neobanks emerged and consumer financial services came online, the prevailing assumption was that credit unions would slowly die off, victims of their focus on local, branch-based banking that often made them slow to adopt new digital innovations. But since COVID lockdowns shuttered branches, credit unions have embraced digital experiences with a new sense of urgency, and innovative, digital-first credit unions are finding new opportunities in domains traditionally owned by fintechs.

- Investing in Lio Seema Amble, James da Costa, Eric Zhou, and Brian Roberts

- Investing in Ease Daisy Wolf, Anish Acharya, and Eva Steinman

- Software’s YouTube Moment is Happening Now Anish Acharya

- Notes on AI Apps in 2026 Anish Acharya

- Need for Speed in AI Sales: AI Doesn’t Just Change What You Sell. It Also Changes How You Sell It. Seema Amble and James da Costa

- Investing in Lio Seema Amble, James da Costa, Eric Zhou, and Brian Roberts

- Investing in Ease Daisy Wolf, Anish Acharya, and Eva Steinman

- Software’s YouTube Moment is Happening Now Anish Acharya

- Notes on AI Apps in 2026 Anish Acharya

- Need for Speed in AI Sales: AI Doesn’t Just Change What You Sell. It Also Changes How You Sell It. Seema Amble and James da Costa

What we're reading

The Fintech Revolution

Post House Capital founder and former Square executive Jackie Reses released a 35-page report on the future of fintech which acknowledges that we are at a key inflection point for financial services technology. The report explores the opportunity for infrastructure development, the importance of proactive regulatory awareness, and the unique wedges that have enabled some of the most successful fintechs of this generation.

Mastercard is dropping the magstripe by 2033

Jordan McKee from 451 Research pointed out a Mastercard blog post announcing the elimination of the magstripe from their cards in favor of the more secure global EMV chip. The U.S. will officially drop its magstripe requirement for banks by 2027.

Why did Visa just buy a ‘CryptoPunk’ NFT for $150,000? (Marketwatch)

Cuy Sheffield, Visa’s head of crypto talks to Marketwatch about why the card network decided now was the time to enter the world of digital assets.

The Cold Start Problem

The forthcoming book The Cold Start Problem by a16z general partner Andrew Chen looks at how network effects have spurred some of the world’s largest businesses — examining the impact of two-sided networks on everything from the growth of the original credit card networks to modern social networks. Pre-orders are available now.