Early in the COVID pandemic, my colleague D’Arcy Coolican and I penned “COVID-19 and the Great Rehiring”. The premise of the piece was that the magnitude of the disruption to employment during the pandemic would require a better set of tools to enable the unemployed to be efficiently rehired.

But there was one thing that we missed in the piece – that as the pandemic reshuffled workers’ priorities and revealed new ways to work, a ton of employed people would start quitting their jobs, what is now referred to as “The Great Resignation”.

It’s not exactly clear why so many people are deciding to quit their jobs — a myriad of reasons have been reported. Maybe the pandemic motivated them to re-evaluate their career direction. Maybe their employer put into place pandemic policies that they didn’t like, be that forced return-to-office or forced remote (depending on the person). But it’s also not clear what these people plan to do next.

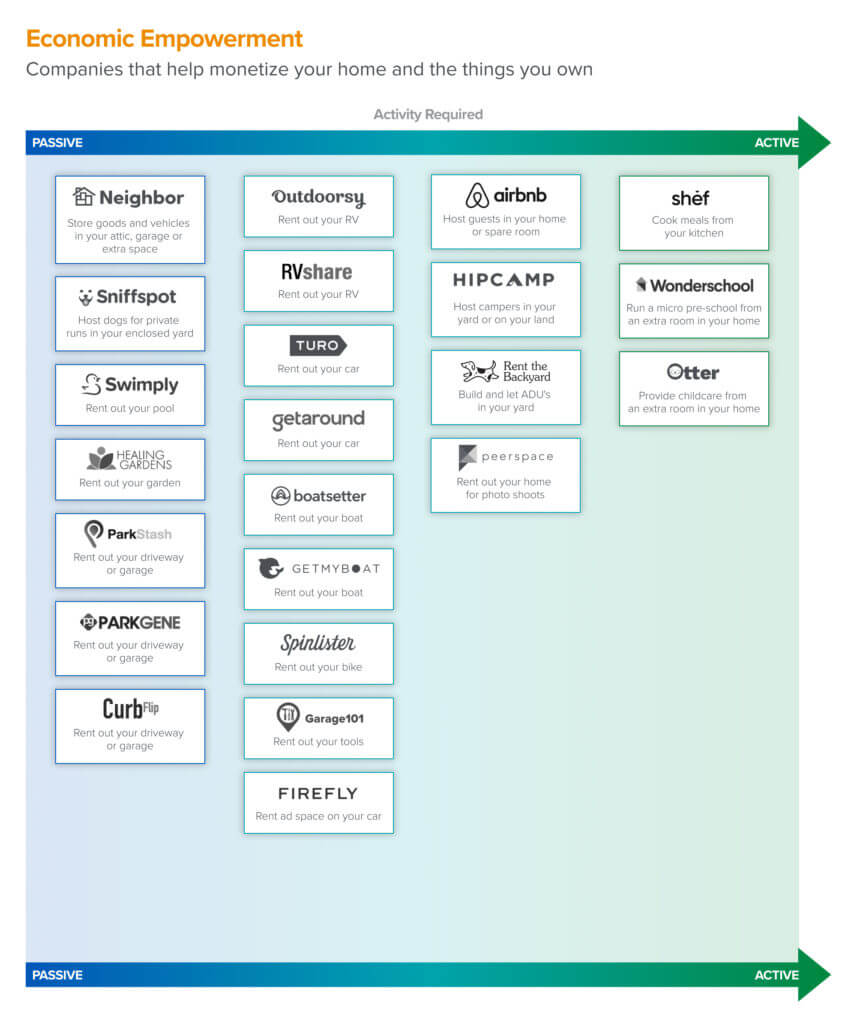

I love businesses that enable individuals or small businesses to be economically empowered; platforms that give people the opportunity to build and run their own business, to reach potential customers or open up new active and passive revenue streams. I operated companies that do this, including eBay.com, PayPal, and OpenTable, and I’ve invested in companies that do this, including Airbnb, Instacart, and Shef among others. I track the category very closely.

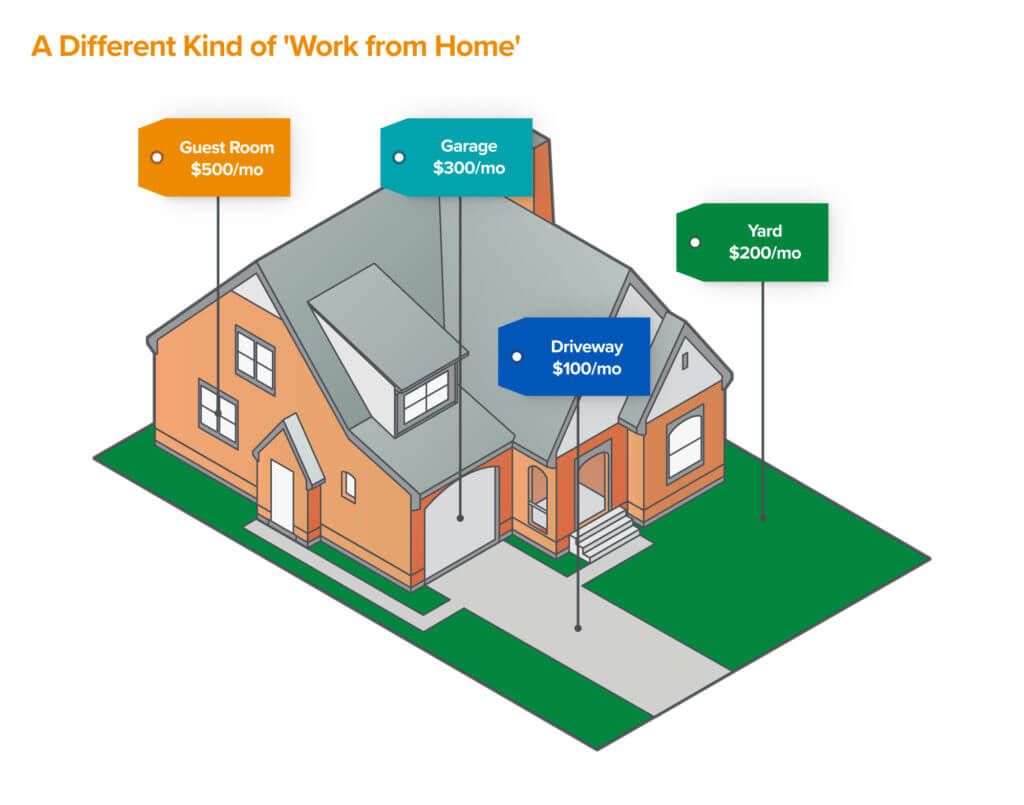

What has become clear to me is that thanks to a rise in new marketplace platforms — there are new ways for many people to earn additional income or even a living — all from the comfort of their homes! A decade ago, I read a book called “What’s Mine is Yours; How Collaborative Consumption is Changing the Way We Live” by Rachel Botsman and Roo Rogers. My key take-away from the book was that each home has a plethora of assets that are badly utilized, and sharing them collaboratively could be good business for the owners. And sharing these assets means that others won’t need to purchase them, promoting sustainability.

And the earnings from these activities can be substantial. Take the example of Airbnb. The average earnings for new U.S. hosts who started hosting a single location during the pandemic was $8,000 for the year. TOP earning new hosts generated hundreds of thousands of dollars in income for the year. And many of these activities can be done at the same time – one could host guests in a spare bedroom on Airbnb, store goods or vehicles in your garage through Neighbor, cook meals in your kitchen through Shef, etc. There certainly is the potential to earn enough incremental income to quit a job!

The world that Botsman and Rogers envisioned probably took longer to materialize than they anticipated a decade ago, but it’s now here in full force. Individuals now have all kinds of economic empowerment options leveraging the assets they own or lease — both passively and actively. The below is intended as a partial catalogue of companies that have caught our attention, and is not comprehensive. But this set of new, innovative businesses can let participants of “The Rise of a Different Work-from-Home” have alternatives to earn a living other than signing up for a new corporate gig — whether that means monetizing their assets, earning passive income, or creating a meaningful small business. Enjoy!