- What Big Ideas Might Fintech Tackle in 2022?

- Fintech x crypto

- The web3 community will emerge as a major political constituency in the U.S. midterm elections

- Community-first social investing platforms

- Fintech x healthcare

- Fintech x sustainability

- Trends within fintech

- Emerging markets will see more fintech

- Renewed focus on underwriting for insurance MGAs

- Also from the a16z fintech team in 2021

This first appeared in the monthly a16z fintech newsletter. Subscribe to stay on top of the latest fintech news.

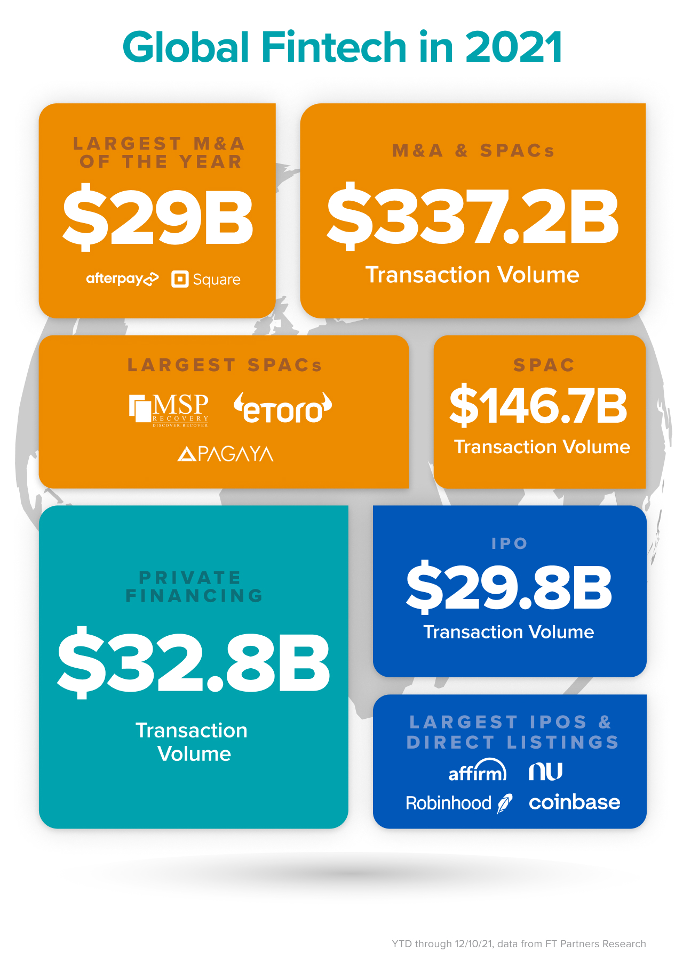

In 2021, financial services continued to have its moment – fintech fundraising surpassed all years prior; it was a banner year for fintech IPOs; and fintech mega M&A activity was at an all time high. We saw one of the largest fintech IPOs just before year-end with Nubank raising $2.6B (as the largest digital bank), one of the largest fintech M&As with Square acquiring Afterpay at $29B, the first ever direct listing in the UK with Wise, the first ever fintech/crypto direct listing with Coinbase, and multiple fintech SPACs.

What Big Ideas Might Fintech Tackle in 2022?

Fintech x crypto

Angela Strange, Sumeet SinghCrypto infuses all financial services

Twenty years ago, “is it an internet company?” was a common question. Today, (almost) every company is an internet company. Ten years ago, “is it a mobile company” was a common but now obsolete question. Similarly, we will soon stop asking “Is it a crypto company?” because most companies – starting with the broader financial services industry – will have a crypto component.

As crypto takes up more and more mindshare of consumers, financial apps are adding crypto products to gain further wallet share. For instance, Robinhood started with stock trading and now facilitates some crypto trading; some neobanks allow customers to earn higher yields through DeFi (decentralized finance); and larger banks are in the early days of experimenting with crypto offerings. In 2022, we’ll see more crypto infrastructure built for transfers, wallets and yield as a service, custody, and more, so consumers can continue to integrate and manage both their fiat and crypto financial lives. We’ll also see a new wave of fintech companies that are powered by crypto infrastructure in the back-end, and what others are calling DeFi mullets (fintech in the front, DeFi in the back).

The web3 community will emerge as a major political constituency in the U.S. midterm elections

As we close out the year, one in five American voters now owns cryptocurrency. According to a recent poll we conducted, web3 and the future of the internet will impact the way many people vote in the 2022 U.S. midterm elections.

The web3 constituency is young and diverse: 79% of millennial voters, 73% of Hispanic voters, and 79% of Black voters are more likely to vote for a candidate that supports expanding web3. These voters largely came of age in the wake of the Great Recession, and many of them come from communities that have been given short shrift in their attempts to build generational wealth. They seek a meaningful alternative to the current financial system — one that gives them direct control over their money and provides investment options for parts of society underrepresented by traditional financial institutions.

So what do these voters care about? By a wide margin, they want policymakers to focus on regulations that crack down on bad actors and illegal activity while being careful that regulations don’t stymie economic opportunity for average Americans. They want policymakers to lean in and participate in our national technology strategy. They overwhelmingly believe that web3 can give consumers more control over their data. They believe that web3 can bolster U.S. technology leadership on the global stage. And they want government to play an active role in supporting community-owned web3 platforms.

There’s no question that web3 will be a major part of next year’s election, and policymakers are quickly coming to realize what’s at stake.

Fintech x healthcare

David Haber, Julie YooEvery healthcare company is a fintech company

Fintech products enable vertical SaaS businesses to diversify into new revenue streams, as we’ve said before. In healthcare – a system that represents 20% of our nation’s GDP – we see three areas where fintech capabilities can supercharge the industry in 2022: consumer payments and lending, provider practice enablement, and insurance. Healthcare payments are particularly complex due to our country’s third-party payor system, in which providers bill for services, payors reimburse for those services, and consumers receive the service. So a generalized solution, such as Stripe, is unlikely to provide the full set of capabilities, like regulatory compliance and health plan integration, needed to comprehensively support a medical practice. This leaves open the opportunity for vertical-specific payment gateways and financing products, such as “buy now, pay later” (BNPL), that help consumers finance their healthcare bills and mitigate the risk of bankruptcy from unplanned medical expenses.

On the provider side, BNPL can improve collection rates, which can be as low as 20% in some areas. There are also emerging fintech products designed to help provider practices normalize their business models into “per member per month” (PMPM) arrangements by bearing risk, as well as add billing capabilities for new service lines to diversify revenue and margin streams.

Finally, the unbundling and rebundling of traditional health insurance has created new fintech platforms that support the blossoming of novel insurance coverage products targeted at individuals and businesses. These companies modularize the underwriting, claims processing, provider network management, and utilization management capabilities that help organizations manage risk across their covered populations in more nimble, affordable, and transparent ways.

As fintech makes its way into healthcare services and software, we see the potential to rewire incentives and remove inefficiencies to pave the way for a more value-oriented healthcare system.

Fintech x sustainability

Marc AndruskoFintech goes for carbon zero

Have you noticed that the default setting in Google Maps now directs you to the most fuel-efficient routes? Or how billers open your account with the “paperless statements” box already checked? This type of environmentally-minded configurability is coming to fintech. Imagine a checkout experience in which toggling between debit, credit, ACH, PayPal, BNPL, and all the various payment methods available to us in 2021 shows you which is least harmful to the environment for that particular merchant. Or, better yet, which embeds the functionality for you to add $x to your purchase to offset the emissions of whichever route you choose. Improvements to emissions data infrastructure and technology is making this more and more possible at a rapid rate. With companies like Patch, Capture, and Wren making it much easier for businesses and consumers to not only understand their climate footprint, but also act on it, payment providers, neobanks, logistics firms and more will likely embed carbon offsetting optionality into their products.

What remains to be seen, however, is what will motivate consumers to choose greener products or delivery methods over those that may be more convenient. Just like the eco-friendly route on Google Maps might actually be the slowest, today, green choices in commerce tend to be the most expensive. Startups at the intersection of climate and fintech will have to create novel incentive structures that make eco-friendly options not only more responsible, but also more affordable and rewarding than their legacy counterparts. Think higher APYs, lower APRs, better returns, or reduced fees.

One of our favorite case studies around creative incentive alignment in this space comes from Powerledger, a blockchain platform for peer-to-peer energy trading, and Carlton United Brewery, an Australian beer company. When Carlton set a goal to be powered entirely by renewable energy by 2025, they teamed up with Powerledger to create an eco-friendly beer drinker’s fantasy loyalty program: excess energy for kegs. Carlton’s customers could sign up to exchange surplus energy produced by their home’s solar panels for beer delivered straight to their homes.

Trends within fintech

Anish AcharyaBeating rising CAC with partnerships and product-led growth

Over the last few years we’ve seen meaningful inflation in digital customer acquisition channels (FB & GOOG) as competition has increased and changes like Apple Ad Tracking have made attribution harder. Furthering competition the vast majority of fintech companies have focused on the same customer profile (subprime), with the same product offering (e.g., banking, investing, lending) and a set of ever increasing customer subsidies to join (free money on the internet!). How then will a company distinguish itself in 2022 in the face of increasingly competitive and constrained digital acquisition channels?

We believe that there are two answers – the best companies will either achieve growth through products that lend themselves to product-led growth or partnerships represent non-inflationary distribution opportunities.

On the product side we’re seeing today’s products become tomorrow’s primitives; simply offering a bank or brokerage account is no longer good enough to stand out as new APIs make it extraordinarily simple to integrate the core features of banking (e.g., saving, spending, lending, investing) into almost any app experience. Instead, the products that capture consumer’s imagination will remix these primitives in new and interesting ways that leverage communities, crypto, and commerce. In particular, we expect to see more multiplayer products driving product-led growth – money is inherently multi-player (medium of exchange!), but to date, financial products have largely been single-player.

On the partnership side, we’ve already seen Credit Karma partner with the Houston Rockets deal and Chime with the Dallas Mavericks deal, as well as the Guideline distribution deal with Gusto and the Melio distribution deal with Intuit. Though these channels have price leverage and may raise prices over time, they represent the kind of predictability and volume in both acquisition cost and acquisition supply that has largely been missing from digital marketing channels as of late. Founders would be wise to note these examples – the companies that have historically been the best in class at direct to consumer marketing are now looking to business development and partnerships for continued growth, and we expect this trend to continue well into 2022.

Emerging markets will see more fintech

Seema Amble, David Haber, Gabriel VasquezThis year, emerging markets saw explosive startup activity, record funding, and impressive exits. Nubank IPO, in particular, was a watershed moment for Latin America and for fintech globally, representing a massive exit in Latin America and generating a cohort of founders in its wake. 2022 will bring more growth in investment and innovation in financial services across emerging markets. We’ll likely see several broad trends in the types of companies that emerge.

There’s been a lot of B2C fintech in emerging markets historically, and now we’ll see more B2B helping small businesses as well as enterprise customers with digitizing and optimizing payments, more efficiently paying employees, procuring supplies, handling accounting, insuring themselves and more.

Second, new modern APIs will make it possible for companies to make payments, access bank account information, issue cards, bridge crypto, verify identity, and more. Rather than needing to manually build one-off integrations with traditional financial systems, companies will be able to plug into modern infrastructure and, therefore, launch new fintech products with less cost upfront. There needs to be enough demand to justify new infrastructure, and we’re starting to hit the point in the ecosystem where this makes sense.

Third, the business models that will emerge are going to look more and more to other emerging markets for inspiration rather than the U.S. and Europe. There are a number of business models and feature sets based on existing user behavior, regulation, and stage of digitization that fit better across emerging markets. For example, India and Latin America have seen a number of homegrown B2B marketplaces (with embedded fintech) that don’t exist in the U.S. or Europe, in part because these marketplaces provide small businesses access to things like credit and logistics, which are often particularly costly and friction-filled to find otherwise in emerging markets. We’ve seen business models like superapps (both consumer and enterprise focused) and community buying platforms thrive, as well as feature sets like starting with funds instead of stock trading for investing apps.

We’re already seeing the interconnectedness of entrepreneurs across these regions. We’ve met founders building small business accounting infrastructure in Sao Paulo getting regular advice over WhatsApp from peers in Jakarta. Entrepreneurs in Lagos finding business model inspiration for their B2B marketplaces in Karachi. COVID accelerated many tech trends, but it also shrunk the world considerably.

Renewed focus on underwriting for insurance MGAs

Joe SchmidtMuch of the first wave of insurance startups focused on bringing historically offline processes online, leaving most of the underwriting process untouched. With a prolonged low interest rate environment, carriers have been more willing to test new markets and strategies to find yield. That, combined with a lack of scale of the insurance startup ecosystem compared to the rest of the market, had many capacity partners treating new entrants as test partners to learn and try to find new profitable strategies. As interest rates rise and markets harden, a renewed focus on underwriting differentiation and profitability will become a priority, potentially driving acquisitions in the gen1 insurtech world as well as new entrants focused on monetizing underwriting advantages.

Also from the a16z fintech team in 2021

- How to Move Money in the 21st Century | Seema Amble and David Haber

- The Rise of Many in Consumer Fintech | Anish Acharya, Sumeet Singh, and Alex Immerman

- Come for the Tool, Stay for the Exchange: Bootstrapping Liquidity in the Private Markets (Future) | David Haber

- As More Workers Go Solo, the Software Stack Is the New Firm (Future) | Seema Amble, D’Arcy Coolican, and Alex Rampell

- Open Source Is Finally Coming to Financial Services (Future) | Angela Strange

- IPOs and Beyond: A Guide to Exit Options for Companies (Future) | Blake Kim and Quinten Burgunder

- A Quick Pulse Check on Direct Listings (Future) | Scott Kupor

- Latin America’s Fintech Boom | Angela Strange and Matthieu Hafemeister

- The Case for Credit Unions | Anish Acharya and Seema Amble

- Breaking Down the Payment for Order Flow Debate | Alex Rampell and Scott Kupor

- The Case for Default Insurance | Angela Strange and Seema Amble

- “Buy and Hold” No More: The Resurgence of Active Trading | Anish Acharya and Matthieu Hafemeister

- Fintech’s Final Frontier: Central Banks and Disintermediation | Alex Rampell