We are in the early days of consumer fintech — today, only 15% of Americans bank exclusively through fintechs, and Wall Street real estate remains dominated by legacy players. But that is poised to change, and we are seeing the rise of many consumer fintech banks. Often these banks seem to be competing for the same customers with similar value propositions. So will consumer fintech be a winner-take-all market? Or is there room for multiple players?

We believe consumer fintech will largely mirror traditional banking, with large broad-based platforms and services for core consumer needs and specialized vertical services for segments with unique needs and specialized value propositions. At the same time, the internet is making it possible for vertically focused fintechs to aggregate niche audiences across geographies in ways not previously possible.

How traditional banking evolved

To understand how consumer fintech may emerge, let’s look at how traditional banking evolved. Traditional banking started with a local and regional focus — the branch was the place where business was done, and lending decisions were made by a relationship manager with a combination of judgement and data. Over time, these local banks were subsumed and augmented by large national banks that leveraged efficiencies of scale, capital, and customer acquisition. As the benefits of scale compounded, many of these nationwide players began to diverge from community banks in perceived quality, ubiquity, and breadth of product offerings.

But rather than declining as national players emerged, community banks and credit unions have continued to thrive — over 100M Americans bank with a credit union and the Community Bank Index Fund (QABA) has outperformed the largest banks (KBQ) in the past 10 years. The reason? Credit unions and community banks serve a narrow vertical audience, often with a customer specific utility. For instance: Silicon Valley Bank specializes in loans and mortgages for tech founders with illiquid assets and unpredictable cash flows; First Entertainment Credit Union provides savings accounts for child actors; and Navy Federal Credit Union offers down payment assistance programs for active duty military members and veterans.

What about consumer fintech?

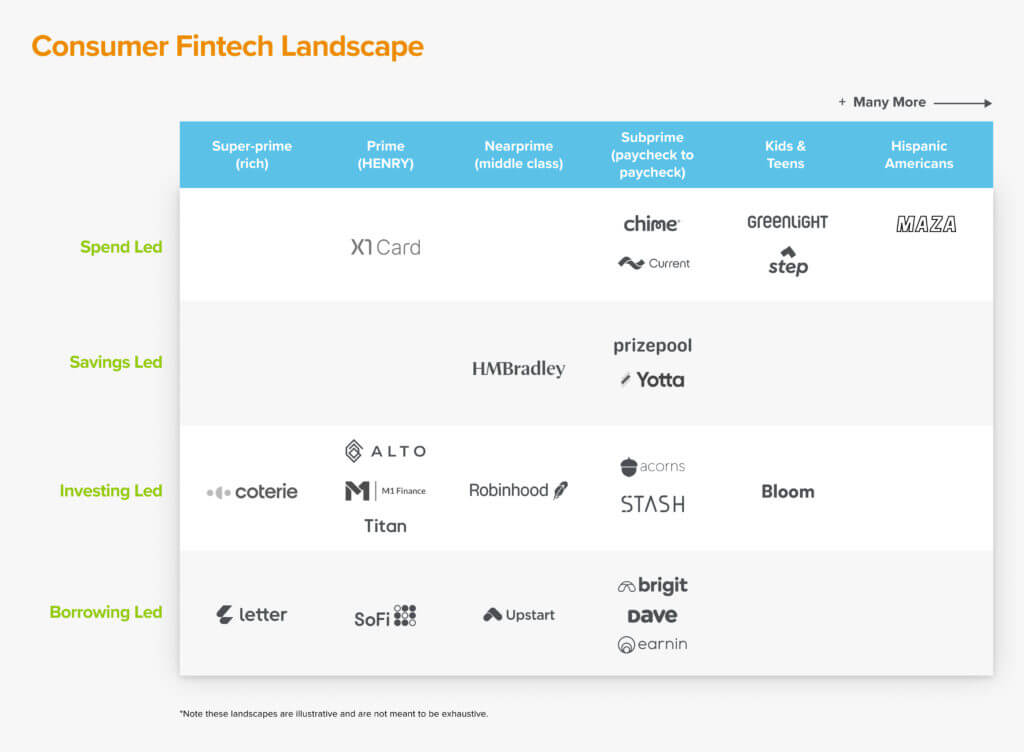

The evolution of traditional banking helps to explain why consumer fintech companies that at first appear competitive are actually differentiated offerings. Just as community banks and credit unions have thrived by focusing on narrow vertical audiences, consumer fintechs serve distinct customers with distinct value propositions. But where community banks and credit unions have been constrained by geography, consumer fintechs can use the internet to more easily aggregate a customer segment — for instance, hispanic americans or Gen Z students — with shared needs.

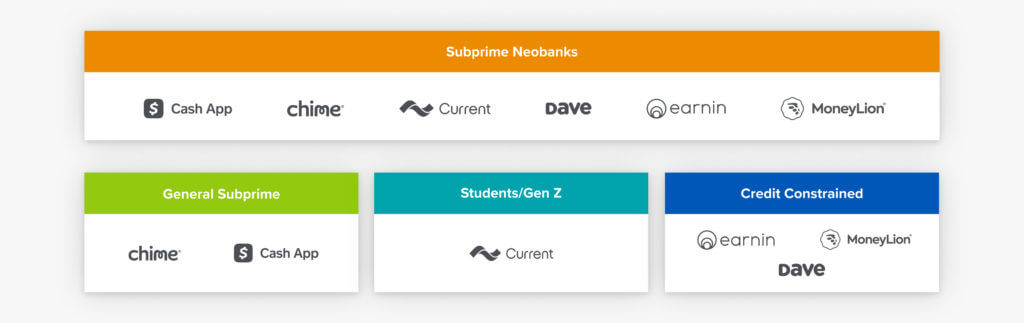

For example, a number of subprime neobanks — Chime, Current, Cash App, Earnin — have emerged with overlapping product offerings. Why then are they all succeeding? The main reason is that they focus on different customer segments within the broader subprime audience.

Further, banks typically only do four key functions for consumers — savings, spending, investing and lending. And despite the myth of cross-selling and the “money button,” most consumer fintechs lead with and innovate around one of these categories — Cash App with their boost product for spending and Earnin helping credit constrained consumers access capital for example. This, along with the vertical audience they focus on, ends up largely defining their brand.

As a result, we believe that there will be many $10B-$100B consumer fintech companies, providing spending + saving + investing + lending to a wide swath of vertical audiences. Below we illustrate some of these opportunities, but since different vertical audiences can be defined by age, race & ethnicity, religion, sexual orientation, credit history, and more, this is by no means an exhaustive representation of the opportunity.

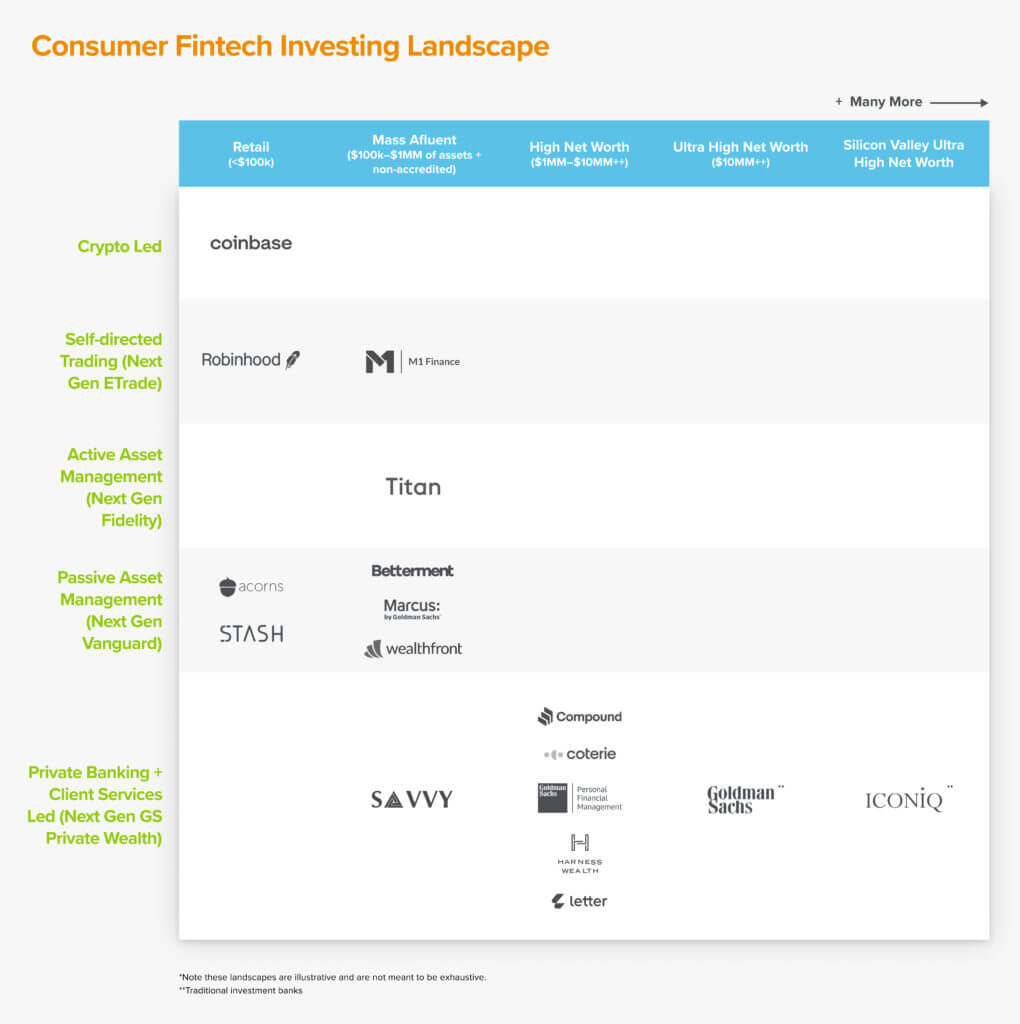

In fact, even the above table glosses over how much potential room there is for new players. If we double click on the Investing led focus area, we find another set of non-competitive companies, as shown below, further demonstrating the rise of many.

As consumer fintech continues to grow we expect to see the rise of many winners, and while products may find an initial wedge innovating on one primitive (savings, spending, lending, investing), what will differentiate these products in the long-run will be the features that are purpose built for a specific community or audience. And with most Americans continuing to use traditional banking services that have overdraft fees, account fees, and mispriced debt, the awareness and use of consumer fintech will only grow from here.

-

Anish Acharya Anish Acharya is an entrepreneur and general partner at Andreessen Horowitz. At a16z, he focuses on consumer investing, including AI-native products and companies that will help usher in a new era of abundance.

-

Sumeet Singh is a partner at Andreessen Horowitz, investing at the intersection of fintech and other categories such as consumer social, marketplaces, commerce, and healthcare.

-

Alex Immerman is a partner on the Growth team at Andreessen Horowitz, where he focuses on fintech, consumer, enterprise, and crypto/web3 companies.