The most significant bottleneck in the adoption of healthcare technology to date has been distribution. Over the last decade, generations of digital health companies have struggled to reach escape velocity—not because their products and services weren’t transformative, but because they failed to find an executable path for sustainable distribution and value capture.

Some of that was simply due to the overall immaturity of the market and its inability (or resistance) to absorb and pay for novel, software-based products that didn’t slot easily into existing budgets and care plans. Some of it was that companies lacked the capital to be able to survive long healthcare enterprise sales cycles that were the primary path for going to market.

In response, resourceful digital health founders have been finding creative and efficient ways of getting their technology to market. We believe this is important for our healthcare system. So, we have been collecting insights and knowledge from these founders in our Digital Health Go-To-Market Playbook series, in hope that our learnings will help you build your companies.

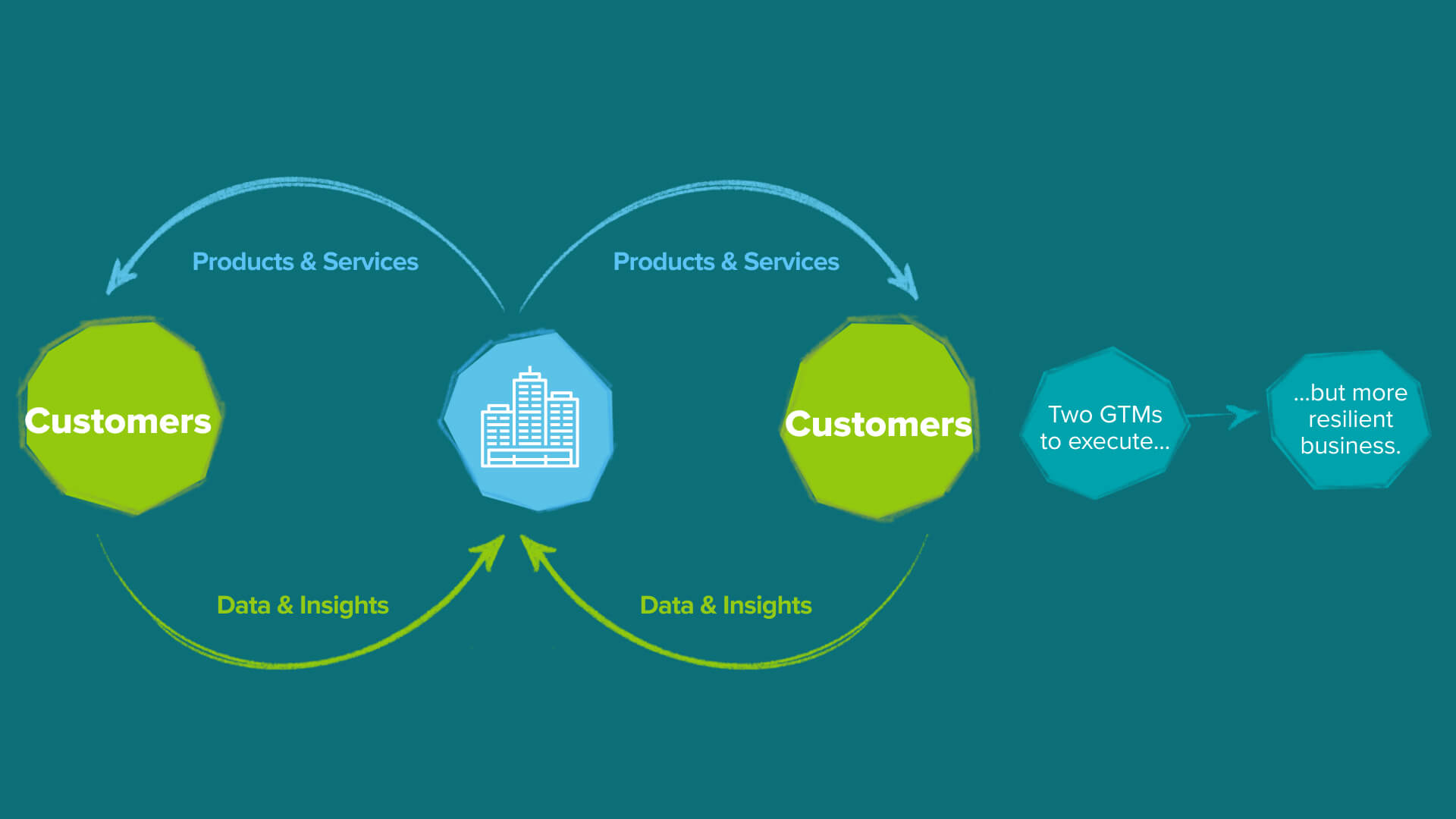

One exciting go-to-market strategy we’ve observed is to build a two-sided network. In this approach, a company builds products and services that are valuable to one market constituent—say, patients, providers, payors, pharma/biotech, or pharmacies—and then leverages that network of users, as well as the data generated in serving those users, into offering products and services to another set of constituents. Though this strategy comes with added complexity, two-sided networks can result in more durable business models as a result of powerful network effects.

In this episode of our Digital Health Go-to-Market Playbook, we talk about the basics behind a two-sided network model and why it’s a particularly interesting time in healthcare for this approach. Then, we ask five different founders—Iman Abuzeid, MD, CEO, and Cofounder of Incredible Health; Andrew Adams, CEO and Cofounder of Headway; Thomas Clozel, MD, CEO, and Cofounder of Owkin; Doug Hirsch, CEO and Cofounder of GoodRx; and Arif Nathoo, MD, CEO, and Cofounder of Komodo Health—to share their approach to and learnings from successfully executing multi-sided network GTM strategies.

We cover a lot of ground in this GTM Playbook, so use the Table of Contents at left, the timestamps in the video, and the transcript to help you find the information that’s most valuable to you. We’ll continue to post our learnings at our hub page, so please let us know—what’s working best for your team?

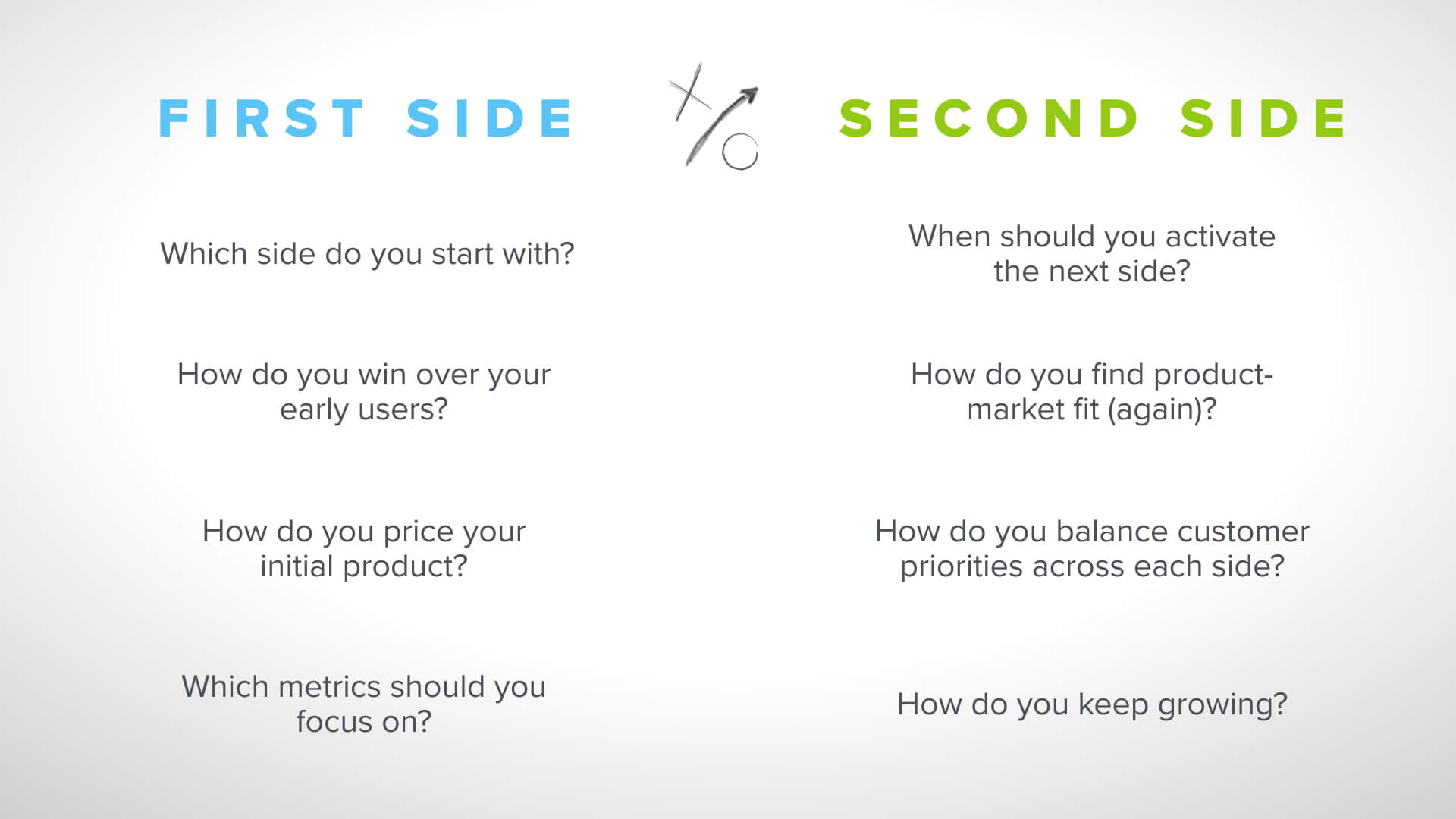

- Which side did you start with? [9:50]

- How did you convince early users to try your product? [16:10]

- How did you price your initial product? [20:15]

- What metrics did you focus on? [21:35]

- When should you activate the next side? [26:56]

- How did you find product-market fit (again)? [28:05]

- How did you balance customer priorities across the two sides? [33:05]

- How do you continue growing once both sides are working? [34:12]

For more on building digital health companies: a16z.com/digital-health-builders

TABLE OF CONTENTS

Transcript

Vineeta: Hi everyone. I’m Vineeta.

Jay: And I’m Jay.

Vineeta: We’re both part of the health and bio investing team here at Andreessen Horowitz.

Welcome back to chapter three of our series on evolving go-to-market motions in the very exciting world of digital health. In the two earlier videos in the series, Jay and Julie explored a strategy that we called B2C2B, and then Justin and Julie analyzed another increasingly prominent strategy of risk-based contracting in the world of value-based care.

Today in episode three, we’re going to chat about yet another go-to-market strategy, which is to build a two-sided network in healthcare. So in this playbook, we’re going to explore: What is a two-sided network, really? How and why are so many digital health builders, five of whom we’re going to highlight today in short clips, choosing to invest in the growth of two-sided networks? And lastly, we’ll share how we as investors evaluate two-sided network businesses ourselves, and how we think about their future as very exciting, impactful, attractive large businesses.

What is a network business in healthcare?

So let’s kick off by defining a network. At the end of the day, a network is a group of interconnected transacting parties—that could be businesses that could be people, companies, patients, and providers.

Today, when we think of really well-connected, integrated networks, healthcare isn’t usually the first industry that comes to mind. We think of healthcare instead as this unfortunately fragmented, siloed world where data is stuck in one part of the industry and can’t flow freely to other parts.

Now there are nuances and gray areas, but the five major constituents of the healthcare industry are what we like to sometimes call the 5 Ps.

There are the pharma companies, also known to a broader extent as life sciences companies. They build the products—that could be drugs, diagnostic tests.

There are pharmacies—that’s the supply chain, people and companies who are ultimately selling those products to end users.

There are providers—those are the doctors, nurses, health systems, hospitals, the infrastructure by which we actually do care delivery, which leverages those life sciences products to help patients.

And there are payors:, the group that pays for healthcare services. That could include insurance companies, that could include Medicare, that could include self-insured employers.

And finally, there are patients—the people that all of these entities collectively try to serve as the healthcare ecosystem.

And oftentimes these 5 Ps struggle to connect or to transact really seamlessly with each other. And that’s exactly the problem, actually, that two-sided network businesses in healthcare are often tackling. They’re building those channels, those connections, between major players in the healthcare industry, and often data reinforces those connections.

What makes a two-sided network work?

Jay: Now let’s take a minute to discuss what makes a two-sided network actually work and how it’s different from a company with two distinct business units.

The two are similar in that both execute one distinct, go-to-market motion for each customer set. But here’s what makes a two-sided network different. The company is building a product that is valuable to one set of customers and the delivery of that product to those customers allows them to do something else for an entirely different set of customers.

And when one company successfully executes two independent, go-to-market motions in parallel, a powerful network effect kicks in and each go-to-market motion becomes easier because the other exists. In short, one plus one is greater than two, and the business becomes greater than the sum of its parts.

Vineeta: So let’s look at some examples of two-sided networks to build a little bit of intuition on what this go-to-market motion means and what it can enable.

So a canonical network business we all know is Google. Google is a business that indirectly connects consumers, the first side of their business, with a vast universe of advertisers on the other side. On the consumer side, we all know that they’ve built a suite of products and services that meet our needs as consumers, from search engines, to email tools, to business tools. And then separately for advertisers, they’ve also built a suite of products, services, and analytics that underpin their advertising business, and that take advantage of all the knowledge that comes from the consumer side of their business. And the key is that these two business arms depend intrinsically on one another. The advertising business only works if it can leverage the deep reach into the consumer world that Google has, and the consumer business can’t live or sustain itself without the funding that comes from the advertising business.

And so both sides of this network become self-reinforcing parts of the overall Google business because of the data, really, that flows through the channel that Google has created by indirectly connecting these two different go-to-market motions.

Jay: So that was a consumer internet example. Let’s talk about a healthcare example that Vineeta and I both experienced through our time at Flatiron Health. Nat Turner, Zach Weinberg, the founders of Flatiron, and the incredible team there built a groundbreaking two-sided network business to organize the world’s cancer data.

The basis for Flatiron was the observation that there’s a lot of data generated every single day by oncology care providers, from patient symptoms, whether and how they respond to drugs, even the genomic profile of tumors. Pharmaceutical companies really want to learn from this exact kind of data to make oncology drug discovery, development, and distribution better and more efficient.

So Flatiron Health built a two-sided network that connected these stakeholders—healthcare providers on one side of the business and pharmaceutical companies on the other—by first building a suite of deeply integrated software products to help providers take care of their patients.

At the same time, they created tools to clean and analyze that data and turn it into a format and structure that’s useful for drug development. Much like in the Google example, the two sides of the business aren’t directly transacting with one another, but the data streams from each side reinforce one another.

Why now in healthcare?

Vineeta: So why are we seeing the rise of a two-sided network go-to-market strategy? We think there are at least three tailwinds playing out over the last several years, which are accelerating this trend and making it durable.

First there’s more healthcare data in a digital format than there ever was before. Almost 95% of care providers have adopted electronic health records in the last decade, since the HITECH Act in 2009. Over 35% of all the world’s data is actually generated in the process of delivering healthcare.

We have all this data now about patients and health records, their diagnostic tests, patient-reported outcomes, claims, and much more. The health industry leaves a very rich data trail. And so all this data now exists and is digitized. That’s the first trend.

The second is that this data is actually more commonly stored in the cloud. Despite privacy concerns about healthcare data, many, many providers, hospitals, clinics, labs, EHR vendors—all that data is actually living in Google Cloud or on AWS, rather than on an on-prem server in the basement of your hospital. And that means that that data is more accessible and easier to share, to analyze, across the entire industry.

And the final trend that we think is important is that our tools and capabilities to process, transform, and analyze this data has also improved.

Our partners have written about this and emerging architectures for the modern data infrastructure stack—and that’s an interesting read, we’d encourage you to check it out. But the industry for those tools was not just focused on a particular application. It’s universally enabling, and healthcare data is no exception.

So not only do we have a lot more data, we also have incredible tools that allow us to learn from that data more rapidly. And so this really is a perfect environment for entrepreneurs to ask: How do I exploit that possibility that I can use data to build connectivity between otherwise siloed parts of the industry?

And two-sided networks look pretty interesting in that light.

When should a startup try a two-sided network play?

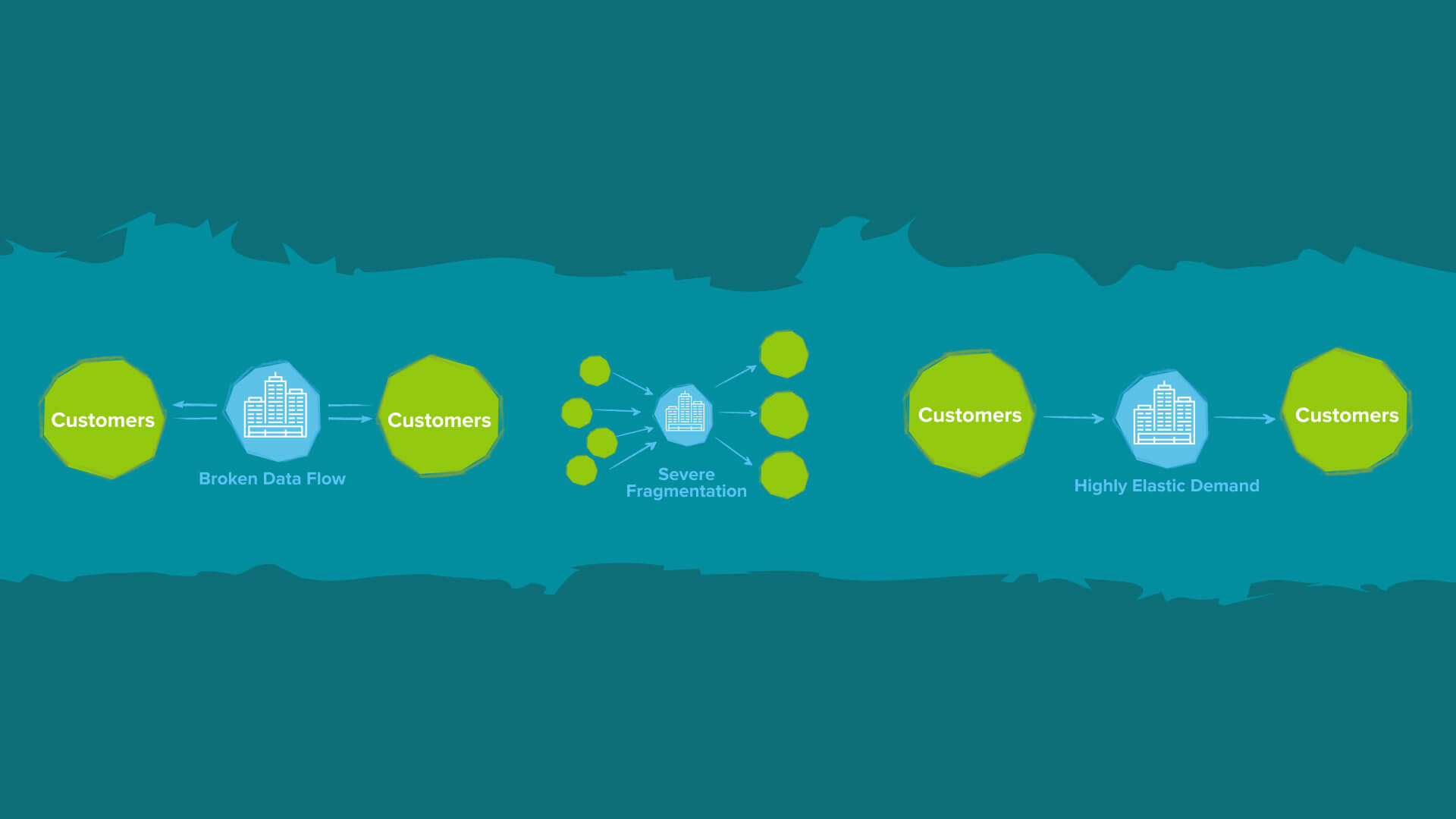

Jay: While two-sided networks can be more complex to execute, founders who choose this go-to-market strategy are typically addressing at least one of three situations in which it can be worth the effort.

One: Broken data flows between two sets of constituents. In this scenario, one party is interested in insights from another party, but this data isn’t flowing frequently between them, typically because there aren’t software rails in-between them. Or alternatively, one party wants to collaborate with the other and needs an efficient channel for engagement. The startup becomes that connecting bridge.

Two: Severe fragmentation in a market that makes it difficult for users to access, navigate or transact with the other side. The interface in this is the marketplace, which aggregates that fragmented ecosystem and makes it more accessible to other parties.

Three: Highly elastic demand whereby you have consumers who really need and are willing to use a certain product or service, but where monetizing directly either isn’t feasible or would slow down adoption or damage retention prohibitively. So finding a sustainable business model elsewhere can make a lot of sense.

There is no perfect, right way to build a two-sided business in healthcare and life sciences. It’s still very much a growing, evolving strategy. We’re fortunate to have spoken with so many founders choosing this approach and we’ll share some of our learnings as well as interview clips from five exceptional founders in particular about how they approach building their businesses and hope that our learnings help you build your companies.

The 8 questions we asked founders

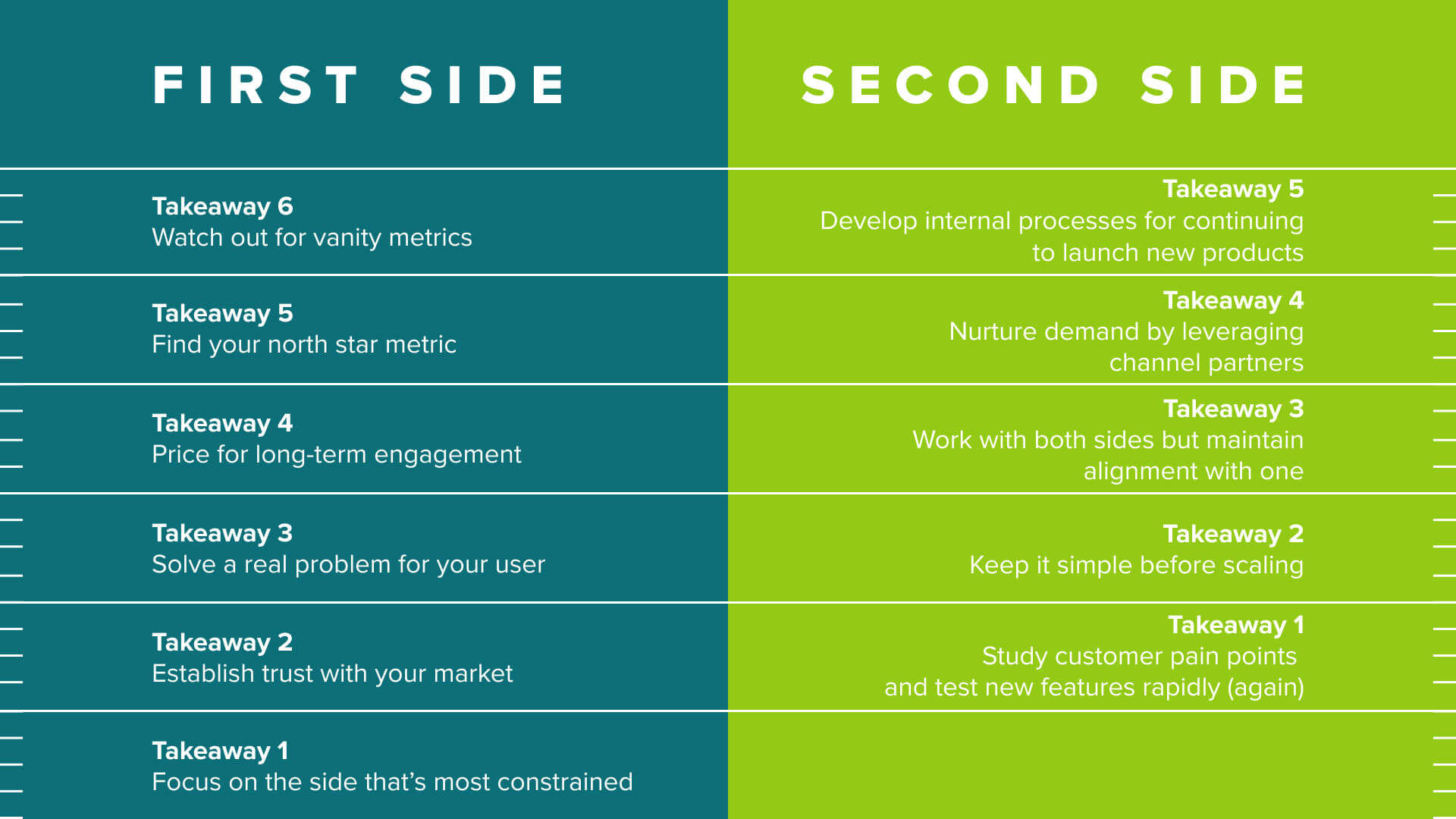

1. Which side did you start with?

When you’re building a business with a two-sided network strategy, it’s often not obvious which side of the business to start with first. We heard from Arif Nathoo, CEO and Cofounder of Komodo Health, which is overcoming broken data flows with a two-sided network connecting life sciences companies on the first side, and providers, payors, and pharmacies on the second side. He described how they started with the demand side, targeting a very narrow set of users, but delighting them relative to their very best next alternative.

Arif: I think every tech company should start with the demand side.

So we actually picked a very specific audience within life sciences, which were these folks on medical affairs teams. Medical affairs teams are responsible for non-promotional scientific exchange, which basically means having scientific conversations with doctors.

We saw their needs were really gated by a lack of visibility into a provider’s overall practice. So you can get lots of information on what doctors are publishing, you can see what clinical trials they’re running, but what you lack is really deep insight as to where they are in the care journey of a patient.

And we thought, hey, if we could bring really, really good insight to that, we could serve this one little niche really well. And so that’s how we started the business. We served one population. And through that we built one application and that application, we sold to that one buyer type and the business really grew from there—but it all started out because we really wanted to get one thing right.

Jay: Alternatively, we heard from Andrew Adams, CEO and Cofounder at Headway, which is overcoming fragmentation with the multi-sided network that connects patients with mental healthcare providers and insurers. He described how they focused on the supply side first—in their case, mental healthcare providers—because of their insight that their market was fundamentally supply constrained.

Andrew: This was particularly core during the early couple of years of Headway, that we very clearly had a patient-oriented mission. We’re building a new mental healthcare system that everyone can access.

But then our means of delivery and our strategic focus was very particularly on the therapist, which is the scarcest entity in the space. It’s the scarcest asset in the space, it’s really hard for payors to work with fragmented providers in which they feel like there’s not enough of them, and it’s really hard for the patient to find a provider.

So we had a very crystal clear clarity, particularly early on. And again, I’m disclaiming early on because once you do this, you have an opportunity to evolve and do more. But very early on, we had the unambiguous clarity of the therapist being our customer.

We framed our demand generation as an activation rate for our supply side. So we very, very rigorously filtered things through that lens of building for the provider. And if you look in terms of technically what we delivered, we did all sorts of things that no patient would ever raise their hand say, I want that. No patient has ever been like, you know what? I’d love a way to find a provider online, but first and foremost, I gotta vet how good their claims engine is, or I want to see how good their credentialing engine is. But that stuff is really important to be able to scalably build for the provider to have something that money just appears, credentialing just happens.

And so we built the best claims engine. We built the best credentialing engine. We built the best benefit interpretation engine in the country, regardless of specialty, because we built it from tech, from the get-go, focused on our vertical mental health. And so we did all these things that were focused on getting active providers. Ultimately to serve our patient mission involved focusing rigorously on the supply side.

Jay: And to make things more complex, we hear some go after both sides in parallel. We heard from Iman Abuzeid, CEO and Cofounder of Incredible Health, which is addressing fragmentation between healthcare workers, specifically nurse practitioners and employers. She described how they were able to go after both sides right away by applying a focus constraint on geography for an initial period before scaling.

Iman: Yeah, so we started with both. We went after supply and demand at the same time, but we stayed geographically very focused, like many other two-sided marketplaces. When we started, we were only live in the San Francisco Bay Area.

And so when you restrict your market like that, it becomes a lot more manageable to get supply and demand, and you can really figure out your playbooks for how you’re going to get supply and demand.

Jay: So our first key takeaway is that whether you start on the demand side, the supply side, or a limited version of both, it’s best to focus on the most constrained aspect of the market to jumpstart the network.

And regardless of who you start with, trust needs to be the foundation. We talked to Thomas Clozel, CEO and Cofounder of Owkin, which is building research infrastructure for both care providers on the first side and biopharma companies on the second side. He emphasized the importance of building trust with their first users—in their case, hospitals.

Thomas: We first really built this trust by saying, this is cool, you see medicine, you don’t see product, you don’t see data, you don’t see cash. And it really felt important because we were working with physicians, you know? So I think that the trust was really the first layer that keeps all these hospitals working with us year after year after year.

Jay: And GoodRx took a very similar approach of addressing fragmentation between individual consumers on one side and manufacturers and pharmacies on the other. CEO and Cofounder Doug Hirsch shared with us how they built trust with their patient users early on to drive adoption and grow the business.

Doug: It’s really, really hard to change people’s behavior.

And they’re looking for a reason, I don’t trust this new thing or they’re up to no good or who knows what. And so we wanted to just—I mean, if you look at GoodRx, the core of GoodRx back in 2012, it was a search box, a price page, and a coupon. And we took great effort to make sure that it was just as easy as possible for someone to get in, the prices that we showed were accurate, it worked when you showed up at the pharmacy.

We put a tremendous amount of effort into, we call it patient advocacy here, but that’s really customer care to others. We have sort of that Zappos model of, just call us for anything. We’ll do our best to solve it for you and do it right.

Jay: So these two stories illustrate our second key takeaway—that trust is essential for building the first side with the strong foundation to enable future sides of the business.

2. How did you convince early users to try your product?

So once you’ve identified your initial users, how do you go about engaging them? We consistently heard an emphasis on identifying single-user utility before highlighting the future network. Doug at GoodRx shared with us how they started with an ultra-simple product and limited the friction of using GoodRx.

Doug: I’m the guy who’s used to just building incredible products without any marketing budget. And if the product is great, people will come and if it’s not, they won’t. And I kind of believe that to this day. We have a very significant marketing department, we spend hundreds of millions of dollars in marketing, but I still ultimately believe that you should be driving a significant amount of your traffic organically because you should be providing a product that provides enough value that people are gonna tell their friends about it.

V1 of GoodRx, which we launched at Health 2.0 in San Francisco, back in 2010/2011, was kind of a fake website to be honest, right? I think Costco published prices on their website, apparently in New York state you can demand a price list—although I challenge you to do that because any pharmacist will look at you like you’re crazy when you do that. We just cobbled, we had people calling places, we asked our friends what price they were paying for certain meds, we just cobbled something together, threw it up there. And then we presented at this conference and there was a voting mechanism at this conference and we came in second place to a much more well-known brand at the time.

I think we also made the decision early on to not require registration, which, you know, one of the biggest downsides of most of the health products that are out there, especially like your own insurance company is it requires such onerous identification and setup in order for someone to use the product that people just don’t bother.

And especially when we’re asking someone to take a flyer on something so important. This is about your care and prescriptions, something so personal. And we thought okay, let’s help you start a search. We then help you spell the name of that drug. And we will immediately take you to prices at pharmacies you recognize. We’re not going to ask you to sign up. We’re not going to ask you to authenticate yourself and do all these crazy things. I’m not gonna ask you to pay even, obviously.

Jay: Similarly, Iman at Incredible Health shared with us the manual matching they did through their personal networks for the first cohort of users in absence of not having the other side of the network fully built.

Iman: We spent some time understanding their problems and we discovered that nurses and other healthcare workers have a terrible job search experience. They apply to 10, 15 places. They don’t even hear back—they describe it as a black hole. And even when they do hear back, it can still take months. And so when we described the main value proposition, like hey, the employers are going to apply to you instead of you applying to them, that was a very appealing value prop to them.

I think the first 30 or 40 nurses, we just recruited through our networks, frankly. There was no software, to your point. And just really used that value proposition of, hey, employers are going to apply to you instead of you applying to them as the main message and that got the first 50 to 100 nurses on our platform.

Jay: In a slightly different approach, Thomas at Owkin shared with us how they built trust with their early users by offering subsidized professional services in the form of custom analytic projects and co-publishing the results with their customers and academic journals all before getting to monetization.

Thomas: With this value proposition about we’re going to work with the hospitals, we came to them, saying, we’re not going to take your data. We don’t want to take your data out. We want to help you curate these data sets. We want to help make big, breakthrough discoveries with our data science team and we have an excellent one. And we want to publish with you. We want to write stuff. We started like that, like let’s work together. Let’s try to find things that had not been discovered before. And then we started to make projects. Start with one center. Curie was the first in France. Then we got a few others coming in.

And we came with this idea and we started to publish, make projects, discover where our technology was the most efficient and start to try to federate the centers together as well and build these federated learning products.

Jay: So this brings us to our third key takeaway, which is that every founder emphasized starting with the narrow gaze of solving a single core problem for your initial users.

3. How did you price your initial product?

Practically, no founder we speak with feels like they optimize pricing, especially in the early days on the first side of their business. One common theme we heard though, was that on the first side, the goal is to optimize for customer feedback and engagement rather than solely on near-term economics.

As one example, Owkin focused on building trust with their provider customers and set their pricing model accordingly. They didn’t want hospitals to pay for their software. And so they developed a revenue sharing model accordingly.

Thomas: Then came our third value. We don’t want to have providers. We don’t want to have hospitals pay. What we want to do is enrich the academic system we’re coming from and we want to help it, we want to make it grow.

So we knew that, and knowing that, we knew that we will never try to make hospitals pay. It’s not a great business anyway, to try to make hospitals pay. Some others do it really well, but we didn’t want to do it and it didn’t feel right. And so we came to the things that we need to find a win-win model with them. And the win-win model was we were going to give you this technology, our platform, we’re going to help you on the data science side, we going to have to curate that up, we also even generate that as a single cell data, special transcriptomic, really high-quality datasets that they don’t have. And we’ll revenue share with you, up to 10% usually. So that’s kind of the new thing. And the model was a really win-win model.

Jay: This story echoes what we’ve heard from many founders as well, that it’s key to price for engagement and learning to inform future product development on both sides.

4. What metrics did you focus on?

Jay: Ultimately, there’s so much nuance in each market, such that your go-to-market journey is going to vary case by case, but we asked founders what metrics they looked at to gauge whether they were on the right track forward. For Arif at Komodo, they anchored to a particular qualitative metric, which they called moments of truth, above all the traditional quantitative enterprise SaaS metrics that they of course looked at as well.

Arif: Well, if I’m basing my pricing to value, I need to base my product metrics to value. That’s really hard for product because I can’t look at a session and say, “are they getting value from that session?” if all I’m looking at is how they’re clicking through or the amount of time they’re spending in the app.

And so what we focused on instead for our product team were “moments of truth.” The customer needs something. How am I driving that value better, faster, and more efficiently than anyone else? And so those moments of truth are actually what we found were highly predictive of outcomes. And so actually our product team invested in running QBRs with every one of our customers, even when we were tiny. And yes, utilization metrics are part of it, but more importantly, the stories around how the customer was driving value in their business from our product became the actual primary way for them to make those calls. And so they would look at that and say, okay, there were like six moments of truth, and we served all of them. And then we shared that with the customer and the customer got really excited. And then they said, okay, here’s what we’re gonna do next quarter. And so it allowed them to start to build their relationship in a deeper way with us.

And we measure ourselves on that revenue retention, dollar revenue retention, whatever sort of retention metric, which factors in essentially your gross churn combined with your upsell. And so every one of these QBRs is not just an opportunity to get a renewal. It’s an opportunity to get an expansion, expand to another team, expand to another product that may suit some of the product needs that the team has. So we don’t think of these as just, get the renewal. We think of it as what is the relationship that allows us to grow our presence with that team across the entire Komodo suite of products.

Jay: Andrew described how Headway focused on one north star quantitative metric, but then changed the north star metric as the company matured through different stages.

Andrew: Early on in our company’s development, we prioritized how many active providers we had, which is active supply side users. We really, really privileged that. And indeed, much like the development of marketplaces, once you really corner supply—and we built the best supply acquisition engine, we are bigger, faster than any would-be competitor—then we really knew as well for some other strategic inputs that it was a time to think about not just cornering and having a north star metric be supply units, but a derivative of GMV, which for us was appointment, supply, and demand intersecting.

Jay: So our fifth takeaway is to find your north star metric, whether it’s qualitative or quantitative, and then be willing to adjust that metric as your company evolves.

We heard many examples of metrics being misleading without context. So the key is to diligently pick the ones that actually drive business value for your network. For GoodRx, which would look at aggregate traffic and page rank among other things, external changes could really skew those.

Doug: We looked at our page rank because we are obviously primarily an organic based company. No one really occupied drug name plus price, and so we wanted to make sure that we were filling that void and that we could actually make some headway by just answering that question again for both consumers and physicians. And so I think, you know, obviously we looked at aggregate traffic, we looked at page rank, we looked at claims.

So let’s say Google suddenly decided that we were the best option for lisinopril. Lisinopril is just a drug. But let’s say lisinopril is the head term, right, not lisinopril plus price. And so all of a sudden our lisinopril traffic would go through the roof, but of course, so would our bounce rate, because people would come and they’re actually looking for side effects of lisinopril, or they were looking for interactions with lisinopril, or should I take it if I’m pregnant or who knows what. And so those could be sometimes confusing. They also of course blow out your metrics because now you’re the head term and you’re the number one search result and all of a sudden it skews things. So you have to be careful because, remember I came from the world of social, I was at Facebook, where time spent was the god metric, like we care about as many eyeballs and as much time as we can. At GoodRx it’s less about time spent and really more about making sure the consumer gets a positive outcome and they’re able to find a great resolution.

Iman: In general, just looking at top of funnel metrics can be very misleading if we’re not looking at the middle and the bottom of the funnel in terms of what the activity you actually want to happen. A vanity metric is just looking at the overall number of talent on the platform, because it doesn’t really matter if there’s a thousand, ten thousand, a million, millions of healthcare workers on the platform if they’re not engaged, if they don’t have their profiles completed and if they’re not being put in front of employers.

Jay: And so our last takeaway for building the first side of your network is to be mindful of the north star metric you choose, and especially to watch out for those vanity metrics.

5. When should you activate the next side?

So after establishing the first side of the business, founders then have to start thinking about how to turn the data stream from the first side of the business to drive the second side’s growth.

Arif: Once you have that core, then the question is: How can you use it to the benefit of the folks who will provide you the next set of insights? And so we actually took that core and we built a lot of insights that helped folks that see patient journeys, like providers, like payors. And by doing that, gave them a reason to both contribute to us and, as well, take something from us.

Jay: In fact, it might even be the case that the data stream and engagement that a business has curated is so good that the second side of the business comes to you.

Doug: We had a number of manufacturers call us up. I had one very senior manufacturer, C-level executive at a major manufacturer, call us up and say, this system’s just broken. You guys have the eyeballs. We want to get in front of the people so that we can tell them about our drug and give them the tools like patient assistance programs and manufacturer discounts. We want to go direct. We want to just end-run this whole messy system. And so we knew there was an opportunity here when we were getting those kinds of phone calls.

6. How did you find product-market fit (again)?

Jay: Now whether you have some inbound demand for the second side of your business or not, you likely still need to do the cycles of customer pain point discovery and product iteration, which you successfully did on the first side of your business, in order to succeed in the second motion. GoodRx was quite disciplined in their approach here.

Doug: We just started slowly calling up manufacturers and saying, hey look, we’ve got more people sitting on the GoodRx slash whatever drug name page than you have at whateverdrugname.com. So what do you want to say to those people? And you start with the basic stuff. You start with the same ads that you see on the Golf Channel and stuff like that.

But then we started thinking about way more sophisticated programs, like we have a program right now where we actually have a nurse, a live 24/7 nurse chat sitting on a drug page. So you can actually talk to a nurse about the drug.

We have, again, integration of patient assistance programs, so if you just simply can’t afford it, they have these incredible programs that’ll bring down the cost to as much as zero. We have all sorts of integrations that ultimately are focused on connecting that provider who traditionally does not have a great relationship, doesn’t really know the patient, because they’re very divorced from it. They often have a drug that you can’t even pronounce that they can’t necessarily connect with the patient. And we’re the glue, we’re the glue that can be in the middle.

Jay: Now it can be daunting and potentially distracting to start again on a new side as the first side of the business is really taking off. But focusing on finding product-market fit in the new segment can drive stickiness for both sides of the network. Incredible Health found that product expansion surfaced more ideas for further product expansion, which surfaced more ideas for product expansion, which continues to fuel their growth today.

Iman: So product expansion in a two-sided marketplace is probably one of the most effective things you can do to drive growth and to drive your own, and to drive a company’s defensibility, and to drive delightful user experiences.

So we’ll talk about it on the talent side and on the employer. So on the talent side, it was very important that we’re not just the place where a nurse and eventually other healthcare workers find a job. We need to do more than that. We need to have, from a product standpoint, we need to have a career-long relationship with them.

So we do offer free continuing education to every single nurse in the country. We offer free salary estimators for every single nurse in the country. We have an advice platform or community built into our apps where nurses can give each other highly personalized advice. It’s like a Quora for nurses.

And we continue to add more and more of these services. In addition to that, our customer support team offers interview preparation, helps with resume guides and so on. And so, I think the more value that we drive to the talent, first of all, the more join us and then the more stay with us. It really is a huge driver of user acquisition and engagement on the talent side.

Now the same is true on the employer side. You know, we incorrectly thought in our early days, if we deliver the talent, we’re good to go. We can just move on. And no, it turns out that we actually have to build quite a lot of B2B workflow software for the employers.

Automatic interview scheduling, in-app chat between the talent and the employers. We had to build an SMS technology, we had to share a robust set of data analytics so they can benchmark themselves against their competitors who were also using the platform so they can improve their internal hiring operations.

Jay: So when it comes to building out the second side of your network, our first takeaway is to repeat the product discovery and iteration process that your organization executed so effectively before in order to find product-market fit again.

But again, excess complexity can start to creep up. Keeping it simple and familiar can drive adoption and growth tremendously.

Andrew: So to payors we get to transact in a way that’s really familiar looking like a doctor’s office. So even though over time, as part of being more than just a provider group we layer on additional pricing complexity and additional product complexity, we looked really familiar. We get paid like a doctor’s office gets paid, which allows us to in turn pay providers like a doctor’s office gets paid. And so for providers, they do not have to see us as some of it entails a SaaS fee. They see patients and then they get paid, there’s not any additional auxiliary fees for what we’re offering.

We get to give away our software to providers for free. They get a marketplace where patients can find them. They get a SaaS portal where the billing and the scheduling happens in a way where insurance is invisible, and then they get paid a straightforward fee for each session.

Iman: The more complexity there is in pricing, the harder it is to close a deal. And right now we’re in hyper-growth mode. Incredible Health grew 400% last year, we’re on track to grow another 300, 400% this year. And our priority right now is to drive market share and expand as much as we can. And so we kept our pricing very simple as a result.

Jay: So as you’re iterating, it’s key to look for any area you can to cut out complexity.

7. How did you balance customer priorities across both sides?

Now, once you achieve success on both sides, you encounter the more pronounced challenge of keeping both sides. Iman at Incredible articulated what we heard from many about serving both, but ultimately being clear about the north star of your network and why that alignment ultimately benefits both sides of your network.

Iman: This happens all the time. We have employers that have asked for exclusivities, they ask, can we get them talent first? And we always say no to those requests.

We explain that we operate like Switzerland, we’re neutral, and we don’t have any preference for one employer over the other. And the reason for that is because of the talent at the end of the day—the mission says to help healthcare professionals find and do their best work.

And at the end of the day, it’s up to the talent where they ultimately want to end up being, and we want to maximize the number of opportunities that the talent has.

Jay: And that’s how we get to our third takeaway, which is of course, to work with all sides of the networks, but to be open and clear about your alignment with one in particular.

8. How do you continue growing once both sides are working?

With both sides humming, what’s next? How do you continue building and growing the business once both sides are working, reinforcing one another? The common theme is that you have to find ways to nurture demand for your product. Komodo focused downstream, building relationships with professional service providers and brokering channel partnerships, which unlock new ways of distribution.

Arif: What’s happened over time is that our relationship with these consultants has grown to the point where they’re the equivalent of a system integrator in a workflow software setting, meaning that they’re the ones that actually carry the last mile often for our customers. And so we’ve made it really easy for them to operate on the Komodo platform. By doing that, we give our customers the alternative of working with their favorite set of consultants or their favorite sort of integrators. And that has actually strengthened our relationship, both with the ecosystem as well as with our customers. So that I don’t say no. I say, guess what? Here are five companies that you could work with that’ll take care of this and take care of this on your terms. And we work with all of them.

Jay: So our fourth takeaway is to look for potential channels and opportunities to help your customers use your products.

Another interesting insight is from GoodRx, who focused on building mini sprint teams to continue launching new products and features to expand their product surface area across healthcare.

Doug: So we spend a lot of time and effort on figuring out how to build small squads to take risks, try things out that don’t necessarily have a direct ROI right now attached to them, with a small group so that we can continue to invest in other ways to fix healthcare.The nice thing about healthcare is there’s just so many markets to go into.

Jay: And this highlights our last key takeaway, which is to establish whichever processes are true to your culture, to ensure you continue to launch new products over time.

Investor perspective

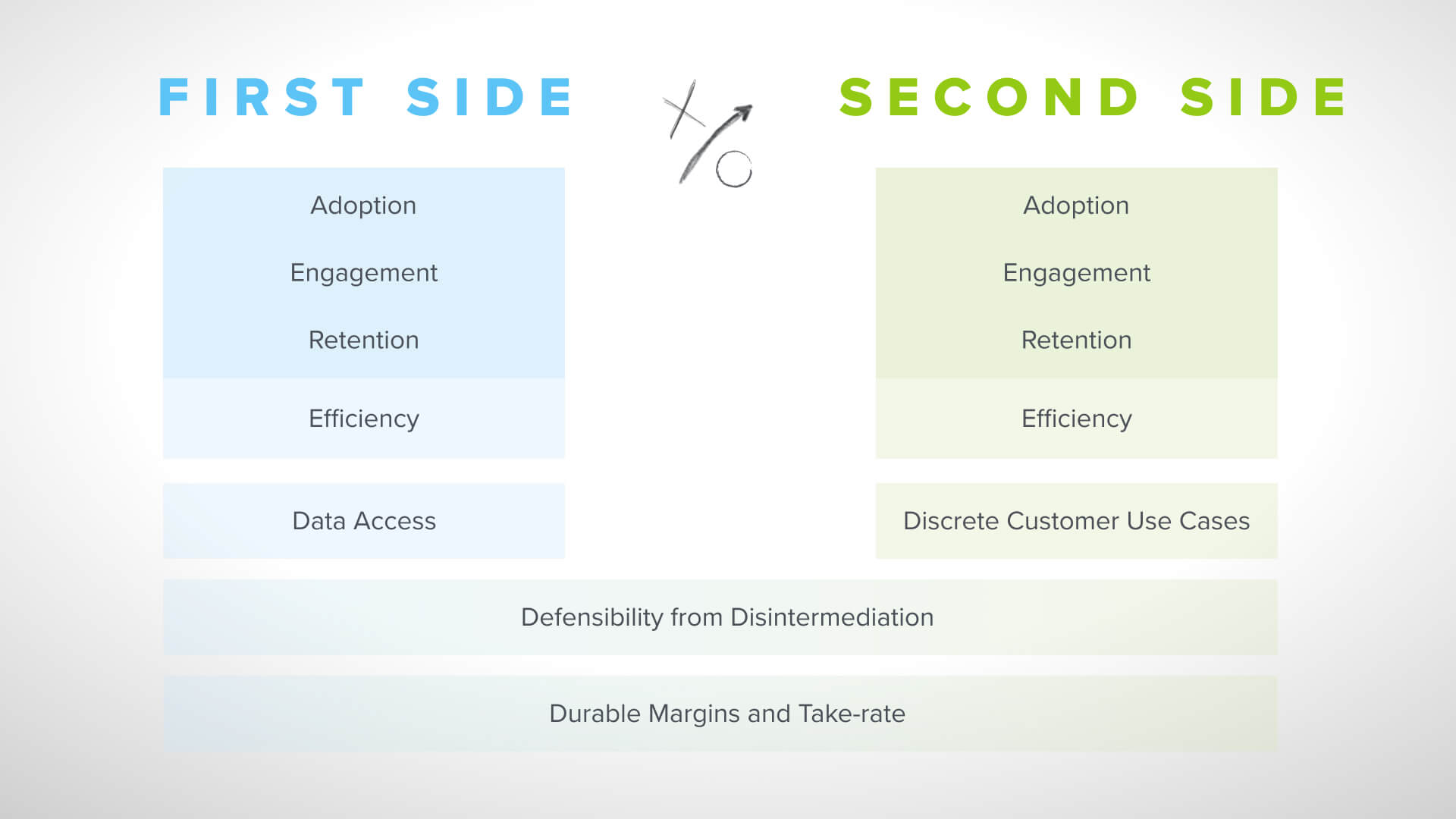

At a16z, we’re incredibly optimistic about the scaled impact these multi-sided network businesses can have on our disjointed healthcare system, but they’re clearly not easy to build. So how do we as investors even go about evaluating businesses like this? Well, we take each side in turn and we benchmark each side’s individual performance to best-in-class healthcare software businesses.

Our firm has written extensively on this (including here, here, here, here, here, here, & here) but to highlight:

First, we’re looking for early indicators of lock-in or product-market fit. On the first side, this spans five elements.

Adoption. Are people signing up? We can measure this in account growth, user growth, revenue growth.

Engagement. Are they using it? We can measure this in time spent in the product, number of clicks, number of transactions, number of visits or whatever the appropriate unit of engagement is to understand engagement frequency and quality.

Retention. Are they coming back to the product? How long do they stick with the product? Typically we’re looking at retention curves through 3, 6, 12 months to understand how much your existing customers are fueling your growth and how favorable your acquisition economics are.

Efficiency. Is growth getting easier over time? Is your incremental acquisition cost going down? Perhaps there’s a network effect emerging that is really driving word-of-mouth referrals and decreasing your dependency on paid acquisition.

Data access. Are you learning from your users and your product? Are you sufficiently receiving information through the first side of the business that enables the subsequent sides of the business?

Ultimately, we get excited by signs that it’s easier to grow the customer base over time.

Then we look for evidence that the second side is reinforcing the first, or that the two-sided network is starting to take form with line of sight to long term durability and attractive economics, even if the business is still taking shape.

We again, look across the same dimensions of adoption, engagement, retention, as well as the efficiency of that growth. But here we have the added lens of looking for qualitative examples of customer use cases that are only possible because of the first side of the business.

And across both, we want to understand your theory of defensibility. Both from disintermediation between the constituents you’re connecting as well as from margin or take rate compression on each side as any one constituent gains share, or you have new competition. Some of this will look slightly different depending on whether you monetize via SaaS fees on each side or by a per transaction marketplace model. But at a high level, these are some of the ways we look to understand these types of businesses.

Vineeta: Thank you all again for listening and thank you to the founders who contributed their hard earned lessons in this episode of healthcare go-to-market strategy. As we at a16z continue examining various go-to-market motions in digital health, we’d love to hear from you on what’s working for your team. What’s something new you’re trying? What’s a learning you’ve had? We’ll continue posting our learnings on our hub page a16z.com/digital-health-builders. Thanks so much.

Headway, Incredible Health, and Komodo Health are a16z portfolio companies.

- Streamlining the Patient Referrals Chain with Trey Holterman

- Fueling Innovation with Data with Arif Nathoo

- Scaling Medicaid Innovation with Afia Asamoah, Rajaie Batniji, and Sanjay Basu

- Mastering Data with Sajith Wickramasekara

- The Freedom to Choose Your Own Insurance with Chris Ellis and Adam Stevenson