In a market full of bears, we are bulls when it comes to consumer health companies. In our last piece, we made the bold claim that a consumer health tech company will become the biggest company in the world. In this piece, we will dive more specifically into areas of consumer health where we see opportunity.

As a reminder, we define consumer health companies as companies with which patients know they’re interacting and have the opportunity to feel loyalty. A consumer health company doesn’t need to be DTC for distribution, cash pay, or a provider of services. In fact, a consumer health company could be B2B2C, entirely covered by insurance, and offering pure technology.

But first, why are we so bullish on consumer health? The current state of affairs is dismal. Patients are unhappy; providers are burned out. In a multi-trillion dollar industry, there are just a handful of major healthcare companies with very strong NPS and brand loyalty (e.g. One Medical).

That said, we believe there are a multitude of reasons why great consumer health companies are launching to fill the void.

For one, everything is being consumerized, from weed killer to renter’s insurance. But there are many healthcare specific reasons, too.

Several years into a global pandemic where we’ve all been faced with our mortality, consumers are taking control of their health more than ever, and healthcare is attracting fierce entrepreneurs seeking a meaningful mission.

Furthermore, deductibles are rising and consumers are footing more healthcare costs, making them more discerning about healthcare experiences and likely to vote with their wallets. In other words, rising deductibles are leading to more free market dynamics in healthcare, and the best companies are built in free markets.

And even though consumers (thankfully) still don’t pay for the majority of healthcare–which is why their consumer experience has been ignored historically–companies are starting to realize that by putting consumers first, you can earn brand loyalty and improve patient engagement, which improves outcomes and lowers costs.

Finally, there’s been talk about the consumerization of healthcare for a decade, but the real unlock didn’t come until 2020 when insurance started to cover telemedicine as a result of Covid. So while the first generation of consumer health companies largely sold generic drugs cash pay on the internet, insurance coverage of telemedicine is now enabling consumer health companies to go after much bigger, hairier problems. Consumer health startups used to operate in relatively small parts of healthcare, but they now stand to improve the entire healthcare experience.

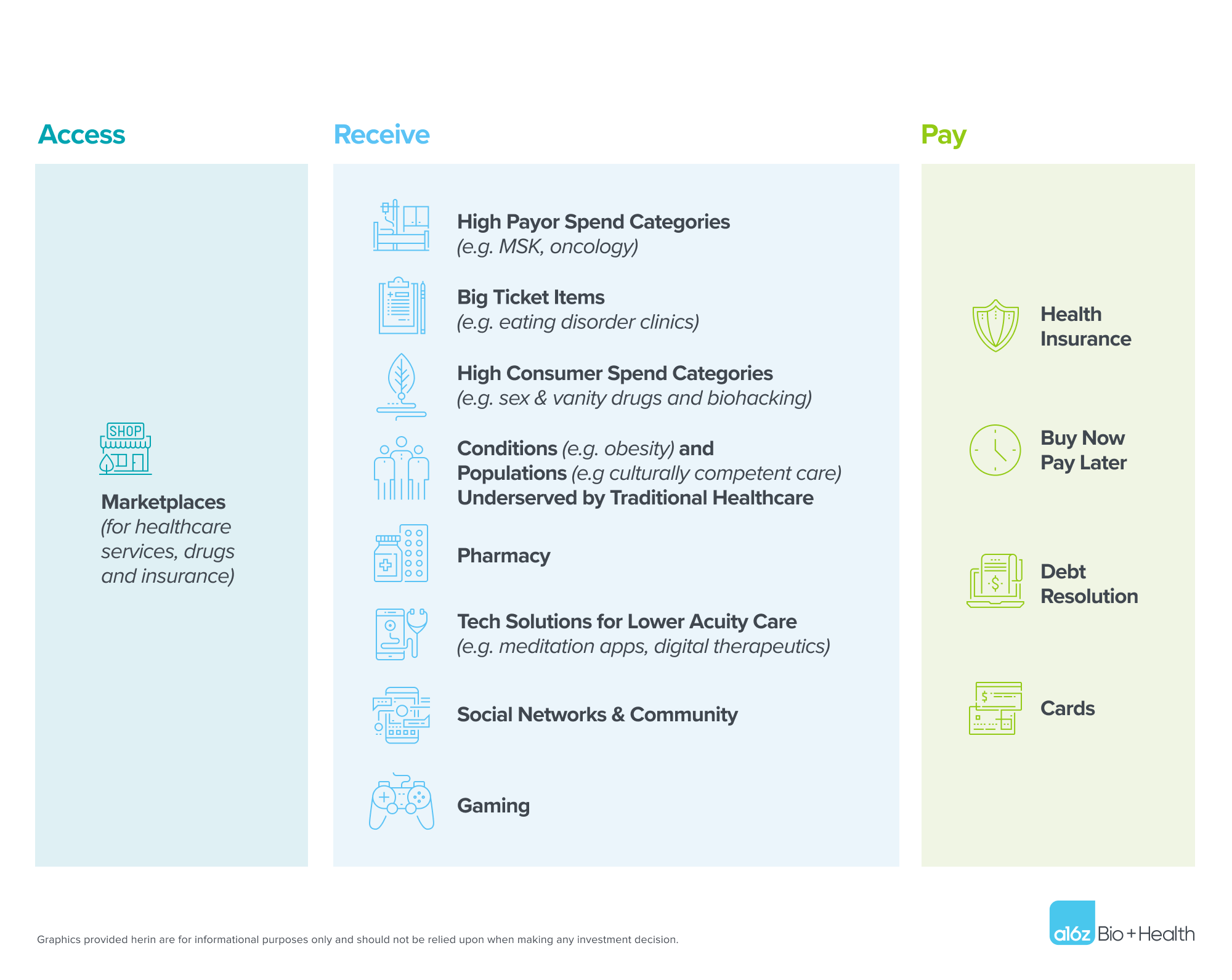

Previously, we stated that the biggest consumer health company would take one of two forms: (a) a vertically integrated payvidor or (b) a horizontal marketplace or infrastructure layer. Breaking that down further, we believe consumer health companies will win by being best-in-class in one of three areas: (1) how we access care, (2) how we receive care, or (3) how we pay for care. This piece will provide a high-level overview of startups we’re seeing in each of those areas, categorizing compelling opportunities in consumer health.

TABLE OF CONTENTS

Access

TABLE OF CONTENTS

Marketplaces

There is still no front door to healthcare. How does someone go about finding a doctor in 2022? One might text a friend to get a recommendation, call that doctor, only to learn that doctor doesn’t take their insurance. Next, they’ll spend 20 minutes trying to find their insurance company’s provider directory, only to be overwhelmed by hundreds of listings that give them no sense of which provider is actually good or has availability.

As we wrote about in our last piece, we believe there is a massive opportunity to be the marketplace where people go to find, obtain, and pay for healthcare services. In an ideal world, this “superapp” would include trusted provider reviews, integrated scheduling capabilities, and price transparency, allowing people to see both cash pay and insurance coverage prices (hence respecting one’s health insurance plan and benefits design). It could even be social, letting people see what doctors their friends like.

Building the front door to healthcare is no small feat. A company must overcome the barrier of connecting all the disparate incumbents involved in this process (the insurers, the individual providers, the revenue cycle management company, etc). That said, there may be hacks for aggregating the supply or demand side, like scraping provider schedules for the former or selling into employers for the latter.

Another challenge for companies aiming to do this is that consumer usage must be frequent and durable enough to justify the CAC–perhaps why previous generations of marketplace-like apps that solely focused on infrequent forms of care struggled. In addition to the hacks mentioned above to aggregate supply and demand and thus lower CAC, a marketplace could increase frequency of usage and LTV by allowing users to shop for cheaper drugs and incorporating more than just traditional healthcare services (e.g. wellness, family and caregiving services). A marketplace like this could even be the place consumers shop for insurance one day, displacing healthcare.gov.

Companies in this category will inherently be marketplaces, but could be monetized in ways beyond the standard marketplace take rate business model, through vertical SaaS or fintech solutions on the supply (clinician) side, or a membership model on the demand (consumer) side covered out of pocket or by employers. And while the first generation of these companies either didn’t incorporate payments or focused on cash pay only, we believe it’s important for current models to predict prices with insurance coverage as well, ideally one day allowing consumers to pay for their care upfront and lock in a price. Price prediction and price guarantees are still very complicated products to build, but new regulation around price transparency and patient data access, which have spawned innovation (e.g. APIs for each), are bringing this closer to becoming reality.

Receive

Most healthtech companies today fall into the category of changing how providers deliver, and in turn, how consumers receive care. We believe this is how it should be–most dollars should be spent delivering care to patients above anything else.

We are interested in the most ambitious companies in this category–those that aspire to be much more than just a digital, high-margin version of a brick-and-mortar clinic. We like companies that aim to do what no in-person clinic ever could. We admire entrepreneurs who want to use their scale to run clinical studies and then use tech and clinical innovations to change the standard of care and deliver better outcomes. Entrepreneurs who will take their superior consumer engagement to develop great relationships with payors. Entrepreneurs who start in one specialty but have Amazon-like aspirations to become The Everything Provider. Entrepreneurs who have visions of massive platforms.

There are countless kinds of digital clinics or clinic extenders out there, and endless ways to categorize them. At a16z, we think a lot about the following categories, particularly as wedges into large, vertically integrated care delivery companies:

High payor spend categories

Some of the easiest categories for venture capitalists to back to date have been specialties that payors spend the most money on: cardiometabolic/diabetes (e.g. Omada, Livongo, Marley Medical), musculoskeletal (e.g. Sword, Vori), oncology (e.g Thyme, Jasper), and pregnancy and childbirth (e.g. Pomelo Care). Why? These are the largest markets in care delivery, and payors are willing to delegate risk to players who can improve outcomes and save money. While this market is relatively developed, we think there is great opportunity here for companies who can leverage their ability to engage consumers, manage medications, and inspire behavior change into broad consumer engagement platforms across multiple patient journeys.

Big ticket items

This category is distinct from the “high payor spend” category in that it doesn’t make up a significant portion of a payor’s total costs, but each individual occurrence is very expensive. Here, real opportunity exists in offering higher efficacy (and often lower cost) solutions to payors. A great example is Equip, which offers entirely digital family-based therapy to eating disorder patients and has garnered impressive contracts with national payors. From the payor perspective, the alternative is generally expensive brick-and-mortar, in-patient clinics with low efficacy, so they’re happy to pay for solutions like this. Other startups are providing digital intensive outpatient programs (IOP) to those with mental health conditions, improving access and diverting unnecessary hospitalizations or inpatient care. Companies like Marker Learning are providing virtualized learning disability assessments and remediation services to consumers and schools at a fraction of the cost.

Not only can these companies radically improve consumer experience, but they generally offer covered services that consumers don’t need to pay for. Referral relationships or special payor contracts often lead to a $0 CAC. The big ticket nature often means high LTV and strong margins. We believe many large consumer health companies will be in this category.

High consumer spend categories

Venture backed successes exist in spaces where people do not expect insurance coverage, and therefore have high consumer willingness-to-pay. Historically, companies like Hims and Ro have prescribed sex and vanity drugs like Viagra, Propecia, and retinol, sometimes using these products as a wedge into higher acuity offerings. Recently, we’ve seen a new wave of companies emerge offering services that have had slower adoption in traditional healthcare, but are quickly gaining traction in DTC, like medication-assisted weight loss, integrative medicine, and psychedelics.

We also believe there is significant opportunity in further extending beyond traditional healthcare, which tends to be reactive, into the more proactive areas of consumer health like biohacking and longevity. Not only are people taking control of their health in light of Covid, consumers are oftentimes easier to influence than doctors, more willing to try groundbreaking medical technologies that could improve health but are still being proven out.

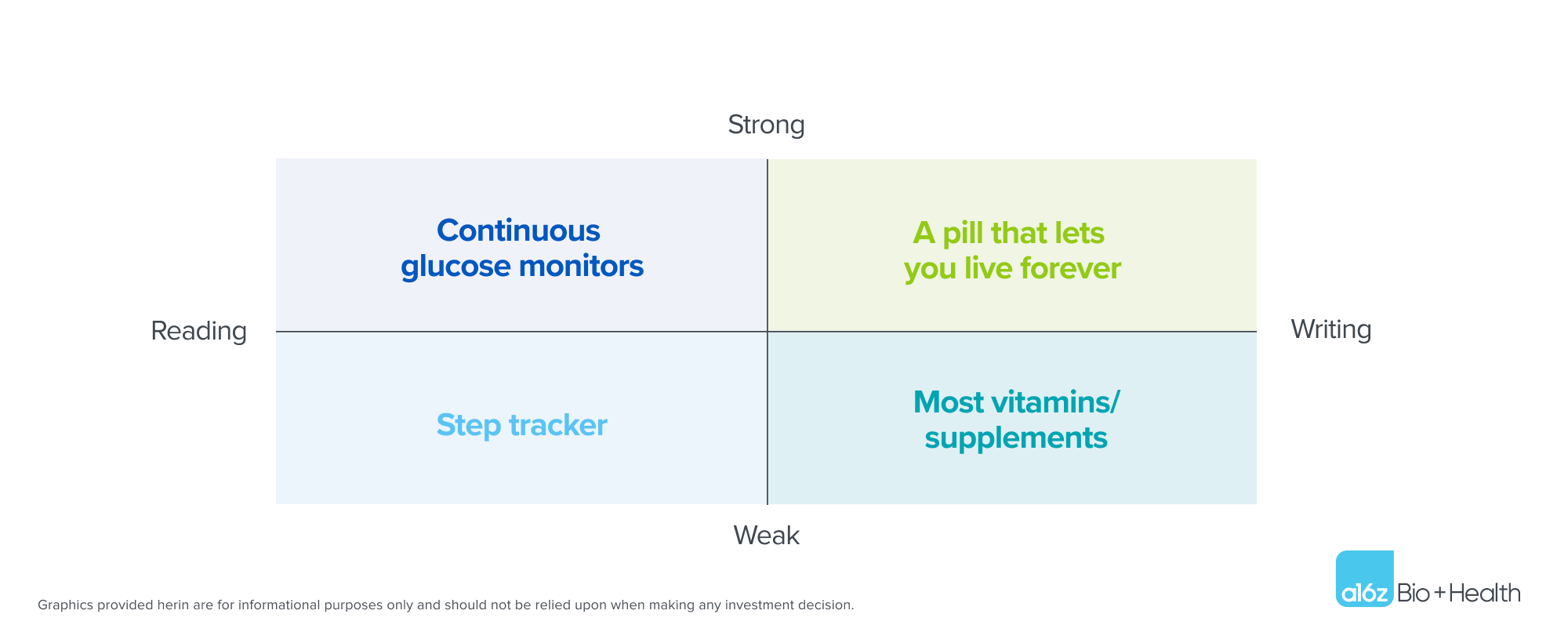

In biohacking–or tracking “the quantified self”–we see two categories: reading and writing, both of which have a strong and weak form. Reading allows people to see what is happening inside their bodies. Reading plus actionability is a strong combination. Levels, which enables people to see how various food and exercise affects their blood glucose levels, actively suggesting tips for stabilization, is a great example of this.

Writing, on the other hand, is harder to achieve: it represents the idea that consumers can dramatically improve their health through drugs, supplements, nootropics, and behavior change. This category is currently the wild west (partially due to lack of FDA regulation), but full of opportunity nonetheless. We’d also include food-as-medicine companies like Season Health which allows providers to “prescribe” healthy food in this domain, where payor attention and coverage is rapidly emerging.

Opportunities in longevity follow the same read/write and weak/strong 2×2. The strongest writing form of a longevity company–the moonshot–will discover a pill or behavior change enabling us to live forever. The weaker form companies that we have today are uncovering diet, supplements, and lifestyle changes to improve lifespan. We expect success in longevity to ultimately combine drug discovery and lifestyle change, so there’s a lot of opportunity in this space.

Categories underserved by the traditional healthcare system

Another space in which we see opportunity are the conditions with high consumer pain that the traditional system is undeserving. Obesity is a great example: over 40% of Americans are clinically obese, and most are simply told by their doctors to diet and exercise. Traditional healthcare has treated obesity as a simple “calories in-calories out” equation, not recognizing it as a complex disease for which patients need intensive clinical support. Companies like Calibrate, Found, and Weekend Health have started to fill this void by offering comprehensive medication, education, and support for weight loss. Other examples in this underserved category include companies like Hey Jane, which makes accessing abortion pills easier in an increasingly regulated world, Zaya Care, which is helps people access insurance-covered lactation consulting and pelvic floor therapy, and Patina, which provides home-based primary care designed entirely for seniors. There is a huge opportunity in helping patients with conditions that are underserved by the traditional healthcare system, but companies must be sure that the patient’s pain point is not caused by the lack of a good therapy or standard-of-care treatment pathway for the medical issue. Care delivery companies can solve access problems and prevent a person from bouncing around the healthcare system, but biotech companies are more likely to develop new therapies for conditions that are underserved.

Companies targeting populations overlooked by traditional healthcare also fall into this bucket. This includes everything from companies serving LGBTQ populations (e.g. Folx and Plume) to companies providing culturally competent care to racial and ethnic minority populations (e.g. Spora and Clever Care). Here, the recipe for success is genuinely hearing and understanding patients, not discrediting their pain, and engaging them to improve health outcomes. All humans deserve excellent healthcare, and there happens to be great business opportunities in providing it to those who haven’t historically received it.

Pharmacy

Another massive consumer health market is pharmacy. The U.S. pharmacy market is over half a trillion dollars, and we’re actively looking to invest in companies improving pharmacy experience for consumers. A few companies like Capsule and Alto are delivering prescriptions to patients’ doors in hours and allowing patients to communicate with pharmacists via text message, but we’re still in the early days. Given large retail pharmacies’ lack of innovation when it comes to consumer experience, we believe there is endless opportunity to delight patients, save healthcare costs, and improve medication adherence (a big deal!).

Technology driven solutions for lower acuity care

This category is a natural fit for venture capital, which has historically invested in pure software businesses. It includes everything from meditation apps like Headspace and Calm to digitized cognitive behavioral therapy (CBT) to companies like Bold, which offers insurance-covered fitness classes.

All digital therapeutics fit into this category, though we believe digital therapeutics describe a go-to-market strategy more than the product itself. Most “digital therapeutics” could monetize via consumers, payors, or providers while they seek FDA approvals and billing codes, which is generally a smart way to get revenue in the door in the early days.

Social networks and community

Not many social networks exist in healthcare to date, and we think there is a huge opportunity here. In healthtech, people tend to refer to social networks as “community” (perhaps due to the negative connotation social networks have today), but the opportunity for network effects exists nonetheless. We’re interested in everything from communities for people with medical conditions like rare cancers to group-based care delivery for chronic conditions. Monetization remains a bit of an open question here, with some companies testing pharma-facing business models for research applications, while others monetize through ads or affiliate referrals, but we maintain that healthcare can greatly benefit from more community.

Gaming

We’re also excited about the intersection of healthcare and gaming and are actively partnering with our dedicated a16z Games Fund to look for startups in this arena. Diverse areas of healthcare ranging from mental health to fitness can all benefit from gamification.

One topic we’re actively debating: will winners in this category gamify healthcare or healthify games? In other words, will the winners look more like Epic Systems or Epic Games? Gamified health is more likely to be designed for efficacy and health outcomes, but healthified games are more likely to have better retention and compliance (which is one of the biggest problems to solve in healthcare).

Pay

Finally, we believe massive companies will emerge to help people pay for healthcare. Half of Americans have medical debt and Americans owe $1 trillion for healthcare services they’ve already received. Medical issues are the #1 driver of bankruptcies in the US, accounting for 66.5% of all cases. Entrepreneurs seeking a major problem to solve: look no further!

We’ve written extensively about opportunities in healthcare x fintech, but see the following as the major consumer opportunities at the intersection:

Health insurance

Less crappy health insurance is the obvious category here, and we’ve seen big companies bult in everything from commercial plans like Oscar to Medicare Advantage plans like Devoted. Players like Firefly are seeking to dramatically improve patient experience and lower cost through virtual-first health plans, hybrid networks, and more.

Patient-friendly BNPL

We’re seeing plenty of novel non-insurance payment products in healthcare now, too. One promising category is buy-now-pay-later–a host of companies like Paytient, Payzen, Walnut, and Cherry are looking to displace CareCredit and offer patients 0% APR installment plans, like Affirm is doing outside of healthcare. We believe the recipe to success here is monetizing payors, providers, and employers (ideally all three), but not patients.

Debt resolution

Also promising is a crop of companies helping consumers file insurance claims and settle medical debt. As we’ve written before, a series of regulatory changes have opened new avenues to use technology to reduce consumer medical debt. There is an opportunity to transform patient advocacy & medical debt reconciliation from a cottage industry into technology-driven solutions accessible to all.

Cards

Finally, numerous card products are aiming to help consumers pay for healthcare. Companies like First Dollar and True Medicine are making HSAs and FSAs easier to use, helping Americans take advantage of the healthcare savings they’re entitled to. Companies like Ness are asking a slightly different question: if credit cards can incentivize and reward travel, why can’t they do the same for healthcare?

There is endless opportunity to help Americans pay for healthcare services in a more consumer friendly manner, and these ideas are all part of the solution (as is regulatory change to help consumers). Winners in this “pay” category will find ways to have long-lasting relationships with consumers, enable choice in healthcare, have diverse revenue streams, and insert themselves into payment flows.

Conclusion

We’re extremely optimistic about the future of consumer healthcare. The 2011 conference panels on the consumerization of healthcare weren’t wrong, they were just a bit ahead of their time. A number of trends–including insurance coverage of telemedicine, consumers footing more of healthcare costs, and a move toward value-based care where engaging consumers can lower costs–all make now the perfect time for consumer health companies to take off. Consumers’ healthcare experiences leave so much to be desired that the opportunities for improvement are essentially endless. By changing the way consumers access, receive, and pay for healthcare, new entrants can build huge businesses that dramatically change healthcare for the better.