Over the last decade, many digital health companies have struggled to achieve escape velocity, not because their products and services weren’t transformative, but because they failed to find a sustainable path for distribution.

The good news is that resourceful digital health founders have been finding new, creative, and efficient ways of getting their solutions to market. We have been collecting and sharing back tactics from these founders in our New Go-To-Market Playbooks for Digital Health Companies series–in hopes that they will help founders build more high quality, durable businesses in healthcare.

One key go-to-market (GTM) strategy in healthcare is selling through channel partners, and that will be the topic of focus for our fifth and final playbook in this series.

Channel partnerships have propelled businesses throughout the history of tech, whether it was Intel selling through PC manufacturers or Salesforce’s AppExchange marketplace for third party app vendors. Not to mention: 95% of Microsoft’s commercial revenue flows through channel partners!

And channel partnerships are particularly relevant right now for at least two reasons: 1) many enterprise buyers in healthcare have thrown up their hands in exhaustion from “point solution fatigue” and are seeking to consolidate their vendor relationships, which creates more barriers for startups to sell directly, and 2) in this recessionary market environment, startups need to drive higher efficiency in their commercial operations, and channel partners could be one way of accomplishing that.

So how can digital health founders successfully implement channel partnerships to accelerate the distribution of their products and services? When should they use them? How should they use them? We spoke with the founders of Omada, Ginger, and Cedar, each of which have successfully utilized channel partnerships, and surveyed 36 other digital health startups to analyze the state of channel partnerships in the market today.

What channels exist in healthcare?

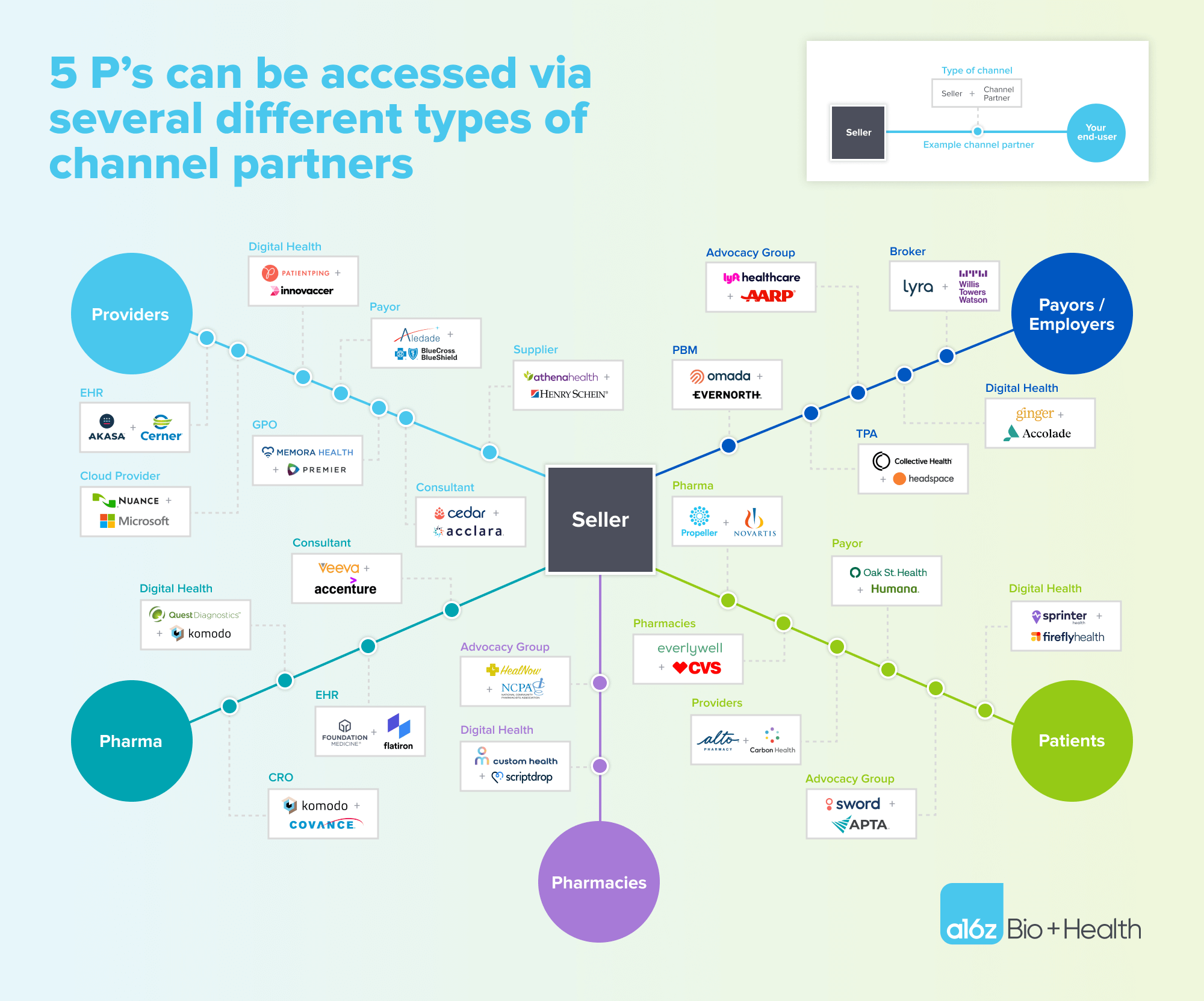

There are thousands of healthcare technology businesses with different offerings and business models, but when thinking about their ultimate end-customers, we boil it down to the 5 P’s of healthcare–providers, payors (including employers), pharma, pharmacies, and patients.

The web of healthcare channels through which a startup could reach those customers is abundant and interconnected. Some customers can even serve as productive channel partners into other customers–for instance, a company could contract with a health plan as an end customer, but also use the health plan’s provider network as a channel into the payor’s employer customers.

Some notable examples of digital health companies partnering with larger channels include:

- Omada Health partnering with Express Scripts through its digital health formulary, to reach joint employer customers

- Ginger (now Headspace Health) partnering with Accolade, also to reach joint employer customers

- Cedar and Memora Health partnering with the GPO, Premier, to reach joint health system customers

- Turquoise Health partnering with Milliman to reach joint payor and employer customers

- AKASA partnering with Cerner to reach joint provider customers

- Kyruus partnering with Salesforce to reach joint health system and payor customers

While not the primary focus of this piece, we’ve also seen a wave of upstarts partnering with other upstarts, to create a more consolidated purchasing experience for a joint end customer. Examples of these include:

- Ribbon Health and Turquoise Health, in which Ribbon resells Turquoise’s contracted rates data through its data APIs

- Hint Health and Eden Health, in which Hint’s direct primary care clinic network is made available to employers through Eden’s employer contracts

- Zus Health and Elation, in which Zus’s shared patient data utility is made available to providers using Elation’s electronic health record (EHR) platform

Why should you consider channel partnerships?

Channel partnerships can add a lot of complexity to how your company goes to market, and they can take months or even years to operationalize. Yet, they can be a powerful and efficient accelerant for your company.

After years of iteration, Sean Duffy, cofounder and CEO of Omada Health, encourages founders to be both highly skeptical that a given channel partnership will work, and highly aware of its critical role in potentially helping your company achieve commercial scale:

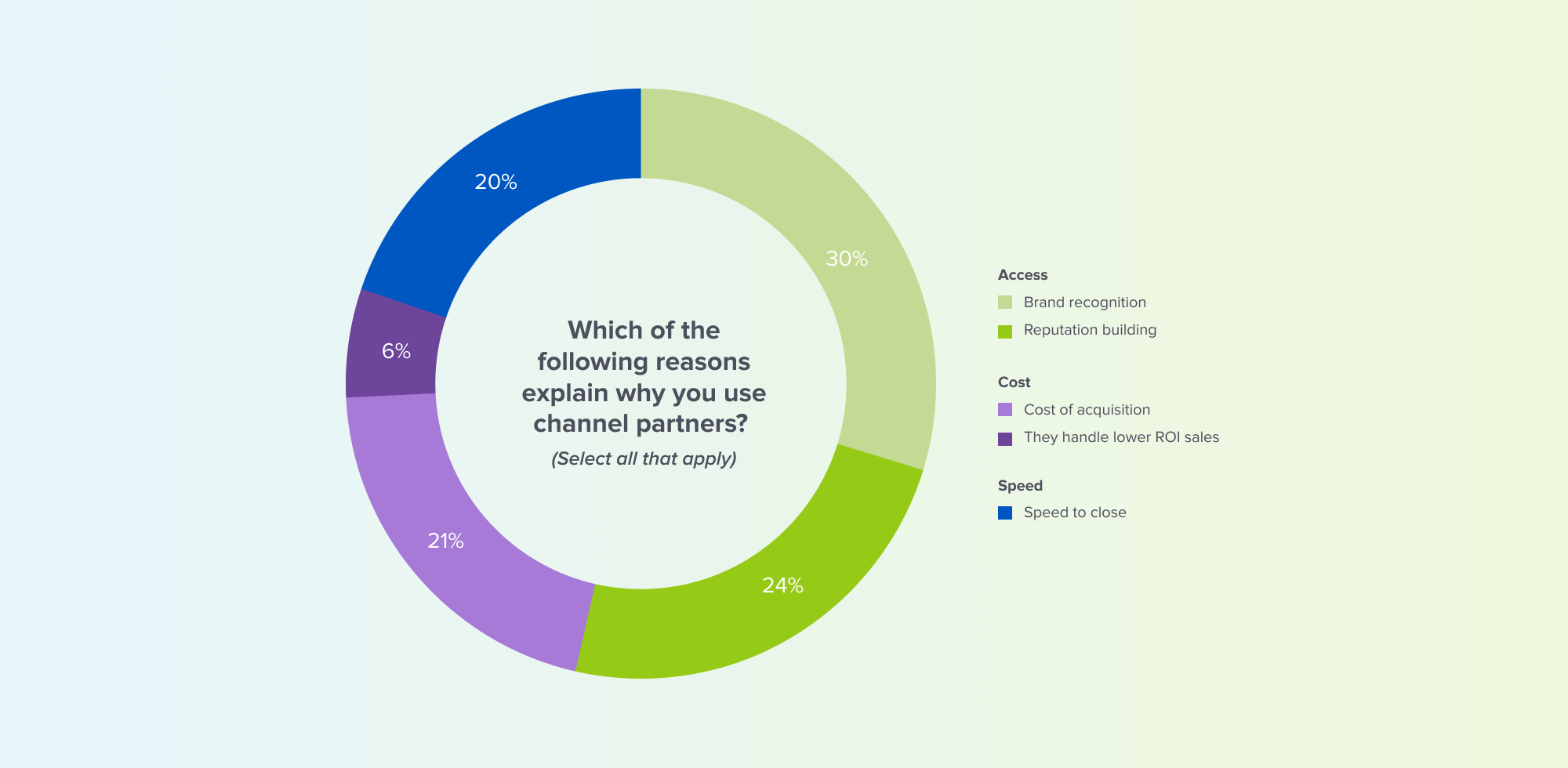

In spite of the added complexity, we see startups choosing to sell through channel partners for three primary reasons:

- Access: sometimes there is a significant pool of healthcare spend that is practically inaccessible to the startup, either because of the customers’ standard buying motion or because the startup simply doesn’t have enough brand equity yet to break through and capture buyers’ attention. Just over half (54%) of our survey respondents cited the latter as a reason they chose to go down the channel partnership route.

- Cost: the financial cost and resources required to build a direct channel to a given market segment may force a company to deprioritize it relative to other market segments. This is especially relevant for adjacent markets that are not long-term strategic to your core business, but the present revenue is attractive to pursue. For instance, a company like AKASA that sells directly to large health systems may decide to rely on channel partners like Cerner to sell to smaller hospitals. 27% of survey respondents cited cost of acquisition as a reason they chose to work with channel partners.

- Speed: a channel partner may offer a significantly faster route to market on an aggregate customer basis. This might be especially important when the value of rapidly boxing out competitors outweighs the tradeoff of shared revenue or less direct relationships with your end customers. An example we often see is when a regulatory requirement drives sudden demand for a compliance solution, and rapid penetration of the market makes sense given that once a customer picks a compliance dance partner, it’s unlikely that they would switch. 20% of survey respondents cited speed as a driver for pursuing a channel partnership.

How should you execute channel partnerships?

Now that we have walked through the ‘what’ and the ‘why’ of channel partnerships in healthcare, it’s time to get to the secret sauce–the ‘how.’

Right path

Executing a channel partnership starts with defining a GTM strategy for a given customer segment, and then determining whether there even exists a channel partnership that can accelerate your path to market.

Who are you trying to reach?

Knowing exactly which buyers (both market segment and buyer persona) you are trying to target helps narrow the aperture for what type of sales motion makes sense. For instance, a target market of HR benefits leaders at SMB employers would mean having to reach upwards of 10,000 organizations to drive sales, while selling a care delivery solution to the clinical leadership of large payors would mean developing deep relationships with a small handful of customers nationwide. The former might seem more conducive to a channel partnership strategy (e.g. through benefits brokers) than the latter, given the scale and leverage you could gain from such a partnership. However, leveraging the brand equity of a channel partner could help get buy-in from large payors, especially if your company is in an established category of solutions.

How do you best access them?

The next step is to understand how these buyers actually purchase solutions like yours, and whether they already have established relationships with channel partners for your category of product. For example, health systems often rely on group purchasing organizations (GPOs) to manage bulk purchases of hospital supplies, and most GPOs now have a software practice where they help health system IT teams manage software purchases. 96-98% of hospitals use at least one GPO, so a company selling into health systems might consider a GPO as a potential partner (per the Cedar/Memora and Premier examples mentioned above).

It’s also possible that spending time directly with your target customers could drive organic demand through their channel partners. Sean Duffy mentions in our conversation that, counterintuitively, the reactive inbound leads for channel partners were sometimes higher quality than the outbound leads, because they were typically an indicator that the target customer had told the channel partner that they wanted them to work with Omada, so the lead was prequalified to some degree.

Right partner

Once you’ve figured out the key categories of players that have established relationships with your target customer base, picking the right dance partner involves finding the win-win while avoiding complications down the road.

Who can best sell your product?

The founders we spoke with and surveyed highlighted that the right partner(s) have a deep understanding of your customers–what makes them tick, how they buy, who the key decision makers are, and what successes and failures they’ve had with other vendors. Ideally, your channel partner will have complementary capabilities to your own and not compete directly with your product–though, as we will discuss later on, this is a common reason channel partnerships fail.

Karan Singh, COO of Headspace Health and cofounder of Ginger, prioritized potential partners who held a strong relationship with a member, offered a path to streamlining the purchasing process for the end-customer, and shared a brand identity and leadership ethos with them.

Who is going to benefit the most from this partnership?

It is critical for a partnership to be mutually beneficial or your channel partner will likely deprioritize selling your product. The economics are usually the most top-of-mind for both parties, but considerations such as customer satisfaction and brand equity (i.e. the channel partner might value the cachet of being seen as innovative if they partner with a buzzy startup) may also matter. In the best case, you would actually drive outsized returns for your partner. For example, UIPath generates $4 of revenue for their partners for every $1 that UIPath receives.

Right timing

The short answer–the right timing depends on the situation. But your likelihood of success is largely dependent on you and your partner living in symbiosis.

At what stage of your company’s development should you consider channel partnerships?

The timing of when in your company building journey you execute a channel partnership strategy really does depend on your specific company and market. For example, Ciitizen started partnering with patient advocacy groups before the product was fully ready and continued to lean heavily on this GTM motion as they scaled, Cedar started exploring channel partnerships in year 2 but didn’t sign its first one until year 4, while Ginger forged its partnership with Accolade almost a decade in and also had success.

Engaging channel partners early could speed up initial market traction, but waiting until later gives you time to solidify your product and positioning so that your partner’s preferences don’t sway your focus and so that you’re more likely to be able to hand your partner a repeatable sales playbook.

Right economics

Finding the right economics for a channel partnership does necessitate protecting your own margins, but your partner also needs to be properly incentivized to drive sales. In addition, ironing out the nitty gritty details proactively helps to set expectations and avoid conflict down the road, as we discuss below.

What should the payment structure and surface area be?

Our survey data suggests that channel partnerships represent ~30% of startups’ revenue, on average. It also suggests that revenue sharing (in which the channel partner gets a cut of the sales price) is the most common payment structure for healthcare channel partnerships. However, other options include referral fees, flat deal closure fees, and commissions.

Florian Otto, the CEO of Cedar, also described having multiple classes of channel partners, each of which could come with different payment terms:

- Marketing partners that simply help generate top-of-funnel leads

- Co-sale partners that collaborate with your sales team to move deals through mid-stage pipeline, and

- Contracting partners that help ease the procurement process at the end of the sales process

The second and third categories might involve a standard revenue share, while the first category might involve a smaller lead generation fee, or no economics at all (if it’s mutually beneficial to both parties to bring each other into deals).

Regardless of the set-up, it’s important to structure the contracts for effective incentivization and accountability for both parties. Florian outlines his approach to accountability as follows:

In addition to payment structure, the surface area of a partnership is also important. We’ve seen companies get very granular–for example, defining whether the partner gets paid per new logo they bring in, per SKU they sell, per net new dollar, or some combination of the above. Other dimensions include whether the partner gets credit for upsells or conversion of pre-existing relationships–we sometimes see exclusion lists of accounts that the startup already has in its pipeline that get carved out of the channel partnership arrangement. All of these details are important to iron out to mitigate conflict down the road.

How much should you be willing to give up?

The answer to this question may change as you scale and have more leverage in the relationship. Our survey data skewed to earlier-stage companies and suggests that these types of companies, on average, pay their channel partners 14% of annual sales brought in. However, Sean, who runs a later stage company, suggested that Omada typically grants 5-10% rev share to its partners. The right number depends on the business, pricing, and partnership dynamics, but we have seen it done best when it walks the fine line of properly incentivizing your partner (both the organization and the individual sales reps you expect to sell your product) while protecting your own margins. Sean provided us with more detail about how Omada set up its revenue share arrangements, including how he has seen incentives align without a revenue share all together:

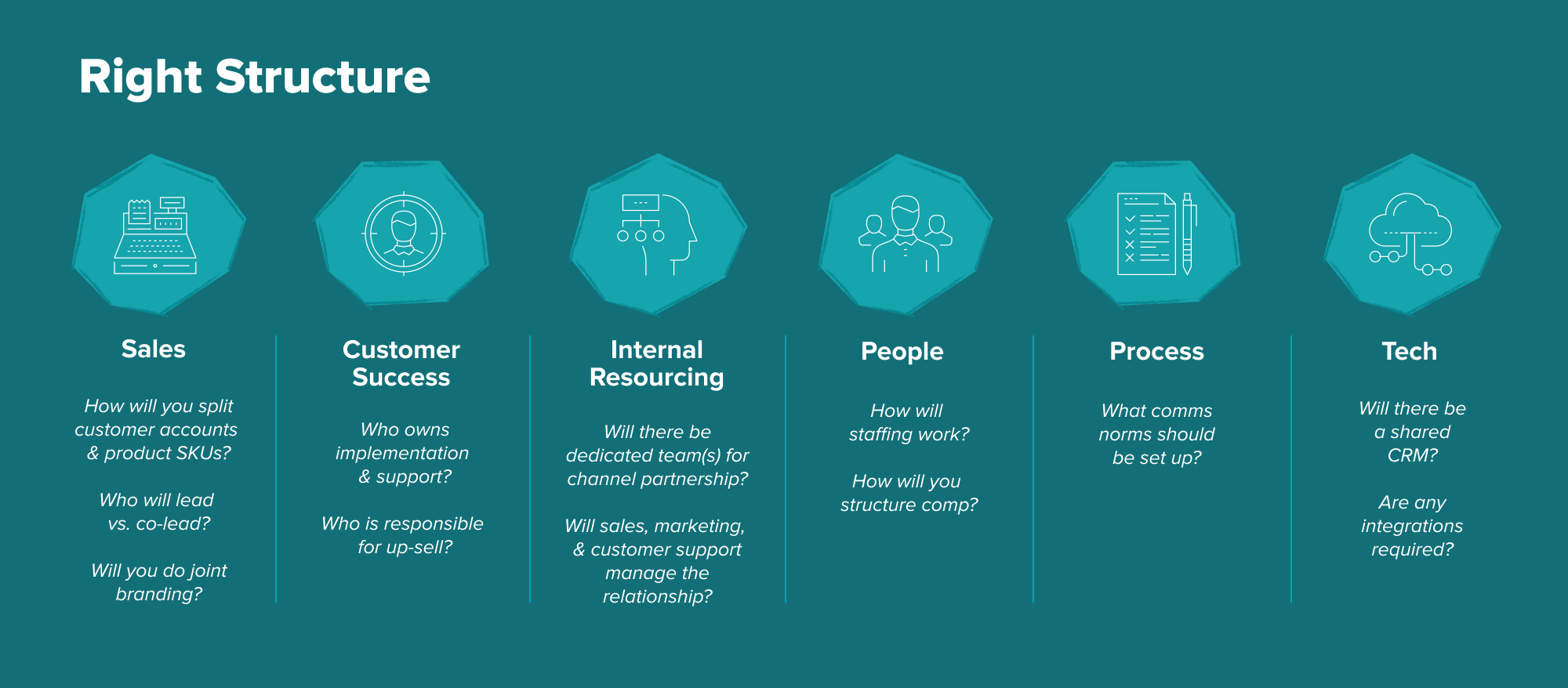

Right structure

A common mistake we’ve seen startups make is to underinvest in a dedicated channel partnership management function. And the team might require more than you think–generally there is a need to support capabilities across many different functional areas, per the figure below.

What is the joint sales approach?

Sean, Florian and Karan all mentioned the importance of establishing a clear plan for pipeline management and determining who will take the lead, and what the escalation paths are, across all stages of the sales process. A dedicated channel partner management team can also help iron out marketing decisions like what branding works for your co-sold products, e.g. does co-branding make more sense, or should you white-label your product?

Who will handle implementation and customer success?

As Sean says, “don’t mess up your implementations,” especially the first one you do with your new channel partner. The channel partner is putting their neck on the line by bringing your solution to their precious customer’s table, so one early hiccup could cost you the entire partnership.

Sean shared some war stories about Omada’s implementation at Costco, an organization so large that the Costco representative warned Sean about how they had “broken” so many other vendors:

How will you staff up to support the partnership?

Within your own organization, who is going to be responsible for handling partnerships and how will you incentivize your own teams to effectively support them? Consider both sales and implementation/customer success incentives. For staffing, you may be able to get away with partial allocation of your sales people, or you may need to consider dedicating an entire individual or team. You can also get creative with how you organize these teams. Florian told us about how his team is structured in a dyad for sales, and how Cedar manages implementation entirely themselves:

Watchouts: When it fails

Our survey suggests failed partnerships are quite common, for reasons Florian mentioned and others:

When a partnership starts to go wrong, it may be tempting to always try to save it. However, it’s worth first determining if that partnership can be turned around and/or if it is of high enough value to you to invest the time and resources to turn it around. Even if your partner has a big name, if they aren’t delivering what you hoped, you may want to let them go. That said, if the relationship can be and is worth saving, truly partnering with your partner will position you to understand the root of the problem and adjust your partnership so both parties are satisfied.

Investor perspective

Channel partnerships can be a lucrative way for startups to get an edge in the market, and they can add to investor conviction when assessing growth, efficiency, and repeatability of the company’s go-to-market motion. What investors will be looking for is whether your channel partnerships result in a more capital efficient and repeatable sales motion, including stronger pipeline development and conversion.

However, investors may probe on several dimensions of your partnerships and partnership strategy to evaluate potential weaknesses. Some areas to be mindful of include:

- Partner concentration: If you are dependent on one channel partner for greater than, let’s say, 30% of your revenue, investors may be concerned about your ability to own your own destiny on distribution. If that channel partnership were to fail, or if the channel partner renegotiated the terms of the relationship, how much of your revenue and future growth would be at risk?

- Margin impact: Investors will scrutinize the economics of the partnerships to ensure that they will be profitable over time. For instance, a 25% revenue share arrangement with a channel partner where the cost of supporting that channel is no lower than that of your direct sales force would imply that the channel is less profitable than direct sales. Thus, we would question the rationale of standing up that channel.

- Weak product feedback loops: Investors may question the strength of your team’s relationships with its customer and end users, because weaker connectivity here may result in poor insights for your product and customer success teams, thus putting retention and renewals at risk, and also limit your ability to upsell and cross-sell customers over time. Having brand recognition with your end-customer (e.g. “Intel Inside”) and/or strong end-customer references can help mitigate this concern.

- Channel conflicts: Depending upon the perceived sophistication of your channel partner, investors might wonder whether your channel partner could choose to compete directly with you over time. For example, Google’s $12.5B acquisition of Motorola Mobility in 2011 was a perceived assault on all the other smartphone manufacturers that included the Android operating system. Similarly, Apple, after reselling Bose headphones in the Apple store for years, began manufacturing their own headphones and ultimately stopped selling Bose in their stores. Strong customer loyalty and channel diversification are key components of your defensibility story.

Comment on generative AI

One of the most fascinating dynamics playing out right now is the huge wave of generative AI startups coming out of the woodwork, and the coincident adoption of large language models (LLMs) by so many incumbent vendors in the legacy ecosystem. EHRs like Epic and eCW are incorporating OpenAI’s GPT into their core products so that providers can take advantage of conversational capabilities integrated into their clinical workflows. Microsoft’s Nuance Dragon scribing solution also recently incorporated GPT into its product suite to drive towards fully automated, real-time scribing capabilities.

Why is this relevant to this GTM playbook? Because it’s a classic example of the battle between the startup and the incumbent, which boils down to whether the startup gets distribution before the incumbent gets innovation. Nuance’s Dragon product is used by hundreds of hospitals and over 550,000 providers; if those providers have a choice between getting a workable solution from Microsoft Nuance that is already integrated into their EHR workflow, versus implementing a shiny new product from a startup, even if it performs far better than Nuance, which will they pick? Should the startup pursue channel partnerships with these companies to help power their products? Or should they go it alone and figure out a way to disrupt from the outside with a unique GTM and product packaging?

This battle is playing out in real time and surfaces the same questions all startups must ask when deciding to sell through channel partners or go it alone.

Conclusion

If executed well, selling through channel partnerships can be an exceptional way for companies to broaden their distribution reach. We hope builders pursuing this go-to-market strategy will find value in these insights and data points as they distribute their products broadly to the market of patients and businesses who need them the most.

Shoutouts

We would like to thank Florian Otto (Cedar), Sean Duffy (Omada Health), Karan Singh (Ginger/Headspace Health), Rajeev Ronanki (formerly Elevance Health), Chris Hogg (Marley Medical), Travis Smith (Signify, Athenahealth), Lora Rosenblum (Cedar), Sophia Cornew (Ciitizen/Invitae), Neil Machhar (PatientPing), Omar Nagji (Memora, Lyft Healthcare), as well as our many survey respondents.

The views expressed here are those of the individual AH Capital Management, L.L.C. (“a16z”) personnel quoted and are not the views of a16z or its affiliates. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by a16z. While taken from sources believed to be reliable, a16z has not independently verified such information and makes no representations about the enduring accuracy of the information or its appropriateness for a given situation. In addition, this content may include third-party advertisements; a16z has not reviewed such advertisements and does not endorse any advertising content contained therein.

This content is provided for informational purposes only, and should not be relied upon as legal, business, investment, or tax advice. You should consult your own advisers as to those matters. References to any securities or digital assets are for illustrative purposes only, and do not constitute an investment recommendation or offer to provide investment advisory services. Furthermore, this content is not directed at nor intended for use by any investors or prospective investors, and may not under any circumstances be relied upon when making a decision to invest in any fund managed by a16z. (An offering to invest in an a16z fund will be made only by the private placement memorandum, subscription agreement, and other relevant documentation of any such fund and should be read in their entirety.) Any investments or portfolio companies mentioned, referred to, or described are not representative of all investments in vehicles managed by a16z, and there can be no assurance that the investments will be profitable or that other investments made in the future will have similar characteristics or results. A list of investments made by funds managed by Andreessen Horowitz (excluding investments for which the issuer has not provided permission for a16z to disclose publicly as well as unannounced investments in publicly traded digital assets) is available at https://a16z.com/investments/.

Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others. Please see https://a16z.com/disclosures for additional important information.

-

Jay Rughani Jay Rughani is a partner at Andreessen Horowitz, where he leads investments in health technology companies.

-

Annie Collins is an investing partner on the Bio + Health team, focused on healthtech.

-

Julie Yoo is a general partner on the Bio + Health team, where she leads investments into companies that are transforming how we access, pay for, and experience healthcare.