Selling into financial institutions (FIs) has long been the end goal for many software-oriented fintech businesses. With massive annual technology budgets and scaled distribution, the largest FIs are the ideal end-buyers. However, a fear of long sales cycles, heavy compliance requirements, and opaque organizational structures preclude many early stage founders from pursuing this go-to-market channel.

We believe, however, these fears are worth tackling, and the current moment is actually an ideal time for fintech businesses to start selling software products into FIs. This is because FIs have long relied on painstaking manual operational processes to accomplish their goals, eschewing technology for human labor. But as investors intensify their scrutiny on companies’ financial performance (including heavily focusing on ROE benchmarks), many FIs are revisiting this approach and looking for more permanent ways to drive operational leverage. In a significant cultural shift, the technology organizations inside these FIs have also started to recognize that not all of their tech products need to be built “in-house.” Meanwhile, FI senior leaders and board members are intrigued by new products like Microsoft 365 Copilot and how generative AI can automate their internal workflows (and improve their bottom lines). Taken as a whole, FIs are at an especially receptive time for greater software adoption.

In this piece, we aim to demystify the “B2FI” (or “business to financial institution”) GTM motion for fintech companies looking to sell to FIs with lessons and advice from companies like SentiLink, Instabase, Databricks, Nova Credit, and Built Technologies—all of whom have successfully scaled as businesses that sell software into financial institutions.

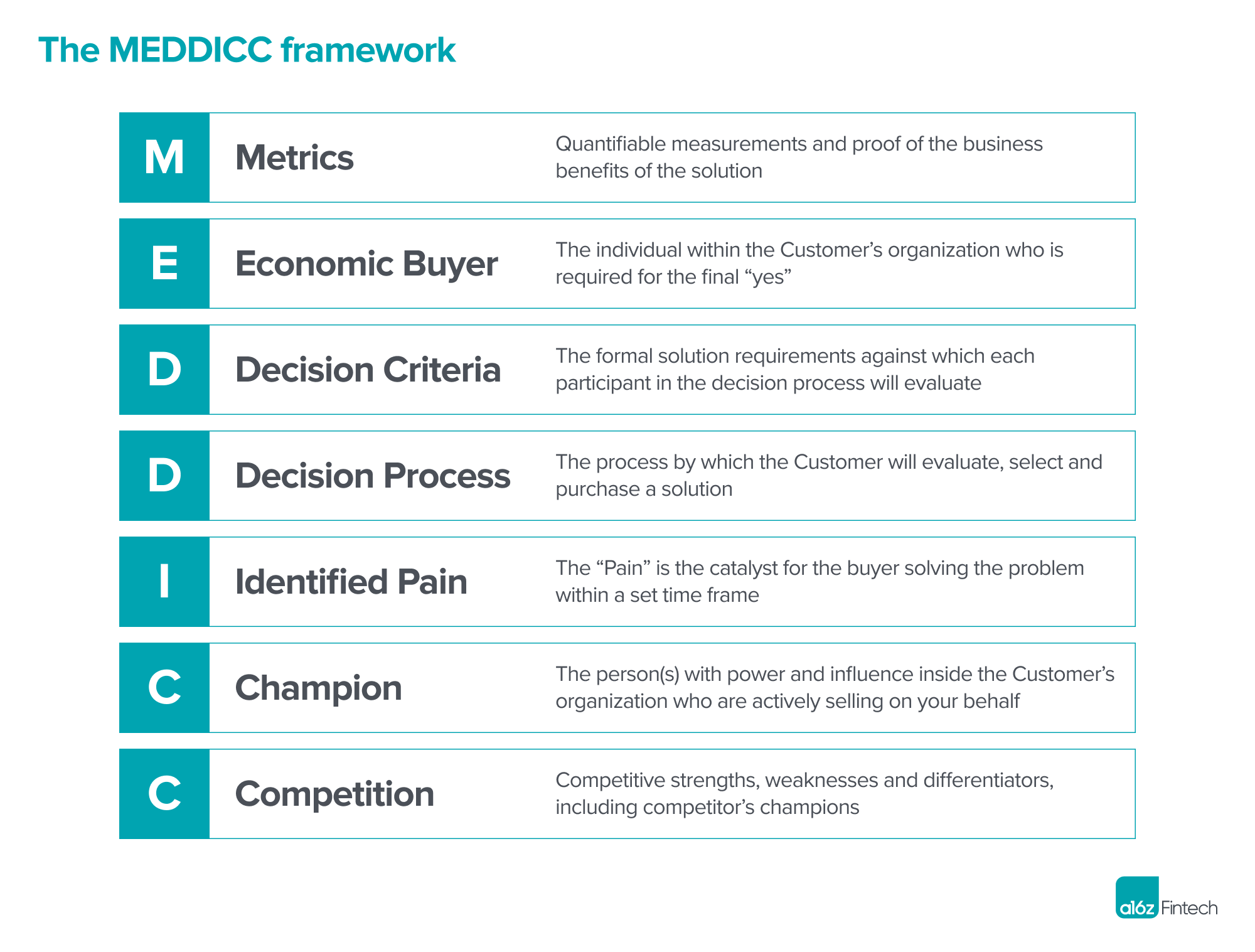

The MEDDICC Sales Framework

To share what we’ve learned from the fintech founders and operators we’ve spoken to about this topic, we have collated their advice under an overarching sales framework known as MEDDICC. This framework, which is frequently leveraged by our GTM team, is a qualification methodology that supports the sales process and can help companies answer internal sales questions such as which customers to go after and how to actually win a deal.

By following a consistent approach like MEDDICC, buyers and sellers are more likely to be aligned throughout the entire sales process, and we believe the probability of success thereby increases by an order of magnitude. Keep in mind: this sales framework is not linear, and these steps should be taken in tandem, not sequentially. It should also be employed only after a company has established their ICP.

Expand each letter below for more

M - Metrics

When seeking to partner with a financial institution, you will need to provide quantifiable metrics—a clear P&L business case—on how your product can benefit your buyer and what ROI they can expect from purchasing the product. No matter how cutting edge or sophisticated, from a technology perspective, your product might be, you’ll still need to present compelling metrics to get a deal signed.

Banks often look for a significant multiple (5-10x) on the value to be delivered vs. the cost of the product, so even before approaching FIs, you need to build an internal case to ensure your product can demonstrate this type of lift.

E - Economic Buyer

To ultimately get a deal signed, it is critical that you simultaneously pursue multiple relationships within different departments at the FI you have targeted. For example, while you certainly need to talk to employees that can help advocate for your product (like the Champion, discussed more in detail below), you must also prioritize getting to know the economic buyer—the person within the FI that actually has access to and can release a company’s dollars to purchase your product; they also make the P&L trade-off decisions. Usually a Chief Information Officer or a Head of Engineering, depending on the organization, the economic buyer is a critical constituent you must win over. (And a surefire way to win over your economic buyer? With compelling metrics, of course!)

D - Decision Criteria

Decision criteria are the factors by which your product will be judged internally, and the employees who set these criteria are known as user buyers and technical buyers. More specifically, user buyers assess how your product will fit into the FI’s core workflows, while technical buyers ensure that your product will meet the FI’s internal specifications around data privacy, security, and stability.

As the seller, you will learn the user buyer and technical buyer’s decision criteria during the POV, or Proof Value, demonstration. This is when the buyers ask “does this product really work?” within a given line of business you are selling into. While constituents from a specific line of business typically attend the POV, it can also be used as an opportunity for you to get a headstart in demonstrating the potential value of your product across multiple departments and get other stakeholders across the organization thinking about how your product could solve their own problems (who do you leverage to get other line of business owners to attend the POV? Through your champion!).

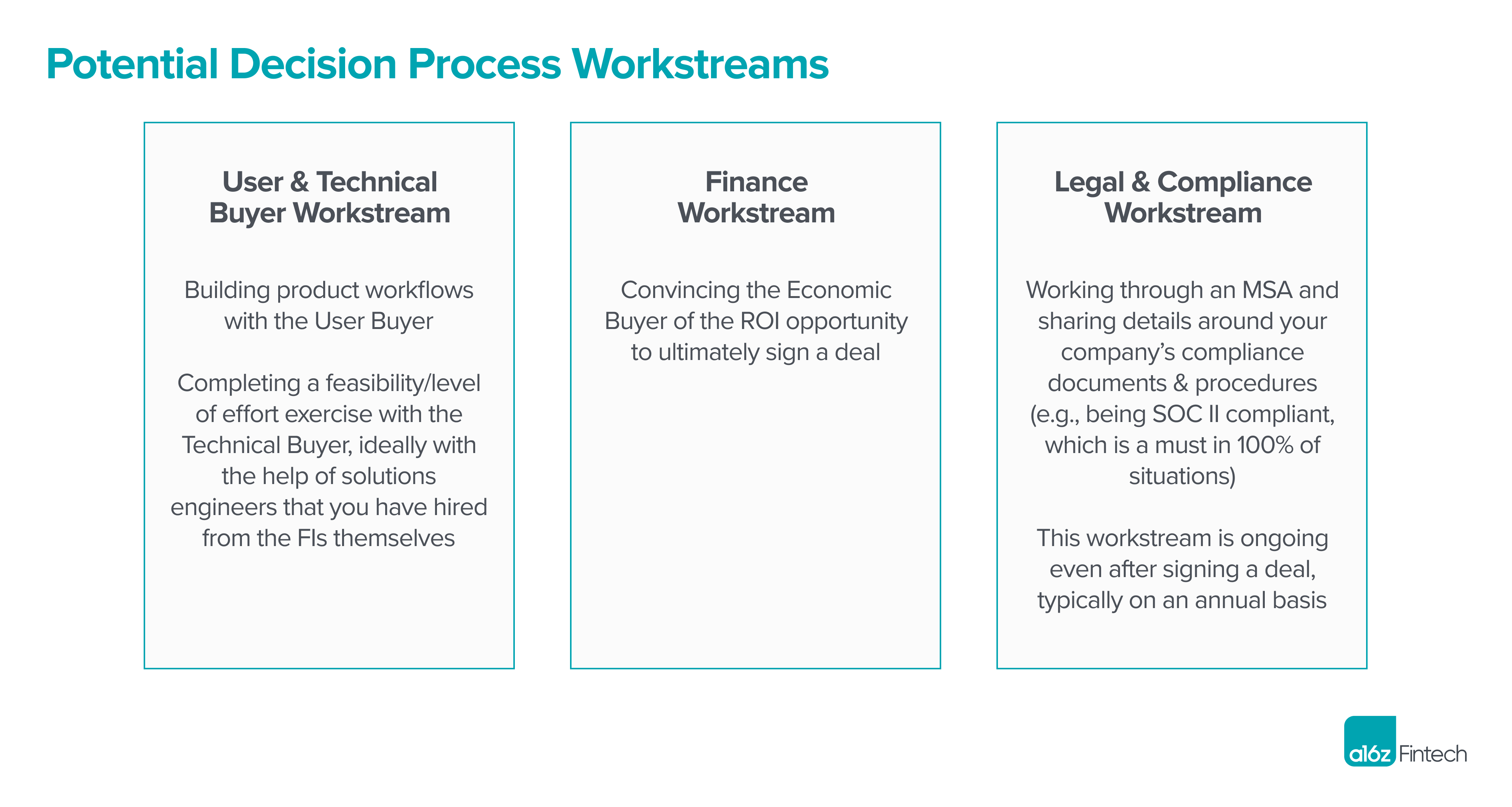

D - Decision Process

I - Identify Pain

It is your job as a seller to identify the business pain points your buyer faces—such as reducing fraud, finding new customers to serve, fighting off fintech upstarts, boosting profitability, etc.— so that you can present your product as a solution to that problem. You can use a bottoms-up or top-down approach (or both) to identify these pain points, but eventually you need to converge to a specific line-of-business problem to focus on. For example, if an IT manager within the FI wants to make their data storage and processing capabilities more effective by using your product, it is your job to translate your solution to a bigger business problem that the c-suite is focused on, such as vendor consolidation (to reduce overall costs).

Similarly, if you’re able to uncover what’s top of mind for your FI’s executive leadership—such as keeping up with the newest generative AI advancements—you still need to match those concerns to a specific line-of-business owner. For example, a sense of needing to keep up with these technology advancements from leadership can be translated down to a VP of Consumer Finance who needs to grow a consumer banking app while battling fintech upstarts and who may be thinking about using AI products to do so–which your product could help enable.

Leverage your investors/advisors to help uncover that inside baseball for you. At a16z, we have made it a top priority to connect with key decision makers at various financial services institutions; we do this through dinners with our portfolio company CEOs and executives, briefings with line-of-business owners, and demo days. This is a two-way relationship, as we regularly share ideas and innovative companies with FIs in our network, including Goldman Sachs, PNC, Morgan Stanley, American Express, and more.

Lastly, another way to identify broad pain points is by working with the innovation groups within FIs—but be wary of those that may want to play gatekeeper with line-of-business owners.

C - Champion

Champions are people with power and influence inside a potential customer’s organization who are actively selling on your behalf. Most champions are line-of-business owners with a problem that’s keeping them up at night—a scrappy or ambitious VP who understands how to enact change and wants to level up professionally. Discovering and cultivating these individuals should be a major priority for your sales team.

To keep things moving along with your champion, you need to ensure that they are aware of who you are meeting with at all times and the results of those meetings. You should also work with them to understand both the decision process and decision criteria to move forward with a deal, as well as where the FI is in its annual budget cycle. Don’t be afraid to work closely with your champion and help them build a business case for your product within the organization.

Additionally, if your champion is in a meeting about you that you’re not privy to, they should be your confidant here. If they’re not, you’re not a priority for the champion and therefore for the broader organization.

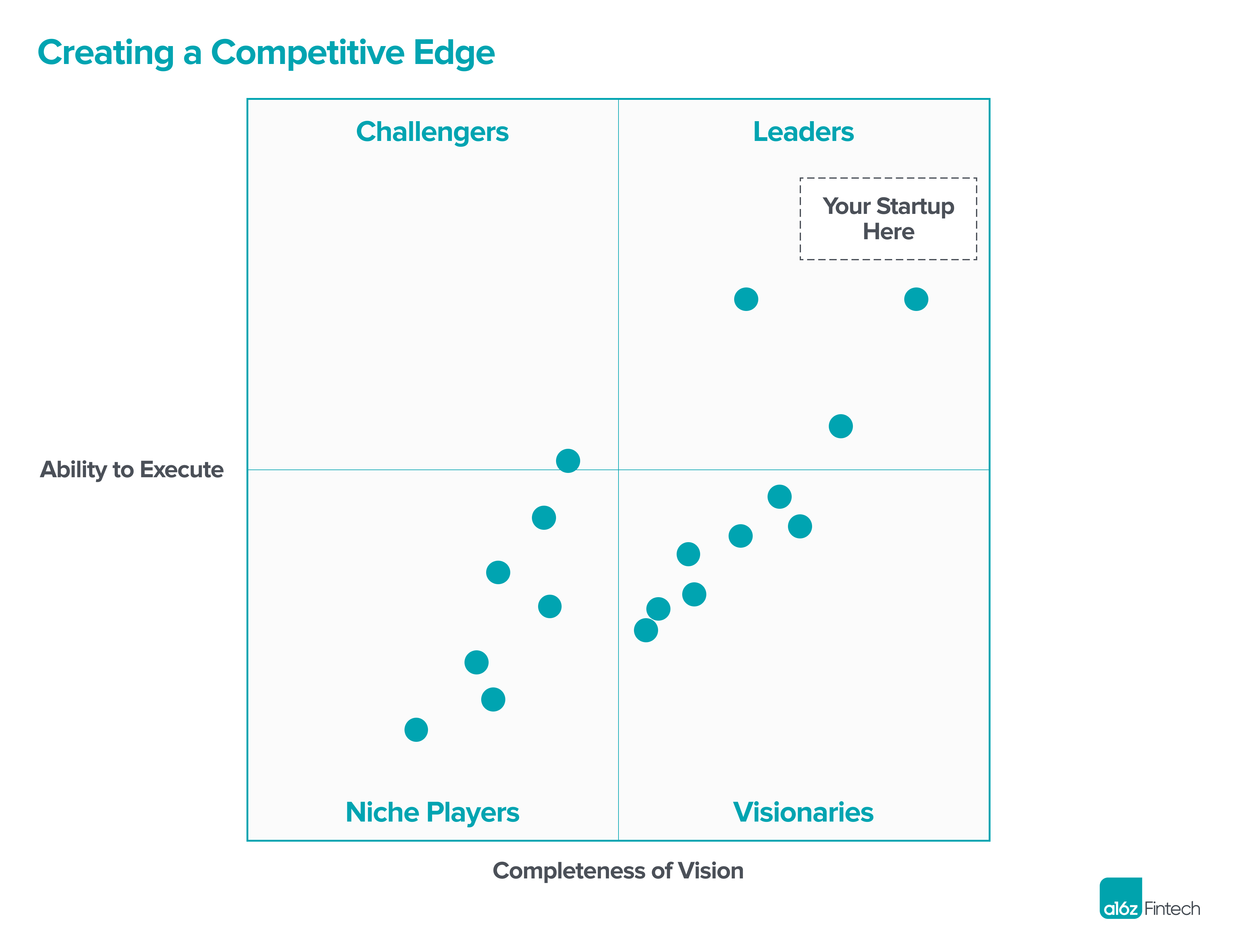

C - Competition

As a fledgling startup, you’ll likely be competing with other startups, incumbent companies that have deep relationships with FIs, and perhaps most critically, internal competition from within the FI. This internal competition can take the form of a culture that is risk averse, buyers that don’t know your product and company or if they need it, customers that often don’t know how to evaluate your startup, or existing processes. There are a few things you can do to overcome this competition, such as:

- Leverage your investors to position your product as best-in-class to senior leadership, or use board members to push your product to an executive who then can push it to a line-of-business owner

- Get advice from your champion, who may have insight into any internal dynamics that may derail the deal, any competitors the firm may be considering, and any other employees you may need to get in front of to win the deal

- Punch above your weight by building visibility with industry experts, publications, companies like Gartner, who can educate your customers on emerging solutions; partnering with channel partners; or gaining credibility with vendors that may refer your product to the FI (e.g., core banking providers like FIS, Fiserv, and Jack Henry)

Looking Ahead

We believe this is the best time for founders to be selling software into financial institutions. Advancements in AI are inspiring senior leaders to drive change across their organizations. As a result, we at a16z have made it a top priority to connect with key decision makers at various financial services institutions—in the form of dinners with our portfolio companies and the CEOs of these firms, briefings with line-of-business owners, and demo days. This relationship is two-way, as we regularly share ideas and innovative companies with FIs in our network including Goldman Sachs, PNC, Morgan Stanley, American Express, and more. If you are working at an incumbent financial institution and interested in the bleeding edge of technology, we’d love to include you in our network.

Similarly, if you’re an entrepreneur tackling this exciting GTM channel, we’d love to learn your best practices and also open our network to you—both from a top-down and bottoms-up perspective—in effort to continue to demystify this B2FI motion. Thank you to all of the founders, operators, and executives for sharing with us the key lessons they have learned in their B2FI journeys.

-

David Haber is a general partner at Andreessen Horowitz, where he focuses on technology investments in B2B software and financial services.

-

Sumeet Singh is a partner at Andreessen Horowitz, investing at the intersection of fintech and other categories such as consumer social, marketplaces, commerce, and healthcare.

-

Brad Kern is the operating partner leading the Go-To-Market Network team.

- Follow

-

Katy Nelson is a partner on the Go-To-Market Network team.