In the past year, we have seen companies of all sizes and across all industries make significant adjustments to their tech stack as technological trends, which were already underway before the COVID-19 pandemic, crested faster and hit harder because of it.

To better understand exactly how enterprise technology stacks are changing, we sent a survey in December 2020 asking technology leaders at Fortune 500, Global 2000, and SaaS 50 companies about the tools they use, or plan to use in the next 12-24 months, for cloud computing, DevOps and agile development, data infrastructure, AI/ML, enterprise apps and collaboration tools, and security.

We received 107 replies from across 30 industries, including software, IT services, financial services, manufacturing, pharmaceuticals, and media. Cross-referencing these responses against data provided by ZoomInfo, we found that the companies in our survey tended to fall into one of two clusters. In general, smaller, more agile companies adopt newer tools that have outsized potential for disruptive innovation, while larger, more established companies prefer platforms that have long been stalwarts of the corporate world. While this cultural and generational divide is not in itself a new observation, the survey results and analysis start to quantify exactly how that divide is playing out.

A Note on Methodology

In our analysis, we define large companies as those with more than 25,000 employees and small companies as those with fewer than 5,000 employees. And while size alone is predictive of some of these trends, we know that many other factors influence appetite for risk. While this analysis does not provide a comprehensive look at industry-specific trends for all respondents, we found that comparing tech companies to financial companies (including banks, financial services companies, and insurance companies) provided a useful bellwether for the differing needs of agile, disruptive companies versus more conservative, heavily regulated ones.

TABLE OF CONTENTS

The Five Megatrends

TABLE OF CONTENTS

Cloud computing is past the tipping point. Adoption of cloud computing has reached a scale that makes it a technological certainty across industries. But as cloud solutions become ubiquitous, we also see enterprises using more than one cloud provider, avoiding vendor lock-in, and complying with regulatory requirements.

Everything is distributed. As critical workloads have moved to Kubernetes environments, almost every capability is being reinvented to be cloud native. The move to globally distributed apps has begun to affect larger industries, like media and ecommerce, demanding a more intelligent and secure network architecture.

Data is the new software. Five years ago, if you were building a system, it was a result of the code you wrote. Now it’s built around the data that is fed into that system. As AI gains the ability to perform some programming tasks traditionally required of software developers, those developers are increasingly working with data as much as with source code. The rise of data infrastructure and a data development toolchain as comprehensive as the software development toolchain promises to reshape the way we develop software.

AI is being democratized. An explosion of AI/ML tools is lowering the barrier to entry to high- end data science. Where AI/ML use cases were previously served by data teams coming up with bespoke ways of serving complex models into production, new tools are gaining wider adoption. Standardized schema for data ingestion and transformation opens the floodgates for more companies to incorporate AI/ML into their products and for downstream AI to recognize and take action on any given dataset.

Remote work is here to stay. So are the security risks. COVID-19 has changed the norms of working remotely, even as the tools we use to collaborate have proven their ability to scale under intense pressure. Tools for all workers will start to look like the tools developers have long used to collaborate, with features like versioning, commenting, and discussion becoming table stakes for real-time and asynchronous collaboration. And APIs will become even more important as SaaS tools have to route information either to share files, memorialize decisions, or capture discussions. Meanwhile, the scaling of remote work has also multiplied enterprise security risks and accelerated the move to zero-trust security.

Cloud

- Most companies expect their reliance on cloud computing to grow in the coming years.

- The majority of companies use more than one cloud provider.

- Companies need better tools for managing work across clouds.

- Cloud use is far more prevalent among small companies and tech startups than among larger enterprise companies and financial companies.

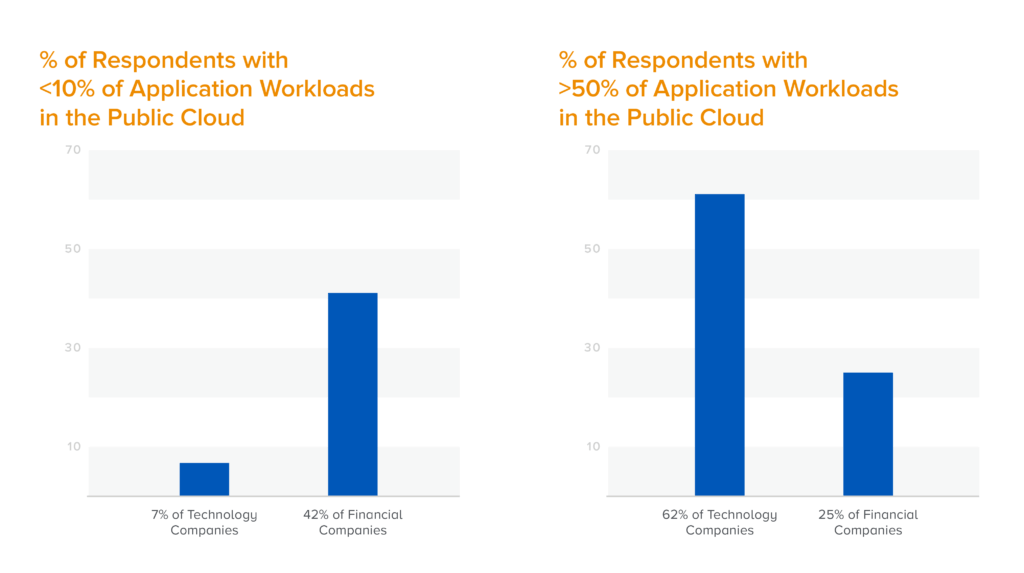

The cultural and generational trends are particularly clear when it comes to the cloud, with younger tech companies significantly further ahead in the move to the cloud. In our survey, 62% of tech company respondents put more than half of their application workloads in the public cloud. By contrast, just a quarter of financial companies used the cloud to that extent, and 42% of financial companies put less than 10% of their application workloads in the cloud.

The cultural and generational trends are particularly clear when it comes to the cloud, with younger tech companies significantly further ahead in the move to the cloud. In our survey, 62% of tech company respondents put more than half of their application workloads in the public cloud. By contrast, just a quarter of financial companies used the cloud to that extent, and 42% of financial companies put less than 10% of their application workloads in the cloud.

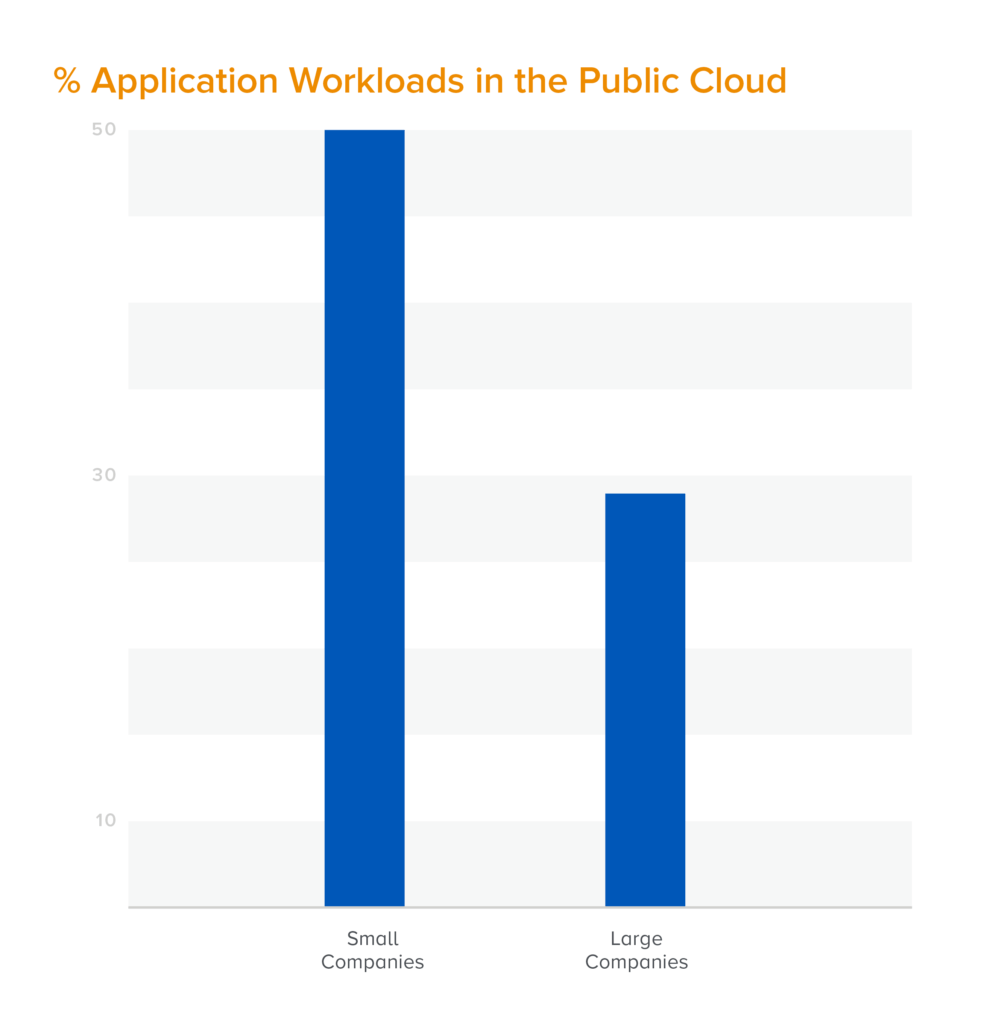

Cloud use is also far more prevalent among smaller companies, with 78% putting at least half of their workloads in the public cloud. Among bigger companies, however, this share is just 24%—a smaller portion than the 29% of these big companies that put less than 10% of apps in the public cloud.

Despite these differences, it’s clear that cloud computing is now ubiquitous, and most companies anticipate transferring even more of their applications to the cloud over the next few years.

Amazon Web Services (AWS), Microsoft, and Google are the dominant cloud providers, but most companies use more than one provider. While a multi-cloud approach makes sense as a form of risk mitigation and to avoid vendor lock-in, it also means that companies need better tools to manage work across clouds. The use of cost tracking and optimization tools is fragmented, and cloud backup tools are underutilized.

DevOps and Agile Development

- Big companies are more likely to use container management tools (70% use at least one).

- Kubernetes dominates container management, with 50% of respondents using it.

- AWS is most popular among Kubernetes users and also leads in serverless tech.

When it comes to deploying code and addressing problems that impact users, speed and agility are key. Most survey respondents said they deploy code frequently — often multiple times per week or per month — and use tools to track the performance of developers. When service interruptions occur, most organizations are able to resolve the issues in a matter of hours or days.

Companies rely on a variety of DevOps tools, such as GitHub and Jenkins, which have become go-to resources across the industry. And just as AWS, Microsoft, and Google are the leading cloud infrastructure providers, they are also the most popular platforms on which to run container management tools and serverless technologies.

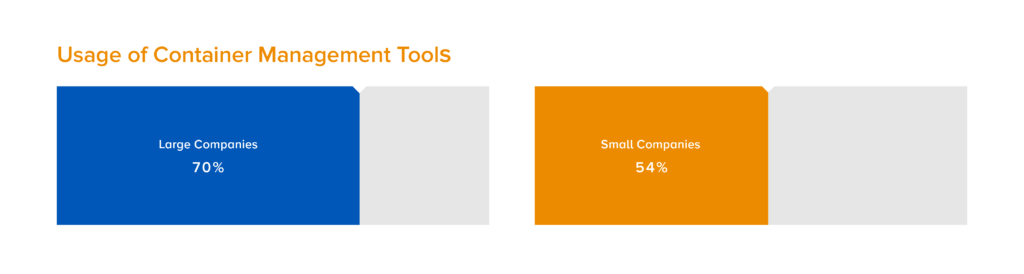

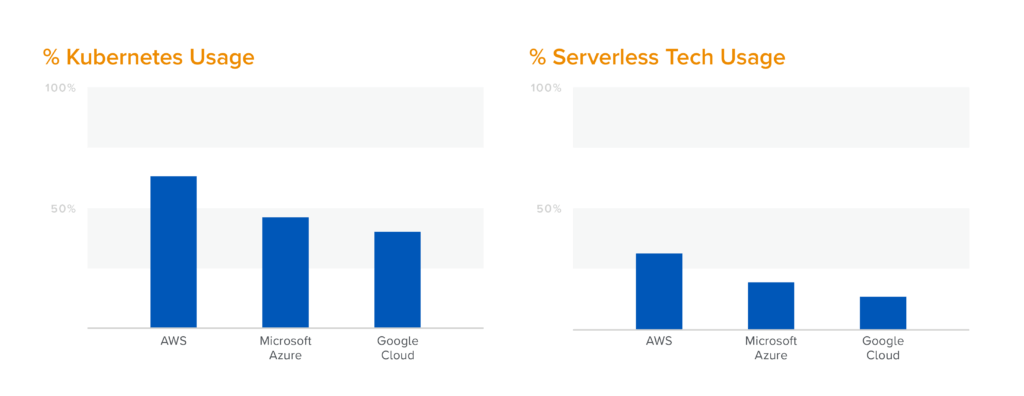

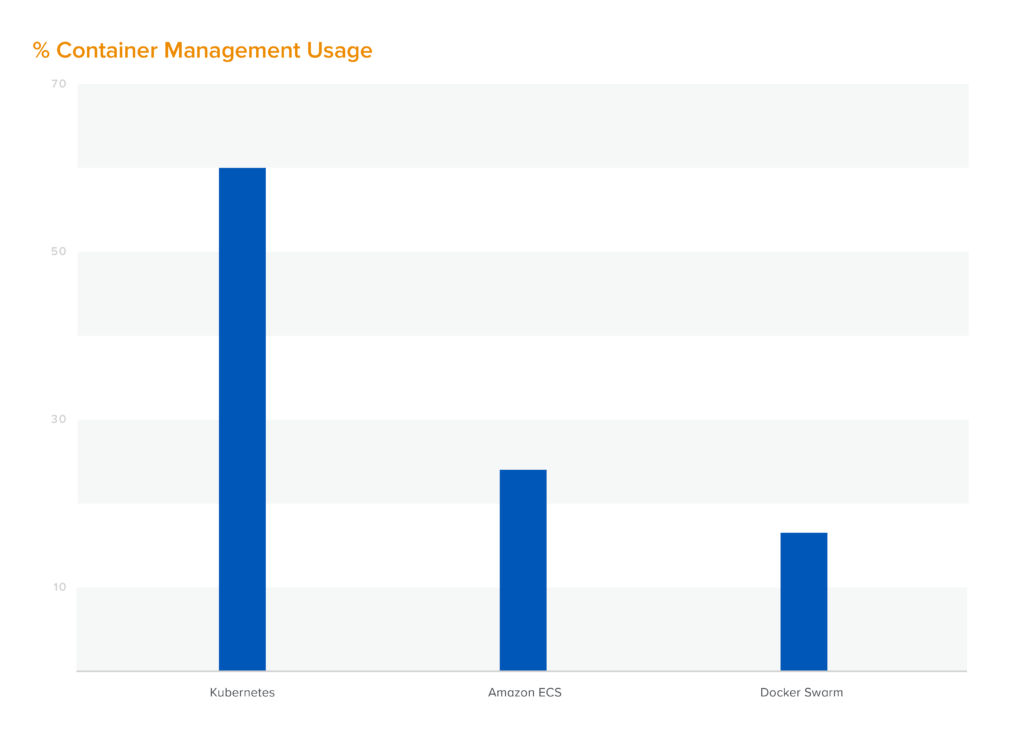

Big companies are more likely to use container management tools (70% of them use at least one, with Kubernetes always among them) than small ones (54% use at least one). Kubernetes continues to dominate container management, with 50% of respondents using it, compared to just 23% who use Amazon ECS and 16% who use Docker Swarm. Among Kubernetes users, AWS is far and away the most popular platform, with 63% of respondents using it, compared to 46% who use Microsoft Azure and 40% who use Google Cloud Platform (GCP).

AWS also leads in serverless tech, at 32%, followed by Azure Cloud at 20% and GCP, at 14%.

Data Infrastructure

- Databricks and Snowflake are the most popular data infrastructure technologies.

- Most companies are using customized internal tools to manage their workflows.

- Data governance and lineage, and improving data science platforms, are key priorities for most companies, particularly financial companies.

- Few companies currently use data governance and provenance tools.

The survey results highlighted the wide array of choices—from data infrastructure technologies like Snowflake and Databricks, to streaming tools like Apache Kafka, to analytics platforms like Informatica—that companies have when it comes to data technology.

There is a strong trend toward data lakes, particularly Databricks, among financial companies. Financial companies are also more likely to complain about inconsistent or disorganized data, whereas tech companies are more likely to worry about unstructured data.

Financial companies are also most concerned about data governance and lineage, as well as improving their data science platforms, citing these as priorities for the next 12 to 18 months. Despite this, there is very little usage of data governance and provenance tools.

Data Science and AI/ML

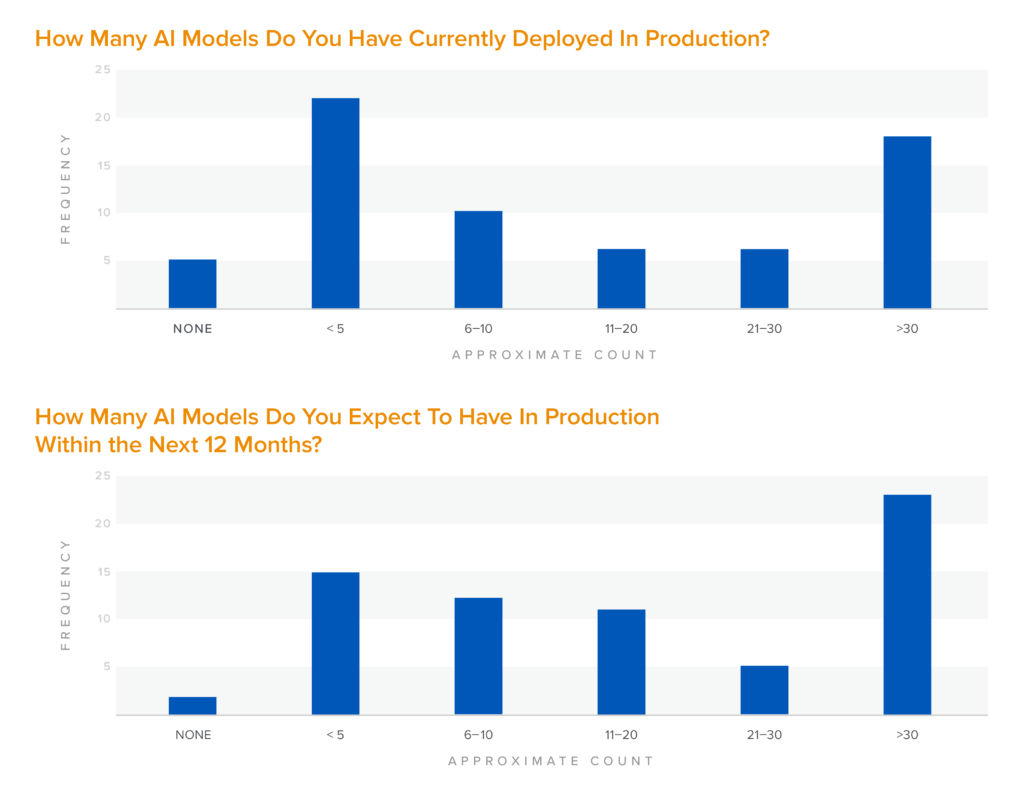

- Most companies have fewer than five AI/ML models currently deployed, but expect to have more than 30 models in production in the next 12 months.

- Companies are slow to deploy AI/ML models, with production typically taking more than one week but less than six months.

- Product & Engineering is the leading area where AI/ML projects are underway.

- Larger companies make far greater use of AI/ML models than smaller companies do.

The AI/ML space is relatively new for most companies, but it is developing rapidly. Most of our survey respondents already have fairly robust data science and AI/ML teams, and these teams will likely grow even more over the next year. Adoption of AI models is already widespread: The vast majority of respondents are using at least some AI, with most respondents using fewer than five models. What is most remarkable is the projection of heavy investment in AI in the coming year, with most respondents predicting that they will be running more than 30 models.

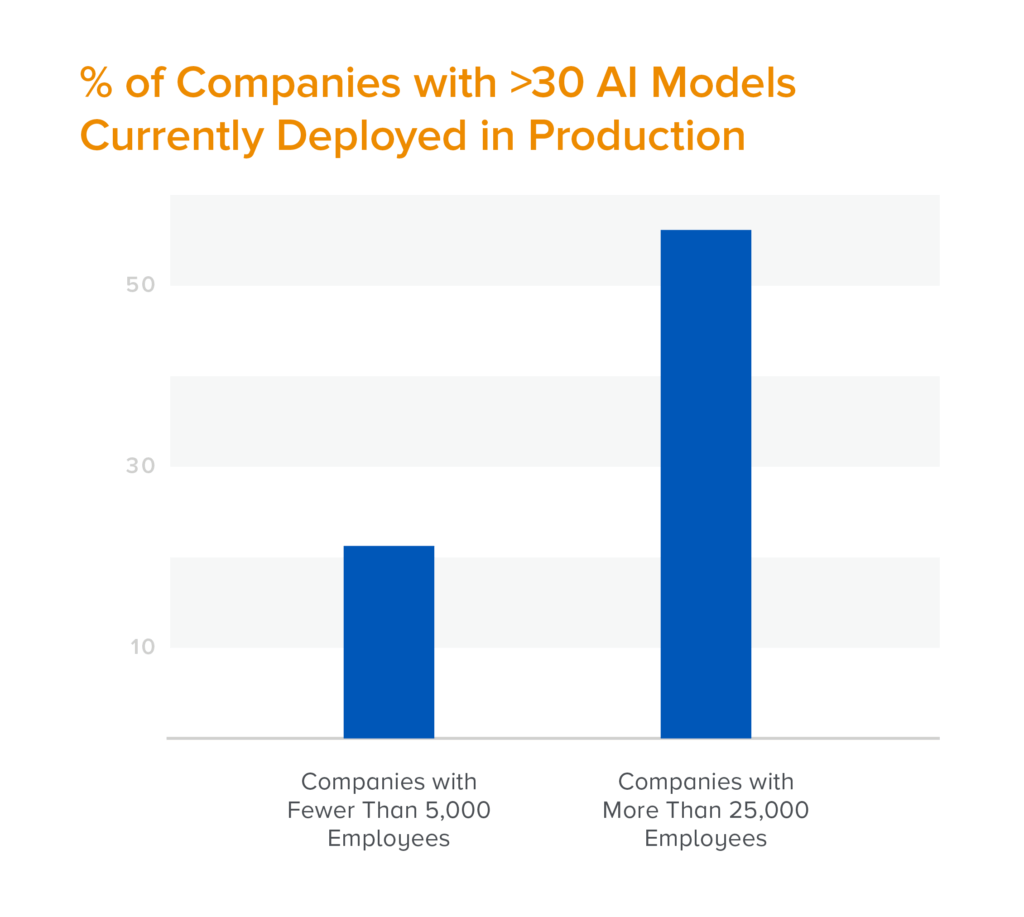

The contrast between technology companies and financial companies holds fairly constant through our survey results, but AI adoption offers an interesting countertrend. Tech companies are indeed planning the greatest number of new hires in data science and AI/ML in 2021, compared to companies in other industries. But larger enterprises actually make greater use of AI models than smaller companies do: 56% of companies with more than 25,000 employees have at least 30 AI models currently deployed in production, whereas just 22% of companies with fewer than 5,000 employees do.

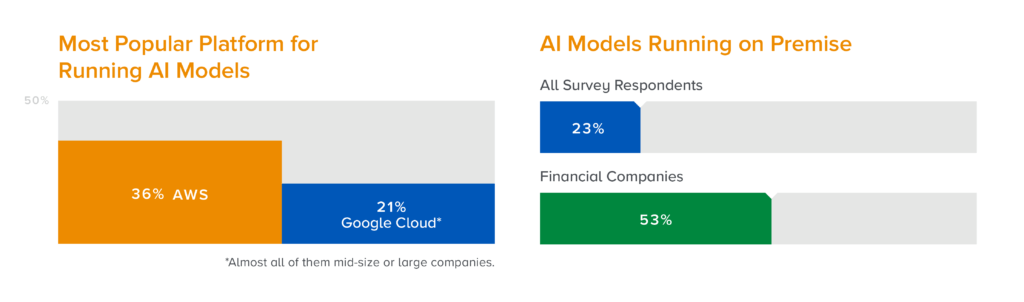

While AWS was the most popular public cloud platform for running AI models, 53% of financial companies ran AI models on-premise, compared to 23% of all survey respondents.

Enterprise Applications and Collaboration Software

- Microsoft’s suite of collaboration tools was the most popular overall.

- Financial companies overwhelmingly relied on Microsoft for email, while technology companies

strongly preferred Gmail. - Microsoft Teams was the preferred messaging software for most companies, particularly financial companies and larger companies. Slack was a close second and is especially prevalent among tech companies and smaller companies.

- Salesforce was the most commonly used application cited in the survey, but among large

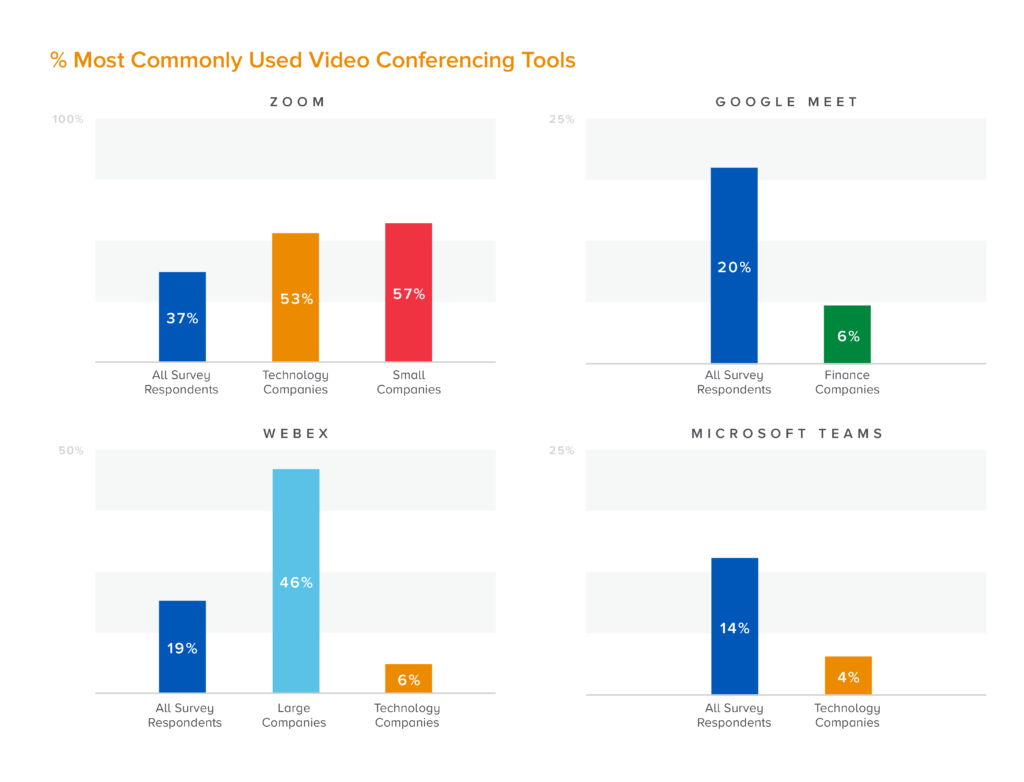

companies, ServiceNow was equally popular. - The choice of video conferencing tools varied widely, depending on the size and type of company. Smaller companies and technology companies tended to use Zoom and Google Meet, while larger companies strongly preferred WebEx.

In a year when many people were working remotely due to the COVID-19 pandemic, video conferencing tools, messaging apps, and collaboration software became more important than ever.

Many companies relied on the suite of tools from Microsoft and Google, but a number of other applications stand out as well. Slack was one of the most commonly used messaging tools, Jira was by far the most popular project management solution, and Zoom was used nearly twice as much as any of its video conferencing rivals. Salesforce was also one of the most commonly used enterprise applications.

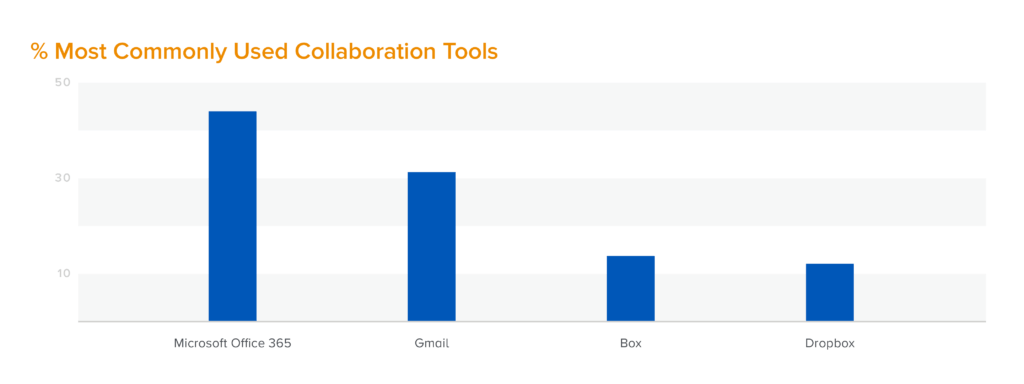

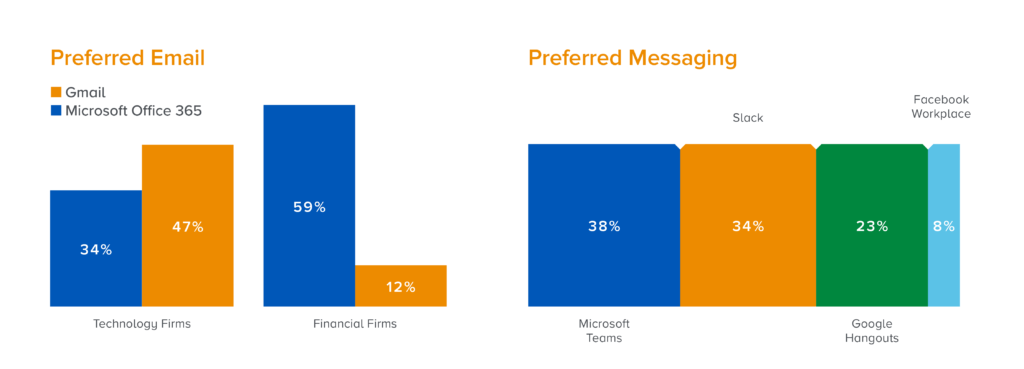

Overall, Microsoft Office 365 and Exchange are the most commonly used collaboration tools, used by 43% of survey respondents. Gmail was the next most popular, at 31%, followed by Box at 14% and Dropbox at 13%. However, Gmail is the preferred email provider for 47% of technology companies, whereas just 12% of financial companies use it. Conversely, nearly 60% of financial companies and large companies rely on Microsoft Office 365 and Exchange, whereas only about a third of tech companies and small companies use Microsoft’s tools.

Loyalty to a specific technology platform isn’t particularly strong, however. Of the companies that use Gmail, for example, only a third of them use Google Cloud IaaS.

For messaging, 38% of survey respondents use Microsoft Teams, particularly financial companies and larger companies. Slack is used by 34% of respondents and is especially prevalent among tech companies and smaller companies. Google Hangouts is used by just 23% of respondents, while only 8% use Facebook Workplace.

Some of the greatest disparity can be seen in the choice of video conferencing tools. Zoom is used by 37% of survey respondents (53% at tech companies and 57% at small companies), followed by Google Meet at 20% (a mere 6% among finance companies). Overall, WebEx is used by just 19% of survey respondents—but it is used by 46% of larger companies. By contrast, it is used by just 6% of tech companies. Microsoft Teams is similarly used by 14% of respondents overall, but just 4% of tech companies.

There are two tools that are popular across larger and smaller companies, however. Among project managers, Jira is the overwhelming favorite, used by 45% of all survey respondents, and Salesforce is the most commonly used application.

Security

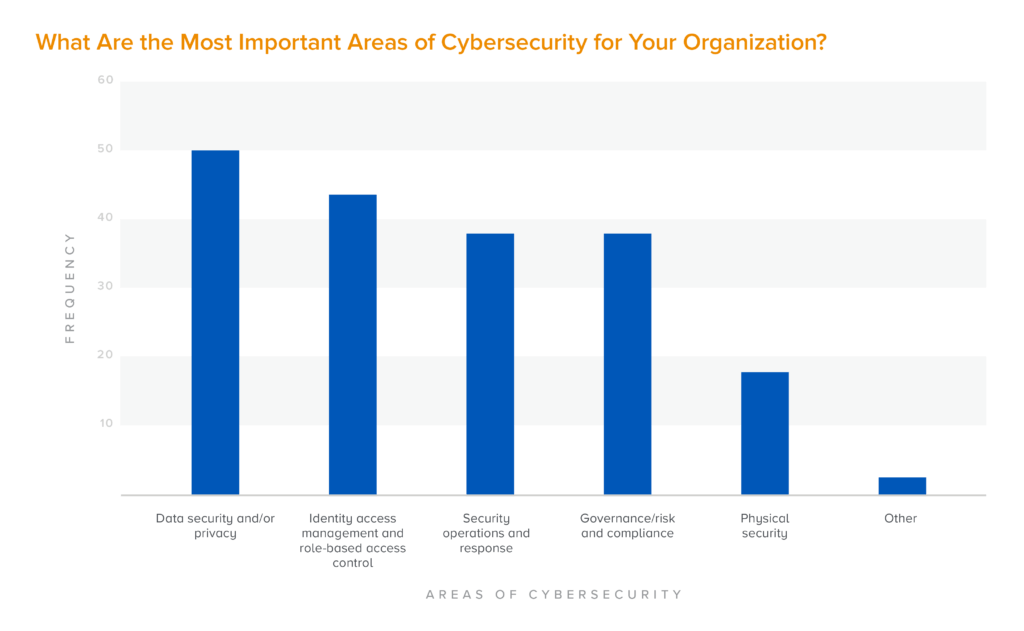

- Data security is the top concern for most companies, followed by role-based access control and governance, risk management, and compliance.

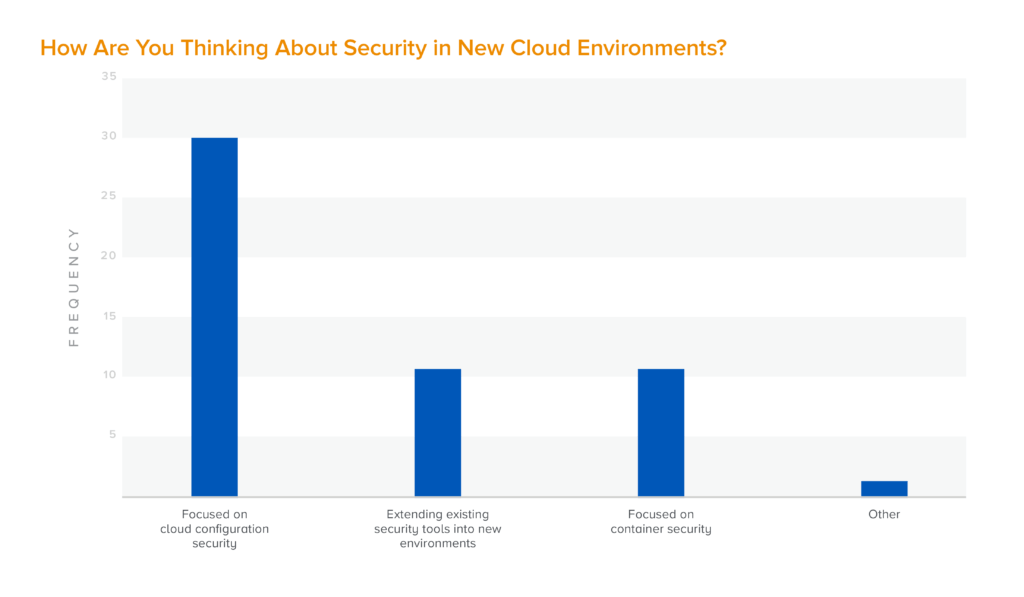

- When it comes to cloud security, cloud configuration management ranks as the top concern.

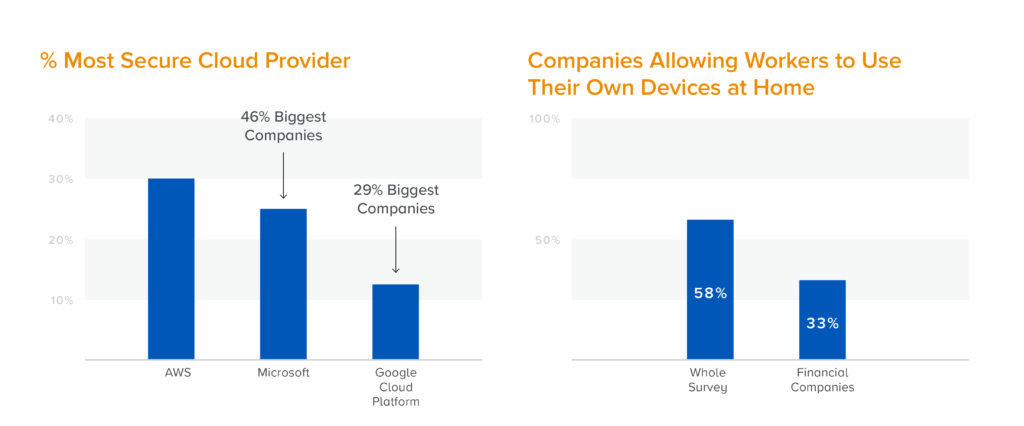

- Overall, AWS was cited as the most secure cloud provider. But big companies are more likely to consider Microsoft the most secure.

- The majority of companies allow remote workers to use their own devices at home, though only 33% of financial companies do so.

The need to protect data and personal information has always been a key priority for any business, but it is receiving even greater attention now, as more operations are moving online and more employees are working from home.

In our survey, 30% of respondents cited AWS as the most secure cloud provider, followed by 25% for Microsoft. However, the biggest companies were much more likely to cite Microsoft (46%) and Google Cloud Platform (29% versus 13% overall) as the most secure.

Most companies are looking to upgrade some aspect of their legacy security apparatus, and many are also considering how to maintain security with employees working remotely. Overall, 58% of respondents are allowing workers to use their own devices at home, but only 33% of financial companies said that they were doing so, versus 59% of tech companies.

Two-thirds of respondents expect to increase their security spending over the next 12 to 18 months, though this share is just half at large companies.

The events of 2020 affected different companies in different ways, depending on size and industry. But the scale of disruption and change to the way we do business has meant that companies of all sizes and across industries have needed the foresight and flexibility to adapt quickly to what the future will bring.

We hope these survey results help teams understand how your current technology stack fares and improve your ability to adapt and architect for the future.

###

-

Stacy D'Amico is an Operating partner at a16z.

-

Brad Kern is the operating partner leading the Go-To-Market Network team.

- Follow