We’re pleased to share our inaugural “State of Markets” slide deck. We share what we’re seeing in the private and public markets, what the state of AI looks like to us, and why today’s winners are just built different.

You can read the deck here (it takes a second to load, there’s a lot in there):

Here’s a sample of what’s in there:

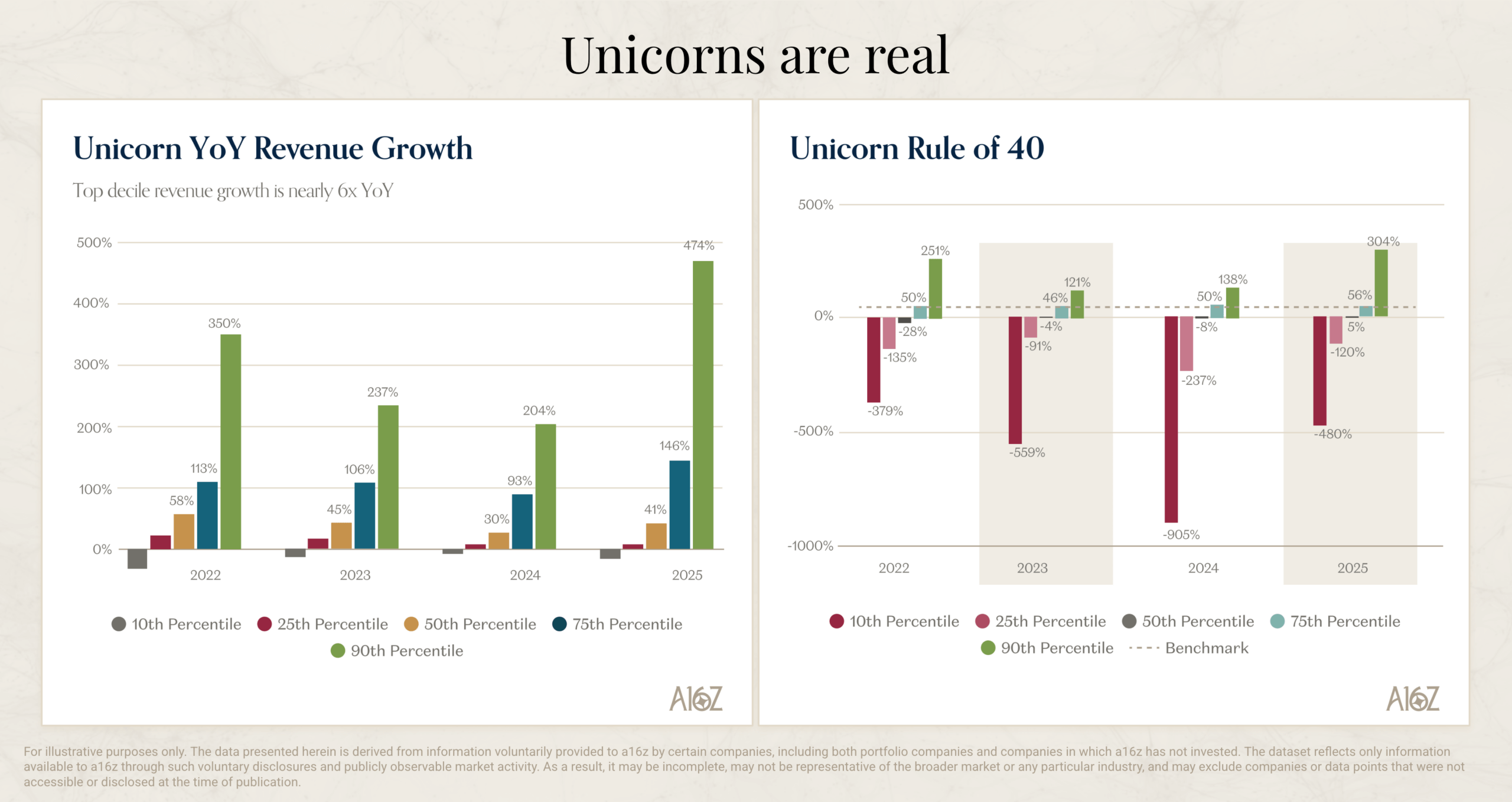

Unicorns are real…

It’s a power law business; always has been. In 2025, Revenue growth exploded upwards for the top quartile and top decile companies, far more than for everybody else.

It’s a power law business; always has been. In 2025, Revenue growth exploded upwards for the top quartile and top decile companies, far more than for everybody else.

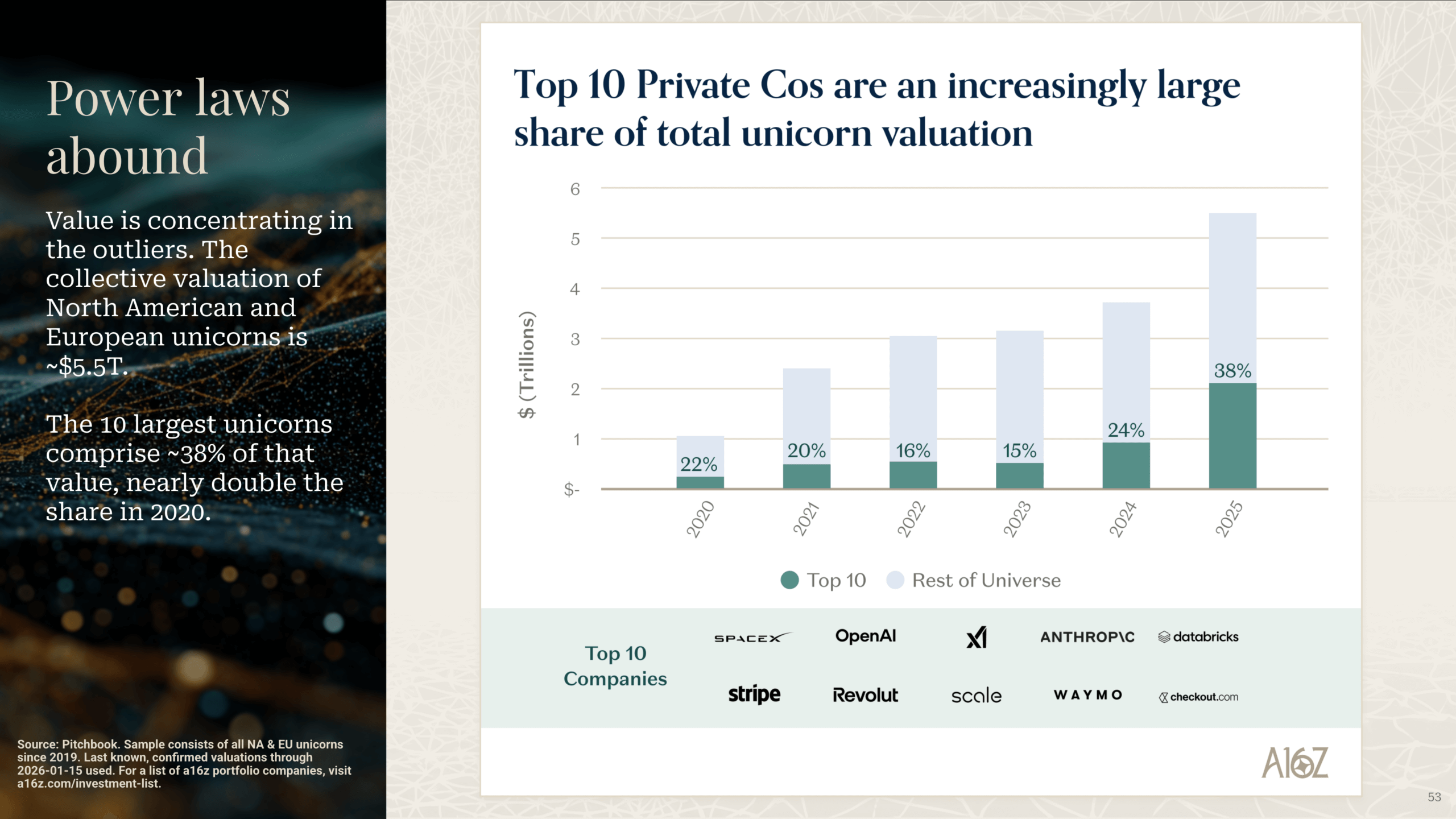

And they run in herds

As private unicorns broke through the $5T mark in aggregate, it’s clear who’s driving the trend: the biggest names.

Meanwhile, in the public markets, a similar story is playing out:

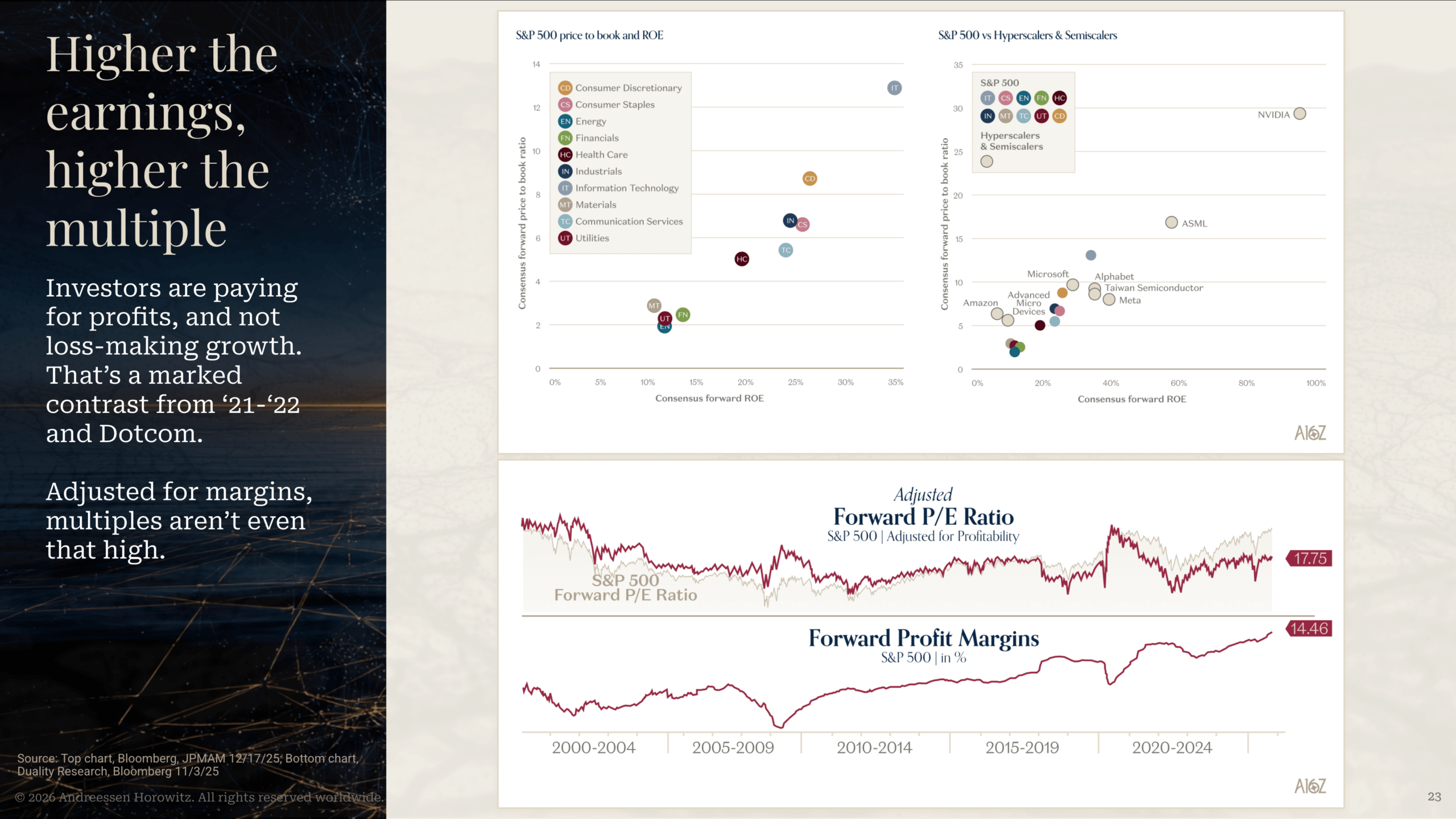

Higher the earnings, higher the multiple

Winners keep winning, whether we’re talking sectors or individual winners. This isn’t a “1x EV TAM” kind of market: the biggest multiples are getting assigned to the big earnings day winners.

Winners keep winning, whether we’re talking sectors or individual winners. This isn’t a “1x EV TAM” kind of market: the biggest multiples are getting assigned to the big earnings day winners.

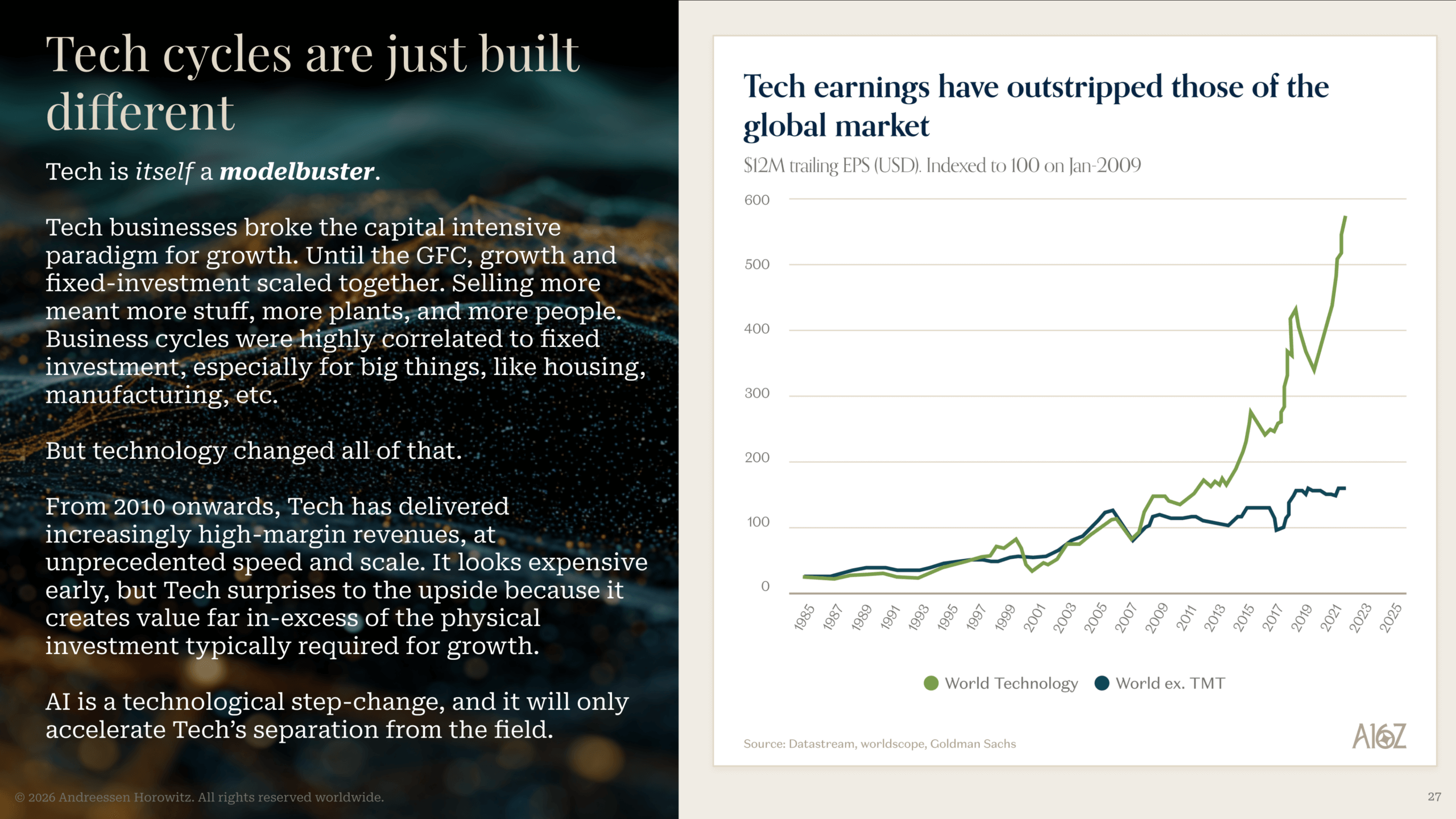

Tech is its own supercycle

Zooming out, those winners tend to be tech companies, and those tech companies have pulled far away from everybody else. Tech isn’t just a subset of companies; it’s increasingly “the great companies”, full stop.

But… is it a bubble?

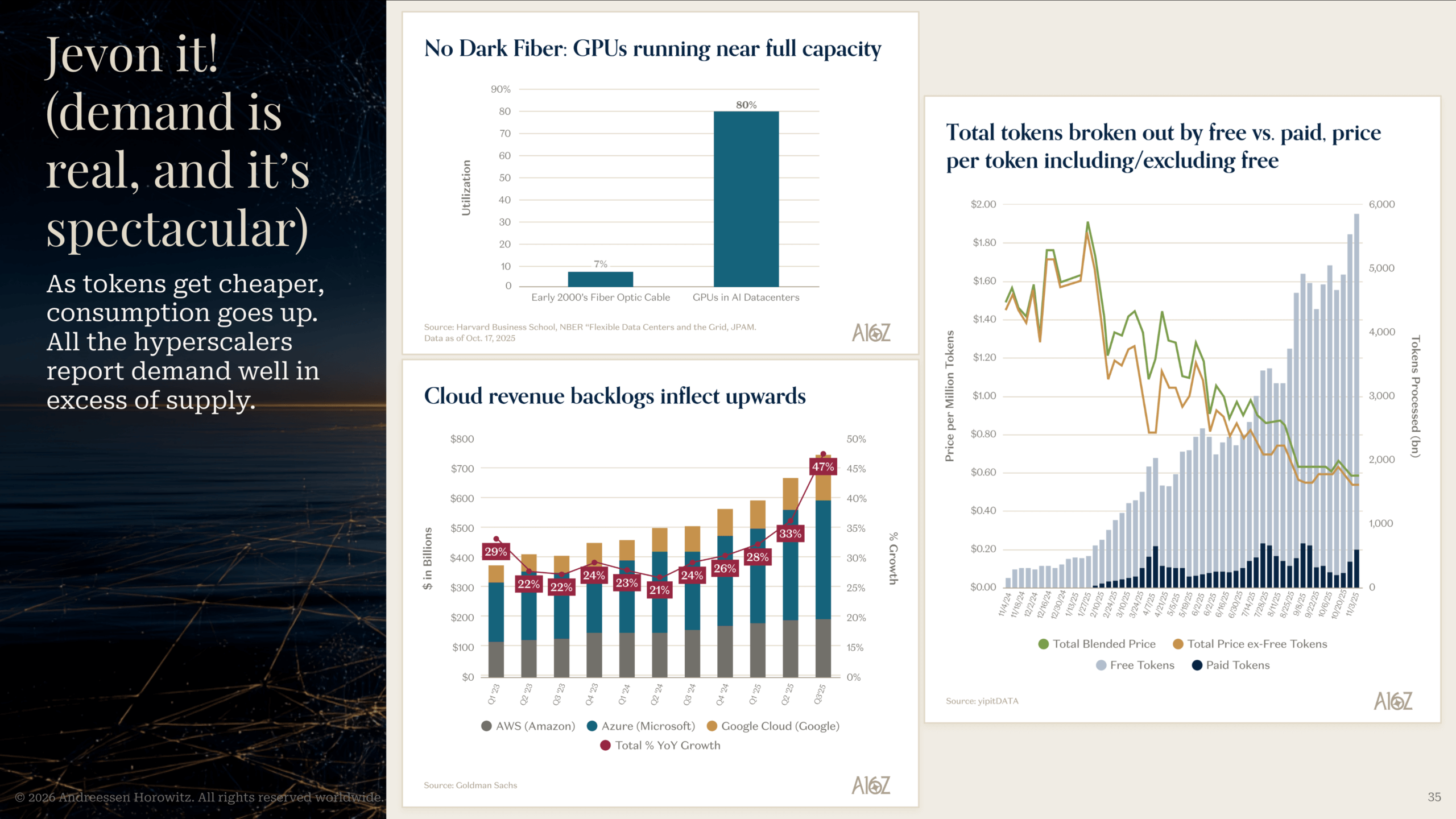

At a16z Runtime late last year, we heard from Google that 7-8 year old TPUs are still running at 100% utilization…

And Jevons’ Paradox is certainly real this time around. The cheaper the tokens get, the more they’re used – especially when indirectly monetized.

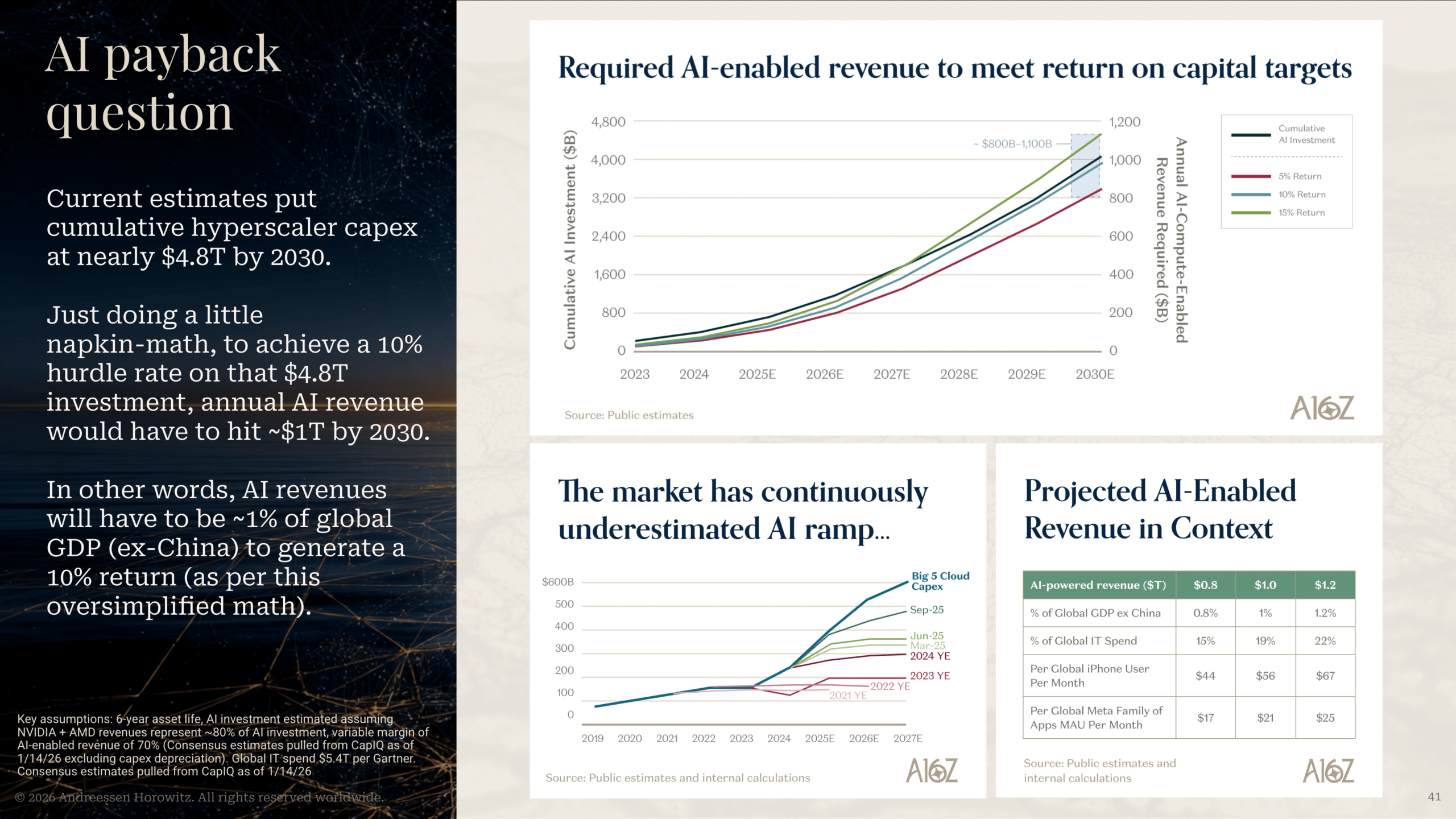

All that’s to say, at the end of the day, it’s got to pay back. Here’s what that’ll take:

(Because a billion dollars isn’t cool. You know what’s cool? A trillion dollars.)

You can view the whole deck here.