Marc Andreessen sat down with Fortune Managing Editor Andy Serwer to discuss the future of jobs, education and your favorite ride. What follows is an edited version of the conversation.

BY MICHAEL V. COPELAND

Andy Serwer: We all understand that the Internet revolution is inevitable at this point, but it’s also kind of controversial. There are scads of new jobs at Facebook and Twitter and other places, but what about the ones that are destroyed by the inroads of technology into every industry? Are you actually creating more than you’re destroying?

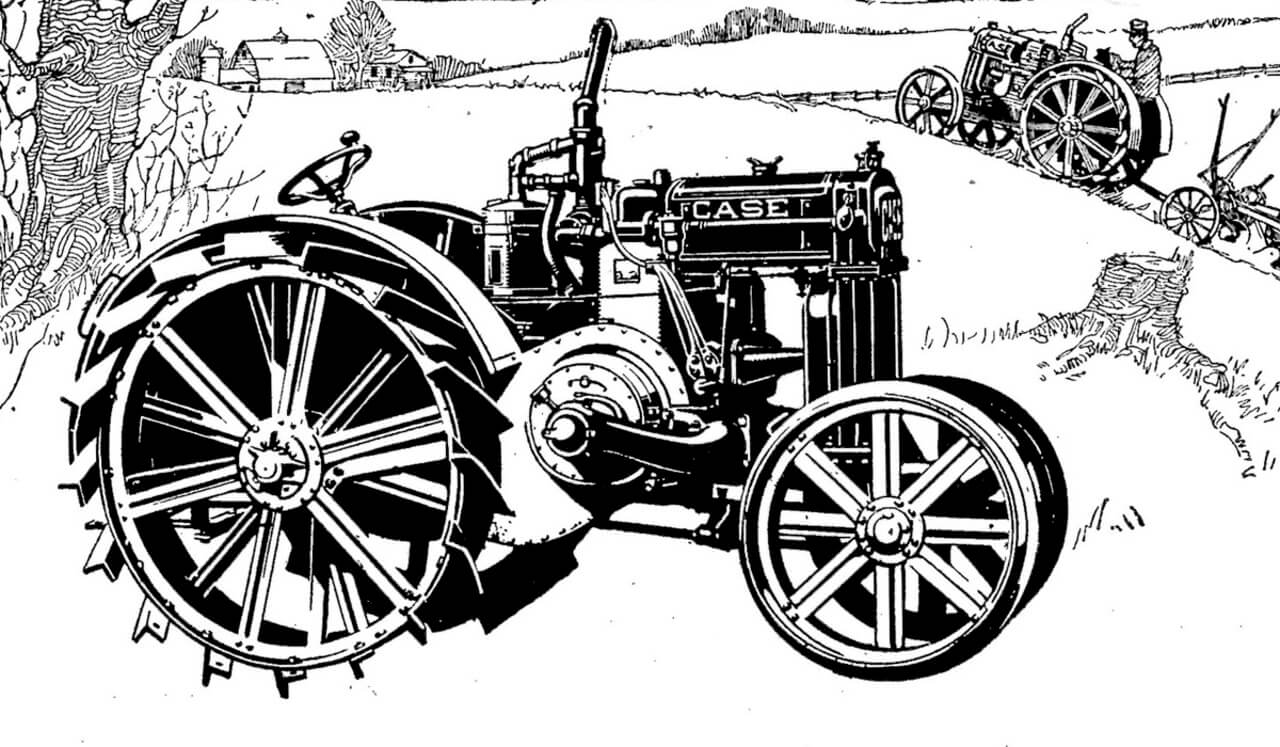

Marc Andreessen: Jobs are critically important, but looking at economic change through the impact on jobs has always been a difficult way to think about economic progress. Let’s take a historical example. Once upon a time, 100 percent of the United States effectively was in agriculture, right? Now it’s down to 3 percent. Productivity in agriculture has exploded. Output has never been higher. The same thing happened in manufacturing 150 years ago or so. It would have been very easy to say, “Stop economic progress because what are all the farmers going to do if they can’t farm?” And of course, we didn’t stop the progress of mechanization and manufacturing, and our answer instead was the creation of new industries.

AS: And the same story will play out with the Internet?

MA: Right. So the jobs are something that happens in the end. But what happens first are improvements in consumer welfare. This is the part that doesn’t get much attention because jobs going away is a much scarier story. Improvements in consumer welfare are more diffuse, and it’s hard to specifically call them out. But it’s a really big deal. It’s a really big deal for people to have a lot more information. It’s a really big deal for people to be able to communicate and collaborate. One of the things that’s going to be huge in the future is the ability to get educated online. That’s a wave that’s going to hit in a major way in the next 20 years, and will be a huge improvement to consumer welfare all around the world. And so the gains to anybody with a screen and a network connection are absolutely phenomenal. It’s one of those things where everybody’s lives keep getting better. But you don’t get the creation without the destruction. And so there is a lot of turbulence, and will be a lot of turbulence.

AS: So how should we think about navigating what for many will be a very bumpy ride ahead?

MA: A big part of the answer is the creation of new businesses and industries. Another big part is existing businesses taking advantage of the new technologies. A great example is any small business in the country that has a product or service that is relevant to people outside of its local area. Those businesses have always had an enormous problem actually ever reaching consumers, right? Say it’s a used bookstore, or an antique store. In the past you would market in the local newspaper and local radio station. Now you go on Google and you buy keyword advertising. You go on Facebook, you buy social advertising. And you can very cost effectively target people who are in the market for your product from all over the world.

And then for all this to work, a lot of people will have to get retrained, they’ll have to develop new skills. Education is going to become even more important. People are going to have to be much more adaptable in this economy. This has been a trend for a long time; the days of lifetime employment are long since over. And the whole system of how everything works – from education to health care and housing – has to adapt to an era in which people are going to have a lot more jobs over the course of their career. When I was growing up in the ‘70s in Wisconsin that was a message everybody was drilling into me. Like, “Get ready. You’re not just going to have one job in your life.” I think at the time the average was seven jobs, and now it is up to 15 or 20.

AS: How many are you up to?

MA: I’m up to like six. So I’m definitely getting there. And of course some people just want this all to stop. Some people just say, “Just let me do what I’ve been doing, and don’t interfere with me.” But the counter-argument to that is always, “Okay, how much worse off should the rest of us be because you don’t want to change?”

AS: How do ever stay up with all this change? I know it’s tough for everyone to stay up, but you’ve got to be that much further ahead than all of us. How do you do it?

MA: I feel like I’m constantly falling behind. I feel like every day I’m out of the office I’m falling behind. At our venture capital firm we only invest in a sort of Silicon Valley style tech. We see 3,000 inbound deals a year. And those are inbound and coming through our referral network, so those are sort of prequalified. We can do maybe 15 or 20 investments out of the 3,000 a year. So I like to say our day job is crushing entrepreneurs’ hopes and dreams. Our main skill is saying “no,” and getting people to not hate us.

It’s absolutely dizzying. But at the same time you have the privilege of seeing an amazing cross-section of innovation. As a consequence, it’s very hard not to be very optimistic because you just see so many sharp, bright people, with so many great ideas and with so much enthusiasm and determination to make the world a better place. And to build big, important businesses.

AS: Did you ever imagine it was going to be like this 20-plus years ago when you were writing code for what would become the first web browser?

MA: No. I never heard the term “venture capital” until I got to California. I got a job and landed in Silicon Valley, and I found out about this venture capital thing. And I was dumbstruck. “You mean there are people who will give you money to invent new things and start a company? Really? Seriously? It’s like wow! That’s really cool!” And of course we got lucky. At Netscape we got funded by John Doerr, one of the legendary venture capitalists of all-time, and who is incredible to work with. And that’s what first got me into the system.

AS: But you are building a different kind of VC firm in that system, and there are people out there who grouse about you guys being the new kids on the block – “That’s not the way we do things traditionally here in Silicon Valley. Who does he think he is?” – kind of stuff. So how are things different?

MA: There’s a whole bunch of theories on how to build tech companies. A key one that we have is that it’s a long-term exercise. There’s nothing short-term about it. There’s nothing transactional about it.

It’s finding the very, very special entrepreneurs and business builders. It’s backing them to the hilt, and it’s backing them through very difficult times. Every new company goes through tremendous challenges. Ask any entrepreneur in the Valley how their company’s going. “Oh, it’s going great. Everything’s fine.” But internally they’re always about to throw up. Because there’s always something going wrong. Some key employee is about to quit, or some new competitor has popped up, or some product has slipped or some customer is suing you or some crazy thing is happening. There’s nothing easy about building a business.

And then you have to have a long time horizon. The great franchises get built over 10, 15 and 20 years. And the really great franchises like Hewlett Packard, IBM, Intel, Cisco and Oracle get built over 40 or 50 years. We just look at the history of the industry, and the companies that have had all the impact are the ones that had this kind of orientation. They had a founder, typically the founder running the company for decades, typically a real commitment to innovation, to R&D, which requires a very long time horizon. And they either had supportive investors, or they figured out how to force the non-supportive ones out. And so we think there is a model for how to do this.

AS: How has the VC business changed since you arrived in the Valley?

MA: Silicon Valley in the ‘80s and ‘90s got a little transactional. In particular companies started to go public very quickly. My company, Netscape, went public 18 months after we were founded, which is not something I would recommend to anybody ever, under any circumstances. And then of course it’s far harder to be a public company today for a new business than it was, you know, 20 years ago because of all the new regulations and all of the new pressures.

AS: Have you actually tried to dissuade some of your portfolio companies from doing IPOs?

MA: Yes. We do that all the time. We actually do two things. We try to talk them out of going public, and we try to talk them out of selling. Talking them out of going public is actually not that hard, just because it’s gotten so painful to be public these days.

Talking them out of selling is actually equally hard, or maybe even harder. In the early stages the great franchise companies always get acquisition offers from the big tech companies that want to buy innovation.

AS: So how do they see the wisdom in saying no?

MA: If you know you’re going to be No.1 in your market, and if you know the market’s going to be large, then selling under any circumstances at any price is almost certainly a mistake. Because if you’re going to be No. 1 in a big market, you can build a very big company around that. It’s very, very common with these things that the founders want to punch out early. One of the things we try really hard to do is only back founders who have a long-term mentality. If they come in and have a slide that says, “Exit strategy, M&A,” whatever, we don’t invest.

AS: What are the broad risks of disintermediation by the Internet on traditional industries and businesses?

MA: The big thing the Internet does to business is it makes everything much more transparent. It makes information flow more easily than it used to. My favorite example of this is a sort of microeconomic example in the developing world involving subsistence farming. The typical experience of a subsistence farmer in many developing countries has been to grow some amount of corn, or some other crop, to be able to feed their family and then sell the excess to a wholesaler. Historically, though, subsistence farmers have not known what the market price is for the product that they grow and so the wholesaler’s been able to take advantage of that. But take a subsistence farmer, give him an Android smartphone, all of a sudden he knows everything about the market price. All of a sudden, he has a better business because he now has transparency. In this example, the wholesaler starts to get disintermediated.

AS: Who’s next?

MA: Jeff Bezos has this line where he says there’s really two kinds of businesses in the world: Those that try to charge consumers more, and those that try to charge consumers less, or try to save consumers money. I think about that more broadly. I reframe it as: There are businesses that have the mentality of adding value, and businesses that have the mentality of extracting value. And the Internet, I think, is an enormous benefit to the model of adding value, and it’s an enormous danger to the model of extracting value.

I think you see that across the economy today. The music industry is a classic case in point. The whole piracy boom of music on the Internet really arose when music buyers essentially rose up in protest and said, “I want one song. Why am I being forced to pay $16 for the entire CD when all I want is one song that I can listen to online.” That’s when you had an earthquake hit the music industry. It was when consumers viewed the pricing to be fundamentally unfair.

Car dealers are going through another version of this. Car buyers have never liked the process. Maybe a few have, but most car buyers have not liked the process of having to go in and really get raked over the coals by a car dealer who takes advantage of the fact that consumers have no idea what the wholesale price of the car is. Now, after a little research online you can walk in armed with a car’s complete wholesale information and get a much better deal.

In traditional business circles that kind of transparency gets viewed mostly as a threat. I think that’s unwarranted. I think the opportunities are just as large and probably larger, especially for businesses that have this view that their role in the world is to add value, is to bring consumers benefits.

AS: So how many examples can you give us of old companies or old industries that have managed to make the transition as the internet brings more transparency to their businesses?

MA: Let’s agree that transitions happen at various rates and speeds. Given that, I would say there are very positive things happening, even in the music business today. There are whole new revenue models in the music business. There is the subscription revenue model with services like Spotify. And while the Internet makes recorded information, anything that you can just pull up, much easier and much cheaper, it’s also had the effect of making live experiences actually more valuable. So the concert business in the music industry is actually booming, like 400 percent over the last 15 years.

In e-commerce a lot of the retailers who distribute other people’s products are under enormous pressure, but retailers that make their own product, branded retailers, are really doing well with the Internet and taking advantage of it. So J. Crew or any other retailer that makes their own product all of a sudden has this whole new channel to be able to reach a much broader base of consumers.

AS: Newspapers, magazines, television. How are these companies going to make money? What’s the future for them?

MA: So this has been—the media industry is a microcosm of the changes that are happening and it’s been fascinating to watch. People are always going to love music, movies, TV and news – it’s evergreen – people are always going to get value out of media. So it’s not a question of whether people want media or not. And in fact, global consumption of media is rising very fast. It’s a huge growth market.

The challenge I think is that in newspapers, magazines and television in particular, and books to a certain extent, you had businesses that looked like they were content businesses, but were actually distribution businesses. They had controlled distribution rights on the newsstand, on your front porch, on the cable or broadcast dial.

The problem is you remove the distribution constraint, all of a sudden you get a massive oversupply of content in each of those categories, and then of course prices come crashing down. And then the adjustment process for an incumbent that’s used to being a monopoly and has a high cost structure, then has a big problem relative to all the new entrants that have tiny cost structures or, you know, user-generated content, like YouTube, with no cost structure. The interesting thing that’s happening right now though is what you might call re-intermediation?

AS: Re-intermediation?

MA: Think of it as re-bundling. My old boss, Jim Barksdale, used to say there’s only two ways to make money in business: One is to bundle; the other is unbundle. Basically media is getting re-bundled. And so you’ve got these new models—Spotify in music, Netflix in video, and Amazon in eBooks, right? — that are re-bundling media together, and by the way, building very big companies around it, just very different kinds of companies than the ones that used to dominate.

AS: What about marketing? How will companies reach their customers five years from now?

MA: I know two things for sure. One: I know for sure that most offline marketing spend is going to move online in the next five to 10 years. The reason I know that for sure is because most consumer attention is moving online, just look at how people are spending their time. Offline media consumption generally is dropping, certainly on a relative basis, and increasingly on an absolute basis. And so if the majority of people’s time and attention is going to be online, then you’re going to want to reach them online.

Two: The other thing I know is that the marketing spend hasn’t moved over yet, and it’s primarily my industry’s fault. The consumer Internet industry, really the consumer Internet media industry, has done a terrible job over the last 20 years at giving brands the marketing solutions that they need. Solutions that provide the level of trust – the provable metrics, audience segmentation and targeting – and the assurance that if something goes wrong it’ll be made good. All the things that traditional advertising companies have been very good at providing. In our world, too many companies try to just put all this stuff online and just make it a free-for-all. What that gets you are these online marketing auctions, these rock bottom CPMs, and these just terrible, useless metrics. And it’s just kind of been a sort of a race-to-the-bottom disaster.

I actually think what happened in retrospect was companies in the Valley tried to implement advertising too quickly. We tried to do it too fast with banner ads, which never should have been the ad format. And so it’s our fault that the money hasn’t moved over. We haven’t been giving the advertisers what they need. What’s changed is companies, in particular Google, are starting to figure this out. Facebook has shown real progress, and now Twitter, and I think Pinterest, which is one of ours, will be the next stop.

AS: The one knock on that kind of advertising is that no one ever decided to buy a BMW by going to Google. You might decide how and where to buy a BMW on Google, but the idea to buy the actual car, how would online advertising ever make that leap?

MA: So this is what was so interesting with Google. Google is an extraordinarily impressive company, but most of Google’s success comes in direct marketing, not in brand advertising. They built this huge business out of direct marketing, which is only a small percentage of the overall advertising landscape. And so Google is a most direct substitution for direct mail, and of course much better.

Google has never been that strong in brand advertising. Facebook as another instance is much stronger in brand advertising. So brand advertising on Facebook is working much better. Pinterest I think will be just as good or better for brand advertising. Pinterest is a sort of a glimmer of the brand-advertising environment of the future. And then I think Twitter is going to turn out to be actually very good for brand advertising, as well. It’s confusing at the moment because people just think of Twitter as just, you know, these little short text things, but I think it’s going to really grow up over the next few years and be very good for brand advertisers. And online advertising makes that leap.

AS: Speaking of cars, you’ve talked about a shared economy where people will share cars. They won’t own cars. You see a little bit of that today, but is that really the way the world’s going?

MA: So this is when I get really excited. This is another example of the impact of information transparency on markets. We are 90 years or so into cars. And we drive our cars around. And we own our cars. And then when we’re not in our cars they sit parked. So the average car is utilized maybe two hours out of the day. It sits idle for 90 percent of the time. The typical occupancy rate in the U.S. is about 1.2 passengers per car ride. And so even when the car is in motion, three-quarters of the seats are unfilled.

And so you start to run this interesting kind of thought experiment, which is what if access to cars was just automatic? What if, whenever you needed a car, there it was? And what if other people who needed that same ride at that same time could just participate in that same ride? What if you could perfectly match supply and demand for transportation?

Taken a step further, what if you could bring delivery into it? Two people were going to drive between towns, and there was also a package that needed to go. Let’s also put that in there so we can fill a seat with a package. Just run the thought experiment and say, “What if we could fully allocate all the cars, and then what if we could have the cars on the road all the time?”

And of course the answer is a whole bunch of things fall out of it. You’d need far fewer cars. The number of cars on the road would plummet by 75 to 90 percent. You’d instantly solve problems like congestion. You’d instantly solve a huge part of the emissions problem. And you’d cause a huge reduction in the need for gas. And then you’d have this interesting other side effect where you wouldn’t need parking lots, at least not anywhere near to the extent that you do now. And so you could turn a lot of parking lots into parks.

AS: But people love their cars. They have their stuff in their cars, the car seats for their baby. Their Frisbees, their golf clubs, it’s their second home. People aren’t going to give that up, are they?

MA: Ask a kid. Take teenagers 20 years ago and ask them would they rather have a car or a computer? And the answer would have been 100 percent of the time they’d rather have a car, because a car represents freedom, right?

Today, ask kids if they’d rather have a smartphone or a car if they had to pick and 100 percent would say smart phones. Because smart phones represent freedom. There’s a huge social behavior reorientation that’s already happening. And you can see it through that. And I’m not saying nobody can own cars. People want to own cars, they can own cars. But there is a new generation coming where freedom is defined by, “I can do anything I want, whenever I want. If I want a ride, I get a ride, but I don’t have to worry. I don’t have to make car payments. I don’t have to worry about insurance. I have complete flexibility.” That is freedom too.

This story originally ran in Fortune.

- a16z Podcast: The Art of the Regulatory Hack

- a16z Podcast: On Corporate Venturing & Setting Up ‘Innovation Outposts’ in the Valley

- a16z Podcast: Connectivity and the Internet as Supply Chain

- a16z Podcast: Infrastructure… is Everything

- a16z Podcast: Open vs. Closed, Alpha Cities, and the Industries of the Future