The professional sports business is at a crossroads.

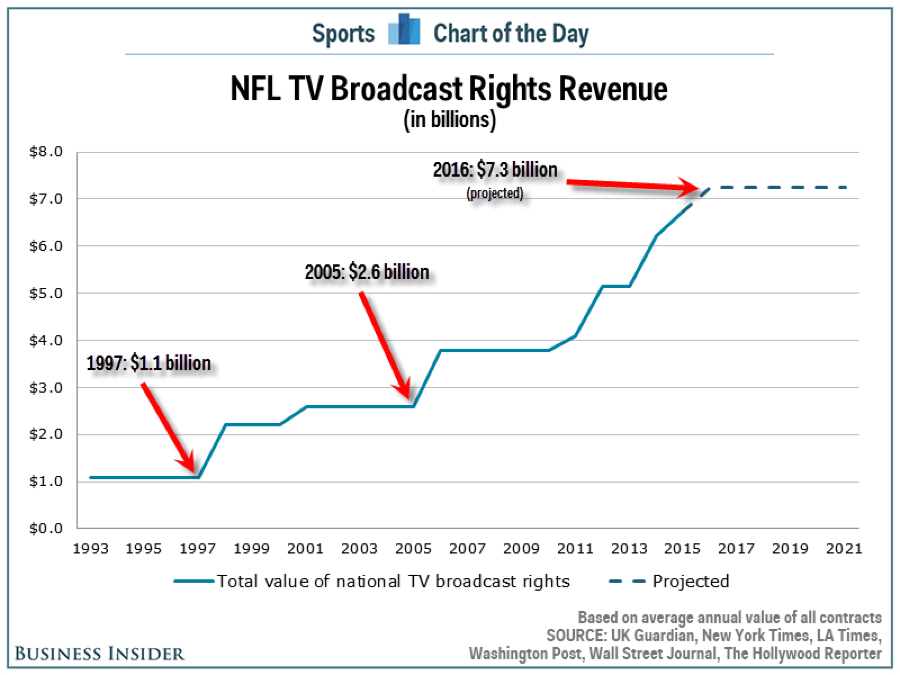

The biggest revenue stream for the major sports leagues is, by far, media — primarily television. Recent decades have seen an explosion in broadcast rights fees. Take, for example, the NFL’s revenue from broadcast rights, which have increased from $1.1B in 1997 to $7.3B in 2017:

These rapidly escalating rights fees have in turn driven an explosion in the value of professional sports franchises. The average NFL team is now worth an estimated $2.5 billion; this is a marked increase from even just five years ago, when the Dallas Cowboys were the only NFL team with a valuation in excess of $2 billion. And every single NBA franchise is now valued at over $1 billion, and NBA team valuations overall have tripled in the past five years.

Competition for the rights to air these games between broadcasters has been the key dynamic behind the escalating value of professional sports franchises. Television broadcasters value sports highly — and for good reason. Leagues such as the NFL consistently deliver some of the largest audiences on television, and games are typically consumed live as “must see TV”, meaning that commercials are actually viewed — all of which makes advertisers very happy.

And yet despite the skyrocketing valuations of sports franchises, the sports media business currently is undergoing rapid changes of seismic proportions. There are two mega-trends:

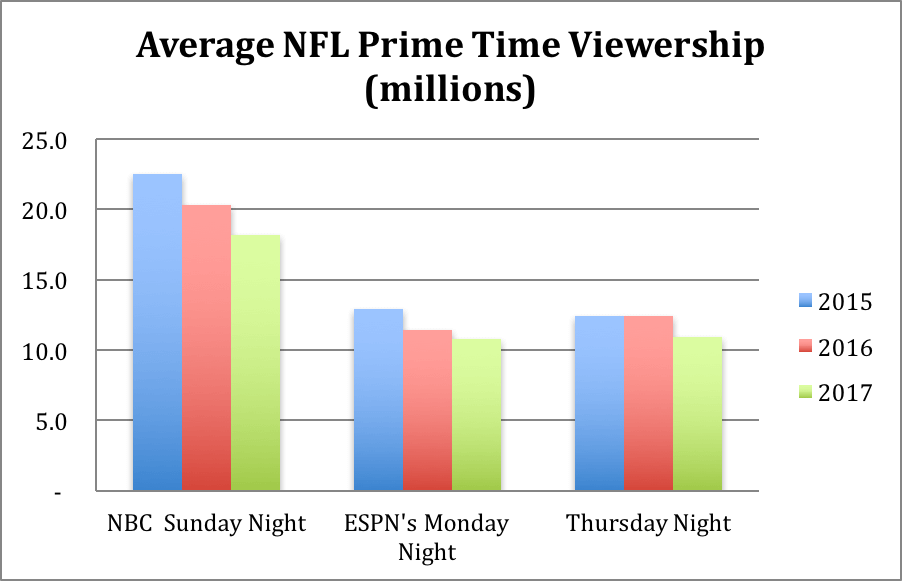

Mega-Trend #1: Many of the top sports leagues and networks are seeing a rapid decline in viewership.

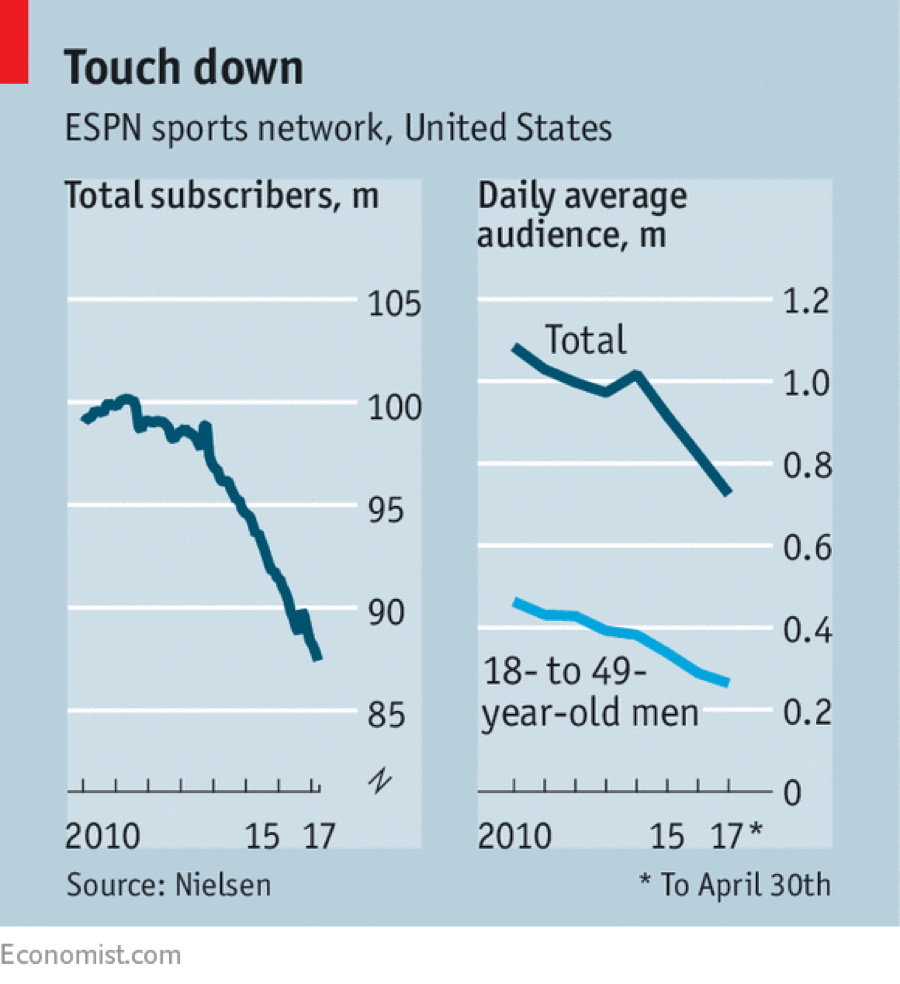

- Subscribers to ESPN, the most valuable TV sports media franchise on the planet and a huge buyer of sports rights, are plummeting.

- NFL viewership has been in free-fall over the past two years: broadcast ratings of the league fell 10% this past year alone, after dropping 9% in the prior season. The ratings decline is even affecting the NFL’s prime time line-up, where ratings are down between 12 and 19% in total over the past two seasons.

- The iconic sports magazine Sports Illustrated is withering on the vine, with publisher Time cutting back the number of issues published in recent years.

To date, the large declines in audience have not impacted broadcast revenue as most of the leagues sign long-term, multi-year deals (smart leagues!). But when these deals expire in the future, it feels inevitable that the rights fees they are willing (and capable) of paying will stop escalating and logically should decline.

Mega-Trend #2: The audiences that continue to tune in to see sports programming are aging rapidly.

Cord cutting is a well-known phenomenon, and has been reducing viewership of many/most TV broadcast programming. But cord cutting is particularly challenging to sports viewership as the large fees paid to the sports leagues by broadcasters have historically been predicated on broadcast exclusivity. As a result, many of the leading leagues offer most or all of their programming only on broadcast TV; it’s largely unavailable to consumers who have cut cords.

There’s also a generational shift at play here, as Generation Z viewing habits have shifted: cord cutting is much, much more prevalent among younger viewers. As a result, the potential sports fans of the future are flocking away from broadcast television and the exclusive sports programming that they’re carrying. The remaining audience that does watch sports programming is aging rapidly — not a good trend for the long-term health of sports programming.

As a result of these mega-trends, sports media business badly needs re-invention. It needs to supplement — and ultimately migrate — viewership from television sets to online venues where their fans of the future are increasingly spending their time. Sports programming needs to follow their audience online. Broadcasters are starting to test potential online strategies, but most currently are at a very small scale and result in much lower monetization on a per user basis.

These mega-trends in sports and media both are the key rationale for our investment in Overtime, which is aspiring to create the sports network of the future. Overtime’s content producers and athletes bring their sports content to where their millennial audience views it — on key digital social media platforms like Facebook, Instagram, Snapchat, Twitter, and YouTube, as well as on Overtime itself. They have highly unique and specialized sports content, currently focusing on high school sports, which is dramatically under-represented on TV due to a highly fragmented (yet nonetheless engaged and passionate!) audiences. Through its users, Overtime has assembled a distributed army of content producers armed with a mobile phone app that lets these producers easily capture and produce highlights from high school games around the country. And Overtime’s editorial approach brings a millennial-based sensibility to their content. It’s authentic and original — a far cry from typical sports programming which increasingly is dominated by talking heads yelling at each other.

Overtime is only a year old, but their approach is clearly resonating with their target audience. Overtime videos already receive over 100 million video views per month on social media, and are growing rapidly. Athletes from otherwise niche teams are already using Overtime to build reputations and celebrity far beyond: LaMelo Ball of the Lithuanian Basketball League now has 3.5 million Instagram followers; and Zion Williamson, a top high school basketball prospect from Spartanburg, South Carolina, has 1.2 million. These are athletes whose talent and skill deserve the attention of a broad audience base — Overtime helped bring these athletes to a larger audience, and made it possible to reach that audience much more quickly.

Overtime has also proven itself as a place for its community of users to discover new talent. Here’s an example that is playing out before our eyes. Last Tuesday, a kid in the stands filmed a up-and-coming high school senior named Mac McClung make an insane between-the-legs dunk, which he posted on Overtime. Less than 5 hours later that clip was airing on ESPN’s SportsCenter as one of their “Top 10 Plays” of the day. In less than a week (as of this writing), the video has generated over 7 million online video views. These are the moments that sports fans live for — and that, without Overtime, would have been experienced only by the handful of fans in the high school bleachers.

We’re proud to support the efforts of co-founders Dan Porter and Zack Weiner and the entire Overtime team to re-invent sports networks for the digital age. Dan is a repeat founder, having built OMGPOP into a digital gaming powerhouse behind the Draw Something franchise. And Zack and the Overtime team of sports-obsessed millennials brings the authenticity and edge that help the network connect with its millennial and Gen-Z fans.