As my partner, Marc Andreessen, often says, “there are no bad ideas in tech, only bad timing.” This can sound a tad crazy at face value, but let me elaborate.

Marc and a16z cofounder Ben Horowitz started a company called LoudCloud on 9/9/99, one of the first companies to explore cloud computing and offer software “as a service.” As we now know, cloud computing was a fantastic idea. Today, it supports huge businesses for companies, including Amazon, Google, Microsoft, Alibaba, Digital Ocean and many more. But the capabilities of hardware and connectivity early in the 20th century were insufficient to make it commercially viable. LoudCloud ended up pivoting into network operations management and re-branded as Opsware (a pivot described in fascinating detail in the first part of Ben’s book The Hard Thing About Hard Things). Marc and Ben got the idea right, but got the timing wrong.

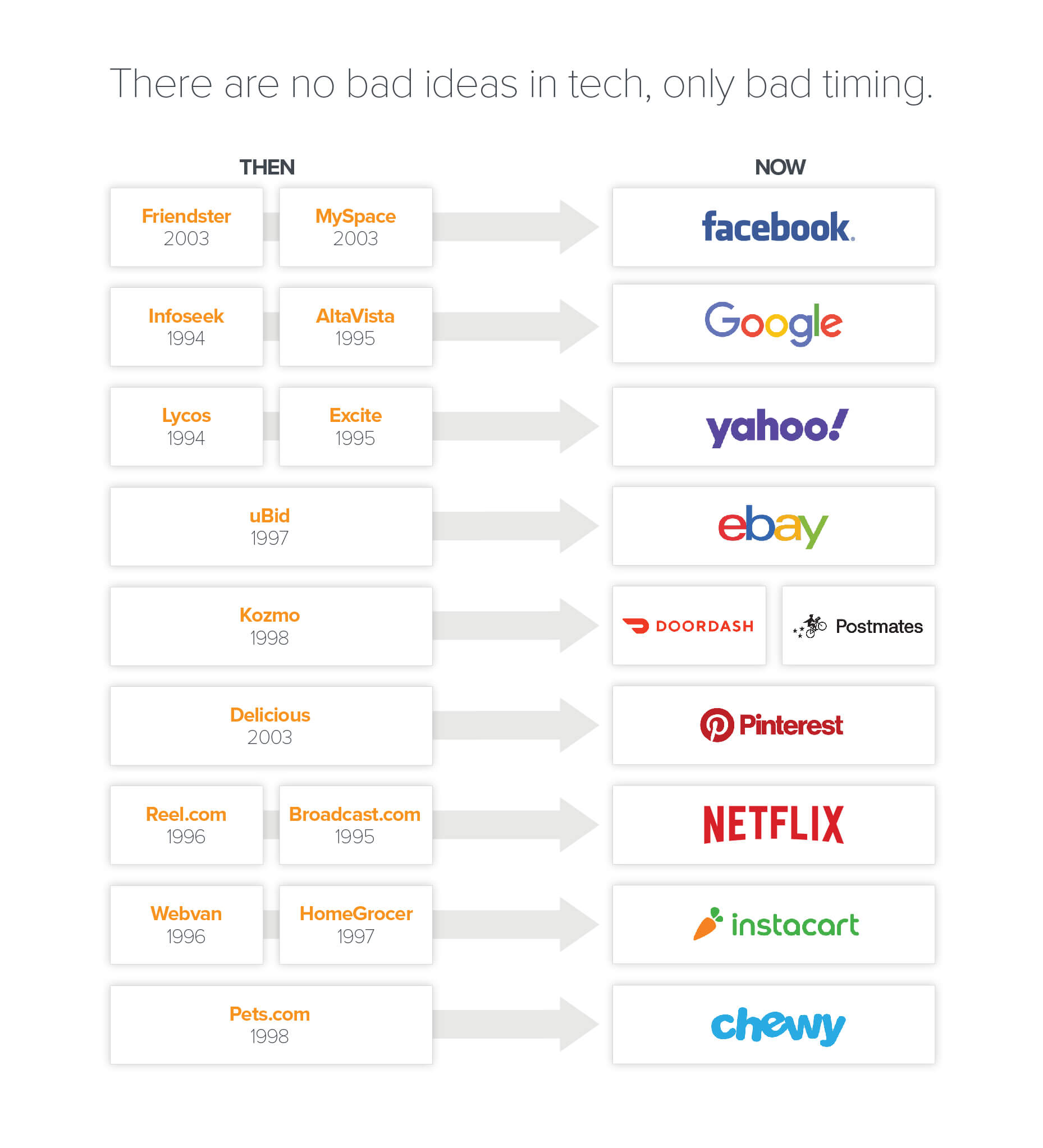

It’s a common story. Here are some other examples of the right idea coming at the wrong time, along with subsequent proof points on the quality of the ideas:

I’m optimistic that my most recent investment will offer new proof of this rule.

I love businesses that provide economic empowerment as part of their business model. My first taste of this was as the GM of eBay.com, way back when Marc and Ben were starting LoudCloud. During my four-year tenure in that role, gross merchandise value exploded from $3 billion to $19 billion, and the vast majority (around 90 percent) of those dollars were retained by eBay sellers. We estimated that by 2004, more than a million sellers were earning part of or all of their income on eBay trade.

I have since doubled (and tripled) down on this thesis. Essentially, Airbnb is a modern eBay, but for physical spaces, and it already puts tens of billions of dollars into the pockets of what Brian Chesky calls “micro-entrepreneurs” around the world. More recently, we invested in Wonderschool, which helps existing and new preschool directors operate and build community schools in their homes. Again, these directors capture the strong majority of the dollars flowing through the platform.

Given that backstory, I’m delighted to announce a16z’s investment in Neighbor, which I see as the “Airbnb of personal storage.” Neighbor enables people to rent out their spare space to other members of their community. It allows homeowners to earn incremental income for an activity that’s almost completely passive—storing stuff for their neighbors. For the storer, it offers a conveniently located, economic, and safe home for stuff they don’t have space for at their own place.

Of course, this idea has been tried before. Clutter, MakeSpace, and Trove have also tried to serve this market—albeit with more capital-intensive models—while companies like Sharespace in the US, and dozens more abroad, have tried to make the “Airbnb for storage” model work.

So why do we think Neighbor will succeed?

- The analog market for self-storage is huge and fast-growing, but it has issues that are creating opportunities for companies like Neighbor. The market is very supply-constrained. That has led to lots of new construction, but also escalating pricing. Also, in that self-storage operators often seek low-cost land, most self-storage locations are in relatively inconvenient locations—driving to these remote facilities can create significant friction for consumers.

- Neighbor’s value prop transcends the limitations of these analog self-service providers. The person with goods to store can pick among a number of participating folks in their community based on proximity and cost. And the goods they store are typically safer than they might be in traditional storage facilities, as Neighbor’s storage “locations” are occupied homes.

- The product execution of the Neighbor team is excellent. It’s very easy to use for both sides of the marketplace, and they’ve executed it in a way that creates trust among the owner of the goods.

- User reception in Neighbor’s first market in Utah has been very strong, and they’ve already shown the ability to launch new markets, largely remotely. Successive markets, like Los Angeles, are growing at an even faster clip.

- The Neighbor team has shown the talent and drive to will this business into life in a very capital-efficient manner.

We look forward to supporting Neighbor in its effort to prove that there are, indeed, no bad technology ideas. The time for this concept is now.

***