In the current economic crisis, businesses have been forced to make difficult decisions around resource allocation and cash flow planning. The person most critical in helping the CEO make those high-stakes calls—the CFO—is more vital than ever. Over the years, the CFO role has become highly strategic. Yet despite an influx of data on which to base business decisions, the tools at the CFO’s disposal have not kept pace.

By necessity, today’s CFO is expected to be part data analyst and part systems architect, stitching together piecemeal data from rudimentary software products. Now, as fintech and enterprise entrepreneurs team up to tackle these long-standing pain points, software innovation is finally reaching the finance suite. This innovation has the potential to significantly reduce time spent acquiring, scrubbing, and structuring data, allowing CFOs to focus instead on the strategic side of their role.

New tools could offer immediate, up-to-date answers to crucial questions, such as:

- Headcount planning – We had planned to increase headcount by 20 to 50 percent across several divisions in January. Now that revenue will miss targets, we need to consider a headcount reduction. How many people were hired under the original plan and at what cost? Where should we reduce staff under various revenue scenarios?

- Cash flow – When are we going to run out of cash in scenarios A, B, and C? When do we next need to raise debt or equity?

- Resource allocation – What’s the fully loaded cost of product A vs. product B? How will allocating more resources to one vs. the other impact our revenue?

- Sales – How does the finance team know to adjust the forecast if the pipeline over the next three months is light, but the company’s financial model doesn’t reflect Salesforce changes in real time?

Companies would run much more efficiently and strategically if these answers were faster and easier to obtain. Now is the time to build a startup in this space, particularly as fintech has enabled more finance software companies to monetize through transaction revenues, in addition to SaaS contracts.

The challenges hampering today’s CFO

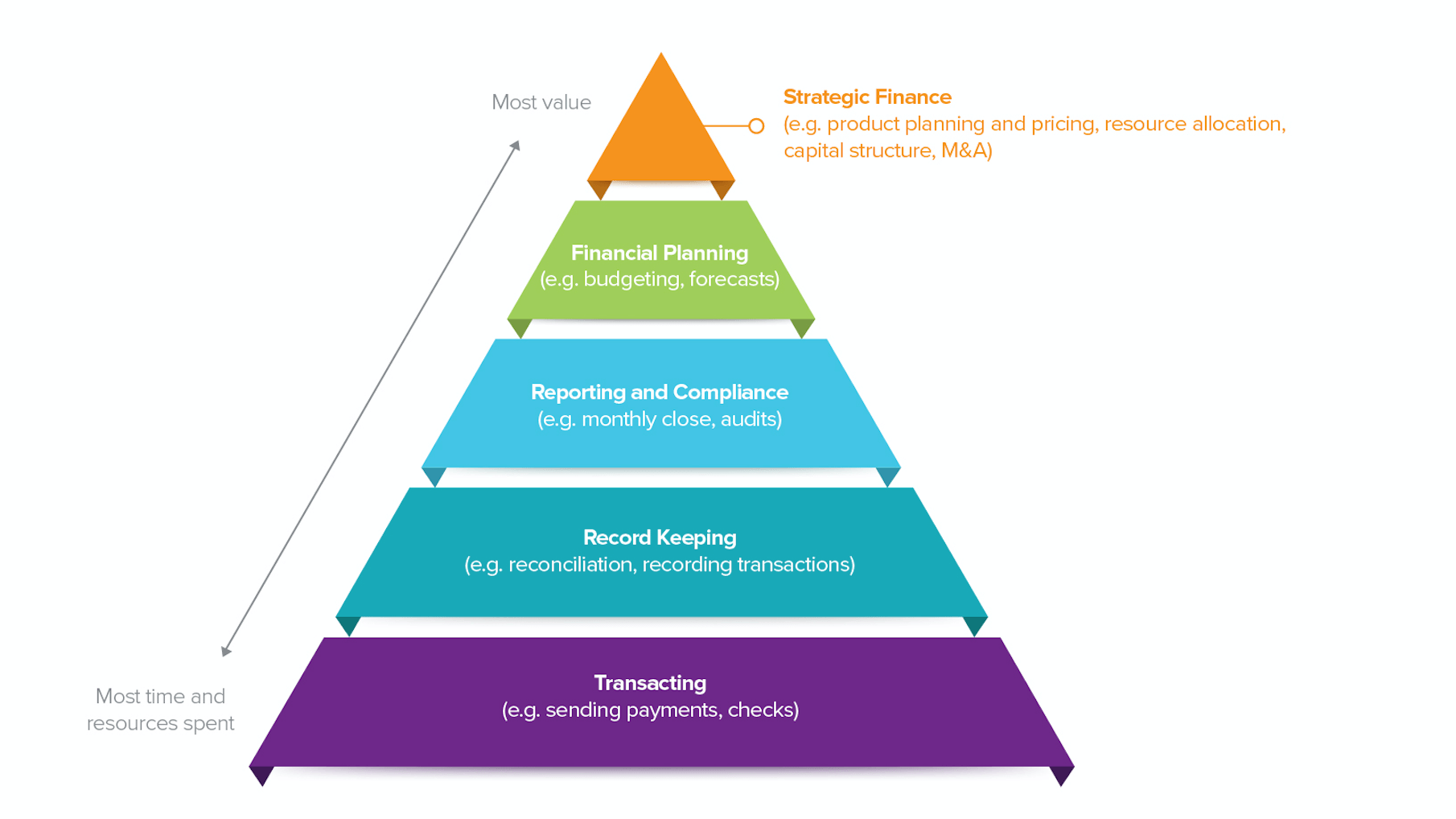

The job of a typical CFO is represented by the graphic below: strategic decision making at the top, supported by a broad base of transactional and reporting tasks.

Traditionally, the finance team has spent the bulk of its time on tasks at the bottom of the pyramid. As a result, most of the CFO tools built in recent years have focused on transacting and record-keeping. Many of those existing finance products are rife with problems:

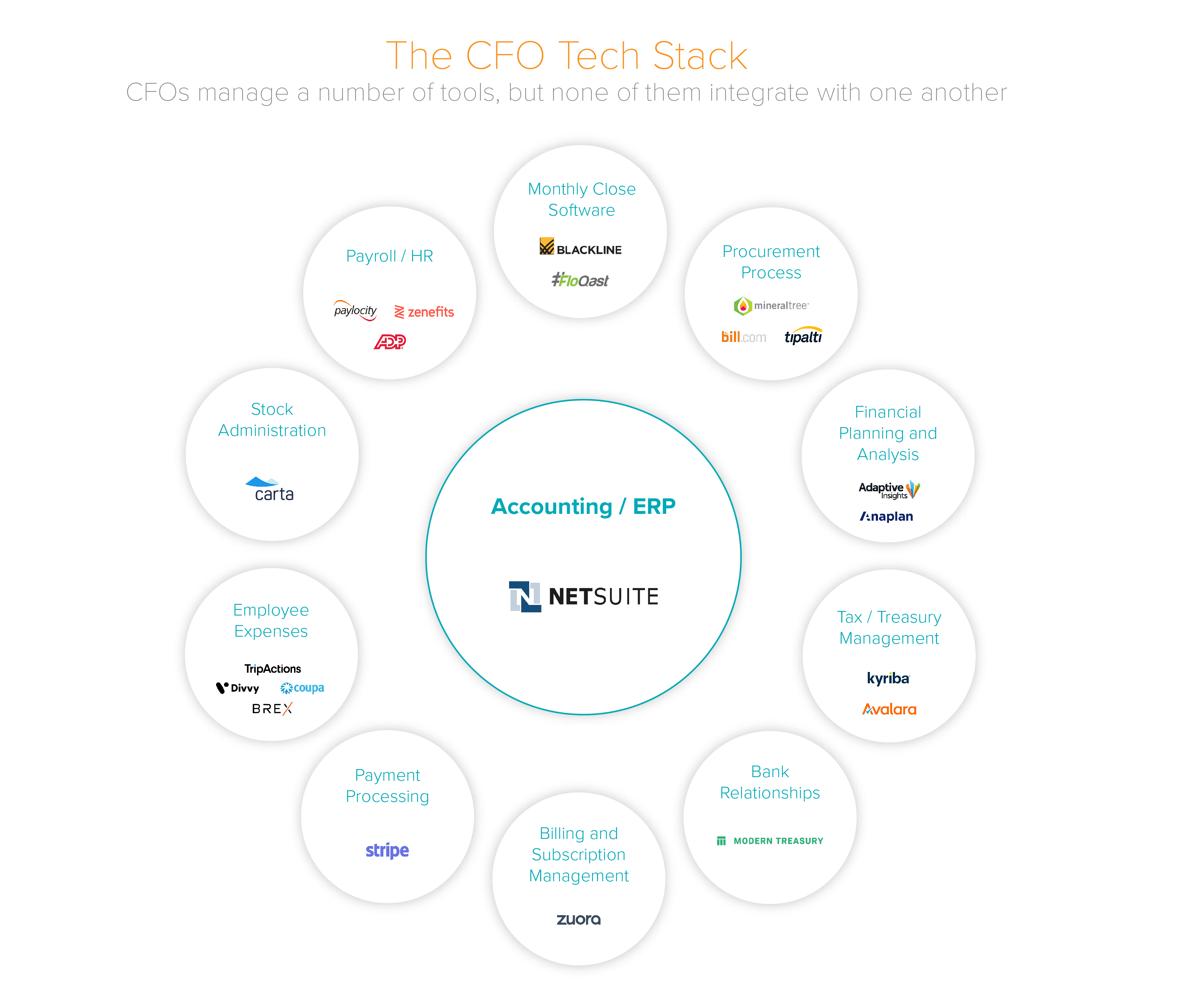

The software stands alone. None of these software products integrate with each other and none of the data flows from one product to another. In addition, these products don’t connect to other key systems for sales, HR, and marketing functions, such as Salesforce, Workday, or Marketo. To update the company’s forecast for a newly hired employee, for example, someone on the finance team typically needs to send a series of emails across the finance and HR departments.

Moreover, each of these products is built solely for the finance team—usually for a single person on that team to own and operate. Though the finance team works closely with other departments to receive input and develop plans, their existing tools don’t allow multiple users across teams to contribute and collaborate.

Moreover, each of these products is built solely for the finance team—usually for a single person on that team to own and operate. Though the finance team works closely with other departments to receive input and develop plans, their existing tools don’t allow multiple users across teams to contribute and collaborate.

Data is stale, limited, and hard to access. An enterprise resource planning (ERP) system, the central repository for financial data, is primarily designed around accounting. As a result, it only gives finance teams a backward-facing view, typically two or more weeks after the month’s end. With that lag, the CFO often has difficulty assessing cash burn, revenue, or expenses in real-time. It goes without saying that, particularly now, most companies can’t afford to wait six weeks to figure out when they are going to run out of cash.

These building block tools also provide little in the way of predictive forecasting and benchmarking against competing companies. Moreover, retrieving that data, cleaning it, and turning it into a user-friendly format often requires SQL experience, which the finance team may or may not have.

Manual entry and reconciliation never end. The CFO role is plagued by manual, repetitive tasks, from initiating bank transfers to recording checks into the ledger. In preparation for the month-end closing, cash movement (wires, credit cards, bank account balances, etc.) needs to be matched against the total product sold and the invoices paid. All of this information is then painstakingly pulled into reports and investor presentations. Though closing software like FloQast exists to create checklists and flag irregularities, data entry and categorizing is largely still performed by hand.

To make matters worse, none of these products have particularly intuitive interfaces and can take months to train users on. It’s why so many finance teams ultimately stick with a familiar workhorse: Excel.

The potential to build something better

As finance has taken an increasingly pronounced role in organizations, we’ve rightly come to expect software that enables predictive analytics, integrated communication, cross-company collaboration, and automation. These new tools will free up time and resources to focus on strategic decision making (and assist in doing so).

These are some of the areas where we see opportunity:

1. Intelligent Building Blocks. It’s time to rebuild tools for point solutions like expense management that can also offer predictive analytics and forecasting. Imagine if your expense software told you who usually paid on time and who didn’t, sent reminders, and set payment terms based on past performance. Already, Brex, Divvy, Airbase, Ramp, and others have replaced clunky legacy systems with products that are intuitive, easily integrated with other systems, and that yield greater control. What’s more, many of these companies issue physical and virtual cards to provide an accurate record of all transactions. This saves countless backoffice hours typically spent correcting human error. A bigger challenge will be to design a new general ledger, one that pulls in operational data and tracks customer lifetime value in real time, rather than just accounting statements.

2. Integrated Data Layer. Another approach is to build connective tissue—software that sits on top of existing tools, extracts data, and provides intelligence to help with dynamic planning. It could also provide benchmarking to help companies better understand how their metrics (from compensation to cash burn to days payable) compares to their peers. That might mean a workforce planning tool that assesses your payroll, cap table management, and budget to enable better headcount decisions. That planning tool would also automatically map headcount to revenue growth and planning for product launches. Or this could be a collaborative cash flow management tool that sits on top of procurement and expense management and tracks spending.

3. Banking Operations. Software can also help companies better manage their banking operations. With software that connects to their bank accounts, companies could understand their cash position, debt, and money movements in real-time. In addition, such software could send and receive payments on an automated basis (better than having to manually fill out a form to initiate wire transfers) and assist with treasury management to reconcile payments.

4. Automating Data Entry and Reporting. Finally, software can help automatically extract and review data. Receipts and checks are not going to disappear overnight, but tech tools like optical character recognition and machine learning can eliminate the need to manually enter invoice information, collect receipts, and match the information against checks received on a company’s bank statement. Similarly, reports and board updates can be automatically pre-populated by creating connections into the right data sources.

Increasingly, companies in this space also have the ability to monetize with fintech, through transaction revenues, lending, or even insurance. This shift has been driven by a few trends. First, companies are eager to transact online—it’s viewed as more efficient and trustworthy than cutting paper checks to pay invoices or payroll. Second, we’ve witnessed the creation of a fintech infrastructure that enables companies to take payments and connect with banking partners. Expense management companies, for example, can easily spin up virtual cards to collect an interchange fee on all expenses filed. Accounts payable (AP) and accounts receivable (AR) software companies can collect transaction fees when customers use their platforms to facilitate payments. Finally, software companies are providing better data to underwrite risk for financial services. Cash flow lending and invoice factoring, for example, are possible based on that AP and AR data. These financial products provide finance software startups with an additional source of revenue. And because those tools are often tied to volume, the market grows—and the product becomes stickier—as customers process more business.

Finance tools for the current moment

These are just a few ideas; there are many possibilities. Such tools will allow companies to manage cash and allocate resources more efficiently in downturns, as well as spend more prudently and collaborate more effectively in good times. Sales, marketing, and engineering have all substantially upgraded their tools over the last 5 to 10 years; it’s time to shift the focus to finance. By blending fintech and enterprise, these products have the potential to finally bring the CFO suite into the modern era.

Thanks to Stewart Ellis, Jeff Jordan, Sharon Olexy, Kristina Shen, and Sid Tiwari for their input.

- Need for Speed in AI Sales: AI Doesn’t Just Change What You Sell. It Also Changes How You Sell It.

- Investing in Stuut: Automating Accounts Receivable

- Investing in FurtherAI

- The AI Application Spending Report: Where Startup Dollars Really Go

- Oil Wells vs. Pipelines: Two Strategies for Building AI Companies